A CREDIT CARD USAGE BEHAVIOUR ANALYSIS

FRAMEWORK - A DATA MINING APPROACH

Chieh-Yuan Tsai

Department of Industrial Engineering and Management, Yuan Ze University

No. 135, Yuantung Rd., Chungli City, Taoyuan County, Taiwan

Keywords: e-Commerce, Customer Relationship Management, Data Mining, LabelSOM, Fuzzy Decision Tree.

Abstract: Credit card is one of the most popular e-payment approaches in current online e-commerce. To consolidate

valuable customers, card issuers invest a lot of money to maintain good relationship with their customers.

Although several efforts have been done in studying card usage motivation, few researches emphasize on

credit card usage behaviour analysis when time periods change from t to t+1. To address this issue, an

integrated data mining approach is proposed in this paper. First, the customer profile and their transaction

data at time period t are retrieved from databases. Second, a LabelSOM neural network groups customers

into segments and identify critical characteristics for each group. Third, a fuzzy decision tree algorithm is

used to construct usage behaviour rules of interesting customer groups. Finally, these rules are used to

analysis the behaviour changes between time periods t and t+1. An implementation case using a practical

credit card database provided by a commercial bank in Taiwan is illustrated to show the benefits of the

proposed framework.

1 INTRODUCTION

Companies across all sectors and of all sizes are now

benefiting from Internet e-commerce where services,

information and/or products are exchanged via the

web. To finalize the online transaction, providing

convenient e-payment approaches for consumers are

very important. Among several e-payment

mechanisms, credit card is one of the most welcome

approaches for online stores. Card issuers earn their

profit from the fee charged to the store that accepts

the credit card, charging interest on outstanding

balances, and fee charged to customers. The major

fees contributed from customers are (1) payments

received late (past the "grace period"); (2) charges

that result in exceeding the credit limit on the card

(whether done deliberately or by mistake); (3) cash

advances and convenience checks; and (4)

transactions in a foreign currency. However, raising

these fees or interesting rates to increase the profit of

card issuers could be very difficult in current

competitive credit card markets.

Another strategy to increase the profit of card

issuers is to forge closer and deeper relationships

with customers by emphasizing on customer

relationship management (CRM) (Giudici and

Passerone, 2002; Tsai and Chiu, 2004). CRM

focuses on customer’s need and regard customer life

cycle as important assets of an enterprise. Due to the

advance of the Information Technology (IT), it is

easy to discover the usage information of what their

customers purchase, when they use the card, and

how often they consume. When the usage

information is available, the card issuers can

encourage customers use their cards more frequently

through offering suitable products and services.

Data mining is the technique to discover

meaningful patterns (rules) from large databases.

Much of existing data mining researches in credit

card fields has focused on building accurate models

for risk and scoring analysis (Lee et al. 2006), cross

selling (Wu and Lin, 2005), and fraud detection

(Kou et al. 2004; Chen et al., 2005b). Relatively

little attention has been made to analyze pattern

changes in databases collected over time (Donato et

al., 1999). However, customer behaviour usually

changes over time. Some frequent patterns at one

time period may not be valid for another time period

(Chen et al., 2005a; Tsai et al., 2007). For example,

a group of customer has preference in shopping at

department stores this year and might change their

preference to doing outdoor activities and travelling

219

Tsai C. (2007).

A CREDIT CARD USAGE BEHAVIOUR ANALYSIS FRAMEWORK - A DATA MINING APPROACH.

In Proceedings of the Second International Conference on e-Business, pages 219-226

DOI: 10.5220/0002108102190226

Copyright

c

SciTePress

in the following year. If issuers cannot capture the

behaviour change dynamically due to the time

difference, it will be hard to retain customers by

tailoring appropriate products and services to satisfy

their real needs.

This paper is organized as follows. Section 2

reviews the literatures related to the change analysis

models. Section 3 introduces the proposed credit

card usage analysis framework that adopts

LabelSOM algorithm and fuzzy decision tree

algorithm. Section 4 provides an implementation

case using a practical credit card database provided

by a commercial bank in Taiwan to demonstrate the

benefit of the proposed framework. A summary and

future works are concluded in Section 5.

2 LITERATURE REVIEW

Current businesses face the challenge of a constantly

evolving market where customer’s needs are

changing rapidly. Some researches applied customer

demographic variables such as recency, frequency,

and monetary (RFM) to analyze customer behavior

(Tsai and Chiu, 2004). Although RFM analysis can

effectively investigate customer values and segment

markets, it is not a suitable tool for detect the

customer behavior changes. Therefore, to better

understand customer behaviors, developing suitable

change detection models becomes an important

research topic in the financial business.

Except the studies of rule maintenance in the

changed database, some researches focus on

discovering emerging patterns. Emerging pattern

mining can be defined as the process to discover

significant changes or differences from one database

to another (Dong and Li, 1999). Emerging pattern

captures emerging trends in time stamped database.

