Assessing the Effects of Extreme Events on Machine Learning Models for

Electricity Price Forecasting

Jo

˜

ao Borges

1,2

, Rui Maia

1

and S

´

ergio Guerreiro

1,2

1

Instituto Superior T

´

ecnico, University of Lisbon, Lisbon, Portugal

2

INESC-ID, Rua Alves Redol 9, 1000-029 Lisbon, Portugal

Keywords:

Extreme Events, Electricity Price Forecasting, Machine Learning.

Abstract:

Forecasting electricity prices in the face of extreme events, including natural disasters or abrupt shifts in

demand, is a difficult challenge given the volatility and unpredictability of the energy market. Traditional

methods of price forecasting may not be able to accurately predict prices under such conditions. In these

situations, machine learning algorithms can be used to forecast electricity prices more precisely. By training

a machine learning model on historical data, including data from extreme events, it is possible to make more

accurate predictions about future prices. This can assist in ensuring the stability and dependability of the

electricity market by assisting electricity producers and customers in making educated decisions regarding

their energy usage and generation. Accurate price forecasting can also lessen the likelihood of financial losses

for both producers and consumers during extreme events. In this paper, we propose to study the effects of

machine learning algorithms in electricity price forecasting, as well as develop a forecasting model that excels

in accurately predicting said variable under the volatile conditions of extreme events.

1 INTRODUCTION

Electricity price forecasting (EPF) is a broad sub-

ject, with numerous contemporary studies that set

out to provide valuable insight to understand what

mechanisms drive this highly volatile system (Weron,

2000). In this work, we set out to contextualize the re-

spective research, to focus on studying extreme phe-

nomena that shock the energy system and the corre-

sponding impact it has on energy price and load fore-

casting. Consequently, we will follow up with intro-

ducing the relevancy of this topic, as well as outline

clear objectives to accomplish with this paper.

In the context of EPF, an extreme event is an in-

stance of abnormally low or high energy prices that

can be caused, according to Liu et al. (Liu et al.,

2022), by an oversupply of renewable energy and the

exercise of market power. However, some of these in-

stances are a reflection of the psychological expecta-

tions of bidding companies within the electricity mar-

ket that is influenced in mid-term scope (Wen et al.,

2021). On this note, and in light of the contemporary

events such as the COVID-19 pandemic and Russian

invasion of Ukraine, this position paper will focus on

studying such occurrences.

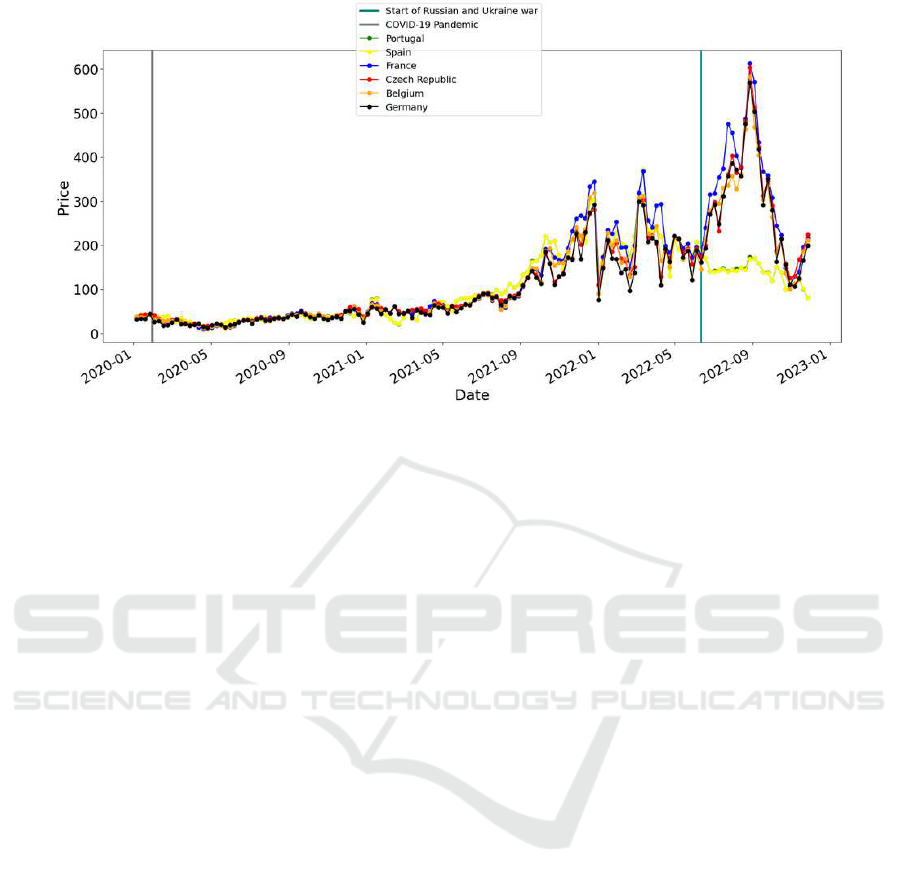

The graph in Fig. 1 solidifies the idea that specific

(extreme) events induce sharp variation in electricity

prices, and studying its effects on price forecasting is

a valuable asset. In the graph, we showcase two ex-

treme events of recent history that are in the basis of

the current energetic crisis, namely, COVID-19 pan-

demic and Russian war on Ukraine, represented by

the gray and teal lines, respectively.

