The Impact of Blockchain on Business Model: A Literature Review

Giacomo Vella, Luca Gastaldi and Antonio Ghezzi

School of Management, Politecnico di Milano, Milan, Italy

Keywords: Blockchain, Business Model, Value Creation, Value Delivery, Value Capture.

Abstract: Blockchain is becoming an increasingly relevant topic and companies are beginning to build business solution

using this technology. Despite the relevance of the changes that blockchain could bring to business and

management, current research is still predominantly focused on technological aspects and practical

applications. Knowledge is lacking also both for academics and practitioners who, still struggle to have a clear

understanding of the potential impacts of blockchain. Moreover, scientific literature addressing the business

adoption of blockchain does not seem to consider the increasing differentiation of blockchain real-world

applications This study hence aims to start filling this gap by investigating the existing body of knowledge

systematically through a review in which the potential impacts of blockchain are presented and future avenues

of research are set out. The review is based on 61 scientific articles published between January 2008 and

January 2020. The review has been structured considering two frameworks: the business model elements of

value creation, delivery, and capture and the different stages of evolution of blockchain applications. The

results provide evidence and future direction for research that are valuable for both academics and managers.

1 INTRODUCTION

Blockchain technology was born in October 2008

when Satoshi Nakamoto published his idea of a peer-

to-peer electronic cash system: Bitcoin. With Bitcoin,

for the first time, value could be reliably transferred

between two distant, untrusting parties without the

need of an intermediary (Catalini & Gans, 2016;

Zamani & Giaglis, 2018). Nowadays blockchain is

not only focused on transactions and cryptocurrencies

but it could be also used to create platforms for the

development of new applications. Companies and

public administrations are starting to increasingly

adopt blockchain in their businesses and the number

of new firms that use blockchain to create innovative

business models continues to grow. Despite the

progression in the adoption of the technology,

institutions still struggle to have a clear understanding

of the benefits of blockchain and how to implement it

in their businesses or to create new business models

based on it.

Blockchain research is strongly increasing, but

still, the main attempts to understand this technology

have been mainly restricted to technical aspects of

blockchain protocols or the financial aspects of

cryptocurrencies (Risius & Spohrer, 2017). Much less

progress has been accomplished in recognizing its

wider implications from organizational and

managerial perspectives, and the extent to which it

could disrupt traditional business models remains a

subject of intense debate (Chong et al., 2019a;

Constantinides et al., 2018).

From a preliminary analysis of literature on this

topic emerge that scholarly understanding of business

applications of blockchain is still a fragmented and

almost unexplored ground, especially for what

concerns business models based on blockchain.

Contributing to the fragmentation of the literature

about the topic, scientific literature addressing the

business adoption of blockchain does not seem to

consider the increasing differentiation of blockchain

real-world applications (Angelis & Ribeiro da Silva,

2019). This complicates the creation of

comprehensive theories about the impact of

blockchain in business.

Hence, the purpose of this work is to review the

literature to analyze and map existing studies that

examine the impact of blockchain on business

models. This will allow a better understanding of the

extant knowledge, highlighting the already existing

studies on the theme and opportunities for future

research.

These objectives are represented in the following

research question:

Vella, G., Gastaldi, L. and Ghezzi, A.

The Impact of Blockchain on Business Model: A Literature Review.

DOI: 10.5220/0011849600003467

In Proceedings of the 25th International Conference on Enterprise Information Systems (ICEIS 2023) - Volume 2, pages 397-405

ISBN: 978-989-758-648-4; ISSN: 2184-4992

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

397

RQ: How scientific literature analyzes the

impact of blockchain on firms’ business models

according to the maturity stage of the technology?

2 SETTING THE STAGE FOR

THE REVIEW

To answer the research question identified, the review

is structured considering two frameworks: the

business model elements of value creation, delivery,

and capture and the different stages that characterize

the evolution of blockchain applications.

2.1 Business Model

“Business model” is a quite vast term that still

nowadays does not recall a univocal definition. In

fact, over the years researchers have formulated

different interpretations and explanations about it,

resulting in blurred and non-univocally identified

concepts.

In this work, the reference definition for Business

Model is the one elaborated by David J. Teece ( 2010)

that identify the business model as a company’s

architecture of value, it represents the way a firm

generates value for its target customers (value

creation), delivers value to such target customers

(value delivery), and captures a share of such value to

make its business sustainable (value capture).

The business model is suitable to be used in the

analysis of the applications of blockchain which is

characterized by the involvement of different

interconnected actors as the point of view of

researchers and practitioners in analyzing and using

the business model concept has shifted from focusing

on a single firm to considering network of firms, not

neglecting the growing interconnection between

businesses.

