International Economic Integration from the Perspective of Economic

Complexity and Economic Fitness: A Methodological Proposal

Arturo González

1,2 a

, Sanny González

2b

, Gabriel Pereira

1c

, Gerardo Blanco

2d

and Christian von Lücken

3e

1

Universidad Americana, Facultad de Ciencias Económicas y Administrativas, Lab-iDi, Asunción, Paraguay

2

Universidad Nacional de Asunción, Facultad Politécnica, Grupo de Investigación en Sistemas Energéticos,

San Lorenzo, Paraguay

3

Universidad Nacional de Asunción, Facultad Politécnica, Núcleo de Investigación y Desarrollo Tecnológico,

San Lorenzo, Paraguay

Keywords: International Economic Integration, Economic Complexity, Economic Fitness, Development, Economic

Block.

Abstract: International Economic Integration can be described as a process in which a group of countries seeks mutual

benefits through mechanisms such as the elimination and/or reduction of trade, social, and political barriers

between others. From an economic point of view, the importance of the integration of countries is fundamental

for their development simply because most of them are part of some system of international economic

integration. In this work, the issue of economic integration will not be discussed in depth but instead will

oversee proposing some well-known metrics in the field of economic development that could be very useful

as analysis and decision-making tools. in the process of regional economic integration. In this sense, this work

proposes using concepts and metrics of Economic Complexity and Economic Fitness to identify combined

productive capacities between countries that are part of an economic block, whether real or fictitious. The

problem in understanding how economically integrate the countries is to identify the combined productive

capacities that would exist if two or more countries that make up an economic block are considered as a single

country. Experimental analyzes were carried out for a fictitious case, where a world with 10 countries and 15

products is presented; in addition, 3 economic blocks were defined, which were analyzed applying economic

complexity and economic fitness metrics. The results obtained reflect the great importance of economic

integration since, by establishing economic blocks, it is possible to capture more productive capacities by

improving both the diversity of the economic block and the ubiquity of the products produced in it by

addressing the productive capacities of the member countries.

1 INTRODUCTION

As time progresses, it is evident that societies are

heading towards a global integration that has been

exponentially accelerated thanks to the advancement

of technology. From an economic point of view, the

importance of the integration of countries is

fundamental for their development, and this is simply

because, except for a few cases, countries are part of

some system of international economic integration

a

https://orcid.org/0000-0001-5672-3679

b

https://orcid.org/0000-0002-8385-2852

c

https://orcid.org/0000-0001-9966-6715

d

https://orcid.org/0000-0001-9773-8922

e

https://orcid.org/0000-0002-2198-1237

(whether regional or international) without discussing

the degree of effectiveness or usefulness of these

(Pérez Bustamante., 2012).

International Economic Integration can be

described as a process (which can be very diverse in

its methods) through which a group of countries seeks

mutual benefits through mechanisms such as the

elimination and/or reduction of trade, social, and

political barriers between others. In this way, two or

more national markets, previously separate and of

different dimensions, come together to form a unified

González, A., González, S., Pereira, G., Blanco, G. and von Lücken, C.

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal.

DOI: 10.5220/0012059400003485

In Proceedings of the 8th International Conference on Complexity, Future Information Systems and Risk (COMPLEXIS 2023), pages 109-121

ISBN: 978-989-758-644-6; ISSN: 2184-5034

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

109

economic space in such a way as to reduce

disadvantages and/or difficulties existing in separate

countries (Pérez Bustamante., 2012).

Achieving International Economic Integration is

complex since it depends on many factors and

variables (Economic, Geopolitical, Social, among

others.). Although there are cases of quite successful

economic integration blocks (European Union, and

others in South America), there are still difficulties to

overcome to get countries to embark on this process.

In this work, the issue of economic integration will

not be discussed in depth but only when immediately

relevant, proposing the use of some well-known

metrics in the field of economic development as

analysis and decision-making tools for regional

economic integration processes.

In this sense, this work proposes the use of

concepts and metrics of Economic Complexity

(Hidalgo & Haussman., 2009) and Economic Fitness

(Tacchella et al., 2012) to identify combined

productive capacities between countries that are part

of an economic bloc, whether real or fictitious, and

thus be able to measure the global performance of the

economic blocks worldwide as if it were a country.

To achieve the goals mentioned above, it is

important to be able to answer the following

questions: Is it possible to use complex systems to

analyze cases of international economic integration?

Are the methods based on complex systems adequate

to analyze cases of regional integration? Is it possible

to quantify the productive capacities of economic

blocks and not only of countries? And finally, is it

possible to propose a method of quantifying the

productive capacities of the economic blocks?

In this article, you can find a well-detailed

methodological proposal to address the problem of

International Economic Integration, for which the

proposal is systematically detailed, and a fictitious

practice case is presented for the experimental

application of the models.

The article is presented as follows: Section 2

presents a literature review of the studied areas;

Section 3 presents the Methodology proposed and

applied in this work; in Section 4, the Results and

Discussions are shown and finally, in Section 5, the

Conclusions.

2 LITERATURE REVIEW

2.1 Economic Complexity

The economic complexity is related to the ubiquity

and diversity of the accumulated knowledge in a

determined economy. Then, in a specific country, as

more people from different sectors interact,

combining their knowledge to produce diverse

products, a more complex economy could be

expected. Therefore, the economic complexity of a

country can be expressed as the share of productive

knowledge it accumulates, because of using and

combining that knowledge (Hausmann et al., 2011).

Knowledge can only be accumulated, transferred,

and preserved if inserted in a people´s network or in

organizations that apply that knowledge for

productive purposes. If producing a product requires

a specific type or combination of knowledge, then the

countries that produce that product reveal that they

have the capabilities and required knowledge to

produce it (Hidalgo & Haussman., 2009; Hausmann

et al., 2011).

The economic complexity of a country reflects the

amount of productive knowledge of its economy,

measured using 2 main indicators, the diversity, and

the ubiquity.

Diversity relates to the number of products produced

in a specific country, while ubiquity refers to the

number of countries that produce a specific product.

𝐷𝑖𝑣𝑒𝑟𝑠𝑖𝑡𝑦=𝐾𝑐,0=

∑

𝑀𝑐𝑝

(1)

𝑈𝑏𝑖𝑞𝑢𝑖𝑡𝑦=𝐾𝑝,0=

∑

𝑀𝑐𝑝

(2)

To generate a more accurate measure of the

number of available capabilities of a country or the

required capabilities for a product, it is necessary to

correct the information that the diversity and ubiquity

hold, using each of them to correct the other and vice

versa. As proposed by (Hidalgo & Haussman.,

(2009); Hausmann et al., (2011)), this can be

expressed as the following equations:

𝑀

´

=

∑

´

,

,

(3)

Therefore, the Economic Complexity Index (ICE)

is defined as follows (Hidalgo & Haussman., (2009);

Hausmann et al., (2011)):

𝐸𝐶𝐼=

⃗

⃗

(

⃗

)

(4)

Where, <𝐾

⃗

> is an average, stdev() represents the

standard deviation, and 𝐾

⃗

is the eigenvector of 𝑀

´

associated with the second largest eigenvalue.

