Investment Lags

A Numerical Approach

M. Al-Foraih, P. Johnson and P. Duck

School of Mathematics, University of Manchester, Oxford Road, Manchester M13 9PL, U.K.

Keywords:

Real Option, Stochastic Models, Time-Varying Demand, Investment Lag.

Abstract:

In this paper we use a mixture of numerical methods including finite difference and body fitted co-ordinates

to form a robust stable numerical scheme to solve the investment lag model presented in the paper by Bar-Ilan

and Strange (1996). This allows us to apply our methodology to models with different stochastic processes

that does not have analytic solutions.

1 INTRODUCTION

Most investment projects take a long time to become

operational so there are often periods where a firm

will incur losses before the project starts generating

income. Such a period might be referred to as the

“construction lag”, “time to build ” or “Investment

Lag” (Costeniuc et al., 2008). These investment lags

can be quite lengthy which can result in a serious cost

for the investor, an example of which is described by

(MacRae, 1989) where it could take up to 10 years

to see the positive income when investing in a power

generating plant – similar situations can be found in

investment projects on natural resources. For exam-

ple, when an oil company buys a license from a gov-

ernment, it takes time to search fields and estimate

the fields’ reserve quantity before the beginning of oil

production. Thus, when evaluating a project such as

this the “lag” should be taken into consideration. If

the sale price of a firm’s product is modelled by a

stochastic process, then the lag brings added risk to

the project since the price may rise or fall during this

lag, resulting in a negative cash flow. This situation

and its effect on an investment has been studied by

(Gauthier and Morellec, 2000) and they implied that

it a has significant consequences on investment deci-

sions.

The use of option theory to value and assess in-

vestment decisions has a long history going back to

(Myers, 1977), but it was (Brennan and Schwartz,

1985) that first allowed the project to be mothballed

rather than abandoned so that it could be reopened at a

later date. They showed that if there was a fixed cost

to move between the states, the decision to start the

project would happen at a price higher than the deci-

sion to mothball. Following on from this, (Bar-Ilan

and Strange, 1996) applied investment lags on irre-

versible investments and they found that a lag can re-

duce the effects of uncertainty in an investment, since

the investor has more time to act on an unexpected

fall in the price or changes in the investment. In order

to generate the results for their model, they present an

analytic technique,(see Brekke and Øksendal, 1994,

for more details. The method as described by (Bar-

Ilan and Strange, 1996) is flawed in that it relies on the

particular form of the process, so they can only solve

the problem with a simple geometric Brownian mo-

tion. The contribution of this paper is to apply a more

generic numerical approach which can be extended to

many classes of stochastic processes. We present a

robust numerical technique for solving generic prob-

lems of this type.

2 MODEL FRAMEWORK

We follow the general framework as laid down by

(Bar-Ilan and Strange, 1996) in valuing a firm that

can pay (on delivery) k ≥ 0 units to exercise an ir-

reversible option to produce and sell 1 unit of product

per unit time forever. The marginal cost of production

is ω per unit, and both the future revenues and costs

are discounted at the rate of ρ. The project can later be

abandoned at a cost of l ≥0. The price of the product

P

t

follows a standard geometric Brownian motion

dP

P

= µdt + σdz. (1)

282

Al-Foraih M., Johnson P. and Duck P..

Investment Lags - A Numerical Approach.

DOI: 10.5220/0004920702820287

In Proceedings of the 3rd International Conference on Operations Research and Enterprise Systems (ICORES-2014), pages 282-287

ISBN: 978-989-758-017-8

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

where

• µ is the rate of return of the product P

t

,

• σ is the volatility of the product price P

t

,

• dz is the increment of the standard Wiener pro-

cess.

When the investment starts, in many cases, it takes

time from the decision to invest until the time the

project begins to generate revenue. For example, if

a firm wishes to build an oil refinery it will make that

decision depending on today’s oil price but it usually

takes around 6 −7 years to start producing oil (Sen-

ate, 2002). We shall denote h ≥0 to be the investment

lag in our model.

As a result the firm at any one time may be in three

different states. The states are characterised as

• V

0

(P) Inactive firm.

