Research on Order Allocation of Group Enterprise Based on

Differential Evolution Algorithm

Shuntang Zhang, Lihua Hu, Zhengyang Shi and Guojun Zhang

Shangdong Institute of Business and Technology, Yantai, China

Keywords: Order Allocation, Procurement Cost, Differential Evolution Algorithm.

Abstract: Aiming at the problem of procurement volume allocation of group enterprises, according to the

characteristics of the internal structure of group enterprises, considering factors such as price discounts,

comprehensive supplier scores, transportation costs, etc., a procurement optimization model based on

internal allocation of group enterprises is established. When establishing the model, it is considered that the

subsidiaries directly order from external suppliers and transfer between subsidiaries with excess inventory,

so as to effectively use internal resources and balance the total inventory. When solving the model, a

differential evolution algorithm with fast convergence speed, simple structure and excellent performance is

selected for simulation solving. Through the example experiment, the procurement quantity and allocation

amount are reasonably allocated, which effectively reduces the procurement cost of the group enterprises,

and shows the effectiveness of the model.

1

INTRODUCTION

Order quantity allocation is the core strategic

decision in procurement, and its scientific rationality

is directly related to the high production cost of the

enterprise. Therefore, it is of great significance to

improve the core competitiveness of enterprises by

optimizing the allocation of order quantity in order

to reduce procurement costs.

Kaur et al.(Kaur, 2021) study order allocation in

the context of Industry 4.0 with multiple materials

and multiple cycles considering supply disruption

risk; Safaeian et al.(Safaeian M, 2019) develop a

multi-objective model for order allocation in a fuzzy

environment considering both incremental discounts

and transportation costs; Ghasemy et al.(Ghasemy

Yaghin R, 2020) study an integrated model for order

allocation and transportation planning in an

uncertain environment considering corporate social

responsibility; Alavi et al. Ghasemy et al. (Alavi B,

2021) studied an integrated model of order

allocation and transportation planning considering

corporate social responsibility in an uncertain

environment; Alavi proposed a sustainable supplier

selection method for circular supply chains based on

a dynamic decision support system; Jia et al.(Jia R,

2020) proposed a new sustainable goal planning

model with distributed robustness considering

carbon emissions. Balakrishnan et al. developed an

integrated optimization model considering both

corporate volume discounts and inventory costs

considering the purchasing demand preferences of

each division of a large company and the

requirements of centralized corporate purchasing;

In this paper, price discounts, supplier scores,

transportation costs, inventory costs, etc. are taken

into account, and when the demand is known, an

order quantity allocation model considering both

procurement and allocation is established, and a

suitable differential evolution algorithm is designed

to solve the problem.

2

MODEL CONSTRUCTION

2.1 Problem Description

In recent years, with the rapid development of big

data, the Internet and other high-tech technologies,

centralized procurement has become the most

concerned procurement mode for domestic and

foreign enterprise groups. Centralized procurement

refers to a procurement mode in which group-type

enterprises integrate the resources of their

subordinate sub enterprises and centralize the

management of resources. Through centralized

Zhang, S., Hu, L., Shi, Z. and Zhang, G.

Research on Order Allocation of Group Enterprise Based on Differential Evolution Algorithm.

DOI: 10.5220/0012273700003807

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Seminar on Artificial Intelligence, Networking and Information Technology (ANIT 2023), pages 51-55

