Cloud Asset Pricing Tree (CAPT)

Elastic Economic Model for Cloud Service Providers

Soheil Qanbari

1

, Fei Li

1

, Schahram Dustdar

1

and Tian-Shyr Dai

2

1

Distributed Systems Group,Technical University of Vienna, Vienna, Austria

2

Institute of Finance, National Chiao-Tung University, Hsinchu, Taiwan

Keywords:

Cloud Price Elasticity, Asset Pricing, Financial Options, Cloud Federation, Cloud Computing.

Abstract:

Cloud providers are incorporating novel techniques to cope with prospective aspects of trading like resource

allocation over future demands and its pricing elasticity that was not foreseen before. To leverage the pricing

elasticity of upcoming demand and supply, we employ financial option theory (future contracts) as a mech-

anism to alleviate the risk in resource allocation over future demands. This study introduces a novel Cloud

Asset Pricing Tree (CAPT) model that finds the optimal premium price of the Cloud federation options ef-

ficiently. Providers will benefit by this model to make decisions when to buy options in advance and when

to exercise them to achieve more economies of scale. The CAPT model adapts its structure to address the

price elasticity concerns and makes the demand, price inelastic and the supply, price elastic. Our empirical

evidences suggest that using the CAPT model, exploits the Cloud market potential as an opportunity for more

resource utilization and future capacity planning.

1 INTRODUCTION

Cloud providers offer APIs associated with their pool

of configurable computing resources (e.g., virtual ma-

chines) so that clients can access and utilize them

by deploying their packages in runtime environments

(Kurze et al., 2011). In a Cloud market, the right

to benefit from these pools of Cloud resources with

their utilization interfaces, can be delivered as “On-

Demand” or “Reserved” instances. For clients, the

reserved instances (RIs) are more reliable and eco-

nomic assets. As a proof, the unit of a resource be-

ing studied here is an Amazon EC2 Standard Small

Instance (US East) at a price

1

of $0.060/hour for an

on-demand instance and for a reserved instance, costs

$0.034/hour with an upfront payment of $61/year,

which is almost half price. Therefore, financially,

clients are more attracted to RIs. Faced with such

dilemma, RIs pose the concern of less future utiliza-

tion as far as it is not used by either the current or

other on-demand clients. This motivates providers to

take the opportunity to achieve more resource utiliza-

tion by keeping all instances in use. Providers may

reallocate unused RIs of current owner to other on-

demand clients to keep all resources utilized. This

1

http://aws.amazon.com/ec2/pricing/

approach makes the RIs unavailable for the current

owner. Obviously, it is an obligation for providers

to assure the availability of RIs associated with own-

ers, otherwise, lack of resources leads to unmet de-

mands and, while reflecting the SLA violations, leads

to financial consequences and penalties. To assure

asset availability when lacking resources, providers

can seek for more affordable and cost-efficient Cloud

open markets to outsource their clients demands. In

addition to the fact that Cloud open marketplaces

(e.g., Zimory, SpotCloud) and federation offerings

(e.g., CloudKick, ScaleUp) offer more resource uti-

lization mechanisms, they also enable further cost

reduction due to the market competitive advantage

among providers.

The decision to outsource the request to the fed-

eration parties is relatively dependent to the asset’s

price. In a similar model, the Amazon Web Services

(AWS) also offer a spot instance pricing model, where

the price fluctuates as the market supply and demand

changes, and the spot instances will be provisioned

to the bidders who won the competition. As soon as

the asset’s spot price goes above the winning bid, re-

sources will be released. In open Cloud markets, the

providers hardly can rely on such mechanism since

there is no guarantee as they might lose the resources

when the asset price crosses their bid. In order to en-

221

Qanbari S., Li F., Dustdar S. and Dai T..

Cloud Asset Pricing Tree (CAPT) - Elastic Economic Model for Cloud Service Providers.

DOI: 10.5220/0004849702210229

In Proceedings of the 4th International Conference on Cloud Computing and Services Science (CLOSER-2014), pages 221-229

ISBN: 978-989-758-019-2

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

courage providers to benefit from the Cloud market,

we need a dynamic economic model that keeps re-

source and financial elasticity sustainably balanced by

controlling the asset price oscillation while demand

and supply fluctuate. To this end, our contribution

is twofold: (i) Analyzing the financial options and

pricing elasticity concepts in Cloud federation mar-

ket. (ii) The flexible pricing model that calculates the

optimal premium price of the federation options effi-

ciently and accurately.

The paper continues with a motivation scenario

in support of an elastic economic model for pric-

ing Cloud federation assets at section 2. Section 3

presents the basic concepts and preliminaries where

the conceptual basis and mathematical models are de-

tailed. Based on this, CAPT pricing model is derived

in section 4. We simulate and evaluate our CAPT

model and numerical results will be given in section 5

to support the efficiency of our model. Subsequently,

section 6 surveys related works. Finally, Section 7

concludes the paper and presents an outlook on future

research directions.

2 MOTIVATION

Along with elastic resource provisioning, providers

may face the limitations and insufficiency of their own

resource pool supply. In effect, they can transfer the

risk of lacking resources to the federation markets.

Federation markets can be of interest for providers

as well as for consumers. Clients may profit from

lower costs and better performance, while providers

may offer more sophisticated services (Kurze et al.,

2011). However, hereinafter we focus on the provider

perspective. Thus providers can benefit from the in-

creasing capacity and diversity of federated resources.

In our model, we employ financial option theory as an

interface to elastically allocate an extra pool of feder-

ated resources. In finance, an option

2

is a contract

which gives the buyer (the owner) the right, but not

the obligation, to buy or sell an underlying asset or

instrument at a specified strike price on or before a

specified date.

