Research on Coal Production Cost Prediction Based on

PCA-SSA-SVR

Shuntang Zhang, Zhenyang Shi, Lihua Hu and Guojun Zhang

Shandong Technology and Business University, Yantai, China

Keywords: Coal Enterprises, Cost Influencing Factors, PCA-SSA-SVR, Cost Prediction Model.

Abstract: This paper starts from the research perspective of lean market-oriented management mechanism within coal

enterprises, establishes key influencing factors indicators in terms of environment, technical equipment and

organizational management, and builds a cost prediction model based on PCA-SSA-SVR, and compares it

with multiple regression analysis and PCA-BP prediction model, the results show that the proposed model

has outstanding It has the advantages of avoiding dimensional disasters, overcoming the shortcomings of

relying on empirical debugging penalty coefficients and kernel function parameters, and the prediction

accuracy meets the requirements, which can provide a basis for modern coal enterprises to formulate labour

quotas and cost control plans.

1 INTRODUCTION

The coal industry plays a crucial role in China's

economic development and energy supply (HOU

Xiaochao, 2020). However, in the current economic

and energy structure transformation period, the coal

industry is facing the challenge of slowing coal

demand (LIU Chang, 2017). To enhance their

competitiveness, coal enterprises must focus on

improving their cost advantage, making refined

production cost management increasingly important

(XU Bo, 2013). Compared to traditional cost

management methods, the internal lean

market-based management approach incorporates

lean thinking and a market-oriented perspective. It

breaks down costs into specific tasks and processes,

optimizes resource allocation within the organization,

and enables finer control over enterprise costs

(JIANG Zhonghui, 2018). The introduction of

mechanized and intelligent equipment has also

brought changes to the cost structure of coal

production (LI Guoqing, 2022). To optimize the

existing cost management system in China's coal

enterprises, it is crucial to conduct a comprehensive

analysis of production factors, design a production

cost forecasting index system, scientifically forecast

coal production cost trends, and reduce subjectivity

in decision-making.

Zhiling and Jiahao (REN Zhiling, 2015)

developed a scheduling scheme based on a grey

prediction mathematical model to predict the

relationship between water inflow and time in

roadways. This scheme effectively reduces

electricity costs. Hossain (Hossain M E, 2015) and

Meng (ZHU Meng, 2015) introduced a dynamic

approach to cost analysis by studying the factors that

influence costs, departing from the traditional static

research method. Data mining and intelligent

algorithms have gained popularity in recent years,

leading researchers to explore both new methods and

existing research results for potential improvements.

Noural (Nourali H, 2018) used a support vector

regression machine prediction model for cost

estimation. Jing (YANG Jing, 2017) et al. improved

the prediction accuracy of coal logistics cost by

constructing a support vector regression machine

based on the chicken swarm optimization algorithm.

Xiaohong and Huijia(TAI Xiaohong, 2017)

enhanced the prediction accuracy of coal mining

cost by utilizing an improved adaptive particle

swarm optimization algorithm to determine the

penalty factor and kernel function for the least

squares support vector machine, resulting in

satisfactory outcomes.

In summary, the industry has developed a

comprehensive set of cost forecasting ideas and

continuously improved forecasting methods.

However, the changing mining mode in modern coal

mining enterprises has altered the structure of

production cost elements. Additionally, existing

literature lacks sufficient focus on the current state

Zhang, S., Shi, Z., Hu, L. and Zhang, G.

Research on Coal Production Cost Prediction Based on PCA-SSA-SVR.

DOI: 10.5220/0012286300003807

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Seminar on Artificial Intelligence, Networking and Information Technology (ANIT 2023), pages 483-487

ISBN: 978-989-758-677-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

483

of coal enterprise cost management, mainly due to a

lack of firsthand data. Furthermore, comprehensive

research progress has revealed that cost forecasting

models in coal enterprises heavily rely on historical

cost data, but the processing of acquired data before

forecasting has been neglected.

2 ANALYSIS OF PRODUCTION

COSTS FOR COAL

COMPANIES

2.1 Coal Enterprise Mining

Characteristics

At present, with the increasing amount of

mechanical and electrical equipment invested in coal

enterprises, maintenance and depreciation costs are

gradually increasing, while the complex mining

environment due to the limitations of special natural

factors has led to changes in the components of

production costs, making it difficult to accurately

forecast production costs for coal enterprises.

(1) Equipment upgrade. Coordinated interaction

between technology and management innovation in

coal enterprises, mechanised equipment gradually

replacing manual operations, labour productivity and

coal production increased significantly, but the high

introduction cost of large equipment, depreciation

and maintenance costs increased cost pressures.

