Dynamic Linkages Between Global Oil Price Volatility and Fertilizer

Stock Indices in China on Pre and During Covid-19 Pandemic

Binlin Li

1*

, Jie Ma

2

and Shitao Wei

1

1

College of Economics and Management Yunnan Agricultural University, Kunming, China

2

College of Economics and Management, East China University of Technology, Nanchang, China

Keywords: Multivariate GARCH, Fertilizer, Oil Price, Covid-19 Pandemic.

Abstract: This study firstly detects the dynamic linkage between WTI oil price and Chinese fertilizer stock indices,

namely potash, phosphorus, and nitrogen fertilizer, respectively. Results indicate a weak long-term

interdependence and the time-varying pathway of connectedness between WTI oil price and fertilizer indices

using a connectedness technique. Then, BEKK, CDCC, and GARCH models are used to display time-varying

changes of dynamic conditional correlations on pre and during Covid-19 pandemic, and a significant increase

of linkage can be identified at the beginning of the pandemic. Finally, response impulse and historical variance

decomposition techniques are employed to analyze the response of fertilizer stock indices from the effect of

the magnitude of oil price. Results help to diversify investment portfolios for investors.

1 INTRODUCTION

The global fertilizer industry has been shocked due to

the effects of the Covid-19 pandemic in many

countries and regions. Because fertilizers are key

nutrients that are beneficial to improve agricultural

productivity and maintain food supply to satisfy

global population growth, we can understand that the

supply security of fertilizer is correlated with the food

security in the globe. Moreover, the oil price has

affected the fertilizer industry because extraction of

phosphate rock and potash, the production of

integrated chemical complexes, transportation, etc.

are greatly impacted by energy use. In past studies,

despite the much literature focusing on the nexus of

oil and major stock indices in the world, the related

empirical research on the nexus of oil price and

fertilizer indices is extremely limited. More

importantly, China is the largest producer and

predominant exporter in the global fertilizer industry,

so it is essential to estimate the dynamic impact of oil

price and fertilizer stock indices to given rise to focus

on detecting the dynamic linkage of oil and fertilizer

stock indices, also provide possible evidence to

facilitate the diversification strategies for investors.

This study contributes to extend previous studies

in several regards. First, this is the first empirical

study to display the time-varying dynamics of WTI

oil price and fertilizer stocks in China, namely potash,

phosphorus, and nitrogen, using the most recent data,

including the pre and during performance Covid-19

pandemic. Second, we use BEKK, CDCC and GO-

GARCH models to display the time-varying

performance of dynamic conditional correlations on

pre and during Covid-19 pandemic. Third, this study

explores the impulse response and historical variance

decomposition analysis to show the shock and impact

of the pandemic.

The remainder of this paper is analyzed as

follows. Section 2 provides the data and preliminary

analysis. Section 3 provides econometric methods.

Section 4 presents the empirical results. Section 5

discusses conclusions.

2 DATA AND PRELIMINARY

TEST

This study uses the closing price data obtained from

Choice system. (http://choice.eastmoney.com/) An

essential

contribution of this study spans the most

recent period from August 4, 2014, to July 23, 2021,

which covers the recent period of pre and during the

Covid-19 pandemic with high fluctuations in global

financial markets due to the pandemic. Daily closing

price returns were calculated by the logarithmic

difference, and all assets return show a characteristic

Li, B., Ma, J. and Wei, S.

Dynamic Linkages between Global Oil Price Volatility and Fertilizer Stock Indices in China on Pre and during Covid-19 Pandemic.

