E-PAYMENT SECURITY

Recommendations about the use of a PKI for e-payment security

El Bakkali Hanan

Ecole Nationale Supérieure d’Informatique et d’Analyse des Systèmes, Rabat, Morocco

Keywords: Electronic Payment, Security, Authentication, Electronic Signature, Certificates, PKI, trust model.

Abstract: The security of the electronic payment requires not only the deployment of cryptographic technologies such

as encoding

and the electronic signature, but above all, the existence of third parties of confidence whose

role is to enable the users of electronic payment applications to have confidence in the use of these

technologies. In general, Authorities of Certification belonging to the same infrastructure of management

and publication of public keys, commonly called Public Key Infrastructure or PKI, can ensure the role of

these third parties of confidence. In this paper, first of all, I will pass in review the various methods of

electronic payment. Then, the requirements of the participants of these methods will be presented. Finally, I

will introduce some elements of response to the question on which this paper is focused: "Which PKI for the

electronic payment security". Indeed, I will present my recommendations concerning both the desirable

qualities and the characteristics of such a PKI, namely, the nature of its entities, its trust model and the

format

of its certificates.

1 INTRODUCTION

No one is unaware of that we start a new era: the era

of new information technologies, where Internet

occupies an increasing important place, not only in

the traditional field of research and teaching, but

also in the artistic, medical, media field and lately in

that of the businesses and the commerce. This type

of commerce via Internet, known under the name of

e-commerce, facilitates the access of the customer to

the information and the products which are adapted

to him, and gives to the companies which adopt it an

important competitive advantage and, thanks to its

universal aspect, an opening to other markets judged

until there inaccessible.

The electronic payment is the mo

st critical part in the

deployment of e-commerce. It often requires the

authentication of all the parts implied in the payment

transaction, the integrity of the exchanged data, the

privacy of these data or, at least, the financial or

personal ones and, finally, the non-repudiation. The

electronic signature, based on public key cryptography,

seems being the suitable means to answer these

requirements, in particular, the need for authentication.

However, without a global and efficient infrastructure

fo

r the public keys management and publication, the

use of the electronic signature remains vain, even

foolish. Indeed, even with the

use of reliable crypto-

graphic protocols which are based on electronic

signature, the mutual authentication of a transaction

actors assumes that each one of them is convinced of

the authenticity of the binding between the other actor

and its public key. The last requirement is precisely

ensured by this type of infrastructure, commonly called

Public Keys Infrastructure (PKI), whose role is to

allow to the users of e-commerce applications to have

`trust' in the use of cryptographic technologies and,

particularly, that of the electronic signature. A PKI uses

for assuming its role the public keys certificates which

make it possible to bind a key to its owner. These

certificates are generally signed by certification

authorities (CAs) of trust that are the PKI key components.

Convinced of the necessity

of a PKI for electronic

payment security purposes, I will try in this paper to

bring some answers to the crucial question: "Which

type of PKI is adapted to the needs for electronic

payment securisation?". The first section of this paper

points out the various methods of electronic payment

according to the used payment instrument. The second

section is devoted to the requirements of the users of

these methods. In the third and last section, I will present

my recommendations concerning desirable qualities in a

PKI for the electronic payment (PKIEP); then, I will

317

Hanan Bakkali E. (2004).

E-PAYMENT SECURITY - Recommendations about the use of a PKI for e-payment security.

In Proceedings of the First International Conference on E-Business and Telecommunication Networks, pages 317-323

DOI: 10.5220/0001396803170323

Copyright

c

SciTePress

translate these qualities of a general nature into terms of

some characteristics suggested for this PKIEP.

2 E- PAYMENT METHODS

The electronic payment has the same actors as the

conventional payment; thus, it has at least a payer and

a paid. Particular financial intermediaries (banks,

credit card operators, compensation systems, etc) can

intervene according to the used payment instrument.

The computerized infrastructure connecting these

intermediaries is already set up on a worldwide scale.

The e-payment contribution lies in the computeriza-

tion of the relation between the paid, the payer and the

financial universe in general. The figure1 shows the

general architecture of an electronic payment system

(O’Mahony, 1997) with the various transactions

between its participants. The issuer is an organization

(in general, the payer bank) which issues to the payer

a valid instrument of e-payment whereas the acquirer

is an organization (in general, the paid bank) that the

paid has charged with checking the validity of the

instrument of payment used by the payer at the time

of the payment transaction and, then, to credit its

account with the transaction amount. The methods of

e-payment are generally classified according to the

payment instrument on which they are based.