ISBN: 978-989-758-677-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

51

procurement, the unified deployment of sub-

distributed procurement resources helps optimize the

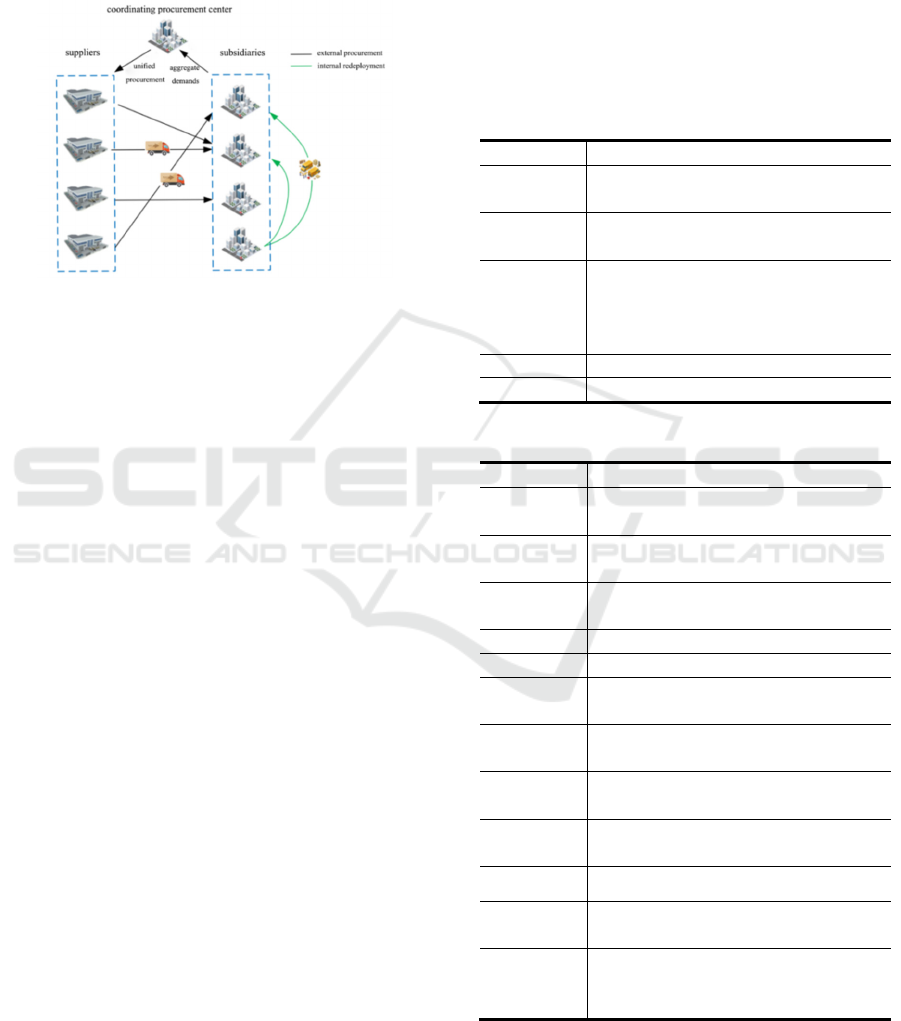

optimal allocation of resources. In this paper, the

procurement model combining centralized ordering,

external procurement and internal redeployment is

adopted, as shown in figure 1.

Figure 1. Schematic diagram of procurement and

redeployment.

The group enterprise establishes a coordinating

procurement center to aggregate the needs of

subsidiaries and then conduct unified procurement.

When purchasing, two sources of supply are

considered: the first is direct procurement from

external suppliers, and the second is transferring

between subsidiaries with excess inventory. After

aggregating demands, the coordinating procurement

center queries subsidiaries with excess inventory on

the information sharing platform of the group

enterprise, takes the subsidiary as the supplier, and

after comparing costs such as transportation costs

and coordination costs, reasonably allocates

procurement volume between suppliers and

subsidiaries and formulates procurement plans to

achieve cost optimization.

2.2 Model Assumptions

To simplify the model, the following assumptions

are made:

Assumption 1: After the group enterprise

conducts uniform procurement, it is assumed that the

procurement quantity in a procurement cycle T can

meet the demand of the subsidiaries, neither

allowing out-of-stock.

Assumption 2: The demand of each subsidiary is

determined and is known.

Assumption 3: The same supplier can supply to

different subsidiaries, and the supply quantity does

not exceed the maximum supply capacity.

Assumption 4: Each supplier uses the same

transport vehicles, i.e. the only factor affecting

transport costs is distance.

Assumption 5: The ordering cost of transferring

between subsidiaries is less than the ordering cost of

purchasing from suppliers.

2.3 Symbol Description

The explanation of the symbols used in the paper is

shown in Tables 1, 2 and 3 below.

Table 1: Sets and Comments.

Assemblies Note

i

Set of subordinate sub enterprises of

the group, i=1,2 ....n

j

The set of materials to be purchased,

j=1,2...J

k

The set of suppliers with supply

capacity, external suppliers if

k=1,2....q, and subsidiaries if

k=q+1....m

T Purchasing cycle

t Discount level, t=1,2...L

Table 2: Variables and Comments.

Parameters Note

k

Z

Fixed procurement costs for a single

procurement activity

ij

D

Subsidiary's demand for material j in

cycle T

kj

E

The maximum supply capacity of the

supplier for material j during the cycle T

g Truck vehicle loading capacity

G Unit weight of purchased materials

ik

d

Distance between the supply side and

the demand side of the business

ik

C

Supply-side transportation costs per unit

distance

kjt

r

Price discount at level t offered by the

supplier for material j

kj

P

The initial price of material j provided

by the supplier

k

h

Overall supplier score

kj

H

Unit material storage cost of the kth

subsidiary

ikt

Y

0-1 variable, equal to 1 means that i is

supplied by supplier k at level t,

otherwise 0

ANIT 2023 - The International Seminar on Artificial Intelligence, Networking and Information Technology

52

Table 3: Decision Variables and Notes.

