A Study on Effectiveness and Performance of SMEs in Indian Society

Deepali Rani Sahoo

a

and Bhavana Sharma

b

1

Symbiosis Law School, NOIDA-Symbiosis International (Deemed University), Pune, India

2

Birla School of Law, Birla Global University, Bhubaneswar, India

Keywords: Small and Medium-Sized Enterprises, Operational Management and Financial Aspects.

Abstract: In the upcoming ten years, the SME sector, one of the main drivers of the Indian economy, is anticipated to be

crucial. Due to its capacity for financial inclusion and creation of significant employment prospects in both

urban and rural areas, its expansion is seen as being vital. Due to their nature as small-scale investors, SMEs

contribute to the protection of workers' rights and the social welfare of billions of people. Compared to main

industries, the industry offers jobs with a significantly higher level of intensity. However, issues with finances,

personnel availability and increased automation are jeopardizing the sector's productivity. Enhancing current

technology and the support system requires evaluating the performance of SMEs. The lack of coordination

between various performance measuring tools and bad management are two common problems in small and

medium-sized enterprises. Due to quality concerns, the market is not yet ready to accept SMES in Delhi

NCR's products, hence their output is mostly dependent on market availability. In this light, the researcher

has made an effort to examine the impact of different factors of Operational, Management and Financial

aspects of SMEs on its overall performance with the use of Factor Analysis and Structural Equation Modelling

based on the views of 510 managers/owners of 384 SMEs spread over some places of Delhi NCR. The study

identified significant impact of Operational, and Financial aspects on “overall performance of SMEs”. In this

work, both inferential and experimental quantitative research methods were employed. The fundamental

objective of the inferential method is for the researcher to create a data base for the topic under inquiry. It

includes selecting a sample in order to extract information about the characteristics of the population. This

generally refers to survey research, which involves researching a sample of the population and analysing the

data to derive conclusions about the population's characteristics. In the sampling procedure, the population

and sample are described in detail.

1 INTRODUCTION

Due to their large range of products and connections

to nearly all of the key industries, including as

agriculture, plastics, food, fertilisers, paints, personal

care items, and others, small and medium-sized

companies (SMEs) serve as the foundation of the

Indian economy. SMEs are typically seen as the main

force behind economic growth (Khatri, 2019). It is the

tool that encourages the growth of the country. This

industry's capacity to create jobs has long been

understood and appreciated (Harvie & Charoenrat,

2015). SMEs, which often have lower capital

expenses than major businesses, promote significant

job prospects (Sarma, 2016). Their support for the

industrial development of rural and undeveloped

a

https://orcid.org/0000-0001-6949-7439

b

https://orcid.org/0000-0002-5287-3327

areas, which greatly lowers regional differences, also

ensures a more equitable division of the nation's

riches. This industry has already shown that it can

generate a sizable number of job opportunities. Over

the next ten years, it is expected to contribute 20% or

more of the GDP, which would add a lot of value. In

light of this, it has the potential to be successful in

order to support the economy and fuel its growth

engine. This industry has already demonstrated its

capacity to create a significant amount of

employment possibilities. According to Sivakami

(2012), the sector is anticipated to contribute roughly

20% of the country's GDP, which is a considerable

amount in terms of value adds. By introducing them

to the idea of "self-sufficiency" through SMEs, the

nation's greatest young population can be used to

speed up economic growth and development.

512

Sahoo, D. and Sharma, B.

A Study on Effectiveness and Performance of Smes in Indian Society.

DOI: 10.5220/0012492500003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 512-520

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Currently, the SME sector accounts for around

50% of all jobs in the nation, and it is projected to

continue expanding across manufacturing, services,

and contract farming. SME has the capacity to

succeed against this backdrop in order to help the

economy and power its growth engine. Accordingly,

SMEs are the backbone of the Indian economy

(Mageswari & Bhuvaneswari, 2019). From the

smallest industry to the proactive one that is rapidly

improving and contributing to India's largest

employer, this sector's progress may be seen. The low

investment pattern of this sector has pushed many

ordinary citizens of the country for the establishment

of small and medium sized enterprises. But a barrier

to the growth of this industry is the lack of a solid,

developed work environment. In light of this

situation, the researcher's goal in conducting the study

was to evaluate how well SMEs were performing.