Nowadays, we distinguish three types of instruments,

which are all inspired by conventional payment means:

electronic cheque, electronic money and credit card.

2.1 Payment with e-cheque

An electronic cheque (e-cheque) must contain an

instruction addressed to the payer bank to carry out a

payment of a specific amount to an identified paid.

The fundamental difference with its paper counterpart

is that this instruction is in an electronic form and is

conveyed via telecommunications networks as Internet.

The e-cheque must contain the electronic signature of

the issuer as well as a paper cheque contains its

handwritten signature. Indeed, in both cases, the

signature ensures the paid about the payer identity.

In addition, an e-cheque, contrary to a paper cheque

which is supposed to circulate only between few

`hands’, is brought to cross an open network where the

information it contains can be intercepted and misused

by bad intentioned people. For this reason, the e-

cheque has to be encrypted before being transmitted.

Lastly, the e-cheque is an electronic instrument of

payment which is intended to be the equivalent of

the paper cheque in the electronic commerce, while

decreasing the risks of fraud, the time of transaction

and the the cheque handling costs. However, even if

it has these advantages as well as indisputable

others, its expansion can be made only if there is a

global PKI implying a growing number of banks and

thus facilitating the use of the electronic signature all

over the world. In the absence of this PKI, the

solutions implying the e-cheque will have an

‘owner’ character and thus, their use will be limited

as it is the case of NetCheck (Netcheck, 2003).

2.2 Payment with e-cash

E-cash is money under electronic form. It is thus

represented by numerical data, which must inform

about the value of the electronic money in question

and the issuing organization (for checking and

money recovery by the paid) and if possible preserve

the anonymity of the payer. Like its counterpart in

the conventional world, the e-cash must also allow

the checking of its authenticity. This authenticity is

proven thanks to the electronic signature of its issuer.

The problem which is particular with the e-cash and

which is not posed with the ordinary cash is the risk

of the sending of the same e-cash on several

occasions to carry out different payments (double

spending). Some systems of payment by e-cash try

to resolve this problem by conserving, in the issuer

databases, the coins already used, as well as the

association of an expiration date to each coin in

order to prevent that these databases do not become

too bulky. Other systems are based on the resistance

of the chip cards (electronic purse) towards faking

attempts to guarantee the use, no more than one

time, of the coins stored on this support.

At first sight, the e-cash presents many advantages, in

particular, for the micro-payments. However, its practical

use remains prone to many challenges. Indeed, unless

being satisfied with solutions whose extent is very

limited as it was the case of E-cash of Digicash (this

solution knew an unhappy failure four years ago), the

future of e-cash resides, on the one hand, in vulgarizing

the chip cards use in order to proceed in an off-line

way without fearing the problem of double spending

and, on the other hand, in the adhesion of the e-cash

ICETE 2004 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

318

Deposit retreat collection

Clearing system

Acquirer

Paid

Payer

Issuer

payment

Figure1: Payement system architecture

issuers (generally banks) in a global PKI and this, in

order to enable paids to check the issuers signatures by

using their certificates and then to be sure about the e-

cash authenticity before even the deposit transaction.

2.3 Payment with credit card

In U.S.A and Europe, credit cards are very much used

like means of payment, not only for the proximity

purchases (great surfaces, hotels and so on), but also

for shopping by telephone or via Internet. Indeed, and

before even the ‘fury’ for the e-commerce, credit cards

were already used for the payment via the telephone

which was used for the transmission of the credit card

number and its expiration date, from the cardholder to

the merchant. This established fact allows credit cards

to become the first means of payment on Internet.

However, in this case and contrary to the conventional

one, the payment validation is based only on the

credit card number and its expiration date and not on

the card itself. Moreover, in absence of a receipt

signed by the payer, the paid cannot check if he is the

legitimate cardholder. In addition, the payer does not

have really any insurance as for the paid identity and

also he risks that its credit card number will be

intercepted and perhaps misused by an intruder.

It is for these reasons that encryption and electronic

signature mechanisms and then certificates are used

massively in e-payment methods by credit card.

They must ensure the privacy of critical information,

the integrity of the transactions, as well as the

authentication of the payer, the paid and any other

implied part such as a third organization which play

the role of the intermediary between the paid and the

financial organizations (credit card operator, acquirer &

issuer) to carry out the payment authorization and the

money deposit in his account, and between the payer

and the paid to ensure the privacy of the transaction

and the mutual authentication of the two parts.