Another related research trend is subjective

interestingness mining. Interestingness mining is to

find unexpected rules with respect to the user’s

existing knowledge. Unexpected changes compare

each newly generated rule with each existing rule to

find degree of difference (Liu and Hsu, 1996). Liu et

al. (Liu et al., 1999) proposed a DM- II (Data

Mining-Integration and Interestingness) system

which has classification and association rule mining

tasks to help users perform interestingness analysis

of the rules. Its analysis compares each newly

generated rule with each existing rule to find degree

of difference, which is useful and important for real-

life data mining applications. Han et al. (1999)

presented several algorithms for efficient mining of

partial periodic patterns, by exploring some

interesting properties related to partial periodicity.

The algorithms show that mining partial periodicity

needs only two scans over the time series database to

make efficient in mining long periodic patterns.

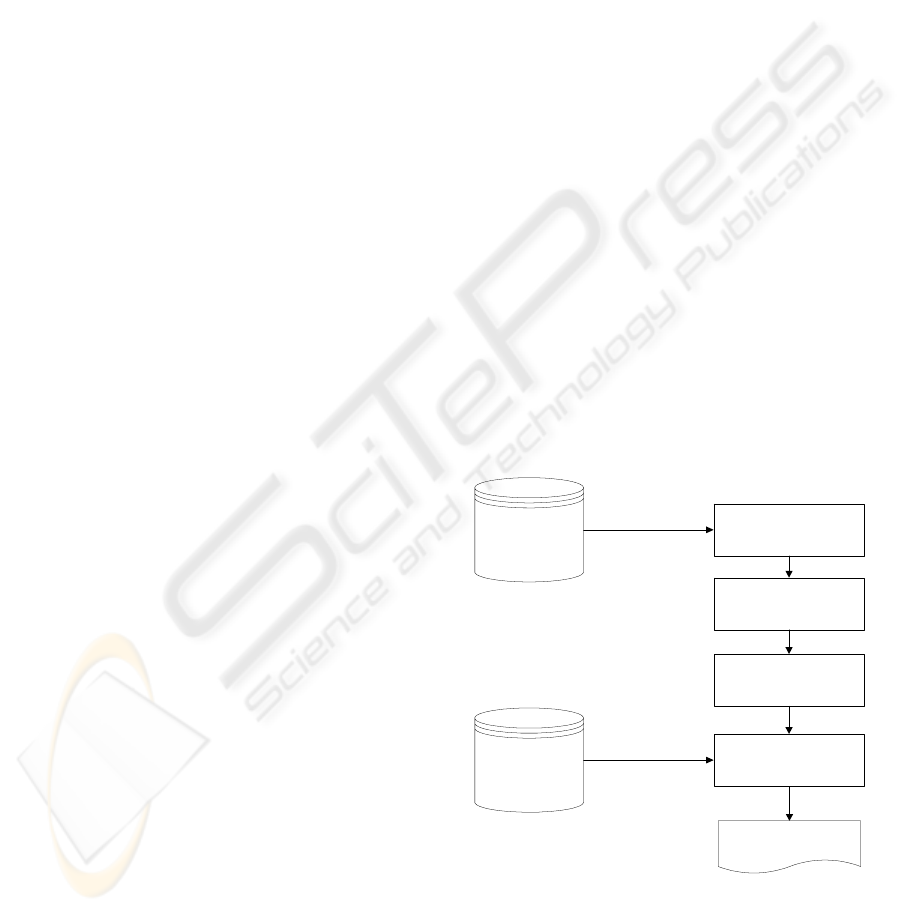

3 ANALYSIS FRAMEWORK

The proposed credit card usage behaviour analysis

framework consists of four major stages as shown in

Figure 1. The first stage is data extraction and pre-

processing. In this stage, the customer profile and

their transaction data at time period t are retrieved

from databases. The second stage is to conduct

customer segmentation using the LabelSOM neural

network. The LabelSOM adaptively cluster

customers into groups and automatically identifies

critical demographic features for each group. In the

third stage, the usage behaviour of the customers in

the interesting group is generated using fuzzy

decision tree (FDT) algorithm that represents usage

behaviour as a set of IF-THEN rules. After obtaining

the usage patterns of interesting customer group at

time period t, we can trace the behaviour changes of

these customers from time period t to t+1 when

retrieving their corresponding data at time period t+1.

The LabelSOM algorithm in the second stage and

the FDT the third stage are further introduced in the

following sub-sections.

Customer and

Transaction data at

time period t

Customer and

Transaction data at

time period t+1

Data Preprocessing

LabelSOM

Neural Network

Fuzzy Decision Tree

Chang Analysis

Select appropriate

customer groups

Generate usage

behavior rules

Marketing

Suggestions

Figure 1: The proposed credit card usage behaviour

analysis framework.