The most used and complete business model

representation tool is the Business Model Canvas

designed by Osterwalder in 2004 (Osterwalder,

2004). This framework has been introduced and

validated all around the world, and it is currently

widely adopted and employed both by practitioners

(Osterwalder & Pigneur, 2010) and academics

(Chesbrough, 2010).The business model canvas has

been chosen as the reference model for analyzing

blockchain impact on firms’ business logic thanks to

its completeness and coherence in considering and

illustrating all factors and related connections that

contribute in building companies’ strategy

(Osterwalder & Pigneur, 2010).

The nine building blocks introduced by the

business model canvas represent a more detailed level

of description of the business model value dimensions

(value creation, value delivery and value capture). In

particular:

• Key Partners, Key Activities, Key Resources and

Value Proposition represent Value Creation

component;

• Customer Relationships, Channels and Customer

Segment represent Value Delivery component;

• Cost Structure and Revenue Streams represent

Value Capture component.

2.2 The Evolution of Blockchain

Applications

As already highlighted, organizations are adopting

blockchain in different ways: from the use of

cryptocurrencies to the development of decentralized

applications.

Despite the real-world applications of blockchain

are increasingly differentiating (Angelis & Ribeiro da

Silva, 2019), this differentiation does not seem to be

considered in scientific literature. This contributes to

the fragmentation of the literature which complicates

the comparison of results and the creation of

comprehensive theories about the impact of

blockchain in business applications.

Different ways of using this technology could

influence its impact on firms’ business models.

Hence, to provide a better representation of the extant

body of knowledge and understand the impact of

blockchain on firms is essential to first categorize the

types of blockchain applications.

One of the most adopted taxonomies about

blockchain applications is the one proposed by Swan

(2015) that differentiates between blockchain 1.0,

2.0, and 3.0. In the view of Swan, blockchain 1.0 is

linked to the deployment of cryptocurrencies in

applications related to cash; blockchain 2.0 is used in

contracts and financial applications different from

simple cash transactions; blockchain 3.0 identifies the

applications beyond currency and finance.

This categorization, albeit widely adopted,

focuses more on the industry where blockchain is

adopted than on how it is applied.

Hence, for the purpose of our research, we

adopted the classification offered by Angelis and

Ribeiro da Silva (2019) that describes the different

stages of maturity of the applications of technology:

• Blockchain 1.0, is focused on transactions,

mainly on the deployment of cryptocurrencies in

applications related to cash, such as currency

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

398

transfer, remittance, and digital payment

systems.

• Blockchain 2.0, is an extension of blockchain 1.0

that encompasses privacy, smart contracts, and

the emergence of non-native asset tokens.

• Blockchain 3.0, expands the blockchain focus

further to incorporate decentralized applications

(dApp); a dApp consists of back-end code that

runs on a decentralized peer-to-peer network

connecting users and providers directly.

The work of Angelis and Ribeiro da Silva also

introduces the concept of blockchain 4.0, defined as

the applications that involve the inclusion of artificial

intelligence (AI) to blockchain technologies. For this

research, however, we do not include this category in

our analysis as this kind of application is still not

widely adopted in business.

3 METHODOLOGY

The review starts by searching the SciVerse Scopus

online database for scientific articles on blockchain

and business models. Since Scopus is less selective

than, for example, the Web of Science, this

potentially means that a wider array of international

outlets are searched which, in turn, could be more

receptive to the emerging topic of blockchain impact

on business models. Moreover, because of the recent

and fast growth of the literature on blockchain, we

decided to review papers published in both academic

journals and conference proceedings. This decision

came about from the consideration that, in dynamic

and growing fields such as blockchain, if the scope of

a literature review is broadened by including

publications that belong to the ‘grey literature’ this

can lead to the inclusion of novel and relevant

findings and avoid the lack of immediacy determined

by the lag of academic knowledge (Adams et al.,

2017).

Since the literature on blockchain is still

fragmented and focused on Computer Science we

wanted to include also documents outside the field of

“Business, Management, and Accounting” to not

exclude any articles with management-type

implications. Hence our search was not limited to a

specific subject area.

In line with previous reviews (e.g. Ghezzi et al.,

2018), we adopted a multi-step process.

In the first step, the following first-level criteria

determined whether articles were included: (1) the

articles were published between January 2008 and

December 2020; and (2) had to contain the term

‘blockchain’ and ‘business model’ in their title,

keywords or abstract. This search resulted in over 373

articles gathered.

As a second step, we retained the articles that met

our more refined second-level criteria: (3) they must

be relevant, as inferred from their title or abstract, or

by examining the paper; (4) their full text has to be

available; and (5) they must be written in English.

This phase allowed us to reduce the number of

papers in the sample significantly, resulting in a

working database of 61 articles.

These articles collected were then examined

through a comprehensive scheme of analysis or third

level criteria, where the following were considered:

title; year; author/s; publication outlet; article type

(for the following labels: empirical; conceptual;

literature review); industry type; research findings;

and Scopus citations.