(2) Coal production operations are complex.

Unlike manufacturing enterprises, coal production

does not consume raw materials and auxiliary

materials do not constitute the product entity, which

also leads to a complex cost composition and

increases the costing workload (ZHANG Qing, 2000).

(3) The operating environment is influenced by

natural factors. The production process of coal is

limited by natural conditions such as geological

formations, reserves and ambient temperature, and

has high auxiliary costs such as safety.

2.2 Internal Lean Market-Based Cost

Management Mechanisms

The internal lean market-based management

framework, depicted in Figure 1, introduces a shift

from traditional administrative subordination within

coal enterprises. It empowers the enterprise, district

teams, teams, and individual positions to operate as

market entities. This decentralization of management

authority creates trading markets between the

various levels of entities. Based on historical

operational data, the framework determines the fixed

unit price for the trading markets at each level,

taking into account the existing economic, technical,

and production levels. This approach establishes a

new cost management mechanism that incorporates

the value chain. By fully engaging the employees

and enhancing the enterprise's fine management

capabilities, the framework aims to reduce costs,

increase efficiency, and enhance competitiveness. It

is important to consider the influence of the

management level of coal enterprises and market

quotas on costs when making cost forecasts within

this framework.

security system

market rules pricing systemquota system evaluation system settlement system

index

annual budget monthly budget

single item miscellaneousmining engineering

Ban Qing Ban Jie

coal mining part-time jodriving Team Services

Personal wage settlement

miscellaneous

single item

miscellaneo

us

Internal lean market cost management mechanism

Primary Trading

Market

secondary

transaction

market

Three-level

trading market

Four level trading

market

lean production

process management

Material lean

management

Multi-skilled

management

Equipment lean

maintenance

Environmental lean

management

project management

system

miscellaneous

Figure 1: Internal lean market management mechanism.

2.3 Building a Framework of Factors

Influencing Coal Production Costs

Through Web of Science, China Knowledge

Network and other databases, we have collected and

screened the literature that has profound research on

coal enterprises' production cost influencing factors

and modelling prediction and control in the past 15

years, combined with the current operating

environment, internal lean market-oriented

management situation and production factor

structure of coal enterprises for analysis and

integration, finally identified and screened out coal

production cost influencing factors and constructed

coal The framework of production cost influencing

factors is shown in Table 1.

Table 1: Influencing factors of coal production cost.

Influencing factors of coal production cost

environmental

factor

Operating temperature, height mining, Thickness

of caving roof, inflow of water

Technical

equipment

factors

Unit footage output, Single cycle yield, Lifting

efficiency, Equipment service life, mechanisation

level, Mining coordination level

the lean

management

level

standardization level, Proposal improvement rate,

safety assessment, labour quality, quality of

manager

Marketized quota

management

Material quota, manual unit price, electricity

expense, maintenance cost unit price, and

others

coal quality, supplying difficulty

ANIT 2023 - The International Seminar on Artificial Intelligence, Networking and Information Technology

484

3 COST FORECASTING MODEL

BASED ON PCA-SSA-SVR

3.1 Principal Component Analysis

Let the coal production cost influencing factors be

12

, , ,

n

X X X

, create a correlation type matrix

X

for

11 12 1

21 22 2

12

n

n

n n nn

X X X

X X X

X

X X X

. Arrange the

non-negative eigenvalues of the correlation

coefficient matrix

i

in the order of

12

0

m

, and according to

1

/ , 1,2, ,

n

i i i

i

in

, count the cumulative

contribution of the former as

p

1

p

i

i

. When

85%

is selected, the eigenvector

12

, , ,

p

r r r

corresponding to the eigenvalue

12

, , ,

p

is

selected to construct the principal component matrix.

12

, , , ( )

T

j j j jn

R r r r j p

The principal components were extracted from

the original data at

p

and the combined principal

component score was calculated using the following

formula

1 1 2 2

* * *,( 1,2, , )

j j jn n

FACj r X r X r X j p

3.2 Sparrow Search Algorithm

The Sparrow Search Algorithm (SSA) is inspired by

the sparrow's ability to complete foraging and

anti-predatory behaviour by updating the positions

of finders, followers and vigilantes, and has the

advantages of strong global search capability and

fast convergence(Zhang K, 2023).

