Detecting Greenwashing in the Environmental, Social, and

Governance Domains Using Natural Language Processing

Yue Zhao

1

, Leon Kroher

2

, Maximilian Engler

2

and Klemens Schnattinger

2

1

Intergration Alpha GmbH, Fabrikstrasse 5, 6330 Cham, Switzerland

2

Business Innovation Center, Baden-Wuerttemberg Cooperative State University (DHBW),

Hangstraße 46-50, 79539 Loerrach, Germany

Keywords: Greenwashing, Natural Language Processing (NLP), Environmental, Social, and Governance (ESG),

Sentiment Analysis, Question-and-Answer Generation, Pharmaceutical Firms, Public Perception, Social

Media, Monitoring Mechanisms.

Abstract: Greenwashing, where companies misleadingly project environmental, social, and governance (ESG) virtues,

challenges stakeholders. This study examined the link between internal ESG sentiments and public opinion

on social media across 12 pharmaceutical firms from 2012 to 2022. Using natural language processing (NLP),

we analyzed internal documents and social media. Our findings showed no significant correlation between

internal and external sentiment scores, suggesting potential greenwashing if there’s inconsistency in sentiment.

This inconsistency can be a red flag for stakeholders like investors and regulators. In response, we propose

an NLP-based Q&A system that generates context-specific questions about a company’s ESG performance,

offering a potential solution to detect greenwashing. Future research should extend to other industries and

additional data sources like financial disclosures.

1 INTRODUCTION

1.1 Research Objective and Hypothesis

This study aims to probe the capability of diverse

Natural Language Processing (NLP) frameworks in

pinpointing greenwashing activities within the

Environmental, Social, and Governance (ESG)

sphere (Kim & Lyon, 2015). Greenwashing refers to

the deceptive portrayal of a firm’s performance in

environmental, social, or governance facets.

Accurately detecting such actions is pivotal for

stakeholders like investors and regulators, ensuring

they gauge a company’s genuine dedication to

sustainability (Delmas & Burbano, 2011). To

accomplish this, we evaluate 12 pharmaceutical

entities based on their 2021 revenue according to

Fortune (2021). Additionally, we introduce

innovative mechanisms tailored for automated

greenwashing surveillance.

Our thesis suggests that a diminished correlation

between sentiment metrics from in-house corporate

resources and external social media narratives hints at

discord between internal strategic utterances and

collective public sentiment (Lyon & Montgomery,

2015). By utilizing the FinBERT-ESG-9-Categories

model pioneered by Huang et al., we aspire to shed

light on potential incongruences in ESG narratives,

hinting at latent greenwashing (Huang et al., 2022).

Through this analytical lens, our research aspires

to shed light on the proficiency of NLP frameworks

in discerning greenwashing undertakings in the ESG

realm, and in the evolution of automated surveillance

systems for a nuanced sustainability performance

appraisal (Asif et al., 2023).

1.2 Greenwashing Detection in ESG via

NLP

Utilizing NLP methodologies for greenwashing

detection in the ESG sphere entails employing

sophisticated computational approaches to scrutinize

and decipher textual data associated with a

corporation’s sustainability endeavours (Davenport

& Harris, 2019). By capitalizing on NLP techniques,

investigators and interested parties can unveil

potential inconsistencies between a firm’s internal

strategic communications and public perceptions,

potentially signifying attempts to overstate or

Zhao, Y., Kroher, L., Engler, M. and Schnattinger, K.

Detecting Greenwashing in the Environmental, Social, and Governance Domains Using Natural Language Processing.

DOI: 10.5220/0012155400003598

In Proceedings of the 15th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2023) - Volume 1: KDIR, pages 175-181

ISBN: 978-989-758-671-2; ISSN: 2184-3228

Copyright © 2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

175

misrepresent ESG accomplishments (Orlitzky, 2011).

Greenwashing detection through NLP may

encompass techniques such as sentiment analysis,

topic modeling, text classification, and knowledge

graph (Liu, 2012). These approaches facilitate the

extraction of valuable insights from diverse data

sources, including corporate reports, press releases,

and social media content (Siano et al., 2021). By

integrating NLP methods in the examination of ESG-

centric data, researchers can devise more rigorous and

dependable mechanisms for identifying greenwashing

practices, ultimately fostering enhanced transparency

and accountability in the corporate sustainability

domain (Delmas & Burbano, 2011).

