Research on Prediction of Decision Tree Algorithm on Different

Types of Stocks

Shipei Du, Xiao Li and Dongjie Yang

Guangdong University of Science and Technology, Dongguan, China

Keywords: Decision Tree, Stock Prices, Prediction.

Abstract: The stock market is an important part of the financial market and is closely connected to a country's market

growth and economic patterns. Because of how much the stock market changes and the non-linear nature of

it, accurately guessing what will happen in the stock market is really hard. In this article, we suggest a

model for predicting the stock market using a decision tree algorithm. We will use historical trading data

from multiple A-shares for our research. We use artificial intelligence and the decision tree algorithm to

study the financial industry and make predictions about stock prices. Our research found that using the

decision tree algorithm to predict stocks gave us good results. This is helpful information for guiding both

big institutions and individuals in making stock investments.

1

INTRODUCTION

In recent years, with the widespread application of

artificial intelligence technology in the financial

field, the decision tree algorithm, as a simple and

effective machine learning algorithm, has become

one of the important tools in the financial field. In

terms of stock market forecasting, the decision tree

algorithm has high accuracy and reliability, which

can help investors better understand market trends

and stock price changes.

Decision tree algorithm is a machine learning

algorithm based on model selection and decision tree

construction, which solves complex problems by

decomposing them into a series of simple problems

and building decision trees 0. In stock market

forecasting, decision tree algorithms can use

historical transaction data for stock price forecasting

and analysis 0. By building a decision tree model,

we can comprehensively analyze various factors that

affect stock prices, such as market conditions,

company fundamentals, and technical indicators, and

obtain stock price forecast results.

Forecasting the final price of stocks can greatly

enhance the profits made from investing in stocks

and help shareholders make better decisions about

their investments 0. Stock price is the core variable

of the stock market, which is affected by many

factors, such as economic factors, policy factors,

company fundamentals, market sentiment, etc. By

predicting the closing price of stocks, investors can

better grasp the trend of stock prices, thereby better

grasping investment opportunities and reducing risks

0. Therefore, predicting the closing price of stocks

has an important guiding role in the investment

decisions of shareholders.

The research object of this research is the

historical transaction data of multiple A-share

stocks. We have selected a number of representative

stocks, including large-cap blue-chip stocks, mid-

and small-cap stocks, and emerging industry stocks.

Through the analysis of the historical transaction

data of these stocks, we found that the decision tree

algorithm has a better effect in stock market

forecasting 0. By constructing a decision tree model,

we can comprehensively analyze various factors that

affect the stock price, and obtain the forecast results

of the stock price 0.

This research applies the decision tree algorithm

to the analysis of A-share historical transaction data,

and uses the decision tree model to predict future

stock prices, aiming to provide valuable insights and

guidance for financial institutions and individual

investors.

Our research contributes to the growing literature

on applied AI techniques in finance 0. We believe

that the decision tree algorithm is a powerful tool

that can improve the accuracy and efficiency of

stock market forecasting. Our findings have

important value to financial institutions and

178

Du, S., Li, X. and Yang, D.

Research on Prediction of Decision Tree Algorithm on Different Types of Stocks.

DOI: 10.5220/0012277000003807

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Seminar on Artificial Intelligence, Networking and Information Technology (ANIT 2023), pages 178-181

ISBN: 978-989-758-677-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

individual investors seeking to make informed

investment decisions.

2

DATASET AND METHOD

In this research, the dataset used comes from the

Shanghai Composite Index data of the first half of

2022 in China, and 6 stocks are selected as research

objects, including 2 blue-chip stocks, 2 Small and

medium cap stocks, and 2 emerging industry stocks.

They are China Telecom (stock code: 601728), Ping

An Insurance (Group)(stock code: 601318), Beijing

Tongrentang (stock code: 600085), China Zheshang

Bank (stock code: 601916), Jiangxi Hongcheng

Environment (stock code: 600461), and Humanwell

Healthcare (Group) (stock code: 600079). For ease

of description, they are coded as BC-1, BC-2, SM-1,

SM-2, EI-1, and EI-2, respectively.

