SPECIFYING AND COMPILING HIGH LEVEL FINANCIAL

FRAUD POLICIES INTO STREAMSQL

Michael Edward Edge, Pedro R. Falcone Sampaio

Manchester Business School, University of Manchester, Booth Street East, Manchester, M16 6PB, U.K.

Oliver Philpott

School of Computer Science, University of Manchester, Oxford Road, Manchester, M13 9PL, U.K.

Mohammad Choudhary

Sparta Technologies Ltd, Northern Incubation Unit, Sackville Street, Manchester, M60 1QD, U.K.

Keywords: Fraud Management, Internet Fraud, Policy-Based Languages, Data Stream Processors, Compilers.

Abstract: Fraud detection within financial platforms remains a challenging area in which criminals continue to thrive,

breaching security mechanisms with increasingly innovative and sophisticated system attacks. Following

the migration from reactive to proactive screening of transactional data to reduce an organisations fraud

detection latency, fraud analysts now find themselves responsible for the maintenance of extensive fraud

policy sets and their implementation as complex data stream processing procedures. This paper presents a

Financial Fraud Modelling Language and policy mapping tool for high level expression and implementation

of proactive fraud policies using stream processors. A key aspect of the approach is reduction of the

complexity and implementation latency associated with proactive fraud policy management through

abstraction of policy functionality using a conceptual level modelling language and innovative policy

mapping tool. This paper focuses upon the rule based language model for high level expression of financial

fraud policies and the associated compiler tool for specifying and mapping policies into StreamSQL.

1 INTRODUCTION

Banking institutions have a strong interest in

increasing the speed at which fraudulent activity can

be detected due to its direct relation to financial loss,

customer service and the organisations status as

reputable financial provider. Existing research into

fraud detection mechanisms based upon data mining

has a limited capability to address the expanding

number of ubiquitous electronic delivery channels

for financial services due to the alerting latency

incurred through post transactional analysis over a

finite data store (reactive fraud management) (Kou,

Lu et al. 2004; Phua, Lee et al. 2005). Accordingly,

emerging technologies are employing real-time

processing models for continuous monitoring of

streaming service channel data and triggering of a

preventive response prior to transaction completion,

minimising the potential fraud deficit (proactive

fraud management) (Entrust 2008; Fair Isaac 2008;

StreamBase 2008). Despite the successful shift of

fraud analytics from ‘post’ to ‘pre’ data storage,

many current proactive solutions are capable of

fraud management only upon a single channel, with

no support for fraud analysis over multiple incoming

data delivery channels. More crucially, few

systematic methods exist for assisting fraud analysts

in the modelling and enforcement of anti-fraud

policies using stream processors, with many

solutions based upon code implementation for low

level stream application programming interfaces

(Chandrasekaran 2003; Arasu, Babu et al. 2006) and

other low level imperative event languages

(Luckham 2005).

This paper outlines the development of a

Financial Fraud Modelling Language (FFML) and

policy mapping architecture for the conceptual level

modelling and implementation of fraud policies

using StreamSQL, an emerging standard for

194

Edward Edge M., R. Falcone Sampaio P., Philpott O. and Choudhary M. (2009).

SPECIFYING AND COMPILING HIGH LEVEL FINANCIAL FRAUD POLICIES INTO STREAMSQL.

In Proceedings of the 11th International Conference on Enterprise Information Systems - Information Systems Analysis and Specification, pages

194-199

DOI: 10.5220/0002001501940199

Copyright

c

SciTePress

processing real-time data streams. Specifically it

details the development and implementation of a

compiler component for the automated parsing of

FFML policy definitions and generation of the

required stream processing representation. A key

element of the work is abstraction of low level

stream processing syntax through conceptual level

Event-Condition-Action policies to reduce the

complexity and implementation latency associated

with proactive fraud policy enforcement.

The remainder of this paper is organised as

follows: Section 2 presents a background on

proactive fraud management and the FFML policy

management framework. Section 3 describes the

FFML policy definition language. Section 4

presents the design and implementation of the FFML

compiler tool. Section 5 illustrates a sample FFML

to StreamSQL mapping. Section 6 details the key

contributions of the work. Section 7 presents a

summary of the work and outlines future research.

2 BACKGROUND

Financial Fraud Modelling Language (FFML)

provides a conceptual level modelling and fraud

prevention architecture using a rule based modelling

syntax to assist fraud analysts in the expression and

assembly of proactive fraud policy sets prior to

representation within target stream processing

solutions (Edge, Sampaio et al. 2007).