2 STATEMENT OF THE

PROBLEM

SMEs are important to the country's economic and

social development. Individual initiative and

inventiveness are the driving forces behind this

sector. It generates 40% of exports, 45% of the

nation's manufacturing output, and 8% of the GDP.

26 million MSME scattered around India provide

employment for about 60 million people nationwide.

The lack of coordination between various

performance measuring tools and bad management

are two common problems in small and medium-

sized enterprises. Due to quality concerns, the market

is not yet ready to accept SMES in Delhi NCR's

products, hence their output is mostly dependent on

market availability. Additionally, due to a lack of

sufficient funding and entrepreneurial vitality, these

divisions inevitably fail even at the start up or

maturity stage of a business. Despite having access to

abundant natural resources, Delhi NCR is one of the

most developed regions, so it is essential to carry out

the study to evaluate the performance of SMEs. The

study's findings can also be used to provide remedial

actions for the SMEs' outstanding growth in Delhi

NCR.

3 REVIEW OF LITERATURES

The Indian economy depends heavily on MSMEs.

This demanding of labour sector of the economy

contributes to the stability of the socioeconomic

system. By fostering economic stability, creating

jobs, and assisting in the growth of society's wealth,

they can lessen economic inequality at the local level.

SMEs are clearly responsible for developing work

possibilities for all socioeconomic groups. To the

average Indian, it gives them a sense of financial

independence. The only sector with a realistic chance

of producing a lot of jobs in the near future is this one

(Gade, 2018). The importance of SMEs to the Indian

economy cannot be overstated. SMEs provide a

significant contribution to the country's development,

but they do not get the support they need from

governmental agencies and financial institutions

(Bagale et al. 2016). This labour-intensive industry

supports the social equilibrium. It encourages

financial independence, supports job creation, and

contributes to society's sustainable development, all

of which help to eradicate socioeconomic disparities

at the local level. (Ahmed 2019; Islam & Gangly

2019; Singh et al. 2017).

A common man is typically encouraged to establish

this industry because SMEs initially require little

funding and a small staff. Even if this sector's

performance isn't great, it's anticipated that it will be

the only one to support job growth. The growth of

rural and urban areas is now being driven by the

SMEs sector. According to SIDBI (2001), Farooqi

and Sibghatullah (2002), the main problems that have

a significant impact on small businesses' performance

at various stages of their operations include

inadequate financing, bad infrastructure, machinery,

management abilities, and unexpected shocks

brought on by tax and economic developments. There

are six main components: marketing, finance,

technology, raw resources, labour, and management.

Maheshkar & Soni highlighted as having an impact

on the performance of MSMEs in 2022. These

MSMEs' operational, managerial, and financial

metrics are listed below (Gyampah & Boye, 2001).

According to Adeola (2016), the technological,

financial situation, political, legal, and sociocultural

environments all significantly affect how well SMEs

succeed. Variables like financial accessibility,

instability, rising competitiveness, insufficient

funding, a lack of leadership skills, cutting-edge

technology, and insufficient marketing have a

significant impact on the performance of SMEs

(Grimsholm & Poblete, 2010; Gaziasayed,

Najmussaharsayed, 2018). Inadequate funding,

inadequate social infrastructures, lack of

organisational skills, and unanticipated disruptions

brought on by economic and tax reforms are the

issues that have the largest impact on how

A Study on Effectiveness and Performance of Smes in Indian Society

513

successfully small enterprises perform at different

stages of their operations. The financial side needs to

be encouraged because it is the main difficulty facing

almost all of the industries that fall under SMEs

(Turyahebwa, 2013). The social welfare of billions of

people is influenced by SMEs. Therefore, it is clear

that the business might generate employment

prospects, especially for low and semi-skilled

employees. The sector provides work that is

substantially more intense. However, problems with

funding, infrastructure, technology, the political &

legal climate are reducing the sector's productivity.