2 LITERATURE REVIEW

2.1 Greenwashing

Researchers have extensively studied methods to

identify and quantify greenwashing, specifically

focusing on the discrepancies between a company’s

public statements and its actual ESG actions (Marquis

et al., 2016). Recent efforts have pivoted towards

exploiting NLP techniques for greenwashing

identification within the ESG framework. Specifically,

Moodaley et al. (2023) employed bibliometric and

thematic analysis to probe the nexus between

greenwashing, sustainability reporting, and the

confluence of AI and ML in scholarly works.

Woloszyn et al. (2021) highlighted the dynamic

interplay between human-driven and machine-driven

computing in detecting green claims, accentuating the

rising significance of machines in the process. The

burgeoning field of automated tools designed to detect

greenwashing is reshaping the research landscape.

These cutting-edge systems facilitate a continuous

analysis of ESG narratives, providing stakeholders

with a more immediate and efficient means to spot

potential greenwashing activities (Starik et al., 2016).

Nugent et al. (2020) explored the use of pre-trained and

fine-tuned models to categorize ESG topics. Despite

the initial strides in harnessing NLP to detect ESG-

focused greenwashing, there remains a void in the

literature. Specifically, there’s a noticeable dearth of

studies that target the accurate identification of

greenwashing and the enhancement of automated

monitoring tools, especially within the pharmaceutical

sector, through NLP approaches. Building upon this,

our research delves deeper by not only examining ESG

topics but also by introducing sentiment analysis and

anticipatory monitoring techniques as well as

endeavors to fill this research lacuna.

2.2 FinBERT

FinBERT, short for Financial BERT, is a specialized

language model based on the BERT (Bidirectional

Encoder Representations from Transformers)

architecture, tailored for financial sentiment analysis.

It is pre-trained on a large corpus of financial text data

to capture the nuances and context found in financial

documents and reports. FinBERT allows for the

extraction of sentiment information from financial

texts, which can be useful in various financial

applications such as predicting stock prices,

evaluating corporate performance, and detecting

potential greenwashing practices (Huang et al., 2022).

3 METHODOLOGY AND TOOLS

3.1 Methodology

Our research framework delves deep into the use of

Natural Language Processing (NLP) for the detection

and monitoring of ESG-centric greenwashing

activities. We sourced textual data from internal

corporate disclosures and Twitter, gaining a dual-

pronged perspective. After data extraction, a

thorough preprocessing phase was initiated,

incorporating tokenization, stopwords removal, and

lemmatization, to ready the data for subsequent

analysis. We then utilized the FinBERT-ESG-9-

Categories model to categorize the data. Sentiment

analysis was performed using TextBlob. A

correlation coefficient analysis was then conducted to

identify disparities indicative of greenwashing.

Further, we introduced an innovative NLP-driven

framework for ESG greenwashing monitoring,

transforming core ESG data into structured question-

and-answer pairs. This comprehensive approach

utilized tools such as spaCy, AllenNLP, and NLTK,

ensuring methodological robustness. Our

methodology’s ultimate goal is to enhance

transparency and accountability in the ESG domain.

3.2 NLP Tools

3.2.1 spaCy

spaCy stands as an avant-garde NLP library known

for its stellar performance. Designed for professional-

grade applications, its attributes of rapid processing,

user-friendliness, and operational efficiency have

made it a mainstay among the developer and research

fraternities. Detailed insights and documentation can

be procured from https://spacy.io.

KDIR 2023 - 15th International Conference on Knowledge Discovery and Information Retrieval

