A Process for Evaluating the Prudence of Enterprise Architecture Debts

Ada Slupczynski

a

, Peter Alexander

b

and Horst Lichter

c

Research Group Software Construction, RWTH Aachen University, Ahornstrasse 55, Aachen, Germany

Keywords:

Enterprise Architecture, Enterprise Architecture Debt, Prudence, Recklessness.

Abstract:

Enterprise architecture (EA) debt represents a situation involving the declining quality of an EA in return for

gains in other aspects. It accumulates through the sub-optimal architecture decisions made by the projects

contributing to the EA. To avoid the reckless accumulation of EA debt, the impact of an architectural decision

on EA debt and its prudence needs evaluation. However, as the scope of an EA debt issue tends to cover

a wide range of systems and stakeholders, there may be different views on its prudence depending on the

evaluation context. Failing to consider all relevant contexts may lead to reckless estimates and justifications

for the EA debt. The analysis of prudence and recklessness exists in related fields of study (e.g., technical

debt and financial debt). However, research has yet to explore the way to apply these concepts in EA debt

management practices. Therefore, this study proposes a process for evaluating the prudence of EA debts,

which we developed based on current insights about prudence and recklessness in related fields of study.

Furthermore, we discuss some open questions and propose future research directions in this context.

1 INTRODUCTION

Enterprise architecture (EA) offers comprehensive

support for promoting business-IT alignment, yet

coping with misalignment issues remains challeng-

ing. Common organizational problems, such as ad-

verse behavior (e.g., poor communication and IT

governance) and incautious trade-off decisions (e.g.,

reusing legacy systems to expedite project delivery),

often lead to misalignment issues. If not managed,

these issues may gradually slow or even stagnate fur-

ther evolution of the EA. Thus, the concept of EA debt

has been proposed (Hacks et al., 2019).

EA debt represents ”the deviation of the cur-

rently present state of an enterprise from a hypothet-

ical ideal state” (Hacks et al., 2019). On the one

hand, EA debt leads to declining architectural qual-

ities (e.g., higher complexity and lower maintainabil-

ity) and tends to increase the cost or difficulty of fu-

ture changes. On the other hand, taking on EA debt

as a short-term solution can be deemed necessary to

cope with tight constraints or to optimize return on

IT investment. Therefore, before taking on EA debt,

all relevant stakeholders should be well aware of the

consequences and their responsibilities for it.

a

https://orcid.org/0000-0001-5403-7720

b

https://orcid.org/0000-0001-6534-278X

c

https://orcid.org/0000-0002-3440-1238

To ensure prudent decisions on EA debt, enter-

prise architects must first understand the factors and

aspects of prudence and recklessness in this context.

However, evaluating the prudence of EA debts can be

challenging as stakeholders’ views on prudence and

recklessness may differ depending on the evaluation

context. This issue often occurs in a complex orga-

nization where a spectrum of interests and contradic-

tions exist among the stakeholders. Finding a consen-

sus here is necessary to avoid taking on EA debt based

on reckless estimates and justifications.

Thus, a process for collaboratively evaluating the

prudence and recklessness of EA debt is needed. Al-

though related studies exist in various debt-related

contexts, e.g., technical debt (TD) and financial debt

(FD), they only describe the basic understanding of

prudence and recklessness without addressing ways

to evaluate them in practice. More importantly, none

has explored prudence and recklessness in the context

of EA debt. Therefore, this study aims to gather in-

sights about prudence and recklessness in related con-

texts to answer the following research question (RQ):

RQ How to evaluate the prudence of EA debts in a

complex organization?

The remainder of this paper is structured as fol-

lows: Section 2 discusses related works on the char-

acteristics of prudent and reckless debts. In section 3,

we propose a process for evaluating the prudence of

Slupczynski, A., Alexander, P. and Lichter, H.

A Process for Evaluating the Prudence of Enterprise Architecture Debts.

DOI: 10.5220/0011971400003467

In Proceedings of the 25th International Conference on Enterprise Information Systems (ICEIS 2023) - Volume 2, pages 623-630

ISBN: 978-989-758-648-4; ISSN: 2184-4992

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

623

EA debts. Then, section 4 demonstrates the process

using an illustrative problem scenario. Section 5 sum-

marizes our interviews with EA researchers and prac-

titioners about the process. Section 6 discusses the

implications and threats to the validity of our result.

Finally, section 7 concludes this paper and motivates

future research directions in this context.

2 RELATED WORK

Our exploration into TD and FD studies identifies var-

ious characteristics of prudence and recklessness. A

study introduced prudence and recklessness as two of

the four classifiers in the TD quadrant: a concept that

helps to decide whether taking on TD is a strategic

move or not (Fowler, 2009). According to the TD

quadrant, a debt is prudent when the ”payoff is greater

than the costs of paying it off” but reckless when it

”results in crippling interest payments or a long pe-

riod of paying down the principal.” Meanwhile, other

TD studies consider debt prudent when all possible

consequences are well-understood before incurring

the debt, including the positive, negative, short-term,

and long-term consequences (Clair, 2016) (Codabux

et al., 2017) (Sas and Avgeriou, 2019) (Silva et al.,

2018) (Waltersdorfer et al., 2020) (Zalewski, 2017);

all relevant stakeholders have deliberately consented

to take on the debt (Sas and Avgeriou, 2019) (Silva

et al., 2018) (Waltersdorfer et al., 2020); when fea-

sible measures to repay the debt have been clarified

(Brenner, 2019) (Silva et al., 2018); and when the un-

derlying premises of the debt are valid as well as well-

documented (Brenner, 2019) (Ernst et al., 2015).

