Option Pricing and Risk Hedging by Black-Scholes Model

and Cox-Ross-Rubinstein Model for Unilever PLC

Sen Chen

1,†

, Boyang Sun

2,*,†

and Jingzhe Lin

3,†

1

The College of Liberal Arts and Sciences, Arizona State University, 336E Orange St Tempe, AZ 85281, U.S.A.

2

Faculty of Science, University of Ottawa, 75 Laurier Ave E, Ottawa, ON K1N 6N5, Canada

3

Faculty of Environment & Faculty of Mathematics, University of Waterloo,

200 University Avenue West, Waterloo, ON, Canada

Keywords: Black Scholes Model, Cox-Ross-Rubinstein Model, Risk hedging, Python, Option pricing.

Abstract: Currently, option pricing and risk hedging are interesting topics in the financial field within the violate world.

This paper studies the performance of the different hedging strategies on options on stocks of Unilever PLC

within the Fast-Moving Consumer Goods Industry, which is helpful for both individual and institutional

investors to build their portfolios and choose a hedging strategy. In this study, implied volatility for each of

Unilever’s stocks is calibrated utilizing data on ten options on that stock. Then, with the Black Scholes Model

and Cox-Ross-Rubinstein model calculated, a hedging portfolio is composed, containing one unit of a specific

option and delta shares of the underlying stock for the company. Finally, the hedging performances of the

options on the company’s stocks are compared. The results in this paper benefit both individual and

institutional investors in choosing the best-fit hedging strategy depending on the nature of the underlying asset

to risk mitigation.

1 INTRODUCTION

To illustrate, a hedging strategy refers to a risk

management strategy that offsets losses in an

investment by taking the opposite position in a related

asset. As a matter of fact, hedging strategies are

widely used by individual investors as well as asset

management companies to mitigate risks and reduce

the extent of potential negative effects without

significantly reducing the rate of return. In addition,

as hedging strategies facilitate investors' investments

in more diverse assets, they help increase the liquidity

of their investments.

Within the numerous hedging strategies, using

options to hedge risks towards equity portfolios is

very critical and widely used, and its related topics

have long been studied, Galai analyzed the

components of the return from hedging options

against stocks (D. Galai, 1983). Also, Platen and

Schweizer provided a new explanation for the smile

and skewness effects in implied volatility from

hedging derivatives (E. Platen, 1998). Also, Bakshi,

*

Corresponding author

†

These authors contributed equally

Cao, and Chen compared the pricing and hedging of

short-term and long-term equity options (G. Bakshi,

2000), and Kumar studied the efficacy of option

Greeks and their significance in risk hedging

strategies (A. Kumar, 2018). Additionally, Howe and

Rustem presented a robust hedging algorithm to

hedge the risk of writing options (M.A. Howe, 1997).

Moreover, Soner, Shreve, and Cvitanic proved that

the least expensive method of dominating a European

call in a Black-Scholes model with proportional

transaction costs is the trivial strategy of buying one

share of the underlying stock and holding it to

maturity (H. M. Soner, 1995). Comparably, Gao, Li,

and Bai et al. also proposed an optimal risk hedging

strategy using put options with stock liquidity (R.

Gao, 2019). Becker, Cheridito, and Jentzen

introduced a deep learning method for pricing and

hedging American-style options as well (S. Becker,

2019).

In this study, the same delta-hedging strategy

utilizing the Black Scholes model and binomial tree

model is applied to a specific option on Unilever

Chen, S., Sun, B. and Lin, J.

Option Pricing and Risk Hedging by Black-Scholes Model and Cox-Ross-Rubinstein Model for Unilever PLC.

DOI: 10.5220/0012033500003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 387-394

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

387

Corporation’s stocks. And the hedging performance

on the company’s option is compared to give insights

into the difference in performances utilizing the same

hedging model across companies and sectors. The

results of this study show that the delta hedging

strategy utilizing the Black Scholes model and

binomial tree model performs well on selected

options.

2 DATA AND METHODS

2.1 Data

The data to be used are collected from Yahoo Finance

(https://ca.finance.yahoo.com). Data are used of five

call options and five put options on Unilever PLC

stocks collected from June 16th to July 18th, 2022,

which are used to calibrate implied volatility for the

stock of Unilever PLC. Unilever PLC, a mass

company with large volume and popularity in the

Fast-Moving Consumer Goods Industry, is supposed

to be representative of the FMCG industry. After

gathering data, a hedging strategy is constructed for

another option in this stock from June 27, 2022, to

July 8, 2022. The ten options used for calibration are

in-the-money, at-the-money, and out-of-the-money,

with similar prices to ensure that the sum of the

standard error is not so large that it is difficult to

calibrate implied volatility. The options information

collected to calibrate the implied volatility of

Unilever's stock is shown below in the table.