176

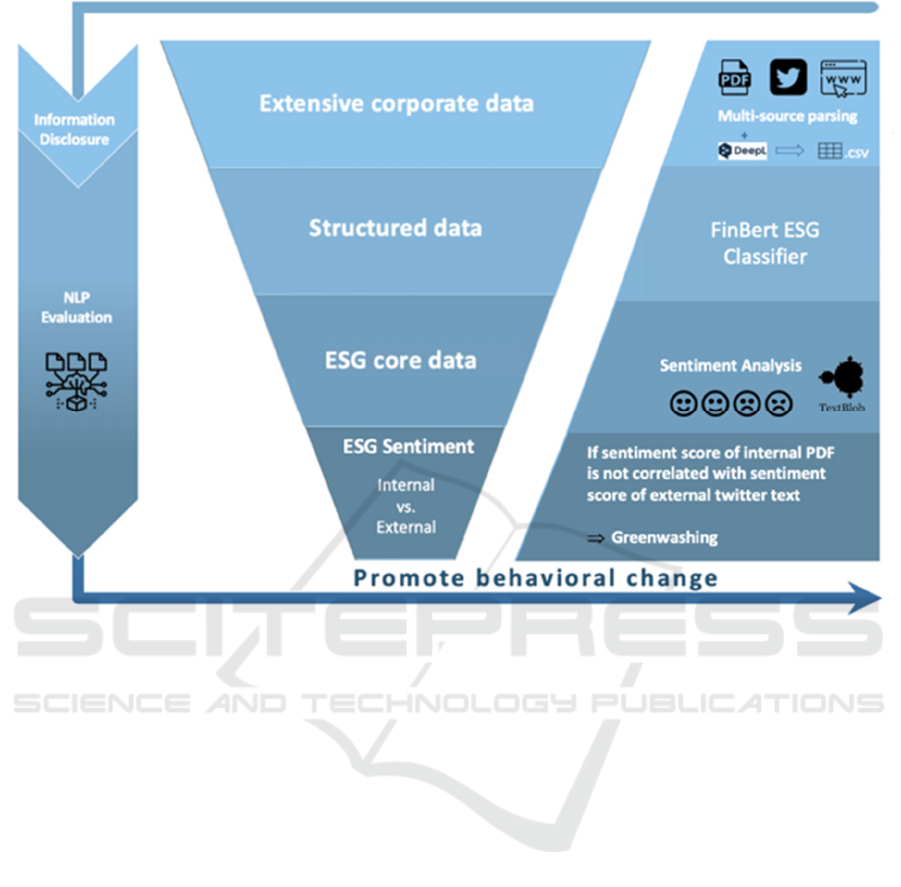

Figure 1: NLP framework to identify ESG-Greenwashing.

3.2.2 AllenNLP

A product of the Allen Institute for Artificial

Intelligence, AllenNLP is a distinguished library

underpinned by PyTorch. It is crafted with a focus on

facilitating deep learning endeavors within the NLP

domain. The library offers superior abstractions and

tools tailored for the construction of sophisticated

NLP models. Comprehensive details can be explored

at https://allenai.org/allennlp.

3.2.3 NLTK

The Natural Language Toolkit (NLTK) serves as an

expansive platform supporting the development of

Python-driven applications for linguistic data

analysis. With interfaces to an extensive range of

corpora and lexical databases like WordNet, NLTK

also offers an arsenal of text manipulation tools.

These tools cover a spectrum of tasks, ranging from

tokenization and stemming to semantic reasoning.

For an exhaustive list of features and utilities, one can

refer to https://www.nltk.org/.

4 NLP FRAMEWORK TO

IDENTIFY

ESG-GREENWASHING

The workflow of the NLP Framework to identify

ESG-Greenwashing is shown in Figure 1. Each step

will be described in detail below.

4.2 Data Collection and Preparation

Detecting greenwashing tactics within the ESG

landscape via NLP methodologies necessitates

sourcing and optimizing relevant textual data from

diverse channels. A vital first step, this guarantees the

data’s suitability for in-depth analysis. Primary data

reservoirs encompass internal corporate disclosures

(Agyei-Mensah, 2016) and external insights derived

from Twitter (Goodell et al., 2019). Together, they

present a holistic understanding of an enterprise’s

ESG undertakings, their efficacy, and any emergent

conflicts (Moodaley & Telukdarie, 2023). As

illustrated in Figure 1, official corporate websites

typically host publicly accessible internal documents

Detecting Greenwashing in the Environmental, Social, and Governance Domains Using Natural Language Processing

177

in their sustainability or ESG sections, usually in PDF

format. Additionally, Twitter content is harvested

using web scraping tools via APIs (Goodell et al.,

2019). Any non-English data extracted are

subsequently translated into English using DeepL, an

online translation service that uses artificial

intelligence and neural networks to provide high-

quality translation between multiple languages, which

renders them primed for analysis (DeepL, 2023). The

data underwent essential preprocessing stages prior to

analysis. These stages included tokenization, the

removal of stopwords, lemmatization or stemming, the

exclusion of special characters and numbers, and

converting text to ensure uniformity across the dataset

(Gautam et al., 2022). From this process, we extracted

a total of 65,763 data points from PDF documents and

118,560 data points from Twitter. In the PDF dataset,

each data point corresponds to an individual sentence,

whereas in the Twitter dataset, each data point

represents a full tweet.