ICE-B 2007 - International Conference on e-Business

220

3.1 Label Self-Organizing Map

(LabelSOM)

Self-Organizing Map (SOM) neural network,

proposed by Kohonen (1990), is recognized as

one of the popular clustering methods. The SOM

employs a competitive unsupervised learning

technique to project high dimension data into a

two-dimensional grid without destroying data

topology. Data points that are close each other in

the input space are mapped to nearby output

neurons in the SOM. An input neuron represents

a data feature in N dimension and an output

neuron represents the clustering result in two-

dimensional space. The output neuron that has the

highest similarity with an input data point is

claimed as the winner (the best matching unit).

The weights of the winner node and its

neighbouring neurons are then adjusted

automatically to force the weights closer to the

input vector. After completing this learning

process, each neuron represents a set of data.

Self organizing maps are an unsupervised

neural network model which lends itself to the

cluster analysis of high dimensional input data.

However interpreting a trained map could be

difficult because the features responsible for a

specific cluster assignment are not evident from

the resulting map representation. To solve this

difficulty, the LabelSOM was developed to

automatically label every node of a trained SOM

(Rauber and Merkl, 1999). That is, LabelSOM

algorithm can not only conduct cluster operation

well but also distinguish the difference between

each cluster clearly. Therefore, the LabelSOM is

adopted for customer segmentation in our second

stage.

The operations of the LabelSOM algorithm

are summarized into the following five steps.

1. Input the primary parameters of the

LabelSOM. The primary parameters include the

number of input neurons, number of output

neurons, number of input data, learning iteration,

learning rate

α

, and radius

η

. In addition, initial

weight matrix W is set randomly.

2. Conduct the following three sub-steps for each

input vector

12

( , ,... )

iiiik

x

xx x= sequentially

where

1,2,...,im=

, m is the total number of input

data points and k is the number of neurons in the

input layer. Notes that k is also the number of

features for an input point.

Calculate the Euclidean distance d

j

between

the input vector i and output neuron j. That

is,

jij

dxw=− where

12

( , ,..., )

j

jj jk

www w

=

, 1,2,...,jn= , and n is

the number of output neurons.

Find the output neuron j* with minimum

Euclidean distance between output neurons

and the input vector. Mathematically, it is

represented as

min

1,2,...,

min

j

jn

dd

=

=

.

Update the weights of output neurons j*

using

** *

()

new old old

i

jj j

ww xw

ζα

=+××− where

exp( / )R

ζ

η

=

− ,

α

is the learning rate,

η

is

the radius, and R is the closed distance.

3. Decrease the learning rate α and radius η and

repeat Step 2 until the stopping criteria of the

learning process are reached.

4. After the above learning process is completed,

the quality of this network is evaluated using an

average total distance measure which is defined

as:

p

j

N

d

G

n

=

where

2

()

p

jpj

p

dxw=−

∑

is

the distance between data p and jth output node,

and n is the number of data in cluster N.

5. Let

j

D

be the set of input vector

i

x mapped

onto node j. Summing up the distances for each

vector element over all the vectors

i

x

(

ij

x

D∈

)

yields a quantization error vector

q

j

for every

node. This can be represented as:

2

(),1...

ij

jl jl il

xD

qwxlk

∈

=−=

∑

3.2 Fuzzy Decision Tree (FDT)

Decision tree algorithms are supervised learning

models that express knowledge rules using a tree

structure. Among several decision tree algorithms,

the ID3 is one of the most popular algorithms since

it is efficient and easy to operate (Quinaln, 1986).

However, data in the input vector to the ID3 should

be in categorical format. All numerical data need to

be discretized into proper categorical data format in

advance. If the discretization process is not well

performed, the classification quality of the ID3 will

be erroneous. In addition, when a new input vector is

fed to the ID3, only one branch of the tree is

initialized and the end node of the active branch

returns the class label for the new input vector.

A CREDIT CARD USAGE BEHAVIOUR ANALYSIS FRAMEWORK - A DATA MINING APPROACH

221

Although this approach is straightforward, the class

information of other branches, which are similar to

the active branch, is not considered. This might

significantly increase the classification error rate. To

solve this difficulty, fuzzy set theory is integrated

with ID3 for generating customer behaviour rules in

the third stage, called the fuzzy decision tree (FDT).

The rules generated using the FDT are easier to be

interpreted by human beings. In addition,

discretization process is not required since fuzzy

membership functions will map the numerical data

into proper membership value. Moreover, more than

one branch of the fuzzy decision tree might be

initiated. Therefore, class labels suggested by

multiple branches will be fused by majority voting

into a more trustable class label.

Let

1

{ ( ,..., , )}

n

jj j j j

Egg g gC==

%%

be the set of our

interesting customer group decided in the last stage

where

i

j

g

represents the value of attribute i for

customer

j and

j

C

is the predefined class label for

customer

j.

1

{ ,..., }

n

A

aa= is the attribute set where

i

aA∈ with value [0,1].