Figure 1: FFML Policy Mapping Approach.

Figure 1 illustrates the FFML policy mapping

approach for translation of fraud policies into the

required stream processing syntax. Fraud policy set

definition is undertaken through a front end GUI

component for the conceptual level management of

complete fraud policy sets using FFML. Automated

parsing validates assembled policy sets against the

FFML language specification to ensure defined

policies are well formed from which the

corresponding stream processing syntax is generated

using the required target platform code generation

component. Target platform adaptors are

implemented in a plug and play architecture

facilitating the mapping of FFML policies into

multiple stream processing implementations,

leveraging a dynamic and extensible policy

management architecture.

3 FRAUD POLICY

SPECIFICATION USING FFML

FFML provides a domain specific language of

constructs and operators to facilitate the expression

of rule-based financial fraud policies which may

span multiple service channels, time windows and

transaction event types, without the restrictions and

extensive programming requirements of the

employed target platform. FFML policies are

assembled as Event-Condition-Action (ECA)

definitions using a domain specific language of

constructs and operators to support the conceptual

level expression and management of proactive fraud

policy controls (Table 1).

Table 1: FFML Policy Structure.

Operator Parameter

POLICYID

policy reference

ON

event statement

IF

condition statement

THEN

action statement

3.1 Event Statement

Policy event triggers define the click stream data

patterns to which policies continually monitor

incoming transaction service channels for invocation

of defined evaluative functionality. Table 2

illustrates the expressiveness of the FFML event

model using the following sample fraud policy

definition: “if there is an online banking session

containing a password change event followed by

funds transfer, or a session containing a failed

logon phase 1 attempt, a failed logon phase 2

attempt and a funds transfer, require two factor

authentication for transaction completion”.

Channel selectors are first declared specifying the

incoming data stream to which the policy applies,

followed by the event, or event sequence upon

which evaluation of defined conditions should be

performed. Event sequences support the matching

of chronological data stream events using the FFML

“SEQ” operator for specifying time window

durations during which defined behaviour will be

matched following occurrence of the initial sequence

event. The policy definition in Table 2 illustrates

the use of 5 minute time windows (300 seconds) for

matching of the specified online user behaviour.

SPECIFYING AND COMPILING HIGH LEVEL FINANCIAL FRAUD POLICIES INTO STREAMSQL

195

Table 2: Simple Online Fraud Policy.

Online Fraud Policy

POLICYID

ONL01234

ON

ONL SEQ(300)[passwordchange, transfer]

OR ONL SEQ(300) [failed_logonphase1,

failed_ logonphase2, transfer]

THEN

TWOFACTOR(transid, sortcode,

accountnumber);

In the specification of event statements and

sequences, the following principle is applied: the

occurrence of particular events implicitly assumes

the occurrence of any prerequisite events. This

achieves syntax reductions by eliminating the need

for definition of events which maybe implicitly

assumed based upon preceding sequence events.

For example, in Table 2 “passwordchange”

implicitly assumes the user has completed a

successful logon process. Similarly, definition of

the “transfer” event following “failed_logonphase2”

also assumes that a successful logon has taken place

between these two event occurrences. Table 2 also

illustrates how multiple event trigger specification is

supported using the disjunctive “OR” operator

providing that a common final channel event exists,

eliminating the need for multiple policy definitions

which require the same evaluative functionality.

Conjunction between event instances has been

restricted due to the window based processing model

of underlying stream processing technologies.

Matching of event/event sequences between user

transaction sessions would open extensive time

windows spanning several hours, or even days for

matching of specified event instances, which is

clearly unfeasible in a global user service and would

have significant performance ramifications within

the supporting business platform. For example,

Table 3 specifies the following sample fraud policy

definition: “if there is over £500 of Card Not Present

transactions in the last 24 hours, followed by an

online banking session containing a failed logon

phase 1 attempt, a failed logon phase 2 attempt and

a transfer with value greater than or equal to £1500,

trigger an alert”.

Table 3: FFML Online Policy Definition.

Online Fraud Policy Definition

POLICYID

ONL01234

ON

ONL SEQ(300)[failed_logonphase1,

failed_logonphase2, transfer]

IF

QUERY TOTALDEBIT(CNP, sortcode,

accountnumber) >= 500

AND

value >= 1500

THEN

ALERT(transid, sortcode, accountnumber);

Preceding transactional account behaviour is

traced through implementation of stored data

operators within the defined condition, using the

latter policy event for triggering of condition

evaluation. Accordingly, policy evaluation is only

performed upon matching of the specified transfer

transaction, rather than opening of extensive time

windows following each CNP transaction for

detection of the subsequent online event sequence.

