Unveiling the Digital and Sustainability Convergence: Leveraging

Blockchain for Grand Challenges Oriented Business Model

Innovation

Davide Moiana, Jacopo Manotti, Antonio Ghezzi and Andrea Rangone

Politecnico di Milano, Department of Management, Economics and Industrial Engineering,

Via Lambruschini 4B, 20156 Milan, Italy

Keywords: Business Model Innovation, Grand Challenges, Emerging Technology, Blockchain, Tokens, DAO.

Abstract: Social and ecological challenges are increasingly threatening the world, asking for concrete actions from all

the actors and sectors of our society. Broad social and environmental problems have been collected below the

definition of “Grand Challenges” (GCs), to represent their wicked nature and tough resolution. In order to

advance these goals, the United Nations in 2015 ratified the so-called 2030 Agenda for Sustainable

Development, which includes 17 Sustainable Development Goals (SDGs). This new imperative implies firms

to shift towards new sustainable practices and innovate their business models. Management research has

identified in emerging technology one of the most powerful means for Business Model Innovation (BMI). In

this regard, blockchain is claimed to have the ability to drastically restructure firms' business structures and

markets. By way of an inductive multiple-case study analyzing 4 start-ups in the Voluntary Carbon Market

(VCM) field, this research proposes a conceptual model summarizing three actionable characteristics (Asset

enabler, Trust machine, Collaborative and coordinated action enhancer) through which blockchain

technologies can drive BMI, making it clear on how they enable to embed GCs in the business model

components.

1 INTRODUCTION

The critical social and environmental issues world is

facing nowadays have been called "Grand

challenges" (GCs), which are wicked issues with

complex, no clear and unequivocal solution (Ferraro,

Etzion, & Gehman, 2015; George, Howard-

Grenville, Joshi, & Tihanyi, 2016). The United

Nations' 2030 Agenda for Sustainable Development

outlines 17 Sustainable Development Goals (SDGs)

aimed at achieving social, environmental, and

economic objectives. To address these goals,

governments, businesses, and individuals must work

collaboratively (Grodal & O'Mahony, 2017; Howard-

Grenville & Spengler, 2022). Firms must also adapt

to the evolving definition of their role in society,

shifting towards generating shared value for all

stakeholders. This requires transitioning towards

sustainable practices, facilitated by technological

solutions (Foss & Saebi, 2017; George et al., 2016),

including blockchain, which we examine in this

research. Through an inductive multiple case study in

the Voluntary Carbon Market (VCM), we identify

blockchain's potential as an asset enabler, trust

machine, and enhancer of coordinated and

collaborative action, proposing a theory of strategic

business model design for Grand Challenges. Our

research contributes to the convergence of the digital

and sustainable imperative and advances the

understanding of technology's impact on business

models.

2 THEORETICAL

BACKGROUND

George and colleagues (2016), describes GCs as

“formulations of global problems that can be

plausibly addressed through coordinated and

collaborative effort” (George et al., 2016; Howard-

Grenville et al., 2019). Namely, GCs call for a

coordinated and consistent effort from a wide range

of stakeholders from different levels of organizations

and society, for alterations in the way economic

136

Moiana, D., Manotti, J., Ghezzi, A. and Rangone, A.

Unveiling the Digital and Sustainability Convergence: Leveraging Blockchain for Grand Challenges Oriented Business Model Innovation.

DOI: 10.5220/0012093800003552

In Proceedings of the 20th International Conference on Smart Business Technologies (ICSBT 2023), pages 136-143

ISBN: 978-989-758-667-5; ISSN: 2184-772X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

activities are planned and carried out and for

advancements in tools and technology (George et al.,

2016; Griggs et al., 2013; Muzio & Doh, 2021). For

profit businesses, alone or in conjunction with

governmental and non-profit organizations, are

relevant actors in this regard, as they represent a

“locus of innovation” and they can play a central role

in fostering social impact collaboration (Bode,

Rogan, & Singh, 2019; Wang, Tong, Takeuchi, &

George, 2016).

Business model innovation (BMI) is increasingly

recognized as a key driver to deliver greater social

and environmental sustainability in the industrial

system, as it entails holistic changes to how business

is conducted on multilevel and multistakeholder

dimension (Bocken et al., 2014; Klein, Spieth, &

Heidenreich, 2021). Zott and Amit (2010) define the

business model as an architecture of value that can be

described as a network of activities, activities and

transactions that involve internal and external

stakeholder that can be described in terms of content,

structure and governance. An activity system is also

characterized by different dominant logics to achieve

value creation: Novelty, efficiency,

complementarities and lock-in (Zott & Amit, 2010).