Furthermore, some studies on FD defined several

characteristics of prudence. These studies argue that

debt is prudent when all relevant risks and expendi-

tures to hedging against the debt have been assessed

(Denton et al., 2003); when the premises underly-

ing the debt and following conclusions are deemed

valid before incurring the debt (Becha et al., 2020);

and when all relevant stakeholders are well-informed

about the debt’s cost-benefit analysis (Wolf, 2013).

Despite all these insights about what prudence and

recklessness are, little is known on how to evaluate

them specifically for EA debts.

3 PROCESS FOR EVALUATING

THE PRUDENCE OF EA DEBTS

Based on our exploration into related literature (as de-

scribed in section 2), we developed a process that al-

lows various stakeholders to collaborate in continu-

ously evaluating the prudence of EA debts, ensuring

an up-to-date and comprehensive view in this context.

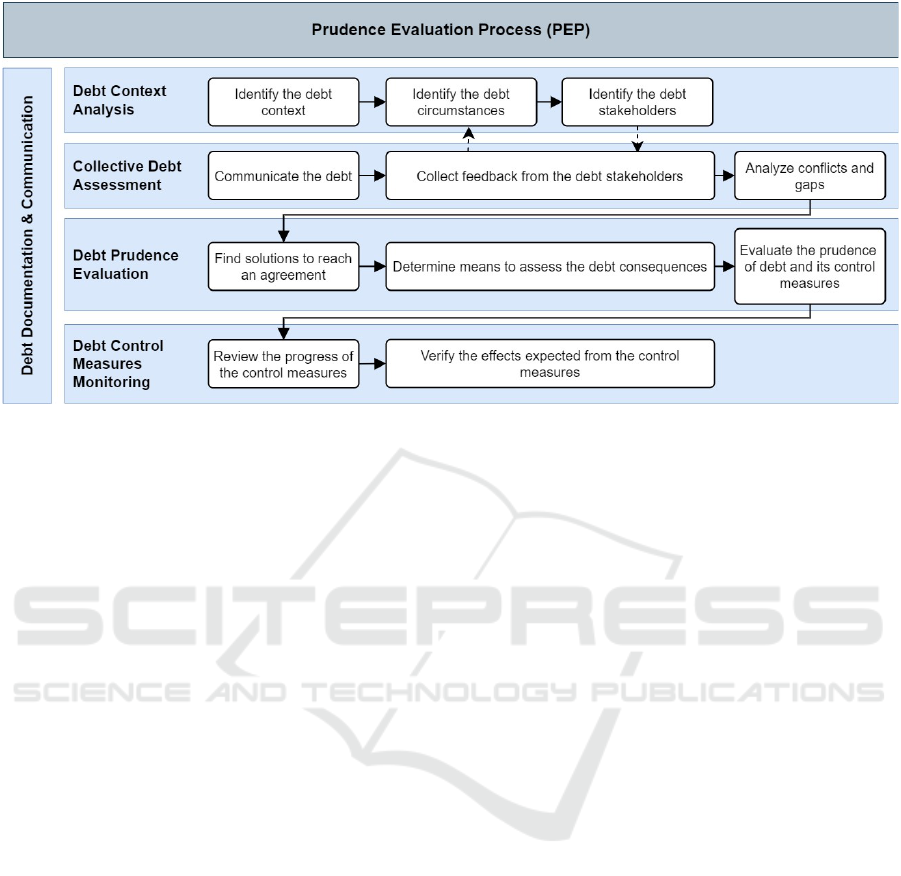

As shown in figure 1, the prudence evaluation process

(PEP) contains six interrelated sub-processes and de-

tailed activities as described in the following.

As suggested in (Becha et al., 2020), (Brenner,

2019), and (Ernst et al., 2015), evaluating the pru-

dence of debt requires an understanding of the under-

lying premises. Therefore, we propose that the PEP

starts with the Debt Context Analysis, which focuses

on identifying the various contexts, circumstances,

and stakeholders to be considered in analyzing the EA

debt. This sub-process starts with identifying the debt

contexts: the organizational contexts in which the EA

debt and its effects are present. A debt context can be

as general as some organizational layers (e.g., busi-

ness, application, security, infrastructure) or as spe-

cific as some organization entities (e.g., capabilities,

applications, processes, standards). Some ways to

identify the debt contexts include having discussions

with the relevant domain experts and analyzing the

available documentation (e.g., EA models). Once the

debt contexts are known, this sub-process continues

with identifying the debt circumstances: the organi-

zational factors that support or oppose the need for

the EA debt under analysis. A debt circumstance can

be some specific organization rule, constraint, or re-

quirement that turns the EA debt into an advantage or

disadvantage for the organization. Next, based on the

debt contexts and circumstances identified, the sub-

process proceeds with identifying the debt stakehold-

ers: the people whose understanding and cooperation

are necessary for the further management of the EA

debt under analysis. A debt stakeholder can be the

person in charge of, e.g., the processes or applica-

tions within the scope of the debt contexts and cir-

cumstances. We argue that all these activities can help

to put the EA debt into a broader perspective and thus

allow for a more reasonable evaluation.

