Research on Bitcoin’s Working Mechanism and Monetary Attributes

Shengye Tao

1, a

and Zhen Li

2, b*

1

Hohai University, School of Marxism, Nanjing, Jiangsu, China

2

Jining University, Jining, Shandong, China

Keywords: Bitcoin, Monetary, Attribute.

Abstract: This paper analyses the currency attributes of bitcoin starting with the operation principle of bitcoin. This

paper argues that 1. Bitcoins are automatically generated by computer algorithms and do not involve social

labor; 2. transaction confirmation time is so long, block capacity is so small, that bitcoin has difficulty in

dealing with the huge amount of transaction payment information; 3. the total amount fixed and high

concentration make the bitcoin unable to perform the function of storage means; 4. the bitcoin is difficult to

conduct credit transactions and financing activities because of highly anonymity; 5. unstable transaction value

and the number of issues of bitcoin does not match the growth of international trade make it difficult to be an

international currency.

1 INTRODUCTION

On November 1, 2008, Satoshi Nakamoto, the

inventor of Bitcoin, published a paper entitled

Bitcoin: A Peer-to-Peer Electronic Cash System on

the Internet. Nakamoto introduced an electronic cash

system based entirely on Point to Point (P2P). In such

a system, blockchain technology and distributed

database are utilized so that both parties of the

transaction can get rid of a third-party intermediary

(commercial banks, for example) and conduct

payment directly, hence creating a brand new

decentralized monetary payment system. This is the

birth of Bitcoin, a digital currency that is not

controlled by central banks and any financial

institutions. The first transaction using Bitcoin took

place in 2010 when an American programmer

managed to exchange 10,000 Bitcoin for two slices of

pizza. At that time. 10,000 Bitcoins were only worth

30 USD. Earlier in 2021, the price of Bitcoin hit its

highest in history, at 46,000 USD. However, it fell

back to 30,000 USD in a few days. Bitcoin’s price has

been soaring since its birth, creating a wave of digital

currency in the world financial sector. Bitcoin has

received wide attention from governments, investors,

and consumers around the world. Germany has

become the first country in the world to recognize the

legal status of Bitcoin. Canada installed its first

Bitcoin ATM, through which citizens can exchange

Canadian dollars and Bitcoins in both directions. The

United States and Singapore are supportive of Bitcoin

trading. The governments of Russia and Thailand,

however, have completely blocked Bitcoin. India,

Norway, and South Korea, on the other hand, are

prudent towards the use of Bitcoins, and have issued

some regulations to restrict the cryptocurrency’s

development. Five Chinese Ministries and

Commissions, including the People’s Bank of China,

jointly issued the Notice of Preventing Bitcoin Risks

in 2013, refusing to recognize the monetary attributes

of Bitcoin and banning its circulation in the domestic

market.

At present, major controversies still exist in the

academic community concerning the monetary

attributes of this cryptocurrency. Scholars with a

supportive attitude believe that Bitcoins can be used

as a universal equivalent that participates in

commodity exchanges. By analyzing the five

functions of a currency, Hong concluded that Bitcoin

is the same as other currencies such as gold and silver

in serving the functions of currency (Hong, 2011).

McHugh described Bitcoin as “another form of

currency” and “a kind of private currency.” (McHugh,

2014) Chowdhury and Mendelson hold the belief that

as more and more people came to recognize virtual

currencies, it is only a matter of time before virtual

currencies go mainstream (Chowdhury, 2014). Jia

believes that Bitcoin is a brand new decentralized

virtual currency that can serve as a measure of value,

an exchange medium, the means of payments, and a

208

Tao, S. and Li, Z.

Research on Bitcoinâ

˘

A

´

Zs Working Mechanism and Monetary Attributes.

DOI: 10.5220/0011733200003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 208-214

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

store of value, forming an independent currency

system. Based on the current challenge facing the

Bitcoin market, Jia also proposed that we should

improve the supervision of Internet financial

institutions and establish a coordinated supervision

mechanism. (Jia, 2013)

However, some scholars hold a dubious attitude

towards Bitcoin’s monetary attributes and durability.