Sustainable business model innovation is defined

as the incorporation of heterogeneous logic within

business, considering the so-called economic,

environmental and social “triple bottom line”

(Bocken et al., 2014; Stubbs, 2017). According to

Cohen & Winn (2007), sustainable business models

should aim to tackle market inefficiencies such as

imperfect competition, negative externalities, and

information asymmetry. However, implementing

sustainable business models can be challenging due

to six managerial problems that pose significant

obstacles to achieving sustainable change, identified

by George and colleagues (2021): knowing,

valuating, communicating, coordination and trust,

access and reach and institution.

Emerging technologies have the potential to

enable sustainable-oriented business model

innovation (BMI) (Foss and Saebi, 2017; Teece

2018). Emerging technology–enabled BMI can have

a profound impact on stakeholders in the ecosystem,

including customers, suppliers, and strategic partners,

creating new needs and leading to novel resource

configurations (Amit & Han, 2017; George et al.,

2021).

Blockchain, an electronic ledger system that

enables secure and transparent transactions without

the need for intermediaries, has emerged as a

particularly interesting technology to study due to its

potential for disrupting various industries. It fulfills

the five parameters identified by Rotolo, Hicks, and

Martin (2015) to define an emerging technology:

radical novelty, fast growth, coherence, prominent

impact, uncertainty, and ambiguity. However, these

properties are not fundamental actionable

characteristics, but rather factors that explain the

diffusion and impact of a technology, allowing it to

be classified as "emergent” and advancing the

consolidated work on technology diffusion (Tushman

& Anderson, 1986; Utterback & Abernathy, 1975).

Recognizing the emergent nature of blockchain

and the possible consequent implications in terms of

BMI and GCs, the research questions investigated in

this study is “How blockchain enables the design of

Grand Challenge-oriented business models?".

3 METHODOLOGY

The unit of analysis aim of this research are the

technological features of blockchain that enable new

sources innovation in the business model design

elements proposed by Zott & Amit (2010) in their

activity-system view, and how they tackle the

managerial problems formulated by George and

colleagues (2021).

Blockchain impact on sustainable business

models is a research field still unexplored, from

which new theory can emerge (Bansal & Corley,

2011; Eisenhardt, 1989). As a result, it is

advantageous to proceed with qualitative research

(Gartner & Birley, 2002). More specifically, it was

chosen to conduct an inductive multiple case study

(Eisenhardt, 1989; Yin, 1984). This approach is

preferred over a single case study due to its robustness

and ability to enable comparisons between different

manifestations of the phenomenon, thereby

increasing the generalizability of results (Eisenhardt

& Graebner, 2007; Meredith, 1998).

3.1 Empirical Setting

Climate change is one of the most critical challenges

facing humanity, as it is widely considered a

significant threat (Pörtner & Roberts, 2022). The

primary issue with climate change is the rising

concentration of greenhouse gases in the atmosphere,

which causes global warming. However, in most

industries, there is no penalty for causing air

pollution.

Carbon markets can be an effective tool for

addressing the negative externalities associated with

greenhouse gas emissions. Voluntary Carbon

Markets (VCM) are non-regulated markets where

Unveiling the Digital and Sustainability Convergence: Leveraging Blockchain for Grand Challenges Oriented Business Model Innovation

137

organizations participate based on self-imposed

emissions reduction goals. Actors can offset their

impact by purchasing carbon credits generated

through the development of mitigation projects that

follow international methodologies, verified and

certified by external accreditation entities such as

Verra and Gold Standard (Ieta, 2021).

Voluntary carbon market should increase by a

factor of or more by 2030 and by a factor of up to 100

by 2050. However, the market faces several

challenges that impede it to scale up, including

measurement technical issues, heterogeneity and

illiquidity of carbon credits, greenwashing concerns,

opaqueness and fragmentation, entry barriers and lack

of regulation (McKinsey, 2021).

The use of blockchain technology is becoming

increasingly popular among practitioners who are

determined to combat climate change and promote

decarbonization of the global economy. This growing

interest is apparent in the astonishing number of new

companies that are emerging, offering innovative

solutions that leverage blockchain for carbon markets

(Morgan Stanley, 2022; Southpole, 2022).

3.2 Case Sampling

To ensure appropriate theoretical reasoning and high-

quality case study research, a theoretical sampling

approach was utilized to select cases for this multiple

case study with potential to offer theoretical insights

(Goffin, Ahlstrom, Bianchi & Richtner; 2019;

Eisenhardt & Graebner, 2007).