In this step, the articles were classified according

to the two frameworks of analysis: the business model

canvas and the three stages of maturity of blockchain

applications.

To analyze the contribution of each article on the

impact of blockchain on business models, we

highlighted each part of the text that provided

relevant information. Hence, the process of text

analysis consisted of the complete document

screening so to highlight sentences expressing

blockchain impact on business models.

Citations reporting the effect of blockchain

adoption on business models have been analyzed so

to derive which business model canvas components

have been affected by the adoption of distributed

ledger technology solutions. This activity helps in

understanding which value architecture components

blockchain technology has the greatest impact on.

Each citation can be referred to one of the three

different blockchain maturity stages and in the same

paper different citations can potentially deal with all

three stages.

4 REVIEW OF THE

LITERATURE

The literature on blockchain impact on business

model is mapped in the section below and discussed

through the business model canvas and the three

stages of maturity of blockchain applications.

4.1 Blockchain 1.0

The adoption of blockchain 1.0 offers an alternative

digital system for cash-related activities and

The Impact of Blockchain on Business Model: A Literature Review

399

transactions mainly characterized by not needing any

intermediary between parties. The adoption of

blockchain 1.0 has the potential to impact all value

architecture dimensions, with value creation being the

most influenced one since all analyzed papers have

reported effects on such dimension.

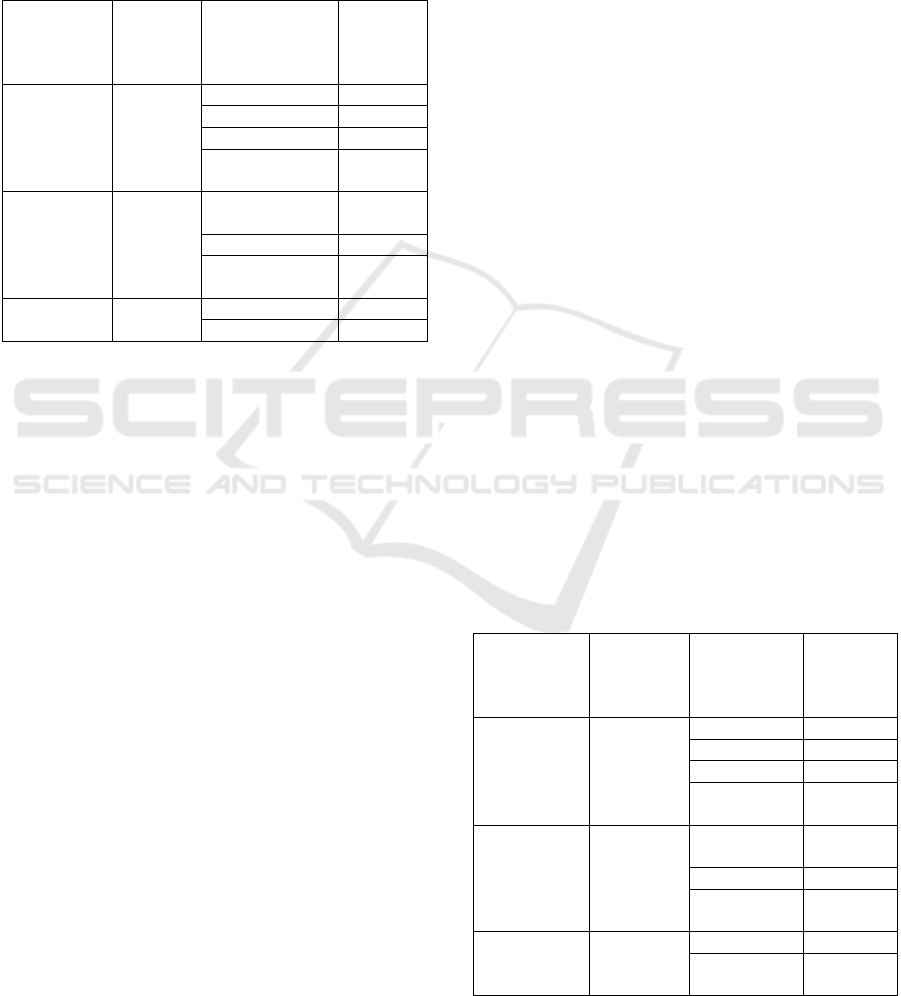

Table 1: Blockchain 1.0 impact on value architecture and

business model canvas

Value

architecture

dimension

Papers

reporting

impact

(%)

Business model

canvas

component

Papers

reporting

impact

(%)

Value

creation

100%

Key partners 0%

Key activities 33%

Ke

y

resources 0%

Value

p

roposition

100%

Value

delivery

33%

Customer

relationshi

p

s

0%

Channels 0%

Customer

se

g

ment

33%

Value

capture

67%

Cost structure 67%

Revenue streams 33%

4.1.1 Key Activities

The adoption of blockchain 1.0 can streamline

common process operations related to money

transfers due to the possibility of accumulating

trustable data related to all network transfers.