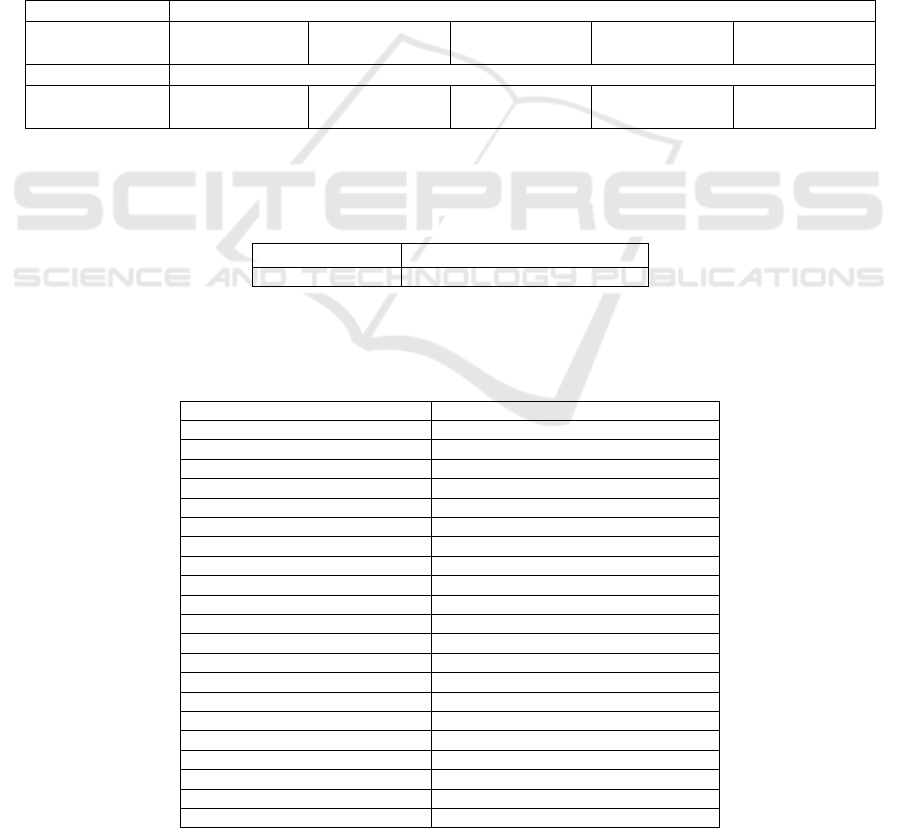

Table 1: 10 options chosen for calibration from uilever plc.

Call options

Unilever PLC

UL220819C000

40000

UL220819C000

42500

UL220819C000

45000

UL220819C000

47500

UL220819C000

50000

Puto

p

tions

Unilever PLC

UL220819P000

40000

UL220819P000

42500

UL220819P000

45000

UL220819P000

47500

UL220819P000

50000

The information on the option used for hedging is

shown in the table below.

Table 2: Option that is chosen for hedging for unilever plc..

Option

Unilever PLC UL220819C00037500

In addition to this, Unilever's share price from

June 17, 2022, to July 18, 2022, is shown below.

Table 3: Stock price of Unilever plc from June 16th,2022, to July 18th,2022.

Date (YYYY/MM/DD) The stoc

k

price of Unileve

r

PLC ($)