Pitchbook, a subscription-based website covering

private capital markets such as venture capital and

private equity, was the primary source for identifying

blockchain-based startups for case selection. Searches

were conducted using keywords such as "Blockchain"

AND "Sustainability" or "Blockchain" AND

"Environmental services." Once a sufficiently large

initial sample was gathered, the cases were filtered to

select the most notable examples for examination,

ensuring the heterogeneity logic and alignment with

the thesis's goal. As a result, the final sample consisted

of four blockchain-based startups: Company A,

Company B, Company C, and Company D.

3.3 Data Collection and Analysis

The research employed a data triangulation approach

to ensure robust results for the qualitative research.

Multiple sources of information were used, including

primary and secondary sources, such as semi-

structured interviews with founders and C-levels, as

well as information from the companies' websites,

whitepapers, and third-party articles. (Yin, 1984;

Bonoma, 1985).

The researchers conducted eight semi-structured

interviews over two distinct waves, with each session

lasting between 31 and 76 minutes. The informant for

each company remained the same during both rounds.

For both the rounds, all sessions lasted between 31

and 76 minutes. A total of 380 minutes of material

was recorded, and the results were transcribed into

107 pages. To improve the overall rigor of the case

study, as recommended by Eisenhardt (1989) and Yin

(1984), the final outcome of primary data was

triangulated with secondary sources.

The study's research question was used to create a

consistent protocol for the pilot interview. The first

set of questions focused on understanding the

business models in terms of design elements and

themes (Zott & Amit, 2010)., while the second set of

questions investigated the sustainability contribution

through the lenses of GCs managerial problems

(George et al, 2021), with a particular emphasis on

the contribution of technology for the resolution of

those problems. The second round of interviews

allowed for a deeper investigation of specific

blockchain applications and topics that were

overlooked in the first phase (Yin, 1984).

After the data collection phase, the data analysis

was carried out. The recordings were transcribed, and

a within-case study data analysis was performed in

accordance with Eisenhardt (1989). Ground theory

methodology (B. Glaser & Strauss, 1967; Strauss &

Corbin, 1998) was adopted to study each case

according to an open coding practice, allowing to

investigate complex phenomena using labels, thus

generating theory from interviews. The collected data

allowed the generation of in-vivo codes dataset and

the analysis following constant comparative method

(Gioia et al., 2013). Subsequently, a comparison of

codes from the different cases was carried out to

obtain the formulation of first-order concepts. The

second-order codes were then aggregated into two

major overarching dimensions: (1) Business model

design themes routed in Zott & Amit (2010) seminal

work; (2) Grand Challenges managerial problems,

based on George and colleagues (2021) work.

In the cross-case analysis, similarities and

differences at different abstraction levels were looked

at to compare the differences between the four cases,

allowing for novel findings (Eisenhardt, 1989). The

correlation between Grand Challenges managerial

problems and design themes was investigated, and the

final result was graphically represented using coding

trees (Gioia et al., 2013).

ICSBT 2023 - 20th International Conference on Smart Business Technologies

138

4 RESULTS

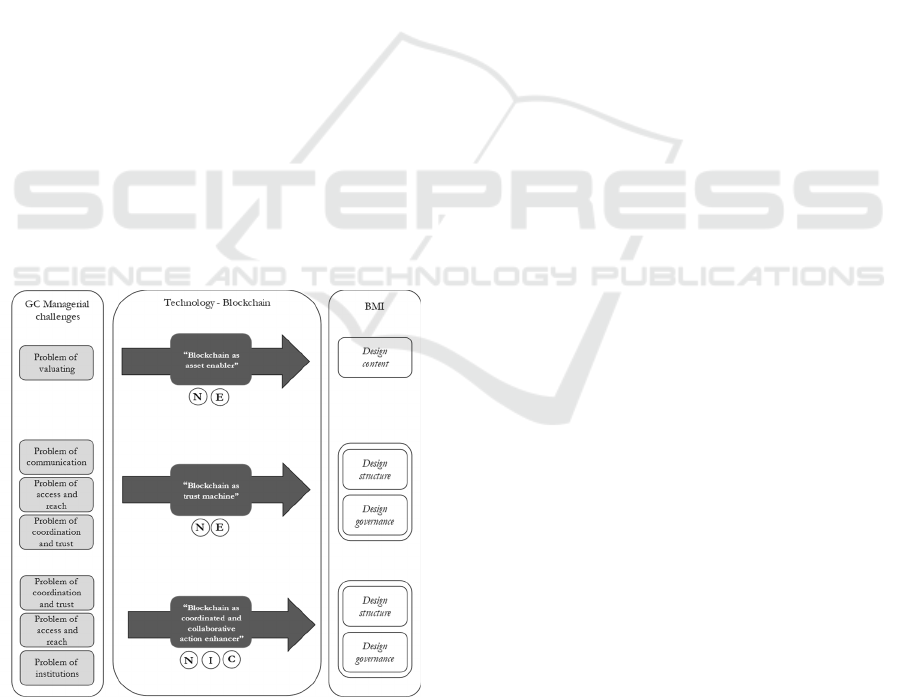

The cross-case analysis, carried out triangulating

primary data coming from interviews with secondary

data, has been the foundation for the conceptual

framework described in figure 1.