Since the occurrence of the COVID-19 outbreak,

we note a steady, minimal, increase in electricity

price, until we reach the beginning months of 2021,

displaying a growing trend of electricity price by the

time of international economy wake following the end

of global pandemic. This is further intensified by the

Russian war on Ukraine, which diminished overall

electricity and natural gas supply for Europe.

What differentiates the electricity market, making

it unique, is mainly the grid-based nature of electricity

as a good. The lack of economically viable electric-

ity storage options (Weron, 2014) pressures supply

and demand to be constantly balanced in accordance

to each other. In turn, at the wholesale level, the elec-

tricity price manifests great volatility throughout each

day, to accommodate for the difference in demand at

the respective peak and off-peak hours.

This variation is also present within the medium-

term and long-term progression of the wholesale mar-

Borges, J., Maia, R. and Guerreiro, S.

Assessing the Effects of Extreme Events on Machine Learning Models for Electricity Price Forecasting.

DOI: 10.5220/0012038700003467

In Proceedings of the 25th International Conference on Enterprise Information Systems (ICEIS 2023) - Volume 1, pages 683-690

ISBN: 978-989-758-648-4; ISSN: 2184-4992

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

683

Figure 1: European day-ahead electricity price (Adapted from: (ENTSO-E, 2021)).

ket. Shifts in electricity price due to behavioral

changes of consumers get diluted within larger de-

grees of data granularity, but other variables pose

interesting correlations for being the foundation of

acute increases in electricity price. Following the

COVID-19 pandemic, the wake of international econ-

omy and rise of global energy demand both coincide

with sharp increases in electricity price, aggravated

by the ongoing war between Russia and Ukraine and

cessation of gas supply (Council, 2022) that also co-

incide with increased energy prices. This bases the

significance of this position paper.

For the following section, we will be laying out

the significance of this problem, followed by section

3, where we dive into researching similar projects of

related literature, then section 4 where we propose a

solution framework for the existing problem, backed

up by the theoretical foundation, and finally section 5

for the conclusion of this position paper.

2 RESEARCH OBJECTIVE

Due to the nature of the electricity spot market, which

requires parties to submit bid prices the day before

buying and selling energy, the value of accurately pre-

dicting electricity price is great. Furthermore, the ex-

istence of extreme events that greatly influence the

market from a short-term perspective opens up the re-

search possibility of achieving greater forecasting ac-

curacy by investigating the most suitable models for

this subject, and what variables have greater influence

within these sporadic situations, thus defining our re-

search objective.

Our proposition for the development of this pa-

per is to have three different deliverable stages that

reflect the respective states of our projects develop-

ment. Data descriptive analysis is the first one, in

which we gather our data from different sources and

transform/clean it to fit our models. Additionally, we

sustain an exploratory analysis on the data to extract

the most suitable features as well as some data visual-

ization to support our analysis and speculations. The

second stage (model development) is for devising our

forecasting models to be applied for our data, and the

final stage (result evaluation) is where we analyze the

results of our models and develop an hypothesis for

explaining their results.

3 RELATED WORK

The following section will focus on structuring rele-

vant background work to support our proposition of

a solution for this position paper, starting with theo-

retical contextualization, followed by state-of-the-art

modelling research.

3.1 Theoretical Contextualization

The liberalization of the Internal European energy

market (IEM) aims, first and foremost, towards low-

ering electricity prices. This liberalization introduces

a competitive force that stimulates firms to develop

innovative technologies and achieve a more cost ef-

ficient operation (Pepermans, 2019), and be able to

ensure business continuity.

Pepermans (Pepermans, 2019) represents the en-

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

684

ergy market liberalization clearly, where electricity

generation companies used to encapsulate transmis-

sion and distribution roles, promoting market mo-

nopolisation and overseeing the definition electricity

prices. After the IEM liberalization, companies were

split (functionality wise), differentiating generation

and distribution companies. Companies with the lat-

ter roles would bid in the electricity spot market (day-

ahead) to balance supply and demand with generation

companies and compete for lowest operational cost,

culminating in an overall reduction in electricity cost.