2022/6/16 43.96

2022/6/17 43.72

2022/6/21 44.37

2022/6/22 44.37

2022/6/23 44.57

2022/6/24 46.25

2022/6/27 46

2022/6/28 45.33

2022/6/29 45.56

2022/6/30 45.83

2022/7/1 46.29

2022/7/5 45.84

2022/7/6 46.18

2022/7/7 46.13

2022/7/8 46.13

2022/7/11 45.18

2022/7/12 46.02

2022/7/13 46.27

2022/7/14 45.93

2022/7/15 46.21

2022/7/18 45.94

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

388

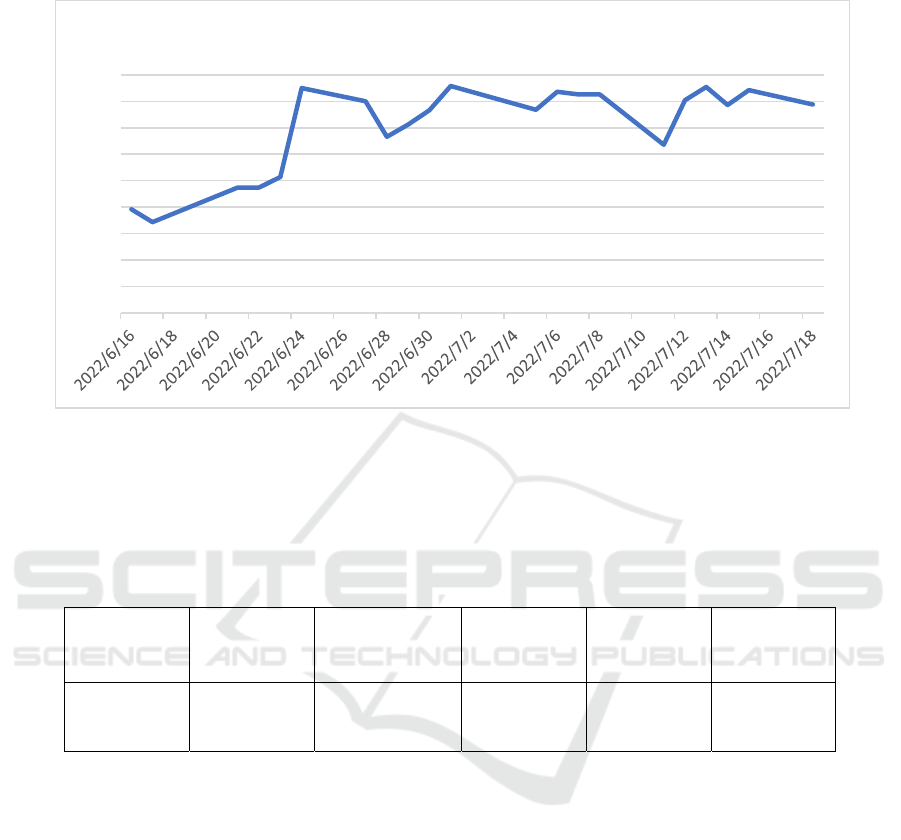

These data are plotted as a linear graph as shown

below.

Figure 1: Stock price trend of unilever plc.

As shown in the figure above, Unilever's share

price has a clear upward trend from June 14, 2022, to

June 24, 2022, rising from $43.96 per share to $46.25

per share, after which the share price remains

relatively stable, there was no obvious rise or fall, and

some volatility appeared during the period. The stock

price remained roughly at around $46 per share these

days.

Table 4: Descriptive statistics of the rate of return of stocks of unilever plc.

MEAN

STANDARD

DEVIATION

MEDIAN 1

ST

QUARTILE 3

RD

QUARTILE

UNILEVER PLC 43.72 0.8288782 45.93 45.18 46.13

As shown in the figure above, the average value of

this group of data is $43.72, while the median is

$45.93. The average value is smaller than the median

value, indicating that this group of data has an extreme

minimum value, and it also implies that Unilever’s

stock price does rose.

2.2 Methods

There are two steps to do with this study. The first step

is to bring the ten options used for calibration into the

Black-Scholes model and the Cox-Ross-Rubinstein

model to calibrate the implied volatility. The second

step is to substitute the calibrated implied volatility

into the formulas for calculating the delta value and

calculating the profit to calculate the profit of the

portfolio without hedging and the profit of the

portfolio with hedging, to test the effectiveness of the

hedging strategy that is constructed by the specific

option mentioned in the data part.

Above all, the Black-Scholes model reduces the

underlying asset and derivatives markets to a set of

rules expressed through mathematical formulas. This

model is widely cited around the world today and is

the basis for most market analyses. This model makes

pricing based on objective data. Objective data

include the time value of the option, the current price

of the asset on which the option is based; the strike

price on the maturity date of the option; and the

volatility of the asset price, which in turn can be

regarded as the probability that the option can be

executed. Despite many considerations, the model

does not require a complex computational process to

compute. However, the Black-Scholes model is not

perfect. The model is limited to calculating European

option prices. In some cases, the model cannot match

actual market conditions, unrealistic factors include

42

42,5

43

43,5

44

44,5

45

45,5

46

46,5

Unilever PLC

($)

Option Pricing and Risk Hedging by Black-Scholes Model and Cox-Ross-Rubinstein Model for Unilever PLC

389

the following: the model assumes that interest rates

are risk-free; volatility is known and constant; pricing

does not take into account transaction costs or taxes;

pricing does not take into account any dividends that

may be received by holders of the underlying asset.

