Marginal Emission Factors in Power Systems: The Case of the

Netherlands

Parnian Alikhani

a

, Nico Brinkel

b

, Wouter Schram

c

, Ioannis Lampropoulos

d

and Wilfried van Sark

e

Copernicus Institute of Sustainable Development, Utrecht University, The Netherlands

Keywords:

Electricity System, Cross-Border Exchange, Decarbonization, Marginal Emission Factors, Merit Order.

Abstract:

The Marginal Emission Factor (MEF) is a consistent metric with increased accuracy, compared to the average

emission factor, to evaluate the avoided emissions as a result of changes in electricity consumption caused

by new technologies and policies. In this study, a method is developed to model MEFs by constructing

merit order profiles in interconnected power systems. The proposed method is applied in a case study of

the Netherlands for the years 2018 to 2022. This method, in contrast to previous studies that developed

marginal emission profiles, does not neglect the share of the electricity demand which is met by countries

in neighboring bidding zones. In this study, the results suggest that ignoring electricity trading significantly

underestimates the marginal emission factors. It is found that the key factors resulting in clear temporal shifts

in the marginal emission profiles are fuel and CO

2

prices. Even though the installed capacity of fossil-fueled

electricity generation has declined over time, these are mainly the power plants that operate at the margin

and often set electricity prices at the wholesale level. Overall, the MEF profiles obtained using the proposed

method could be readily employed in detailed evaluations of the emission optimization of distributed power

systems to support decarbonization.

1 INTRODUCTION

Given the adverse effects of anthropogenic climate

change, impact studies exploring strategies to achieve

maximum greenhouse gas (GHG) emission reduction

and power systems decarbonization are of great im-

portance. Developing techniques or metrics to ac-

curately assess the reduction of CO

2

is an important

step in properly assessing both supply strategies and

demand-side management measures (Lampropoulos

et al., 2013), (Brown and Chapman, 2021). Electric-

ity sector CO

2

emissions vary per location and over

time.

There are two approaches to assess the CO

2

emis-

sions of power systems based on the average emis-

sion factor (AEF), and the marginal emission factor

(MEF). Not only these emission factors make it possi-

ble to assess the CO

2

emissions associated with power

a

https://orcid.org/0000-0003-1678-1588

b

https://orcid.org/0000-0001-9973-2890

c

https://orcid.org/0000-0003-3407-7893

d

https://orcid.org/0000-0001-8566-4970

e

https://orcid.org/0000-0002-4738-1088

systems operations, but can also serve as a driving

force behind individuals’ and businesses’ electricity

consumption behavior.

The AEF is calculated by dividing total CO

2

emis-

sions from electricity generation by the total amount

of generation over a certain period of time (typically

one year) and represents a mixture of all generation

sources. In contrast, the MEF reflects the emission

intensity of the first power plant responding to an in-

tervention at a given time interval and represents the

emissions factor of the generator that is operating at

the margin. When using AEFs to assess the emission

impact of an intervention (e.g., a demand response ac-

tion), it is assumed that a change in electricity gener-

ation is evenly distributed over all generation facili-

ties. This is not in accordance with the operation of

electricity markets (Schram et al., 2019). Comparing

average and marginal emissions factors revealed that

AEFs largely fail to correctly estimate the avoided

emissions resulting from an intervention (Siler-Evans

et al., 2012). Generators do not ramp up produc-

tion equally, instead, the generator at margin responds

to a change in demand and the emissions of this

single generator should be attributed to this demand

50

Alikhani, P., Brinkel, N., Schram, W., Lampropoulos, I. and van Sark, W.

Marginal Emission Factors in Power Systems: The Case of the Netherlands.

DOI: 10.5220/0011855700003491

In Proceedings of the 12th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2023), pages 50-57

ISBN: 978-989-758-651-4; ISSN: 2184-4968

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

change (Woody et al., 2022).

Variation in MEFs by the hour of the day is impor-

tant for the evaluation of technologies and policies de-

signed to incentivize an increase or decrease in elec-

tricity consumption at specific times of the day. An-

other essential use of hourly MEFs is to accurately es-

timate the decrease in emissions associated with non-

dispatchable renewable generation, which typically is

equivalent to the effect of a reduction in load (Holland

et al., 2022).