Pricing elasticity and resource trading among fed-

eration members lead to competitive contracting pro-

cess, which aims at finding reasonable and fair price

of the asset. The contracting process is to write an

option that contains future aspects of trading. For in-

stance, whenever the provider lacks the required re-

sources, then can take advantage of exercising such

options to allocate corresponding resources respec-

2

http://en.wikipedia.org/wiki/Option (finance)

tively. Using options, providers take the rights to pro-

vision seller’s resources which match their demands

among parties at a price equal or above to their expec-

tation of the asset payoff. Now, the concern is, how

to price an option to be reasonable for both parties?

Obviously, option pricing is an elastic process (Dust-

dar et al., 2011), sensitive to the fluctuation of the as-

set price determined by supply and demand between

federation parties in spot market. As a consequence,

pricing elasticity that comes in two types of Demand

and Provisioning may drive a wedge between the buy-

ing and selling price of an asset. Thus controlling the

pricing elasticity of the demand and provisioning with

respect to their effects on revenue stream by fair pric-

ing of such options appears to be vital. This paper

aims at addressing the pricing elasticity of the asset in

federation market by fair pricing of the option. The

option price is determined by a broker acting on be-

half of the Cloud federation and therefore standard-

ised across the federation. This option gives the right

to obtain an instance at a given price, established at

the agreement’s stipulation time.

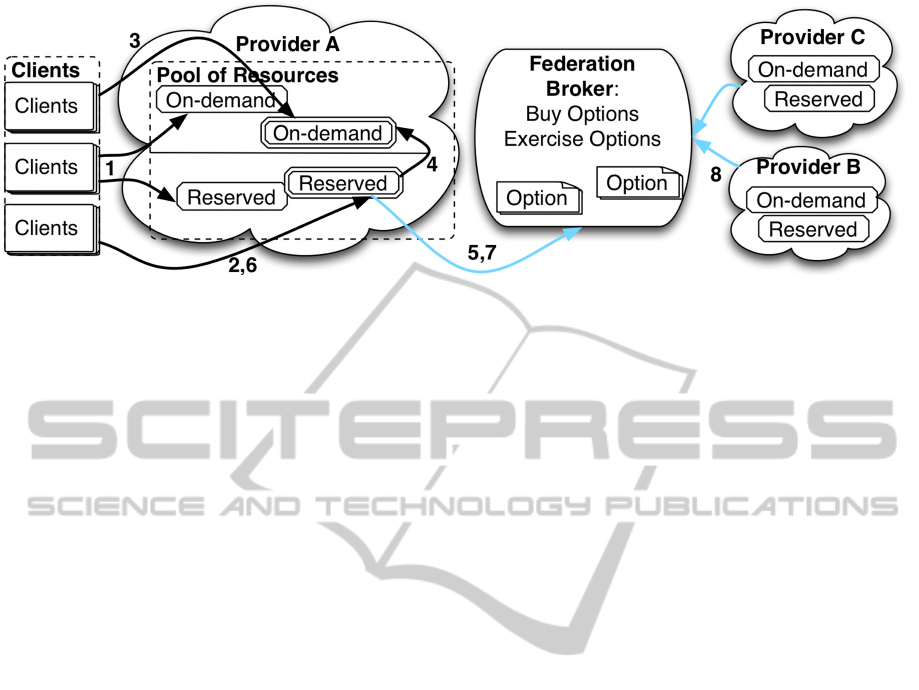

In this scenario, at stage 1 as shown in Fig. 1, the

clients request for on-demand and RIs and keep using

them. At stage 2 another client benefits from the ex-

isting RI. As soon as the RI is suspended, Provider

A can utilize this instance by reallocating it to un-

met on-demand request. Therefore, upon lacking re-

sources, any incoming on-demand request at stage 3

will be responded by reallocation of the RI at 4 to

a new client. At this moment, stage 5, Provider A

buys an option from federation broker as a support-

ing mechanism for future resource capacity planning.

The provider avoids buying resources at a price that is

higher than the one charged to its own customers. As

soon as the previous client claims for the RI at 6 which

is now allocated to the request 3, the provider will take

advantage of the option signed with Provider B by ex-

ercising it at 7 and the Provider B has an obligation to

provision the promised resources at 8. Our focus lies

on stages 5 and 7 where the provider is looking for

a well priced option to be exercised later to achieve

more utilization. In our federation model, Provider A

is the demander and Providers B & C are the resource

suppliers in the federated environment.

The fact that future valuation of federated assets

depends on the correlated elasticity between provi-

sioning and demand, suggests that the optimal utiliza-

tion of an asset is primarily driven by its price volatil-

ity in open Cloud markets. This influences the trend

of providers to be more concentrated on controlling

this pricing elasticity. Although the elasticity of a

demand is an initial impetus in asset valuation, the

pricing elasticity of the demand might lead to ineffi-

CLOSER2014-4thInternationalConferenceonCloudComputingandServicesScience

222

Figure 1: Resource utilization in Cloud federation using options.

cient revenue generation. For instance, the resource

demand can be affected to a greater degree by minor

changes in asset price. This leads to a question, how

can volatility in price cause so much sensitivity in fu-

ture demands? The reason is amplification. Blame

is usually laid on asset price fluctuation and dynamic

valuation. The price changes in federation market

will be propagated across providers (such as domino

effects), causing more sensitivity and concerns on

provider’s demand. The next question is, how can

we control the pricing elasticity and decrease Cloud

market sensitivity to future asset price changes? In

this study we employ financial option theory which

takes care of future valuation of the asset. Then by us-

ing the Binomial-Trinomial Tree (BTT) option pric-

ing (shyr Dai and dauh Lyuu, 2010) methodology, we

control the Cloud asset price changes and its propaga-

tion through the market. As the option price rises or

falls, our CAPT model will adjust its structure to the

price volatility to come up with an option price that is

predictable and fair for both option holder and writer.