Surda believes that without intrinsic value or

government endorsement, Bitcoin’s circulation

depends entirely on users’ confidence and markets’

acceptance. (Surda, 2014) Wang proposed that there

are four major risks in the use of Bitcoin: the

uncertain legal status, the vulnerability of trading

platforms, price fluctuations and Ponzi schemes, as

well as value abrasion. (Wang, 2013) According to

Wu, problems and risks of Bitcoin include excessive

speculation, cybercrime, huge price fluctuations,

waste of social resources, etc. (Wu, 2013) Li

proposed that Bitcoin is a kind of virtual speculative

asset. It is neither a commodity currency nor a credit

currency, which means it can never be a real currency

in China. Bitcoin’s decentralization nature,

fluctuating exchange values, and the fixed amount

that cannot be able to keep up with the international

economic development mean that this cryptocurrency

will never become an international currency. The fate

of Bitcoin depends on how the central banks view it

and the merchants’ willingness to accept it. (Li, 2015)

Bitcoin is generated by computer algorithms, a

great difference from any previous currency. The

author of this paper will start with Bitcoin’s working

mechanism, and then conduct an economic analysis

of Bitcoin before he finally reaches a conclusion.

2 BITCOIN’S WORKING

MECHANISM

By using blockchain technology and a distributed

database, Bitcoin forms a P2P electronic cash

transaction system. No third-party intermediary

would be involved in the transaction process. The

transaction will be carried out solely by the two

parties. It would be a brand-new decentralized

currency payment system.

2.1 Bitcoin’s Payment Mechanism

In traditional centralized payments, financial

institutions such as commercial banks serve as third-

party intermediaries and transfer the money from

Client A’s account directly to Client B’s account.

They use their ledger which stores the balances of all

depositors to make these transactions happen. The

commercial banks lie at the center of the payment.

They have to ensure that the amount in each client’s

account could not be changed for no reason.

Commercial banks set up their computer rooms, build

independent network environments, purchase

advanced servers and hire senior experts for security

reasons.

Bitcoin, however, adopts a decentralized ledger

storage solution. All computers connected to the

Bitcoin system (or the “nodes”) store a ledger that

records all payments up to this point. Since the ledger

is stored at each node, if problems occur at one of

these nodes, the correct data can still be accessed

from other nodes on the network. When the ledger is

updated at a certain node, other nodes would be

notified to change their ledger records.

Bitcoin Payment not only involves paying with

Bitcoin, but also the recording of corresponding

payment information. Such information includes 1.

Bitcoin addresses (id); 2. source of the fund, the

Bitcoin addresses (id) of the previous payment where

you receive these Bitcoins; 3. payers’ electronic

signature in the previous payment where you receive

these Bitcoins for other nodes to verify the

authenticity of the source; 4. destination of the funds,

and the account (public key) of the Bitcoins’

recipient; 5. amount of the fund; 6. payers’ signature

for this transaction to prove that he/she is the issuer

of the payment. Since each transaction order records

the previous owner, current owner, and the future

owner of the funds, we will be able to trace the entire

process of the transaction based on this information.

This is also one of the characteristics of Bitcoin.

Finally, when each transaction is completed, the

system would inform all users of the execution of this

payment. (Yao, 2013)

All information of Bitcoin payments that abide by

the system rules will be packed and stored. The

package they form is what we usually call a “block”.

Currently, the Bitcoin system generates a block every

ten minutes, and each block records the parameters of

the previous block. In this way, each block can be

traced back to its previous block, and even all the way

to Block #0 (or the Genesis Block), hence forming a

complete transaction chain, also a now-famous

blockchain. This blockchain will announce to the

whole network each time a new block is added so that

every “node” in the Bitcoin system could have a copy

of the record. The highly decentralized storage of

transaction information makes it almost impossible

for us to completely lose the Bitcoin blockchain.

We can see from the above introductions that once

Research on Bitcoinâ

˘

A

´

Zs Working Mechanism and Monetary Attributes

209

payment information is stored in a blockchain.