Overarching Dimension 1: GCs Managerial

Problems.

The GCs managerial problems described by George

and colleagues (George-et-al, 2021), are routed in the

business model design elements identified by Zott &

Amit (2010). Namely, the first two problem -

problem of knowing and problem of valuating – are

associated to design content, being the knowledge

and the valuation of natural and social capital,

fundamental to act within sustainability domain. The

third and fourth problem – problem of

communicating and problem of coordination and trust

– are tied to design structure, as they entail the

reshaping of links between actors in the market and

changes in the way they communicate. Finally, the

last two problems – problem of access and reach and

problem of institutions – concern design governance,

as they deal with actors’ access and the institutions’

role in the activity system.

Our cases reveal that blockchain seems not to

cover a role in addressing the technical difficulties in

obtaining an accurate and reliable measurement of a

project's impact (problem of knowing). Being

blockchain a distributed ledger, it has significant

implications for how data is managed and shared

among actors, but not for how data is obtained (for

which other technologies can be leveraged, i.e.,

oracles such as sensors or satellites).

According to the findings, blockchain can

successfully contribute by addressing the

heterogeneity and illiquidity issues of carbon markets

(problem of valuating) – while allowing to tokenize

and fractionalize carbon credits. As described by

Company C CIO: “The liquidity has to do with

creating baskets of tokens on chain where we take a

certain quality of token. There will be a third party

that will just determine which tokens would be

allowed into the basket; in that way, you can have

literally millions of carbon credits in the basket and a

single tradable token can be traded on centralized or

decentralized exchanges." Carbon credit baskets

aggregate credits from comparable carbon offsetting

initiatives, boosting the homogeneity of the supply of

carbon credits. Increased liquidity results in correct

price discovery for each credit class: “The current

illiquid system can work for a company buying a

bunch of credits. But, if you want to have traders in

the market and people who are longing carbon

credits, you need to have much larger liquidity”

(CIO, Company C).

Concerning problem of communicating,

blockchain represent a reliable mean to tackle

greenwashing. In the distributed ledger, all

information about each carbon credit is shared and

accessible: “when somebody buys one of our carbon

credits, they are not only buying a net 0 carbon

reduction. They're also buying ESG reporting data”

(CEO, CAS).

All the startups evaluated addressed the VCM's

opaqueness and fragmentation issues (problem of

coordination and trust). Within a blockchain

distributed ledger system, retiring a credit involves

the burning of the underlying smart contract. This

eliminates the possibility of double-counting, which

can occur when a credit is sold and then resold

through a broker or trader. Moreover, the peer-to-peer

nature of blockchain technology can promote higher

degrees of disintermediation within the activity-

system, where brokers, traders, and merchants no

longer play a vital role in the market. As described by

Company A CEO: “we're basically disrupting the

brokers, traders and exchanges; we're shortening the

value chain”. Furthermore, blockchain's

decentralization features enable the proposal of a new

methodology for carbon offset verification through a

DAO, where token holders can vote on its

implementation, creating a decentralized governance

mechanism.

As a result, blockchain can help by providing the

tools for removing entry barriers (problem of access

and reach). Blockchain-based startups are leveraging

the technology's benefits to reduce transaction costs

and improve financing opportunities for carbon credit

projects. These startups are combining blockchain

with other measuring technologies, such as sensors

and satellites, to develop new digital measurement,

reporting, and verification methodologies. This

approach significantly reduces verification costs for

project developers, making it more efficient and less

time-consuming than traditional manual methods

used by standard organizations such as Verra and

Gold Standard. As described by Company C CEO:

“The process of sequestering carbon is still going to

be at the same speed. It works at the speed of biology.

But hopefully the process to validate and verify and

collect data will be perhaps quicker and more

inexpensive than in other projects”.

Finally, blockchain may fill the institutional

failures (problem of institutions) of traditional

voluntary carbon markets; Blockchain can serve as a

global distributed platform infrastructure for

Unveiling the Digital and Sustainability Convergence: Leveraging Blockchain for Grand Challenges Oriented Business Model Innovation

139

transacting carbon credits, without heavy reliance on

trust intermediaries. As highlighted by Company A

CEO: "[stakeholders] They don't have to trust a close

service report [standards’ organizations services];

you can trust a much more distributed and

decentralized validation of the proof of your carbon

purchase or offsetting”.