Table 3 illustrates the use of the ‘TOTALDEBIT’

query for retrieval of all CNP transactions within the

last 24 hour period.

Table 3 also illustrates how the developed

modelling language supports multi-channel risk

models through policy triggering in response to

events within one streaming data channel, while

supporting condition evaluation over account

transactions performed through other service

channel provisions. FFML therefore facilitates

definition of sophisticated policies which encompass

fraud evaluation over all delivery service channels

towards the deployment of increasingly integrated

and holistic fraud detection frameworks.

3.2 Condition Statement

Condition functionality is defined as a series of

Boolean logic statements assembled using

disjunctive (“OR”) and conjunctive (“AND”)

operators for evaluation of system transactions

which satisfy defined event triggers using incoming

event data, stored data functions and arithmetic

operators.

A key element of the FFML language is the

ability to define policies which evaluate streaming

values against post-transactional data from both

current and past financial trading (Table 4), enabling

a fraud decision to be made based upon examination

of preceding account behaviour rather than through

isolated queries on streaming transactional data

alone. Table 5 illustrates how the developed

approach maybe used to express the following

sample fraud policy scenario: “If there is an ATM

withdrawal that reaches the total daily £250

withdrawal limit, and the daily limit has been

reached 3 times within the last 5 days, stop the

transaction, raise alert and block account”.

Data parameters utilised within Boolean

functions and stored data operations are associated

with the last declared event in each event trigger to

achieve syntax reductions within condition

specification. While this principle restricts the use

of the parameters associated with preceding non-

transactional event instances, it is emphasised that

such instances are used only to assist in the

identification of suspicious transactions, and alone

are unbeneficial for fraud policy definition.

ICEIS 2009 - International Conference on Enterprise Information Systems

196

Accordingly, event sequence specifications shall

always feature one or more non-transactional events,

followed by a concluding transactional instance for

triggering of condition evaluation.

Table 4: Stored Data Retrieval Operators.

Function Database Query

Syntax

QUERY

Parameters QUERY_NAME(parameters) ||

(SELECT….FROM….WHERE)

Description Issue pre-defined queries against stored

transactional data for the current financial day

or cumulatively over multiple financial days if

a day parameter is provided. Standard SQL

maybe utilised for custom data evaluation

functions. Result must return a single value to

be used within a Boolean condition.

(Note: Day parameters not compatible with

HISTORY function – see below.)

Function History Operator

Syntax

HISTORY

Parameters (days)[condition]

Description Evaluates complete conditions over multiple

financial days returning an integer indicating

the number of days on which the query

evaluated to true. Condition contains one or

more QUERY components. HISTORY

functions are therefore use for issuing complete

conditions over each financial day, while

QUERY operators simply return a cumulative

figure for the specified preceding period.

Table 5: ATM Fraud Policy.

ATM Fraud Policy

ON

ATM[withdrawal]

IF

QUERY TOTALDEBIT(ATM, sortcode,

accountnumber) + value >= 250.00

AND

HISTORY(4)

[QUERY TOTALDEBIT(ATM, sortcode,

accountnumber) >= 250.00] >=2

THEN

BLOCK(sortcode, accountnumber)

AND

ALERT(transid,sortcode, accountnumber);

3.3 Action Statement

Actions specify the preventive response to be

triggered within the supporting business platform

upon successful triggering and evaluation of the

defined policy instance. FFML actions are

categorised into two distinct categories; active and

passive. Passive actions are regarded as those

actions which do not alter the current transaction

path and enable the transaction to complete as

normal, for example if an ‘ALERT’ or ‘FLAG’ is

applied for post-transaction examination of the

account by the fraud analyst. Active actions are

those which cause transactions to deviate from their

normal execution path, for example if a ‘BLOCK’

request is issued against a particular account or two

factor authentication is initiated for confirming the

identity of the initiating account holder. All active

actions are implicitly assumed to apply the

“DOINSTEAD” principle for transaction execution,

as described in (Stonebraker, Jhingran et al. 1990).

Multiple actions are applied using the conjunction

operator which are mapped onto the required output

stream for examination by fraud personnel and

triggering of the specified preventive operations.