For the training data set D, use the least squares

regression tree generation algorithm to output the

decision tree f (x). In the input space where the

training data set is located, recursively divide each

area into two sub-areas and determine the output

value on each sub-area, and construct a binary

decision tree. Select the optimal segmentation

variable j and segmentation point s, and solve:

() ( )

,1

2

12

22

12

(,) (,)

min min min

js c

ii

ii

c

xRjs xR js

yc yc

∈∈

−+ −

(1)

Iterates over variable j, scans split point s for

fixed split variable j, partitions the region with the

selected pair (j,s) and determines the corresponding

output value:

{

}

{

}

() ()

12

(,) , (,)

jj

RjsxxsRjsxx s=≤ =>∣∣

(2)

(,)

1

ˆ

,,1,2

im

mim

xR js

m

cyxRm

N

∈

=∈=

(3)

Continue to call formulas (1), (2), (3) for both

subregions until the stop condition is met. Divide the

input space into M regions R

1

, R

2

, ... R

M

and

generate the decision tree:

1

ˆ

() ( )

M

mm

m

f

xcIxR

=

= ∈

(4)

In this research, the data set was analyzed and

processed for data such as date, opening, high point,

low point, closing, and trading volume. Decision

tree machine learning algorithms were used to

predict stock trends. This dataset was divided into a

training set and a test set, with the total number of

datasets being 702, with a training set-to-test set

ratio of 85% to 15%. For a single stock, the total

number of samples was 117, with a training set of

100 samples and a test set of 17 samples. The

maximum depth of the decision tree was set to 100

layers, and the minimum number of samples at a leaf

node was set to 2. Regression forecasting models

were utilized, and data analysis techniques were

employed to accurately explain the pattern of data

movement and create visual representations of the

analysis outcomes. Additionally, we used different

evaluation indicators to perform performance

analysis on our prediction model.

Table 1: The real and predicted values of BC-1, BC-2,

SM-1, and the deviation.

Sample

BC-1

real

BC-1

p

redictio

n

BC-1

d

eviatio

n

BC-2

real

BC-2

p

redictio

n

BC-2

deviation

SM-1

real

SM-1

prediction

SM-1

d

eviatio

n

1 4 4.01 0.25% 48.45 49.03 1.19% 46.74 46.75 0.02%

2 3.85 3.85 0.13% 43.66 43.05 1.40% 35.49 35.44 0.15%

3 4.13 4.13 0.00% 51.46 51.74 0.54% 42.84 44.32 3.46%

4 3.75 3.74 0.40% 46.13 45.99 0.30% 51 52.68 3.28%

5 4.03 4.02 0.25% 49.54 49.03 1.04% 45.94 45.84 0.21%

6 4 3.98 0.42% 48.47 48.50 0.06% 42.92 41.29 3.81%

7 3.91 3.86 1.21% 44 44.27 0.61% 45.68 45.98 0.66%

8 4.14 4.10 1.09% 50.92 51.05 0.26% 46.42 45.84 1.24%

9 4.19 4.16 0.66% 54.16 53.78 0.71% 43.63 43.46 0.39%

10 3.75 3.75 0.00% 44.14 44.65 1.15% 49.77 45.84 7.89%

11 4.3 4.35 1.16% 52.07 51.25 1.58% 48.4 49.42 2.11%

12 4.08 4.03 1.23% 48.25 47.44 1.69% 43.36 43.37 0.02%

13 4.41 4.35 1.36% 53.04 54.17 2.14% 45.43 45.98 1.22%

14 4.3 4.30 0.08% 51.3 51.25 0.11% 51.45 49.00 4.76%

15 4.31 4.35 0.93% 55.59 53.78 3.26% 42.97 44.97 4.65%

16 3.91 3.92 0.34% 44.15 44.14 0.02% 46.58 45.84 1.58%

17 3.85 3.86 0.26% 43.29 43.76 1.09% 40.99 41.23 0.59%

3

EXPERIMENT AND ANALYSIS

A type of algorithm based on a tree structure is

called a "decision tree," which can be used to make a

series of decisions and ultimately reach the best

conclusion 0. This is a supervised learning algorithm

that is suitable for both classification and regression

problems. In classification problems, the decision

tree divides the data set into different classes; in

regression problems, the decision tree predicts a

continuous value. In general, decision trees use

Research on Prediction of Decision Tree Algorithm on Different Types of Stocks

179

information entropy or information gain as a

measure of how to partition data. Although the

advantage of decision trees is that they are easy to

understand and can visually represent the decision-

making process, overfitting is a problem that needs

to be paid attention to 0. The quality and quantity of

training data are crucial for decision trees.