Overarching Dimension 2: Design Themes.

The cross-case analysis suggests that blockchain's

novelty is primarily through tokens. Governance

tokens enable new forms of decentralized governance

(i.e., Decentralized Autonomous Organizations),

while utility tokens represent on-chain carbon credit

revival. Regarding these digital artifacts, Company D

whitepaper affirms: “Tokens have multiple

advantages over legacy offsets, including full

transparency, programmability and

fractionalization”.

The tokenization of carbon credits allows for

more efficient and transparent transactions, as the use

of smart contracts on a decentralized ledger

eliminates the need for intermediaries and automates

trustless transactions. This leads to a decrease in

transaction costs and information asymmetry,

improving the overall efficiency of carbon markets.

Additionally, the use of tokens as a representation of

carbon credits allows for fractionalization and

increased accessibility for smaller investors, further

promoting the efficiency and democratization of the

market.

Figure 1: Conceptual Framework.

Concerning the value source of complementarity,

two main insights emerge. First, the application of

blockchain is empowered with the usage of a

combination of other emerging technologies to

innovate the measurement phase (i.e., oracles):

“There are complementarities from a technological

point of view, with the convergence of IoT, Remote

Sensing, Satellite's image and blockchain is possible

to develop D-MRV methodologies” (CIO, Company

C). Secondly, blockchain's open-source logics

facilitate cooperation among various actors, leading

to composability and encouraging innovation in the

carbon market. Governance tokens and DAOs allow

investors to participate in decision-making and share

profits, generating new lock-in mechanisms.

5 DISCUSSION AND

CONCLUSIONS

This study contributes to the call by Bocken,

Heidenreich, Spieth, Tucci and Zott (2022), who

asked researchers to investigate business model

innovation as a mean to address Grand Challenges.

By drawing on the case of voluntary carbon market,

we get to explore how blockchain can contribute to

the improvement of sustainable issues. In particular,

our contribution is twofold.

First, we provide a theoretical contribution to the

BMI and GCs literatures by studying business model

innovation as a means of addressing Grand

Challenges. In particular, we shed light on the so-

called "digital and sustainability imperative

convergence" (George-et-al, 2021). Building on the

business model construct proposed by Zott & Amit

(2010) in their activity-system view, our framework

(fig.1) illustrates three features that characterize

blockchain as enabler of novel forms of design

content, structure and governance; specifically,

blockchain acts as asset enabler, as trust machine and

as coordinated and collaborative action enhancer.

Feature 1: Blockchain as Asset Enabler.

Blockchain acts as an asset enabler as it offers new

ways to design and create digital and real-world

assets. Ownership is a fundamental attribute that

blockchain adds to the internet we use today, which

allows for the emergence of new asset classes.

Governance tokens are a prime example of asset

classes that are built natively on-chain and govern the

consensus mechanism of blockchain protocols and

projects. These tokens offer new forms of stake,

rights, and participation (F. Glaser, 2017; Trabucchi,

Moretto, Buganza, & MacCormack, 2020).

Additionally, tokenized assets are digital twins of

current real assets that are represented and

ICSBT 2023 - 20th International Conference on Smart Business Technologies

140

transferrable on the distributed ledger (Gan,

Tsoukalas, & Netessine, 2021; George et al., 2021).

The emergence of tokens as a source of design

content creates new activities that are related to token

design (i.e., defining the conditions under which

participants can earn new tokens for contributing

resources to the network and defining the rights

associated with token ownership) (Catalini & Gans,

2020; Forman et al., 2019; F. Glaser, 2017).

Tokens also contribute to sustainable

development by addressing the problem of valuation.

As our research confirms, tokenization transforms

natural capital into precise, manageable, fungible, or

non-fungible, tradeable units for which new markets

can establish prices. By using tokens, it becomes

possible to assess and value ecological and social

assets in new ways. This creates opportunities for

individuals to gain access to asset classes and risks

that may have been beyond their capacity (George et

al., 2021; Santos, Pache, & Birkholz, 2015).

Feature 2: Blockchain as Trust Machine.

The trust machine property is linked to the nature of

its distributed ledger and consensus mechanism.