Several studies have been conducted in recent

years to develop methods to calculate MEFs and out-

line the importance of the topic. Hawkes (Hawkes,

2010) developed a regression-based approach to con-

struct MEF profiles for the UK by evaluation of power

system historical data. This methodology has been

applied in subsequent studies as well (Holland et al.,

2015), (Thomson et al., 2017). This method might

not be feasible if significant changes in the power

system occur. The most accurate approach is based

on electricity market models by taking into account

power plant dispatch. In such models, changes in the

power systems could be taken into account. Genera-

tors at the margin are not usually published. Schram

(Schram et al., 2019) proposed a method to estimate

the marginal power plant based on the Day-Ahead

Market (DAM) price and the marginal costs of a

power plant.

There are several studies using MEFs to estimate

emissions-saving in demand-side management. In

Ontario, passenger Electric Vehicle (EV) charging

profiles optimization to minimize MEF led to 50%

lower EV emissions (Tu et al., 2020). Similar re-

sults were obtained applying regional-specific MEFs

where optimized charging of EVs reduced emis-

sions by as much as 31% for standard use and 59%

for vehicle-to-grid (V2G) use (Hoehne and Chester,

2016). In addition, the trade-off between electric-

ity cost and MEFs using multi-objective optimization

and optimal solutions using Pareto frontiers for EV-

controlled charging was investigated in (Brinkel et al.,

2020).

While several studies have investigated AEF and

MEF, there is no prior study, to the best of our knowl-

edge, that considers electricity produced by genera-

tors in neighboring countries/states and cross-border

trade as a result of electricity market coupling. Em-

ploying an electricity-interconnected market is re-

ferred to as market coupling which aims to harmo-

nize various systems of electricity exchanges and, in

particular, to reduce price differences by linking con-

trol areas and market areas. Integration of the Euro-

pean electricity markets is an approach to contribute

to the decarbonization of the European energy sys-

tem and increasing the security of supply. In the

early 2000s, some Central Western Europe (CWE)

countries started to move towards market coupling

in agreements with several regional initiatives (Ten-

neT, 2021b). The convergence in market prices across

CWE countries is one of the main targets of market

integration. Therefore, transmission capacities allo-

cated to cross-border trading and the level of price

convergence have increased over time. Full price

convergence within CWE reached 48% of the hours

in 2021 (TenneT, 2021a). Higher price convergence

contributes to better European market integration, and

market coupling has created efficient trading at the

day-ahead stage (Gissey et al., 2019).

A large and highly interconnected grid has many

economic and operational constraints, which make

challenging the identification of marginal generation

units (Siler-Evans et al., 2012). Due to the increased

market coupling, the generator at the margin that re-

sponds to a change in demand might be not located in

the studied country, but in one of the surrounding bid-

ding zones. This can considerably affect the marginal

emission factor profiles for electricity, in particular

when the variation in the electricity generation capac-

ity mix between bidding zones is significant. The con-

cept of market coupling has not been integrated into

the methods proposed in previous studies to generate

marginal emission profiles.

In this study, we develop a method to model MEFs

for national power systems by constructing merit or-

der profiles of all generation facilities while taking

cross-border trade into account. Next, the approach

is applied to the case of the Netherlands to derive

MEFs from 2018 to 2022. This method takes into

account the electricity imported by considering the

power plants in CWE countries with a high amount

of hours of DAM price convergence with the Nether-

lands. The proposed approach is also compared with

the results of a scenario in which electricity trading is

neglected.

In Section 2, the methodology is presented. The

case study and datasets are discussed in Section 3. In

section 4, the results of the proposed method for a

given case study are presented. Section 5 contains the

key conclusions.

2 METHOD

The construction of the MEF profiles is based on the

countries’ generation facilities and historical data and

is developed using the approach proposed by (Schram

et al., 2019). This method calculates the marginal

costs of each power plant in one country, and marginal

Marginal Emission Factors in Power Systems: The Case of the Netherlands

51

costs are linked with the DAM price to find which

generator is at the margin. However, this method

neglects that a high level of price convergence has

been observed in recent years within the CWE re-

gion (ENTSO-E, 2021).