In this study, the information is separated into

two groups: one for training and the other for

testing. There are 702 pieces of information for 6

stocks in total. For one stock, there are 117 pieces of

information. The training set contains 85% of the

data, and the test set contains 15% of the data. There

are 100 examples in the training group and 17

examples in the testing group. The results of the

prediction can be seen in Table 1 and Table 2.

Table 2: The real and predicted values of SM-2, EI-1, EI-

2, and the deviation.

Sample

SM-2

real

SM-2

prediction

SM-2

deviation

EI-1

real

EI-1

prediction

EI-1

deviation

EI-2

real

EI-2

prediction

EI-2

deviation

1 3.32 3.34 0.70% 7.59 7.49 1.32% 17.25 17.11 0.83%

2 3.25 3.21 1.38% 7.77 7.68 1.19% 14.2 13.73 3.35%

3 3.44 3.43 0.22% 7.98 8.08 1.25% 18.86 19.13 1.41%

4 3.36 3.38 0.67% 8.04 8.03 0.16% 17.29 17.58 1.65%

5 3.42 3.38 1.10% 7.75 7.94 2.45% 16.94 17.30 2.10%

6 3.33 3.34 0.40% 7.57 7.55 0.31% 15.25 14.41 5.51%

7 3.25 3.26 0.31% 8.05 8.15 1.28% 16.16 16.42 1.62%

8 3.47 3.50 0.86% 8.21 8.23 0.18% 18.43 18.37 0.34%

9 3.52 3.50 0.57% 8.27 8.22 0.60% 19.19 18.99 1.04%

10 3.28 3.31 0.76% 8.07 8.01 0.78% 16.15 15.59 3.47%

11 3.52 3.50 0.57% 8.5 8.57 0.76% 23.59 24.21 2.64%

12 3.28 3.29 0.41% 7.21 7.17 0.52% 17.23 17.06 0.97%

13 3.55 3.55 0.00% 8.2 8.18 0.21% 20.18 19.53 3.21%

14 3.5 3.50 0.00% 8.58 8.57 0.17% 24.65 24.21 1.77%

15 3.57 3.56 0.28% 8.23 8.22 0.12% 19.01 20.11 5.80%

16 3.28 3.21 2.29% 8 8.05 0.63% 16.58 16.49 0.56%

17 3.28 3.25 0.84% 8.08 8.11 0.31% 16.02 16.52 3.12%

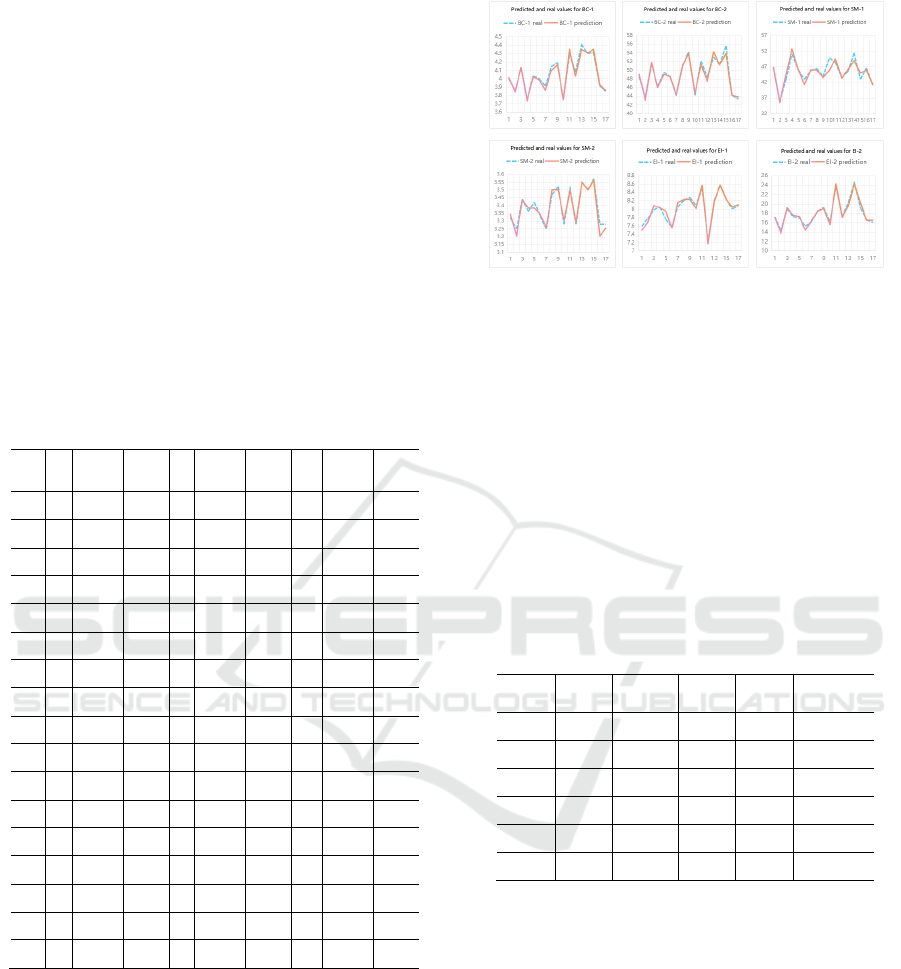

It can be seen from the above table that most of

the deviations between the predicted values of the

six stocks and the real values are less than 3%. The

curves of the predicted values and the real values of

the six stocks are shown in Figure 1.