Analogously, the Product Complexity Index

(PCI) is defined.

𝐼𝐶𝑃=

⃗

⃗

⃗

(5)

Where, 𝑄

⃗

is the eigenvector of 𝑀

´

associated to

the second largest eigenvalue.

COMPLEXIS 2023 - 8th International Conference on Complexity, Future Information Systems and Risk

110

[Experimental Data Box]

All the data and results can be found at: https://bit.ly/complexis23_Data

Table 1: Product Export Matrix - Test Model for Experimental Analysis (X

cp

).

Table 2: Experimental Process to obtain the Export Matrix that contains an International Economic Block (X

cp

to X

mp

) -

Example of Ec. Block. #1.

𝐶´=

{

𝑐

,𝑐

,𝑐

,𝑐

}

(a) Conformation of the International Economic Bloc #1

(b) The Export matrix of the Economic Block #1 (𝑬𝑩

𝒌𝒑

) is built

(c) Calculation of Vector "B", using the (9, of total export values of the International Economic Block #1

(e) Vector "B" replaces all the countries that make up the International Economic Block #1 and the export matrix that

contains it is formed. As a result, the Matrix (X

mp

) is obtained.

(a) M

cp

from the Original Export Matrix

(b) M

cp

of the Export Matrix that contains the International

Economic Bloc

k

#1

(c) M

cp

of the Export Matrix that contains the International

Economic Bloc

k

#1

(d) M

cp

of the Export Matrix that contains the International

Economic Bloc

k

#1

Figure 1: M

cp

Matrices of the (a) Original Export Matrix (X

cp

) and of the (b, c & d) Export Matrices of the Economic Blocks

(X

mp

) Proposed for this study calculated with the Eq. 7.

X

cp

p

1

p

2

p

3

p

4

p

5

p

6

p

7

p

8

p

9

p

10

p

11

p

12

p

13

p

14

p

15

c

1

0 42.627 0 0 0 0 0 0 0 0 0 7.095 0 0 0

c

2

28.350 277.775 1.674 371.691 46.857 3.034.718 26.355.142 0 1.515.962 0 14.802 42.371.264 6.284.352 1.372.309.632 1.201.978

c

3

0 5.216 0 9.158 0 156.295 86.464 24.779 5.648.211 16.256.469 304.646 10.071 619.167 0 0

c

4

26.227 40.294 0 4.780 0 12.626.318 4.678 6.920 3.306.102 65.784.052 31.552 444.469.600 362.779 33.522 8.441

c

5

430.025.280 102.318.904 6.954.244 58.085.384 234.929 233.119.760 137.473.696 84.333.632 90.806.104 0 29.043.196 5.741.459.456 369.889.600 185.851.248 9.093.049

c

6

6.400.370 11.242.664 6.264 3.643.282 725.795 4.410.605 307.132 0 4.157.532 0 2.731 7.407.275 10.967 5.067.202 17.794

c

7

6.871.145 6.349.536 0 15.359.048 0 96.720.000 10.334.506 332.191 25.312.052 0 503.529 182.173.968 11.194.842 116.190.032 274.509

c

8

0 0 0 29.464.208 17.703.662 16.929 0 810.382 24.814.384 42.568.613.888 12.799.707 12.226.431 3.497 1.548.972 2.750

c

9

518.443.552 95.476.752 29.089.984 11.991.583 17.625.200 456.977.600 81.602.312 289.626.240 8.044.192.768 27.847.991.296 27.986.572 21.523.519.488 496.113.344 124.086.304 194.398.960

c

10

25.424.708 2.667.031 76.896 1.779.958 0 18.301.440 16.807.418 4.748.828 403.493.536 638.850.560 640.625 297.708.000 1.121.468 39.320.432 822.995

EB

kp

p

1

p

2

p

3

p

4

p

5

p

6

p

7

p

8

p

9

p

10

p

11

p

12

p

13

p

14

p

15

c

1

0 42.627 0 0 0 0 0 0 0 0 0 7.095 0 0 0

c

2

28.350 277.775 1.674 371.691 46.857 3.034.718 26.355.142 0 1.515.962 0 14.802 42.371.264 6.284.352 1.372.309.632 1.201.978

c

3

0 5.216 0 9.158 0 156.295 86.464 24.779 5.648.211 16.256.469 304.646 10.071 619.167 0 0

c

5

430.025.280 102.318.904 6.954.244 58.085.384 234.929 233.119.760 137.473.696 84.333.632 90.806.104 0 29.043.196 5.741.459.456 369.889.600 185.851.248 9.093.049

p

1

p

2

p

3

p

4

p

5

p

6

p

7

p

8

p

9

p

10

p

11

p

12

p

13

p

14

p

15

B =

430.053.630 102.644.522 6.955.918 58.466.23

3

281.786 236.310.77

3

163.915.302 84.358.411 97. 970.27

7

16.256.46

9

29.362.64

4

5.783.847.886 376.793.11

9

1.558.160.880 10.295.02

7

X

m

p

p

1

p

2

p

3

p

4

p

5

p

6

p

7

p

8

p

9

p

10

p

11

p

12

p

13

p

14

p

15

B

430.053.630 102.644.522 6.955.918 58.466.233 281.786 236.310.773 163.915.302 84.358.411 97.970.277 16.256.469 29.362.644 5.783.847.886 376.793.119 1.558.160.880 10.295.027

c

4

26.227 40.294 0 4.780 0 12.626.318 4.678 6.920 3.306.102 65.784.052 31.552 444.469.600 362.779 33.522 8.441

c

6

6.400.370 11.242.664 6.264 3.643.282 725.795 4.410.605 307.132 0 4.157.532 0 2.731 7.407.275 10.967 5.067.202 17.794

c

7

6.871.145 6.349.536 0 15.359.048 0 96.720.000 10.334.506 332.191 25.312.052 0 503.529 182.173.968 11.194.842 116.190.032 274.509

c

8

0 0 0 29.464.208 17.703.662 16.929 0 810.382 24.814.384 42.568.613.888 12.799.707 12.226.431 3.497 1.548.972 2.750

c

9

518.443.552 95.476.752 29.089.984 11.991.583 17.625.200 456.977.600 81.602.312 289.626.240 8.044.192.768 27.847.991.296 27.986.572 21.523.519.488 496.113.344 124.086.304 194.398.960

c

10

25.424.708 2.667.031 76.896 1.779.958 0 18.301.440 16.807.418 4.748.828 403.493.536 638.850.560 640.625 297.708.000 1.121.468 39.320.432 822.995

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal

111

It is necessary to consider the Revealed

Comparative Advantage to establish the M

cp

Matrix,

which allows the calculations of the Economic

Fitness. The definition of Revealed Comparative

Advantage (RCA) proposed by Balassa (1965) makes

countries and products comparable since it represents

the exports of products by country. This index

establishes that a country has revealed a comparative

advantage in a product if it exports more than the rest

of the world, in which case the RCA index adopts a

value equal to or greater than one; if it is less than one,

it indicates the opposite. It is formally defined as:

𝑅𝐶𝐴

=

X

X

X

X

(6)

Where:

X

=Exports o

f

the countr

y

"c" o

f

the product "p".