3 TERMS AND PRELIMINARIES

In this section we present basic concepts, economic

terms and numerical methods and their interpretations

considered in the study.

3.1 Cloud Federation Contracts

In finance, an option is a contract but the major dif-

ference arise from the rights and obligations of an op-

tion’s buyer and seller. A Call option gives the buyer

the right, but not the obligation, to purchase the under-

lying asset at a specified price (the strike or exercise

price) during the life of the option. The cost of ob-

taining this right is known as the option’s ”premium”

which is the price that is offered in the exchange. We

use the term premium for an option premium in this

study. The option buyer’s loss is limited to the pre-

mium paid. When you own a Call, what you do by ex-

ercising your right is to Call for Resource Provision-

ing from provider that offered the Call to you. The

buyer’s right becomes the seller’s obligation when the

option is exercised. An American option can be exer-

cised at any time during the life of the contract while

European option can only be exercised at maturity

date. The CAPT is modeled with American call op-

tions.

American options are provided by a pool of

providers and purchased by other providers as a hedge

to cover potential excess demand. Using this method,

providers are able to re-sell on-demand VMs that have

previously been sold as RI. If the RI owner decides to

use the instance then rather than violate an SLA, the

excess demand can be covered by exercising previ-

ously purchased options to enable Cloud-bursting us-

ing the federated pool of resources. The option pric-

ing model determines an option price that is inelastic

(such that supply and demand are not highly sensitive

to price), thereby reducing self-reinforcing oscilla-

tions in supply and demand. The paper demonstrates

that the option pricing model converges to a more

stable price over time and the simulated provider in-

creases profit from outsourcing provisioning using

options.

3.2 Cloud Asset Pricing Elasticity

In Cloud systems, elasticity is the ability to automat-

ically increase or decrease resource allocation to as-

set instances as demand fluctuates. Cloud financial

elasticity is a measure of how much resource buyers

and sellers respond to changes in market conditions.

It’s a measure of the responsiveness of quantity de-

manded or provisioned to a change in one of its deter-

minants like price or quality. In this paper we address

the Cloud federation asset pricing elasticity. The law

of demand states that a fall in the price of a resource

CloudAssetPricingTree(CAPT)-ElasticEconomicModelforCloudServiceProviders

223

raises the quantity demanded. To be more specific,

the price elasticity of demand measures how willing

providers are to buy less or more options as its price

rises or falls. To sum up, the concept of Price Elastic-

ity of Demand (PEoD) measures of how much the re-

source quantity demanded due to a price change. And

the Price Elasticity of Provisioning (PEoP) measures

how much the resource quantity provisioned due to a

price change (Mankiw, 2012). The PEoD and PEoP

formulas are:

PEoD =

(%Change in Quantity Demanded)

(%Change in Price)

(1)

PEoP =

(%Change in Quantity Provisioned)

(%Change in Price)

(2)

3.3 Pricing Elasticity Interpretation

Regarding interpretation, we analyze the Cloud asset

price elasticity only with their absolute values. The

PEoD variable values, denote how sensitive the de-

mand for an asset is to a price change. In financial

markets, the rule is if a provider’s asset has a high

elasticity of demand, the more the price goes up, the

fewer consumers will buy and try to economise their

needs. Correspondingly, in Cloud federation markets,

a very high price elasticity suggests that when the

price of a resource goes up, our provider will be more

sensitive and demand for less assets or buy less call

options. Conversely, when the price of that resource

goes down, then the provider will demand for more

assets or buy more call options. A very low price elas-

ticity implies just the opposite, that changes in price

have little influence on demand or exercising the call.

To sum up, when demand is price inelastic, total rev-

enue moves in the direction of a price change. When

demand is price unit elastic, total revenue does not

change in response to a price change. When demand

is price elastic, total revenue moves in the direction of

a quantity change. In order to see whether the price is

elastic or inelastic we use the following rule of thumb:

VM PEoD =

>1 Demand is price elastic.

=1 Demand is unit elastic.

<1 Demand is price inelastic.

(3)

Next is price elasticity of provisioning in federa-

tion resource supply pool. The law of supply states

that higher prices raise the quantity supplied. The

price elasticity of supply measures how much the

quantity supplied responds to changes in the price.

Supply of a good is said to be elastic if the quan-

tity supplied responds substantially to changes in the

price. Supply is said to be inelastic if the quantity sup-

plied responds only slightly to changes in the price.

PEoP denotes how sensitive the provisioning of an as-

set is to a price change. In Cloud federation markets, a

very high price elasticity of provisioning suggests that

when the price of a resource goes up, Cloud federa-

tion members will be more sensitive to price changes

and provision more assets or sell more call options

to make more profit. Thus, the resource quantity

supplied can respond substantially to price changes.

Same as PEoD, in order to see whether the price is

elastic or inelastic in PEoP, we use the following rule

of thumb:

VM PEoP =

>1 Provisioning is price elastic.

=1 Provisioning is unit elastic.

<1 Provisioning is price inelastic.