Theoretically speaking, it cannot be modified or

deleted. With its unique technical characteristics,

Bitcoin provides us with a new payment mechanism.

2.2 Bitcoin’s Generation

Once a Bitcoin transaction occurs, the system will

first verify the transaction information throughout the

entire network to ensure that the source and

destination of the Bitcoins are authentic and valid to

prevent false payments and double payments. If the

verification succeeds, these transactions will be

temporarily stored in a valid transaction pool; they are

called “unconfirmed transactions”. Eventually, the

unconfirmed transactions will be loaded into a block.

Only when the newly formed block is added to the

entire blockchain, can the transaction be declared

settled. From that moment, the transactions can no

longer be modified or deleted anymore. On the other

hand, if the verification fails, the transaction will be

deemed as an “invalid transaction.”

As was mentioned earlier, in times of a new block

being added to the chain, the blockchain will

announce the whole network, so that every computer

connected to the Bitcoin system could make a copy of

the record. The more computers connected to the

Bitcoin system are, the more secure the transaction

information, i.e., the blockchain will be. To encourage

more people to connect their computers to the Bitcoin

system and make use of their idle computing power

for accounting, certain rewards are provided for each

computer node that gains the power to add a new

block for the first time. Those rewards are today’s

well-known Bitcoins. The newly generated

information of Bitcoin is also stored in the new block.

In January 2009, the first block, Block #0, or the

Genesis Block, was included in the public ledger at

6:15 p.m. at server time. The reward was 50 Bitcoins.

Besides a certain amount of Bitcoin, these nodes that

have the right to add a new block will also be

rewarded some “transaction fees” from the

transaction orders in the new blocks.

So far, as Bitcoin continues to enter the public eye,

more and more people (or computers) are connected

to the Bitcoin system. Every node on the system is

vying for the power to add a new block so that they

can gain more rewards. The process is vividly called

“mining”. Users participating in the Bitcoin system

would install mining software on their computers and

use them to solve complex problems that are

automatically generated by the system. In fact, what

these computers need to do is to calculate the hash

value generated by the Hash function with the

parameters of the previous block. The first node

solving the problem will be granted the right to add a

new block and at the same time, gain a certain amount

of Bitcoin for rewards, while other nodes can only

copy the newly added block without any rewards.

According to the setting of the Bitcoin system, the

Bitcoins rewarded for each added new block are

halved every four years. When the year 2009 first

started, the reward was 50 Bitcoins for each new

block added. It was 25 Bitcoins for 2013-2016; 12.5

for 2017-2021. The ultimate setting is that the total

amount of Bitcoin in the system will reach the upper

limit of 21 million in 2140. (Yang, 2014)

Since the number of miners mining

simultaneously is uncertain, the Bitcoin system will

automatically adjust the problem difficulty based on

the total computing power of all nodes, which means

if the total computing power is bigger in the system,

the problem difficulty will be increased, and vice

versa. This rule ensures that the generation rate of

new blocks (Bitcoin) remains within an acceptable

range. The current rate is one new block generated

every ten minutes. As more netizens are interested in

mining Bitcoins and invest their computing power in

the Bitcoin system, the mining also gets significantly

difficult. Now the miners have already formed

groups, connecting their computers with each other’s

and joining their computing powers, forming a so-

called “mining pool” to get the ability to solve more

difficult mathematical problems and increase the

odds of gaining Bitcoins. The Bitcoins then gained

will be handed out to the group members based on

their contributions.

2.3 Bitcoin’s Characteristics

Based on the above analysis of Bitcoin’s working

mechanism, we can conclude that Bitcoin with the

following characteristics:

2.3.1 Decentralization

Most existing currencies are issued by a country’s

central bank. They receive endorsement from the

local governments, and their circulation is guaranteed

by the law. Bitcoin, on the other hand, is

automatically generated by computer algorithms. Its

generation rate and total supply have already been

determined at the time of its birth, not subject to the

influence of any institution or individual.

2.3.2 High Anonymity

The forming of Bitcoin addresses (id) does not

require real-name authentication. All the users need

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

210

to do is to submit applications on related websites,

and then they can get one or more Bitcoin addresses.