X

=Total Exports of the country "c".

X

=Total World Exports o

f

the product "p".

X

=Total World Exports o

f

the year (All Products).

This measure makes it possible to build a matrix

that connects each country with the products it

manufactures. The entries in the matrix are 1 if the

export of the product in each country with Revealed

Comparative Advantage is greater than or equal to 1,

and 0 otherwise. We formally define this as the M

cp

matrix as (Hidalgo & Haussman., (2009); Hausmann

et al., (2011)):

𝑀

=

1, i

f

RCA

≥1

0, otherwise

(7)

2.2 Economic Fitness

The Economic Fitness theory proposes a new

algorithm that shows an iterative and non-linear

approach, which makes it possible to efficiently

capture the link formed between the export basket of

different countries and their industrial

competitiveness (Tacchella et al., 2012; Cristelli et

al., 2013; Tacchella et al., 2013). This model has its

initial basis in the construction of a binary matrix of

countries and products (Mcp), which represents the

export basket of each country, whose elements are 1

if country "c" exports product "p" with revealed

comparative advantage and 0 otherwise (See Eq. 7).

This method consists of coupled non-linear maps and

new information is added in each iteration.

Therefore, the general idea of the algorithm

proposed in the Economic Fitness theory lies in

defining an iteration process for the Fitness of the

countries (F

c

) with the complexity of the products

(Q

p

) and then obtaining the values of the

convergence. In the case of F

c

, it is appropriate to be

proportional to the sum of the exported products

weighted by their complexity Q

p

.

For the case of Q

p

it becomes less intuitive

because, in a first approximation, the complexity of a

product is inversely proportional to the number of

countries that export it. However, in each iteration,

more information is added, considering that if a

country has a high level of Fitness, the weight is

reduced to limit the complexity of a product. On the

other hand, countries with low Fitness contribute

more and tend to limit the complexity of the products

(Tacchella et al., 2012; Cristelli et al., 2013;

Tacchella et al., 2013; Pugliese, Zaccaria &

Pietronero., 2016). These ideas are summarized in the

iteration of the following equations:

⎩

⎪

⎨

⎪

⎧

F

()

=M

Q

()

Q

()

=

1

∑

M

1

F

()

→

⎩

⎪

⎨

⎪

⎧

F

()

=

F

()

〈

F

()

〉

Q

()

=

Q

()

〈

Q

()

〉

(8)

Where:

n=Index of iteration.

c=Total number of countries.

p=Total number of products.

F

=Fitness of the country "c".

Q

=Product Complexity "p".

M

=Product − Country Logical Matrix.

𝑂𝑏𝑠.: F

and Q

corresponding to the

normalization

Since this theory proposes that less complex

exporters make a dominant contribution to product

complexity, non-linearity is a fundamental Mathema-

tical property that is unavoidable given the problem of

economic diversification (Cristelli et al., 2013). For the

definition of the complexity of the products, the sum in

the denominator is strongly dominated by the countries

with a lower Fitness measure. Another issue that must

be considered when considering the product

complexity denominator is that, as the total number of

countries that export that specific product increases,

this means that the complexity of the products

decreases, considering thus the product's ubiquity.

2.3 Economic Complexity and

Economic Fitness

The application of the Economic Complexity metrics

has had a great impact from the 2010s onwards

(Hidalgo & Haussman., 2009; Haussman et al.,

2011). It has become a quite popular tool for studying

economic development, economic geography and has

been applied to numerous case studies (Countries,

COMPLEXIS 2023 - 8th International Conference on Complexity, Future Information Systems and Risk

112

cities, etc.) It has also been related to other topics,

such as greenhouse gas emissions, economic growth

and inequality, in addition to extrapolating their

metrics for cases unrelated to the economy or at least

not directly (Hidalgo., 2021).

Although there are multiple applications and

work carried out under the Economic Complexity

approach, there are still many challenges in terms of

research topics, overcoming the issue of the difficulty

of having reliable data in the world and even more

outside of the products (services, patents, and others.),

in addition, several points remain pending, such as

being able to work at subnational or even international

levels (International Economic Blocks). In short, one

of the greatest contributions to the development of

Economic Complexity lies not in the mathematical

model itself, but in the integration of researchers from

areas of knowledge that long ago were on separate

paths (network scientists, economic geographers,

innovation economists, physicists, and others.)

achieving a very interesting interaction between

academics from different areas (Hidalgo., 2021).

Another metric for the analysis of the Economic

Complexity of countries and products is the

Economic Fitness proposed by Tacchella et al.

(2012). In a study carried out by Cristelli et al. (2013)

a comparison was made between both methods. To

deepen the methods and metrics of Economic Fitness,

the following literature is recommended (Tacchella et

al., 2013; Cristelli, Tacchella & Pietronero., 2015;

Mariani et al., 2020; Morrison et al., 2017; Vinci &

Benci., 2018 and Hidalgo., 2021).

2.4 International Economic Integration

International Economic Integration refers to the

process by which countries in a particular region

coordinate their economic policies and remove trade

barriers to increase trade and investment among each

other. In South America, regional economic

integration has been a major objective for many years,

aiming to boost economic growth and reduce poverty

(Carranza, 2017; Basnet & Pradhan, 2017).

One of the key initiatives in South America toward

economic integration is the formation of the Southern

Common Market (MERCOSUR), established in 1991.

MERCOSUR is a customs union that promotes free

trade and the movement of goods, services, and people

among its member countries. MERCOSUR has helped

to reduce trade barriers and increase trade among its

members, resulting in increased economic growth and

improved standards of living for the citizens of its

member countries. (Basnet & Pradhan, 2017; Caceres,

2011).

Despite these positive developments,

MERCOSUR has faced many challenges in its pursuit

of economic integration. One of the main challenges

has been the lack of political will among its members

to fully implement the agreements and remove all

trade barriers. This has resulted in the slow progress

of MERCOSUR and limited its ability to achieve its

goals of boosting economic growth and reducing

poverty. (Baer et al., 2002).

Another challenge facing MERCOSUR is the

lack of coordination among its members on

macroeconomic policies, such as fiscal and monetary

policies. This lack of coordination can lead to

imbalances in trade and investment among its

members and undermine the objectives of economic

integration. To overcome this challenge,

MERCOSUR must establish stronger mechanisms

for policy coordination among its members and

ensure that their policies are aligned with the

objectives of the organization. (Baer et al., 2002).

In conclusion, regional economic integration in

South America has made some progress. However,

there is still much work to be done to boost economic

growth and reduce poverty. MERCOSUR must

overcome its challenges and establish stronger

mechanisms for policy coordination to achieve its

objectives. Further research is needed to assess the

impact of MERCOSUR on economic growth and

poverty reduction in South America and to identify

the most effective ways to promote economic

integration in the region.