Full price convergence refers to exact same price

between two neighboring bidding zones. The mar-

ket coupling could cause the marginal generator to be

located in another bidding zone. Price convergence

between bidding zones indicates that the DAM clear-

ing was not restricted by transmission constraints be-

tween bidding zones, causing the same merit order

to be applied to both countries. Hence, a moment

of price convergence between two or more bidding

zones indicates that the same generator is at the mar-

gin in these bidding zones. In this study, it is assumed

to have electricity exchange within CWE countries at

times with full price convergence.

After collecting and pre-processing the data sets

which are explained in section 3, the merit order con-

struction is the first step in modeling the MEFs pro-

file. This is the electricity generation mix ranked

based on ascending order of marginal operation costs

(MC). MC (in

C/MWh) of facility i is the sum of

three components, namely the fuel costs, the emis-

sion costs, and the variable operating costs (Biggar

and Hesamzadeh, 2014), and thus could be obtained

as follows (Schram et al., 2019):

MC

i

=

FP

i

η

i

+

EF

i

η

i

×C P + V OC

i

(1)

where FP is the price of fuel (in C/MWh

t

), η is

the conversion efficiency, EF is the emission factor

of the fuel (in tCO

2

/MWh

t

), CP is the EU Emission

Trading System (ETS) CO

2

price (in C/tCO

2

), and

VOC is the Variable Operational Costs (in C/MWh).

The marginal emissions (ME) (in tCO

2

/MWh) of

facility i which is determined to be at margin are ob-

tained as follows (Schram et al., 2019):

ME

i

=

EF

i

η

i

(2)

For constructing the MEF profile, first, the facility

at the margin is determined by the clearing prices of

the DAM. Then, the MEF profile can be created us-

ing the marginal facility’s emissions. To identify the

marginal power plant, the following assumptions re-

lated to the marginal facilities are made:

• To determine the marginal operating facility, the

power plant with marginal costs closest to the spot

price is assumed to be the marginal operating fa-

cility.

• When the investigated country’s DAM price is

equal to the DAM price of other bidding zones,

we take into account all power plants generating at

the investigated country and other bidding zones

with the exact same DAM price. It is assumed

that there is electricity exchange within the CWE

region at times when the price fully converges.

• When the investigated country’s DAM price is not

equal to any other bidding zones’ DAM prices, we

take only the investigated country’s power plants

into account.

• When the investigated country DAM price is neg-

ative, we assume that renewable resources are at

the margin.

• When the investigated country’s DAM price is

lower than one-third of the lowest MC of con-

sidered power plants, we assume that renewable

resources are at the margin as well. It is assumed

that electricity with lower prices is generated from

renewable sources.

In addition, several other assumptions have been

made to construct the merit order and MEF profiles

which are as follows:

• Hard coal, Natural Gas (NG), Lignite, Nuclear,

and Renewable Energy Sources (RES) are iden-

tified as the marginal energy supply sources based

on their generation capacity in the countries.

• All power plants are assumed to operate at their

maximum efficiency; efficiency losses of operat-

ing at partial load are not considered.

• Coal and natural gas plants with a capacity under

100 MW are excluded from the list due to their

low efficiencies.

• No assumptions about future scenarios are made.

• It is assumed that market participants bid based on

the marginal costs of their power plants.

• Bid strategies of retailers were not considered.

3 CASE STUDY SPECIFICATIONS

AND DATA COLLECTION

The methodology is applied to the Dutch power sys-

tem for the years 2018 to 2022. The countries in CWE

with a high number of hours with full price conver-

gence with the Netherlands are Germany, Belgium,

France, Austria, and Denmark. Table. 1 indicates

the price convergence time percentages that occurred

every year with the above-mentioned countries. In re-

cent years, prices have converged considerably. How-

ever, in 2022, the Russo-Ukrainian War significantly

affected the energy markets, resulting in a decrease in

electricity price convergence.

SMARTGREENS 2023 - 12th International Conference on Smart Cities and Green ICT Systems

52

Table 1: Countries in CWE that have the highest amount of hours with full price convergence in 2018-2022.