These Bitcoin addresses are merely some irregular

character strings made of letters and numbers, whose

only function is to accept or pay Bitcoins. Therefore,

no owner information could be drawn from these

addresses. Also, no connection could be seen between

different accounts of the same owner, so others would

not be able to calculate the total amount of Bitcoins

owned by a particular user.

2.3.3 Perfect Traceability

The blockchain records all the transactions that have

ever happened in history. Each Bitcoin can be traced

back to the time when it was first generated. Every

node in the Bitcoin system keeps a complete copy of

the transaction history, which means anyone could

have access to the transaction records of every

account. This puts the whole network under

supervision to ensure a fair and transparent market

order.

2.3.4 Irreversibility of Bitcoin Transactions

Sustainable right to add a new block would be

guaranteed, unless a certain node possesses more than

51% computing power of the entire system. Once a

transaction is recorded on the blockchain, other nodes

would copy and save the record immediately. It would

be impossible to cancel the change or delete the

record. This design prevents the payer from

infringing the payee’s interests by canceling any

operations.

2.3.5 No Inflation Will Be Seen in The

System

As was mentioned above, the total amount of Bitcoin

would be 21 million, and the generation rate of new

Bitcoin halves every four years. The new Bitcoin is

automatically generated by computer algorithms, so

no sudden will increase or decrease in circulation.

2.3.6 Bitcoin Knows No Borders

Anyone who possesses a Bitcoin address (id) with a

password (or private key) can receive or pay with

Bitcoin on any computer in every corner of the world,

without government supervision.

2.3.7 The Transaction Fees of Bitcoin Are

Low

Only 1 bitcent would be charged for each transaction.

No exchange rate exists in cross-border transactions.

(Jia, 2013)

3 BITCOIN’S CURRENCY

ATTRIBUTES

From Bitcoin’s working mechanism, we can see that

Bitcoin has unique characteristics compared to any

traditional currencies. Both western economics or

Marxist economics agree that a currency should have

the following five functions: a measure of value, an

exchange medium, means of payments, store of

value, and universal currency. The author believes

that Bitcoin is still sufficient in fulfilling its functions.

3.1 A Measure of Value

The value of a commodity depends on the relative

quantity of labor that is necessary for its production.

Here the socially necessary labor time serves as the

intrinsic measure of commodity value. Currency is a

kind of universal equivalent. The reason why it can

be a measure of value is that currency itself also

possess value. Therefore, the value contained in other

commodities can be measured with the currency as

the scale.

Bitcoin was first created to encourage more

“nodes” to connect themselves to the Bitcoin system

and devote their idle computing power to solving

math problems. Bitcoin is entirely generated by

computer programs automatically, with no social

labor involved in this process. Some believe that the

computing hardware and electric power invested in

the “mining” process can be seen as the value of

Bitcoin. But the truth is, to raise or decrease such

investment has little impact on the speed of Bitcoin

generation. No matter how many people are engaged

in the “mining”, Bitcoin will be always generated at a

set rate. It is worth noting that to maintain this rate,

the Bitcoin system will automatically adjust the

problem difficulty based on the sum of computing

power in the systems. In other words, if there is more

computing power in the system working on the same

problem simultaneously, the problem gets more

difficult, and vice versa. As the number of “miners”

gradually increased, the problems also get more and

more difficult, leading to a serious waste of social

resources. According to the statistics of the Bitcoin

Energy Consumption Index, by the end of 2020, the

electricity consumption devoted to Bitcoin mining in

2020 reached 29.51 Terawatt Hours (TWh),

accounting for about 0.13% of global electricity

Research on Bitcoinâ

˘

A

´

Zs Working Mechanism and Monetary Attributes

211

consumption. This figure was higher than the yearly

power consumption of nearly 160 countries or

regions, including Iceland and Nigeria. If all the

Bitcoin miners around the globe were to form a new

country, its power consumption would rank 61st in

the world. ((Sources: power compare)

3.2 An Exchange Medium

Currency serves as a medium of commodity

exchange. In the exchange process, the sellers convert

their goods into money, and then use the money they

received to purchase new goods. Here, currency

serves as the exchange medium that enables goods

circulation.