4.3 Data Analysis

In our quest to thoroughly analyze the primary ESG

Data, we followed a systematic methodology.

Firstly, leveraging the specialized capabilities of

the FinBERT-ESG-9-Categories model, we meticu-

lously classified our dataset into relevant ESG themes.

These include Climate Change, Natural Capital,

Pollution & Waste, Human Capital, Product Liability,

Community Relations, Corporate Governance,

Business Ethics & Values, and a catch-all non-ESG

category, as expounded by Huang et al. (2022).

With our data now suitably categorized, we

proceeded to evaluate its emotional undertones using

TextBlob, a lexicon-focused sentiment analysis

library. It assigns sentiment scores to textual content,

ranging from negative to positive (Liu, 2012). The

essence of sentiment analysis lies in its ability to

measure the affective orientation of opinions

embedded within texts (Liu and Zhang, 2012). By

applying TextBlob to our segmented data, we could

gauge the general mood encompassing corporate

internal ESG declarations and juxtapose this with the

prevailing sentiment on social platforms like Twitter

(Pang and Lee, 2008).

Each of the ESG themes, from Climate Change to

Business Ethics & Values, underwent in-depth

sentiment scrutiny. This allowed us to extract

correlations (or the lack thereof) between the

sentiments expressed in internal corporate reports and

those voiced by the public on Twitter.

To move beyond a simple sentiment score and to

deeply understand the dynamics between internal

corporate sentiments and external public opinions, we

employed correlation coefficient analysis. This

method, highlighted in research by Yu et al. (2023),

offers insights into the strength and direction of the

relationship between these two sentiment sources. By

adopting this approach, we were able to pinpoint

discrepancies that might hint at greenwashing

practices, a phenomenon outlined by Delmas and

Burbano (2011).

Through this layered analytical methodology, our

study aimed to shed light on potential divergences

between corporate ESG narratives and public

perceptions, offering stakeholders a clearer picture of

potential greenwashing instances.