DOI: 10.5220/0011721700003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 45-51

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

45

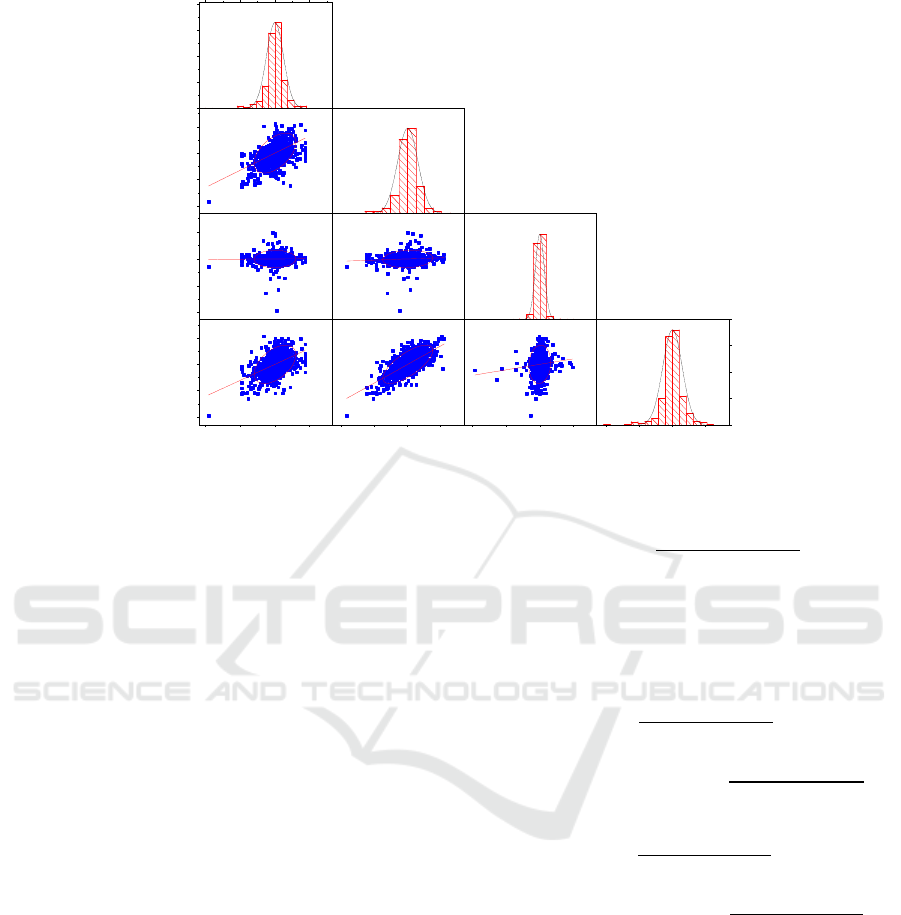

Figure 1: Scatter matrix graph between WTI oil price and Chinese fertilizer stock indices returns.

of more volatile clustering. The results of preliminary

statistics indicate that WTI oil return shows the

highest standard deviations and volatility clustering

pattern. Kurtosis results indicate that all series

probability distributions exist in fat tails, and Jarque-

Bera (J-B) shows a normal distribution does not exist.

Augmented Dickey-Fuller (ADF) test and KPSS test

support all assets series are stationary at/ the 1%

significance. The ARCH-LM (20) test confirms the

ARCH effects for all returns. Fig. 1 visually shows

the correlation of different assets return by using a

scatter-matrix graph. It is observable that a weak

positive correlation exists between oil price and

fertilizer indices, and the highest value exists between

oil price and nitrogen return.

3 ECONOMETRIC METHODS

3.1 Net Pairwise Connectedness

Connectedness technique was proposed by Diebold

and Yilmaz (2012) (Diebold, 2012) to estimate

directional and net connectedness. We only provide a

simple introduction of the method. Detailed

introduction can be seen in many previous studies.

The generalized forecast error variance

decomposition of the H-step ahead error variance in

forecasting the j-th following shocks from the k-th

variable can be expressed as follows:

Θ

𝐻

=

∑

∑

(1)

Θ

(𝐻) captures the contribution of the H-step ahead

error variance.