Implied volatility reflects the level of uncertainty

or risk in the market and typically affects option

prices. Implied volatility is calculated by substituting

the traded option price into the price model and

inversely deriving the volatility value. First, a Black-

Scholes model is used to calibrate implied volatility.

The stock prices, expiration date, and strike prices of

all ten options used to calibrate implied volatility are

collected, and all stock prices from June 16 to July 18

are collected, and their standard deviation is

calculated to serve as the σ in the Black-Scholes

model with the formula below. σ represents the

implied volatility in the calibrated model but should

be assumed as a number to be substituted in the

calibration process, 𝑡 represents the time to maturity,

𝑆(𝑡) represents the stock price, 𝐾 represents the strike

price of each option, r represents the interest rate of

each option, here it is assumed to be zero as for the

time to maturity is quite short. Equation (1) and

equation (2) below calculate the prices of call options

and put options respectively, equation (3) and

equation (4) below represent the formula to calculate

𝑑1 and 𝑑2, which are the probability factors in the

Black-Scholes model, and 𝑁(𝑑1) and

𝑁

(

𝑑2

)

represent the normal distribution of d1 and d2

respectively (L.S. Lima, 2021; S. Ampun, 2021).

𝐶=𝑁

(

𝑑1

)

𝑆

(

𝑡

)

−𝑁

(

𝑑2

)

𝐾𝑒

(1)

𝑃=𝑁

(

−𝑑2

)

𝐾𝑒

−𝑆

(

𝑡

)

𝑁(−𝑑2)

(2)

𝑑1 =

𝐿𝑛

𝑆

(

𝑡

)

𝐾

+𝑟+

σ

2

t

𝜎

√

𝑡

(3)

𝑑2 =

ln

𝑆

(

𝑡

)

𝐾

+𝑟−

𝜎

2

𝑡

𝜎

√

𝑡

=𝑑1−𝜎

√

𝑡

(4)

The option prices calculated by the Black-Scholes

model will be compared with the actual market prices

of options, and the sum of standard error will be

calculated by equation (5), where 𝑃

(𝐵) represents

option prices that are calculated by the Black-Scholes

model, 𝑃

(

𝑀

)

represents market prices of options.

The implied volatility will be calibrated by

minimizing the sum of standard error.

(𝑃

(

𝐵

)

−𝑃

(

𝑀

)

)

𝑃

(

𝑀

)

(5)

The second, the Cox-Ross-Rubinstein model, also

named the binomial tree model, supposes that the

stock price fluctuates only in two directions, up and

down, and assumes that the range of up or down

fluctuations in the stock price remains unchanged

during the whole period. The model will divide the

entire period into several stages, simulate all possible

development paths of the underlying assets during the

whole duration based on the historical volatility of the

stock price, and calculate the option exercise profit

and usage for each node on each path. The option

price is calculated by the discount method. Compared

with the Black-Scholes model, the option pricing by

the Cox-Ross-Rubinstein model is more intuitive and

simpler to calculate, it can be applied to the pricing of

European options, American options, and some other

options. Moreover, the Cox-Ross-Rubinstein model

takes into account the interest rates and dividends

available to the underlying holders. The disadvantage

is that, when there are too many stages, that is, the step

size is too large, which will cause calculation

difficulties; when there are too few stages, that is, the

step size is too small, will reduce the accuracy, and the

gap between the market price and the actual price will

inevitably be large.

To be started, a Cox-Ross-Rubinstein model is

used to calibrate the implied volatility. Since the time

to maturity is relatively short, the 2-step binomial

option pricing model is used here, and the model has

still assumed the risk-free rate, which is denoted by

𝑟=0. In the Cox-Ross-Rubinstein model, ∆𝑡

represents the expiration time corresponding to the

options in each stage, u represents the multiplier when

the stock rises, d represents the multiplier when the

stock falls, and p represents the probability of the

stock rising. Equation (9) is used to calculate the stock

price in each layer, x represents the number of times

the stock increases, and 𝑆(0) is the original stock

price corresponding to the option. After that, compare

the calculated stock price with the strike price to

calculate the profit of option execution or non-

execution, calculate the probability of occurrence of

each income through the binomial formula, and add

the expected value of the profit to obtain the final

option price.

