Analysis of Production Costs: An Approach to Decision-Making

Sebastián Tapia-Quezada

1a

, Lisseth Lucero-Hurtado

1b

, Fabiola Reino-Cherrez

2c

,

Lorena Siguenza-Guzman

2,3 d

and Rodrigo Arcentales-Carrion

1,2 e

1

Faculty of Economics and Administrative Sciences, University of Cuenca, Cuenca, Ecuador

2

Department of Applied Chemistry, Faculty of Chemical Sciences, University of Cuenca, Cuenca, Ecuador

3

Centre for Industrial Management Traffic & Infrastructure, KU Leuven, Celestijnenlaan 300,

Box 2422, BE- 3001, Leuven, Belgium

Keywords: Textile Products, Production Costs, Textile Production, Decision-Making Cost Systems.

Abstract: Due to competitive growth, companies need to have a cost system that allows them to identify all the costs

incurred in the production process. Furthermore, it is necessary to know the company's needs and production

characteristics for its implementation. That is why the present investigation analyzes the production costs in

an Ecuadorian textile SME dedicated to manufacturing and commercializing lingerie for the home. This study

aims to identify a cost model that adapts to the characteristics and needs of the organization, both economical

and productive. The methodology is based on a) organizational knowledge and information gathering, b)

analyzing the production costs, and c) establishing the optimal cost model proposal. The findings indicate that

the textile SME does not have a production cost system that allows timely decision-making. Thus, the study

proposes implementing a cost system for operations since it best adapts to the characteristics and needs of the

case study. Furthermore, this system aims to optimize the entity's internal processes, allowing timely decision-

making, both strategic and productive.

1 INTRODUCTION

Cost accounting is a technique or method that

establishes the price of a project, process, goods,

and/or service (Kesimli, 2022). Its main objective is

to provide "internally oriented" information, which

allows the valuation of the costs involved in the

production process (Rogosic, 2021). Production costs

include raw materials, labor, and manufacturing

overhead (MOH) (Istan et al., 2021). Thus, the direct

raw material is easily identifiable in a specific good

or service (Mekonnen et al., 2019). Labor represents

the payments made to the workers to transform the

raw material (Putri, 2017). Finally, MOH is monetary

disbursements that constitute the indirect part of the

transformation process of a product (Dey et al., 2020).

Adequate management of production costs and a

cost system allows an organization to establish the

correct monetary value of the resources used in

a

https://orcid.org/0000-0001-9106-5368

b

https://orcid.org/0000-0003-0588- 3423

c

https://orcid.org/0000-0002-6011-665X

d

https://orcid.org/0000-0003-1367- 5288

e

https://orcid.org/0000-0002-9700-8898

product production without affecting it (Cirilo &

Cunha, 2018). Moreover, having a cost system is

essential to generate helpful information that solves

the inefficiencies linked to the transformation and

marketing of a given product (Hoozée & Ngo, 2018).

Thus, the selection of the cost system depends on the

information needs required by each company. The

most common cost accumulation systems in

organizations that produce goods are by production

orders, processes, and Activity-Based Costing (ABC)

(Cárdenas et al., 2020). The production order system

is used for limited manufacturing and corresponds to

a specific work order (Handayani et al., 2020). The

processing system is used for large-scale, continuous

production. Combining the system with production

orders and processes gives rise to the system by

operations. This system considers that the processing

operations are similar, while the direct materials used

in production are different (Chacón, 2016; Flores,

2016). Finally, the ABC system is based on the

82

Tapia-Quezada, S., Lucero-Hurtado, L., Reino-Cherrez, F., Siguenza-Guzman, L. and Arcentales-Carrion, R.

Analysis of Production Costs: An Approach to Decision-Making.