Smart contracts enable multiple parties who do not

trust one another to engage in exchanges of value

when certain conditions are met (Catalini & Gans,

2020; Forman et al., 2019; Murray, Kuban, Josefy, &

Anderson, 2021). The distributed ledger and

consensus mechanism of blockchain technology have

significant implications for reducing transaction

costs. These costs are associated with intermediaries

and their related expenses, including verification,

searching, and coordination costs, which traditional

and digital intermediaries have emerged to address

(Bailey & Bakos, 1997; Clemons, Reddi, & Row,

1993; Malone, Williamson, 1993; Yates, &

Benjamin, 1987; Zott et al., 2011). Our study shows

that blockchain technology enhance trust and

transparency by reducing costs and time for

validating trading partners. By shifting trust to the

consensus algorithm rather than to a central entity,

blockchain enables actors to trade in a large-scale

decentralized fashion, without the need for a

trustworthy intermediary. This allows participation

for actors who were previously excluded from

existing activity systems, opening new possibilities

for economic and social participation Santos et al.,

2015). Building trust is essential in various domains

of sustainability, especially when exchanging goods

or services that have a social or ecological impact. A

transparent distributed ledger can enhance trust by

preventing information asymmetries and

opportunistic behaviors (George, 2021).

Feature 3: Blockchain as Coordinated and

Collaborative Action Enhancer.

The definition of Grand Challenges provided by

George and colleagues (2016), emphasizes the need

for “coordinated and collaborative effort”. However,

traditional organizational structures may not be

suitable for GCs as they lack centralized control over

their participants, as argued by some researchers

(Ferraro et al., 2015; Howard-Grenville & Spengler,

2022; Luo, Zhang, & Marquis, 2016). Blockchain

protocols pave the way to new distributed governance

paradigms, incentives systems, and new open-source

collaboration mechanisms. These can serve as a

mechanism for designing new forms of rewards

aimed at achieving alignment in addressing Grand

Challenge. This aligns with Adner's (2017) definition

of "ecosystem-as-a-structure," which characterizes

ecosystems as the structural alignment of multiple

partners who must interact to realize a central value

proposition. In the context of Grand Challenges, a

social or environmental challenge may represent the

central value proposition that a set of partners

collectively tackle with their efforts.

Blockchain, Value Creation Logics and

Technological Convergence.

Prior literature has highlighted the importance of

synergy across value logics to achieve good designs

(Amit & Zott, 2001). We find not only that

blockchain based business model exhibit all the value

creation themes (novelty, efficiency,

complementarity and lock-in), but also that there is

strong inter-relationship among them. Specifically,

we show how the "asset enabler" and "trust machine"

properties of blockchain promote efficiency and

novelty logics, while the "coordinated and

collaborative action enhancer" property stimulates

novelty, complementarity, and lock-in logics.

Additionally, building upon Teece's (2018) argument

on technological convergence, we observe that the

composability within different Blockchain protocols,

as well as their integration with other consolidated

and emerging technologies (i.e., oracles, including

remote sensing and satellites) play a crucial role in

unlocking the emerging technology's full potential.

REFERENCES

Adner, R. (2017). Ecosystem as Structure: An Actionable

Construct for Strategy. Journal of Management, 43,

39–58.

Amit, R., & Han, X. (2017). Value Creation through Novel

Resource Configurations in a Digitally Enabled World:

Novel Resource Configurations in a Digitally Enabled

Unveiling the Digital and Sustainability Convergence: Leveraging Blockchain for Grand Challenges Oriented Business Model Innovation

141

World. Strategic Entrepreneurship Journal, 11, 228–

242.

Amit, R., & Zott, C. (2001). Value creation in E-business.

Strategic Management Journal, 22, 493–520.

Bailey, J. P., & Bakos, Y. (1997). An Exploratory Study of

the Emerging Role of Electronic Intermediaries.

International Journal of Electronic Commerce, 1, 7–20.

Bansal, P. (Tima), & Corley, K. (2011). The Coming of Age

for Qualitative Research: Embracing the Diversity of

Qualitative Methods. Academy of Management

Journal, 54, 233–237.

Bocken, N. M. P., Short, S. W., Rana, P., & Evans, S.

(2014). A literature and practice review to develop

sustainable business model archetypes. Journal of

Cleaner Production, 65, 42–56.

Bode, C., Rogan, M., & Singh, J. (2019). Sustainable Cross-

Sector Collaboration: Building a Global Platform for

Social Impact. Academy of Management Discoveries, 5,

396–414.

Bonoma, T. V. (1985). Case Research in Marketing:

Opportunities, Problems, and a Process. Journal of

Marketing Research, 22, 199.

Catalini, C., & Gans, J. S. (2020). Some Simple Economics

of the Blockchain.

Clemons, E. K., Reddi, S. P., & Row, M. C. (1993). The

Impact of Information Technology on the Organization

of Economic Activity: The “Move to the Middle”

Hypothesis. Journal of Management Information

Systems, 10, 9–35.