There are several approaches used to analyze

regional economic integrations, including the neo-

classical trade theory, the new trade theory, and the

political economy approach.

The neo-classical trade theory views regional

economic integration as a means of increasing trade

and promoting economic growth by removing trade

barriers and creating a single market. This approach

focuses on the benefits of trade, such as increased

efficiency and specialization, and argues that these

benefits will lead to increased economic growth and

improved living standards for the participating

countries citizens. (Pereira et al., 2021; González et

al., 2019).

On the other hand, the new trade theory focuses

on the importance of economies of scale and the role

of multinational corporations in shaping trade

patterns. This approach recognizes that multinational

corporations can use their bargaining power to

influence trade policies and shape the trade structure

within a region. The new trade theory also recognizes

that technological advances and the growth of the

service sector have changed the nature of trade,

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal

113

making it more difficult for governments to influence

trade patterns through traditional trade policies.

(Amine,1986).

The political economy approach focuses on the

role of political institutions and power relations in

shaping regional economic integration. This approach

argues that the political dynamics of a region,

including the distribution of power among countries

and the bargaining power of different actors,

significantly impact the success or failure of regional

economic integration efforts. The political economy

approach recognizes that the distribution of costs and

benefits of integration is not equal among the

participating countries, and that the ability of

countries to participate in regional integration efforts

is influenced by their relative power and bargaining

position (Zaman et al., 2021; Timini & Viani, 2022).

3 METHODOLOGIES

This paper proposes a well-structured methodology to

analyze the incidence of different regional and

international economic blocks in world economic

complexity. To achieve the goal, not only the well-

known methods such as Economic Complexity or

Economic Fitness, which have been studied from

2010 onwards, are required.

In this sense, a methodology is presented that

extrapolates concepts of economic complexity to

analyze regional economic integration, as seen in the

work of Pereira, González & Blanco., (2021) or

González, Pereira & González., (2022), who did so to

identify sustainability capacities in the countries.

Therefore, it is feasible to establish a methodological

and experimental framework to apply to real data and

real economic blocks (even fictitious) such as

MERCOSUR (In South America) and the EU (In

Europe), among others.

A methodology defined in two parts is presented;

in the first where the Methodology is designed based

on the tools and metrics of Economic Complexity and

Economic Fitness. In the second part, the

recommended Experimental Process is presented.

3.1 Economic Complexity and

Economic Fitness Approaches for

International Economic

Integration: A Methodological

Proposal

The Methodological Design for the Study of

International Economic Integration is presented in

three well-detailed steps, for analyzing the scientific

community and its possible practical application. The

steps are detailed below:

Step 1: The Problem of International Economic

Integration

The theory of Economic Complexity establishes that

those countries that can produce and export more

products than others and that these products are not

exported by other countries to a large extent have a

great probability of having more complex economies

and consequently greater probability of development

and well-being for its inhabitants. In simple terms,

productive capabilities are highly embedded in

societies with complex economies.

Therefore, and from this point of view, the

problem in understanding how to integrate the

countries economically is to identify the combined

productive capabilities which would exist if two or

more countries that make up an economic bloc are

considered as a single country. This process is

feasible to analyze, and a theoretical and

experimental work framework can be established,

which is presented in this study and begins as follows.

Originally there is a matrix 𝑋

𝑐𝑝

of World Exports

for a certain year, where:

• 𝑖 = {1,2,3,..,𝑐} where “𝑐” is the quantity of

countries with records of total exports in the

world in a certain period (usually it is annual).

• 𝑗 ={1,23,..,𝑝} where “𝑝” is the quantity of

registered and standard coded products in the

world (The Standard International Trade

Classification (SITC) or the Harmonized

System (HS) code can be used as a reference for

real products).

𝑋

𝑐𝑝

=

𝑝

1

𝑝

2

⋯𝑝

𝑗

𝑐

1

𝑐

2

⋮

𝑐

𝑖

𝑥

11

𝑥

12

𝑥

21

𝑥

22

⋯𝑥

1𝑗

…𝑥

2𝑗

⋮⋮

𝑥

𝑖1

𝑥

𝑖2

⋱⋮

⋯𝑥

𝑖𝑗

Each entry in the Matrix corresponds to the total

exported (in monetary terms, generally in US Dollars)

from a country "𝑖" registered for the product "𝑗". So,

for this study, it is proposed to analyze regional

economic integration through "Economic Blocks", if

possible, it would be good if such blocks exist. In any

case, it does not matter that they are fictitious since

they could be a case study for academic purposes.

An "Economic Block" is defined as a composition

of at least two countries, which can be fictitious or

real, where the combination of productive capabilities

COMPLEXIS 2023 - 8th International Conference on Complexity, Future Information Systems and Risk

114

is assumed by adding the total exports of each similar

product from the member countries.

The process of defining the analysis of the

International Economic Integration begins with the

definition of the "Economic Blocks", where there is a

matrix, whose entries correspond only to the data of

the products exported from the countries that make up

the block. The following matrix is obtained:

𝐸𝐵

𝑘𝑝

=

𝑝

1

𝑝

2

⋯𝑝

𝑗

𝑐´

1

𝑐´

2

⋮

𝑐´

𝑙

𝑥

11

𝑥

12

𝑥

21

𝑥

22

⋯𝑥

1𝑗

…𝑥

2𝑗

⋮⋮

𝑥

𝑙1

𝑥

𝑙2

⋱⋮

⋯𝑥

𝑙𝑗

where:

• 𝐶´=

{

𝑐´ / 𝑐´∈𝑋

∨ 𝑛

(

𝐶´

)

≥2

}

where

𝐶´ represents the set of countries that

are part of a certain international economic

block. E.g. 𝐶´={𝑐

,𝑐

,𝑐

} international

economic block made up of countries c

1

, c

2

and c

3

.

• 𝑙 ={1,2,3,…,𝑘} where 𝑘=𝑛

(

𝐶´

)

and

represents the quantity of countries of a cert of

a certain international economic block. E. g. If

the set 𝐶´=

{

𝑐

,𝑐

,𝑐

}

of the countries that

are part of a given international economic

block is taken,

𝑘=𝑛

(

𝐶´

)

represents the

number of countries that belong to the block.

It is a mandatory condition that 𝑘≥2.

Subsequently, a single-row vector is obtained that

corresponds to the sum of all the export values of all

the countries of the block, for each one of the

products, maintaining the quantity of these and thus

disappearing the countries that originated them. the

block. The block vector is obtained as follows:

𝐵=

(

𝑏

𝑏

⋯𝑏

)

and each of the of the entries of the vector is

calculated as follows:

𝑏

= 𝑥

(9)

This new vector 𝐵 replaces the countries that

belong to the economic bloc and there is a new world

export matrix for the given year. There is the

particularity that 𝑘<𝑐 since the Economic Block

had to absorb at least two countries to be considered

as such.