4 FFML GUI AND POLICY

COMPILATION TOOL

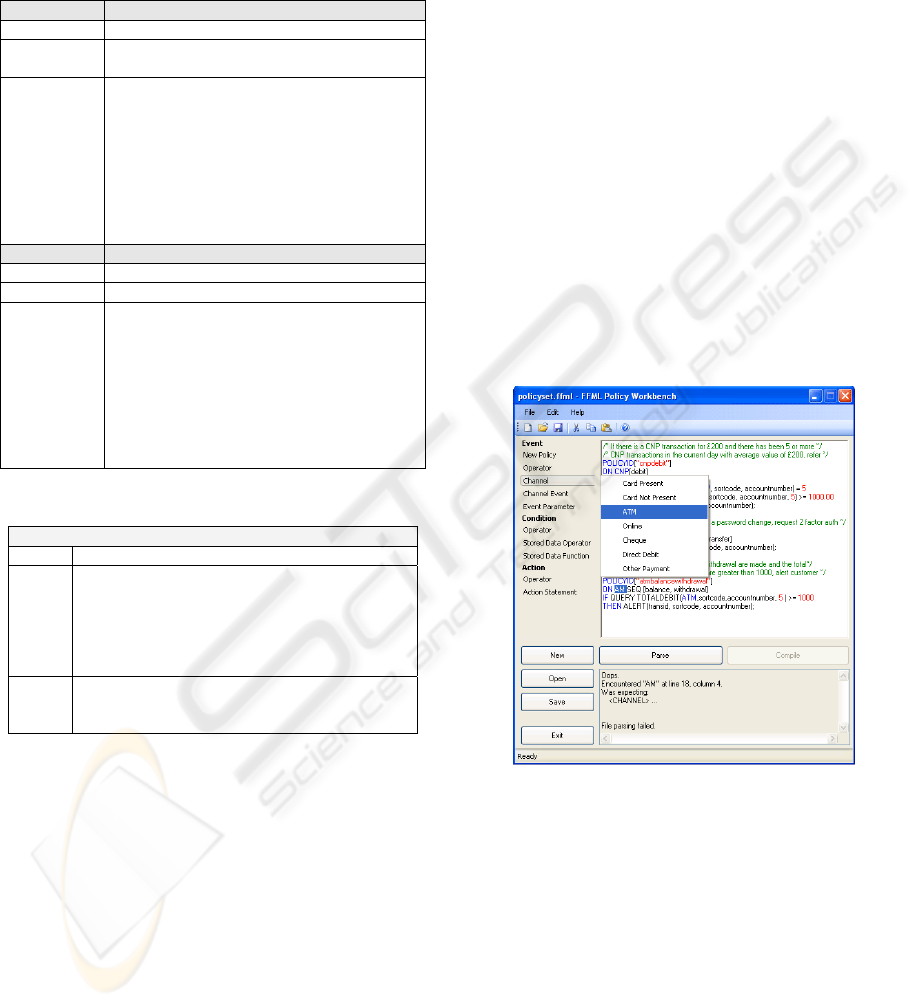

The FFML tool provides fraud analysts with a suite

of tools for the construction, manipulation and

compilation of FFML policy sets. The developed

graphical front-end component comprises a source

code editor, parser, compiler and file management

system, for rapid policy set construction and

management of an organisations fraud policy

deployment from a single point of control (Figure 2).

Figure 2: FFML GUI Tool.

4.1 Compiler Architecture

FFML policy statements are translated into the target

syntax model using an automated compiler

component, implemented using the JavaCC parser

generator. More specifically, the compiler is

specified using JJTree (a pre-processor for JavaCC),

enabling the insertion of tree-building actions into

the JavaCC grammar for generation of Abstract

Syntax Tree (AST) definitions utilised in the

validation of FFML policies and generation of target

implementation code. Figure 3 demonstrates how

the developed components are used for validation

SPECIFYING AND COMPILING HIGH LEVEL FINANCIAL FRAUD POLICIES INTO STREAMSQL

197

and mapping of FFML statements into the target

syntax model.

Figure 3: FFML Compiler Architecture.

4.2 Code Generation

Stream processing implementations such as

StreamSQL implement computational functionality

through the assembly of data functions and internal

streams within a data processing network. A clear

requirement for mapping of policies onto stream

processing language models is the need to maintain

a state between node visits to facilitate the exchange

of internal stream references between generated data

functions. The utilised visitor design pattern

addresses this requirement through the logical

grouping of visit methods using a “syntax separate

from interpretation” programming model for all

syntax tree nodes, facilitating the use of collections

and other programming data structures within each

interface implementation for internal reference

storage.