Cohen, B., & Winn, M. I. (2007). Market imperfections,

opportunity and sustainable entrepreneurship. Journal

of Business Venturing, 22, 29–49.

Eisenhardt, K. (1989). Building Theories from Case Study

Research. The Academy of Management Review, Vol.

14, No. 4, 532–550.

Eisenhardt, K., & Graebner, M. (2007). Theory Building

From Cases: Opportunities And Challenges. Academy

of Management Journal, Vol. 50, No. 1.

Ferraro, F., Etzion, D., & Gehman, J. (2015). Tackling

Grand Challenges Pragmatically: Robust Action

Revisited. Organization Studies, 36, 363–390.

Forman, C., Henkel, J., Leiponen, A. E., Thomas, L. D. W.,

Altmann, P., Halaburda, H., … Obermeier, D. (2019).

The Trust Machine? The Promise of Blockchain-Based

Algorithmic Governance of Exchange. Academy of

Management Proceedings, 2019, 13603.

Foss, N. J., & Saebi, T. (2017). Fifteen Years of Research

on Business Model Innovation: How Far Have We

Come, and Where Should We Go? Journal of

Management, 43, 200–227.

Gan, J. (Rowena), Tsoukalas, G., & Netessine, S. (2021).

Initial Coin Offerings, Speculation, and Asset

Tokenization. Management Science, 67, 914–931.

Gartner, W. B., & Birley, S. (2002). Introduction to the

special issue on qualitative methods in entrepreneurship

research. Journal of Business Venturing, 17, 387–395.

George, G., Howard-Grenville, J., Joshi, A., & Tihanyi, L.

(2016). Understanding and Tackling Societal Grand

Challenges through Management Research. Academy

of Management Journal, 59, 1880–1895.

George, G., Merrill, R. K., & Schillebeeckx, S. J. D. (2021).

Digital Sustainability and Entrepreneurship: How

Digital Innovations Are Helping Tackle

Climate Change and Sustainable Development.

Entrepreneurship Theory and Practice, 45, 999–1027.

Gioia, D. A., Corley, K. G., & Hamilton, A. L. (2013).

Seeking Qualitative Rigor in Inductive Research: Notes

on the Gioia Methodology. Organizational Research

Methods, 16, 15–31.

Glaser, B., & Strauss, A. (1967). The discovery of

Grounded Theory. Aldine Transaction.

Glaser, F. (2017). Pervasive Decentralisation of Digital

Infrastructures: A Framework for Blockchain enabled

System and Use Case Analysis. Presentato al Hawaii

International Conference on System Sciences.

https://doi.org/10.24251/HICSS.2017.186

Goffin, K., Åhlström, P., Bianchi, M., & Richtnér, A.

(2019). Perspective: State‐of‐the‐art: The quality

of case study research in innovation management.

Journal of Product Innovation Management, 36(5),

586-615.

Griggs, D., Stafford-Smith, M., Gaffney, O., Rockström, J.,

Öhman, M. C., Shyamsundar, P., … Noble, I. (2013).

Sustainable development goals for people and planet.

Nature, 495, 305–307.

Grodal, S., & O’Mahony, S. (2017). How does a Grand

Challenge Become Displaced? Explaining the Duality

of Field Mobilization. Academy of Management

Journal, 60, 1801–1827.

Holotiuk, F., Pisani, F., & Moormann, J. (2019).

Radicalness of blockchain: An assessment based on its

impact on the payments industry. Technology Analysis

& Strategic Management, 31, 915–928.

Howard-Grenville, J., Davis, G. F., Dyllick, T., Miller, C.

C., Thau, S., & Tsui, A. S. (2019). Sustainable

Development for a Better World: Contributions of

Leadership, Management, and Organizations. Academy

of Management Discoveries, 5, 355–366.

Howard-Grenville, J., & Spengler, J. (2022). Surfing the

Grand Challenges Wave in Management Scholarship:

How Did We Get Here, Where are We Now, and

What’s Next? In A. Aslan Gümüsay, E. Marti, H.

Trittin-Ulbrich, & C. Wickert (A c. Di), Organizing for

Societal Grand Challenges (pp. 279–295). Emerald

Publishing Limited.

Ieta.org. (2021). The anatomy of carbon market. Retrieved

from: https://www.ieta.org/resources/Resources/GHG

_Report/2021/IETA-2021-GHG-Report.pdf

Klein, S. P., Spieth, P., & Heidenreich, S. (2021).