1

{ ,..., }

i

ii ip

Da a=

denotes

the set of fuzzy linguistic terms for attribute

i

a

where

i

ip

a

can be described using membership

function

()

ip

i

a

x

μ

. Thus, ()

ip

i

i

aj

g

μ

is the membership

value for attribute

i of vector j for fuzzy linguistic

term

ip

a . In addition, for each node N in the fuzzy

decision tree,

N

F

denotes the set of fuzzy

restrictions on the path leading to

N.

ip

Na denotes

the particular child of node

N created using

i

a to

split node

N and following the branch

i

ip

a

.

The training process for the FDT algorithm

contains five steps and is introduced as follows

(Janikow, 1998).

1. Set all input vector set of the interesting

customer group

E in the root node of the tree. At

node

N to be expanded, compute the number of

data included in the node which need to be

subdivided as:

1

C

NN

k

k

PP

=

=

∑

where

C is the number of predefined classes,

N

k

P

is the number of vectors belonging to kth

class and is computed as

{}

1

1

j

E

NN

kjCk

j

PX

=

=

=×

∑

where

{}

10

j

Ck=

=

if

j

Ck

≠

and

{}

11

j

Ck=

= if

j

Ck

=

.

2. Compute the information gain at node

N as

1

(log)

C

NN

N

kk

NN

k

PP

I

PP

=

=− ×

∑

where

i

a means all

clustering attributes which have not appeared at

path

N

F

.

3. Compute the extended attached nodes from the

above attributes

ip

Na . The information quantity

of

iip

Da

∈

is

ip

aN

I

.

4. Choose the attribute

*

i

a with largest

information gain. The formula to compute

information quantity is

i

Na

N

ai

GII=−

where

1

()

ip

ii

Na

Na D

pp

IwI

=

=×

∑

. The weight

p

w is the

proportion of examples belonging to

node

ip

Na and is shown as

ip ip

Na Na

p

p

wP P=

∑

/ .

5. Subdivide the node N again by clustering

attribute

*

i

a and delete the attached nodes with

few vectors.

4 A CASE STUDY

The proposed framework is implemented using the

database provided by a major credit card issuer in

Taiwan.

4.1 Data Extraction and Data

Preprocessing

In the database, there are 314,339 activate card users

who generated 2,153,062 transactions in year 2001

(time period t) and 2,561,202 transactions in year

2002 (time period t+1). Marketing managers want to

concentrate on the customer behaviour of their VIP

customers. The VIP selection criteria are based on

the corporation regulations, credit assessment

policies, and customer life value evaluations. “No

delayed payment is made in recent nine months” and

“lowest limit amount are paid in the past two

months” are two typical criteria they set. A serial of

COBOL (common business oriented language) and

ICE-B 2007 - International Conference on e-Business

222

JCL (job control language) programs are coded to

retrieve customer profiles and customer behaviour

data from the VSAM (virtual storage access method)

files in OS/390 operation system of an IBM

9121main frame computer. As a result, 9,086 VIP

customers are identified. In addition, these

customers made 354,063 transactions in year 2001

and 440,010 transactions in year 2002.

4.2 Customer Segmentation Using

LabelSOM

Based on the available data in the database,

demographic attributes of gender, age, marital

status, education, occupation, card holding

period, and credit limit are used to describe a VIP

customer profile. Therefore, seven input nodes

are required for the LabelSOM neural network. In

addition, a two-dimension rectangle topology is

selected as output layer. Since the clustering

quality of the LabelSOM might be affected by

different parameter settings, a number of

experiments are conducted based on literature

suggestion (Vesanto and Alhoniemi, 2000; Zhang

and Li, 1993) and our own experience. Table 1

shows the primary parameter settings in our

experiments.

Table 1: The parameters of LabelSOM.

Parameter Value

N

umber of Inpu

t

nodes 7

Topology Two-dimension rectangle

N

umber of output nodes 3~7 for each side

Learning coefficient 0.3~0.9

N

eighbourhood radius 1~35

Epoch 9,086

Training number 272,580

After a systematic experimental design, the best

clustering result with minimal distance 0.346 is

found. The best clustering result consists of five VIP

customer groups where the number of customers and

the average total distance for each group are shown

in Table 2. Table 3 shows the quantization error

vectors, introduced in Section 3.1, of all attributes

for the five groups. The smaller vector value

indicates that the attribute is more important for

distinguishing data among clusters.