In this stage there is no money invested and

no revenue.

• V

2

(P,t) the firm in the process of construction

where t is the clock that starts after the decision

is made (0 ≤ t ≤ h).

In this stage the firm has made the decision

to invest and is waiting until time h when the firm

will pay k and start production.

• V

1

(P) Active firm and generating revenue.

In this state we have invested the amount k

and it is working and generating the amount of P

for each unit produced.

Our goal is to find at what price of the product should

we invest and for what price should we leave the

project. We shall denote P

H

as the price at which it

is high enough to start construction at a cost of ke

−ρh

(discounted value of the payment at time t = 0), and

P

L

as the price of product which is low enough to

abandon the project for cost of l.

2.1 Calculating the Firm’s Value at

Different Situations

Suppose it is not optimal to invest at an infinitesimal

period of dt, then

V

0

(P

t

) = e

−ρdt

E

t

[V

0

(P

t+dt

)], (2)

where P

t

is the price at time t. Using Ito’s Lemma we

can write

σ

2

2

P

2

V

′′

0

(P) + µPV

′

0

(P) −ρV

0

(P) = 0. (3)

The boundary condition for P = 0 is simply

lim

P→0

V

0

(P) = 0, (4)

and given that we optimally decide to invest the fol-

lowing must hold

V

0

(P

H

) = V

2

(P

H

) −ke

−ρh

(5)

V

′

0

(P

H

) = V

′

2

(P

H

). (6)

General solutions to the ODE in (3) can be found

of the form

V

0

(P) = BP

β

(7)

where B is a constant and β is the positive solution of

the characteristic equation of

σ

2

2

ξ(ξ−1) + µξ−ρ = 0. (8)

For V

1

(P), if we assume it is optimal to sell prod-

ucts over the next small period in time we have

V

1

(P

t

) = e

−ρdt

E

t

[V

1

(P

t+dt

)]

+ E

t

Z

t+dt

t

(P

t

−ω)e

−ρ(τ−t)

dτ

,

where the extra term here is the total amount of profit

from selling at the rate one product per unit time. We

calculate the value of the active firm in the same man-

ner as we did in the inactive case to arrive at

σ

2

2

P

2

V

′′

1

(P) + µPV

′

1

(P) −ρV

1

(P) = ω −P. (9)

The boundary condition as P → ∞ takes the form

lim

P→∞

V

1

(P) = lim

P→∞

P

ρ−µ

−

ω

ρ

. (10)

Therefore, solutions of equation (9) can be written

V

1

(P) = AP

α

+

P

ρ−µ

−

w

ρ

, (11)

where A is yet to be determined and α is the nega-

tive solution of equation (8). Since we can optimally

decide to shut down operations we also have

V

1

(P

L

) = V

0

(P

L

) −l (12)

V

′

1

(P

L

) = V

′

0

(P

L

). (13)

These form the solution of the investment and

disinvestment problem in Pindyck and Dixit (1996),

where the time to build is not considered. For the in-

vestment lag problem, we must now consider the extra

state of the firm V

2

(P,t) during the lag. Giving that we

are waiting for production to start we can write

V

2

(P

t

,t) = e

−ρdt

E

t

[V

2

(P

t+dt

,t + dt)], (14)

and following standard procedure we obtain

∂V

2

∂t

+

1

2

σ

2

P

2

∂

2

V

2

∂P

2

(15)

+ µP

∂V

2

∂P

−ρV

2

= 0

InvestmentLags-ANumericalApproach

283

where the boundary conditions are

lim

P→0

V

2

(P,t) = −le

−ρ(h−t)

, (16)

lim

P→∞

V

2

(P,t) = lim

P→∞

Pe

(ρ−µ)(h−t)

ρ−µ

−

ωe

−ρ(h−t)

ρ

, (17)

and

lim

t→h

V

2

(P,t) =

AP

α

+

P

ρ−µ

−

ω

ρ

if P ≥P

L

BP

β

−l if P < P

L

.

These equations describe the three states of the firm,

which all need to be solved to determine P

L

and P

H

.