That being said, electricity price has shown a decreas-

ing trend since 2011 while cross-border trade flows

steadily increase, pointing to the idea that this trend

is not only a consequence of the liberalization of the

market, but instead the combination of several exter-

nal variables and events.

The author highlights that we can’t attribute the

successful electricity price decline to the existing in-

tegration. A combination of other factors also influ-

ence this decreasing trend, namely the economic cri-

sis of 2008 that drove electricity demand 6.8% lower

and climate change and renewable policies pushing

out thermal plants with higher marginal costs, further

contributing to the existence of extreme events that

have high short-term impact on electricity price

As we stated previously, according to Liu et al.

(Liu et al., 2022), extreme events - such as natural

catastrophes, epidemics, financial crises, and so on

- reflect on the energy market as meaningful spikes

on electricity prices (low or high) and can cause sub-

stantial damage to the economy. They can have long-

lasting repercussions and are highly difficult to pre-

dict, making it necessary to study the impact of these

events in different fields of research. The increased

frequency of such events, added to the higher degree

of magnitude they manifest incentives market bidders

to take these events’ effects into account in their fore-

casting models, as it will prove ever more useful for

the future where conditions for extreme events are

ever more likely to occur.

The unpredictable nature of these events causes

sudden electricity price crashes in the market, usually

with an intense degree of magnitude (as stated previ-

ously), which makes typical point forecasting models

showcase low accuracy scores when accounting for

occurrences of extreme events (Liu et al., 2022).

3.2 Prediction Modelling

Achieving accurate forecasting of time series has a

plethora of characteristics that need to be taken into

account, which we will be exploring before tackling

specific models to develop. To begin, an ordered set

of values that are measured at regular intervals of

time is referred to as a time series. It is very useful

in several fields, including finance, economics, and

meteorology, and it is used to forecast short-term to

long-term changes based on its data (Che and Wang,

2010).

On this topic, we define the scope of our forecast-

ing objective. Within the context of EPF, the defi-

nition of time intervals for making predictions is not

well established. Weron (Weron, 2014) states that

short-term forecasting accounts for predicting values

a few minutes to a few days ahead, medium-term for a

few days to a few months and long-term for anything

else.

External factors that influence the electricity mar-

ket in short-term to medium-term are related to unex-

pected events that provoke fluctuations in the energy

price due to psychological market expectations, while

factors that affect the market long-term are more

closely related to the basic supply and demand rela-

tionship of electricity as a good (Wen et al., 2021).

This work focuses on assessing the effects of extreme

events on EPF, as such, the time period for making

predictions for EPF suits a medium-term scope, ac-

cording to Weron’s definition.

Exogenous features require careful consideration

before developing a forecasting model. Several stud-

ies point to the existence of variables that heavily

correlate with electricity price, specifically calendar

variables, such as seasonality, and electricity demand

(Weron, 2014) that constantly show a strong relations

with electricity price. Other variables, depending on

the context, can also be relevant. Bento et al. (Bento

et al., 2022) discriminate another select group of vari-

ables that prove useful in this context: weather con-

ditions, fuel costs and long-term trends, as well as

broadening the seasonality variable into different ones

of independent granularity (weekly, monthly, yearly).

The importance of variable correlation is high for

EPF, and constructing a robust dataset that incorpo-

rates important variables promises positive results for

our predictions. The variables mentioned previously

showcase positive results within the overall field of

EPF, but under our different circumstances of extreme

events, results can differ.

Liu et al. (Liu et al., 2022) detail two different

types of variables that are included in their MLgR

model, being: historical prices and market character-

istics. The purpose of this model is EPF in extremely

low and high price situations. In both cases, market

characteristic variables have the most weight for their

predictions. For the lowest prices, reserve capacity

has the most weight (33.94%), followed by intercon-

nector flow (28.27%), VRE proportion (25.25%) and

Assessing the Effects of Extreme Events on Machine Learning Models for Electricity Price Forecasting

685

load demand (12.54%). For the highest prices, re-

serve capacity has, too, the most weight (37.00%),

followed by reserve capacity (30.56%), VRE propor-

tion (19,49%) and interconnector flow (12.95%).

According to their structure, Lu et al. (Lu et al.,

2021) divide EPF models into four categories: a com-

bination of a data cleaning method, optimizer, and

basic model; a combination of data cleaning method

and basic model; a combination of optimizer and ba-

sic model; and just the basic model. Typically, the

most popular structure is the basic model alone, fol-

lowed by the model with prior data cleaning. The hy-

bridization of models and prediction architectures us-

ing multiple techniques is becoming a research focus

and may be a future development direction.

EPF research is gathering noteworthy research

popularity since the early 2000s (Weron, 2014),

providing us with a vast amount of insights for the

most suitable forecasting models within this context.