Discoverer location update formula in SSA is

1

,2

,

,2

exp / ( ) ( (0, ));

( ,1)),

e

e

ij

ij

e

ij

dy

X i D if R S

X

dx

X QL if R S

In the above equation,

1,2, ,jd

and

d

are

the population dimensions;

e

is the current number

of iterations;

D

is the maximum number of

iterations;

Q

is a random number with a normal

distribution;

ij

X

is the location of the sparrow

i

in

the

j

dimension;

(0,1

is a uniform random

number;

22

( 0,1 )RR

and

( 0,1 )SS

are the

warning and safety values, respectively;

L

is a

1 d

matrix with each element being 1.

Accession position update formula:

2

,

1

,

11

,

exp ( ) / ( ( / 2, ));

( ( / 2, )),

e

worst i j

e

ij

e e e

p i j p

Q X X i if i m

X

X X X A L if i m

In the above equation:

worst

X

is the current global

worst position;

p

X

is the best position occupied by

the current finder;

A

is a matrix of

1 d

with -1 or

1 elements each and

1

()

TT

A A AA

; the number

of sparrows is

m

, when

/2i m

indicates that the

first

i

joiner is less adapted and not getting food and

needs to fly to another position to feed for energy.

When a hazard is detected, the vigilante

position is updated with the formula:

,

1

,

,

,

( ( , ));

( ),

()

e e e

best i j best i g

e

ee

ij

i j worst

e

i j i g

iw

X X X if f f

X

K X X

X if f f

ff

In the above equation:

is the minimum

constant;

1,1K

is a random number;

is a

random number that follows the mean standard

normal distribution,

best

X

is the global current best

position;

i

f

is the sparrow's fitness value;

g

f

and

w

f

are the global best and worst fitness values.

3.3 Support Vector Regression Models

Support vector regression model (SVR), a derivative

branch of support vector machine (SVM), introduces

a fitted loss function to solve the regression problem

for non-linear systems. SVR is not only capable of

separating input vectors in a multi-dimensional

space with a maximum distance hyperplane, but it

also has better results in predicting small sample

data(Zhou Z, 2022).

The SVR function can be represented as

( ) ( )

T

f x w x b

where

()x

is a non-linear

function,

()fx

represents the predicted output and

w

and

b

are the corresponding coefficients.

Also the SVR is an optimisation problem and can

be expressed as

2

, , , *

1

1

min + + *

2

n

wb

i

wC

( )

. Where

n

is the sample size,

and

*

are the relaxation

variables and

0C

is the regularisation factor.

Also the dual form of the optimisation problem

can be obtained using the Lagrangian equation

which can be represented by the equation.

Research on Coal Production Cost Prediction Based on PCA-SSA-SVR

485

,*

1 1 1

1

max ( *) ( *) ( *)( *) ( , )

2

ii

n n n

i i i i i i i j j i j

i i i

y k x x

where

1

( *) 0

n

ii

i

,

0

i

,

*

i

C

, and

the SVR function can be expressed as

1

( ) ( *) ( , )

n

i i i j

i

f x a a k x x b

. Where

i

and

*

i

are Lagrange multipliers;

( , )

ij

k x x

is the

kernel function and the expression for the Gaussian

RBF kernel function chosen for this study is defined

as

2

( , ) exp( ) , 0

ii

k x x x x

.