DOI: 10.5220/0011857000003494

In Proceedings of the 5th International Conference on Finance, Economics, Management and IT Business (FEMIB 2023), pages 82-88

ISBN: 978-989-758-646-0; ISSN: 2184-5891

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

activities of an organization and focuses on the

expenses involved in the production process (Areena,

2019). From the ABC system comes the Time-Driven

Activity-Based Costing (TDABC) model. This

system provides the cost based on the time consumed

by each activity (Kaplan & Anderson, 2004).

This research analyzes the production costs

corresponding to 2020 to determine the optimal

costing system for a textile SME, contributing to

timely decision-making. For confidentiality reasons,

the entity in which this research is carried out is

known as the "case study.” This article comprises

four sections: 1) Theoretical background; 2) Study

methodology; 3) The results expressed in phases; and

finally, 4) Conclusions and recommendations.

2 MATERIALS AND METHODS

The case study selection was based on convenience

due to the availability of two parameters: 1) the

confidential and limited access data on production

costs and 2) the availability of the collaborators

involved in the investigation. On the other hand, the

present study is based on the procedure for the cost

construction that facilitates decision-making

proposed by Mejía (2015) and the diagnostic process

for determining the cost system developed by Ríos

(2014). In this sense, for the research development, a

combination of the exposed methodologies was

carried out, resulting in three main phases a)

Knowledge of the entity and review of information,

b) Analysis of production costs, and c) Determination

and proposal of a cost system. Therefore, it is

essential to document each step in-depth in the

general phases.

The first phase focused on the collection and

review of information in order to determine whether

the organization has control of production costs. This

was done through visits to the facilities and

interviews with the collaborators of the case study

entity. The production costs were analyzed in the

second phase to know how they are treated. For this

purpose, the sample was selected based on purposive

sampling. Finally, the third phase focused on

proposing a costing system for the company to assist

in timely decision-making. For decision-making, a

literature review matrix of the costing systems

applicable to the case study was prepared. From this,

a first selection was made, using a decision matrix, to

choose the cost systems that can be used as favorable

alternatives in the characteristics of the entity. Then,

with the results obtained in the previous process, the

final selection was made using the weighted factors

technique, which takes as parameters: the

requirements and needs of the organization)}.

2.1 Knowledge of the Entity and

Review of Information

The initial phase of the investigation was based on

preliminary knowledge of the company, which starts

from two approaches. The first refers to the

understanding of the entity's internal production.

Then, by applying an interview addressed to the

commercial department and later with an analysis

carried out with the annual production reports,

information was obtained regarding the products with

the highest demand and rotation in the period studied.

Thus, the products with the most significant

representation in 2020 were quilts, cushions, and

sheets.

Figure 1 represents the monthly production level

for the year 2020. In this sense, it is evident that there

was a drastic drop in the production of its main textile

articles between March and June. This atypical

productive behavior refers to the health emergency

from COVID-19 that went through the town from

March onwards. For this reason, the Management and

the departments related to manufacturing considered

implementing new textile articles such as biosafety

suits and masks:

Figure 1: Production level. Household linen products vs.

products outside the business line.

The second approach concerns the organization's

treatment of internal production costs. According to

the Manager, the Production Leader, and several

collaborators framed within the operational process,

a) the sale price of the items is established

according to the supply chains and the model

customization, and

Analysis of Production Costs: An Approach to Decision-Making

83

b) deficiencies in the payment of concepts, such as

labor, transportation, maintenance, and fuel, are

detected. Reviewing the documentation provided,

such as Kardex, balance sheets, financial statements,

digital databases, and physical reports, verified this.

2.2 Production Costs Analysis

In this second phase, the study's universe was initially

established to determine the research's scope.

Therefore, this process consisted of organizing all the

products produced in 2020 by category. Table 1

illustrates the sales level of textile products for the

year under study. The results obtained were: 147,292

articles produced, grouped into 49 categories, of

which almost 56% of sales come from three main

types: quilt, cushion, and sheet. Similarly, at the

management’s request, the item "table runner" was

considered for analysis in the investigation due to a

significant increase in customer orders in recent

months.