Models that employ variable segmentation (separat-

ing models for each period), neural networks, which

simulate nonlinear behavior, and forecast combina-

tions are greatly endorsed by researchers in the field

(Bunn, 2000).

3.3 Statistical Modelling

Statistical models are used to forecast future values, in

this case of electricity price, by using a mathematical

of historical data of electricity price and other exoge-

nous variables that might be suitable (Weron, 2014).

Additionally, according to Weron R., the attractive-

ness of these models stems from the requirement of

physical interpretation that may aggregate to their re-

spective components, facilitating the understanding of

this type of model’s behavior. Nevertheless, they are

still criticized for their limited ability to model nonlin-

ear behavior of electricity price and respective related

variables. Still, their independent performance com-

petes to the models that excel in nonlinear modelling.

Lu et al. (Lu et al., 2021), in their decade re-

view of data-driven models for price forecasting, di-

vide these models for EPF into 5 different categories,

namely: TS models, regression models, ANN-based

models, SVM-based models and decision tree-based

models, where the first two categories belong in statis-

tical forecasting models. According to these authors,

TS forecasting is the prediction of future market de-

velopment based on past market trends, whose pri-

mary models are the AR (Autoregressive) mode, the

MA (Moving average) model, the ARMA model and

the ARIMA model. ARMA is the combination of the

AR and MA models and can be used to achieve sim-

pler models the more the data is similar to a good-

ness of fit. The ARIMA model, which is based on

the ARMA model, solves non-stationary sequence

problems, allowing the original sequence to be distin-

guished. They state that the EPF works developed in

the decade prior to this review (2021), the most pop-

ular statistical models are the ARMA, ARIMA and

GARCH models, the latter being a regression model

tailored for financial data. TS models are widely used

for the short-term prediction of oil prices and elec-

tricity price, often as the dominant model, as well as

auxiliary, illustrating the potential of their inclusion

in hybrid models of machine learning and statistical

algorithms.

According to these authors, regression forecasting

is referred as the construction of a regression equa-

tion between variables and using it as a forecasting

model based on market analysis. When employing

these prediction methods it is vital to identify and col-

lect data on the main market factors that influence the

prediction objects. In this context of EPF, popular re-

gression models are linear regression (LR), ridge re-

gression (RR) and LASSO regression. Some common

uses for these techniques include hourly prediction of

electricity price, prediction of natural gas and crude

oil daily prices and hybrid models.

Some authors defend that, in the context of EPF,

hybrid models outperform the component models in-

dependently (Bissing et al., 2019). The hybridization

of ARIMA and the multiple regression model com-

bines the benefits of the two, by maintaining the mag-

nitude of the values and the proper shape of the price

per hour plot, respectively. Moreover, the combina-

tion of ARIMA and Holt-Winters was the best per-

forming model in most situations, even when compar-

ing to other hybrid models present in the literature.

3.4 Machine Learning Modelling

Multiple machine learning algorithms are well suited

for EPF. Weron R. (2014) (Weron, 2014) studies the

most common ones to execute this task, and in terms

of machine learning models, defined by the author

as ’computational intelligence models’, two types are

described: Deep learning models and Support Vector

Machines (SVM).

According to Weron (Weron, 2014), an SVM is a

classification and regression (SVR) tool that performs

a nonlinear mapping of the data into a high dimen-

sional space before utilizing simple linear functions

to build linear decision boundaries between the data

points in the new space, providing a less complex so-

lution that is based on a global minimum of the opti-

mized function and has a more flexible structure, less

based on heuristics (i.e. an arbitrary choice of the

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

686

model).

However, the usage of an SVM in EPF is usu-

ally a component of an hybrid model for predicting

electricity price (Weron, 2014). Che et al. (Che

and Wang, 2010) combine both ARIMA and SVR,

that have shown to be effective in linear and nonlin-

ear modelling, respectively, into a new model called

SVRARIMA. The authors state that, due to the nature

of electricity price time series, which include both lin-

ear and nonlinear components, forecasting electric-

ity price using an hybrid model such as this is the

best path to achieve accurate results. They conclude

that, individually, their neural network model has the

best average value for the evaluation metrics (RMSE

and MAPE) when compared to ARIMA and SVR in-

dependently. However, the SVRARIMA model has

the best results overall, even when compared to the

hybridized model of NN and ARIMA. The authors

explain that this can be expected due to the nature

of SVR to maintain linear patterns undamaged, con-

trary to NN models, making week-ahead forecasting

of electricity price more accurate for the hybrid model

SVRARIMA. Nevertheless, Che et al. propose that

simply combining the best individual models doesn’t

necessarily produce the best results, promoting, in-

stead, a structured selection of the hybrid model.