Furthermore, after identifying the debt stakehold-

ers, it is necessary to ensure they are informed about

all possible consequences of taking on the debt, as

suggested in (Clair, 2016), (Codabux et al., 2017),

(Sas and Avgeriou, 2019), (Silva et al., 2018), (Wal-

tersdorfer et al., 2020), (Wolf, 2013), and (Zalewski,

2017). Therefore, following the Debt Context Anal-

ysis, we propose the Collective Debt Assessment,

which focuses on preparing and conducting a col-

laborative debt assessment among all debt stakehold-

ers. This sub-process starts with communicating the

debt to its stakeholders. To effectively communicate

the debt, it may be necessary to tailor the debt rep-

resentations according to the debt stakeholders’ spe-

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

624

Figure 1: An overview of processes for evaluating the prudence of EA debts.

cific viewpoints (Maqsood et al., 2022). Next, to ob-

tain a comprehensive view of the debt’s consequences

from all relevant perspectives, we propose to collect

feedback from the debt stakeholders. During this ac-

tivity, it is necessary that all kinds of consequences

(e.g., financial, functional, strategic consequences) re-

ceive the debt stakeholders’ attention, as suggested

in (Denton et al., 2003). Thus, using approaches to

elicit structured feedback (e.g., questionnaire, check-

list) should be considered. Also, looking into the

stakeholders’ feedback may identify new debt con-

texts and circumstances that require further examina-

tion by other stakeholders. The identification of debt

circumstances and stakeholders may thus repeat un-

til the needed level of comprehensiveness is reached.

Then, as there are often some contradictions and dis-

crepancies among stakeholders, we propose to ana-

lyze conflicts and gaps within their feedback. Con-

cretely, a conflict means a disagreement among the

debt stakeholders, whereas a gap refers to the lack of

shared awareness about the debt’s consequences. The

conflicts and gaps identified should then be discussed

with the corresponding stakeholders to correct misun-

derstandings and improve the shared understanding.

Further, as suggested in (Brenner, 2019), (Sas and

Avgeriou, 2019), (Silva et al., 2018), and (Walters-

dorfer et al., 2020), it is necessary to ensure that the

debt and its possible control measures are deliberately

consented by all relevant stakeholders. Therefore, we

propose the Debt Prudence Evaluation, which fo-

cuses on achieving consensus among the debt stake-

holders about the prudence of the debt under analysis

and the feasibility of its control measures. To achieve

this objective, the debt stakeholders must first agree

on the debt’s consequences. Thus, this sub-process

starts with finding solutions to reach an agreement

in the mid of conflicting interests, needs, or attitudes

among the debt stakeholders. To support this ac-

tivity, the use of conflict management strategies and

the presence of a moderator may be necessary. As

the moderator, we suggest choosing someone knowl-

edgeable of the organization’s methods, projects, and

stakeholders. The next activity is to determine means

to assess the debt consequences, namely the criteria

and tools for evaluating the prudence of debt. When

selecting the evaluation criteria, it is necessary to con-

sider the organization’s goals, principles, and general

recommendations, e.g., considering debt as prudent

when its ”payoff is greater than the costs of paying it

off” (Fowler, 2009). After the evaluation criteria are

selected and accepted by the relevant stakeholders,

we suggest determining the suitable metrics and tools

for measuring them. Apart from the metrics specific

to the organization, some key performance indicators

of EA management (as proposed in (Matthes et al.,

2012)) can also be used. Finally, this sub-process

proceeds with evaluating the prudence of debt and

its control measures, which focuses on measuring the

debt’s consequences and possible control measures

using the criteria, metrics, and tools selected in the

previous activity. Also, different weights and thresh-

olds can be applied to the evaluation criteria to reflect

the organization’s priorities and tolerance on various

aspects. Based on the determined values and trade-

offs among the evaluation criteria, stakeholders can

classify the debt as either prudent or reckless.

Classifying debt into prudent or reckless provides

an outlook of the debt’s future impact on the organi-

A Process for Evaluating the Prudence of Enterprise Architecture Debts

625

zation. This outlook will remain valid provided the

debt and its circumstances are controlled as planned.

Therefore, we propose the Debt Control Measures

Monitoring, which focuses on continuously track-

ing the progress and results of planned debt control

measures. This sub-process starts with reviewing the

progress of the control measures to inform stakehold-

ers about the current status, supporting factors, and

inhibitors of the debt control measures. Here, collab-

oration management tools can help to ensure that all

the responsible stakeholders deliver the needed con-

tributions in time. Next, upon completing the debt

control measures, we suggest verifying the effects ex-

pected from the control measures to confirm the costs

and benefits of their implementation. As such effects

may propagate through the dependencies among the

affected systems or projects, analyzing these effects

should take a broader perspective. Thus, the use of

dependency analysis approaches can be helpful here.