Once the sampling was established, elaborating

on the products was recognized as a second step.

Physical monitoring of all the activities and methods

was carried out in the elaboration of the different

articles. Subsequently, it was determined that

exclusivity is the main differentiating characteristic

of the manufacture of the pieces. Thus, the

manufacturing process per category is similar, with

differences only in the strokes, cut, type of raw

material, and design.

Table 1: Representation of sales level of textile products in

the year analyzed.

N° Product category Representation

1 Quilt 25.27%

2 Cushion 16.89%

3

Bedsheet

13.65%

4

Table runner

0.01%

5

Other

44.20%

Total 100%

Sales concentration 55.81%

3 FIELDWORK

This section details the main results of developing the

methodology presented in this research. The

following results were obtained for raw material,

labor, and MOH within the company's behavior and

treatment of its production costs.

Raw Material. The raw material consumption is

generally known before the budget analysis to reveal

the quantity required of this input per period. That is

why its behavior in 2020 showed an unusual trend in

certain months, with a decrease in the production of

textile articles. This is evidenced in Fig. 2. It shows

that, between March and April, there was a reduction

in the participation of this cost element due to the lack

of supply chains, the paralysis of the services of

certain suppliers, and the difficulty in raw material

import. However, a remarkable recovery can be seen

since September, somewhat managing to redeem the

low production of previous months.

Figure 2: Monthly general behavior of the raw material of

the articles studied.

Table 2: Percentage of the cost of materials used in the

manufactured products.

Comforter Sheets Cushion

Table

runne

r

Poster

0.7%

Adhesive

2.0%

Banner

0.7%

Label

0.4%

Label

0.2%

Poster

0.8%

Label

0.7%

Thread

1.5%

Cover

13%

Elastic

4.2%

Canvas

46.5%

Back

6.9%

Thread

1.2%

Label

0.4%

Brocade

17.2%

Main

25.5%

Micro-

thread

27.5%

Packaging

3.8%

Marker

33.8%

Cardboard

1.2%

Polyester

27.9%

Thread

1.3%

Card

1.1%

Sublimated

48.6%

Down

29.5%

Base

36.2%

Card

2.3%

Envelope

38%

Packaging

13.5%

Sleeve

13.2%

Total

100%

100% 100% 100%

For calculating the general participation of the

raw material in the textile articles determined in the

sample, the material consumption reports

corresponding to 2020 were taken as a reference. In

this manner, the raw material represents an average of

FEMIB 2023 - 5th International Conference on Finance, Economics, Management and IT Business

84

40.20% of the total production costs. Therefore, it

proves that this cost element is the primary basis of

the manufacturing process. In addition, the company's

treatment of the raw material begins with registering

inventories through internal software managed by the

warehouse owner. In this sense, Table 2 contemplates

a summary of the raw material control of the entity.

This control is based on a percentage determination

and is managed by software. Based on this, an

estimate of the price of household linen is established.

The raw material is the cost element with the most

excellent control in the case study. Hence, efficient

management in consuming material resources and

supplies is promoted. That is why it is evident that the

internal organizational priority, both for control and

the departments related to production, is to focus its

objectives on optimizing all raw material costs,

reducing waste, and keeping records of material

consumption. However, despite rigorous internal

control of this input, a specific treatment of a

currently existing cost model has not been evidenced.

Labor. Labor participation in production is

crucial for the textile SME's performance. Based on

the analysis of the annual behavior of this cost

element, it was determined that the direct

participation of labor had shown a dangerous

tendency from March to June. Figure 3 shows a high

percentage of growth, and it is powerfully

demonstrated that there is a significant increase in

labor cost in the first quarter compared to the others.

Figure 3: Monthly general behavior of the workforce in the

products.

This unique behavior refers to two main factors. First,

a strict mobility restriction derived from COVID-19

was established in the town; however, the case study

company continued to work usually with all its

collaborators. Second, the home linen product line

had to be restructured and executed on minor scales,

prioritizing the manufacture of items outside its line

of business. In this sense, labor represented an

average of 29.13% of the total production costs of

textile articles.