3 NUMERICAL APPROACH

Although this problem has been solved in (Bar-Ilan

and Strange, 1996) and later again by (Sødal, 2006),

in this paper we present a new methodology which

gives more flexibility to the practitioner. The idea is to

solve the problem using finite differences with body-

fitted co-ordinates to quickly solve for P

H

and P

L

. To

simplify the algebra in the method we first apply a log

transformation to the ODEs (3) and (9) and the PDE

(15).

3.1 Derivation

To solve the problem we define two grids of x and y

each of which have m+ 1 points. We apply log trans-

forms to the equations involving V

1

and V

2

by setting

P = P

L

e

y

=⇒ y = ln

P

P

L

, (18)

The grid itself is generated from

∆y =

y

min

−y

max

m

. (19)

using the parameters

y

min

= 0 and y

max

= 10σ

√

h. (20)

Likewise, for equation involving V

0

we apply a log

transform

P = P

H

e

x

=⇒ x = ln

P

P

H

. (21)

The grid becomes

∆x =

x

min

−x

max

m

. (22)

such that

x

min

= −10σ

√

h and x

max

= 0. (23)

First we can apply the log transform (18) to the

equation of the active firm value (9) to get

σ

2

2

∂

2

V

1

∂y

2

+ (µ−

σ

2

2

)

∂V

1

∂y

−ρV

1

= ω−P

L

e

y

. (24)

Using the notation

v

i

1

= V

1

(P = P

L

e

i∆y

) = V

1

(e

y

i

) (25)

we apply standard finite differencing and a Newton

linearisation with

v

i,k+1

1

≃ v

i,k

1

+ δv

i

1

and P

k+1

L

≃ P

k

L

+ δP

L

(26)

where k is the number of iterations. The resulting

scheme is given by

σ

2

2(∆y)

2

−

2µ−σ

2

4∆y

δv

i−1

1

+

−

σ

2

2(∆y)

2

−ρ

δv

i

1

(27)

+

σ

2

2∆y

+

2µ−σ

2

4∆y

δv

i+1

1

+ e

y

i

δP

L

= F (P) (28)

where

F (P) = −

1

2

σ

2

v

i−1

1

−2v

i

1

+ v

i+1

1

2(∆y)

2

(29)

−(µ−

1

2

σ

2

)

v

i+1

1

−v

i−1

1

2∆y

+ ρv

i

1

−P

i

L

e

y

i

+ ω.

Now for the smooth pasting boundary conditions we

use a one sided difference of the form

V

′

1

(P = P

L

) =

−3(v

0

1

+ δv

0

1

) + 4(v

1

1

+ δv

1

1

) −(v

2

1

+ δv

2

1

)

2∆yP

L

(30)

and to calculateV

′

0

(P

L

) we use central differencing

V

′

0

(P

L

) =

V

0

(P

L

(1+ ∆y)) −V

0

(P

L

(1−∆y))

2∆yP

L

(31)

where the values of V

0

(P

L

(1 + ∆y)) and

V

0

(P

L

(1−∆y)) must be interpolated. For the

contact boundary condition at P = P

L

we expand with

a Taylor series to get

δv

0

1

−V

′

0

(P

L

)δP

L

= V

0

(P

L

) −v

0

1

(32)

Similarly, for the inactive or mothballed firm

V

0

(P) defined in equation(3), we apply a log transfor-

mation on P

H

with standard differencing and a New-

ton linearisation. The result is the same left hand side

as in (28) with δv

i

1

and δP

L

replaced by δv

i

0

and δP

H

,

and the right hand side is now given by

F (P) = −

1

2

σ

2

v

i−1

0

−2v

i

0

+ v

i+1

0

2(∆x)

2

− (33)

(µ−

1

2

σ

2

)

v

i+1

0

−v

i−1

0

2∆x

+ ρv

i

0

.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

284

As before the boundary conditions become

δv

m

0

−V

′

2

(P

H

)δP

H

= V

2

(P

H

) −ke

−ρh

−v

m

0

(34)

and

3δv

m

0

−4δv

m−1

0

+ δv

m−2

0

2∆xP

H

= V

′

2

(P

H

)−

3v

m

0

−4v

m−1

0

+ v

m−2

0

2∆xP

H

(35)

where V

2

(P

H

) here is V

2

(P

H

,t = 0) which must be

calculated from (15).