(4)

Finding the right balance between these two po-

lar approaches of PEoD and PEoP to come to a new

equilibrium is a challenge as we address it using our

CAPT model. In equilibrium, asset aggregate demand

has to equal the asset supply. To be more specific, in

our evaluation, we will show that our pricing model,

calculates the fair price of the option that makes the

demand, price inelastic and provisioning, price elas-

tic. This leads to increasing demand, regardless of the

asset price oscillation.

3.4 Assumptions

It is an indication that the following assumptions un-

derlying our model has been considered for the proper

positioning of this study. In a Cloud market, resources

are virtualized to abstract concepts like virtual ma-

chines (VMs) and assumed as intangible assets. They

are also seen as assets as long as associated with a

contract that can be exercised by an option. Fed-

eration formation pose some concerns like contract

management, data policies, SLA violations and etc.

We believe these concerns should be addressed in the

business models agreed among parties.

4 CAPT MODEL

The option pricing can be represented by numerical

methods like trees. This section shows how to gen-

erate the CAPT tree for pricing options. The model

benefits from the Binomial and Trinomial tree meth-

ods as detailed below. This section shows how to gen-

erate the CAPT tree for pricing options.

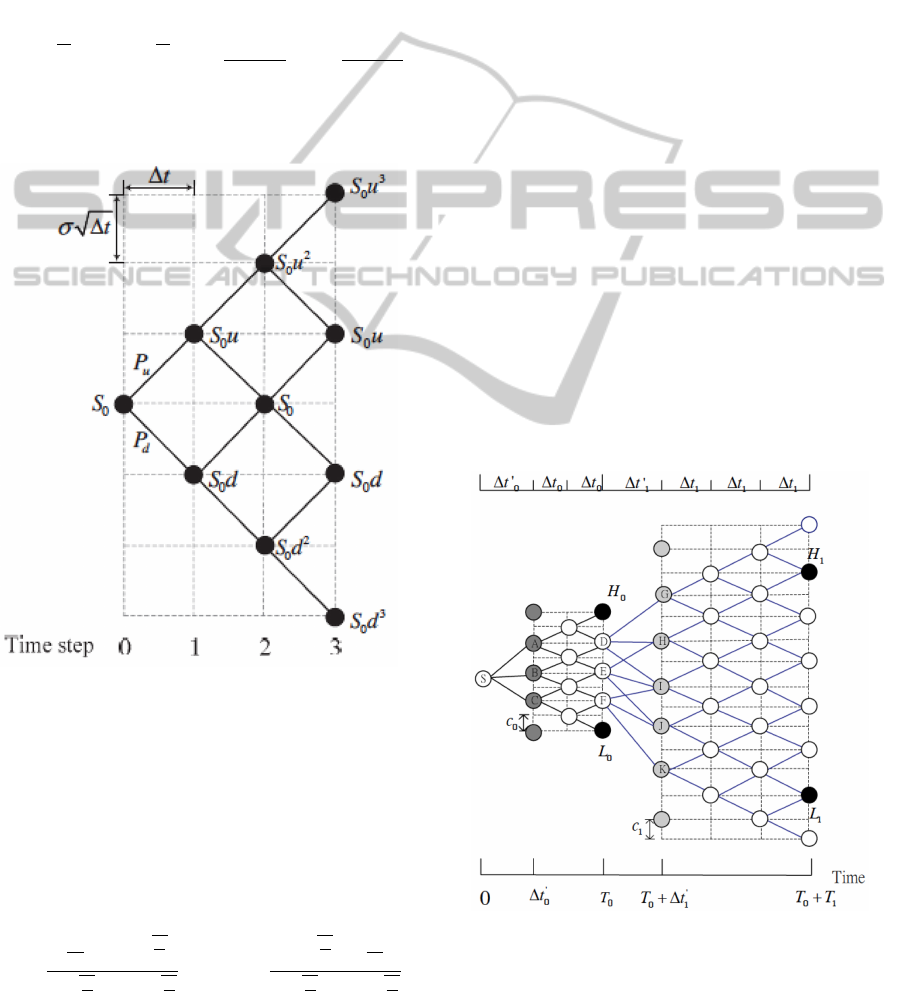

4.1 Binomial Tree

Binomial tree model is a numerical pricing method

that approximates option price. Let a derivative on

CLOSER2014-4thInternationalConferenceonCloudComputingandServicesScience

224

S

(t)

initiates at time 0 and matures at time T . A lattice

partitions this time span into n equal-distanced time

steps and specifies the value of S

(t)

at each time step

which denotes the Cloud asset price. Let the length

between two adjacent time steps be ∆t ≡T /n. The es-

tablished Cox-Ross-Rubinstein (CRR) binomial tree

(Cox et al., 1979) is shown in Fig. 2. As we move

forward in time, each asset price S can either move

upward to become S

u

with probability P

u

, or move

downward to become S

d

with probability P

d

≡1−P

u

.

The CRR lattice adopts the following solution:

u = e

σ

√

∆t

,d = e

−σ

√

∆t

,P

u

=

e

r∆t

−d

u −d

,P

d

=

e

r∆t

−u

d −u

(5)

Where σ is price volatility, ∆t is duration of a step and

r denotes the interest rate.

Figure 2: CRR Binomial Pricing Tree.

4.2 Trinomial Tree

A trinomial tree can be built in a similar way to the

binomial tree but has three possible paths (up, down,

and stable) per node leading to more efficient pricing.