Year Germany Belgium France Austria Denmark

2018 36.09% 40.48% 37.07% 33.95% 19.05%

2019 49.28% 46.77% 42.65% 44.55% 37.36%

2020 48.95% 49.75% 44.67% 44.25% 38.64%

2021 53.73% 51.70% 48.64% 48.49% 51.10%

2022 38.89% 36.14% 33.49% 33.60% 38.12%

To construct the MEF profiles, several datasets

are required as input. First, the characteristics

of all generation facilities, namely each unit’s in-

stalled capacity, efficiency, and generation types,

which are obtained using the JRC open power plants

database (JRC, 2019). CO

2

prices in addition to fuel

prices for coal, NG, and uranium are collected from

Investing (Investing, 2022). Lignite price is collected

from Federal Statistical Office of Germany (German

Federal Statistical Office, 2022). VOC is assumed to

be 2.56 C/MWh for NG-fired facilities, 3 C/MWh for

coal-fired power plants, and 6.4 C/MWh for nuclear

power plants (De Vita et al., 2018). The emission

factor of bituminous coal, natural gas, lignite, ura-

nium, and RES are determined as 0.341, 0.202, 0.364,

0.031, and 0.015 tCO

2

/MWh

t

, respectively (Koffi

et al., 2017).

4 RESULTS AND DISCUSSION

4.1 Marginal Emissions Factors of the

Case Study

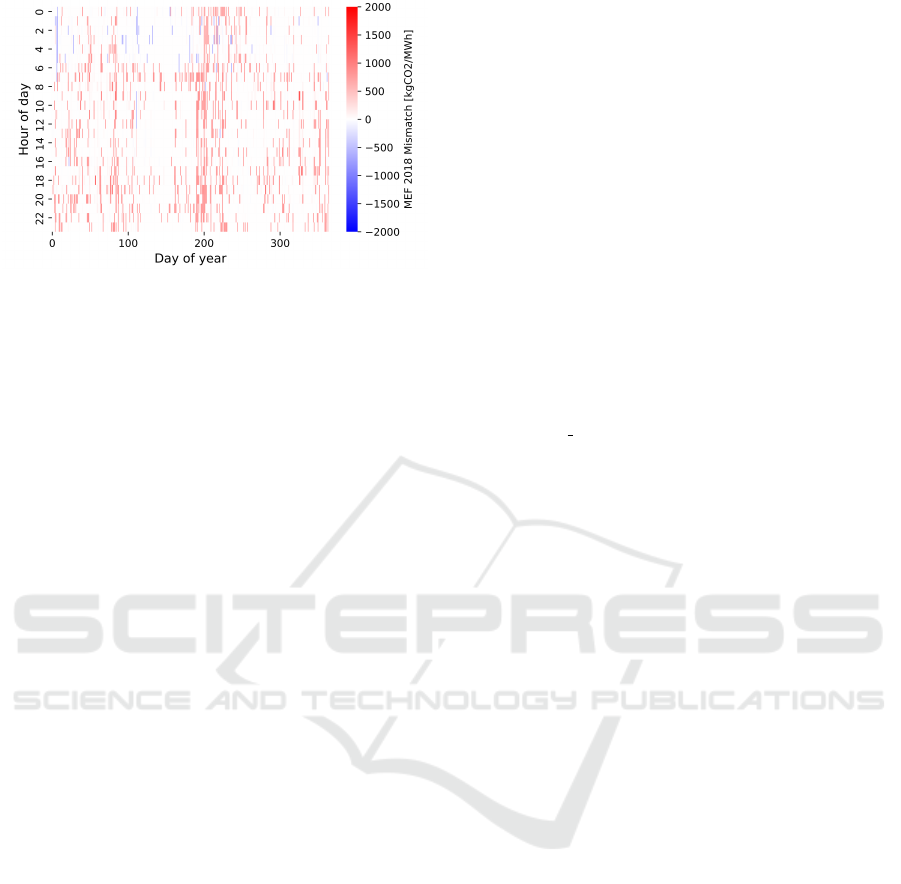

In Fig. 1 the MEF profiles by the hour of the day and

day of the year, from 2018 to 2022, are illustrated.