Decision

Variables

Note

ijk

X

Quantity of material j purchased

by subsidiary i from supplier k

2.4 Model Building

The objective function is as follows:

k

min

ijk

kjt ikt kj ik ik ijk k ijk

GX

Z

ry p Cd XT hX

g

=+ + + −

(1)

Constraints:

11

nn

ijk ij

ii

X

D

==

≥

(2)

1

n

ijk kj

i

X

E

=

≤

(3)

1

1

l

ikt

t

y

=

≤

(4)

0

ij

D ≥

(5)

0

ijk

X ≥

(6)

The objective function (1) is the minimum total

procurement cost, which is the fixed ordering cost,

procurement cost, transportation cost, subsidiary

storage cost and supplier comprehensive

performance merit score, respectively. Since the

supplier comprehensive merit score is the larger the

better, and the objective function is the smaller the

cost function, the negative sign is taken here.

Constraint (2) indicates that the subsidiary's

procurement quantity must be greater than the

demand quantity, i.e., no shortage is allowed;

constraint (3) indicates the supply capacity

constraint; constraint (4) indicates that the group

enterprise enjoys at most one level of price discount

at the supplier; constraint (5)(6) indicates that the

demand quantity and procurement quantity can only

be positive values.

3

SOLVING ALGORITHM

For the linear programming model of this

multivariate and multi-constraint condition, its

solution is an NP problem, so a differential evolution

algorithm is designed to solve it in this paper. In

general, differential evolution algorithms mainly

include four main steps: population initialization,

mutation, crossover, and selection.

3.1 Initializing the Population

Let N and D be the population size and the

dimension of the search space, respectively, and the

initial population is generated in the form of a

uniform distribution according to the given range of

variables.

{

}

,1 ,2 ,

, ... ; 1, 2... , 1, 2...

iiiiD

XX X i Nj D===X

(7)

,

()

ij j j j

XLBUBLBrand=+ − ×

(8)

where

,

j

j

LB UB

denotes the upper and lower bounds

of the jth dimension, respectively, and rand is a

random number uniformly generated between (0,1).

3.2 Variant Operation

At generation t, a variation vector corresponding to

the parental vector

i

V

is generated by the variation

strategy, and the classical variation strategy is as

follows:

,1, 2,3,

()

ij r j r j r j

VX FX X=+⋅ −

(9)

where

1, 2, 3,

,,

rj r j r j

XXX

is a random selection

of three mutually dissimilar individuals from the

population, F is a mutation proportionality factor

that controls the differential variation of

2, 3,rj rj

XX−

and [0,2]F ∈ .

3.3 Cross-Operation

After generating the variance vector, it enters the

crossover phase, which produces a candidate

solution at

i

U

, operating as follows:

,

,

,

,

,

i j rand

ij

ij

V if rand CR or j j

U

X otherwise

<=

=

(10)

Where,

j

rand

is the jth solver of the uniform

random number generator,

[0,1]

j

rand ∈

, CR is the

given crossover probability,

[0,1]CR ∈

,

j

rand

is

the number of randomly selected numbers from

dimension D ensuring that

i

U

gets at least one

parameter from

i

V

.

3.4 Evaluation Options

Using the greedy rule to compare the objective

function values of

i

U

and

i

V

, the individual with

Research on Order Allocation of Group Enterprise Based on Differential Evolution Algorithm

53

the lowest function value for the minimization

problem will be selected to be passed to the next

generation, with the following expression:

,, ,

,1

,

,()()

,

it it it

it

it

UiffU fX

X

Xotherwise

+

≤

=

(11)

The above is the basic steps of the differential

evolutionary algorithm, run iteratively through the

above steps, and stop when the optimal solution is

reached to get the optimal solution

4

NUMERICAL CALCULATION

EXAMPLE

Suppose there are 3 subsidiaries out of stock, namely

123

,,EEE

, and they are supplied by 3 external

suppliers selected after evaluation, namely

123

,,SS S

,

and the subsidiary with internal transfer capability is

456

,,SSS

, only one kind of material is purchased,

the unit weight of the purchased material is G=1 ton,

the vehicle load is g=100 tons, the transportation

cost per unit distance of each transport vehicle is $20,

the ordering period is T=30 days, the demand for

material 1 from

123

,,EEE

is 135 pieces, 500 pieces

and 280 pieces respectively. The unit inventory cost

of

123

,,EEE

for material 1 is $1.5/per piece per day,

$1.8/per piece per day, and $1.2/per piece per day,

and the initial prices offered by the supplier

123

,,SS S

,

456

,,SSS

are $1600, $1650, $1750,

$1600, $1700, and $1500 per piece, respectively,

and the fixed order costs are 1000, 1000, 1000, 300,

300 , 300 yuan/piece, the maximum order capacity is

950, 800, 1000, 300, 500, 550 pieces, and the

comprehensive evaluation scores are 9.3, 9.0, 9.1, 10,

10, 10, 10, and the different price discount levels of

suppliers and the transportation distance between

supply and demand enterprises are shown in tables 4

and 5 below.