𝑢=𝑒

√

∆

(6)

𝑑=𝑒

√

∆

=

1

𝑢

(7)

𝑝=

𝑒

∆

−𝑑

𝑢−𝑑

(8)

𝑆(𝑥) = 𝑆(0)(𝑢

)(𝑑

()

)

(9)

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

390

The option prices calculated by the Cox-Ross-

Rubinstein model are compared with the actual

market prices of options, and the sum of standard error

will be calculated by equation (5) above. Again,

𝑃

(𝐵) represents option prices that are calculated by

the Black-Scholes model, and 𝑃

(

𝑀

)

represents the

market prices of options. The implied volatility will

be calibrated by minimizing the sum of standard error.

Hedging strategies are formed against specific

options in Unilever stock after calibrating for implied

volatility. Then the collected Unilever PLC stock

price from June 27, 2022, to July 8, 2022, and the

implied volatility calibrated with each of the two

models are substituted into the following equations.

Equation (10) and equation (11) represent the

portfolio value of day 1 and each day after the first

day1, where 𝑁(𝑑1) in equation (11) uses the same 𝑑1

as the 𝑑1 in equation (3) and the algorithm is the same

as the Black-Scholes model, 𝑁(𝑑1) represents the

delta value of the option. The value of 𝑁(𝑑1)

changes with the changes in data each day, thus it

needs to be recalculated every day. Equation (12) and

equation (13) represent the loss without hedging and

the loss without hedging for each day.

Day1(June 27,2022)

𝑃𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 𝑣𝑎𝑙𝑢𝑒 X(1) = 𝐶(1,𝑆

(

1

)

)

(10)

Days after day1(June 28,2022-July 8,2022)

𝑝𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 𝑣𝑎𝑙𝑢𝑒 𝑋

(

𝑡

)

=𝑋

(

𝑡−1

)

+ 𝑁(𝑑1)(𝑆

(

𝑡

)

−𝑆

(

𝑡−1

)

)

(11)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ𝑜𝑢𝑡 ℎ𝑒𝑑𝑔𝑖𝑛𝑔(𝑡)

=𝑆

(

𝑡

)

−𝐾

−𝐶(1,𝑆

(

1

)

)

(12)

𝐿𝑜𝑠𝑠 𝑤𝑖𝑡ℎ ℎ𝑒𝑑𝑔𝑖𝑛𝑔(𝑡)

=𝑆

(

𝑡

)

−𝐾−𝑋(𝑡)

(13)

Compare the loss with hedging and the loss

without hedging calculated by the equations above, to

examine the difference between the two and the effect

of hedging.

3 RESULTS AND DISCUSSION

3.1 Results

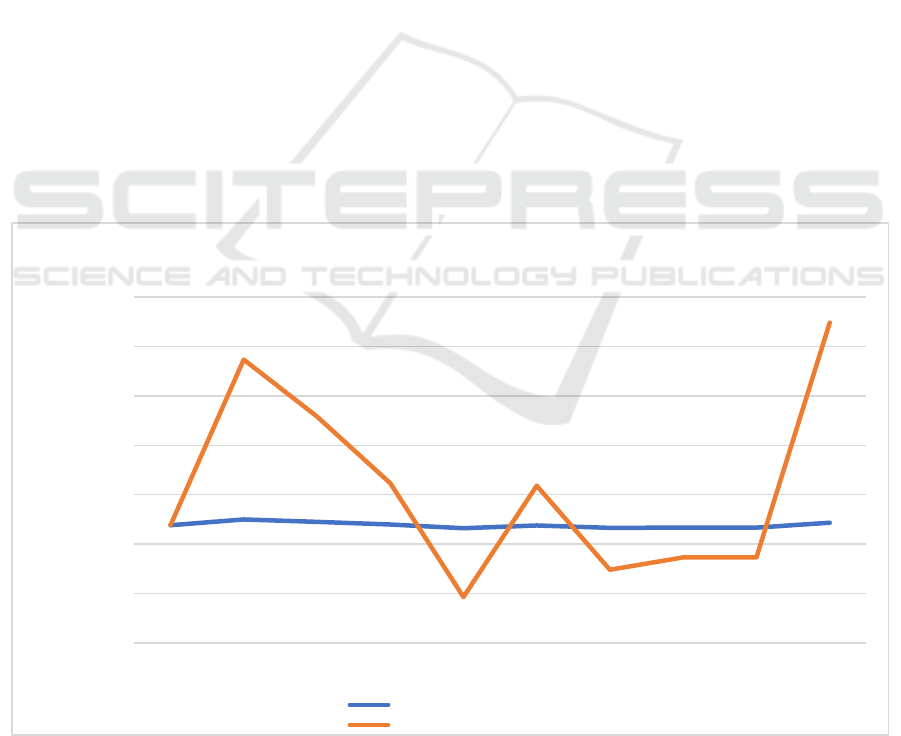

First, substituting the implied volatility calculated by

the Black-Scholes model to calculate the profit before

and after hedging within the specific option of

Unilever PLC between June 27th, 2022, and July

11th, 2022. The comparison of trends for the two is

shown below.