Common variables that are included in EPF mod-

els, such as electricity load, showcase non-linear be-

havior (Busseti et al., 2012) which might lower the

effectiveness of statistical models which excel at fore-

casting linear behaviour. The authors demonstrate

that a deep learning architecture ensures more accu-

rate predictions for large datasets with nonlinear pat-

ters when compared to linear and kernelized regres-

sion models. This supports the potential of using

machine learning techniques for EPF under extreme

event circumstances, which causes high degrees of

volatility to the data. The deep recurrent neural net-

work model was the authors’ model with the best per-

formance, outperforming both linear and kernalized

regression as well as a feedforward neural network

(FFNN). Busseti et al. state that the accuracy level

achieved by their deep learning model approaches the

same accuracy level of private sector demand fore-

casting services, which demonstrate a MAPE value of

0.84%-1.56%, further more supporting the usage of

machine learning models under nonlinear conditions,

which are aggravated by extreme events.

The potential of deep learning models is not ex-

clusive to its inclusion into hybrid models. To pre-

dict the day-ahead price of electricity in the Turk-

ish market, Ugurlu et al. (Ugurlu et al., 2018) de-

veloped several neural network architectures (CNN,

ANN, LSTM and GRU) and tested their results in-

dependently, while using state-of-the-art statistical

methods (Naive method, Markov regime-switching

auto regressive model, self-exciting threshold auto-

regressive model and SARIMA) as benchmark mod-

els to assess the accuracy of their own. The results

show a success of the neural network based mod-

els in comparison to the statistical one, with special

attention to LSTM and GRU. In both seasonal and

monthly comparison of results, GRU finds success in

both analysis, and LSTM only in the latter. Both of

these variables are important for time series forecast-

ing, which can prove useful for developing a success-

ful framework to predict electricity prices in short and

medium-term.

Following the work of Zhang et al. (Zhang et al.,

2020), we can identify a successful implementation

of a hybrid framework for EPF, based on deep learn-

ing models. This framework is divided in four main

modules: Feature preprocessing, deep learning-based

point prediction, error compensation and probabilistic

prediction. Feature preprocessing consists of detect-

ing outliers and find the best correlating features. The

second module is for extracting nonlinear features

by means of deep belief networks, LSTM and CNN

models. The following model, error compensation,

is aimed towards reducing the residual error between

forecasting and actual prices, and the final module is

for calculating uncertainty at different levels of confi-

dence. This proposed hybrid framework aims to over-

come the underlying limitations that physical, statis-

tical and machine learning methods have, combining

multiple machine learning techniques that results in a

competitive advantage of the model for point forecast-

ing in terms of high-speed performance, simplicity

and convenience as well as uncertainty risk control,

both important features for a model in circumstances

of high volatility and risk of the consequences of ex-

treme events.

Other authors have developed hybrid models to for

EPF. SEPNet (Huang et al., 2021) is the hybridiza-

tion of a Variational Mode Decomposition (VMD),

Convolutional Neural Network (CNN) and Gated Re-

current Unit (GRU). Due to the seasonal variation in

the electricity price time series, the authors use elec-

tricity pricing data from New York City from 2015

to 2018 and divide it into four seasons (spring, sum-

mer, autumn, and winter). A CNN architecture is

used to extract time-domain features from these in-

trinsic mode functions (IMFs) with varying center

frequencies. The GRU is then used to process and

learn the features collected by the CNN, producing

the final prediction. Once again, the hybridization

of these models outperform their accuracy indepen-

dently, whereas the VMD-CNN algorithm, on the

Assessing the Effects of Extreme Events on Machine Learning Models for Electricity Price Forecasting

687

same data, has an improved MAPE and RMSE of

84% and 81%, respectively.

Regarding hybrid models, one interesting ap-

proach for EPF utilizes a fully neural network-based

architecture developed by Kuo et al. (Kuo and

Huang, 2018). Their model (EPNet) takes the price

of electricity in the prior 24 hours and generates, as

the output, the prediction of electricity price for the

next hour. In this approach, they utilize a CNN for

feature extraction and an LSTM for forecasting prices

by analyzing the features extracted by the CNN. This

CNN includes two 1D convolutional layers to im-

prove training efficiency and batch normalization is

used after the second convolutional layer, while using

ReLU as the overall activation function.

The data preprocessing phase of this model’s sys-

tem flow begins with the original dataset being nor-

malized, with values restricted to the range of 0 and

1, and then being divided into a training set and a test

set. The optimizer then adjusts the EPNet parame-

ters using backpropagation based on the resulting loss

value. Following training, EPNet enters the testing

phase, where the testing set is used as an input and

the output is compared to real-world electricity prices

to assess performance. EPNet’s results are compared

to those of SVM, RF, DT, MLP, CNN, and LSTM ar-

chitectures separately, and EPNet obtains the lowest

MAE and RMSE scores, confirming the potential of

neural network architectures in EPF.