The directional connectedness received by market

i (or j) from all other markets j (or i) is given by

𝑇𝐷

= 100 ×

∑

Θ

(

𝐻

)

,

∑

Θ

(

𝐻

)

,

= 100 ×

∑

Θ

(

𝐻

)

,

𝑛

(2)

𝑇𝐷

= 100 ×

∑

Θ

(

𝐻

)

,

∑

Θ

(

𝐻

)

,

= 100 ×

∑

Θ

(

𝐻

)

,

𝑛

(3)

Thus, a net connectedness index for variable i can be

identified as

𝑁𝐸𝑆

(

𝐻

)

= 𝑇𝐷

−𝑇𝐷

. (4)

3.2 BEKK, CDCC, and GO-GARCH

Models

Following Ahmad et al. (2018) (Ahmad, 2018), Kang

et al. (2017) (Kang, 2017), and Sadorsky et al. (2014)

(Sadorsky, 2014), we provide the dynamic

conditional correlations depend on BEKK, CDCC,

-0.22 -0.11 0.00 0.11

0

180

360

540

720

potash

potash

-0.156

-0.078

0.000

0.078

Pearson's r=0.51691

nitrogen

nitrogen

-0.50

-0.25

0.00

0.25

Pearson's r=0.01783

oil

Pearson's r=0.09982

oil

-0.22 -0.11 0.00 0.11

-0.192

-0.096

0.000

0.096

Pearson's r=0.50196

phosphorus

potash

-0.156 -0.078 0.000 0.078

Pearson's r=0.73087

nitrogen

-0.50 -0.25 0.00 0.25

Pearson's r=0.09321

oil

-0.192 -0.096 0.000 0.096

0

160

320

480

640

phosphorus

phosphorus

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

46

and GOGARCH models. Previous studies have

provided detailed equations, and we introduce a

simple review of methods in the study. Previous

studies have provided a very detailed introduction.

BEKK-GARCH model defines a positive 𝐻

without

imposing an explicit restriction for coefficients. 𝐻

can be indicated by Eq. (1) and construct a diagonal

BEKK by 2 X 2 matrices A and B.

𝐻

= 𝐶

𝐶 + 𝐶

𝑢

𝑢

,

+ 𝐵

𝐻

𝐵

(5)

𝐶 =

𝐶

𝐶

0 𝐶

, 𝐴 =

𝑎

0

0 𝑎

, 𝐵 =

𝑏

0

0 𝑏

(6)

where C denotes an upper triangular of 2 X 2 matrices

An orthogonal method of GO-GARCH model,

assuming the residuals of 𝜀

= 𝑧𝑒

, and z denotes

linear map and 𝑒

is uncorrelated section. the

conditional covariance matrix 𝐻

is given by

𝐻

= 𝑍

𝑍𝐺

(7)

The GO (1, 1) is indicated as:

𝐺

= 𝐶

𝐶 + 𝐴

𝑒

𝑒

,

+ 𝐵

𝐺

𝐵 (8)

Engle (2002) (Engle, 2002) proposed a two-step

procedure of dynamic conditional correlation (DCC)

model. A matrix of conditional correlations 𝛾

can

be shown as:

𝛾

= diag

(

𝜉

∗

)

⁄

𝜉

diag

(

𝜉

∗

)

⁄

, 𝑤𝑖𝑡ℎ 𝜉

∗

= 𝑑𝑖𝑎𝑔

𝜉

.

(9)

𝜉

denotes the symmetric positive-definite matrix

and can be shown as:

𝜉

=

(

1 −𝛼−𝛽

)

𝜉

̅

+ 𝑎𝜀

𝜀

+ 𝑏𝜉

,

with a, b > 0, and a+b<1. (10)

Aielli (2013) (Aielli, 2013) proposed a corrected

version of the correlation process as in Equation (11):

𝜉

=

(

1 −𝛼−𝛽

)

𝑆+ 𝛼(𝜉

∗/

𝜀

𝜀

𝜉

∗/

)+

𝛽𝑄

𝜅

,

𝜅

>0, and 𝜅

+ 𝜅

<1. (11)