Figure 2: Profit(loss) of unilever plc portfolio with calibration by black-scholes model.

-0,40000000

-0,20000000

0,00000000

0,20000000

0,40000000

0,60000000

0,80000000

1,00000000

2022.6.272022.6.282022.6.292022.6.30 2022.7.1 2022.7.5 2022.7.6 2022.7.7 2022.7.8 2022.7.11

Profit(Loss)

loss with hedging

loss without hedging

($)

Option Pricing and Risk Hedging by Black-Scholes Model and Cox-Ross-Rubinstein Model for Unilever PLC

391

The yield curve with hedging is shown close to a

straight line, parallel to the x-axis, which indicates

that the effect of hedging is relatively good, and the

volatility of returns is effectively reduced, which also

implies that the risk of options is reduced, and the risk

is close to zero, which avoids the loss of the option.

However, the disadvantages also emerged. As the risk

approaches zero, the option profit also decreases. The

profit with hedging was basically below 0.2, while the

high point of the income before hedging is around 0.8,

and the frequency was twice. In the statistics of time,

the profits with hedging are higher than the profits

without hedging in only four days, and the profits

without hedging of these four days are in a state of

loss. However, although there are four days of

negative option returns, it still does not affect the sum

of benefits brought by high returns without hedging is

higher than the sum of returns with hedging.

Figure 3: Profit(loss) of unilever plc portfolio with calibration by cos-ross-rubinstein model.

Option hedging strategies based on implied

volatility calibrated with a Cox-Ross Rubinstein

model also performed well. Its performance is roughly

equivalent to the option hedging strategy based on the

implied volatility calibrated by the Black-Scholes

model, and profit with hedging is basically a straight

line parallel to the x-axis, which proves that it

successfully hedged the fluctuation of the option price

and keeps the return value at a positive number, while

it also means that the risk is reduced, and the

possibility of high returns is also reduced at the same

time. As shown in the figure, although the hedging

returns continue to remain positive, the returns are

close to zero. From the comparison of the curve

amplitudes in the graph, the hedging strategies based

on Cox-Ross-Rubinstein model-calibrated implied

volatility seem to have lower returns than that of

hedging strategies based on Black-Scholes model-

calibrated implied volatility, which also means that

their returns are lower than hedges former strategy.