The visitor design pattern also supports the

mapping from conceptual level policy definitions

into multiple target language implementations

without extensive re-engineering of the supporting

compiler component. New target language

implementations are supported through development

and integration of the necessary visitor module for

expressing the mappings from FFML grammar

productions to the corresponding stream based

operations. Run-time binding of target platform

adaptors therefore creates a highly dynamic and

extensible architecture for fraud policy management

in fragmented and multiple disparate fraud

management environments.

5 POLICY MAPPING EXAMPLE

Table 3 (Section 3.1) presents a sample FFML

policy definition for an online banking channel.

Translation of the policy statement requires

construction of several StreamSQL target operators

and associated internal streams for the feeding of

information through the data processing network.

Appendix A illustrates how implementation of the

sample fraud policy scenario therefore requires a

total of 52 lines of StreamSQL code. Table 3

expresses the same policy functionality using just 6

lines of FFML, resulting in over an 80% reduction in

the required syntax compared to direct

implementation within the target stream processing

model. This is seen as a significant advancement for

assisting fraud analysts in the definition and

maintenance of proactive fraud policy controls using

stream processors.

6 KEY CONTRIBUTIONS

Conceptual Level Specification of Proactive Fraud

Policies - Poor declarative specification of complex

policies often results in unorganised distribution of

policy code throughout target platform

implementation code, which requires significant re-

engineering in subsequent development phases at a

substantially escalated cost. FFML provides a

domain specific language for the expression and

management of proactive fraud policies over

multiple streaming channels and differing time

windows from a single modelling perspective.

Complexity is therefore abstracted from low level

implementation of fraud controls to enable

conceptual level construction of complete fraud

policy sets usable by both expert and non-expert

users.

Automated Policy Set Implementation in a

Stream Based Language – Plug and play target

platform adaptors encapsulate the semantic

knowledge for mapping of FFML policies to

simplify the complexities associated with direct

implementation of large scale policy sets within

explicit low level programming formalisms. FFML

therefore provides an innovative policy management

architecture supporting the mapping of policies to

multiple disparate target implementations and future

changes to underpinning fraud technologies through

simple re-mapping of an organisations fraud policy

set to new target syntax models.

Improved Responsiveness and Policy Set

Realignment– FFML significantly enhances an

organisations responsiveness to fraud threats through

reduction of the implementation latency associated

with future maintenance operations to existing fraud

policy sets. New policies and modifications to

existing policies may be rapidly implemented

through the developed GUI environment using the

FFML toolset for abstraction of the complexity

associated with management of policies directly

within low level target language models.

Furthermore, expression of fraud policies within a

common conceptual level language supports the

ICEIS 2009 - International Conference on Enterprise Information Systems

198

active sharing of fraud policy data between financial

sector organisations using a service oriented

architecture, significantly reducing the latency

associated with discovery and deployment of fraud

policies in response to emerging industry threats

(Edge, Sampaio et al. 2008).

7 SUMMARY

This paper presents a financial fraud policy

specification language and policy mapping

technology for simplifying the challenges associated

with proactive fraud policy management using

stream processors. Fraud policies are defined using

a domain specific modelling language (FFML) and

translated into a StreamSQL representation using the

developed compiler component. A key element of

the framework is the application of an Event-

Condition-Action model for specification of

proactive fraud policies which span multiple

channels, time windows and events, and mapping

into the required stream processing implementation.

It is also illustrated using a simple example how the

expression of fraud policies using FFML can result

in significant syntax reductions over direct

implementation within the underlying stream

processing language model. Future work will

include the development of a real-time customer

profiling mechanism using signature-based models

(Edge and Sampaio 2009) and a component for

optimisation of generated StreamSQL code.

REFERENCES

Arasu, A., S. Babu, et al. (2006). "The CQL continuous

query language: semantic foundations and query

execution." The VLDB Journal 15(2): 121-142.

Chandrasekaran, S. (2003). TelegraphCQ: Continuous

Dataflow Processing for an Uncertain World. CIDR

Edge, M. E. and P. R. F. Sampaio (2009). "A Survey of

Signature Based Methods for Fraud Detection."

Computers and Security [To appear].