Finally, cutting across the above sub-processes

of PEP, the Debt Documentation and Communi-

cation sub-processes focus on ensuring up-to-date

and meaningful documentation of all information in-

volved in the PEP as well as facilitating the commu-

nication of it among the stakeholders. In this way,

stakeholders are less likely to rely on ”tribal memory,”

which often happens in enterprise-level management

(Brenner, 2019) (Klinger et al., 2011). To achieve

consistency in this context, one should consider us-

ing structured documentation and communication ap-

proaches (e.g., forms, reports, catalogs).

4 EXAMPLE

This section introduces a toy use case and presents the

process of applying the proposed PEP to evaluate the

prudence of EA debts contained in this use case.

4.1 Use Case

A company has been working on a core functional-

ity project. Due to its complexity, the project grew

to require many dependencies, making maintenance

harder. Thus, the company decided to invest in reduc-

ing the project’s TD through refactorings and enforc-

ing updated architectural guidelines. The new archi-

tectural guidelines include, among others, avoiding

further dependencies between newly developed func-

tionalities and the non-refactored parts of the legacy

solution. However, due to time and budget pres-

sure, the company managed the refactoring only par-

tially while still having to deliver the new functional-

ity quickly. To cope with this situation, a stakeholder

proposed temporarily deviating from the guidelines

and incurring EA debt by reusing some parts of the

non-refactored systems for the new functionality.

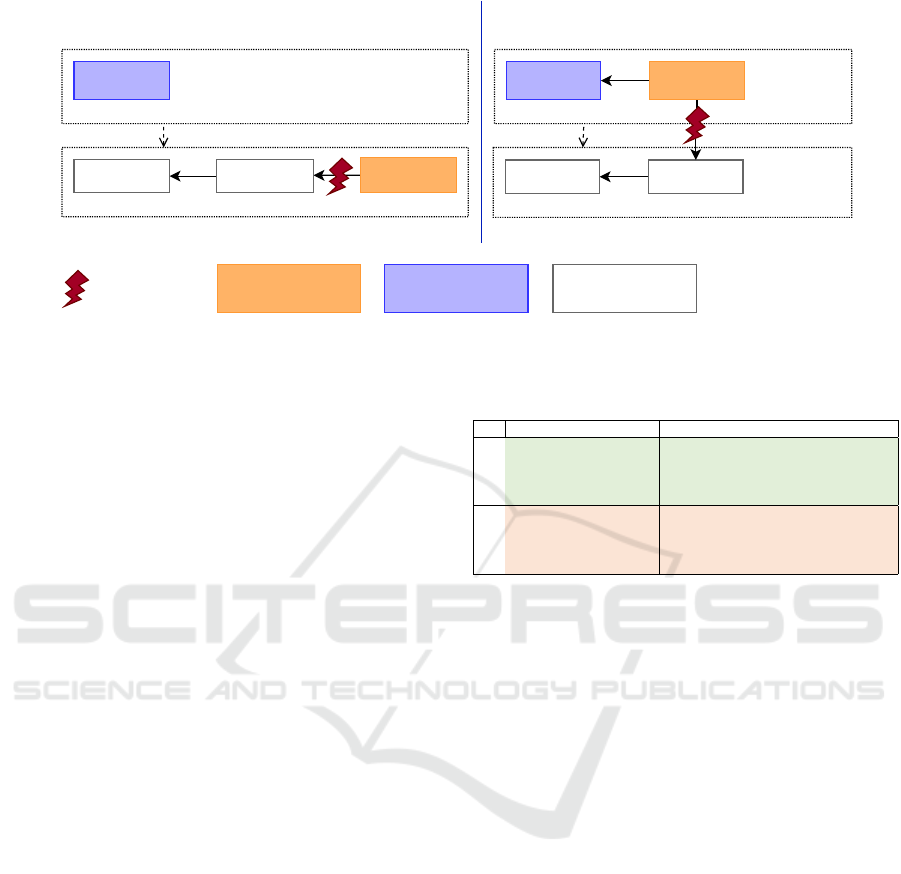

The system under study consists of two sub-

systems: Modern System and Legacy System. Mod-

ern System uses a popular language—it is easy to find

programmers knowing it. However, Modern System

is dependent on some functionalities of the Legacy

System, which uses an old language—its program-

mers are rare and expensive. The whole system has

three applications of interest (see Figure 2). Applica-

tion A is already modernized and decoupled from the

Legacy System. Application B is still a legacy appli-

cation and depends on another, i.e., Application C.

The new functionality requires the introduction of

Application D, which requires some functionalities of

Application B. Going forward, there are two decision

alternatives: The first is to deploy Application D on

the Legacy System. The second is to deploy Applica-

tion D on the Modern System and establish a cross-

systems communication with Application B. These

decision alternatives are subject to EA assessment.