Based on the above, the textile SME, a

manufacturing company, establishes that direct labor

costs (DLC) represent 64.81% of the company's total

employees. Within DLC, they cover work areas such

as cutting, sewing, finishing, and machine operators.

On the contrary, Indirect Labor Costs (ILC) represent

a total of 35.19% and are mainly made up of strategic

(18.52%) and support (16.67%) personnel. This

indirect labor participation includes work areas such

as production assistants, designers, and production

and sales leaders.

Manufacturing overhead. Regarding the behavior

analysis of this last cost element, Fig. 4 illustrates the

MOH behavior throughout the period studied.

Therefore, compared to the cost elements analyzed

above, their behavior is relatively standard, with

different cost variations with insignificant increases

and decreases. This is due precisely to the level of

direct participation of external entities that provide

finishing and manufacturing services for certain

textile products because, at certain times, it is at its

maximum production capacity. Consequently, the

company must resort to these expenses to fulfill its

customers' orders on time. That is why the share of

indirect manufacturing costs is represented by

30.68%.

Figure 4: Monthly general MOH behavior in the products

studied.

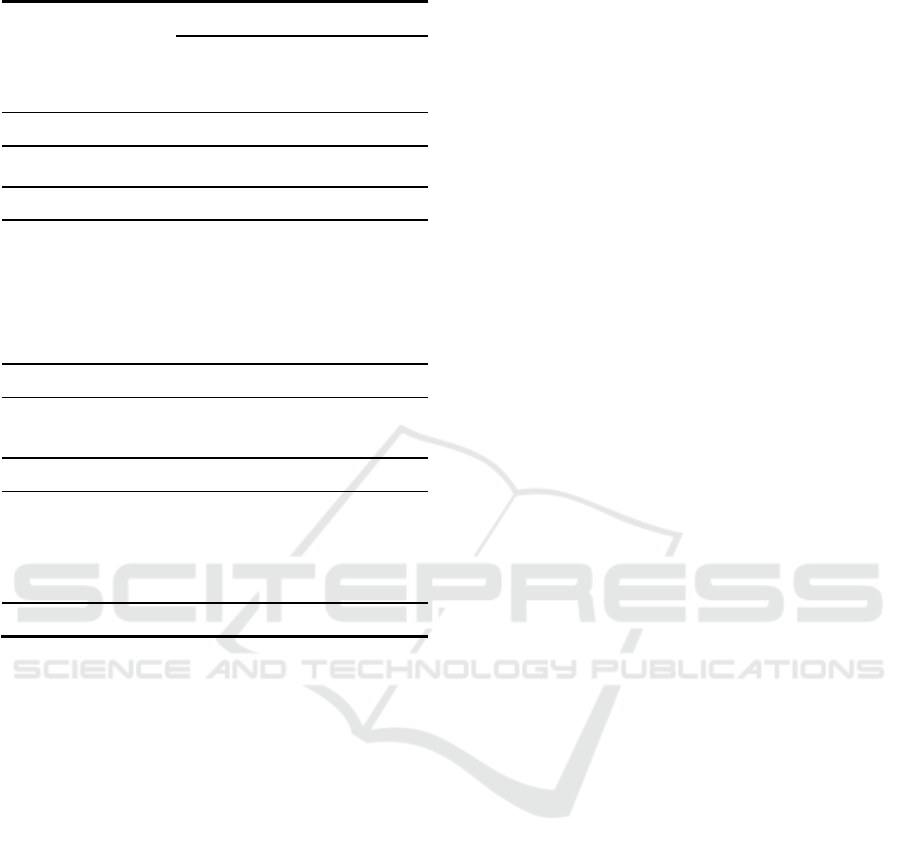

Figure 5 presents the main items that make up the

MOH. The indirect cost with the highest monetary

value incurred by the organization was the item of

garments to outsourcers (maquilas), representing

50.3% of the total MOH, followed by indirect

manufacturing supplies (16.6%) and leases to

establishments (11.4%).