4.4 Research Findings

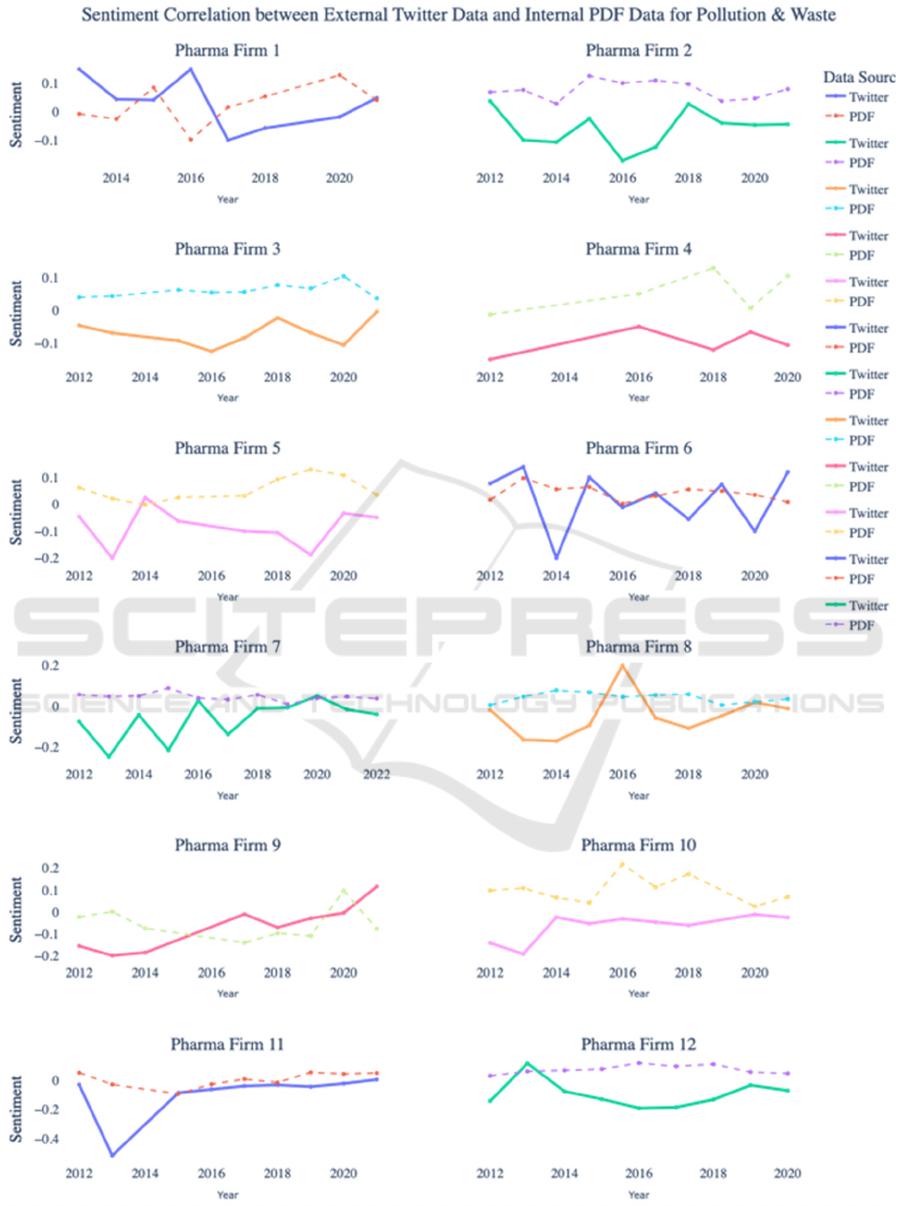

Our findings reveal a discernible disconnect between

the sentiments expressed in internal ESG strategies

and those voiced in public opinions on social media.

The internal sentiment scores, derived from official

PDF documents, exhibit a predominantly positive and

stable trajectory, contrasting with the more volatile

sentiment evident in Twitter scores. By juxtaposing

the sentiment scores from official documents with

those on Twitter, we computed correlation

coefficients. For example, the “pollution and waste”

category exemplifies this discrepancy most

prominently, as depicted in Figure 2. Over the period

from 2012 to 2022, most companies showcased in

Figure 2 have a negative linear correlation between

their official sentiment scores and Twitter. While the

general trend indicates a divergence, a notable

exception is Company 4. Between 2012 and 2014, its

official sentiment scores and Twitter scores exhibited

a mild positive correlation. Cumulatively, these

results underscore a discord between a company’s

internal ESG declarations and the broader public

perception, underscoring the urgency for deeper

scrutiny of potential greenwashing activities.

5 NLP FRAMEWORK TO

MONITOR

ESG-GREENWASHING

To address the burgeoning need for vigilant

greenwashing monitoring, we present a framework

driven by NLP, specifically designed for ESG

greenwashing detection and assessment. This

framework harnesses the essence of core ESG data

extracted from internal corporate documents and

adeptly transforms this data into organized

KDIR 2023 - 15th International Conference on Knowledge Discovery and Information Retrieval

178

Figure 2: Sentiment correlation between internal PDF data and external Twitter data for pollution & waste.

Detecting Greenwashing in the Environmental, Social, and Governance Domains Using Natural Language Processing

179

question-and-answer pairs. This structure immensely

simplifies the process of internally validating ESG

claims. When enterprises interact with our system by

posing queries, it efficiently correlates these queries

with our pre-established database, a product of our

data collection. As a result, it swiftly prese pertinent,

pre-formulated questions coupled with their

corresponding answers, offering a seamless

mechanism to verify and substantiate ESG assertions.

To further refine the raw ESG core data, we

incorporate prominent NLP tools including spaCy,

AllenNLP, and NLTK. Given that each entry in the

core data equates to an entire paragraph, the first

phase entails paragraph parsing. This involves

segmenting the paragraph, resolving coreferences and

abbreviations, and determining textual entailment—

tasks adeptly handled by AllenNLP. One might

question the handling of ambiguities or contradictory

information during this phase. Our system has been

trained on a vast corpus of ESG data, enabling it to

identify and flag such ambiguities for human review.