Bitcoin is favored by users due to its

decentralization, high anonymity, transaction

irreversibility, perfect traceability, and low

transaction fees. Many people regard it as a safe and

effective means of payment. But we still need to

remind you that Bitcoin still poses some concerns:

First, the Bitcoin system generates a new block every

ten minutes and only at this time, the transaction

record loaded on the blockchain will be preliminarily

confirmed. The transaction will be further confirmed

once the new block is connected to the previous

block. Based on the technicality of the Bitcoin

system, the transaction could be truly and irreversibly

confirmed only after the confirmation of six new

blocks. The means to truly confirm a Bitcoin

transaction takes about an hour, which is too slow

compared to the current centralized payment system

that only takes seconds. The slow transaction speed is

closely linked to the underlying technical design of

the Bitcoin system. Second, a block is 1 M in size,

which is big enough to contain around 1,000 pieces

of transaction information. This means that a large

amount of transaction information will be temporarily

stored in the transaction pool to be confirmed. This

would prolong the transaction time, posing great

limits on the number and scale of transactions being

conducted simultaneously. Third, every node in the

Bitcoin system must keep a copy of the entire

blockchain, and this chain is still getting longer, with

one new block added every ten minutes. Currently, its

size is even bigger than the storage capacity of any

personal computer. Many Bitcoin users have to seek

help from the supercomputers in large institutions,

which contradicts Bitcoin’s decentralization nature.

Since deficiencies like this were developed out of

Bitcoin’s decentralization nature, they cannot be

1

Geek: With the rise of the Internet culture, geeks refer to

those who show passion for computing and Internet

fixed by merely upgrading the central hardware or

software just like what has been done on a centralized

trading system. The solutions to those problems are

still unknown and under discussion.

3.3 Store of Value

Currency as a store of value refers to its being

preserved as a symbol of social wealth when it is no

longer circulated on the market. It can adjust the

amount of currency being circulated. Only authentic

and pure gold and silver, in the forms of coins and

bars, can be kept as a store of value. When kept in

banks, paper money can be seen as the symbol of

one’s assets, but it can never be a store of value.

People will only keep paper money only when its

value could remain stable for a long time.

Bitcoin does not possess any value in itself, so it

can never be a store of value like gold and silver.

Though the total amount of Bitcoin was set to be 21

million, some people insist that it has high resistance

to inflation. However, two shortcomings that exist

with Bitcoin make it almost impossible for this

cryptocurrency to become a store of value. On the one

hand, there will be only 21 million Bitcoin in this

world, but our total economic and social production

capacity is far greater than this. We all know that

Bitcoin can be divided into eight decimal places, so it

seems possible for it to satisfy the transactions of the

whole society. However, owners of Bitcoin, seeing

the rising trend of Bitcoin prices, would not use their

Bitcoin for transactions. Instead, they will hoard them

and wait for them to appreciate. An American

economist, Paul Krugman, once wrote: “What we

want from a monetary system is not to make people

holding money rich; we want it to facilitate

transactions and make the economy as a whole rich.”

“Due to the expectation that Bitcoin economy will

grow, people will tend to hoard the virtual currency

rather than spending it,” resulting in “money-

hoarding, deflation and depression.” On the other

hand, when Bitcoin first appeared, only geeks 1

would collect this virtual currency, leading to today’s

excessive concentration of Bitcoin. As reported by

Bloomberg, nearly 40% of the world’s Bitcoin is

owned by a thousand users. “They have a great

impact on the Bitcoin market. They are known as

whales.” If Bitcoin can serve as a store of value, it

means nearly 40% of the social wealth would be in

the hands of these one thousand people. Obviously, it

is unacceptable to almost any economy or society.

technologies and are willing to devote much of their time

in learning such technologies.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