The new export matrix, including the economic

block represented by B, should have the dimension

𝑋

where 𝑚 = 1 + (𝑐 − 𝑘). In this way, there is

1 (one) new country and "𝑘" countries of the

economic block are excluded from the total of "𝑐"

original countries. The matrix is as follows:

𝑋

𝑚𝑝

=

𝑝

1

𝑝

2

⋯𝑝

𝑗

𝐵

= 𝑐

1

𝑐

2

⋮

𝑐

𝑥

11

𝑥

12

𝑥

21

𝑥

22

⋯ 𝑥

1𝑗

…𝑥

2𝑗

⋮⋮

𝑥

𝑓1

𝑥

𝑓2

⋱⋮

⋯𝑥

𝑓𝑗

Where:

• 𝑓 = {1,2,3,..,𝑚} where “𝑚” is the quantity of

countries and the international economic block

with records of total exports in the world in a in

a specific year.

• 𝑗 ={1,23,..,𝑝} where “𝑝” is the quantity of

registered and standard coded products in the

world.

The data will be obtained from the export matrix

𝑿

𝒎𝒑

to carry out the analysis of the incidences of the

international economic blocks with the selected

metrics (Economic Complexity or Economic

Fitness).

Step 2: Quantification of Productive Capabilities of

International Economic Blocks.

To determine if a country has minimum productive

capacities for a certain product, Hidalgo &

Haussman., (2009) established the use of the

Revealed Comparative Advantage Index (RCA)

proposed by Balassa. (1965) as a mechanism;

therefore, it is a mandatory step to use the Economic

Complexity and Economic Fitness metrics.

Then, we calculate the VCR index for the Original

Export Matrix (X

cp

) and for the Export Matrix that

includes an International Economic Block (All the

X

mp

of the blocks formed). It is recommended to carry

out the analysis with a single economic block at a

time, or failing that, if tests are to be carried out with

two or more blocks at the same time, that these be

mutually exclusive with their member countries, that

is, that each block has its own their own countries

without repeating them in the other blocks (More

details on this subject are presented in Section 3.2).

Once the calculations of the RCA (See (6) to X

cp

and to all the X

mp

blocks have been completed, the

M

cp

matrix must be determined for each case. With

this it is possible to obtain the different measures of

Economic Complexity or Economic Fitness.

Step 3: Complexity approaches to the model:

Economic Complexity and Economic Fitness

Given the M

cp

Matrix, calculated according to the

procedure mentioned in the previous step, it is then

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal

115

possible to use the mathematical models of

complexity measures proposed by Hidalgo &

Haussman., (2009) for the case of Economic

Complexity and those proposed by Tacchella et al.,

(2012) in the case of the Economic Fitness models.

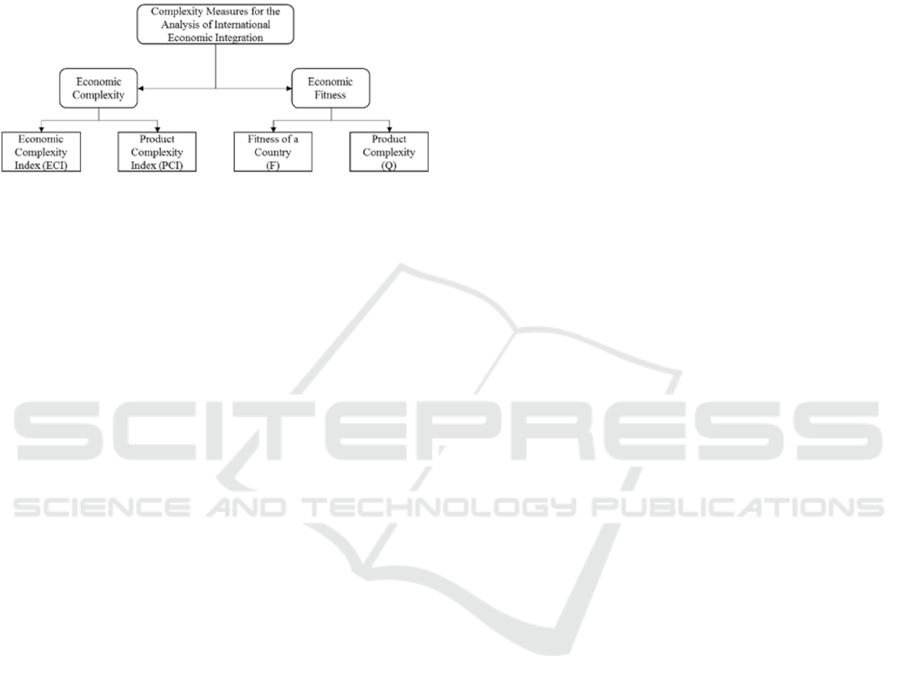

Figure 2 shows a scheme of the main metrics

recommended to apply to the analysis of international

economic integration.

Figure 2: Recommended Measures of Complexity.

If the Economic Complexity approach is used, the

recommended metrics are the Economic Complexity

Index (ECI) and the Product Complexity Index

(PCI). It would also be feasible to carry out the

Product Space calculations, however, with the first

two measurements, it would be enough. In the case of

the Economic Fitness approach, the metrics are

recommended: Country Fitness (F) and Product

Complexity (Q). They would be the counterparts of

the previous ones. Both approaches have their

particularities, pros and cons, and the debate on them

continues to this day.

3.2 Experimental Application Steps

It is important to note that in section 3.1, a

methodology has been developed in a general way

that allows the study of international economic

integration, however making a detailed study with

real data entails quite an interesting effort and even

makes it quite difficult to apply the two approaches.

proposed (Economic Complexity and Economic

Fitness). It is possible, that for a real situation, it

should be done separately. In this part of the work,

some steps to follow are proposed to apply an

experimental case study, where all the recommended

metrics are used (See Figure 2).

The experimental process carried out in this study

will be systematically detailed, as well as

recommendations for its application with a real case.

This will serve to have a first approximation of what

it would have at the time of a real application. It is

important to highlight that an Experimental Data Box

will be presented in a general way that will serve as a

guide in this section and in each step. The data, results

and graphs will be available in a repository for those

who are interested (See Experimental Data Box).

Step 1: Definition of Fictitious Economic Blocks

For this experimental study, a dummy export data

matrix was defined, consisting of ten countries (𝑐=

10) and fifteen export products (𝑝=15). Thus, there

is an 𝑿

𝒄𝒑

matrix with the following dimensions

𝑿

𝟏𝟎,𝟏𝟓

for further analysis. Matrix entries were

arbitrarily defined and randomly drawn from a real

export dataset, with 147 countries and more than 1000

products. It is recommended to adopt this procedure

that ensures a good random process, however

functions that generate a random matrix can be used

for analysis.

To have a basic guide of this procedure, and those

that come in the following steps, an "Experimental

Data Box" is presented where you can observe the

steps that will be described. In this sense, the

Fictitious Matrix for this case study can be seen in

Table 1.

For a possible application to real cases, the use of

export data is recommended either under the SITC

coding or under the HS coding. With a disaggregated

four-digit export database, it will be possible to have

a very good basis for working on the procedure

presented in this paper.

Step 2: Definition of the International Economic

Blocks and Initial Calculations.