Blockchain 1.0 provides transparency during

transfers, allowing an overall simplification of the

clearing process by providing secure access, for all

involved parties, to the needed information, no longer

requiring relying on multiple and repeated data

exchange (Chong et al., 2019a).

4.1.2 Value Propositions

Blockchain 1.0 offers a solution for solving

traditional payment systems limitations. Distributed

payment services enable instant, low cost and

borderless payments reducing service prices for both

sellers and buyers that traditionally used centralized

payment systems such as PayPal. This allows

blockchain network users to get access to direct value

exchange services characterized by having lower

transaction fees thanks to the elimination of

previously vital third parties, decreasing the overall

cost sustained by customers to access previously

centralized services (Chen & Bellavitis, 2020;

Weking et al., 2019).

4.1.3 Customer Segment

The reduced involvement of centralized institutions

enables cheaper services and can hence attract new

customers. Moreover, cryptocurrencies are not tied

up to a specific authority or country making them

inherently borderless allowing any person with an

internet connection to access a decentralized network

to manage money transactions (Chen & Bellavitis,

2020). Particularly, cryptocurrencies can have an

impact on developing economies where the financial

inclusion of companies and individuals can be

fostered thanks to blockchain adoption (Holtmeier &

Sandner, 2019).

4.1.4 Cost Structure

As previously described, the disintermediation

process generated by blockchain 1.0 adoption allows

for a decrease in transaction costs. This effect can not

only be offered to the market as a distinctive

characteristic of the provided service but can also be

leveraged by firms to reduce money transfer activities

costs compared to traditional payment systems (Chen

& Bellavitis, 2020; Chong et al., 2019a).

4.1.5 Revenue Streams

Transaction tracking capabilities provided by the

available ledger which displays all transactions,

allows firms also to enhance their ability to manage

cash flows, improving cash balance management and

interest earned hence optimizing revenues (Chong et

al., 2019b).

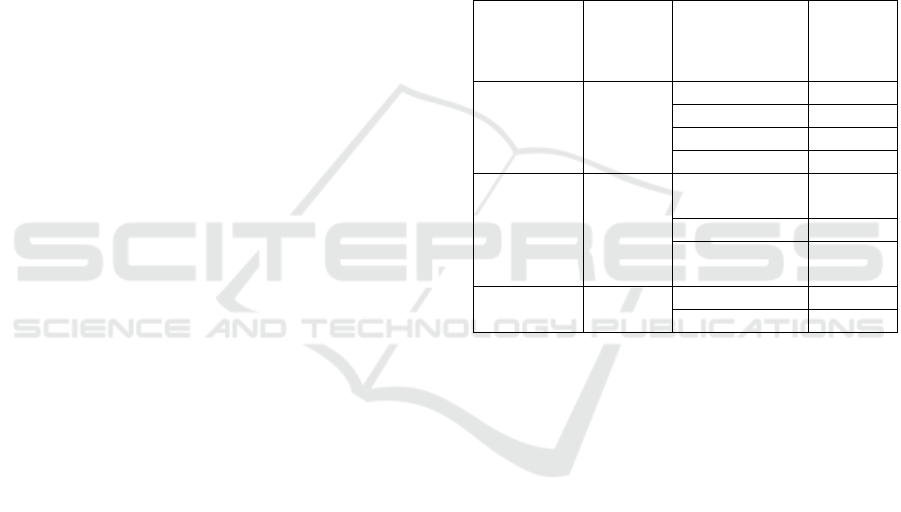

Table 2: Blockchain 2.0 impact on value architecture and

business model canvas.

Value

architecture

dimension

Papers

reporting

impact (%)

Business

model canvas

component

Papers

reporting

impact

(%)

Value

creation

100%

Key partners 41%

Key activities 86%

Key resources 36%

Value

p

roposition

98%

Value

delivery

56%

Customer

relationshi

p

s

33%

Channels 19%

Customer

se

g

ment

41%

Value

capture

76%

Cost structure 55%

Revenue

streams

47%

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

400

4.2 Blockchain 2.0

Blockchain 2.0 application falls outside the

conception of purely monetary value but rather

considers value in its most generic sense. These

applications are characterized by the use of digital

assets and smart contracts to allow companies to do

business with untrusted parties without the need for a

trustworthy intermediary.

4.2.1 Key Partners

The use of smart contracts for managing contractual

relationships and the growing availability of trustable

data allow new collaborations with previously

unreachable partners and collaboration activities

based on simultaneous cooperation and competition

(coopetition) (Bedin et al., 2021; Schneider et al.,

2020).

Blockchain provides increased transparency and

security of operations, leading to a modification in

business relationships, that shift from the ones based

on trust and long-term relationships to new ones

characterized by being shorter and more flexible,

whereby partners are selected prioritizing the

provided competencies rather than the existing trust

(Klöckner et al., 2020; Nowiński & Kozma, 2017;

Tiscini et al., 2020).