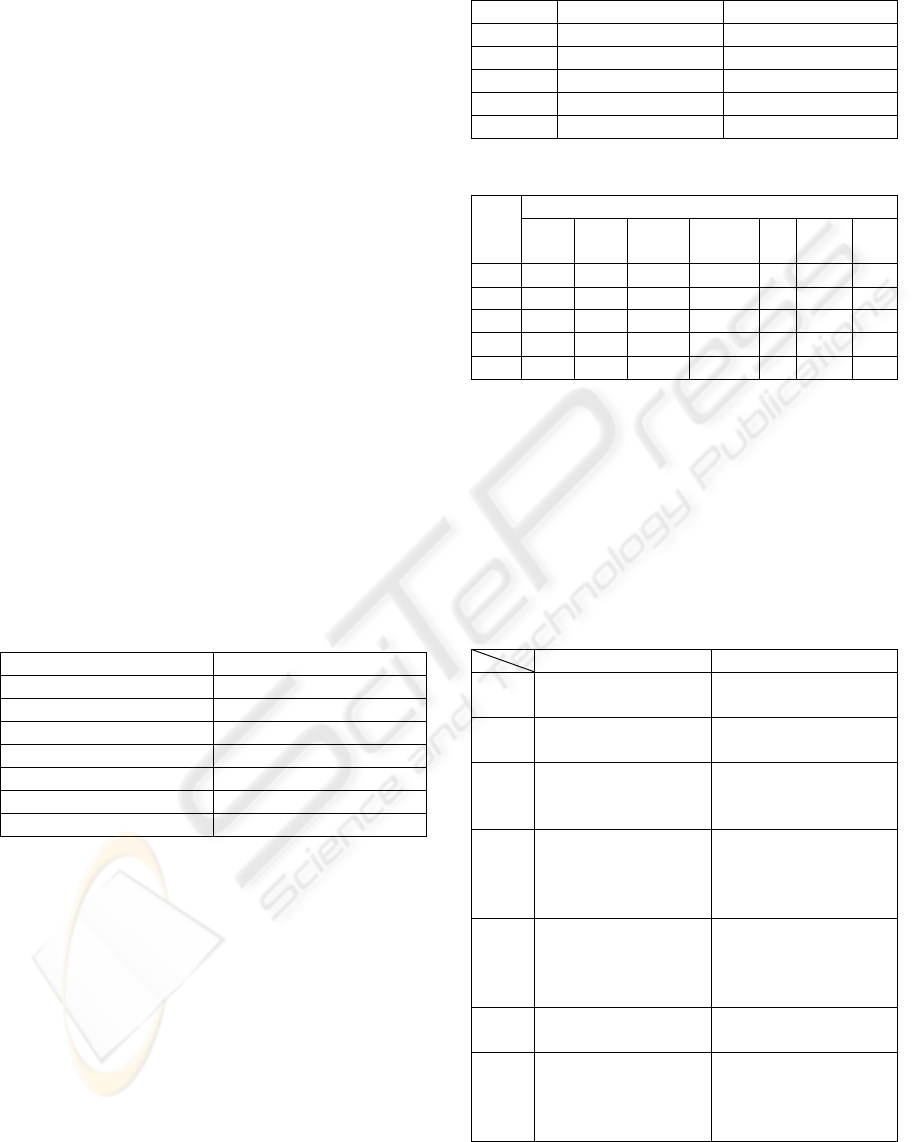

Table 2: The grouping results for the best experiment trial.

Group No. Number of Customers Average Total Distance

1 1697 0.263

2 3279 0.429

3 1594 0.369

4 1379 0.379

5 1137 0.294

Table 3: The quantization error vectors for all attributes.

Attributes

Group

No.

GenderMartial

Status

Edu. Occp. Age Holding

period

Credit

Limit

1 0 0 0 6.376 6.929 8.385 1.380

2 0 0 18.140 8.852 9.894 13.439 2.698

3 0 0 11.354 5.714 5.558 7.639 1.141

4 0 0 11.030 5.739 4.911 7.114 1.209

5 0 0 3.945 5.464 5.314 7.915 1.307

4.3 Customer Behaviour Pattern

Generation Using FDT

After discussion with marketing managers, they are

interesting in the customers in VIP Group 2. Table 4

shows the comparison between the customers in

Group 2 and all customers.

Table 4: The comparisons between Group 4 and all VIP

customers.

Group 2 Average for all VIP

Gender Male: 100%

Female: 49%

Male: 51%

Martial

Status

Married: 100%

Married: 67%

Single: 33%

Edu.

High School: 8%

Undergraduate: 54%

Graduate: 38%

High School: 5%

Undergraduate: 47%

Graduate: 48%

Occup.

Self or Intl. Business:

88%

Finance or Service: 10%

Others: 2%

Self or Intl. Business: 88%

Finance or Service: 10%

Others: 3%

Age

20~29: 0.4%

30~39: 24%

40~49: 44%

50~59: 25%

20~29: 5%

30~39: 39%

40~49: 36%

50~59: 16%

Holding

Period

3~7 Year: 59% 3~7 Year: 65%

Credit

Limit

Below 100K: 10%

100K~200K: 27%

200K~300K: 37%

300K~400K: 14%

Below 100K: 17%

100K~200K: 37%

200K~300K: 31%

300K~400K: 9%

For managerial reasons, each customer was

classified as one of the four types (Type 1 to 4)

according to their RFM scores in year 2001 (time

A CREDIT CARD USAGE BEHAVIOUR ANALYSIS FRAMEWORK - A DATA MINING APPROACH

223

period t). Marketing managers want to know

whether this classification method is still valid in

year 2002 (time period t+1). Therefore, a

classification model for year 2001 needs to be

constructed first.

There are two factors that might affect the

inference result of the FDT algorithm. They are the

number of linguist terms for each variable, and the

shape of membership functions for each linguistic

term. To understand the influence, the following

experiments are conducted.