Table 4: Supplier discount levels for different prices.

Discount

Level

(0,300) (300,700) (700,1000) (1000, )

1

S

1 0.95 0.85 0.75

2

S

1 0.94 0.85 0.74

3

S

1 0.9 0.78 0.71

4

S

1 1 1 1

5

S

1 1 1 1

6

S

1 1 1 1

Table 5: Transportation distance between supply and

demand enterprises.

Transportation

distance

(

km

)

1

E

2

E

3

E

1

S

48 35 18

2

S

25 15 40

3

S

20 40 45

4

S

30 25 18

5

S

20 28 30

6

S

20 35 21

The above examples were solved by using the

differential evolutionary algorithm, setting the

parameters as follows: variance proportionality

factor F=0.9, crossover probability CR=0.8, 100

iterations, population size N=20, and using python

software to perform the operation, and the results are

shown in table 6.

Table 6: Optimal Purchase Volume.

Purchase

volume (pieces)

1

E

2

E

3

E

1

S

0 118 132

2

S

4 0 44

3

S

72 181 0

4

S

54 7 120

5

S

6 56 5

6

S

0 140 82

Figure 2: Convergence diagram of the algorithm.

The optimal procurement volume of the group

enterprise is shown in table 6, and the total

procurement cost is 16.128 million. After 100

iterations, the convergence curve of the differential

evolutionary algorithm is shown in figure 2, which

has good convergence and indicates the

ANIT 2023 - The International Seminar on Artificial Intelligence, Networking and Information Technology

54

effectiveness and feasibility of this algorithm.

5

CONCLUSION

The allocation of order quantity is an important part

of the enterprise in making purchasing decisions,

and a scientific and reasonable allocation can

effectively reduce the production cost of the

enterprise. In this paper, combining the

characteristics of group enterprises, the procurement

considers two ways: direct ordering from suppliers

and transferring among subsidiaries with excess

inventory, and establishes a procurement

optimization model based on internal transfer for

group enterprises by considering factors such as

price discount, comprehensive rating of suppliers,

full truck transportation and inventory cost. Through

the experiment of arithmetic cases, a differential

evolutionary algorithm is designed for simulation

solution with the help of python software, and the

procurement volume of each subsidiary with

procurement demand is calculated between suppliers

and subsidiaries with transfer capability, which

effectively reduces the procurement cost of the

group enterprise and illustrates the effectiveness and

feasibility of the model.

REFERENCES

Kaur H, Singh S P. Multi-stage hybrid model for supplier

selection and order allocation considering disruption

risks and disruptive technologies(J). International

Journal of Production Economics, 2021, 231: 107830.

https://doi.org/10.1016/j.ijpe.2020.107830

Safaeian M, Fathollahi-Fard A M, Tian G, et al. A

multi-objective supplier selection and order allocation

through incremental discount in a fuzzy environment(J).

Journal of Intelligent & Fuzzy Systems, 2019, 37(1):

1435-1455. https://doi.org/10.3233/JIFS-182843

Ghasemy Yaghin R, Sarlak P. Joint order allocation and

transportation planning under uncertainty within a

socially responsible supply chain(J). Journal of

Modelling in Management, 2020, 15(2): 531-565.

https://doi.org/10.1108/JM2-03-2019-0048

Alavi B, Tavana M, Mina H. A dynamic decision support

system for sustainable supplier selection in circular

economy(J), Sustainable Production and Consumption,

2021, 27: 905-920. https://doi.org/10.1016/j.spc.

2021.02.015

Jia R, Liu Y, Bai X. Sustainable supplier selection and

order allocation: Distributionally robust goal

programming model and tractable approximation(J).

Computers & Industrial Engineering, 2020, 140:

106267. https://doi.org/10.1016/j.cie.2020.106267

Balakrishnan A, Natarajan H P. Integrated procurement

planning in multi‐division firms(J). Production and

operations management, 2014, 23(10): 1795-1810.

https://doi.org/10.1111/poms.12096

Research on Order Allocation of Group Enterprise Based on Differential Evolution Algorithm

55