4.2 Process

Due to various perspectives and needs, the EA man-

agers decided to use PEP for their assessment. In

the Debt Context Analysis, the EA managers iden-

tify the context of the debt. The company is currently

working on modernization. The development budget

for the legacy system was reduced after the decision

to modernize it. Additionally, the number of expe-

rienced programmers for the legacy system has sig-

nificantly diminished over the past few years, while

the number of modern system programmers has in-

creased. In the next step, the circumstances of the

debt are analyzed. One of the circumstances is the

guidelines requiring new functionality to be built in-

dependently of the legacy system. As they analyzed

the documentation, they identified the debt stakehold-

ers - a modernization team leader, a group of pro-

grammers working with the Modern System, a group

of programmers working with the Legacy System,

and finally, the requirements analyst, who was work-

ing with the client on the new functionality require-

ments. All findings are documented to support the

further steps of the process.

All debt stakeholders are invited to discuss the two

options, as per Collective Debt Assessment. The EA

managers communicate their findings to the gathered

stakeholders, inviting a discussion. Each of the in-

vited stakeholders is asked to provide feedback. The

feedback is documented during the discussion, and

the relevant information is identified. For example,

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

626

Modern System

Legacy System

Legacy System

Modern System

Application B

Application DApplication A

Application C

1st Option 2nd Option

New Development

Legend

Application A

Application C Application B

Modern Systems Legacy Systems

Application D

Violation to

EA standard

Figure 2: Example of evaluating the prudence of EA debt using the PEP process.

the need to deliver quickly is identified from the feed-

back of the client’s representative. Another require-

ment provided by the modernization team leader is

that the modernization project is on a limited bud-

get spread over a couple of years. From this, EA

managers identify that modernizing Application B to

deliver the new functionality on time is not feasi-

ble in the given time frame. The Legacy System

programmers argue for the implementation involving

the Legacy System. Due to their extensive system

knowledge, this option would be delivered sooner,

saving time and meeting the deadline. Due to their

experience, it would also be a more reliable result.

Upon this, the EA managers note that this violates the

company guidelines and would eventually require the

modernization of the new Application D. The Modern

System programmers advocate development using the

Modern System. They point out the guideline accor-

dance and the integration of new functionality with

the Modern System. They are confident in their pro-

gramming skills but acknowledge lesser knowledge

of Legacy System applications, including Application

B, on which Application D would depend. They also

identify that this option would cost more, as it would

require the development of an interface to allow for

the use of Application B. The legal representative pro-

vides information on the contractual penalty of cross-

ing the time-to-deliver. Based on the stakeholder dis-

cussions, the EA managers identifies a conflict of time

and cost versus guidelines. They also identify a com-

munication gap between the two teams. This issue

leads to another round of discussions.

After listening to all stakeholders and analyzing

the conflict, the EA managers started the Debt Pru-

dence Evaluation. They evaluate the two options on

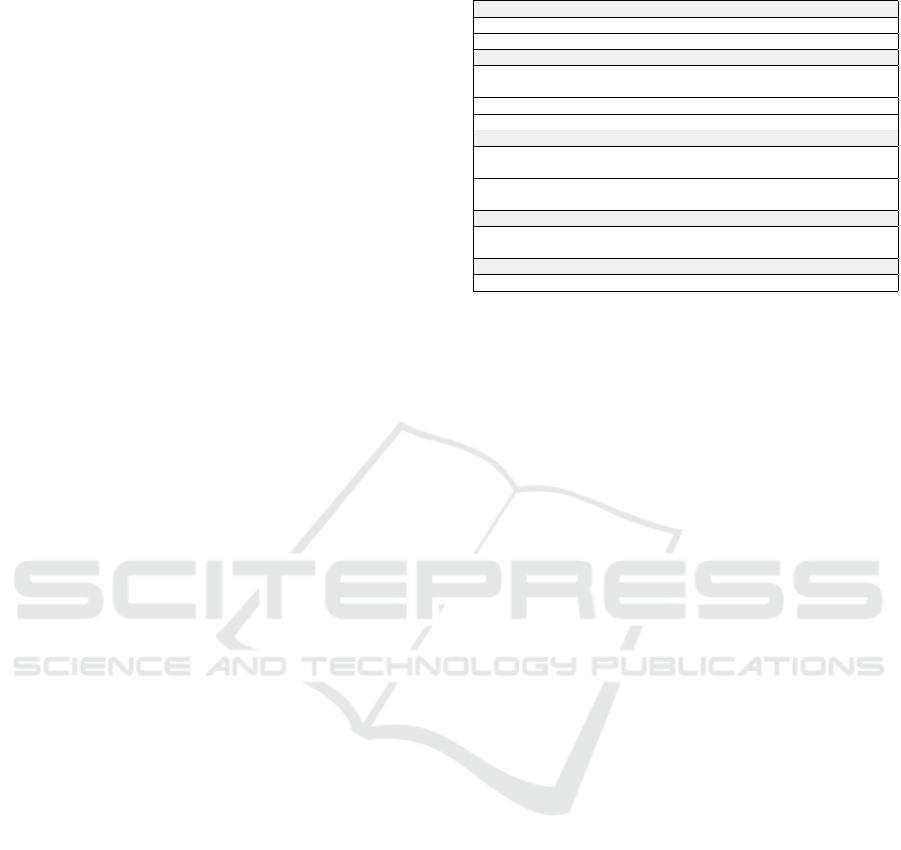

their cost and resulting benefit (see Table 1). The

first option is considered according to the cost of dis-

regarding the guidelines and modernizing in the fu-

Table 1: Costs and benefits analysis of the two options in

the toy example.