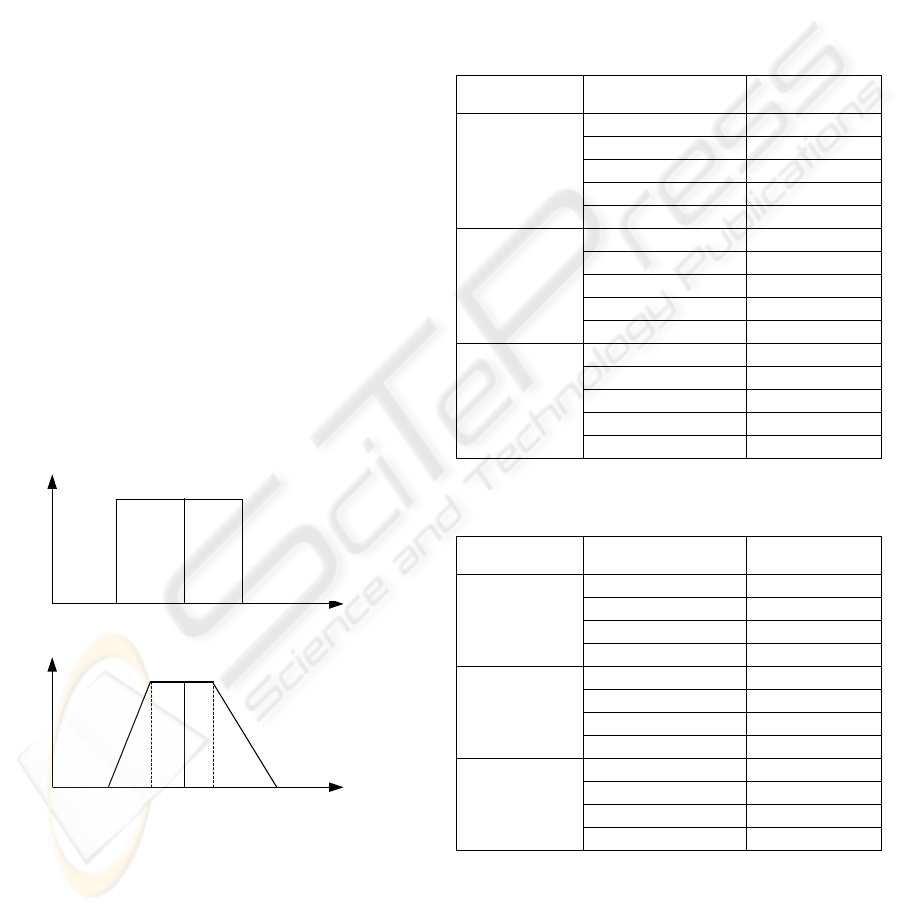

Assume that a trapezoid membership function,

which can be described as T(a, b, c, d, e), is to

represent an numeric interval in this study where a is

the left-bottom corner point, b is the left-top corner

point, c is the middle point between b and d, d is the

right-top corner point, and e is the right-bottom

corner point. If we adjust top and/or bottom widths

of T(a, b, c, d, e), the fuzzy degree will be different.

Therefore, an experiment Shape(x, y) denotes that a

trapezoid fuzzy number T(a, b, c, d, e) is modified as

T (a×(1-y), c-(c-b)×x, c, c

+(d-c) ×x, e×(1+y)). For

example, Figure 2(a) shows a linguistic term

“Medium” with a crisp membership function

T(210000, 210000, 250000, 290000, 290000) for a

“credit limit” attribute, while Figure 2(b) shows the

fuzzy membership functions T(199500, 240000,

250000, 260000, 304500) after Shape(25%, 5%) is

applied to T(210000, 210000, 250000, 290000,

290000).

μ (χ )

1

Credit Limit

199500 304500240000 250000 260000

(b)

μ (χ )

1

Credit Limit

210000 290000250000

(a)

Figure 2: Crisp and fuzzy membership functions.

Table 5 shows examples of our experiment result

when an attribute is represented using 3, 5, and 7

linguistic terms respectively. For each linguistic

term, one crisp and four fuzzy membership functions

with different bottom widths are experimented. It is

clear that the classification accuracy using fuzzy

membership functions are higher than the one using

crisp membership function in all cases. In addition,

the classification accuracy using 5 linguistic terms is

higher than ones using 3 or 7. It also indicates that

when the bottom with of the trapezoid fuzzy number

increases, a more accurate classification result can

be obtained. Table 6 shows the experiment results

when the top widths of fuzzy membership functions

change.

Table 5: The classification accuracy using different

number of linguist terms and membership functions (I).