A fully neural-network based framework for EPF

has also been proposed by Yang et al. (Yang and

Schell, 2022), in the context of modelling extreme

events, with highly volatile behavior. They state

that the most popular statistical models for this pur-

pose (ARIMA and GARCH) are falling out of use,

given their inadequacy for high frequency time se-

ries, which is even more important under extreme

events’ conditions. Therefore, they propose a tri-

branch CNN-GRU model (GHTnet) for forecasting

electricity price, in real-time, under extreme condi-

tions. The three distinct branches that make up the

general model architecture—two GRU modules and

one fully connected dense layer—share the same sub-

architecture. To transform the output of the branches

into the required prediction, all branches output to two

successive dense layers.

The three branches that comprise the previous

framework are: the sliding window branch, the day

interval branch and the time series branch. The first

one is based on GoogLeNet, which is a mature deep

learning model based on CNNs. The interest of

GoogLeNet for this framework is that the parallel lay-

ers of CNN provide the ability of extracting features

on a different scale of the input, as well as alleviat-

ing overfitting, gradient explosion and gradient van-

ishing. The second branch takes historical price data

as input and its purpose is to model long-term changes

in the time series data, which can be ignored by gra-

dient vanishing. The last branch takes time series

statistics as inputs, since the inclusion of these fea-

tures has been proven, in the author’s work, that it can

increase the ability of the model to capture extreme

events. This is done by stacking CNN modules in or-

der o extract date information and reduce the feature

size.

Results showed that GHTNet outperformed state-

of-the-art deep learning algorithms according to the

MAE and MAPE criterion. It also outperformed pop-

ular statistical methods for EPF. The performance of

each branch was evaluated, arriving at the conclusion

that the GoogLeNet branch was the most important

in achieving good prediction accuracy, and increas-

ing the number of parallel CNNs further improved the

performance of the model

To conclude, the definition of a model that can

fit our needs in EPF under extreme events can be

done through a plethora of ways. From fully statis-

tical frameworks, machine learning models or the hy-

bridization of the two, we can expect accurate pre-

dictions. However, understanding the context of our

paper, regarding the volatility of extreme events, nar-

rows down the definition of a suitable model for our

paper regarding the consequences of extreme events

in EPF.

4 PROPOSED SOLUTION

The proposed solution is to develop an hybrid fore-

casting framework with predictions based on neu-

ral network architectures. This framework has been

proven to be effective in EPF, as stated previously, so

it will be the base for the development of this position

paper. This solution will incorporate a combination of

data cleaning, preprocessing, and optimization, given

that the main model for predictions will be based on

neural network architectures.