We can use either quadrature integration (Andri-

copoulos et al., 2003) or finite difference to solve

for V

2

in (15). For any point x of the n points on

V

2

(x,t = 0) we have

V

2

(x,t = 0) = A(x)

Z

∞

−∞

B(x,y)V

2

(y,t = h)dy, (36)

then we calculate the value of V

2

using

A(x) =

1

√

2σ

2

πh

e

−

1

2

kx−

1

8

σ

2

k

2

h−ρh

, (37)

and

B(x,y) = e

−(x−y)

2

/2σ

2

h+1/ky

, (38)

and

k =

2(ρ−d)

σ

2

−1 (39)

where d is the dividends (d = ρ −µ). The reason we

calculate V

2

(y,t = 0) usingV

2

(y,t = h) that is because

we solve the problem backwards in time where

V

2

(y,t = h) =

V

1

(y) if e

y

> 1(P > P

L

)

V

0

(y) −l if e

y

≤ 1(P ≤ P

L

)

.

(40)

Given the fact we have applied a different transforma-

tions on V

0

andV

1

we must interpolateV

0

to get values

in the y grid points using the relation

x = y

i

+ log(

P

H

P

L

). (41)

We may use the asymptotic form of the solution to fill

in the gaps outside the grid, then we write

V

2

(x,t = 0) = A(x)(

Z

y

max

y

min

B(x,y)V

2

(y,t = h)dy+ I

1

+ I

3

)

(42)

where

I

1

= −

Z

y

min

−∞

B(x,y)le

h

dy (43)

and

I

3

=

Z

∞

y

max

B(x,y)(

e

y−(ρ−µ)h

ρ−µ

−

we

−ρh

ρ

)dy (44)

4 Cox-Ingersoll-Ross MODEL

In a novel extension to the problem, we set the pro-

cess followed by the sale price as a Cox-Ingersoll-

Ross (CIR) process. These sort of processes are often

appropriate when modelling commodity prices as the

price tends to a mean value over a long time scale. We

can write the new price process as

dP = κ(Φ−P)dt + σ

√

Pdz (45)

such that

• κ is the speed of reversion

• Φ : is the long term mean level

and σ and P are as defined previously. Now the equa-

tions of V

0

(P), V

1

(P) and V

2

(P) will become

σ

2

2

PV

′′

0

(P) + κ(Φ−P)V

′

0

(P) −ρV

0

(P) = 0, (46)

σ

2

2

PV

′′

1

(P)+κ(Φ−P)V

′

1

(P)−ρV

1

(P) = w−P. (47)

and

∂V

2

∂t

+

P

2

σ

2

∂

2

V

2

∂P

2

(48)

+ κ(Φ−P)

∂V

2

∂P

−ρV

2

= 0.

At P = 0 we solve the degenerate ODE for V

0

κΦV

′

0

−ρV

0

= 0 (49)

and the degenerate PDE for V

2

∂V

2

∂t

+ κΦ

∂V

2

∂P

−ρV

2

= 0 (50)

For large P we set

V

1

∼P

−

ρ

κ

+

P

ρ+ κ

+

κΦ

ρ(ρ+ κ)

−

ω

ρ

, as P → ∞, (51)

and assume a linear solution for V

2

so solve

∂V

2

∂t

+ κΦ

∂V

2

∂P

−ρV

2

= 0. (52)

The terminal condition for V

2

is as before given by

V

2

(P,t = h) =

V

1

(P) if P ≥P

L

V

0

(P) −l if P < P

L

The smooth pasting conditions are the same as

those defined in equations (5), (6) and (12), (13). We

now transform the P-grid with a linear stretch get x

and y grids

P = yP

L

for V

1

(P) = V

1

(yP

L

)

P = xP

H

for V

0

(P) = V

0

(xP

H

). (53)