Credit cards are certainly, at the present time, the

favorite means of payment on Internet but that does not

prevent that many among the Net surfers still hesitate

to cross the step by giving their credit card number to a

'virtual' and completely unknown merchant (especially

for the first time). Moreover, many are the countries (as

mine) in which the citizens do not have the possibility

yet of paying by credit card on Internet because of the

not-convertibility of their national currency. For the

hesitant ones, the encoding of the credit card number

before its sending to the merchant via Internet (as it is

possible by using SSL (Freir, 1996)) is far from being

sufficient, because if that protects them from the

intruders, it does not do the same vis-à-vis the

merchant. In this connection, the implication of an

intermediate organization of trust makes it possible to

ensure the payer for the credibility of the merchant.

However, the not-disclosure of the credit card number

to the merchant remains always more reassuring. The

protocol SET (MasterCard, 1997) that was developed

jointly by visa and MasterCard with other partners

precisely makes it possible to avoid this disclosure.

However, SET supposes the existence of a hierarchical

PKI for the certificates management, necessary to the

authentication of the paid, the payment gateway (third

part of trust) and the payer, which is currently different

for each solution of e-payment based on SET.

3 E-PAYMENT REQUIREMENTS

The electronic payment can take a true take-off only if

the used methods fulfill the requirements of the

various actors. Admittedly, the criteria to be satisfied

can vary from a method to another and from an actor

to another. Nevertheless, three essential criteria make

the unanimity of all the actors, that are: security,

conviviality and universality of the payment process.

3.1 Security

Security is the most paramount criterion of a method

of e-payment. This security is not however supposed

to exceed that usually assured by the conventional

payment methods. Indeed, the payment security is

not synonymous with impossibility of frauds or

conflicts between actors. This criterion of security

cannot be filled by a method of e-payment only if it

ensures the following points:

-Authentication: It is the process that allows the identity

checking of an actor by another. As we’ve seen, each

part implied in a payment transaction (except sometimes

the payer) must be able to be authenticated in a sure way

by the others. For example, a purchaser must be sure about

the merchant identity before the payment transaction.

E-PAYMENT SECURITY - Recommendations about the use of a PKI for e-payment security

319

- Authentication of the instrument of payment: The

payment instrument himself must be conceived in

such way that the parts concerned can check its

validity. As we saw that in the case of a payment by

e-cash, the paid must ensure itself of the authenticity

of the electronic coins, which he receives, from the

payer and this by checking the issuer signature.

-Privacy: The information contained in the transactions

of an e-payment method in particular the payment

transaction must remain confidential and only readable

by its recipient(s). For example, the credit card number

must be illegible except for the part(s) which must

know it to make succeed the payment transaction.

- Integrity: it makes it possible to prove to the actors

of an e-payment method that the information

contained in a transactions is authentic in the sense

that it was not modified by unauthorized thirds.

- Non-repudiation: It allows to protect the payer

against the possible refusal from the paid to deliver

the actually paid goods/services and this, while

denying to have received the corresponding payment

transaction. It also permits to protect the paid against

false complaints from the payer.

3.2 Conviviality

A method of e-payment must be easy to use and also

to implement particularly on the level of the payer.

The response times must be acceptable especially for

the on-line methods. It should be noted here that the

conviviality of the payment process does not go hand

in hand with its security. However, it is necessary that

a payment method overcome these problems by finding

a compromise between the two so that the satisfaction

of the actors requirements as for the payment security

does not block the method conviviality.

3.3 Universality

Internet being universal, a method of payment via

Internet which can be adopted only by one restricted

community on the level of the payers or of the paids,

does not offer to the latter all the copetitive

advantages of the e-commerce. The e-payment

method ‘quality’ is also measured by the possibility

of its adoption by general public.

4 WHICH PKI FOR THE E-

PAYMENT (PKIEP)?

The description of the various methods of e- payment

as well as the requirements of the actors of these

methods, which we have just seen in the preceding

sections, show that a global PKI is essential to ensure

the security of the electronic transactions between

these actors who can a priori not have any pre-

established relation between them and even to belong

to different legislations. In this connection, we notice

that more and more governments become aware of

the importance of such a PKI for the e-commerce

deployment. The government of Canada is, on this

level, pioneer in the implementation of a PKI which

aims at satisfying the security requirements of the

electronic service of the federal services but also to

emphasize Canadian industry on a leader position in

the increasingly popular field of the e-commerce (

The

Government of Canada PKI,

2004). Asia on its side has a

forum for the promotion of PKIs and the e-commerce

which is called Asia PKI Forum (

Asia PKI Forum,

2002

). The first forum took place in June 2001 in

Tokyo and he knew the participation in more of Japan

of many Asian countries like Malaysia and Indonesia.