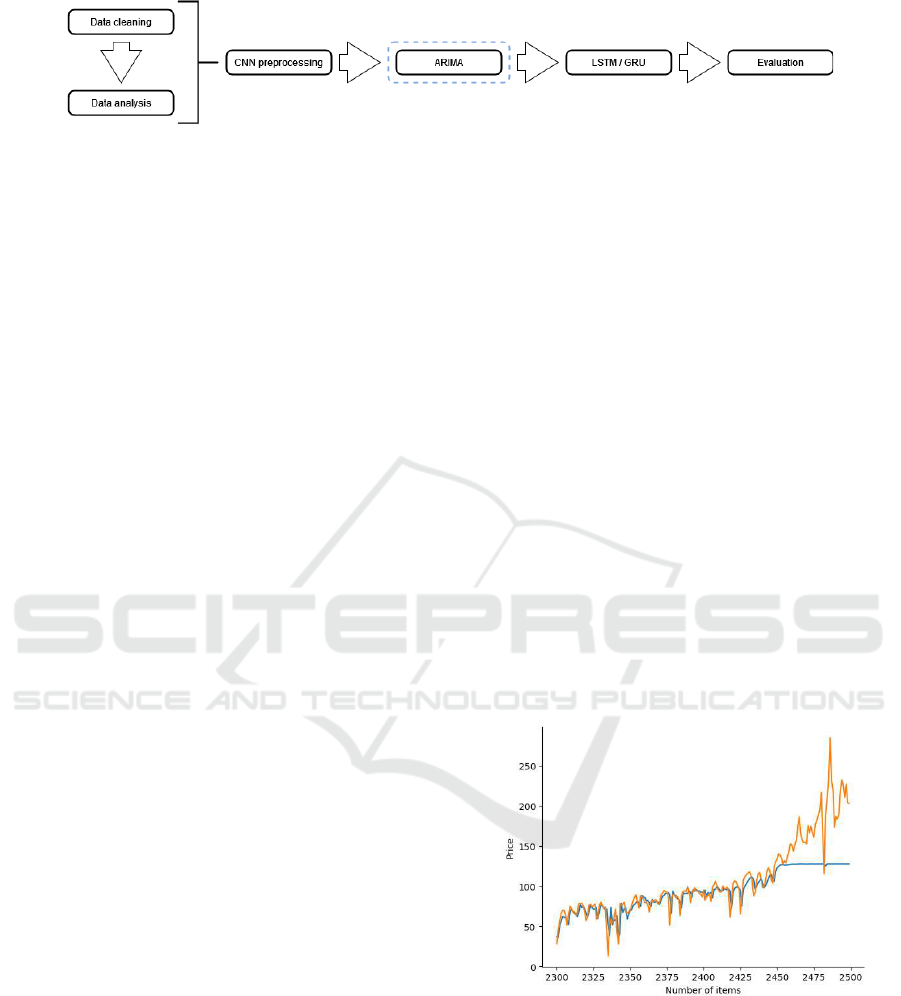

In figure 2, we indicate said functional architec-

ture of this proposed solution, to be explained further.

The data cleaning and transformation will be done

by a thorough descriptive analysis of our original data

and respective transformation into a single set. Af-

terwards, preprocessing methods will be incorporated

(feature extraction and normalization) to allow for

accurate predictions and standardization of the input

data, with additional archetypal scaling techniques of

the same input data. Afterwards, for all phases of

model development, we propose two methods. One

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

688

Figure 2: Proposed solution functional architecture.

that is fully based on neural network architectures and

another that incorporates the benefits of linear mod-

elling of statistical methods with the nonlinear ca-

pabilities of a neural network model, as both archi-

tectures have been achieved great results in related

projects in EPF.

For the fully neural network-based architecture,

we propose a similar approach to Kuo et al. (Kuo

and Huang, 2018). In the context of extreme events,

electricity prices have additional volatility, which may

indicate that algorithms for modelling nonlinear be-

havior, based on machine learning, may be better

suited for this specific scenario. A CNN architecture

has been proven successful for feature extraction pur-

poses of the models, being potential candidates for

it. For making the predictions, LSTM and GRU are

popular for this purpose and have also been proven

successful, therefore being the foremost candidate to

incorporate in this model.

Given that the main purpose of this project is to

investigate the effects of extreme events in EPF, we

propose another framework, one that has the addi-

tional hybridization of a statistical method with the

LSTM/GRU module for forecasting. As a statistical

method, ARIMA seems the most popular choice, that

has been extensively used in the field to great effec-

tiveness. As a machine learning model, we will incor-

porate the previous architecture, of neural network-

based preprocessing and prediction with CNN and

LSTM/GRU respectively.

The development of these two models, and the

comparison between the two, will allow us to better

grasp if a fully machine learning-based framework is

better suited for predictions in such an environment

of extremely high and low electricity price spikes, or

if the incorporation of statistical models, that are his-

torically well suited to model linear behavior, is still

beneficial. Furthermore, machine learning models,

with special attention to neural networks in more re-

cent years, have been showcasing great potential for

modelling in EPF, and are stated by various author in

the referenced works as an unexplored subject in this

field, being greatly encouraged for future projects.

Prior to the development of said frameworks, and

just as important, is the establishment of a robust

and fitting set of data. To gather said data, we in-

tend to on using, mainly, public electrical grid data,

from ENTSO-E, and meteorological data from spe-

cific weather institutes that can provide fitting data to

our problem. We have established, in previous sec-

tions, that extreme events have an underlying effect on

the price of electricity, in turn effecting the electrical

grid and its components. By including such variables

in our framework, we speculate to successfully model

the behavior of these events, as a creative variable.

For the subject of EPF, the amount of research that

has been done in recent years is great. Multiple mod-

els have been developed that excel in this task, even

during extremely volatile events. Developing a neural

network based architecture for this solution was cho-

sen because of the, relative, novelty of this types of

models in the area, but also because of the great po-

tential it seems to have. We want to research deeper

into the capabilities of neural networks in this subject,

and the great value they can contribute to electricity

market bidding strategies. Furthermore, including a

statistical model, like ARIMA, as it is popular in the

field, will allow us to better assess the neural network

potential, since we can gauge the performance of each

framework independently.

Figure 3: Training results of time series forecasting of elec-

tricity price (Adapted from: ENTSO-E).

The line graph that is showcased in figure 3 ref-

erences the very incomplete and initial stages of the

model development. The orange line represents the

real training values for energy price, and the blue

line represents the predicted training values, of the

day-ahead market electricity price data, gathered from

ENTSO-E (ENTSO-E, 2021). These predictions

where made by developing a simple LSTM model

Assessing the Effects of Extreme Events on Machine Learning Models for Electricity Price Forecasting

689

for forecasting electricity price time series from July

2021 to November 2022. It is clear that the model

lacks the capacity of correctly modelling the most

volatile behavior, stating the express need for cor-

rectly modelling it.