In the event of potential mismatches or contradictions

within the text, the system triggers an internal review

protocol where a human expert can intervene to

ensure accuracy.

The ensuing phase involves sentence-level

parsing. This includes sentence segmentation,

punctuation realignment, constituency parsing, and

semantic role labeling, tasks for which spaCy is

particularly well-suited. Each sentence, in essence, is

dissected into its granular components, providing the

foundational bricks upon which our subsequent

question-and-answer pairs are built. Post these

parsing procedures, the crux of our methodology

surfaces: the generation of question-and-answer

pairs. These pairs are formulated by gleaning the

pivotal ESG-related assertions within the internal

corporate data. For illustration, if an enterprise’s

internal dossier mentions a decrease in carbon

footprints, our system could potentially generate a

pair such as:

QUESTION: Over the decade from 2009 to

2019, by what percentage have we curtailed our

carbon emissions?

ANSWER: 50% reduction

It’s important to underline how answers are

crafted. They aren’t merely extracted in a raw form

and serve as repositories of information but are a

product of the system’s deep semantic understanding

of the input data, they act as a litmus test for veracity.

The framework intelligently discerns context,

evaluates claims against benchmarks, and composes

answers that are succinct and accurate. This question-

and-answer infrastructure not only acts as a self-

monitoring tool but also as a real-time verifier,

returning vetted answers from the database in

response to stakeholders’ inquiries, hence promoting

transparency and accountability.

6 CONCLUSIONS

This study ventures into the untapped potential of

NLP methodologies in pinpointing potential

greenwashing tendencies within the ESG landscape,

an area of immense significance to stakeholders’

intent on discerning the authenticity of corporate

sustainability pledges. Our analysis draws parallels

between the sentiment scores from internal ESG

strategies and the public sentiment aired on Twitter

for 12 pharmaceutical giants spanning a decade

(2012-2022). Stemming from this analysis, we

designed an innovative NLP-driven question-and-

answer system, envisioned to expedite and enhance

the process of monitoring greenwashing.

The findings illuminate a palpable disjunction

between internal ESG sentiments and those

manifested on Twitter. While internal sentiments

predominantly radiate positive vibes and maintain

consistency, their external counterparts on Twitter

exhibit more fluctuations. The pollution and waste

sector showcases a pronounced incongruity in

sentiment alignment. This disparity signals a

potential disconnect between corporate ESG

proclamations and the prevailing public sentiment,

accentuating the necessity for meticulous scrutiny of

potential greenwashing practices. Our pioneering

NLP blueprint, capitalizing on core ESG data to forge

pertinent question-and-answer pairings, emerges as a

formidable tool in the arsenal against greenwashing.

However, this research is not without its caveats.

Primarily, our lens is confined to the pharmaceutical

arena, analyzing a sample of merely 12 companies.

The vistas for future inquiries are expansive, ranging

from diversifying the industries under study to

assimilating an eclectic mix of data sources like

financial disclosures and third-party ESG

evaluations. Furthermore, there lies a rich tapestry of

sentiment analysis tools—like Vader, NLTK, and

more—that beckon a deeper dive, perhaps integrating

advanced deep learning architectures to bolster

detection precision. The NLP model we’ve rolled out

serves as a groundwork, ripe for tailoring to cater to

sector-specific requisites. Additionally, the

inaccessible nature of certain internal corporate

KDIR 2023 - 15th International Conference on Knowledge Discovery and Information Retrieval

180

datasets curtails our ability to present a more robust

statistical quantitative analysis, leading our findings

to emphasize potential greenwashing red flags rather

than unequivocal greenwashing occurrences. A

fascinating trajectory for future probes might involve

juxtaposing our system’s outputs with results gleaned

from avant-garde platforms like OpenAI. In

summation, while this work establishes the

plausibility of greenwashing detection, any concrete

identification and subsequent mitigation strategies

necessitate the proactive engagement of the corporate

entities in question.

REFERENCES

Agyei-Mensah, B. K. (2016). Internal control information

disclosure and corporate governance: evidence from an

emerging market. Corporate Governance: The

international journal of business in society, 16(1), 79-

95.