4.2.2 Key Activities

The availability of a reliable database allows firms to

streamline entire business processes (Nowiński &

Kozma, 2017; Rejeb & Rejeb, 2020) such as

verification of compliance to standards (Rijanto,

2020).

The use of smart contracts allows firms to

completely automate entire business processes such

as the billing and payment in different sectors ranging

from insurance, freight transportation to energy

(Berntzen & Johannessen, 2019; Tan & Sundarakani,

2020). Hence companies can offer products and

services to customers and automatically collect

payments once the requested product or services is

accessed, increasing the overall process efficiency

(Atlam et al., 2018).

4.2.3 Key Resources

The identified potential impacts on key resources are

strictly interconnected with the one reported in the

key activities segment. Firms can experience an

increase in resource fluidity thanks to the

establishment of a new ownership paradigm, shifting

from the original possession of assets towards flexible

access to resources when needed (Morkunas et al.,

2019). Moreover, the increased efficiency of

operational processes and activities allows to free up

both human (Tönnissen & Teuteberg, 2020) and

technical resources (Klöckner et al., 2020; Massaro et

al., 2020), allowing firms to enjoy greater flexibility

in resource management and maximize their usage

(Mas et al., 2020).

4.2.4 Value Proposition

Blockchain 2.0 can be applied to create a distributed

database where data are securely stored and

accessible to all network users that can enjoy

trustable, traceable, and immutable information,

providing a reliable timeline of network exchanges

for all network parties (Tan & Sundarakani, 2020).

This particular type of distributed database

constitutes a common source of truth for all entities

relying on such information, increasing products

information accountability, verifiability, and

traceability enabling higher safety, detection, and

prevention of illicit behaviours (Tönnissen &

Teuteberg, 2020), while removing the need of a third

party necessary to establish trust between untrusted

parties and creating peer-to-peer connections

between network actors (Chen & Bellavitis, 2020).

Moreover, thanks to the introduction of non-

native tokens, blockchain 2.0 generalized the concept

of value beyond monetary terms, including all

possible digital assets (Morkunas et al., 2019)

building a new protocol for data exchange that offers

transparency, immutability, security, and traceability

of network shared information that can be used for

supporting transactions of value without needing any

trusted intermediary (Schneider et al., 2020).

The process of tokenization whereby assets,

whether physical or digital (Lohmer & Lasch, 2020),

are represented as tokens in a blockchain-based

environment, supports and reinforces the broaden

Internet of value potential of blockchain 2.0 by

offering users new sources of value not only

monetary.

4.2.5 Customer Relationship

The use of tokens and smart contracts to build new

offerings contributes to the automation of

relationships with customers that can enjoy the

requested value proposition by autonomously access

the dedicated smart contract (Massaro et al., 2020).

An example of this relationship is represented by the

issuing of tokens through ICOs for involving people

in future launches of products and services while

raising funds to develop the project (Chen &

The Impact of Blockchain on Business Model: A Literature Review

401

Bellavitis, 2020; Morkunas et al., 2019). This issuing

doesn’t require any customer dedicated resource but

is carried out automatically by smart contracts.

Tokens can be used by companies also to create

token-based communities and rewarding systems to

interact and relate with their customers, stimulating

customer engagement and lock-in effects (Mas et al.,

2020; Rijanto, 2020; Schneider et al., 2020).

4.2.6 Channels

The analyzed papers didn’t highlight a particular

impact on the channel dimension apart from

underlining the increasing trend of relying on digital

devices such as phone applications, websites, and

more general digital databases (Tiscini et al., 2020).

4.2.7 Customer Segment

The increasing product safety and compliance to

standards provided by the use of blockchain

applications, allows firms to generate trust in

customers, increasing positive brand perception and

customer loyalty, ultimately favoring an increase in

company customer base enabling final consumers

who don’t usually trust displayed information

accountability and safety, to participate in the

business model (Palas & Bunduchi, 2020; Tiscini et

al., 2020).

4.2.8 Cost Structure

The impact on the costs structure component is

strictly related to key activities. A direct consequence

of simplification of business operations thanks to

increased automation, higher availability of

information, and reduced coordination activities effort,

is a reduction in operating costs related to business

activities and processes (Chen & Bellavitis, 2020; Mas

et al., 2020; Tönnissen & Teuteberg, 2020).

4.2.9 Revenue Streams

Blockchain 2.0 gives firms improved access to capital

thanks to innovative fund-raising alternatives such as

ICOs, a blockchain-related crowdfunding solution

that allows companies to collect capital from different

investors without the need of any financial

intermediary (Chen & Bellavitis, 2020; Morkunas et

al., 2019; Nowiński & Kozma, 2017). Moreover,

blockchain 2.0 allows for the creation of new sources

of monetization for customers that can enjoy

additional profits from previously unavailable value

sources.