The heatmap shows a clear change in the MEF pro-

files over the years. In 2018, during the peak hours

(i.e., 8:00-10:00 and 17:00-19:00), MEFs are rela-

tively low which coincides with high DAM prices,

and MEFs increase outside the peak times. In 2019

and 2020, this trend is reversed, and higher MEFs

are obtained during the morning and afternoon hours

when demand is ramping up, and lower MEFs are ac-

quired in the late evening when the demand decreases.

There are several shifts in trends in 2021 and 2022,

which make the trends seem inconsistent throughout

the year.

The main reasons behind these shifts are the

change in NG and CO

2

prices. As shown in Fig. 2,

marginal costs of NG power plants are higher than

other facilities in 2018 which makes NG frequently

the marginal fuel source. NG prices decreased in

2019 and 2020, explaining the shift in the daily MEF

pattern from 2018 to 2019, when peak hours with

higher prices coincided with higher emission factors

from coal or lignite generators. Later at the end of

2021, a significant rise in NG price as well as the in-

crease in CO

2

price lead to NG power plants being

at the margin during high-demand hours when DAM

price is high. Moreover, the increase in CO

2

price re-

sults in the marginal cost of coal-fired power plants

increasing more than NG plants due to their higher

emission factor.

The MEF profiles of a randomly chosen day e.g.

16 September in both 2018 and 2020 are illustrated in

Fig. 3 to visualize how the MEF pattern changes over

time. In 2018, the MEF profile mostly behaves the op-

posite of the DAM price trend, however, it almost fol-

lows the DAM price behavior in 2020. This demon-

strates that scheduling demand to minimize cost is not

always the best strategy from an environmental point

of view since it could increase the amount of CO

2

pro-

duced by power plants. Fig. 4 shows the daily aver-

age and 7-day rolling average MEFs. As a result of

changes in marginal fuel, MEFs show a trend to de-

cline from 2019 through 2021 and significant rises in

the second half of 2021 and 2022.

Fig. 5 shows how marginal generation sources

have shifted over the last four years. The fraction of

time that different units are at the margin is identified

for each year. The share of NG as the marginal gener-

ator has increased since 2018. This development has

largely been due to NG’s declining price worldwide

in recent years until 2021 along with CO

2

’s sharp

rise in price, resulting in NG replacing coal. It is

shown that the coal power plants started responding

more again to marginal changes in 2021. The price

of coal was significantly low compared to that of NG

after the pandemic in 2021. As a result, NG facilities,

which emit less CO

2

per generated unit of electric-

ity, have been at the margin less in 2021 and 2022

than years earlier. Nuclear, Lignite, and RES genera-

tors are rarely at the margin due to their low marginal

costs and insufficient installed capacity to satisfy the

entire demand.

In addition, a considerable increase in RES gen-

eration and a reduction in load demand in 2019 and

later in 2020 due to the global pandemic lead to a de-

crease in DAM prices which are driven by supply and

demand. DAM price changes as well as a decrease

Marginal Emission Factors in Power Systems: The Case of the Netherlands

53

Figure 1: Hourly marginal emission profile for the Netherlands from 2018 to 2022.

Figure 2: The marginal cost of each type of power plant per half a year. It includes fuel, CO

2

, and variable operational costs

taking into account the average efficiency of each type of power plant.

in NG prices made coal-burning power plants, as the

biggest emitters, be at the margin less than before and

result in less CO

2

emissions.

Even with a 20.85 percentage point (p.p.) increase

in renewable energy generation from 2018 to 2021,

fossil-fueled generation units remained the main

power plants at the margin, whilst producing only

63% of the Netherlands’ electricity in 2021 (CBS,

2022). There were 99.44% of times when fossil fu-

els were marginal in 2018. Despite renewable energy

reducing this share to 96.24% in 2021, the marginal

power plant still relies heavily on fossil fuels. Addi-

tionally, there is a 13.06 p.p. increase in the marginal

generator’s dependency on imports from neighbor-

ing bidding zones in 2021 versus 2018, demonstrat-

ing the improvement in European electricity market

SMARTGREENS 2023 - 12th International Conference on Smart Cities and Green ICT Systems

54

Figure 3: Day-ahead price versus marginal emission factor

for 16 September 2018 and 2020.