4 RESULTS

4.1 Connectedness Analysis

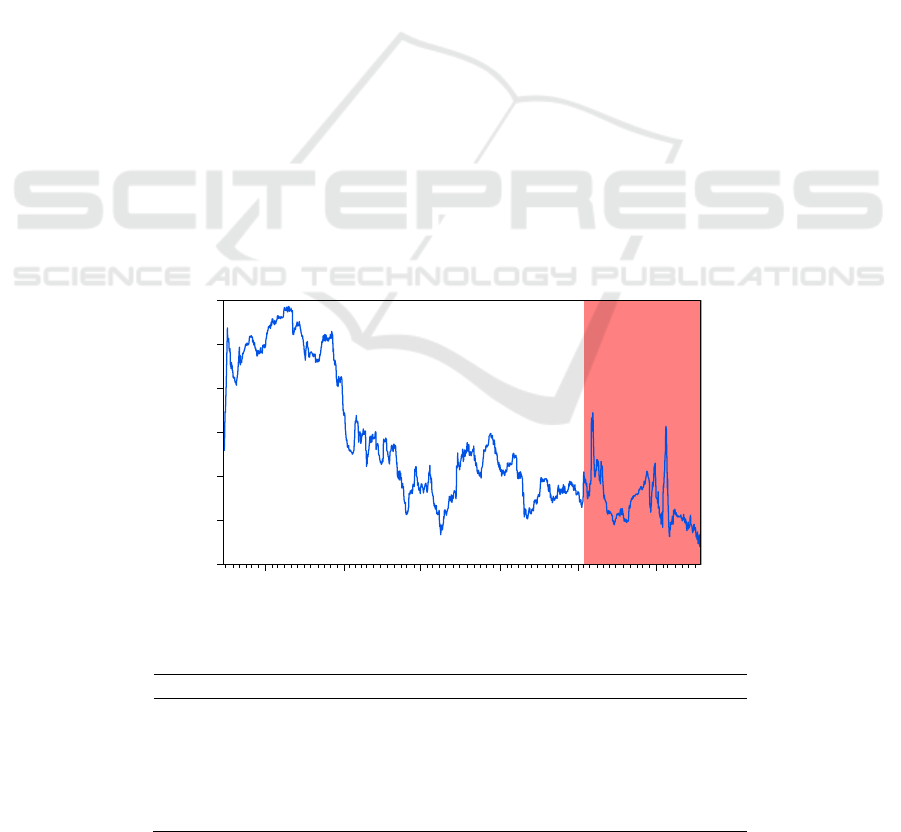

Fig. 2 plots the total connectedness index (TCI) by

employing Diebold and Yilmaz (2012). We calculate

based on a 200-day rolling technique and 10-day

forecasting horizon. The results show that TCI was

22.3% and a weak interdependence between oil and

fertilizer indices, but potash, phosphorus, and

nitrogen stock return seems easily transmitted. From

a time-varying perspective, the TCI shows as high as

30-40% during 2014-2016 then decline rapidly, and

about 22%-36% during the Covid-19 pandemic.

As shown in Table 1, Potash and Phosphorus

stock index contributed the statistically larger of TCI

Figure 2: The dynamics of the total connectedness index.

Table 1: Total connectedness index (TCI) and net pairwise connectedness results.

Oil Potash Phosphorus Nitrogen From

Oil 98.8 0.4 0.6 0.3 1.2

Potash 1.0 97.8 0.5 0.7 2.2

Phosphorus 1.9 25.3 72.2 0.5 27.8

N

itrogen 2.7 26.6 28.8 41.9 58.1

Contribution to. 5.7 52.3 29.9 1.4 89.3

Contribution includin

g

104.4 150.1 102.1 43.3 22.3%

20

24

28

32

36

40

44

2015 2016 2017 2018 2019 2020 2021

Dynamic Linkages between Global Oil Price Volatility and Fertilizer Stock Indices in China on Pre and during Covid-19 Pandemic

47

Figure 3: Dynamic pairwise connectedness between WTI oil price and WTI oil price, potash, phosphorus and nitrogen returns

(red shaded area is the period of Covid).

to other assets, with 52.3% and 29.9%, and received

spillovers from others with 2.2% and 27.8%,

respectively. Oil transmitted 5.7% of the shocks to

others and received 1.2% from others, implying oil

return is the net transmitter but weak interconnected

with Chinese fertilizer stock indices. It is worthy to

note that Phosphorus stock index have a important

role during assets. Phosphorus stock index

contributed 29.9% to others, and receive about 27.8%

from others. Nitrogen stock index is the biggest

receiver among all assets, and received 58.1% from

other assets.