4.3 Blockchain 3.0

Blockchain 3.0 introduces the concept of

Decentralized Applications (DApps) which are

constituted by computer codes running on

decentralized systems instead of centralized ones as

for commonly known apps.

Blockchain 3.0, as the two previous maturity

stages, has highlighted the potential impact on all

three value architecture components and value

creation is still the most impacted one with all

analyzed documents reporting effect on such

dimension.

Table 3: Blockchain 3.0 impact on value architecture and

business model canvas.

Value

architecture

dimension

Papers

reporting

impact

(%)

Business model

canvas

component

Papers

reporting

impact

(%)

Value

creation

100%

Key partners 0%

Key activities 0%

Key resources 100%

Value proposition 100%

Value

delivery

33%

Customer

relationships

0%

Channels 0%

Customer

segment

33%

Value

capture

67%

Cost structure 0%

Revenue streams 67%

4.3.1 Key Partners and Key Resources

In blockchain 3.0 the role of the network provider is

separated from the one who develops the business

solution. By decoupling the blockchain platform

provider role in two different actors, new links and

relationships are established. Blockchain network

provider represents a key partner for a service

provider who relies on its technical knowledge and

supplied blockchain network (key resource) for

designing value propositions to be offered to the final

customers (Chong et al., 2019b; Trabucchi et al.,

2020; Weking et al., 2019).

4.3.2 Value Proposition

In blockchain 3.0 the value proposition is split

between two distinctive roles: blockchain provider,

offering platform as a service, and service provider

that is responsible for designing the final application

on top of the existing blockchain network. Taking the

perspective of blockchain providers, they offer a

complete distributed ledger-based network on top of

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

402

which customized business solutions can be

designed, providing indeed great application design

flexibility. On the other hand, service providers

purchase access to such blockchain network that

enables them to offer highly flexible applications to

their customers to solve a vast set of customers’

business needs (Trabucchi et al., 2020). In blockchain

3.0 the technology is offered as an open-source

platform to developers that can leverage existing

blockchain networks thanks to dedicated APIs that

are proposed to developers without any specification

of asset or channel for distribution (Weking et al.,

2019) that can foster cooperative innovation aimed at

developing customized business applications

independently from the application field (Chen &

Bellavitis, 2020).

4.3.3 Customer Segment

The presence of multiple service providers and the

multiple roles played by users in a blockchain

environment allows increasing direct network

externalities in two-sided blockchain-based

platforms, increasing the attractiveness of such

solutions and addressing the chicken and egg paradox

(Trabucchi et al., 2020).

4.3.4 Revenue Streams

In blockchain 3.0 the platform provides access to new

sources of revenues thanks to the innovative value

proposition offered to service providers. In particular

transaction fee still constitutes a major source of

revenues for distributed ledger providers that also

profit from technology rental fees, obtained by

charging third parties for the use of the network, and

token reselling whereby blockchain providers profit

from the reselling of their network-related tokens

(Trabucchi et al., 2020; Weking et al., 2019).

5 AVENUES FOR FUTURE

RESEARCH

The review has highlighted how the literature about

blockchain impact on firms’ business model is still in

its early stages.

Available documents refer mostly to blockchain

2.0, neglecting the other two maturity stages. The low

number of studies on blockchain 1.0 could be related

to the fact that research on this type of application is

focused more on a technical perspective rather than a

business one. There has not been a mass adoption by

general firms of blockchain 1.0 instruments, such as

cryptocurrencies, leading to a lack of practical cases

to analyze. Recently though, important actors of the

financial sector such as banks, fintech companies, and

regulators have started to approach this kind of

blockchain application.

Similarly, also blockchain 3.0 has shown a low

number of studies. This phenomenon might be

justified by the fact that blockchain 3.0 has been only

recently introduced as a way of applying blockchain

technology. Hence, related research is still scarce so

little information has been found. At the same time, it

could represent one of the most promising and

innovative interpretations of blockchain. The

increasing number of released DApps on blockchain

platforms like Ethereum and the related user's number

testifies the high potential of blockchain 3.0.

Looking at the impact on business model canvas

components, literature doesn’t analyze multiple

dimensions: blockchain 1.0 available documents have

not provided significant impacts for key resources,

key partners, and customer relationships components;

blockchain 2.0 lacks analysis on channels; blockchain

3.0 related studies have neglected the impact on key

activities, channels, customer segment, customer

relationships. Hence, future research should focus on

filling the current literature gaps about the missing

consideration on business model canvas dimension of

each blockchain maturity stage. Future research can

additionally investigate the magnitude of the impact

of each highlighted effect so to provide a quantitative

scale of impact and an additional categorization

variable to discriminate the most relevant effects from

the least relevant ones.