The jump sizes (u, d) can be calculated in a similar

way with doubled time spacing. The transition prob-

abilities are given as:

P

u

=

e

r∆t

2

−e

−σ

q

∆t

2

e

σ

q

∆t

2

−e

−σ

q

∆t

2

2

P

d

=

e

σ

q

∆t

2

−e

r∆t

2

e

σ

q

∆t

2

−e

−σ

q

∆t

2

2

(6)

P

m

= 1 −P

u

−P

d

(7)

Now it is possible to find the value of the underly-

ing asset, S for any sequence of price movements. It

will generate a directed graph with nodes labeled as

asset prices and edges connecting nodes separated by

one time step and a single price up, down and middle

jumps as N

u

,N

d

,N

m

, where the price after i period

at node j (or after i ups and j downs) is given by:

S

(i, j)

= u

N

u

d

N

d

m

N

m

S(t

0

) where N

u

+ N

d

+ N

m

= i. Fi-

nally, in both binomial and trinomial tree methods, the

option value can be computed by standard backward

induction method.

4.3 Growing the CAPT Tree

This section visualizes how the BTT tree is con-

structed for pricing the options briefly. In this model

as illustrated in Fig. 3 the root of the tree is the node

S which is formed by a trinomial tree and the rest of

the tree is constructed using binomial method with the

first two time steps truncated. The barriers (the black

nodes) are H

0

and L

0

at time T

0

and H

1

and L

1

at time

T

0

+T

1

. These barriers define the allowable range for

the price fluctuation of the underlying asset serving

to limit both, profits and losses, for federation parties.

The tree adjusts and adapts its structure to the price

volatility and the moving barriers to come up with an

option price that is predictable and fair for both option

holder and writer.

Figure 3: Cloud Option Pricing using Bino-Trinomial Tree.

The combinatorial pricing algorithm (Dai and

Lyuu, 2007) is used to evaluate the option values on

the three CRR trees as shown in Fig. 3, with root

CloudAssetPricingTree(CAPT)-ElasticEconomicModelforCloudServiceProviders

225

nodes A, B, and C. The option price of the CAPT at

node S is also evaluated by the backward induction

method.

5 MODEL EVALUATION

Now, we present results from our simulation obser-

vation that show the efficiency of our model. We

have implemented a Cloud federation environment

using Cloud simulation platform, CloudSim (Cal-

heiros et al., 2011). The simulated Cloud federation

uses our option pricing model for trading assets and

VM provisioning. The unit of resource being ob-

served is an Amazon EC2 Standard Small Instance

(US East). At the date of simulation (Sept 2013), re-

sources advertised at a price of $0.085/hour for an

on-demand instance. For RIs, the same type instance

for 12 months costs $0.034/hour. For evaluation pur-

poses, (i) the reserved capacity of the data center is

considered as steady constant value during simula-

tion. (ii) to economize the equations, we do not take

into account the operational costs (i.e., hardware and

software acquisition, staff salary, power consumption,

cooling costs, physical space, etc.) of the data center.

It imposes a constant value within the model.

5.1 Simulation Setup

The simulation environment is developed to capture

the behavior of our CAPT model in Cloud federation

where supply and demand fluctuate in daily patterns

directly inspired by real-world market. For a provider,

who benefits from this market, simulation was im-

plemented with a resource pool capable of 400 si-

multaneous running VMs capacity including reserved

and on-demand. We have implemented the following

three components on top of CloudSim simulator. Fur-

ther details of our option-based federation simulator

entities and settings are as follows.

5.1.1 CAPT Request Generator (ReqG)

The workload pattern generation was needed in order

to mimic the real world IaaS Cloud requests. We im-

plemented CAPT-ReqG agent to create jobs by using

the Cloudlet class in CloudSim. In our model, each

job has an arrival time as we scheduled the workload

on a daily-basis pattern and a duration time which is

the holding time of the instance by the job and me-

tered to charge the consumer respectively. Given that

our workload follows daily pattern based on normal

Gaussian distribution for the 24 hours of a day and

considering standard business hours (from 9 to 17) as

peak hours, we generate a randomly distributed ar-

rival time for requests in each specific hour. The load

decreased 60% on weekends.

5.1.2 CAPT Resource Allocator (ResA)

We have developed the CAPT-ResA agent to deter-

mine the association between jobs and federated re-

sources. Our allocation policy finds a mapping be-

tween the batch of jobs outsourced to the federation

and VMs associated to options. In the simulation, the

VM provisioning policy is extended to best fit with

respect to the option status. The providers are im-

plemented using DataCenter class in CloudSim, as it

behaves like an IaaS provider. The CAPT-ResA re-

ceives requests from CAPT-ReqG, allocates resources

and binds the jobs to the VMs accordingly. For re-

source allocation, we have used shared pool strategy.

In case of arriving a new on-demand job, the agent

checks if the number of currently running on-demand

jobs exceeds the capacity of on-demand pool and if

so, it will allocate VMs from its reserved pool while

buying an option from federated Cloud. As soon as

it receives requests which can not be met in-house,

the agent will exercise the options that were bought

before and outsource the new jobs to federated pool.

5.1.3 CAPT Option Handler (OptH)

Our CAPT-OptH agent implements the option pric-

ing model as detailed in section 4. It also routes the

option exercising request to the CAPT-ResA agent to

have the requested resource provisioned. The pricing

policy is set to resource/hour consumed for each in-

stance, for the duration an instance is launched till it

is terminated. Each partial resource/hour consumed

will be charged as a full hour. There are six metrics

that affect the CAPT option pricing, (i) the current

stock price, S

0

set to $0.034/hour (ii) the exercise

price (spot price), K is generated based on Amazon

spot price observed pattern. (iii) the time to option

expiration T set to 1 month (iv) the volatility σ which

is the range and speed in which a price moves, set

to 31.40%per annum. It is observed by the cloudex-

change.org

3

which is real-time monitoring of Ama-

zon EC2 spot prices. (v) the interest rate, r is set to

19.56% per annum since the Amazon EC2 SLA

4

in-

terest rate is 1.5% per month and (vi) the dividend

expected during the life of the option is set to $5.17.