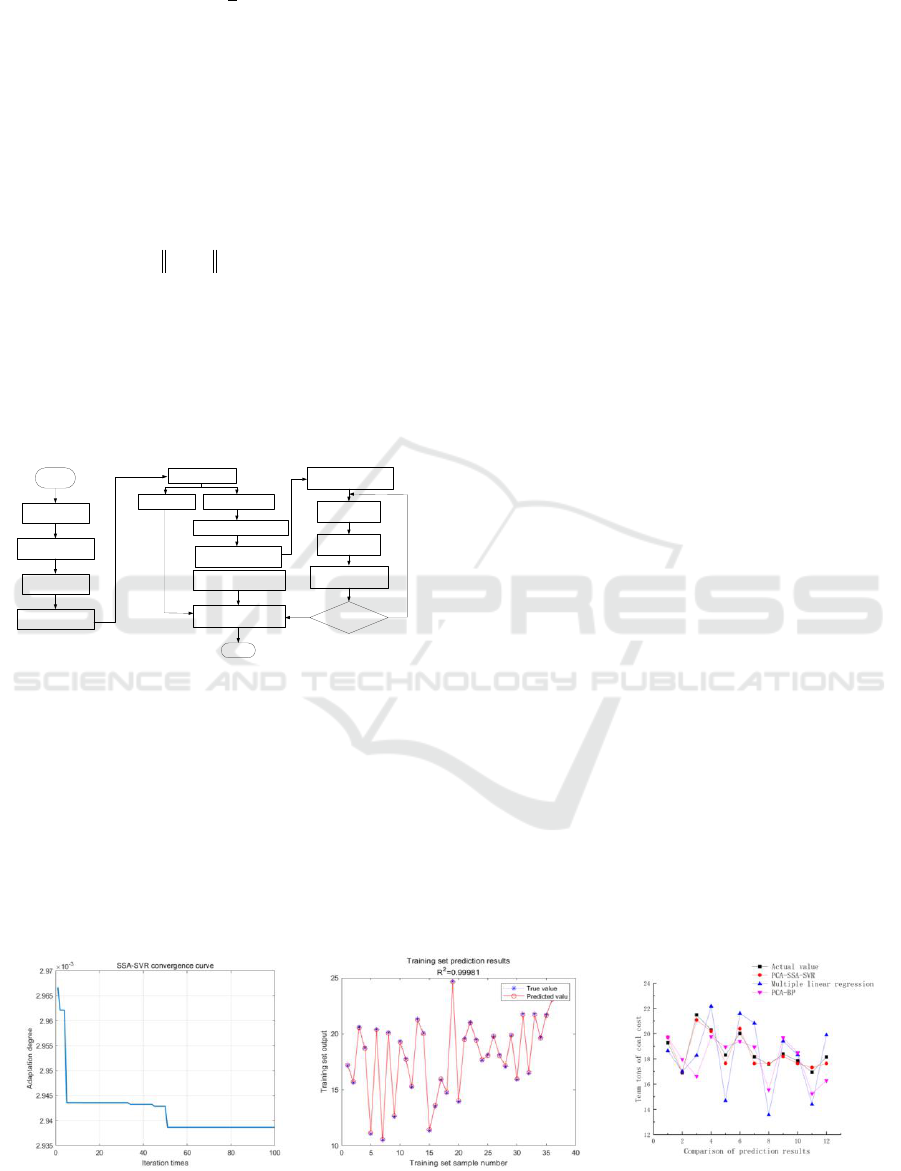

3.4 PCA-SSA-SVR Prediction Model

Construction

In this paper, a PCA-SSA-SVR model is established

to forecast coal production costs, and its specific

steps are shown in Figure 2.

start

Number of samples

constructed

Sample matrix

standardization

correlation

coefficient matrix

Determine the number of

principal components

Principal component

matrix

Test set ( 30 % )

Determine the optimized

penalty factor and kernel

function parameters

Support vector machine

regression

Intelligent prediction model

Construct a support vector

machine regression model

end

Initialize sparrow search

algorithm parameters

The population is divided

into discoverer and joiner

Update the location

of discoverers and

joiners

Update the alerter

Population location

Calculate the best

fitness and update the

best individual position

Training set ( 70 % )

Satisfy termination

conditions

Y

N

Figure 2: PCA-SSA-SVR model process.

4 MODEL APPLICATIONS

4.1 Data Collection

Using a coal mine in Shaanxi as an example to

validate the proposed prediction model, the

production information of the mine for the past three

years was collected, including market-based labour

quota standards, lean production performance

assessment data, each team's staffing table, material

consumption data, equipment replacement and

maintenance records, production per shift, internal

lean market-based accounting data of the mine,

underground operating environment, operating

workers, production equipment and other

information, and after sorting and filtering steps to

The data was aggregated to form the set containing

21 coal production cost impact factors.

4.2 Analysis of Prediction Results

The PCA method was used to reduce the

dimensionality of the 21 influencing factors

indicators of coal production cost, and the calculated

principal component analysis data was used as the

input data of the prediction model, corresponding to

the marketed unit cost per tonne of coal of that

district team as the output layer. The population size

was set to 30 during the model training, the

maximum number of iterations was 100, and the

penalty coefficient and kernel function parameters

were taken to be between 0.001 and 1000.

The optimal penalty coefficient and kernel

function parameters after algorithm optimization are

388.705 and 113.337 respectively. The above

optimal parameters are brought into SVR. The

training results of PCA-SSA-SVR prediction model

show that the correlation coefficient between the

actual value and the predicted value is

0.88R

,

indicating that the hybrid model has strong learning

ability and high prediction accuracy. The remaining

12 sets of data are used as prediction samples. After

training various prediction models, the prediction

results are shown in Figure 3. It can be seen

intuitively that the error between the predicted value

and the actual value of the PCA-SSA-SVM model is

the smallest, and it has better prediction ability.