Edge, M. E., P. R. F. Sampaio, et al. (2007). Towards a

Proactive Fraud Management Framework for

Financial Data Streams. The 3rd IEEE International

Symposium on Dependable, Autonomic and Secure

Computing (DASC'07), Loyola College Graduate

Center, Columbia, MD, USA., IEEE.

Edge, M. E., P. R. F. Sampaio, et al. (2008). A Policy

Distribution Service for Proactive Fraud Management

over Financial Data Streams. IEEE International

Conference on Services Computing, 2008. (SCC '08),

Honolulu, Hawaii, USA.

Entrust. (2008). "www.entrust.com."

Fair Isaac. (2008). "www.fairisaac.com."

Kou, Y., C.-T. Lu, et al. (2004). Survey of fraud detection

techniques. IEEE International Conference on

Networking, Sensing and Control.

Luckham, D. (2005). The RAPIDE Pattern Language. The

Power of Events: An Introduction to Complex Event

Processing in Distributed Enterprise Systems, Pearson

Education: 145 - 174.

Phua, C., V. Lee, et al. (2005). "A Comprehensive Survey

of Data Mining-based Fraud Detection Research."

Stonebraker, M., A. Jhingran, et al. (1990). "On Rules,

Procedures, Caching and Views in Data Base

Systems." Proceedings of the 1990 ACM SIGMOD:

281 - 290.

StreamBase. (2008). "www.streambase.co.uk."

APPENDIX

CREATE INPUT STREAM ONL

_

fa

i

led

_

logonphase1(

transid string(10), sortcode string(6),

accountnumber string(8), datetime timestamp,

onlineid string(20), ipnumb string(25),

sessionid string(25), password1_entered

string(25));

CREATE INPUT STREAM ONL_failed_logonphase2(

transid string(10), sortcode string(6),

accountnumber string(8), datetime timestamp,

onlineid string(20), ipnumb string(25),

sessionid string(25), password2_entered

string(25), password3_entered string(25));

CREATE INPUT STREAM ONL_transfer(

transid string(10), sortcode string(6),

accountnumber string(8), datetime timestamp,

onlineid string(20), ipnumb string(25),

sessionid string(25), currency string(3),

amount double, dest_sortcode string(6),

dest_accountnumber string(8), dest_transferdate

string(10));

CREATE STREAM out__Pattern_1;

SELECT ONL_transfer.transid AS transid,

ONL_transfer.sortcode AS sortcode,

ONL_transfer.accountnumber AS accountnumber,

ONL_transfer.onlineid

AS onlineid,

ONL_transfer.ipnumb AS ipnumber,

ONL_transfer.sessionid AS sessionID,

ONL_transfer.currency AS currency,

ONL_transfer.amount AS amount,

ONL_transfer.dest_sortcode AS dest_sortcode,

ONL_transfer.dest_accountnumber AS

dest_accountnumber,

ONL_transfer.dest_transferdate AS

dest_transferdate

FROM PATTERN ((ONL_failed_logonphase1 THEN

ONL_failed_logonphase2)

THEN ONL_transfer) WITHIN 300 TIME

WHERE ONL_failed_logonphase1.transid =

ONL_failed_logonphase2.transid

AND ONL_failed_logonphase2.transid =

ONL_transfer.transid INTO out__Pattern_1;

CREATE STREAM out__TOTALDEBIT_2;

APPLY JDBC accountdata

"SELECT sum(amount) AS currentdaytotal FROM

transactions

WHERE (channel = 'CNP')

AND sortcode = {sortcode} AND accountnumber =

{accountnumber}

AND type = 'deb'

AND transdate >=

CONVERT(datetime,(FLOOR(CONVERT(float(GETDATE()

)))

AND transdate <

CONVERT(datetime,FLOOR(CONVERT(float,DATEADD(dd

,1,CURRENT_TIMESTAMP))));" FROM out__Pattern_1

INTO out__TOTALDEBIT_2;

CREATE STREAM out__Filter_3;

SELECT * FROM out__TOTALDEBIT_2

WHERE currentdaytotal >= 500 INTO

out__Filter_3;

CREATE STREAM out__Filter_4;

SELECT * FROM out__Filter_3

WHERE value >= 1500 INTO out__Filter_4;

CREATE

OUTPUT STREAM ALERT;

SELECT transid AS transid,

sortcode AS sortcode ,

accountnumber AS accountnumber

FROM out__Filter_4 INTO ALERT;

SPECIFYING AND COMPILING HIGH LEVEL FINANCIAL FRAUD POLICIES INTO STREAMSQL

199