In this paper, I anticipate a little while thinking of

qualities and characteristics of a global PKI for the

electronic payment (PKIEP) and which would be, I

hope that, probably the fruit of such forums.

4.1 Recommended qualities in PKIEP

I present in what follows the qualities that I

recommend in this PKI for e- payment PKIEP:

- Global: PKIEP must be able to provide its services

to the potential users of e-commerce applications,

namely, the community of Net surfers, the companies

which are presents (or will become so) on the Web as

well as governments, banks, credit card operators, etc.

-Extensible: More the Net surfers number increases

more the potential users number of the e-commerce

applications increases too. It is thus obvious that PKIEP

must be extensible in order to follow the growing

number of its users and their corresponding certificates.

- Flexible: PKI basic technologies are various and

can moreover know important changes and

improvements in the future. PKIEP should not

depend closely on technologies which it uses. It

must be, on the contrary, flexible in such way that

can be adapted to new technologies as they appear.

- Universal: if PKIEP will be ‘born’, the developed

countries will be the countries most implied in its

creation. Nevertheless, from its global nature, several

governments and organizations with high international

notoriety and operating in financial and communications

security fields must take part in its development and, once

created, participate in its management and maintenance.

-General: A PKI of this scale and inevitably implying

a heavy investment on behalf of several participants

should not be limited to only one type of use. The

various e-payment applications must be concerned as

like as those of other e-commerce applications.

ICETE 2004 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

320

-Of trust: CAs of PKIEP must enjoy of notoriety near

the end-users. Indeed, the governments implication is

more than desirable. Also, it is necessary that the

certificate policies of CAs be available to the certificates

verifiers so that they can judge of the confidence degree

which they will assign to the certificates issued by these

CAs. On this subject, it is very useful that these

policies are written in a formal way in order to allow

an easy and non-ambiguous reading.

- Feasible & convivial: It should not be so much

‘perfect’ at the point to become impracticable. It

should not be forgotten that e-commerce is not

supposed being surer than traditional commerce.

Moreover, if the e-payment applications must become

less convivial to be able to use the PKIEP services,

the users naturally will turn aside from these applications.

These qualities are obviously both general and

informal; they show, however, the great difficulty of

the undertaking task to create this PKI and even the

practical impossibility of this task. I believe, in spite

of that, that while proceeding in a progressive way

this PKIEP-dream can become a reality, especially if

there is behind a real determination and if the

tendency towards the commerce globalization and the

fury towards the e-commerce applications continue.

4.2 Recommendations concerning the

PKIEP characteristics

In this section, it is a question of presenting my

recommendations concerning the PKIEP characteristics

for which I discussed above the general ‘qualities’. The

PKIEP characteristics, that I consider here, relate to its

certificates format, its trust model and its entities.

4.2.1 Certificates format

To remain in conformity with qualities of

universality and globality of the PKIEP, there should

preferably have one format for the certificates.

However, this format must be flexible enough to

contain the various types of certificates, that is to

say, identity and authorization certificates.

X.509 V3 format (Housley, 1999) could be the format

used in PKIEP provided that it undergoes certain

improvements. Among those, I suggest that the

‘name’ field becomes more general in the way that it

will contain information not identifying the certificate

subject, for example, a nickname (

Clarke, 2001).

Moreover, one extension -to be standardized- should

be reserved for the attributes, roles or privileges of

the certificate subject. Indeed, it is sometimes

useless to know the payer identity, but what it is, on

the other hand, necessary, it is to know some ones of

its attributes. I notice besides that the majority of the

individual/payers prefer to keep their anonymity at

least with respect to the paid.

At this level, to minimize the risks of frauds, I propose

that only the CA, which certifies the payer, takes note

of its identity at the time of its first registration. This

CA issues then an attributes certificate to him -after

checking their attributes-which comprises a 'Nickname'

that it will associate to its true identity and this, for

example, in a confidential document that the payer

should sign. Among the attributes which could be

useful to individual/payer, I propose the followings:

age, nationality, profession, police record, existence of

a valid account for e-cheques, e-cash or credit card, a

hash of the account or credit card number, etc.