Option 1 Option 2

faster delivery guideline accordance

deadline met

modern technology

no modernization needed

Benefits

reliable

violates guidelines lesser knowledge of Legacy System

needs additional work needs additional interface

higher cost with time higher cost now

Costs

might cross time-to-deliver

ture. Similarly, the second option is evaluated in its

worst-case scenario, adding the penalty for crossing

the time-to-deliver. Team leaders are expected to pro-

vide estimations of their respective solutions. The

costs and gains of the two solutions are compared to

evaluate the prudence of the debt. The first solution

seems quicker and cheaper, but it does not follow the

guidelines and introduces additional debt. The second

solution follows the guidelines and promises fewer

problems in the future, but it is more costly and less

reliable. Given the comparison, the EA managers de-

cide to suggest the first solution. However, to mitigate

the incurred debt, they propose cooperation between

the two teams to simplify future modernization. All

proceedings are to be thoroughly documented. The

findings of the PEP process are documented and pre-

sented to the board for final evaluation and decision.

After a while, the EA managers perform an audit

and observe that the modern language programmers

are more knowledgeable regarding the Legacy System

thanks to the cooperation. All recommendations have

been followed, and the documentation is kept up-to-

date. This activity is performed as part of the Debt

Control Measures Monitoring. The entirety of the

process is documented for future reference and com-

municated to all involved stakeholders as part of Debt

Documentation and Communication activities.

A Process for Evaluating the Prudence of Enterprise Architecture Debts

627

5 EVALUATION

The evaluation was planned and performed in the

form of an expert interview. Before the interview,

the invited participants obtained a short version of the

presentation slides, introducing the topic. Three EA

Debt experts participated in the evaluation of PEP.

5.1 Background

The first section of the interview was participant’s

background, based on three different aspects. The

first aspect was the work performed. All participants

have extensive experience in EA research. Two work

as associate professor and professor at two differ-

ent universities (neither being RWTH Aachen Univer-

sity). The third participant has industry background

as a Lead Information Architect of a large company.

The second aspect was the participants’ under-

standing of EA. Participants agreed that EA relates

to a holistic consideration of the organization, meant

to align IT and business needs. Additionally, the use

of EA models, structure and visualization was deemed

necessary to obtain an overview of the organization.

The third aspect was the consideration and under-

standing of prudence and recklessness. One partic-

ipant related debt to a gap between the holistic per-

spective and the reality along with the delta describ-

ing it. In this understanding, prudence is trying to re-

duce the gap, while recklessness is allowing the gap.

Another participant focused on consciousness. This

would place prudence as making an informed deci-

sion, and recklessness being not aware or not caring

about doing wrong. The third participant did not de-

cide on the two concepts. They argued that prudence

requires common understanding, which requires defi-

nitions, examples, and best practices.

5.2 Process

The second section focused on assessing the applica-

bility of the proposed PEP. When discussing PEP and

its contribution, the process was first introduced to the

participants. Then each activity was examined sepa-

rately to determine the correctness of PEP.

The evaluation of the process was split into two

parts. The first focusing on usability, second on reli-

ability of the process. First, questions about the use

of prudence evaluation in decision making, the per-

son responsible for the execution of PEP and its col-

laborativeness were asked. Afterwards, the interview

moved towards activity-related questions as presented

in Table 2. The final question was concerning the dif-

ficulties related to the application of the process.

Table 2: Activity-related process questions.

Debt Context Analysis

Which data/documents can be used to determine the context of a debt?

How can the stakeholders relevant to making a decision be identified?

Debt Collective Assessment

Can comprehensive concerns be determined from the gathering

of the stakeholders?

How can it be verified if all relevant concerns were identified?

How to manage potential disagreements?

Debt Prudence Evaluation

Can comprehensive consequences be determined from the

gathered concerns?

Given the consequences and based on the provided definition,

can the prudence of the debt be determined?

Re-evaluation step

Would a re-evaluation require stakeholders involved previously

or only those related to the concern, whose information got updated?

Debt Documentation and Communication

Who and how can document the activities performed?

6 DISCUSSION

In this chapter, we will first discuss the results of the

evaluation and the contribution of this study, and fi-

nally consider the threats to validity of this study.

6.1 Evaluation Feedback

Through the expert interviews, we obtained various

feedbacks as summarized in the following.

On Facilitating Common Understanding: The

evaluation showed that although prudence can sup-

port decision-making, it needs to be more defined to

allow for a shared understanding of prudence among

involved stakeholders. PEP requires the context of

the decision and the joint agreement of relevant stake-

holders. The evaluation showed that the process can

be collaborative, supporting expert integration.