For this case study, three fictitious economic blocks

were established that will be analyzed separately in

such a way as to compare the results obtained first

with the reference, which is the Original Matrix

(Without any economic block), and with the results

obtained from the other blocks. Given that there are a

total of ten fictitious countries, the conformation of

the 3 blocks is the following:

• 𝐶´=

{

𝑐

,𝑐

,𝑐

,𝑐

}

Ec. Block #1

• 𝐶´=

{

𝑐

4

,𝑐

,𝑐

}

Ec. Block #2

• 𝐶´=

{

𝑐

,𝑐

,𝑐

,𝑐

,

𝑐

,

𝑐

}

Ec. Block #3

This step simply consists of grouping the

countries that make up an international economic bloc

into sets 𝑪′. For an application with real data, existing

blocks such as the European Union or MERCOSUR

can be used, but also for academic purposes fictitious

blocks or those that are not really conformed can be

created, such as URUPABOL (Uruguay, Paraguay,

and Bolivia in South America) or the BRICS bloc

(Brazil, Russia, India, China, and South Africa). In

this way, many issues could be analyzed that could be

COMPLEXIS 2023 - 8th International Conference on Complexity, Future Information Systems and Risk

116

starting points for economic integration policies

between countries, among other things.

Then, the following steps should be

systematically applied:

• Build an export matrix where there are only

the countries that make up a block or in this

case, the different blocks. In other words, the

Export Matrix 𝑬𝑩

𝒌𝒑

is defined.

• Immediately the vector 𝑩 must be calculated,

which consists of the sum of all the exports of

each country for each of the products, using (9.

• Subsequently, the new Export Matrix is

established where the data of all the countries

that are part of the blocks are replaced by the

respective data of vector 𝑩. The Final

Exportation Matrix 𝑿

𝒎𝒑

is defined.

• Finally, the corresponding calculations are

made to obtain the M

cp

Matrix of each of the

economic blocks studied. The (6 and the (7 are

used for this purpose.

Once these steps are completed, the mathematical

complexity models can be applied to each case. Table

2 shows in detail the process to be followed with one

of the blocks defined for this study as an example.

And Figure 1 shows the four M

cp

matrices that will

be applied to the mathematical models of complexity

for this case study.

The problem of International Economic

Integration is complex, and with many edges to

observe and certainly, this proposal has a high

potential to become an analysis tool that can be used

by policy makers and decision makers within the

framework of the problem.

Step 3: Experimental Rounds under the Economic

Complexity and Economic Fitness models

For the case study, calculations will be made for all

previously recommended complexity measures (See

Figure 2). The mathematical-computational model

was created based on the Economic Complexity

models proposed by Hidalgo & Haussman., (2009)

and based on the Economic Fitness models proposed

by Tacchella et al., (2012) and runs were made using

proprietary models in the software MatLab®. (In case

any interested party requires the models, they can

request it from the authors without any

inconvenience).

The calculations were systematically performed

as follows:

Table 3: Complexity Measures Applied to the Study

Matrices.

Applied to

Economic

Complexity

Economic

Fitness

ECI PCI F Q

Original Matrix x x x x

Ec. Block #1 x x x x

Ec. Block #2 x x x x

Ec. Block #3 x x x x

Step 4: Analysis of Experimental Results

Once the experimental runs were finished to the data

presented with the approaches to economic

complexity and economic fitness, the following

analyzes of the results and discussions were carried

out:

• Descriptive analysis of the results of the MCP

(original matrix and economic blocks):

Descriptive analysis of two fundamental

indicators for the studies of the complexity

metrics that are: the diversity of the countries

(k

c,0

) and the ubiquity were carried out and the

ubiquity of products (k

p,0

). The discussions

about these results will mark the guideline on

the results of the different complexity

measures.

• Analysis of the results corresponding to the

complexity of the products for each metric

(ICP & Q

P

): For practical purposes, the

positions that the products occupy according

to their performance with the PCI and the PCI

and the QP were used. It is important to keep

in mind that the number of products does not

vary depending on the configuration of the

economic blocks, therefore, it is easier to

directly compare the variation of the

performances according to the position in the

ranking that the products occupy. Depending

on this, analysis and discussions were carried

out.

• Analysis of the results corresponding to the

economic complexity of the countries for

each metric (ECI & FC): It is important

directly the variation of the performances

according to the position in the ranking that

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal

117

each country and each block occupies based

on the performance of its ECI and the F

C

. The

comparisons were made for each economic

block and for the original matrix each with

themselves but comparing the results obtained

in the ECI Vs. F

C

in such a way to analyze and

discuss those results.

In the case of the application to real data, it is

advisable to carry out a good study either using the

Economic Complexity measures or the Economic

Fitness measures. Although it is not something

extremely difficult to do, there are many factors and

elements that must be analyzed for each approach. In

fact, the analyzes carried out in this work are barely

minimal.

Step 5: Conclusions and Recommendations

After the analysis of the results, a conclusion on the

methodological proposal is presented, as well as a

critical review of the results and the model presented.

4 RESULTS & DISCUSSIONS

After the application of the mathematical models of

Economic Complexity and Economic Fitness, to the

different M

cp

matrices (Original Matrix and

Economic Blocks), the following coupled results of

some discussions are presented. Prior to the analysis

of the results of the complexity metrics, in Figure 3,

you can see a graph where the behavior of the

ubiquities of the products is recorded. It is observed

that the economic blocks affect the different

ubiquities as the block is more comprehensive or

large. In the curve of the original matrix (light blue

line), ubiquity peaks are observed, that is to say that

there were products for which many countries had the

capacity to produce them, however, for Economic

Block #3 (the block with the largest number of

members), ubiquities decrease drastically, which

implies that many capabilities are absorbed, both by

the block itself, which becomes more diverse, and by

products that become less ubiquitous, which could

affect the complexities (ECI & F

c

).

In Figure 4, another very important indicator for

complexity measures can be seen, which is the

diversity of countries. It can be clearly seen in the

figure that the crosses are not continuous, since the

economic blocks that were formed imply the

disappearance of the countries that formed them. In

general, blocks that include many countries, or even

those that contain countries that are already diverse,

have a high diversity index. However, those blocks

like Ec. Block #2 (B#2), whose member countries are

c

4

, c

6

and c

8

; which are countries with a low level of

diversity, clearly affect the bloc. It is important to

note that both Diversity and Ubiquity by themselves

do not provide all the information on the complexity

of a given country. Although the block is not very

diverse, perhaps the capabilities that they ended up

"absorbing" could generate an increase, or rather, a

variation in complexity.

Figure 3: k

p,0

- Ubiquity of the Products for each matrix M

cp

(Original Matrix and Economic Blocks).

Figure 4: k

c,0

- Diversity of the countries and economic

blocks defined in each matrix M

cp

(Original Matrix and

Economic Blocks).

Analyzing the first measure of complexity,

Figure 5 shows the results of the PCI of the Products

for each case study. This measure corresponding to

the Economic Complexity approach shows a very

important variation for each of the economic blocks

and initially to the results corresponding to the

original matrix. The most complex product for the

Initial Matrix is Product 15 (p

15

) which undergoes

variations in its position and consequently its

complexity did. The most evident behavior is that the

complexities undergo considerable changes due to the

variation of blocks, at least with the PCI metric.