InvestmentLags-ANumericalApproach

285

0

2

4

6

8

10

12

0 0.2 0.4 0.6 0.8 1

V0

V1

V2

V

P

Figure 1: the Prices of V

0

, V

1

and V

2

with σ

2

= 0.1,ρ =

0.025,µ = 0, ω = 1., l = 0,k = 1, h = 6 years grid size of

1000.

and

x ∈[0, 1]

y ∈[1,y

max

]. (54)

Therefore, equation (47) will be transformed to

1

2

σ

2

yV

′′

1

+ κ(Φ−yP

L

)V

′

1

−ρP

L

V

1

= P

L

(ω−yP

L

)

(55)

and (46) will be transformed to

1

2

σ

2

xV

′′

0

+ κ(Φ−xP

H

)V

′

0

−ρP

H

V

0

= 0. (56)

We can follow the same method using a finite differ-

ence scheme with Newton linearisation. To calcu-

late V

2

, we must now solve the PDE using a Crank-

Nicolson scheme since the kernel does not exist for

this price process.

5 RESULTS

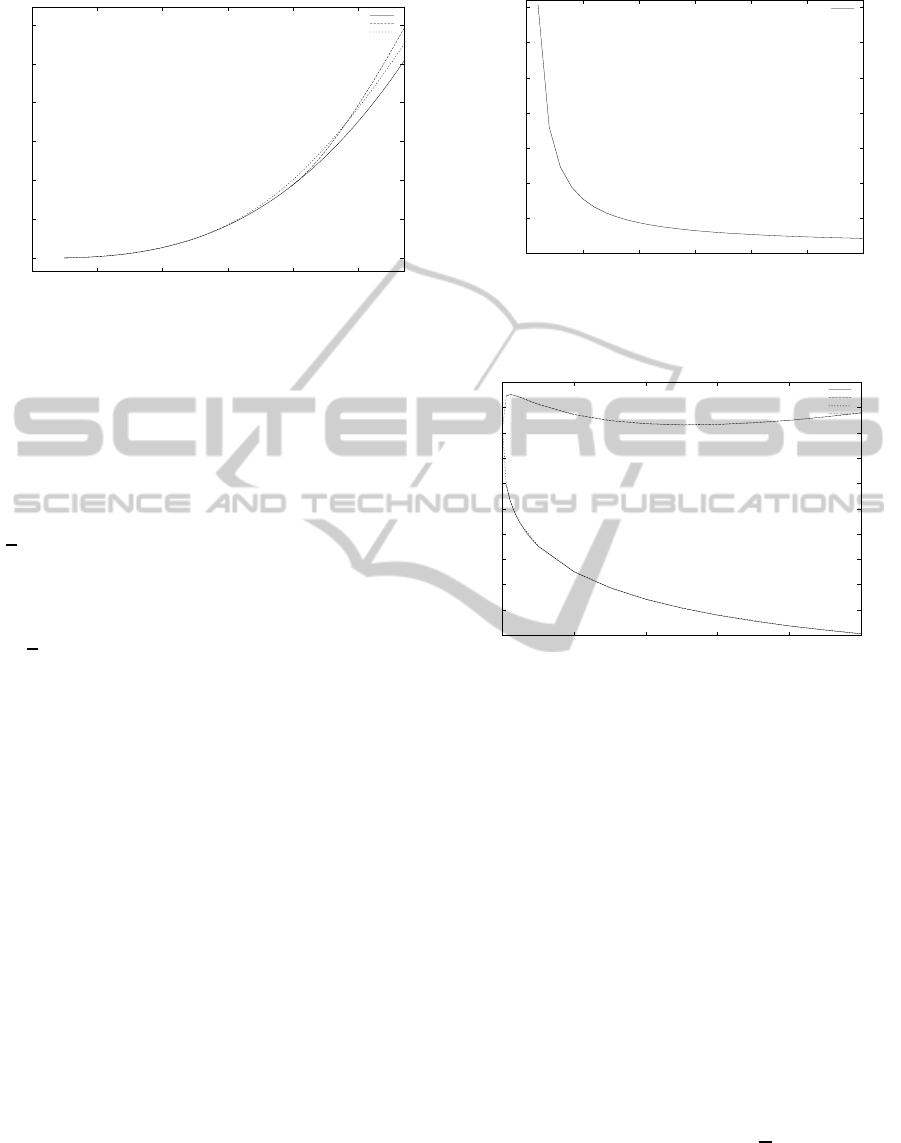

In figure 1, the switch from closed to in-construction

(V

0

→V

2

−ke

−ρh

) happenswhen P

H

= 1.14632 which

is the optimal price to start construction, while at

P

L

= 0.793442 the price is so low that it is not worth

continuing production (V

1

→ V

0

−l). We can notice

in this figure that P

H

is higher than P

L

, which is to

be expected since we should only invest if the price

is higher than the abandon price. Now we compare

our results to those of (Sødal, 2006) in figure 3, and

we find that our method generates values of P

L

and P

H

that are very close to the previous method. To demon-

strate the integrity of our scheme, in figure 2 we plot

the value of P

L

for an increasing number of nodes.

The convergence of the scheme can be shown empiri-

cally to be second order which matches with the finite

difference methods used.

0.059

0.0595

0.06

0.0605

0.061

0.0615

0.062

0.0625

0 500 1000 1500 2000 2500 3000

price

nodes

PL

Figure 2: The convergence of P

L

as we increase the

nodes to calculate P

L

using the numerical method with

ρ = 0.035,µ = 0.5, ω = 2., l = 3,k = 2,h = 4, σ

2

= 0.02.

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

1.1

1.2

0 0.2 0.4 0.6 0.8 1

Pl Quad

Ph Quad

pl paper

Ph paper

P

σ

2

Figure 3: The values of P

L

of P

H

with µ = 0,ρ = .025,l =

0,k = 1, ω = 1, σ

2

= 0.01 using Algebraic equations vs the

numerical method.