Figure 5: Percentage of MOH representation in textile

production.

Thus, external companies' participation in

different production services represents the highest

indirect cost within the production costs, alluding to

a stable behavior in the period studied. However, the

company's treatment of this cost element is null since

it only keeps accounting records and documentation

supported by files in correspondence with all the

expenses incurred in the company in general.

Analysis of Production Costs: An Approach to Decision-Making

85

3.1 Knowledge of the Entity and

Review of Information

The last phase began with elaborating a literature

review matrix illustrated in Annex 1. It revealed what

type of production is directed, cost allocation,

companies to be applied, and purpose. This is to know

which systems are coupled to the company's

characteristics. Moreover, identifying the company's

features (Annex 2) was considered the first procedure

for the correct cost system selection. This report was

approved and validated by the General Management.

Table 3 presents the selection process, taking the

matrix that Joya (2016) and Guevara (2021)

elaborated on. "X" means the section is met, and "O"

does not apply to the evaluation section.

In this sense, the cost models representing the

highest rating in a final sum were three systems:

Purchase Orders, Processes, and Operations. The

ABC and TDABC cost systems were not considered

because the company does not have well-defined

productive activities. In addition, its adaptation

requires a lot of time and high costs. Therefore, a

second selection was made, considering the results of

the previous table. In this manner, a series of

requirements adapted to the entity's needs were

established to implement a cost model that allows

adequate control and an equitable allocation of costs.

Table 3: Selection of the cost system based on the

company’s characteristics.

Selection cost

systems based

on the

characteristics

of the

case study

By

Orders

By

Processes

By

Operations

ABC TDABC

Type of

company

X X X X X

Type of

p

roduction

X O X O O

Operational

structure

O X X O O

Similar

p

roduction

p

rocesses

O X X X X

Exclusive

designs

X O X O O

Planned

p

roduction

O X X X X

Cyclic

p

roduction

O X X X X

The specific

direct raw

material is

r

equired to

p

roduce each

category

X O X O O

The raw

material enters

through various

p

rocesses in

several

departments

O X X X X

Reception of

p

roduction.

X O X O O

Control of cost

elements

X X X X X

Product Costing X O X O O

To this end, the technique of weighted factors

expressed in (1) was used. For Solano (2020), this

technique considers a "quantitative analysis that

compares alternatives to achieve an optimal decision,

in which the options are affected by factors that

contain a relative weight.” In this sense, a series of

steps are established for decision-making. The

procedures include a) defining the critical success

factors or decision criteria, b) assigning a weight to

each criterion, c) defining a scale of values for the

decision criteria, d) multiplying the weight score of

each factor and calculating the total score and, e)

explaining the quantitative results (Heizer & Render,

2011).

(1)

Where:

Sj: Overall score of each alternative.

Wi: Weighted weight.

Fij: Score of the j alternatives for each factor i.

Annex 3 illustrates the decision criteria based on

the company's needs for correctly implementing a

cost system. In addition, each requirement was

assigned a weight based on the importance of each

criterion. Finally, the conditions and the established

percentage were validated with interviews with the

General Directorate, dialogues with the entity's

collaborators, results of the previous phases, and

direct observation.

Next, a weighting matrix was created based on the

decision criteria. First, the cost system with the highest

qualification was chosen, as shown in Table 4. Thus, a

score of 0 to 3 was established for each system, where:

zero - does not apply, one - barely meets the decision

factor, two - partially complies with the deciding

factor, and three - fully complies with the deciding

factor. Subsequently, a weighting was made between

the weight and the individual rating of each decision

criterion for each system. As a result of the total

weighting, the highest rating was the cost per

operations system, with a score of 2.95, which best

adapts to the company's production process.