Number of

Linguistic Terms

Membership Functions

Classification

Accuracy

crisp 59%

Shape(25%, 5%) 68%

Shape(25%, 10%) 69%

Shape(25%, 15%) 72%

3

Shape(25%, 20%) 72%

crisp 63%

Shape(25%, 5%) 70%

Shape(25%, 10%) 74%

Shape(25%, 15%) 74%

5

Shape(25%, 20%) 77%

crisp 62%

Shape(25%, 5%) 69%

Shape(25%, 10%) 69%

Shape(25%, 15%) 68%

7

Shape(25%, 20%) 68%

Table 6: The classification accuracy using different

number of linguist terms and membership functions (II).

Number of

Linguistic Terms

Membership Functions

Classification

Accuracy

Shape(20%, 10%) 68%

Shape(25%, 10%) 69%

Shape(30%, 10%) 68%

3

Shape(35%, 10%) 68%

Shape(20%, 10%) 72%

Shape(25%, 10%) 74%

Shape(30%, 10%) 72%

5

Shape(35%, 10%) 72%

Shape(20%, 10%) 68%

Shape(25%, 10%) 69%

Shape(30%, 10%) 68%

7

Shape(35%, 10%) 68%

4.4 Change Analysis

Based on the experiment result of Table 5 and Table

6, managers decide to use the FDT for the following

analysis where the number of linguist terms for each

variable is 5 and the shape of membership functions

ICE-B 2007 - International Conference on e-Business

224

for each linguistic term is fuzzy(25%, 20%). Under

these settings, the FDT generate 109 rules and has

the highest classification accuracy. Among these

rules, 16 rules are to identify Customer Type 1, 30

rules are to identify Customer Type 2, 38 rules are to

identify Customer Type 3, and 25 rules are to

identify Customer Type 4. Figure 3 shows some of

these rules.

Rule1:

Usage=Very Low (0~17) &

Interest Amount = Very Low(0~432)&

Expenditure Amount = Very Low (0~27423)

=>Customer Type 1

Rule 2:

Usage =Very Low (0~17) &

Interest Amount=High(8929~18251)&

Expenditure Amount=Very Low (0~27423) &

Credit Limit=Low (125000~250000) &

=> Customer Type 2

Rule 3:

Usage =High (37~81) &

Expenditure Amount=High (119140~393753) &

Interest Amount=Very Low (0~432) &

Credit Limit=High (255000~360000)

=> Customer Type 3

Rule 4:

Usage =Very High(63~317)&

Expenditure Amount=Very High (316215~4944133) &

Credit Limit=High (255000~360000) &

Interest Amount=Low (0~432) &

=> Customer Type 4

Figure 3: Example rules generated by the FDT algorithm.

For example, rule 4 indicates that, in year 2001 (time

period t), if a customer has the usage behaviour

such as “Usage = Very High (63~317) AND

Expenditure = Very High (316215~4944133) AND

Credit Limit = Very High (310000~3600000) AND

Interest Amount = Very Low (0~432),” then he/she

should be “Customer Type 4”. When we further

check the database, 143 customers in year 2001

(time period t) satisfy this rule. However, when this

rule applies to these 143 customers in year 2002

(time period t+1), only 107 customers still confirm

this rule. 24 customers change to Type 3, 11

customers change to Type 2, and 1 customers

change to Type 1. Table 7 summarizes basic

changing information. It is surprised that all

changing persons are male customers, married, and

own business. The company should note the changes,

since customer Type 4 is most valuable for the

company.

Table 7: The changing information for Type 4 customers.

Type (4 → 1)

(1 person)

Type (4→2)

(11 persons)

Type (4→3)

(24 persons)

Gender

Male Male Male

Martial

Status

Married Married Married

Edu.

High School

and Below

High School: 2

Undergraduate: 6

Graduate: 3

High School: 4

Undergraduate: 15

Graduate: 5

Occup.

Self or Intl.

Business

Self or Intl.

Business

Self or Intl.

Business

Age

46

30~39: 3

40~49: 4

50~59: 3

60~69: 1

30~39: 3

40~49: 8

50~59: 11

60~69: 2

Holding

period

8 Year 5~10 Years 4~12 Years

Credit

Limit

500K 325K~650K 320K~1850K

Interest

Amount

Y2001: None

Y2002: None

Y 2001: None

Y2002: 1

Y2001: 1

Y2002: 3

Average

Spending

Amount

Y2001: 362704

Y2002: 242075

Y2001: 688302

Y2002: 303967

Y2001: 499210

Y2002:: 354909

5 CONCLUSIONS

The magnificent increase in credit card markets for

e-commerce leads card issuers put more efforts to

understand their usage behaviour. In reality,

customer behaviours usually change over time.

Some frequent patterns at one time period may not

be valid for another time period. To fulfil this need,

this research proposes an integrated data mining

approach for credit card usage behaviour analysis.

The proposed credit card usage behaviour

analysis framework consists of four major stages.

The first stage is data extraction and pre-processing.

In this stage, the customer profile and their

transaction data at time period t are retrieved from

databases. The second stage is to conduct customer

segmentation using the LabelSOM neural network.