MSA(Mean Squared Absolute Error),

RMSE(Root Mean Squared Error), MAE(Mean

Absolute Error), and R

2

(R-squared) are all

commonly used regression error metrics or scoring

indicators. MSA is calculated as the square root of

the mean of the squared differences between the

Figure 1: The curves of the predicted value and the real

value of the six stocks.

predicted and true values. RMSE is calculated as the

square root of the average of the squared differences

between the predicted and true values. MAE is

calculated as the average of the absolute values of

the differences between the predicted value and the

true value. R

2

is calculated as the ratio of the square

of the regression coefficient to the sum of the

squares of the residual. The value of R

2

is between 0

and 1, and the closer to 1, the better the fitting effect

of the model. For the above six stocks, the

forecasting performance indicators are shown in

Table 3.

Table 3: The performance of the decision tree model.

Stock MSE RMSE MAE R

2

Average

deviation

BC-1 0.001 0.035 0.026 0.968 0.57%

BC-2 0.379 0.616 0.481 0.972 1.01%

SM-1 1.707 1.306 0.927 0.907 2.12%

SM-2 0.001 0.031 0.024 0.915 0.67%

EI-1 0.008 0.091 0.062 0.918 0.72%

EI-2 0.349 0.591 0.428 0.944 2.32%

As shown in Table 3, the R

2

values of the

decision tree model on all 6 stocks are close to 1,

and the prediction performance of the model is good,

while the Average deviation of SM-1 and EI-2 is

obviously different from that of the other 4 stocks,

which may be It is related to the industry

background of these two stocks. These two stocks

are Beijing Tongrentang and Humanwell Healthcare,

both of which are in the pharmaceutical industry.

This also gives us an inspiration. For different

industries, machine learning algorithms may obtain

different prediction performance. This is also one of

our future research directions.