On Helping Identify Relevant Stakehold-

ers: The process needs to be supported by

documentation—EA models were unanimously

deemed relevant in the context determination. One

problem might be missing documentation. Thus, it

might be relevant to develop methods and tools for

supporting the identification of context and relevant

stakeholders. To achieve such methods and tools, the

understanding of the company, relations among its

stakeholders, and sources of relevant information is

required.

On Performing a Screening Test: As it can be

challenging to gather all inputs from the stakehold-

ers (due to them being unavailable or simply human

error), the process should be supported by a screen-

ing test to identify potential disagreements. Such test

could show potential outcomes, allowing stakehold-

ers to review the process for correctness. The dis-

agreements could then be prioritized and solved with

conflict management methods.

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

628

On Assessing Accuracy Of Evaluation: The de-

termination of prudence depends on the accuracy of

identified concerns and their consequences. The ac-

curacy depends on the method used for evaluation and

expected reliability of information. As such, support

tools (e.g. correlations between concerns and their

consequences) can increase process’s reliability.

On Performing The Re-Evaluation: Given new

or changed information, the iterative steps support-

ing re-evaluation need to be considered. The re-

evaluation should involve as few participants as pos-

sible, e.g. a necessary core and a review group.

The consideration could require some of the previ-

ously identified stakeholders to participate; however,

it might also identify new ones. The usual workflow

of the company would not be disturbed by each itera-

tion of the process.

On Keeping a Central Documentation: All par-

ticipants agreed that the most important aspect of the

documentation is its type. Initially, a wiki is enough,

but all in all it should be supported by a dedicated tool

containing all necessary information, e.g. about the

decisions and relevant stakeholders. The information

would be stored centrally, allowing for easy access.

On Using in Practice: The process was deemed

lightweight, allowing it to be used in practice. How-

ever, methods used, governance, and standardization

need clarification, improving the ease of use.

6.2 Contribution

The contribution is twofold. One aspect is the contri-

bution towards the research community. Another are

the implications of this study for EA practitioners.

For researchers, the first benefit of this contribu-

tion is the consideration of prudence and recklessness

in the context of EA Debts. During our work, we

found no paper considering the two concepts in this

context. This shows a need for further research on

aspects affecting the decision making. Another bene-

fit is that PEP aims to increase awareness of EA debt

while also allowing to understand specific decisions’

reasons, benefits, and risks.

For practitioners, the first benefit is the classifica-

tion of EA debts into prudent and reckless based on

various criteria, as discussed in Section 2. Such clas-

sification helps to reason the decisions made, leading

to a better overall understanding and management of

EA debt. Also, it helps to improve communication

among various stakeholders. Another benefit is the

support for ensuring a comprehensive understanding

of EA debt consequences, which is necessary for pri-

oritization in decision-making. Finally, the proposed

process activities provide initial guidelines that can be

adapted according to the immediate needs of a spe-

cific enterprise, thereby allowing for a tailored priori-

tization of the debt based on the goals of the enterprise

and the concerns of its stakeholders.

6.3 Threats to Validity

Validity was considered with the help of the defini-

tions provided by (Wohlin, 2000).

The concept of internal validity discusses the

trustworthiness of the relationship between the study

and its results. Due to this, it requires an objective

approach when assessing the data. One potential dan-

ger to internal validity is subjective assessment and

classification. All results presented in this paper were

consulted with an expert at each study stage. The re-

sults were also discussed and presented to further ex-

perts in the form of the performed evaluation. This

ensures objectivity in the scientific proceedings. An-

other essential aspect when considering internal valid-

ity is how much the results represent the actual state

of the art. To ensure this, the development process

was based on the cited scientific works, which had to

be reviewed before publication. This means the sci-

entific fundament for this study was evaluated objec-

tively, without the interference of the authors.

The concept of external validity considers the gen-

eralizability of presented results to other contexts. For

the results to be replicable, we presented the entire

procedure that underlies our results. Additionally, we

restricted our process to the context of EA but not to

other contexts. The presented process is a structure,

requiring further work on more detailed aspects. As a

result, this process can easily be adapted to other con-

texts. The measures mentioned in the Debt Prudence

Evaluation step are to be selected and adapted by the

specific project, allowing their application in various

contexts. To further strengthen the external validity

of our findings, we performed the evaluation not only

with scientific researchers but also practitioners.

7 CONCLUSIONS

The concepts of prudence and recklessness have been

used in TD and FD literature to differentiate good de-

cisions from bad ones. However, the process of eval-

uating them in the context of EA debt has yet to be

defined. Therefore, this paper proposes a process for

assessing the prudence and recklessness of EA deci-

sions considering their consequences and root causes.

Analysis of the most common causes might lead to

discovering a bigger EA problem. Also, understand-

ing the consequences allows stakeholders to realize

A Process for Evaluating the Prudence of Enterprise Architecture Debts

629

and select the most appropriate decision strategies.

These supports are necessary for making timely and

effective decisions.

This paper also intends to motivate further studies

in this context. One possible research direction is to

identify relevant decision-making contexts and ways

to elicit stakeholders’ perspectives on these contexts.