The dynamic trajectory of the net pairwise TCI of

WTI oil price and fertilizer indices is indicated in

Fig.3. We can observe that transmission from WTI oil

price to fertilizer stock indices was not highly

influenced.

The pairwise connectedness of oil-phosphorus

and oil-nitrogen have higher performance on the pre-

Covid-19 pandemic, and oil-potash shows the

weakest. During the Covid-19 period, we can observe

that the pairwise connectedness is highly volatile for

all pairs, and the potash stock index is more sensitive

to oil shocks. The findings have implications of

indicating the connectedness of oil and potash stock

s have a significant increase during Covid-19, and

investors can consider possible strategies based on

the time-varying path of the connectedness.

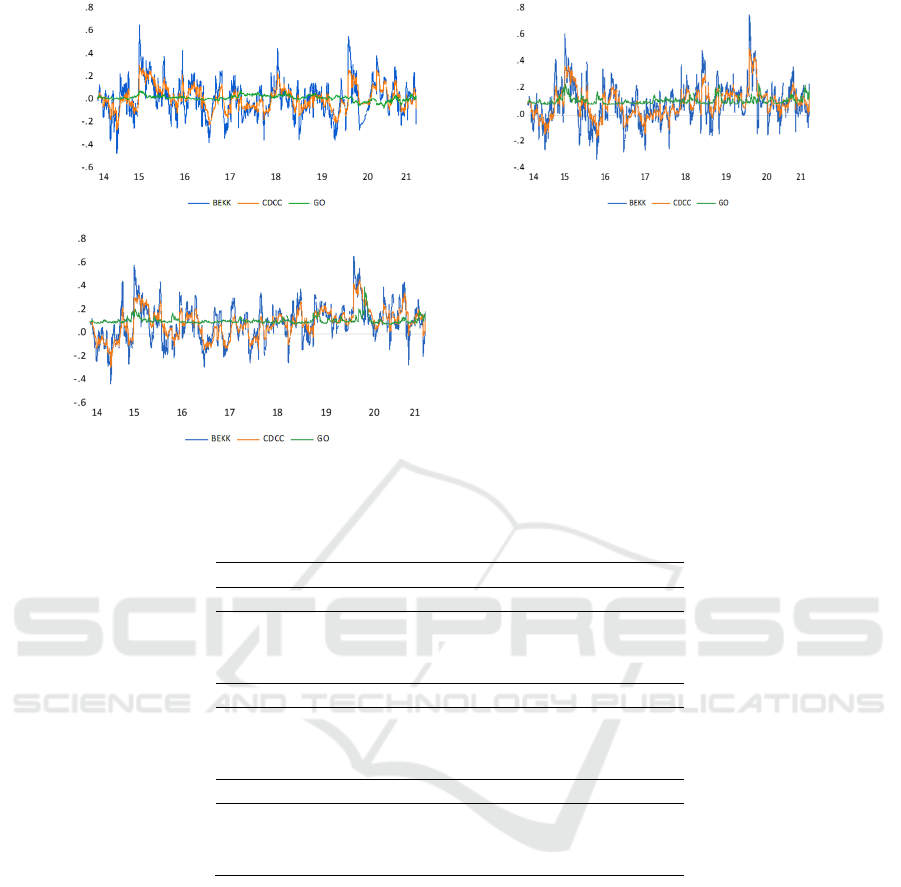

4.2 Dynamic Conditional Correlations

Fig. 4 displays the time-varying changes of dynamic

conditional correlations of WTI oil price and fertilizer

stock indices on pre and during Covid-19 pandemic

by comparing three multivariate GARCH models

(BEKK, CDCC and Go-GARCH).