COMPLEXIS 2023 - 8th International Conference on Complexity, Future Information Systems and Risk

118

Figure 5: Position in the performance ranking of Product

Complexity Index (PCI) for all case studies.

On the other hand, in Figure 6, the results of the

positions of the products based on the Q

p

metric show

more robust (They maintain the same position

regardless of the economic block analyzed) results for

the main products (the most complex ones),

especially those characterized by low ubiquity. The

behavior is quite different from that recorded in

Figure 5. The products p

15

, p

6

and p

8

are quite robust

to the variation of the economic blocks. In this way,

it can be observed how the results of the complexity

of products (PCI & Q

p

), set the pattern of the effects

produced by the economic integration of the

countries.

Figure 6: Position in the performance ranking of Product

Complexity (Q

c

) for all case studies.

Figure 7: Position in the performance ranking of complexity

metrics (ECI - F

c

) for the case of the Original Matrix.

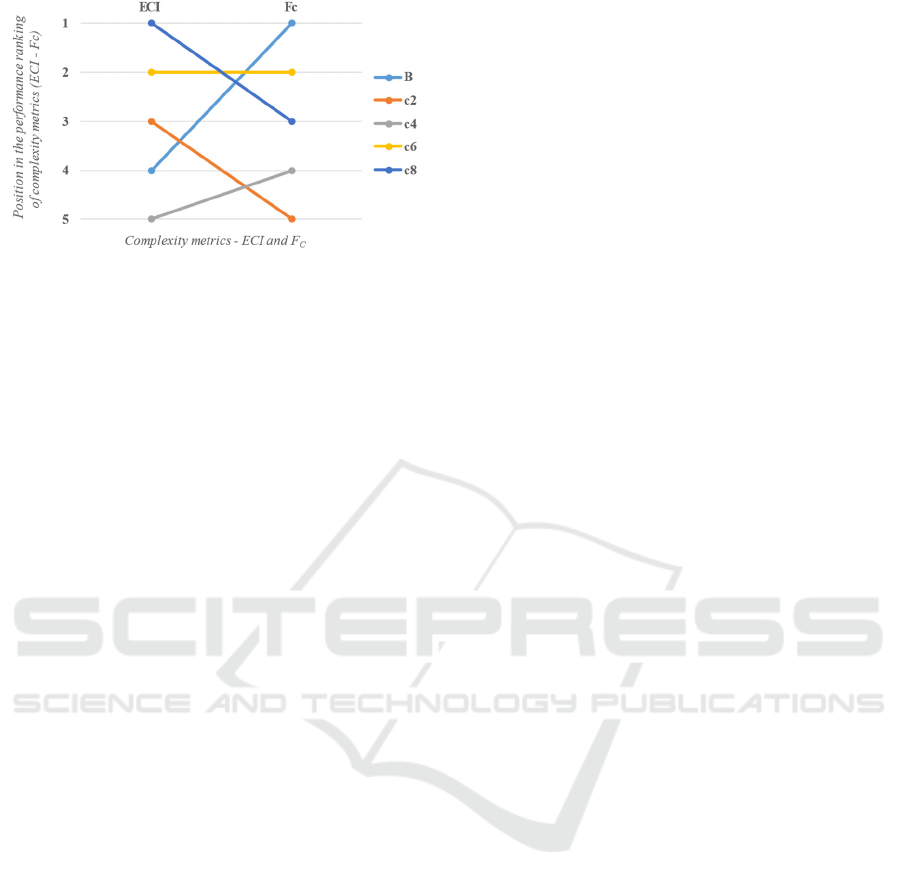

Observing from the point of view of the countries,

in Figure 7, you can see the results of the original

matrix, where only the countries are and without any

blocks. The differences between the ranking of the

countries for the ECI and F

c

metrics show certain

differences, although in some cases, such as c

4

, c

2

and

c

1

, which are very marked, the rest, relatively, behave

in a similar way. The logic behind the results can be

observed, for example, c

4

and c

9

, which are the best

performers for the different metrics (ECI and F

c

), the

first is characterized by having low diversity and the

other with high diversity, however, for the ECI

approach, the c

4

products are less ubiquitous, which

generates that greater capacities are required,

however, for the Fc approach, the c

9

country that has

a higher level of diversity, has several products that

are less ubiquitous, so it provides more information

to generate a highly complex situation in the country.

In the case of Economic Block #1, in Figure 8, it

is found that for both metrics, the most complex

country is c

9

, given that in this case, the block studied

is in the highest places in both cases, therefore that it

can be seen joining the economic bloc favors the

member countries and what has been mentioned so

far has been fulfilled.

Figure 8: Position in the performance ranking of complexity

metrics (ECI - F

c

) for the case of the International

Economic Block #1.

Figure 9: Position in the performance ranking of complexity

metrics (ECI - F

c

) for the case of the International

Economic Block #2.

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal

119

Figure 10: Position in the performance ranking of

complexity metrics (ECI - F

c

) for the case of the

International Economic Block #3.

In the case of Economic Block #2, there are two

well-marked behaviors. Within the same block is the

country c

2

, which already in Figure 7, occupied the

first places with the ECI, however, in the same way,

this behavior is repeated.

In the latter case, the behavior of the last

economic block studied can be observed. Economic

block #3 represents the block with the largest number

of countries (See Figure 10). In the case of the F

c

, the

Block represents the country with the highest fitness,

on the other hand, the country c

8

, is located in the

highest position with the ECI, since at the end of the

capacity identification process, it ends up with only

two products with comparative advantages, in

addition, these products end up being less ubiquitous,

which is why for the approach (ECI), it ends up

becoming a more complex economy.

5 CONCLUSIONS

With this work, it was possible to carry out a very

important analysis that allowed us to describe the

results obtained by applying various complexity

metrics to some case studies where economic blocks

were formed with various experimental tests with

fictitious data. In this way some very important

questions could be answered to begin to study

international economic integration.

It is possible to apply Economic Complexity

metrics (Economic Complexity Index and Product

Complexity Index) and also Economic Fitness

metrics (Country Fitness and Product Complexity),

for which certain hypotheses must be assumed, which

certainly they would be quite strong, but mainly it

must be assumed that when establishing an economic

bloc, the productive capacities of the countries that

are part of the economic blocs are directly added,

which is very simple in practical terms, however, in

the It actually represents a very complex and difficult

situation to achieve. But following the

methodological proposal, it is possible to quantify the

productive capacities of an economic block quite

effectively.

The most important points that can be concluded

with the results of the experimental tests are that the

economic blocks affect both the ubiquity of the

products and the diversity of the countries, which

implies a direct effect on the complexity metrics

(ECI, PCI, F

c

and Q

c

). The economic blocks

represent an opportunity for countries to improve

their possible situations in terms of Complexity,

which would increase the probability of achieving

development (increasing complexity implies

increasing the probability of achieving economic

development and improvement in many things).