Figure 3: Training results of PCA-SSA-SVR prediction model.

ANIT 2023 - The International Seminar on Artificial Intelligence, Networking and Information Technology

486

5 CONCLUSION

Aiming at the problem of cost forecasting in modern

coal enterprises, this study screens and summarizes

the key influencing factors of coal production costs

based on the internal lean market management

mechanism of coal enterprises, establishes the

PCA-SSA-SVR cost forecasting model, and applies

and verifies the model. Finally, the following three

conclusions are drawn:

(1) Compared with the traditional method of

distributing the cost of machinery and equipment

according to the standard, the internal lean

market-oriented management mechanism

implements the lean improvement system within the

enterprise, introduces a market-oriented mechanism,

and formulates labor quotas, which is more

conducive to the realization of fine-grained

enterprise costs management.

(2) By analyzing and summarizing the

interrelationship and change law between coal

production cost and various influencing factors, this

study comprehensively establishes the key factor

indicators that affect coal production cost from the

aspects of environment, management level, and

marketization quota, so as to ensure that coal

production cost Scientific Validity of Predictions.

(3) The results of the model application test show

that: based on the PCA-SSA-SVR model, the

efficient and accurate prediction of production costs

can be realized, which can provide a basis for coal

enterprises and other fields to formulate labor quotas

and cost control plans, and has certain promotion

and application for coal enterprises value.

REFERENCES

HOU Xiaochao, ZHANG Lei, YANG Qing. Chinese

medium and long-term coal demand forecast based on

Monte Carlo method (J). Operations Research and

Management Science, 2020, 29(01): 99-105.

LIU Chang, SUN Chao. Long-term future prediction of

China's coal demand (J). China Coal, 2017, 43(10):

5-9+20.

XU Bo, HUANG Wusheng. Management system of

accurate ore actual valueactual valuecosting for gold

mines (J). Metal Mine, 2013(05): 125-127.

JIANG Zhonghui, LUO Junmei, MENG Chaoyue. A study

on the path of dual-perception to overcoming inertia

(J). Journal of Zhejiang University (Humanities and

Social Sciences), 2018, 48(06): 171-188.

LI Guoqing, WU Bingshu, HOU Jie, et al. Mining cost

prediction model for underground metal mines (J).

Metal Mine, 2022(05): 62-69.

REN Zhiling, HAN Jiahao. Energy saving control research

on mine drainage system based on model predictive

control (J). Journal of System Simulation, 2015,

27(12): 3032-3036+3043.

Hossain M E. Drilling costs estimation for hydrocarbon

wells (J). Journal of Sustainable Energy Engineering,

2015, 3(1): 3-32.

https://doi.org/10.7569/jsee.2014.629520.

ZHU Meng. Study on safety cost of coal companies based

on systematic dynamics model (J). Coal Engineering,

2015, 3(1): 3-32.

Nourali H. Mining capital cost estimation using Support

Vector Regression (SVR) (J). Resources Policy, 2019,

62: 527-540.

https://doi.org/10.1016/j.resourpol.2018.10.008.

YANG Jing, LI Junfu, ZHANG Gaoqing. Coal logistics

cost prediction based on improved support vector

regression (J). Journal of Guangxi University (Natural

Science Edition), 2017, 42(04): 1623-1627.

TAI Xiaohong, ZHANG Huijia. Coal mining cost

prediction model based on IAPSO-LSSVM (J).

Journal of Liaoning Technical University (Natural

Science), 2017, 36(05): 554-560.

ZHANG Qing, WANG Dongping, LI Xingdong. An

analysis on main factors affecting cost of enterprise of

coal mine (J). Journal of Liaoning Technical

University (Natural Science), 2000(03): 323-326.

Zhang K, Chen Z, Yang L, et al. Principal component

analysis (PCA) based sparrow search algorithm (SSA)

for optimal learning vector quantized (LVQ) neural

network for mechanical fault diagnosis of high voltage

circuit breakers(J). Energy Reports, 2023, 9: 954-962.

https://doi.org/10.1016/j.egyr.2022.11.118.

Zhou Z, Dai Y, Wang G, et al. Thermal displacement

prediction model of SVR high-speed motorized

spindle based on SA-PSO optimization (J). Case

Studies in Thermal Engineering, 2022, 40: 102551.

https://doi.org/10.1016/j.csite.2022.102551.

Research on Coal Production Cost Prediction Based on PCA-SSA-SVR

487