Figure 4: Daily average and 7-day rolling average marginal

emission factors over the studied years.

coupling. The Dutch electricity grid appears to be

largely balanced by interconnections with Germany.

The Russo-Ukrainian War negatively affected the en-

ergy market in 2022, resulting in a decrease in the

level of price convergence.

4.2 Performance Evaluation of the

Proposed Method

Fig. 6 shows the range of emission factors for power

plants in the Netherlands and other bidding zones that

take efficiencies into account. Power generated from

lignite and nuclear, along with numerous hard coal

and natural gas power plants with different efficien-

cies located in neighboring countries, would be elim-

inated in case of neglecting power exchange impact.

Figure 5: Percentage of hours for each type of fuel being at

the margin per year.

Figure 6: An overview of the emission factors of power

plants in the Netherlands and other bidding zones.

As a result, marginal generator emissions in the other

bidding zones are not taken into account when calcu-

lating MEFs.

MEF profiles without taking into account electric-

ity exchange with other bidding zones are also con-

structed for comparison of the results of this study.

Fig. 7 illustrates the mismatch between MEFs that are

constructed using the proposed approach and those

that neglect trading in 2018. Observations indicate

that MEFs are underestimated when power exchanges

are neglected, and the proposed approach improves

the accuracy of emission factors for the power sector.

If the model neglects electricity trade among neigh-

boring bidding zones, then only power plants in the

Netherlands are taken into account. This ignores the

emission factors of power plants that do not exist in

the country, i.e., lignite and nuclear. Hence, ignoring

the electricity exchange leads to underestimating the

emission factors by not accounting for electricity gen-

erated from other units, especially units with higher

emissions, such as coal and lignite installed in other

bidding zones.

Marginal Emission Factors in Power Systems: The Case of the Netherlands

55

Figure 7: Marginal emission factors differences between

scenarios considering versus ignoring electricity imports.

5 CONCLUSIONS

In this paper, we provide an approach for the deter-

mination of MEF profiles from the electricity sector

and applied the method to the case of the Nether-

lands from 2018 to 2022 via generation facilities merit

order construction. The impact of electricity trade

with other bidding zones is taken into account, lead-

ing to higher accuracy compared to ignoring elec-

tricity trade, which results in underestimating emis-

sion factors. Although the share of electricity gen-

erated from renewable sources has increased substan-

tially over the past few years, electricity prices are still

largely determined by carbon-intensive power plants

at the margin. Variations in MEF profiles and shifts

in marginal power plants are primarily caused by fuel

and CO

2

prices. It is expected that future develop-

ments will increase the share of renewables and in-

crease the variability of marginal generation as a re-

sult. Although the current share of renewable energy

in the electricity mix account for only a small share of

the marginal mix, this is expected to change in the fu-

ture. The consequences of these changes for a future

scenario could be investigated in future work.

In conclusion, the proposed MEF construction ap-

proach is well suited to be used in the emissions opti-

mization of distributed power systems to promote de-

carbonization e.g., scheduling of electricity demand

and evaluating load shifting potentials.

ACKNOWLEDGEMENTS

This study is supported by the Dutch Ministry of

Economic Affairs and Climate Policy and the Dutch

Ministry of the Interior and Kingdom Relations

through the ROBUST project under grant agreement

MOOI32014. This study is also supported by the

Horizon 2020 program and the ARV project under

grant agreement 101036723.

REFERENCES

Biggar, D. R. and Hesamzadeh, M. R. (2014). The eco-

nomics of electricity markets. Wiley Blackwell.

Brinkel, N., Schram, W., AlSkaif, T., Lampropoulos, I.,

and Van Sark, W. (2020). Should we reinforce the

grid? cost and emission optimization of electric ve-

hicle charging under different transformer limits. Ap-

plied Energy, 276:115285.

Brown, M. A. and Chapman, O. (2021). The size, causes,

and equity implications of the demand-response gap.

Energy Policy, 158:112533.

CBS (2022). More electricity from renewable sources,

less from fossil sources. https://www.cbs.nl/en-

gb/news/2022/10/more-electricity-from-renewable-

sources less-from-fossil-sources, Accessed: Decem-

ber 9, 2022.