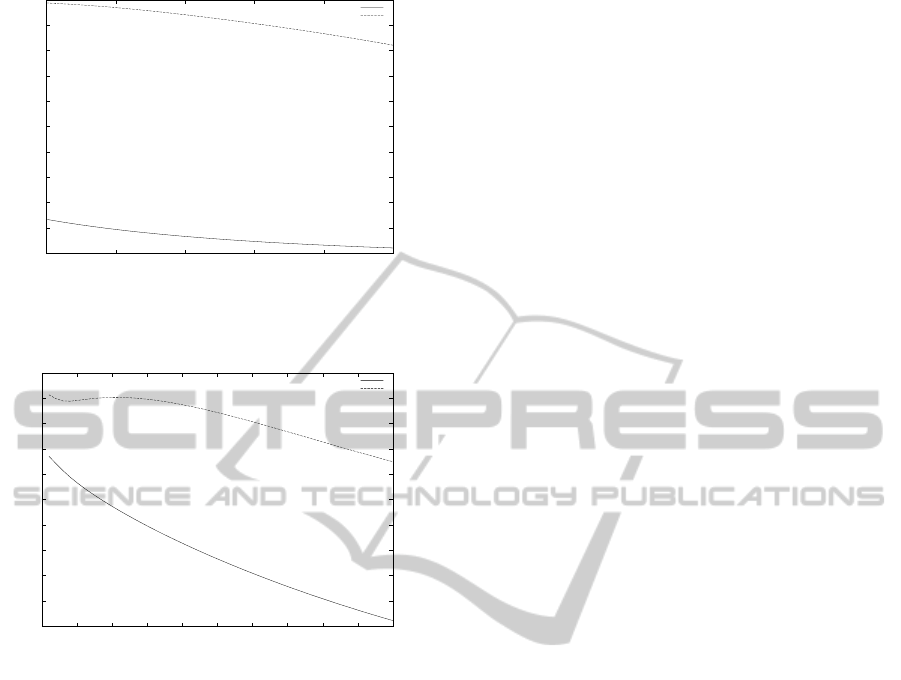

Next we show results for when we apply our

method to the CIR process. In figure 4, we plot the

values of P

L

and P

H

for varying values of h. We

have noticed that the change in the values of P

H

and

P

L

are not high as we increase h and that is because

of the behaviour of the CIR process, since no mat-

ter how long is the lag period, the price will always

return to the mean therefore the effect of P

L

and P

H

does not change significantly as we increase h, where

both P

L

and P

H

decreases slowly, since as we increase

h it is more likely to reach the mean. On the other

hand, the effect of σ we can see in figure 5 on the

prices of P

H

and P

L

is relatively higher than h, since

as we increase the volatility, the price increases. Con-

sequently the values P

L

and P

H

decreases, where as

we increase σ significently, both P

L

and P

H

goes to

zero because of the CIR property (σ

√

Pdt). However,

we believe that to model mean reversion process like

some commodities, the price of the product P will re-

turn to the mean eventually. Therefore, the investor

must not start the investment once it reaches the price

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

286

0.75

0.8

0.85

0.9

0.95

1

1.05

1.1

1.15

1.2

1.25

0 2 4 6 8 10

PL

PH

P

h

Figure 4: The values of P

L

of P

H

on CIR process using for

different values of h with κ = 0.01,Φ = 1.,ρ = .025,l =

0,k = 1,ω = 1,σ = 0.1.

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

1.1

1.2

1.3

0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5

PL

PH

P

σ

2

Figure 5: The values of P

L

of P

H

on CIR process using for

different values of σ

2

with κ = 0.01,Φ = 1., ρ = .025,l =

0,k = 1,ω = 1,h = 6.

of P

H

, before the price of the product stays around this

price for a longer period. In otherwords, the invest-

ment lag model with mean reversion process should

be modelled as Parisian option rather than European

option as we did in this paper. The application of the

Parisian option will be studied in future time.

6 CONCLUSIONS

In conclusion, we solved the problem for we have