It is very important to highlight that this

methodological procedure is the first step to advance

in an area that has practically not taken this type of

problem into account, which is economic integration

or international productive integration. The

complexity of creating integration ties between

different nations is high and has been the subject of

study for a long time, and this methodology aims to

provide a useful tool that can be used by policy

makers and decision makers as an input in the

process. analysis and design of international policies

in the area. The problem of international economic

integration will always persist; therefore, new

analytical tools and perspectives will always be of

great help in the process.

In terms of academic essays, it is recommended

to continue with them, experimentally, applying more

than one economic block for each run or calculation

of complexity metrics (both approaches) in addition

to carrying out more in-depth studies to interpret the

particularities obtained by both approaches. and their

differences (Economic Complexity Vs. Economic

Fitness). In the case of the use of real export data, it

is recommended to study historical data and approach

the studies with separate approaches (Economic

Complexity and on the other hand Economic Fitness),

in such a way that an analysis of the results can be

adequately carried out.

ACKNOWLEDGEMENTS

The authors are very grateful to the Paraguayan

National Council of Science and Technology

(CONACyT) for financial support through the

PRONII Program.

COMPLEXIS 2023 - 8th International Conference on Complexity, Future Information Systems and Risk

120

AUTHORS CONTRIBUTIONS

The authors declare the following contributions in

this study:

Activities

Methodology

Literature

Review

Mathematic

Model

Data

Manuscript

Calculations

Results

Analysis

A.G. X X X X X X X

S. G. X X X X X X X

G. P. X X X X

G. B. X X X

C. vL. X X X

REFERENCES

Amine, L. S. (1986). Multinational corporations in Eastern

Europe: Welcome trade partners or unwelcome change

agents?. Journal of Business Research, 14(2), 133-145.

Balassa, B. (1965). Trade liberalisation and “revealed”

comparative advantage 1. The manchester school,

33(2), 99-123.

Basnet, H. C., & Pradhan, G. (2017). Regional economic

integration in Mercosur: The role of real and financial

sectors. Review of development finance, 7(2), 107-119.

Basnet, H. C., & Pradhan, G. (2017). Regional economic

integration in Mercosur: The role of real and financial

sectors. Review of development finance, 7(2), 107-119.

Baer, W., Cavalcanti, T., & Silva, P. (2002). Economic

integration without policy coordination: the case of

Mercosur. Emerging Markets Review, 3(3), 269-291.

Cristelli, M., Gabrielli, A., Tacchella, A., Caldarelli, G., &

Pietronero, L. (2013). Measuring the intangibles: A

metrics for the economic complexity of countries and

products. PloS one, 8(8), e70726.

Cristelli, M., Tacchella, A., & Pietronero, L. (2015). The

heterogeneous dynamics of economic complexity. PloS

one, 10(2), e0117174.

Carranza, G. G. (2017). Íter constitutivo y desafíos del

Parlamento del Mercosur. Especial alusión al caso

argentino. Cuestiones constitucionales, (36), 51-77.

Caceres, L. R. (2011). Economic integration and

unemployment in Mercosur. Journal of Economic

Integration, 45-65.

González, S.; Pereira, G. and González, A. (2022).

Sustainability and Goal Fitness Index for the Analysis

of Sustainable Development Goals: A Methodological

Proposal. In Proceedings of the 7th International

Conference on Complexity, Future Information Systems

and Risk - COMPLEXIS, ISBN 978-989-758-565-4;

ISSN 2184-5034, pages 105-115. DOI:

10.5220/0011122400003197

González, A., Ortigoza, E., Llamosas, C., Blanco, G., &

Amarilla, R. (2019). Multi-criteria analysis of

economic complexity transition in emerging

economies: The case of Paraguay. Socio-Economic

Planning Sciences, 68, 100617.

Hausmann R, Hidalgo CA, Bustos S, Coscia M, Chung S,

Jimenez J., Simoes, A., Yildirim, M., 2011. The Atlas

of economic complexity: mapping paths to prosperity.

Cambridge, Mass: Center for International

Development, Harvard University; Harvard Kennedy

School; Macro Connections, Massachusetts Institute of

Technology

Hidalgo CA, Hausmann R. The building blocks of

economic complexity. Proc Natl Acad Sci USA

2009;106(26):10570–5. http://dx.doi.org/10.1073/pnas.

Hidalgo, C. A. (2021). Economic complexity theory and

applications. Nature Reviews Physics, 3

(2), 92-113.

Mariani, M. S., Vidmer, A., Medo, M., & Zhang, Y.-C.

(2015). Measuring economic complexity of countries

and products: which metric to use? The European

Physical Journal B, 88(11). doi:10.1140/epjb/e2015-

60298-7

Morrison, G., Buldyrev, S. V., Imbruno, M., Doria Arrieta,

O. A., Rungi, A., Riccaboni, M., & Pammolli, F.

(2017). On economic complexity and the fitness of

nations. Scientific Reports, 7(1), 15332.

Pugliese, E., Zaccaria, A., & Pietronero, L. (2016). On the

convergence of the Fitness-Complexity Algorithm. The

European Physical Journal Special Topics, 225(10),

1893-1911.

Pereira, G.; González, A. and Blanco, G. (2021).

Complexity Measures for the Analysis of SDG

Interlinkages: A Methodological Approach. In

Proceedings of the 6th International Conference on

Complexity, Future Information Systems and Risk -

COMPLEXIS, ISBN 978-989-758-505-0; ISSN 2184-

5034, pages 13-24. DOI: 10.5220/0010374600130024

Pérez Bustamante, R. (2012). Formas y ventajas de la

integración. Mediterráneo Económico, 22, 205-212.

Pereira, G., González, A., & Ríos, R. (2021). Capturing

multidimensional energy poverty in South America: a

comparative study of Argentina, Brazil, Uruguay, and

Paraguay. Frontiers in Sustainable Cities, 46.

Tacchella, A., Cristelli, M., Caldarelli, G., Gabrielli, A., &

Pietronero, L. (2012). A new metrics for countries'

fitness and products' complexity. Scientific reports,

2(1), 1-7.

Tacchella, A., Cristelli, M., Caldarelli, G., Gabrielli, A., &

Pietronero, L. (2013). Economic complexity:

conceptual grounding of a new metrics for global

competitiveness. Journal of Economic Dynamics and

Control, 37(8), 1683-1691.

Timini, J., & Viani, F. (2022). A highway across the

Atlantic? Trade and welfare effects of the EU-Mercosur

agreement. International Economics, 169, 291-308.

Vinci, G. V., & Benzi, R. (2018). Economic complexity:

Correlations between gross domestic product and

fitness. Entropy, 20(10), 766.

Zaman, M., Pinglu, C., Hussain, S. I., Ullah, A., & Qian, N.

(2021). Does regional integration matter for sustainable

economic growth? Fostering the role of FDI, trade

openness, IT exports, and capital formation in BRI

countries. Heliyon, 7(12), e08559.

International Economic Integration from the Perspective of Economic Complexity and Economic Fitness: A Methodological Proposal

121