212

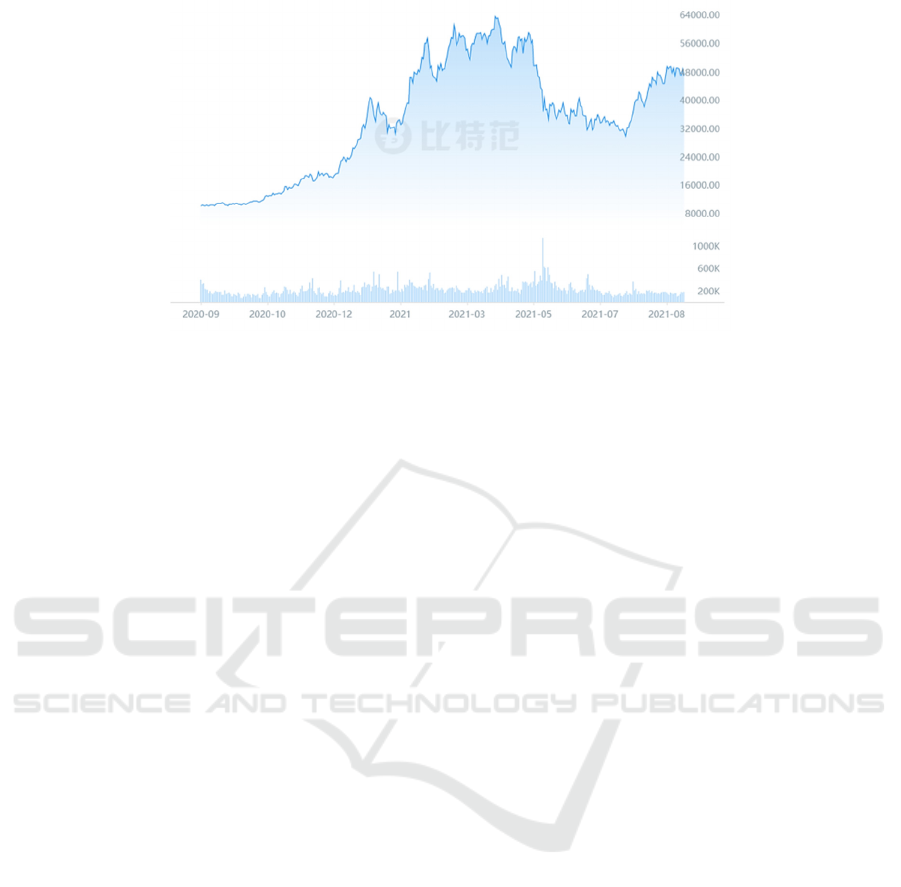

Figure 1: Bitcoin’s Price History in the Previous Year (Sources: www.price.btcfans.com).

Even though Bitcoin cannot be a real currency

enabling economic and social circulation, such a high

concentration still contradicts Bitcoin’s decentralized

nature.

3.4 Means of Payments

Currency serves as a means of payment during debt

repayment. In fact, commodity exchange can be done

without cash. Deferred payment can be possible,

where the cash will be paid after a certain period.

Here currency serves as a means of payment. Its

function as a means of payment was first seen in

commodity exchange, and later expanded outside of

it. With the rise of deferred payment, various credit

currencies also appeared, such as promissory notes,

checks, money orders, banknotes. These diverse

credit currencies also function as means of payment.

In the meantime, the debts they represent can offset

each other, which has significantly reduced the

amount of currency being circulated in the market.

Based on Bitcoin’s trading mechanism, deferred

payments or credit behaviors are still impossible in

transactions of Bitcoin. First of all, the irreversibility

of Bitcoin transactions can effectively protect the

recipients’ privacy, but not the interests of the payers.

A third party, for instance, Alipay, is required to

protect their interests. To this end, one or several

centralized nodes could be generated to ensure the

smooth progress of transactions, which will also

contradict the decentralized nature of Bitcoin.