Asif, M., Searcy, C., & Castka, P. (2023). ESG and Industry

5.0: The role of technologies in enhancing ESG

disclosure. Technological Forecasting and Social

Change, 195, 122806.

Delmas, M. A., & Burbano, V. C. (2011). The drivers of

greenwashing. California Management Review, 54(1),

64-87.

Devlin, J., Chang, M. W., Lee, K., & Toutanova, K. (2018).

BERT: Pre-training of deep bidirectional transformers

for language understanding. arXiv preprint

arXiv:1810.04805.

Davenport, T. H., & Harris, J. G. (2019). Competing on

analytics: Updated, with a new introduction: The new

science of winning. Harvard Business Review Press.

DeepL. (2023). Why DeepL Pro? DeepL.

https://www.deepl.com/en/why-deepl-pro

Fortune. (2021). Fortune 500. https://fortune.com/

ranking/fortune500/

Goodell, G., & Aste, T. (2019). A decentralized digital

identity architecture. Frontiers in Blockchain, 2, 17.

Gautam, A. K., & Bansal, A. (2022). Performance analysis

of supervised machine learning techniques for

cyberstalking detection in social media. Journal of

Theoretical and Applied Information Technology,

100(2), 449-461.

Huang, A. H., Wang, H., & Yang, Y. (2023). FinBERT: A

large language model for extracting information from

financial text. Contemporary Accounting Research,

40(2), 806-841.

Kim, E. H., & Lyon, T. P. (2015). Greenwash vs.

brownwash: Exaggeration and undue modesty in

corporate sustainability disclosure. Organization

Science, 26(3), 705-723.

Lyon, T. P., & Montgomery, A. W. (2015). The means and

end of greenwash. Organization & Environment, 28(2),

223-249.

Liu, B. (2012). Sentiment analysis and opinion mining.

Synthesis Lectures on Human Language Technologies,

5(1), 1-167.

Liu, B., & Zhang, L. (2012). A survey of opinion mining

and sentiment analysis. In Mining text data (pp. 415-

463). Springer, Boston, MA.

Marquis, C., Toffel, M. W., & Zhou, Y. (2016). Scrutiny,

norms, and selective disclosure: A global study of

greenwashing. Organization Science, 27(2), 483-504.

Moodaley, W., & Telukdarie, A. (2023). Greenwashing,

Sustainability Reporting, and Artificial Intelligence: A

Systematic Literature Review. Sustainability, 15(2),

1481.

Nugent, T., Stelea, N., & Leidner, J. L. (2020). Detecting

ESG topics using domain−specific language models

and data augmentation approaches. arXiv preprint

arXiv:2010.08319.

Orlitzky, M. (2011). Institutional logics in the study of

organizations: The social construction of the

relationship between corporate social and financial

performance. Business Ethics Quarterly, 21(3), 409-

444.

Pang, B., & Lee, L. (2008). Opinion mining and sentiment

analysis. Foundations and Trends® in information

retrieva

l, 2(1–2), 1-135.

Schnattinger, K., Walterscheid, H. (2017). Opinion Mining

Meets Decision Making: Towards Opinion

Engineering. In Proceedings of the 9th International

Joint Conference on Knowledge Discovery, Knowledge

Engineering and Knowledge Management - Volume 1:

KDIR, pages 334-341.

Siano, A., Vollero, A., Conte, F., & Amabile, S. (2021).

“More than words”: Expanding the taxonomy of

greenwashing after the Volkswagen scandal. Journal of

Business Research, 117, 577-586.

Starik, M., Kanashiro, P., & Collins, E. (2016).

Sustainability management textbooks: Potentials,

limitations, and future directions. Organization &

Environment, 29(1), 69-95.

Woloszyn, V., Kobti, J., & Schmitt, V. (2021). Towards

Automatic Green Claim Detection. In Proceedings of

the 13th Annual Meeting of the Forum for Information

Retrieval Evaluation, 28−34.

Yu, H., Liang, C., Liu, Z., & Wang, H. (2023). News-based

ESG sentiment and stock price crash risk. International

Review of Financial Analysis, 88, 102646.

Detecting Greenwashing in the Environmental, Social, and Governance Domains Using Natural Language Processing

181