6 CONCLUSIONS

Blockchain technology adoption is evolving through

diverse applications and new instruments. This paper

contributes to the understanding of the impact on

business models of the different types of blockchain

applications.

This study can benefit academics by contributing

to the growing stream of literature that addresses the

impact of blockchain on organizations from a

strategic perspective, especially by providing

contributions to the impact of blockchain on business

models.

This research can also benefit practitioners that

are still struggling in the adoption of blockchain

technology and with the understanding of how they

can create value, by providing tools to understand

how blockchain can modify their business models.

The Impact of Blockchain on Business Model: A Literature Review

403

Important implications for practitioners have also

been derived suggesting that each maturity stage of

the application of blockchain provides a precise set of

characteristics that can be leveraged by firms to solve

defined business needs.

This study has been developed minding

limitations that mainly consists in the lack of

documents analyzing the research topic thus bringing

to a restricted pool of information to which

elaborating considerations on, and the intrinsic delay

of academic literature that generates a gap between

released practical cases and theoretical considerations

elaborated on such evidence.

REFERENCES

Adams, R. J., Smart, P., & Huff, A. S. (2017). Shades of

Grey: Guidelines for Working with the Grey Literature

in Systematic Reviews for Management and

Organizational Studies. International Journal of

Management Reviews, 19(4), 432–454.

https://doi.org/10.1111/ijmr.12102

Angelis, J., & Ribeiro da Silva, E. (2019). Blockchain

adoption: A value driver perspective. Business

Horizons, 62(3), 307–314. https://doi.org/10.1016/j.

bushor.2018.12.001

Atlam, H., Alenezi, A., Alassafi, M., & Wills, G. (2018).

Blockchain with Internet of Things: Benefits,

Challenges and Future Directions. International Journal

of Intelligent Systems and Applications, 10.

https://doi.org/10.5815/ijisa.2018.06.05

Bedin, A. R. C., Capretz, M., & Mir, S. (2021). Blockchain

for Collaborative Businesses. Mobile Networks and

Applications, 26(1), 277–284. https://doi.org/10.

1007/s11036-020-01649-6

Berntzen, L., & Johannessen, T. B. and M. R. (2019). Multi-

Layer Aggregation in Smart Grids a Business Model

Approach. 405–409. http://www.iadisportal.org/digital

-library/multi-layer-aggregation-in-smart-grids-a-busin

ess-model-approach

Catalini, C., & Gans, J. S. (2016). Some Simple Economics

of the Blockchain. SSRN Electronic Journal.

https://doi.org/10.2139/ssrn.2874598

Chen, Y., & Bellavitis, C. (2020). Blockchain disruption

and decentralized finance: The rise of decentralized

business models. Journal of Business Venturing

Insights, 13. https://doi.org/10.1016/j.jbvi.2019.e00151

Chesbrough, H. (2010). Business model innovation:

Opportunities and barriers. Long Range Planning.

https://doi.org/10.1016/j.lrp.2009.07.010

Chong, A. Y. L., Lim, E. T. K., Hua, X., Zheng, S., & Tan,

C. W. (2019a). Business on chain: A comparative case

study of five blockchain-inspired business models.

Journal of the Association for Information Systems,

20(9), 1308–1337. https://doi.org/10.17705/1jais.00568

Chong, A. Y. L., Lim, E. T. K., Hua, X., Zheng, S., & Tan,

C. W. (2019b). Business on chain: A comparative case

study of five blockchain-inspired business models.

Journal of the Association for Information Systems,

20(9), 1308–1337. https://doi.org/10.17705/1jais.00568

Constantinides, P., Henfridsson, O., & Parker, G. G. (2018).

Platforms and Infrastructures in the Digital Age

Keywords: Digital platforms • digital infrastructure •

architecture • governance • platform scale • platform

policy. https://doi.org/10.1287/isre.2018.0794

Ghezzi, A., Gabelloni, D., Martini, A., & Natalicchio, A.

(2018). Crowdsourcing: A Review and Suggestions for

Future Research. International Journal of Management

Reviews, 20(2), 343–363. https://doi.org/10.1111/ijm

r.12135

Holtmeier, M., & Sandner, P. (2019). The impact of crypto

currencies on developing countries. https://www.

semanticscholar.org/paper/The-impact-of-crypto-curren

cies-on-developing-Holtmeier-Sandner/1960210301938

d655b56de00101a763ef926057f

Klöckner, M., Kurpjuweit, S., Velu, C., & Wagner, S. M.

(2020). Does Blockchain for 3D Printing Offer

Opportunities for Business Model Innovation? Research

Technology Management, 63(4), 18–27. https://

doi.org/10.1080/08956308.2020.1762444

Lohmer, J., & Lasch, R. (2020). Blockchain in operations

management and manufacturing: Potential and barriers.