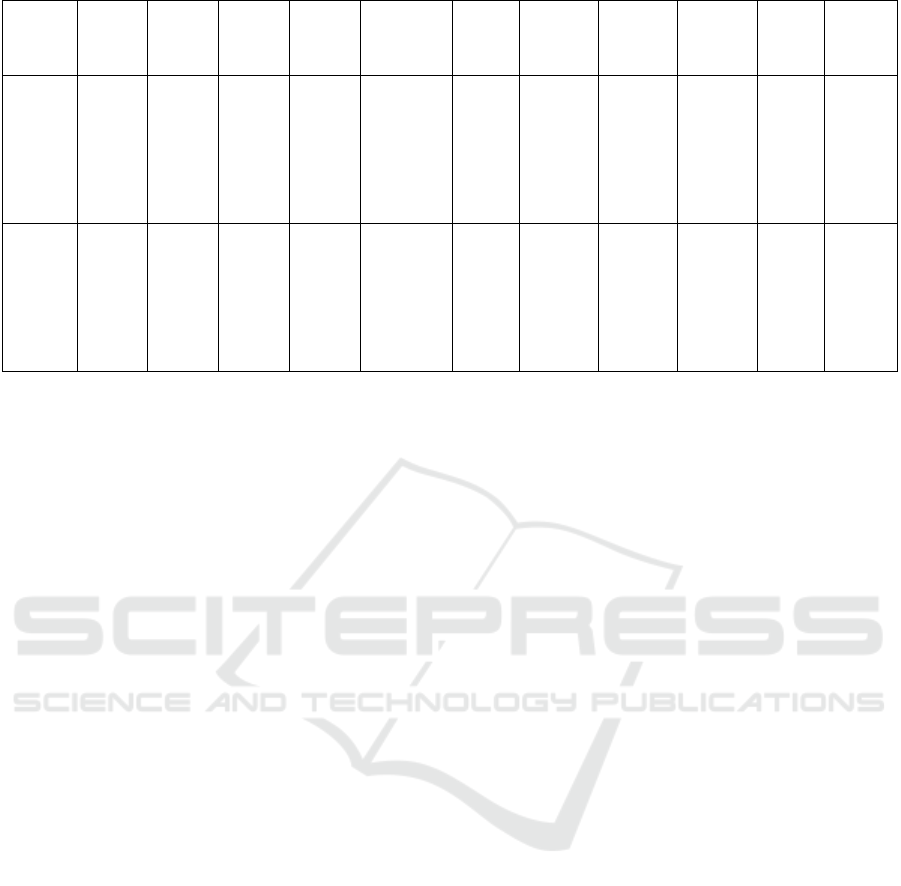

Table 5: The comparison of profits with hedging and profits without hedging of the specific option.

($)

2022/6/

27

2022/6/

28

2022/6/

29

2022/6/

30

2022/7/1 2022/7

/5

2022/7/6 2022/7/7 2022/7/8 2022/7

/9

sum

Profit

with

hedging

(Black-

Scholes

model)

0.0765

04

0.1003

22

0.0900

73

0.0796

25

0.064559

0.0758

90

0.06600

5

0.06716

8

0.06716

8

0.0867

79

0.7740

94

Profit

withou

t

0.0765

04

0.7465

04

0.5165

04

0.2465

04

(-)0.21349

6

0.2365

04

(-)0.103

496

(-)0.053

496

(-)0.053

496

0.8965

04

2.2950

39

-0,40000000

-0,20000000

0,00000000

0,20000000

0,40000000

0,60000000

0,80000000

1,00000000

2022.6.272022.6.282022.6.292022.6.30 2022.7.1 2022.7.5 2022.7.6 2022.7.7 2022.7.8 2022.7.11

Profit(Loss)

loss with hedging

loss without hedging

($)

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

392

hedging

(Black-

Scholes

model)

Profit

with

hedging

(Cox-

Ross-

Rubinst

ein

model)

0.0149

80

0.0220

62

0.0186

12

0.0153

61

0.011089

0.0138

59

0.01124

11

0.01151

3

0.01151

3

0.0157

81

0.1460

10

Profit

without

hedging

(Cox-

Ross-

Rubinst

ein

model)

0.0149

80

0.6849

80

0.4549

80

0.1849

80

(-)0.27502

010

0.1749

80

(-)0.165

020

(-)0.115

020

(-)0.115

020

0.8349

80

1.6797

990

As can be seen from the figure, the total profit

brought by the hedging strategy using the implied

volatility calibrated by the Black-Scholes model from

June 2, 2022, to July 9, 2022, is $0.774094, the non-

hedging yield is $2.295039, which is higher than the

yield after hedging. The total income brought by the

hedging strategy using the implied volatility

calibrated by the Cox-Ross-Rubinstein model from

June 2, 2022, to July 9, 2022, is $0.146010, and the

non-hedging yield is $1.6797990, which is also

greater than the profits with hedging. In contrast, its

profit with hedging is lower than that of the hedging

strategy based on the implied volatility calibrated by

the Black-Scholes model.