De Vita, A., Kielichowska, I., Mandatowa, P., Capros,

P., Dimopoulou, E., Evangelopoulou, S., Fotiou, T.,

Kannavou, M., Siskos, P., Zazias, G., et al. (2018).

Technology pathways in decarbonisation scenarios.

Tractebel, Ecofys, E3-Modelling: Brussels, Belgium.

ENTSO-E (2021). Transparency platform; day-ahead

prices. https://transparency.entsoe.eu/transmission-

domain/r2/dayAheadPrices/show, Accessed: January

13, 2023.

German Federal Statistical Office (2022). Preise -

erdgas- und stromdurchschnittspreise. https://www.

destatis.de/, Accessed: January 9, 2023.

Gissey, G. C., Guo, B., Newbery, D., Lipman, G., Mon-

toya, L., Dodds, P., Grubb, M., and Ekins, P. (2019).

The value of international electricity trading. A project

commissioned by Ofgem.

Hawkes, A. (2010). Estimating marginal co2 emissions

rates for national electricity systems. Energy Policy,

38(10):5977–5987.

Hoehne, C. G. and Chester, M. V. (2016). Optimizing plug-

in electric vehicle and vehicle-to-grid charge schedul-

ing to minimize carbon emissions. Energy, 115:646–

657.

Holland, S. P., Kotchen, M. J., Mansur, E. T., and Yates,

A. J. (2022). Why marginal co2 emissions are not

decreasing for us electricity: Estimates and implica-

tions for climate policy. Proceedings of the National

Academy of Sciences, 119(8):e2116632119.

Holland, S. P., Muller, N. Z., Mansur, E. T., and Yates, A. J.

(2015). Environmental benefits from driving electric

vehicles? National Bureau of Economic Research:

Cambridge MA.

Investing (2022). Stock market quotes and financial news.

https://www.investing.com/, Accessed: October 5,

2022.

JRC (2019). European commission open power plants

database(jrc-ppdb-open). http://data.europa.eu/89h/

SMARTGREENS 2023 - 12th International Conference on Smart Cities and Green ICT Systems

56

9810feeb-f062-49cd-8e76-8d8cfd488a, Accessed:

October 5, 2022.

Koffi, B., Cerutti, A., Duerr, M., Iancu, A., Kona, A., and

anssens Maenhout, G. (2017). Com default emission

factors for the member states of the european union -

version 2017. https://data.jrc.ec.europa.eu/dataset/jrc-

com-ef-comw-ef-2017, Accessed: October 5, 2022.

Lampropoulos, I., Kling, W., Ribeiro, P., and van den Berg,

J. (2013). History of demand side management and

classification of demand response control schemes,

ieee power & energy society general meeting. Van-

couver BC.

Schram, W., Lampropoulos, I., AlSkaif, T., and Van Sark,

W. (2019). On the use of average versus

marginal emission factors. In SMARTGREENS 2019-

Proceedings of the 8th International Conference on

Smart Cities and Green ICT Systems, pages 187–193.

SciTePress.

Siler-Evans, K., Azevedo, I. L., and Morgan, M. G. (2012).

Marginal emissions factors for the us electricity sys-

tem. Environmental science & technology, 46:4742–

4748.

TenneT (2021a). Annual market update 2021, elec-

tricity market insights. https://www.tennet.eu/

company/publications/technical-publications/, Ac-

cessed: August 16, 2022.

TenneT (2021b). Market news. https://www.tennet.eu/

market-newsw, Accessed: October 2, 2022.

Thomson, R. C., Harrison, G. P., and Chick, J. P. (2017).

Marginal greenhouse gas emissions displacement of

wind power in great britain. Energy Policy, 101:201–

210.

Tu, R., Gai, Y. J., Farooq, B., Posen, D., and Hatzopoulou,

M. (2020). Electric vehicle charging optimization

to minimize marginal greenhouse gas emissions from

power generation. Applied Energy, 277:115517.

Woody, M., Craig, M. T., Vaishnav, P. T., Lewis, G. M.,

and Keoleian, G. A. (2022). Optimizing future cost

and emissions of electric delivery vehicles. Journal of

Industrial Ecology.

Marginal Emission Factors in Power Systems: The Case of the Netherlands

57