Computers & Industrial Engineering, 149, 106789.

https://doi.org/10.1016/j.cie.2020.106789

Mas, F. D., Dicuonzo, G., Massaro, M., & Dell’Atti, V.

(2020). Smart contracts to enable sustainable business

models. A Case Study. Management Decision. https://

doi.org/10.1108/MD-09-2019-1266

Massaro, M., Mas, F. D., Jabbour, C. J. C., & Bagnoli, C.

(2020). Crypto-economy and new sustainable business

models: Reflections and projections using a case study

analysis. Corporate Social Responsibility and

Environmental Management, February, 1–11. https://

doi.org/10.1002/csr.1954

Morkunas, V. J., Paschen, J., & Boon, E. (2019). How

blockchain technologies impact your business model.

Business Horizons, 62(3), 295–306. https://doi.org/

10.1016/j.bushor.2019.01.009

Nowiński, W., & Kozma, M. (2017). How can blockchain

technology disrupt the existing business models?

Entrepreneurial Business and Economics Review, 5(3),

173–188. https://doi.org/10.15678/EBER.2017.050309

Osterwalder, A. (2004). The business model ontology a

proposition in a design science approach. Doctoral

Dissertation, Université de Lausanne, Faculté Des

Hautes Études Commerciales.

Osterwalder, A., & Pigneur, Y. (2010). Business Model

Generation—A handbook for visionaries, Game

Changers and challengers striving to defy outmoded

business models and design tomorrow’s enterprises.

The Medieval Ous: Imitation, Rewriting, and

Transmission in the French Tradition.

Palas, M. J. U., & Bunduchi, R. (2020). Exploring

interpretations of blockchain’s value in healthcare: A

multi-stakeholder approach. Information Technology

and People. https://doi.org/10.1108/ITP-01-2019-0008

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

404

Rejeb, A., & Rejeb, K. (2020). Blockchain and supply chain

sustainability. Logforum, 16, 363–372. https://doi.

org/10.17270/J.LOG.2020.467

Rijanto, A. (2020). Business financing and blockchain

technology adoption in agroindustry. Journal of Science

and Technology Policy Management, 12(2), 215–235.

https://doi.org/10.1108/JSTPM-03-2020-0065

Risius, M., & Spohrer, K. (2017). A Blockchain Research

Framework: What We (don’t) Know, Where We Go

from Here, and How We Will Get There. Business and

Information Systems Engineering, 59(6), 385–409.

https://doi.org/10.1007/s12599-017-0506-0

Schneider, S., Leyer, M., & Tate, M. (2020). The

Transformational Impact of Blockchain Technology on

Business Models and Ecosystems: A Symbiosis of

Human and Technology Agents. IEEE Transactions on

Engineering Management. https://doi.org/10.1109/T

EM.2020.2972037

Swan, M. (2015). Blockchain: Blueprint for a new

economy. In Climate Change 2013—The Physical

Science Basis. https://doi.org/10.1017/CBO978

1107415324.004

Tan, W., & Sundarakani, B. (2020). Assessing Blockchain

Technology application for freight booking business: A

case study from Technology Acceptance Model

perspective. Journal of Global Operations and Strategic

Sourcing, ahead-of-print. https://doi.org/10.1108/JG

OSS-04-2020-0018

Teece, D. J. (2010). Business models, business strategy and

innovation. Long Range Planning, 43(2–3), 172–194.

https://doi.org/10.1016/j.lrp.2009.07.003

Tiscini, R., Testarmata, S., Ciaburri, M., & Ferrari, E.

(2020). The blockchain as a sustainable business model

innovation. Management Decision. https://doi.org/

10.1108/MD-09-2019-1281

Tönnissen, S., & Teuteberg, F. (2020). Analysing the

impact of blockchain-technology for operations and

supply chain management: An explanatory model

drawn from multiple case studies. International Journal

of Information Management, 52(January), 0–1.

https://doi.org/10.1016/j.ijinfomgt.2019.05.009

Trabucchi, D., Moretto, A., Buganza, T., & MacCormack,

A. (2020). Disrupting the Disruptors or Enhancing

Them? How Blockchain Reshapes Two-Sided

Platforms. Journal of Product Innovation Management,

37(6), 552–574. https://doi.org/10.1111/jpim.12557

Weking, J., Mandalenakis, M., Hein, A., Hermes, S., Böhm,

M., & Krcmar, H. (2019). The impact of blockchain

technology on business models – a taxonomy and

archetypal patterns. Electronic Markets, Lacity 2018.

https://doi.org/10.1007/s12525-019-00386-3

Zamani, E. D., & Giaglis, G. M. (2018). With a little help

from the miners: Distributed ledger technology and

market disintermediation. Industrial Management and

Data Systems, 118(3), 637–652. https://doi.org/

10.1108/IMDS-05-2017-0231

The Impact of Blockchain on Business Model: A Literature Review

405