Facilitating business model innovation: The influence

of sustainability and the mediating role of strategic

orientations. Journal of Product Innovation

Management, 38, 271–288.

Luo, X. R., Zhang, J., & Marquis, C. (2016). Mobilization

in the Internet Age: Internet Activism and Corporate

Response. Academy of Management Journal, 59, 2045–

2068.

Malone, T. W., Yates, J., & Benjamin, R. I. (1987).

Electronic markets and electronic hierarchies.

Communications of the ACM, 30, 484–497.

ICSBT 2023 - 20th International Conference on Smart Business Technologies

142

McDonald, R. M., & Eisenhardt, K. M. (2020). Parallel

Play: Startups, Nascent Markets, and Effective

Business-model Design. Administrative Science

Quarterly, 65, 483–523.

McKinsey. (2021). Carbon credits: Scaling voluntary

markets. Retrieved from: https://www.mckinsey.com

/a-blueprint-for-scaling-voluntary-carbon-markets-to-

meet-the-climate-challenge

Meredith, J. (1998). Building operations management

theory through case and field research. Journal of

Operations Management, 16, 441–454.

Morgan Stanley. (2022). Crypto & Carbon. Retrieved from:

https://www.morganstanley.com/im/publication/insigh

ts/articles/article_cryptoandcarbon_us.pdf

Murray, A., Kuban, S., Josefy, M., & Anderson, J. (2021).

Contracting in the Smart Era: The Implications of

Blockchain and Decentralized Autonomous

Organizations for Contracting and Corporate

Governance. Academy of Management Perspectives,

35, 622–641.

Muzio, D., & Doh, J. (2021). COVID-19 and the Future of

Management Studies. Insights from Leading Scholars.

Journal of Management Studies, 58, 1371–1377.

Pörtner, H.-O., & Roberts, D. C. (s.d.). Climate Change

2022: Impacts, Adaptation and Vulnerability. 3068.

Rotolo, D., Hicks, D., & Martin, B. R. (2015). What is an

emerging technology? Research Policy, 44, 1827–

1843.

Santos, F., Pache, A.-C., & Birkholz, C. (2015). Making

Hybrids Work: Aligning Business Models and

Organizational Design for Social Enterprises.

California Management Review, 57, 36–58.

Snihur, Y., Zott, C., & Amit, R. (Raffi). (2021). Managing

the Value Appropriation Dilemma in Business Model

Innovation. Strategy Science, 6, 22–38.

Southpole. (2022). Blockchain and carbon. Retrieved from:

https://www.southpole.com/fr/blog/blockchain-and-

carbon

Strauss, A., & Corbin, J. (1998). Basics of qualitative

research: Techniques and procedures for developing

grounded theory (2nd ed.). Sage Publications.

Stubbs, W. (2017). Sustainable Entrepreneurship and B

Corps. Business Strategy and the Environment, 26,

331–344.

Teece, D. J. (2018). Profiting from innovation in the digital

economy: Enabling technologies, standards, and

licensing models in the wireless world. Research

Policy, 47, 1367–1387.

Trabucchi, D., Moretto, A., Buganza, T., & MacCormack,

A. (2020). Disrupting the Disruptors or Enhancing

Them? How Blockchain Reshapes Two‐Sided

Platforms. Journal of Product Innovation Management

,

37, 552–574.

Tushman, M. L., & Anderson, P. (1986). Technological

Discontinuities and Organizational Environments.

Administrative Science Quarterly, 31, 439.

Utterback, J. M., & Abernathy, W. J. (1975). A Dynamic

Model of Process and Product Innovation. Omega, VoI.

3, No. 6, 639-656.

Voegtlin, C., Scherer, A. G., Stahl, G. K., & Hawn, O.

(2022). Grand Societal Challenges and Responsible

Innovation. Journal of Management Studies, 59, 1–28.

Wang, H., Tong, L., Takeuchi, R., & George, G. (2016).

Corporate Social Responsibility: An Overview and

New Research Directions. Academy of Management

Journal, 59, 534–544.

Williamson, O. E. (1993). Calculativeness, Trust, and

Economic Organization. The Journal of Law and

Economics, 36, 453–486.

Yin, R. K. (1984). Case study research: Design and

methods. Beverly Hills, Calif.: Sage Publications.

Zott, C., & Amit, R. (2010). Business Model Design: An

Activity System Perspective. Long Range Planning, 43,

216–226.

Zott, C., Amit, R., & Massa, L. (2011). The Business

Model: Recent Developments and Future Research.

Journal of Management, 37, 1019–1042.

Unveiling the Digital and Sustainability Convergence: Leveraging Blockchain for Grand Challenges Oriented Business Model Innovation

143