Secondly, whether it is direct financing or indirect

financing, the borrower’s identity needs to be

confirmed and the borrower’s credit information is

needed as the basis for risk evaluation. However,

Bitcoin’s high anonymity makes it almost impossible

for relevant information to be collected. If an

intermediary institution like a bank is brought in to

bridge the borrowers and lenders, it means another

central node has to arise. All these mean that although

it is technically feasible to finance through Bitcoin,

the action will undermine the virtual currency’s

decentralized nature. Financing difficulties will

become a major obstacle to Bitcoin’s development.

Thirdly, even if financing becomes possible in the

Bitcoin system, credit instruments like promissory

notes, checks, money orders, banknotes will be

created. The excessive use of credit instruments could

result in the forming of a central banking system, also

contrary to Bitcoin’s decentralization.

3.5

World Currency

When a currency serves as a universal equivalent in

the world market, it is also called a world currency.

Bitcoin knows no borders. Anyone can receive and

pay Bitcoin on any computer in every corner of the

world without government supervision. However, as

it is pointed out by Li, Bitcoin could never become a

world currency. If we want Bitcoin to become a world

currency, its “decentralization” has to be replaced by

“centralization”; its exchange value must remain

stable; its total amount shall be able to meet the

requirements of global economic development (Li,

2015). At present, Bitcoin is not able to serve the

function of being a world currency.

4 CONCLUSIONS

Bitcoin is a major breakthrough in currency

development. The devising of a reliable electronic

payment system provides valuable experience for

designing future payment systems and virtual

currency systems. Bitcoin’s inherent advantages

Research on Bitcoinâ

˘

A

´

Zs Working Mechanism and Monetary Attributes

213

provide a series of innovative ideas and methods for

solving the currency-related problems faced by all

countries around the globe, especially inflation.

Financial institutions of all countries can learn from

Bitcoin’s design concept. However, though Bitcoin

presents technical innovations and solutions to

traditional problems, it also brings some new and

serious problems that are not easy to be fixed, which

casts a shadow over its long-term development. As

the concept of Bitcoin went viral in recent years,

people’s attention has been shifted from this

technological innovation to its possible price bubble.

it is concluded that, instead of Bitcoin itself, we

should focus more on its underlying techniques,

namely blockchain technology and distributed

storage technology. The latter will surely play a

bigger role in future economic development and

provide more feasible solutions and technical support

for solving practical problems.

REFERENCES

Chowdhury A, Mendelson B K. Digital Currency and

Financial System. (2014) The Case of Bitcoin[J].

Investments & Wealth Monitor.

Hong S. Bitcoin. (2011) A Cryptocurrency’s Challenge to

the Financial System [J]. China Credit Card, 2011(10):

61-63

Jia L. Theories. (2013)Practices and Influence of Bitcoin

[J]. Studies of International Finance, 2013(12): 14-25.

Jia L. (2013) Theories, Practices and Influence of Bitcoin

[J]. Studies of International Finance, 2013(12): 14-25.

Li C.(2015) Will Bitcoin Become a Currency? [J].

Contemporary Economic Research, 2015(4): 60-65.

Li C. (2015) Will Bitcoin Become a Currency? [J].

Contemporary Economic Research, 2015(4): 60-65.

McHugh S, Yarmey K. Near field communication. (2014)

Recent developments and library implications [J].

Synthesis Lectures on Emerging Trends in

Librarianship, 2014, 1(1): 1-93.

Surda P. (2014) The Origin, Classification and Utility of

Bitcoin[J]. Classification and Utility of Bitcoin (May 4,

2014), 2014.

Wang G., Feng Z. (2013) Risks, Current Regulations and

Policy Recommendation of Bitcoin [J]. Finance and

Economy, 2013(9): 46-49.

Wu H., Fang Y., Zhang Y. (2013) A Crazy Digital Currency:

Nature of Bitcoin and its Enlightenment [J]. Journal of

Beijing University of Posts and Telecommunications,

2013, 15(3): 49-50.

Yao Y. (2013) Easy Understood Bitcoin Mechanism.

www.btcl23.com/data/docs/easy_understood_Bitcoin_

mechanism.pdf

Yang C., Zhang M. (2014) Dynamics, Characteristics and

Prospects of Bitcoin [J]. Chinese Review of Financial

Studies. 2014(1): 38-53.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

214