Both High and Low barriers are set to $0.039 and

$0.030. The simulation was run 50 times. The exper-

iment duration is set to 6 months and the mean value

3

https://github.com/tlossen/cloudexchange.org

4

http://aws.amazon.com/agreement/

CLOSER2014-4thInternationalConferenceonCloudComputingandServicesScience

226

of the results is evaluated to mimic the real-world en-

vironment.

5.2 Evaluation Measure

There are four empirical measures as we care to spec-

ify and observe their behavior during the simulation:

(i) Provider’s profit (P

pr

), which our model claims

to ensure the optimal utilization of the resources for

providers. The profit measurement equation is:

P

pr

= R

on

+ R

res

+ R

(op,exe)

−C

(op,pre)

−C

(gen)

(8)

where R

on

and R

res

are the providers’ total revenue

received over their own on-demand and RIs. R

(op,exe)

is the revenue of exercising the options since the op-

tion exercise price is less than their own instance price

sold to their clients before. C

(op,pre)

denotes the pre-

mium to be paid for the purchase of the option which

our model calculates accurately. Finally, C

(gen)

cov-

ers general costs of provider as we assumed a con-

stant value. (ii) Second measure is QoS Violations

(QoS

v

), that holds the number of rejected or unmet

reserved and on-demand instances reflecting the SLA

violations. Third and forth measures are (iii) Price

Elasticity of Demand (ε

D

) and (iv) Price Elasticity

of Provisioning (ε

P

) where their absolute values are

highly correlated with the asset price changes. Their

computation is done with these equations:

ε

D

(vm) =

%∆

Qd

%∆

P

vm

and ε

P

(vm) =

%∆

Qp

%∆

P

vm

(9)

The ε

D

(vm) and ε

P

(vm) denote the price elasticity

of demand and provisioning of an asset, and mea-

sures the percentage change in the quantity of VM de-

manded and provisioned per 1% change in the price

of its option premium. Our economic model should

make ε

D

(vm) “price inelastic” and ε

P

(vm) “price

elastic” as interpreted in section 3.2.

5.3 Results and Debate

The aggregate results imply utility and are reported

as summary in Table 1. Results show that those

providers are able to reach an utilization rate of 99%

and achieve gains both from the in-house instances

and from those obtained by exercising the option’s

rights from other providers of the federation. Tak-

ing these results together, four points stand out in this

simulation. First, is the profit made from exercising

options. To interpret this, note that in our approach,

providers buy the options that its exercise price are

less than their own VM provisioning price. As ob-

served, providers were able to meet 86% of an incom-

ing requests by inhouse provisioning and outsourced

14% of their demands to the federation, in which

are fully provisioned to celebrating 8.7% more profit.

Second, is the achievement over the QoS agreed with

the client for resource delivery. For both reserved

and on-demand, no QoS violation (no unmet request)

is detected. Third, as our results indicate, the value

of pricing elasticity of demand (PEoD) is kept less

than 1 denoting that the demand became “price in-

elastic” serving to increasing demand, regardless of

the asset price oscillation. From the federation per-

spective (resource suppliers side), the value of pric-

ing elasticity of provisioning (PEoP) is more than 1

denoting that the provisioning became “price elas-

tic” indicating the providers are flexible enough to

adapt the amount of resources they provision. These

values are consistent with the number of options pur-

chased and exercised, leading to more economies of

scale. Finally, is the utilization value, which is con-

siderable. This indicates that optimal utilization of

resources is achieved to exploit the efficiency and ac-

curacy of our model.