ANIT 2023 - The International Seminar on Artificial Intelligence, Networking and Information Technology

180

4

CONCLUSION

This study uses a type of technology called decision

tree in machine learning to anticipate the behavior of

stocks. It focuses on well-established stocks, smaller

to medium-sized stocks, and stocks from new

industries. It uses past data from the first six months

of 2022 to guess what the closing stock prices will

be. The results of the experiment show that the

decision tree model is better at predicting how the

stock will change in the future, and it does a good

job of making accurate predictions.

The way the price of stocks goes up and down is

the main thing about the stock market. Many things

can affect it, like the economy, policies, how

companies are doing, and how people feel about the

market. These things will affect stock prices in

different ways, causing the prices to go up and

down. So, figuring out how to use these factors to

make better predictions about stocks is something

that can be looked into more in the future.

ACKNOWLEDGMENTS

This research was funded by the Social Science

Project of Guangdong University of Science and

Technology(GKY-2022KYYBW-6), Humanities

and Social Science Youth Program of Guangdong

Provincial Department of Education

(2018WQNCX206).

REFERENCES

Rath S, Gupta B K, Nayak A K. Stock Market Prediction

Using Supervised Machine Learning

Algorithm[C]//Advances in Distributed Computing and

Machine Learning: Proceedings of ICADCML 2021.

Springer Singapore, 2022: 374-381.

Zhang C, Sjarif N N A, Ibrahim R B. Decision Fusion for

Stock Market Prediction: A Systematic Review[J].

IEEE Access, 2022.

Sakhare N N, Shaik I S, Saha S. Prediction of stock

market movement via technical analysis of stock data

stored on blockchain using novel History Bits based

machine learning algorithm[J]. IET Software, 2022.

Lee C S, Cheang P Y S, Moslehpour M. Predictive

analytics in business analytics: decision tree[J].

Advances in Decision Sciences, 2022, 26(1): 1-29.

Zi R, Jun Y, Yicheng Y, et al. Stock price prediction based

on optimized random forest model[C]//2022 Asia

Conference on Algorithms, Computing and Machine

Learning (CACML). IEEE, 2022: 777-783.

Illa P K, Parvathala B, Sharma A K. Stock price prediction

methodology using random forest algorithm and

support vector machine[J]. Materials Today:

Proceedings, 2022, 56: 1776-1782.

Kebonye N M, Agyeman P C, Biney J K M. Optimized

modelling of countrywide soil organic carbon levels

via an interpretable decision tree[J]. Smart Agricultural

Technology, 2023, 3: 100106.

Kurani A, Doshi P, Vakharia A, et al. A comprehensive

comparative study of artificial neural network (ANN)

and support vector machines (SVM) on stock

forecasting[J]. Annals of Data Science, 2023, 10(1):

183-208.

Behera J, Pasayat A K, Behera H, et al. Prediction based

mean-value-at-risk portfolio optimization using

machine learning regression algorithms for multi-

national stock markets[J]. Engineering Applications of

Artificial Intelligence, 2023, 120: 105843.

Shaikh B, Iyer A, Koneti M, et al. Stock Price Prediction

with Sentimental Analysis[C]//2022 4th International

Conference on Smart Systems and Inventive

Technology (ICSSIT). IEEE, 2022: 1632-1638.

Yun K K, Yoon S W, Won D. Interpretable stock price

forecasting model using genetic algorithm-machine

learning regressions and best feature subset

selection[J]. Expert Systems with Applications, 2023,

213: 118803.

Srinu Vasarao P, Chakkaravarthy M. Time series analysis

using random forest for predicting stock variances

efficiency[M]//Intelligent Systems and Sustainable

Computing: Proceedings of ICISSC 2021. Singapore:

Springer Nature Singapore, 2022: 59-67.

Deng S, Xiao C, Zhu Y, et al. Dynamic forecasting of the

Shanghai Stock Exchange index movement using

multiple types of investor sentiment[J]. Applied Soft

Computing, 2022, 125: 109132.

Lombardo G, Pellegrino M, Adosoglou G, et al. Machine

Learning for Bankruptcy Prediction in the American

Stock Market: Dataset and Benchmarks[J]. Future

Internet, 2022, 14(8): 244.

Research on Prediction of Decision Tree Algorithm on Different Types of Stocks

181