Overall, the findings confirm there is a weak

integration between WTI oil price and the Chinese

fertilizer industry, implying oil price has a weak

impact on the fertilizer industry in China. Moreover,

BEKK and CDCC-GARCH models have a similar

performance of capturing the co-movements and

dynamic conditional correlations, and the results of

GO-GARCH are significantly different. Most

importantly, during the Covid-19 pandemic, a

significant clustering and increase can be observed

for all pairs, and oil-potash shows a sudden increase.

In the case of the WTI oil price and phosphorus stock

index pair, the conditional correlation stayed more

stable, with an average of 0.147 over the sample

period. The Covid-19 pandemic also increase the

linkage of WTI oil price, and shows a correlation of

0.2. It is observable that the strongest linkage

between oil and phosphorus stock was shown at the

begging of the Covid-19, also implying the sudden

crisis have significant news impact on stock market.

Nitrogen stock index shows a stronger co-movement

with oil price compared to other stock indices. In the

covid-19 period, the correlation is 2 times more than

pre-Covid-19, which is averaged of 0.245.

60

70

80

90

100

14 15 16 17 18 19 20 21

OIL-OIL

0

5

10

15

20

25

30

14 15 16 17 18 19 20 21

OIL-POTASH

0

4

8

12

16

14 15 16 17 18 19 20 21

OIL-PHOSPHORUS

0

2

4

6

8

10

12

14 15 16 17 18 19 20 21

OIL-NITROGEN

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

48

WTI oil

p

rice-Potash WTI oil price-Phosphorus

WTI oil price-Nitrogen

Figure 4: Time-varying dynamic conditional correlations of WTI oil price and Chinese fertilizer stocks indices.

Table 2: Mean and average value of the dynamic conditional correlation from different methods.

BEKK CDCC GO Average

Oil-Potash

all 0.011 0.018 0.023 0.026

Pre-Covid 0.000 0.006 0.030 0.018

During Covid 0.047 0.054 -0.004 0.048

Oil-Phosphorus

all 0.090 0.093 0.112 0.147

Pre-Covid 0.076 0.076 0.109 0.131

During Covid 0.135 0.144 0.122 0.200

Oil-Nitrogen

all 0.091 0.091 0.114 0.148

Pre-Covid 0.062 0.062 0.111 0.117

During Covid 0.176 0.185 0.129 0.245

4.3 Impulse Response and Historical

Variance Decomposition

We conduct an impulse response to show the

dynamics of WTI oil price on the Potash, Phosphorus,

and Nitrogen fertilizer index over 10 periods,

respectively. A new technique of bootstrapping with

a 95% confidence interval is used to show the results.

Fig. 5 presents the response of Potash,

Phosphorus, and Nitrogen from WTI oil price to

display the impact of oil shocks. The results indicate

the impact exists shortly for all indexes, and the

impact is relatively weak from WTI oil price. There

is only a positive impact on all fertilizer stock index

from first to third year, and the peak year exists in the

second year. And positive effect from the fourth year,

then gradually decline after the eighth year.

In order to indicate the different performance of

oil price shocks, in the following, we use generalized

weights of historical variance decomposition of

fertilizer stock indices from WTI oil return. The

output is very similar to previous results. The Covid-

19 pandemic has an essential impact on the

correlation of oil and fertilizer stocks. Moreover, it is

observable that the impact is minimal and only exists

at the beginning of the Covid-19 pandemic (See in

Fig.6)

Dynamic Linkages between Global Oil Price Volatility and Fertilizer Stock Indices in China on Pre and during Covid-19 Pandemic

49

WTI oil

p

rice-Potash WTI oil

p

rice-Phos

p

horus

WTI oil

p

rice-Nitro

g

en

Figure 5: Response of Chinese fertilizer stock indices to WTI oil price.

during Covid-19 during Covid-19

during Covi

d

-19

p

re-Covi

d

-19

pre-Covid-19 pre-Covid-19

Figure 6: Historical variance of decompositions of fertilizer stock indices from WTI oil price on pre and during Covid-19

pandemic.