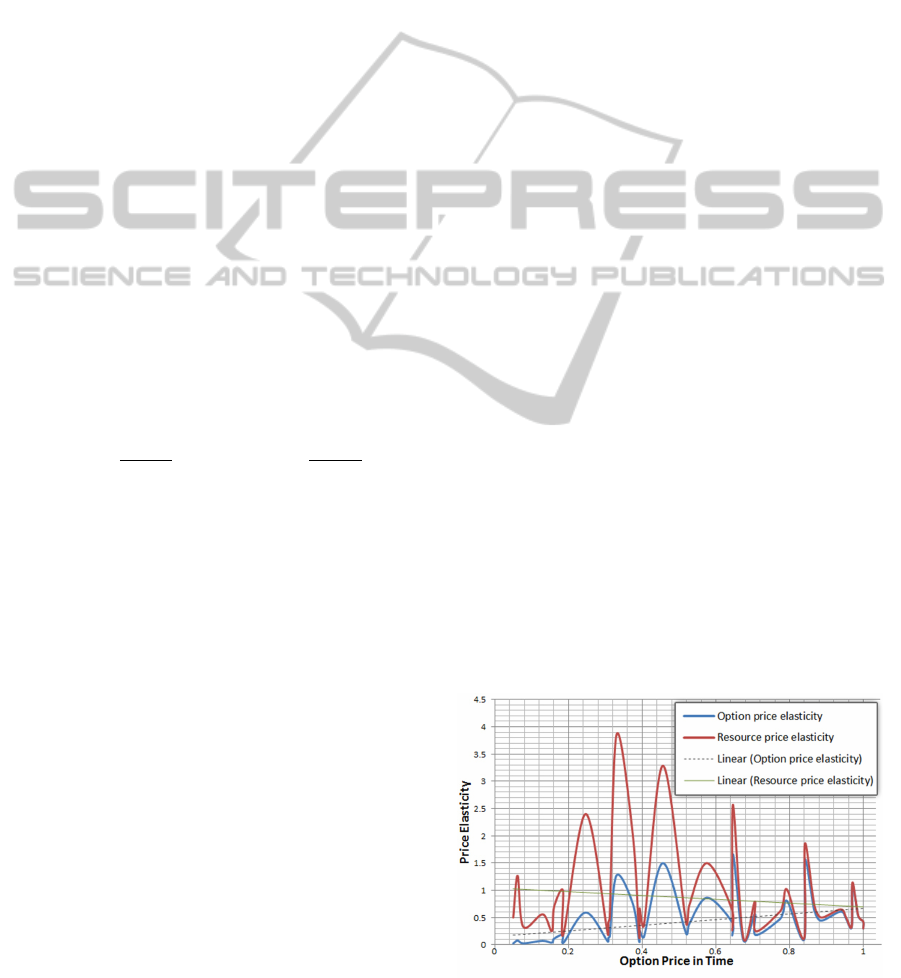

To form a basis for comparison, our next two fig-

ures depict the dependencies between option pricing

elasticity and its demand and provisioning. Fig. 4,

shows how CAPT controls the option pricing elastic-

ity and converges to a more stable price smoothly.

Our approach finds the optimal option price of the

federated resource in the Cloud to come to an equilib-

rium between PEoD and PEoP. The asset equilibrium

price occurs when the supply resource pool matches

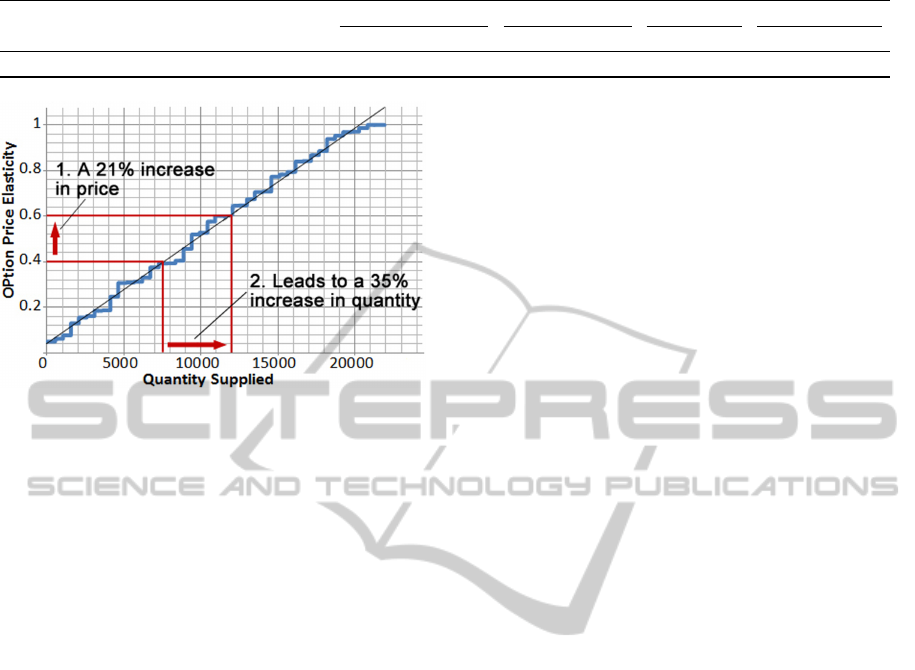

the aggregate demand indicating an optimal resource

utilization. From the provisioning perspective, as

shown in Fig. 5, it can be seen, that a 21% increase

(using midpoint method) in the asset price leads to a

35% increase in quantity provisioned. This indicates

an elastic supply. Since the asset pricing elasticity is

controlled, we see a synchronous correlation between

price and supply changes. As a result, the total rev-

enue moves in the direction of price change.

Figure 4: Resource price elasticity controlled via options.

CloudAssetPricingTree(CAPT)-ElasticEconomicModelforCloudServiceProviders

227

Table 1: Cloud federation market simulation summary (6 months).

QoS Violations Profit Price Elasticity Options

Market↓ Measures → Workload Utilization Reserved On-demand In-house Option PEoD PEoP Bought Exercised

Cloud Federation Market 98455 99% 0 0 35293.63 3339.97 0.095 1.28 25676 14020

Figure 5: Price elasticity of resources provisioned.

6 RELATED WORK

In relation to our approach, there are some alterna-

tives that propose federation economic model more

focused on the provider’s perspective. A broker-based

federation approach has been proposed by (Villegas

et al., 2012), (Rogers and Cliff, 2012) and (Raj, 2011).

These studies decouple the brokerage strategies and

federation economic valuation. Zhang proposes an

economic model for the evaluation of the economic

value of Cloud Computing Federation in providing

one computing unit such as the power and human

resources (Zhang and Zhang, 2012). Just as Clouds

enable users to cope with unexpected demand loads,

a Federated Cloud will enable individual Clouds to

cope with unforeseen variations of demand. Authors

in (Gomes et al., 2012) investigate the application

of market-oriented mechanisms based on the General

Equilibrium Theory of Microeconomics to coordinate

the sharing of resources between the Clouds in the

federated environment. In (Zhao et al., 2012), au-

thors present an online resource marketplace for open

Clouds by adopting an eBay style transaction model

based on auction theory. Here (Samaan, 2013) es-

tablishes a novel economic sharing model to regu-

late capacity sharing in a federation of hybrid Cloud

providers. The idea of financial options is used by

(Sharma et al., 2012) as a financial model for pricing

Cloud compute commodities by using Moore’s law on

depreciation of asset values, to show the effect of de-

preciation of Cloud resource on QoS. In (Toosi et al.,

2012) authors incorporate financial options as a mar-

ket model for federated Cloud environments. In con-

trast to existing approaches, we use financial option

theory for asset trading and propose a dynamic and

adaptive option pricing model which enhance profit

by controlling the pricing elasticity of demand and

provisioning in the Cloud federation.