FEMIB 2023 - 5th International Conference on Finance, Economics, Management and IT Business

86

Table 4: Weighting matrix for the cost system selection.

Decision

Criteria

Weight

Cost Systems

Production

Order

By

Processes

By

Operations

Production

Production

p

rocess.

20% 1 1 3

Control of cost elements

Raw material

control.

15% 3 3 3

Labor control. 15% 3 3 3

Indirect

manufacturing

cost control.

15% 3 3 3

Determination of costs

Unit

production

costs.

15% 3 3 3

Information systems and decision making

Information

systems

10% 3 3 3

Decision

making

10% 3 3 3

Summary 100% 19 19 21

Total 2.6 2.6 3

4 CONCLUSIONS

In correlation with the analysis of production costs

carried out in the case study company, it was

determined that: a) the only existing treatment during

the manufacturing process of textile articles is the raw

material input. This element is based on physical and

digital documentary evidence, which contains the

homogeneous distribution of material costs,

mathematical calculations, and statistical

representations that allow a partial approximation of

the sale price of textile garments. b) On the other

hand, inputs such as labor and indirect manufacturing

costs do not show a specific procedure by the

production departments. In this sense, it is concluded

that these inputs represent together more than 50% of

the total production costs, evading the proportional

cost allocation in the textile products determined in

the sample. That is why they are not considered

within establishing the actual cost of textile products.

c) From the previous sections, it is also inferred that

the textile SME understudy does not have a cost

system, much less follow a specific cost model as a

reference.

In correspondence with what was described above

on determining the case study's particularities and

internal productive needs, it was concluded that the

cost system for operations is considered an ideal

proposal for the textile company. This was confirmed

through the different qualifications assigned in the

selection processes to the possible cost systems to be

applied in the establishment. On the other hand, the

processing system could be successfully

implemented because it has a batch production

volume and the various departmental processes to

which the raw material is subjected to reach the final

product. However, it was not selected due to the

company’s production type. The nature of its

products is made according to the modifications and

designs requested by customers.

The operations system combines the process cost

model to establish conversion costs and the job order

system to allocate direct material costs. Thus, this

cost model would grant the following benefits to the

case study. First, it records and controls raw

materials, labor, and manufacturing overhead.

Second, it adapts to the nature of the entity and its

producing manner, whether it is a batch or an order of

orders. Third, it conforms to the information systems

provided by the company. Fourth, it gives more

accurate information that improves the delivery of

results for timely decision-making. Finally, it

facilitates the planning and control of production

processes.

ACKNOWLEDGMENTS

This study is part of the research project

"Incorporating Sustainability concepts to

management models of textile Micro, Small and

Medium Enterprises (SUMA).” The authors thank

the Vice Rectorate for Research of the University of

Cuenca (VIUC) for the funding provided, the

company used for the case analysis, and the "SUMA"

project team coordinated by the Industrial

MAnaGement and INovation rEsearch - IMAGINE

research group.

REFERENCES

Areena, S. (2019). A review of Time-Driven Activity-

Based Costing Systems in various sectors. Journal of

Modern Manufacturing Systems and Technology, 2,

15–22.

Analysis of Production Costs: An Approach to Decision-Making

87

Cárdenas, B. E., Guamán Ochoa, M. M., Siguenza-

Guzman, L., & Segarra, L. (2020). Integración de

información de costos para la toma de decisiones en

industrias de ensamblaje. Revista Economía y Política,

31, 100-117. https://doi.org/10.25097/rep.n31.2020.07

Chacón, G. (2016). Costeo por operaciones Aplicación para

la determinación de precios justos en la industria del

plástico. Actualidad Contable FACES, 19(32), 5- 39.

Cirilo, C., & Cunha, J. (2018). Development of a costing

system in a small nautical company of the Manaus

industrial pole. Publons, 7.

Dey, T., Dey, S., Pandey, D., & Sheik, I. (2020). Persuasive

Metamorphosis of Manufacturing Overhead at The

Golden Doors of Disparaging Uttermost Cost of Goods.