The LabelSOM adaptively cluster customers into

groups and automatically identifies critical

demographic features for each group. In the third

stage, the usage behaviour of the customers in the

interesting group is generated using fuzzy decision

tree (FDT) algorithm that represents usage

A CREDIT CARD USAGE BEHAVIOUR ANALYSIS FRAMEWORK - A DATA MINING APPROACH

225

behaviour as a set of IF-THEN rules After obtaining

the usage patterns of interesting customer group at

time period t, we can trace the behaviour changes of

these customers from time period t to t+1 when

retrieving their corresponding data at time period t+1.

The proposed model has been successfully

implemented using real credit card data provided by

a commercial bank in Taiwan. The provided analysis

procedure should provide card issuers a systematic

approach to set up marketing strategies for

interesting customer groups. However, there are still

some rooms for improvement in the future.

Currently, only the fuzzy number with trapezoid

shape is considered. It is suggested that automatic

membership function fitting algorithms can be

incorporated into the proposed framework. Besides,

it will be worthwhile to explore variant customer

groups and study what marketing strategies can

affect their behaviour.

REFERENCES

Chen, M.-C., Chiu, A.-L. and Chang, H.-H., 2005a.

Mining changes in customer behavior in retail

marketing, Expert Systems with Applications, Vol. 28,

No. 4, pp. 773-781.

Chen, R., Chen, T., Chien, Y., and Yang, Y., 2005b.

Novel questionnaire-responded transaction approach

with SVM for credit card fraud detection, Lecture

Notes in Computer Science (LNCS), Vol. 3497, pp.

916-921.

Donato, J. M., Schryver, J. C., Hinkel, G. C., Schmoyer, R.

L., Leuze, M. R., and Grandy, N. W., 1999. Mining

multi-dimensional data for decision support, IEEE

Future generation Computer Systems, Vol. 15, No. 3,

pp. 433-441.

Dong, G., Li, J., 1999. Efficient mining of emerging

patterns: discovering trends and differences, In

Proceedings of the Fifth International Conference on

Knowledge Discovery and Data Mining, pp. 43-52.

Giudici, P., Passerone, G., 2002. Data mining of

association structures to model consumer behavior,

Computational Statistics and Data Analysis, Vol. 38,

No. 4, pp. 533-541.

Han, J., Dong, G. and Yin, Y., 1999. Efficient mining of

partial periodic patterns in time series database. In

Proceedings of the Fifteenth International Conference

on Data Engineering, pp. 106-115.

Janikow, C. Z., 1998. Fuzzy decision trees: issues and

Methods, IEEE Transactions on Systems, Man, and

Cybernetics-Part B: Cybernetics, Vol. 28, No. 1, pp. 1-

14.

Lee, T.-S., Chiu, C.-C., Chou, Y.-C. and Lu, C.-J., 2006.

Mining the customer credit using classification and

regression tree and multivariate adaptive regression

splines, Computational Statistics & Data Analysis, Vol.

50, No. 4, pp. 1113-1130.

Kohonen, T., 1990. The self-organizing map, In

Proceedings of the IEEE, Vol. 78, No. 9, pp. 1464-

1480.

Kou, Y., Lu, C.-T., Sirwongwattana, S., Huang, Y.-P.,

2004. Survey of fraud detection techniques, In

Proceedings of IEEE International Conference on

Networking, Sensing and Control, Vol. 2, pp. 749- 754.

Liu, B., Hsu, W., 1996. Post-analysis of learned rules, In

Proceedings of the Thirteen National Conference on

Artificial Intelligence, pp. 220-232.

Liu, B., Hsu, W., Ma, Y. and Chen, S., 1999. Mining

interesting knowledge using DM-II, In Proceedings of

the Fifth International Conference on Knowledge

Discovery and Data Mining, pp. 430-434.

Quinaln, J. R., 1986. Induction of decision trees. Machine

Learning, Vol. 1, No. 1, pp. 81-106.

Rauber, A. and Merkl, D., 1999. The SOMLib digital

library system. In Proceedings of the Third European

Conference, ECDL'99, pp. 323.

Tsai, C.-Y., Chiu, C.-C., 2004. A purchase-based market

segmentation methodology, Expert Systems with

Applications, Vol. 27, No. 2, pp. 265-276.

Tsai, C.-Y., Wang, J.-C., Chen, C.-J., 2007. Mining usage

behavior change for credit card users, WSEAS

Transactions on Information Science and Applications,

Vol. 4, No. 3, pp. 529-536.

Vesanto, J., Alhoniemi, E., 2000. Clustering of the Self-

Organization Map, IEEE Transactions on Neural

Networks, Vol. 11, pp. 568-600.

Wu, J. and Lin, Z., 2005. Research on customer

segmentation model by clustering. In Proceedings of

the 7th international Conference on Electronic

Commerce (ICEC '05), pp. 316 – 318.

Zhang, X., Li, Y., 1993. Self-organizing map as a new

method for clustering and data analysis, In

Proceedings of International Joint Conference on

Neural Networks, pp. 2448-2451.

ICE-B 2007 - International Conference on e-Business

226