In addition, I prefer that the paid and the other actors

be identified to avoid many frauds. However, I

suggest also, for the paids/merchants certificates,

that the extension reserved to the attributes contains

information which can be useful for the payers, such

as: Web site address, references, certifications, trading

licence number, jurisdiction, sales turnover, etc.

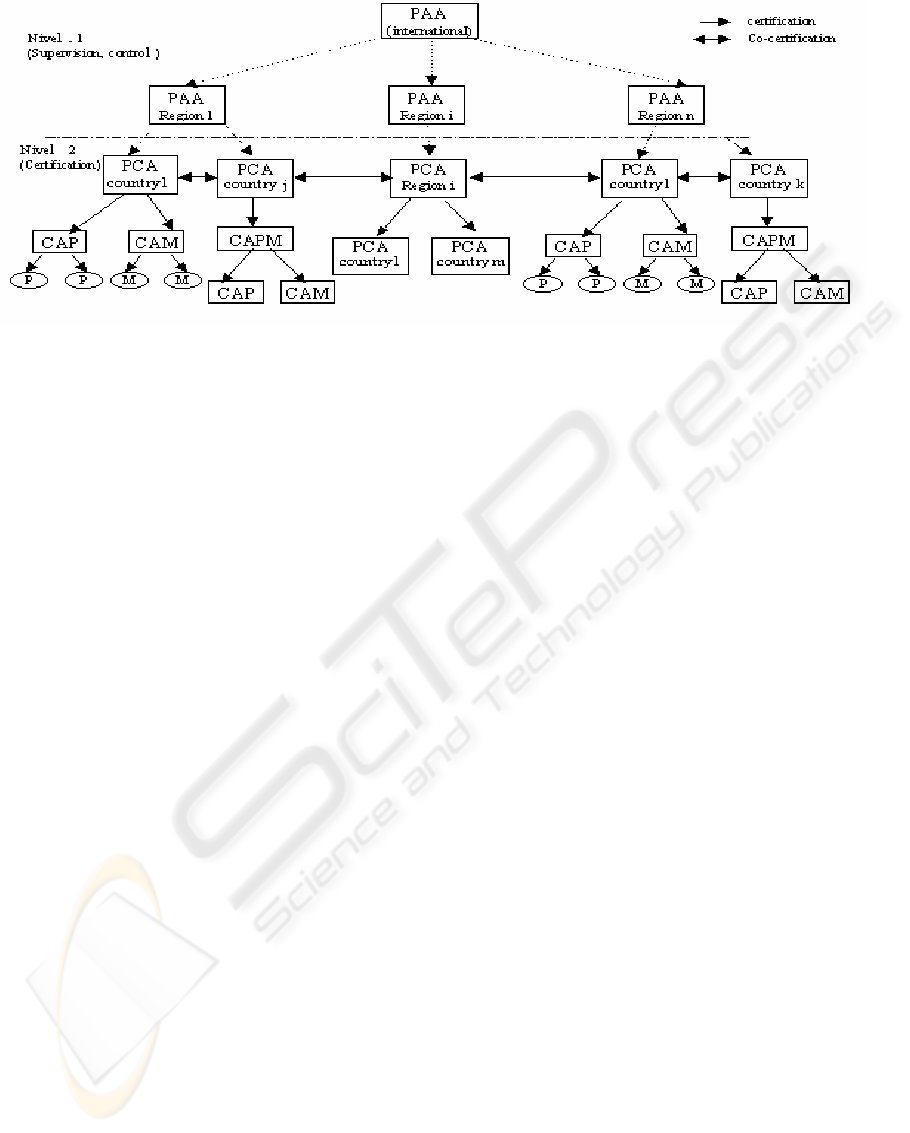

4.2.2 Trust model and entities of PKIEP

Figure 2 shows the architecture of the trust model

that I suggest for PKIEP. As it is illustrated through

this figure, I suggest the existence of various types of

entities, each one with different functions. Indeed, I

make the distinction, on the one hand, as it is often the

case in a PKI, between two categories of entities: end

entities (EEs) and certification authorities (CAs) and, in

addition, between various types of the same category:

a- EEs of PKIEP:

I suggest making the distinction between two kinds

of EEs: on a side, the web surfers who will play the

role of payers primarily and, more rarely, that of

paids; and on the other side, merchants and

companies present on the Web which will play the

role of paids but also of payers (in the case of B to B).

b- Certification Authorities of PKIEP:

I insist here on the importance owing to the fact that all

the CAs of PKIEP must be trustworthy and especially

‘approved’ by their corresponding governments. Indeed,

it is not necessary that the users of e-payment methods,

all over the world, be constrained to undergo the

monopoly of a private company (like that it seems to be

concretized with Verisign (Verisign, 2004)). In addition,

I suggest that there are various types of CAs in PKIEP:

- PCAs (Policy Authorities Creation): are CAs ables

(and authorizeds) to establish suitable certificates

policies to various contexts of e-payment or e-

commerce. As it is shown on the figure2, I propose that

each country has at least one PCA under the supervision

of the government that can be, in its turn, certified and

E-PAYMENT SECURITY - Recommendations about the use of a PKI for e-payment security

321

Figure 2: Trust model proposed for PKIEP

'supervised' by a higher level PCA, which would

correspond to the 'economic' region of this country.

I encourage, here, co-certification between PCAs which

the role is to certify CAs of their country and to check

the respect by these CAs of the certificate policies.

- CAMs (CAs for Merchants): are CAs specialized in

the certification of merchants and companies present

on the Web and which want to adhere to PKIEP.

These CAMs must be equipped with means which

enable them to check the attributes of one merchant

(society), as those which I mentioned in (4.2.1).

I think that CAMs can be under the supervision of the

Chamber of Commerce or the Commerce Ministries.

- CAPs (CAs for Private persons): are CAs which

can certify only private persons who want to use

applications of e-payment. These CAPs must have

trust relationships with these private persons in the

real world. The banking organizations are thus very

suitable for this role especially that they are already

equipped with technical skills in the field of security.

- CAPMs (CAs for Private persons and Merchants):

are CAs which can play the role of CAMs and CAPs.

These CAPMs can certify in their turn CAMs and

CAPs if the number of merchants and private persons

wanting to adhere to PKIEP would require it.

Lastly, I suggest that the PKIEP 'initiators' be under the

responsibility of several governments, as being, for

example, the members of a committee of the United

Nations, the World Organization of the Trade or of the

International Chamber of Commerce. This committee

should start by creating an entity PAA (Policy Approval

Authority) that will have, as an initial task, to work out

the general directives concerning the PKIEP objectives

and the roles of its various entities. Once the PKIEP

created, this PAA should approve the certificate

policies created by different PCAs, control the respect

of these policies by these PCAs and finally supervise

co-certifications between PCAs of various countries.

This 'world' PAA could delegate some of its functions

to regional PAAs which would be more able to control

PCAs of their region. It is advisable to specify here

that the PAAs should not issues certificates, in order to

avoid the problem having a Root-CA for all the world

as well as the limitations raised in (Josang, 2000).

5 CONCLUSION

The e-payment methods are as diversified as the

conventional ones. Nevertheless, their use is undeniably

more limited and this, primarily because of the insecurity

feeling which they inspire to a great number of users.

The security of e-payment methods is thus the key

factor of their deployment. In this connection, the

existence of a global PKI having precisely as objective,

the security of these methods, would allow their

expansion and, then, the takeoff of the e-commerce.

In this paper, I presented my recommendations

concerning desirable qualities in such a PKI and a part

of my vision as-to the nature of its entities, its trust

model and the format of its certificates. I thus hope

that these recommendations constitute a contribution,

though modest, in the emerging of such a PKI.

Lastly, I currently work on other characteristics of

this PKI, in particular its certificate policies.

REFERENCES

Clarke, R., 2001. The Fundamental Inadequacies of

Conventional Public Key Infrastructure, In ECIS’01.

Freir, A., Karlton, P. and Kocher, P., 1996, The SSL

Protocol version 3.0, Internet Draft.

Josang, A., Pedersen, I.G., and Povey, D., 2000, PKI

Seeks a Trusting Relationship, in ASISP 2000.

Housley, R., Ford, W., and Solo, D., 1999, Internet PKI;

Part I: X.509 Certificate and CRL Profile, IETF X.509 PKI

(PKIX) Network Working Group, RFC2459.

ICETE 2004 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

322

MasterCard and Visa, Secure Electronic Transaction

(SET) Specifications book 1,2,3, 1997.

O’Mahony, D., Peirce, M., and Tewari, H., 1997,

Electronic Payment Systems, Artech House.

Asia PKI Forum, 2002, http://www.asia-pkiforum.org/

Netcheck, 2003, http://www.netcheck.com

The Government of Canada PKI,

2004,

http://www.cse.dnd.ca/en/services/pki/pki.html

Verisign Server, 2004, http://www.verisign.com/

E-PAYMENT SECURITY - Recommendations about the use of a PKI for e-payment security

323