However, finding all the contexts and stakeholders re-

lated to an EA debt can be intricate, especially when

the EA landscape and management structure is large

and complex. Therefore, future research should de-

velop methods and tools to contextualize EA debts,

collect and organize relevant information from var-

ious sources, and bridge communication among the

relevant stakeholders. Following this, future research

should focus on developing ways to use the informa-

tion collected for meaningful assessments. Thus, we

recommend investigating the relationship between the

information pieces and existing debt-related key per-

formance indicators (KPI) and viewpoint-based ap-

proaches to assessing EA debt. Finally, future re-

search should develop practical ways to conclude the

prudence or recklessness of an EA debt based on the

assessments performed and to select appropriate con-

trol measures. Thus, we recommend exploring the

applicability of existing decision analysis approaches

and debt mitigation strategies to determine, e.g., when

to mitigate risks and reject the decision.

The second research direction is to evaluate the

proposed process in practice. As our evaluation re-

sult suggests, many aspects have yet to be considered

in the core design of the process, e.g., the financial

and project management aspects when evaluating the

prudence of EA debts. Thus, we recommend further

validation and development of the process to make it

more practical, concrete, and well-rounded for real-

world industrial scenarios through, e.g., performing a

series of workshops with various companies and ded-

icated experts. Such workshops can help identify the

unclear but needed aspects of the process.

The third research direction would be to consider

providing a tool to manage all the gathered informa-

tion in one place. Such a tool should classify the infor-

mation based on provided parameters and register the

relations between various information pieces, helping

to find needed information and make decisions.

REFERENCES

Becha, M., Dridi, O., Riabi, O., and Benmessaoud, Y.

(2020). Use of machine learning techniques in fi-

nancial forecasting. In 2020 International Multi-

Conference on: “Organization of Knowledge and Ad-

vanced Technologies” (OCTA).

Brenner, R. (2019). Balancing resources and load: Eleven

nontechnical phenomena that contribute to forma-

tion or persistence of technical debt. In 2019

IEEE/ACM International Conference on Technical

Debt (TechDebt).

Clair, K. (2016). Technical debt as an indicator of library

metadata quality. D-Lib Mag 22, 11/12.

Codabux, Z., Williams, B., Bradshaw, G., and Cantor, M.

(2017). An empirical assessment of technical debt

practices in industry. Journal of Software: Evolution

and Process 29, 10, page e1894.

Denton, M., Palmer, A., Masiello, R., and Skantze, P.

(2003). Managing market risk in energy. IEEE Trans-

actions on Power Systems 18, 2, pages 494–502.

Ernst, N., Bellomo, S., Ozkaya, I., Nord, R., and Gorton, I.

(2015). Measure it? manage it? ignore it? software

practitioners and technical debt. In Proceedings of the

2015 10th Joint Meeting on Foundations of Software

Engineering.

Fowler, M. (2009). Technical debt quadrant.

Hacks, S., Hofert, H., Salentin, J., Yeong, Y., and Lichter,

H. (2019). Towards the definition of enterprise

architecture debts. 2019 IEEE 23rd International

Enterprise Distributed Object Computing Workshop

(EDOCW).

Klinger, T., Tarr, P., Wagstrom, P., and Williams, C. (2011).

An enterprise perspective on technical debt. Proceed-

ing of the 2nd working on Managing technical debt -

MTD ’11.

Maqsood, A., Alexander, P., Lichter, H., and Tanachutiwat,

S. (2022). A viewpoints-based analysis of enterprise

architecture debt. In Wang, C.-C. and Nallanathan, A.,

editors, Proceedings of the 5th International Confer-

ence on Signal Processing and Information Communi-

cations, pages 133–154, Cham. Springer International

Publishing.

Matthes, F., Monahov, I., Schneider, A., and Schulz, C.

(2012). Eam kpi catalog v 1.0. Technical report, Tech-

nische Universit

¨

at M

¨

unchen, Munich, Germany.

Sas, D. and Avgeriou, P. (2019). Quality attribute trade-

offs in the embedded systems industry: an exploratory

case study. Software Quality Journal 28, 2, pages

505–534.

Silva, V., Jeronimo, H., and Travassos, G. (2018). Technical

debt management in brazilian software organizations.

In Proceedings of the 17th Brazilian Symposium on

Software Quality - SBQS.

Waltersdorfer, L., Rinker, F., Kathrein, L., and Biffl, S.

(2020). Experiences with technical debt and manage-

ment strategies in production systems engineering. In

Proceedings of the 3rd International Conference on

Technical Debt.

Wohlin, C. (2000). Experimentation in software engineer-

ing: An introduction / by Claes Wohlin ... [et al.], vol-

ume 6 of The Kluwer international series in software

engineering. Kluwer Academic, Boston and London.

Wolf, E. (2013). Stochastic simulation of optimal insurance

policies to manage supply chain risk. In 2013 Winter

Simulations Conference (WSC).

Zalewski, A. (2017). Risk appetite in architectural decision-

making. In 2017 IEEE International Conference on

Software Architecture Workshops (ICSAW).

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

630