7 CONCLUSION AND OUTLOOK

Providers consider federations as an alternative pool

of resources to their expected consumption growth.

Their demand to use the federated asset is dependent

to the pricing elasticity of demand, as if the elastic-

ity is high, then they will be more careful on buy-

ing options. In this paper, we proposed a financial

option pricing model to address the pricing elasticity

concerns in above situation. Our economical model

is for implementing a future market of virtualized

resources in a system where a federation of Cloud

providers is used to reduce risks and costs associ-

ated with the capacity planning of Cloud providers.

Providers will benefit by this model to make decisions

when to buy options in advance and when to exercise

them to achieve more economies of scale.

So far, we have proposed an economic model that

considers future aspects of trading like capacity plan-

ning or resource allocation over upcoming demands.

The CAPT model empowers vendors to get addi-

tional resources as and when required. This economic

model aims for the leverage of demand and supply

form the IaaS provider and third party providers point

of view, finding suboptimal price policies between re-

sources ownered by the provider and options to ex-

ternal providers using Cloud bursting when needed.

This study covers two aspects of resource elasticity:

Resource Quantity and Price. As an outlook, our fu-

ture work includes further extension to the model that

can also support the Quality of Service (QoS) aspect

in federation environment.

REFERENCES

Calheiros, R. N., Ranjan, R., Beloglazov, A., De Rose,

A. F., and Buyya, R. (2011). Cloudsim: a toolkit for

modeling and simulation of cloud computing environ-

ments and evaluation of resource provisioning algo-

rithms. Softw. Pract. Exper., 41(1):23–50.

CLOSER2014-4thInternationalConferenceonCloudComputingandServicesScience

228

Cox, J. C., Ross, S. A., and Rubinstein, M. (1979). Option

pricing: A simplified approach. Journal of Financial

Economics, 7(3):229–263.

Dai, T.-S. and Lyuu, Y.-D. (2007). An efficient, and fast

convergent algorithm for barrier options. In Kao, M.-

Y. and Li, X.-Y., editors, Algorithmic Aspects in In-

formation and Management, volume 4508 of Lecture

Notes in Computer Science, pages 251–261. Springer

Berlin Heidelberg.

Dustdar, S., Guo, Y., Satzger, B., and Truong, H.-L. (2011).

Principles of elastic processes. Internet Computing,

IEEE, 15(5):66–71.

Gomes, E. R., Vo, Q. B., and Kowalczyk, R. (2012). Pure

exchange markets for resource sharing in federated

clouds. Concurr. Comput. : Pract. Exper., 24(9):977–

991.

Kurze, T., Klems, M., Bermbach, D., Lenk, A., Tai, S.,

and Kunze, M. (2011). Cloud federation. Comput-

ing, (c):32–38.

Mankiw, N. G. (2012). Elasticity and its applications. In

Principles of Microeconomics, 6th Edition, pages 89–

109. Harvard University.

Raj, G. (2011). An efficient broker cloud management sys-

tem. In Proceedings of the International Conference

on Advances in Computing and Artificial Intelligence,

ACAI ’11, pages 72–76, New York, NY, USA. ACM.

Rogers, O. and Cliff, D. (2012). A financial brokerage

model for cloud computing. Journal of Cloud Com-

puting, 1(1):1–12.

Samaan, N. (2013). A novel economic sharing model in a

federation of selfish cloud providers.

Sharma, B., Thulasiram, R., Thulasiraman, P., Garg, S.,

and Buyya, R. (2012). Pricing cloud compute com-

modities: A novel financial economic model. In Clus-

ter, Cloud and Grid Computing (CCGrid), 2012 12th

IEEE/ACM International Symposium on, pages 451–

457.

shyr Dai, T. and dauh Lyuu, Y. (2010). The bino-trinomial

tree: A simple model for efficient and accurate option

pricing. Journal of Derivatives, 17(4):7–24.

Toosi, A., Thulasiram, R., and Buyya, R. (2012). Finan-

cial option market model for federated cloud environ-

ments. In Utility and Cloud Computing (UCC), 2012

IEEE Fifth International Conference on, pages 3–12.

Villegas, D., Bobroff, N., Rodero, I., Delgado, J., Liu, Y.,

Devarakonda, A., Fong, L., Masoud Sadjadi, S., and

Parashar, M. (2012). Cloud federation in a layered ser-

vice model. J. Comput. Syst. Sci., 78(5):1330–1344.

Zhang, Z. and Zhang, X. (2012). An economic model for

the evaluation of the economic value of cloud comput-

ing federation. In Zhang, Y., editor, Future Communi-

cation, Computing, Control and Management, volume

141 of Lecture Notes in Electrical Engineering, pages

571–577. Springer Berlin Heidelberg.

Zhao, H., Yu, Z., Tiwari, S., Mao, X., Lee, K., Wolin-

sky, D., Li, X., and Figueiredo, R. (2012). Cloud-

bay: Enabling an online resource market place for

open clouds. In Utility and Cloud Computing (UCC),

2012 IEEE Fifth International Conference on, pages

135–142.

CloudAssetPricingTree(CAPT)-ElasticEconomicModelforCloudServiceProviders

229