TIJOTIC, 1(1), 8–15. https://doi.org/10.5281/

ZENODO.3873374

Flores, C. (2016). Análisis comparativo de tres sistemas de

costeos para la Unidad de Propagación de Plantas de la

Escuela Agrícola Panamericana Zamorano. Escuela

Agrícola Panamericana, Zamorano.

Guevara, O. (2021). Diseño e implementación de un

sistema de costos. [Santo Tomás]. https://repository.

usta.edu.co/jspui/bitstream/11634/33

291/11/2021GuevaraOscar.pdf

Handayani, E. S., Winarni, Akiah, S., & Suriyanti. (2020).

Analysis of production cost calculation base on order

(job order costing) in Rafi Jaya Mebel (RJM) suak

temenggung. Research in Accounting Journal, 1(1), 9.

Heizer, J., & Render, B. (2011). Dirección de la producción

y de operaciones: Decisiones estratégicas. Pearson

Educación de México, SA de CV. https://public.

ebookcentral.proquest.com/choice/public

fullrecord.aspx?p=5134046

Hoozée, S., & Ngo, Q.-H. (2018). The Impact of Managers’

Participation in Costing System Design on Their

Perceived Contributions to Process Improvement.

European Accounting Review, 27(4), 747-770.

https://doi.org/10.1080/09638180.2017.1375417 Istan,

M., Husainah, N., Murniyanto, M., Suganda, A. D.,

Siswanti, I., & Fahlevi, M. (2021). The effects of

production and operational costs, capital structure and

company growth on the profitability: Evidence from the

manufacturing industry. Accounting, 7(7), 1725-1730.

https://doi.org/10.5267/j.ac.2021.4.025

Joya, J. (2016). Diseño de un sistema de costos para la

empresa de accesorios Ltda. [Industrial de Santander].

http://tangara.uis.edu.co/biblioweb/tesis/2016/165473.

pdf

Kaplan, R. S., & Anderson, S. R. (2004). Time-Driven

Activity-Based Costing. 1(1). https://hbr.org/2004/11/

time-driven-activity-based- costing

Kesimli, I. (2022). A review in Three International

Accounting History Journals. Accounting and Financial

History Research Journal, pp. 22, 53–78.

Mejía, C., Higuita, C., & Hidalgo, D. (2015). Metodología

para la oferta de servicio diferenciado por medio del

análisis de costo de servir. Estudios Gerenciales,

31(137), 441-454.

https://doi.org/10.1016/j.estger.2015.08.002 Mekonnen,

N., Lemech, S., & Seid, K. (2019). Cost and

management accounting part I (ACFN201). Kedir Seid.

https://eopcw.com/assets/stores/Cost%20and%20Man

agement%20Accounting%20I/lecturenote_875129059

Cost%20and%20Managerial%20Accounting%20%20I

.pdf

Putri, R. L. (2017). Analysis of production cost calculation

using process costing method in suli tofu factory.

Ekonmika´45, 5(1). https://www.jurnal.univ45sby.ac.id/

index.php/ekonom i/article/view/167

Ríos, M. (2014). Método de diagnóstico para determinar el

sistema de costes en una Pyme. Un caso de estudio.

RIGC, 12(24), 13.

Rogosic, A. (2021). Public sector cost accounting and

information usefulness in decision-making. Public

Sector Economics, 45(2), 209–227. https://doi.org/

10.3326/pse.45.2.2

Solano, C., Figueroa, V., Jiménez, J., & Hernández, S.

(2020). Aplicación de herramientas estratégicas para la

implementación de métodos de ubicación en una

empresa del sector de maderería. 42(136), 19

APPENDIX

Appendix A – Cost systems literary review matrix

available at:

https://imagineresearch.org/csa_appendix/

FEMIB 2023 - 5th International Conference on Finance, Economics, Management and IT Business

88