3.2 Discussion

As for the results, hedging strategies constructed from

the implied volatility calibrated by the two models

performed well on the specific options of Unilever

PLC. This is reflected in the fact that both hedging

strategies keep the option return at a positive value,

and the return level is stable, a little higher than zero,

which means that the risk is well hedged. In order to

illustrate this point, first, volatility generally reflects

risk, and a relatively stable yield curve can better

reflect that risk has indeed been reduced. Second,

delta can also be understood in options calculation as

always, the probability of an option that can benefit or

lose. For instance, for an at-the-money option, the

delta value is generally around 50%. This is because

the stock price is equal to the strike price of the option

at a certain moment, and at the next moment, the stock

price is equal to the strike price of the option. It may

go up or down, and the probability of both is 50%. If

the stock price increases, then this at-the-money call

option becomes an in-the-money call option, and the

delta value will be higher than 50%. This option has a

greater than 50% probability of being exercised and

profiting. If the stock price decreases at the next

moment, this option will become an out-of-the-money

call option, and the delta value is less than 50%,

indicating that this option has a less than 50% chance

of being exercised and benefiting. The option selected

in this paper is an in-the-money call option with a

delta value higher than 50%, which implies that it has

a higher than 50% probability of being exercised and

benefiting on the expiration date. At the same time,

the object of this paper is Unilever PLC to represent

the FMCG industry. From July 2022 to August 2022,

the stock prices of most FMCG companies, including

Unilever PLC, have a slight upward trend. It can be

seen from the Unilever PLC stock price trend table in

the data section of this paper that when Unilever

PLC's share price rises, the delta value of the selected

in-the-money call option will inevitably rise, and the

possibility of profit is greater. When it is less than the

stock price at a certain moment, the possibility of

making a profit is also inevitable, which also shows

that the options profit without hedging increases and

is greater than the profits with hedging. The hedging

strategy made in this paper is to neutralize the delta

value and make it zero, which reduces the risk and

also inhibits the possibility of profiting by options.

Therefore, when the stock price is known to be rising

and the object of the hedging strategy is in the case of

in-the-money call options, it is inevitable that the

return after hedging is less than the return before

hedging, and the two hedging strategies with different

implied volatility make the level of the return curves

after hedging close to 0, indicating that they are well

achieved for the purpose of hedging delta.

In addition, it can be seen from the Results section

that the hedging strategies constructed by the implied

Option Pricing and Risk Hedging by Black-Scholes Model and Cox-Ross-Rubinstein Model for Unilever PLC

393

volatility calibrated by the two different models have

different returns. The implied volatility calibrated by

the Black-Scholes model is considered to have higher

accuracy because the Black -Scholes model itself has

the function of calibrating the implied volatility, and

the value of delta calculated in the hedging method

used in this paper is different from Black-Scholes are

closely related. The Cox-Ross-Rubinstein model may

not be very accurate in calculating the data in the

paper. This is because of its model characteristics. The

more stages this model has, the more accurate the

calibrated implied volatility will be. However, given

that the option expiration time is too short, this paper

adopts a 2- step volatility binary tree model, which

may cause certain errors in the calculation of implied,

hence the returns calculated by the two hedging

strategies with different implied volatility are slightly

different, however, it does not affect the good effect

of the hedging strategy constructed by the two.

4 CONCLUSION

Currently, option pricing and risk hedging are

interesting topics in the financial field. In this paper,

we combine the two issues for the Unilever PLC

stock. The empirical processes can be summarized as

follows. First, relevant data on the targeted asset is

carefully selected. Second, the Black Scholes Model

and Binomial Tree model are applied. Finally, the

hedging performance is compared for the two models,

and the results show that the related investors may

benefit from the hedging strategies when investing

Unilever PLC. However, deficiencies exist. For

example, option pricing models and hedging

strategies have numerous alternatives, in this paper,

limited methods are adopted, thus, applying other

models deserves further investigations.

REFERENCES

A. Kumar. A Study on Risk Hedging Strategy: Efficacy of

Option Greeks. Abhinav National Monthly Refereed

Journal of Research in Commerce & Management,

2018, 7(4), 77-85.

D. Galai. The components of the return from hedging

options against stocks. Journal of Business, 1983, 45-

54.

E. Platen, and M. Schweizer. On feedback effects from

hedging derivatives. Mathematical Finance, 1998, 8(1),

67-84.

G. Bakshi, C. Cao, and Z. Chen. Pricing and hedging long-

term options. Journal of econometrics, 2000, 94(1-2),

277-318.

H. M. Soner, S.E. Shreve, and J. Cvitanic. There is no

nontrivial hedging portfolio for option pricing with

transaction costs. The Annals of Applied Probability,

1995, 5(2), 327-355.

L.S. Lima and J.H.C. Melgaço. Dynamics of stocks prices

based in the Black & Scholes equation and nonlinear

stochastic differentials equations. Physica A: Statistical

Mechanics and its Applications, 2021, 581, 126220.

M.A. Howe, and B. Rustem. A robust hedging algorithm.

Journal of Economic Dynamics and Control, 1997,

21(6), 1065-1092.

R. Gao, Y. Li, Y. Bai, and S. Hong. Bayesian inference for

optimal risk hedging strategy using put options with

stock liquidity. IEEE Access, 2019, 7, 146046-146056.

S. Becker, P. Cheridito, and A. Jentzen. Pricing and

hedging American-style options with deep learning.

Journal of Risk and Financial Management, 2019,

13(7), 158.

S. Ampun, and P. Sawangtong. The approximate analytic

solution of the time-fractional Black-Scholes equation

with a European option based on the Katugampola

fractional derivative. Mathematics, 2021, 9(3), 214.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

394