-.001

.000

.001

.002

.003

.004

12345678910

Response of POTASH to OIL

-.002

.000

.002

.004

.006

12345678910

Response o

f

PHOSPHORUS to OIL

-.002

.000

.002

.004

.006

12345678910

Response of NITROGEN to OIL

-.2

-.1

.0

.1

.2

14 15 16 17 18 19

Total stochastic oil

phosphorus

from oil

-.15

-.10

-.05

.00

.05

.10

14 15 16 17 18 19

Total stochastic oil

nitrogen

f

rom oil

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

50

5 CONCLUSIONS

The empirical results of the study firstly provide the

evidence to extend previous works of literature to

examine the nexus of WTI oil price and fertilizer

stocks in China. Several conclusions can be obtained.

First, the total connectedness index was 22.3%,

implying a weak interdependence between oil and

fertilizer indices. From a hedging strategy

perspective, it is not an ideal asset to hedge the risk

for energy markets. WTI oil has a fragile impact on

the fluctuations of the others, and the potash stock

index was a significant contributor, and the nitrogen

stock index was a receiver in the long run. Second,

primarily positive dynamic conditional correlations

between the WTI oil price and stock indices were

observable pre and during the Covid-19 period. More

importantly, it can be obtained the Covid-19 had a

significant impact on fertilizer stock indices at the

beginning of the pandemic. Oil-Nitrogen showed a

higher dynamic linkage during the sampling period,

and Oil-Potash showed a weaker performance. The

findings from Impulse response and Historical

variance decomposition analysis also are consistent

with the results. The impact of the Covid-19 on the

nexus of Oil price and fertilizer stock indices only

exists at the beginning of the pandemic, then shows a

rapid decline. The results are beneficial to investors

and portfolio managers to assess risk management to

optimize portfolios if they consider the nexus of the

energy market and fertilizer industry. Moreover,

policymakers can use this analysis to monitor the

changes in energy costs in the fertilizer industry.

ACKNOWLEDGEMENT

This study was conducted with the support of two

projects. Project 71763034 supported by National

Natural Science Foundation of China. Project

2020JY08 supported by YNAU Outstanding Scholar

Project.

REFERENCES

Ahmad, W., P. Sadorsky, and A. Sharma. 2018. Optimal

hedge ratios for clean energy equities. Economic

Modelling 72:278–95. doi:10.1016/j.econmod.

2018.02.008.

Aielli, G. P. 2013. Dynamic conditional correlation: On

properties and estimation. Journal of Business &

Economic Statistics 31 (3):282–99. doi:10.1080

/07350015.2013.771027.

Diebold, F. X., and K. Yilmaz. 2012. Better to give than to

receive: Predictive directional measurement of

volatility spillovers. International Journal of

Forecasting 28(1):57–66. doi:10.1016/j.ijforecast.

2011.02.006.

Engle, R. 2002. Dynamic conditional correlation. Journal

of Business & Economic Statistics 20 (3):339–50.

doi:10.1198/073500102288618487.

Kang, S. H., R. Mciver, and S.-M. Yoon. 2017. Dynamic

spillover effects among crude oil, precious metal, and

agricultural commodity futures markets. Energy

Economics 62:19–32. doi:10.1016/j.eneco.2016.

12.011.

Sadorsky, P. 2014. Modeling volatility and correlations

between emerging market stock prices and the prices of

copper, oil and wheat. Energy Economics 43:72–81.

doi:10.1016/j.eneco.2014.02.014.

Dynamic Linkages between Global Oil Price Volatility and Fertilizer Stock Indices in China on Pre and during Covid-19 Pandemic

51