5 CONCLUSIONS

This position paper provided the necessary contextu-

alization of extreme events in the context of EPF, and

state-of-the-art models and frameworks that fit the de-

sired purpose of modelling the highly volatile behav-

ior of electricity price.

Theoretical background regarding the electricity

market was done for understanding the importance of

researching forecasting frameworks for this subject.

Research into state-of-the-art statistical and ma-

chine learning models was done afterwards, with the

purpose of understanding what are the most suitable

models and frameworks that are available to success-

fully create a forecasting model of EPF during ex-

treme events.

Ultimately, the proposed solution is the develop-

ment of a forecasting framework that incorporates

data cleaning and transformation, the inclusion of a

CNN architecture for feature extraction prior to the

basic forecasting model.

This latter model is to be based on a LSTM/GRU

architecture, with optimization. To better study the

effects of extreme events in EPF, the additional in-

clusion of an ARIMA model will be added to the

forecasting model, to compare the benefits of statis-

tical model inclusion in hybrid neural network-based

frameworks.

ACKNOWLEDGEMENTS

This work was supported by national funds through

Fundac¸

˜

ao para a Ci

ˆ

encia e a Tecnologia (FCT) with

reference UIDB/50021/2020 (INESC-ID).

REFERENCES

Bento, P. M., Pombo, J. A., Mariano, S. J., and Calado,

M. R. (2022). Short-term price forecasting in the

iberian electricity market: Sensitivity assessment of

the exogenous variables influence. In 2022 IEEE In-

ternational Conference on Environment and Electri-

cal Engineering and 2022 IEEE Industrial and Com-

mercial Power Systems Europe (EEEIC/I&CPS Eu-

rope), pages 1–7. IEEE.

Bissing, D., Klein, M. T., Chinnathambi, R. A., Selvaraj,

D. F., and Ranganathan, P. (2019). A hybrid regression

model for day-ahead energy price forecasting. IEEE

Access, 7:36833–36842.

Bunn, D. (2000). Forecasting loads and prices in com-

petitive power markets. Proceedings of the IEEE,

88(2):163–169.

Busseti, E., Osband, I., and Wong, S. (2012). Deep learning

for time series modeling. Technical report, Stanford

University, pages 1–5.

Che, J. and Wang, J. (2010). Short-term electricity prices

forecasting based on support vector regression and

auto-regressive integrated moving average modeling.

Energy Conversion and Management, 51(10):1911–

1917.

Council, E. (2022). Energy price rise since 2021.

ENTSO-E (2021). Entso-e transparency platform - sfpt

guide. https://transparency.entsoe.eu/content/static

content/Static.

Huang, C.-J., Shen, Y., Chen, Y.-H., and Chen, H.-C.

(2021). A novel hybrid deep neural network model for

short-term electricity price forecasting. International

Journal of Energy Research, 45(2):2511–2532.

Kuo, P.-H. and Huang, C.-J. (2018). An electricity price

forecasting model by hybrid structured deep neural

networks. Sustainability, 10(4):1280.

Liu, L., Bai, F., Su, C., Ma, C., Yan, R., Li, H., Sun, Q., and

Wennersten, R. (2022). Forecasting the occurrence of

extreme electricity prices using a multivariate logistic

regression model. Energy, 247:123417.

Lu, H., Ma, X., Ma, M., and Zhu, S. (2021). Energy price

prediction using data-driven models: A decade review.

Computer Science Review, 39:100356.

Pepermans, G. (2019). European energy market liberaliza-

tion: experiences and challenges. International Jour-

nal of Economic Policy Studies, 13(1):3–26.

Ugurlu, U., Oksuz, I., and Tas, O. (2018). Electricity price

forecasting using recurrent neural networks. Energies,

11(5).

Wen, J., Zhao, X.-X., and Chang, C.-P. (2021). The im-

pact of extreme events on energy price risk. Energy

Economics, 99:105308.

Weron, R. (2000). Energy price risk management. Physica

A: Statistical Mechanics and its Applications, 285(1-

2):127–134.

Weron, R. (2014). Electricity price forecasting: A review

of the state-of-the-art with a look into the future. In-

ternational Journal of Forecasting, 30(4):1030–1081.

Yang, H. and Schell, K. R. (2022). Ghtnet: Tri-branch deep

learning network for real-time electricity price fore-

casting. Energy, 238:122052.

Zhang, R., Li, G., and Ma, Z. (2020). A deep learning based

hybrid framework for day-ahead electricity price fore-

casting. IEEE Access, 8:143423–143436.

ICEIS 2023 - 25th International Conference on Enterprise Information Systems

690