showed a new methodology using a mixture of

Quadrature method and finite difference method with

a body-fitted co-ordinate algorithm to solve an invest-

ment lag problem presented in (Bar-Ilan and Strange,

1996) and with a very high convergence rate and

an acceptable speed of computing. Additionally, we

have shown the the results presented in this paper are

as accurate as the results presented in (Sødal, 2006)

for the GBM process. Moreover, we have applied this

model on other stochastic process such as CIR mean

reversion process and have shown the results.

REFERENCES

Andricopoulos, A. D., Widdicks, M., Duck, P.W., and New-

ton, D. P. (2003). Universal option valuation using

quadrature methods. Journal of Financial Economics,

67(3):447–471.

Bar-Ilan, A. and Strange, W. C. (1996). Investment lags.

The American Economic Review, 86(3):pp. 610–622.

Brekke, K. A. and Øksendal, B. (1994). Optimal switching

in an economic activity under uncertainty. SIAM Jour-

nal on Control and Optimization, 32(4):1021–1036.

Brennan, M. J. and Schwartz, E. S. (1985). Evaluating nat-

ural resource investments. The Journal of Business,

58(2):pp. 135–157.

Costeniuc, M., Schnetzer, M., and Taschini, L. (2008). En-

try and exit decision problem with implementation de-

lay. Journal of Applied Probability, 45(4):1039–1059.

Gauthier, L. and Morellec, E. (2000). Investment under un-

certainty with implementation delay. New Develop-

ments and Applications in Real Options.

MacRae, K. (1989). Critical issues in electric power plan-

ning in the 1990s: executive summary. Canadian En-

ergy Research Institute, 1(1):42–105.

Myers, S. C. (1977). Determinants of corporate borrowing.

Journal of financial economics, 5(2):147–175.

Senate, U. (2002). Gas prices: How are they really set. Re-

port prepared by the Majority Staff of the Permanent

Subcommittee on Investigations, released in conjunc-

tion with the Permanent Subcommittee on Investiga-

tions? Hearings on April, 30.

Sødal, S. (2006). Entry and exit decisions based on a dis-

count factor approach. Journal of Economic Dynam-

ics and Control, 30(11):1963–1986.

InvestmentLags-ANumericalApproach

287