There are many studies that highlight the difficulties

faced by SMEs, but few that examine the effects of

various operational, management, and financial

elements on SMEs' overall performance. Therefore,

the researcher has made an effort to conduct the study

to evaluate the performance of SMEs operating in

Delhi-National Capital Region and to test the

hypothesis that various performance measurement

techniques' operational, management, and financial

aspects have a significant impact on SMEs'

performance.

4 METHODOLOGY

4.1 Population

There are over 160167 SMEs located throughout

Delhi NCR. All SMEs cannot be used as a basis for

the research. Therefore, a sufficient number of SMEs

will be included in the study on the basis of annual

turnover and the number of employees working in

each SMEs

4.2 Sample Size

The adequacy of the sample size has been tested by

the following mentioned formula.

n =

()

()

= 384 (Approx.)

The number of small and medium sized industries of

each type constitutes the sub-population size (𝑁

)

1.1.1.1 N = Population size (Total number of

SMEs) = 160167

P = Proportion of SMEs = 0.5

e = Margin error = 5%

Z = Critical value for large sample at 95%

confidence level = 1 .645

The scope of study is limited to 384 small and

medium sized enterprises, 510 owners/managers of

SMEs. Operational aspect of performance is

associated with nature, type, number of years of

operation of SMEs, gender, age and qualification of

the entrepreneurs of SMEs. Management aspect of

performance is associated with nature, type, number

of years of operation of SMEs, gender, age and

qualification of the entrepreneurs of SMEs

Limitation of the study -The study only examines the

effects of three factors on the performance of SMEs:

updated technology, capital structure, and

infrastructural facilities.

4.3 Methods of Collecting Data

Data from both primary and secondary data sources

were used in the study. Data about SMEs and

entrepreneurship in Delhi NCR were compiled using

secondary sources, such as government reports and

websites. Sample data collected from secondary

sources are mainly through journals, magazines,

articles, books, published and unpublished

documents and thesis on MSMEs. In most of the

cases government publications, public websites,

reports and articles on the role of MSME have been

referred for the secondary data collection.

Governmental documents, open-access websites,

reports, and articles on small- and medium-sized

businesses have typically been used as sources for

secondary data collecting. 510 owners and managers

of 384 SMEs provided the primary sources for the

data.

A well-designed questionnaire with eight operational

aspect questions, seventeen management aspect

questions, and nine financial aspect questions about

SMEs was utilised as a tool to gather data on a 5-point

scale. Whereas a score of 5 indicates a strong

disagreement with the item or statement in question

and a score of 1 suggests a strong agreement.

Following extensive literature investigation, the

choices were made. The information was gathered

over the course of four months in 2022. Using SPSS-

23, the gathered data were examined.

4.4 Techniques of Data Analysis

When analysing the effects of various factors on the

performance of SMEs, structural equation modelling

and factor analysis are applied. The application of

factor analysis enables the reduction of a "huge mass

of data" to distinct "factors". The researcher

conducted a multivariate statistical method using

factor analysis to pinpoint the operational,

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

514

management, and financial aspects of SMEs.

Regression modelling is used in structural equation

modelling (SEM) to determine the influence of a

collection of independent factors on a single

dependent variable. It is conceptualized as a

‘multivariate statistical' method that combines 'factor

analysis' and ‘multiple regression analysis'.

5 RESULTS AND DISCUSSION

To begin with, factor analysis is utilized to identify

the key variables that can account for the

"operational aspect," "management aspect," and

"financial aspect" of SMEs' performance. SEM is

used to further evaluate the effects of the elements

that were retrieved from the first phase of the

investigation. The impact of the factors extrapolated

from the factor analysis on the general performance

of SMEs is investigated in this case using SEM.

5.1 Operational Aspects of

Measurement Techniques

Reliability of the Scale - Cronbach Alpha is a widely

used as internal reliability measure.

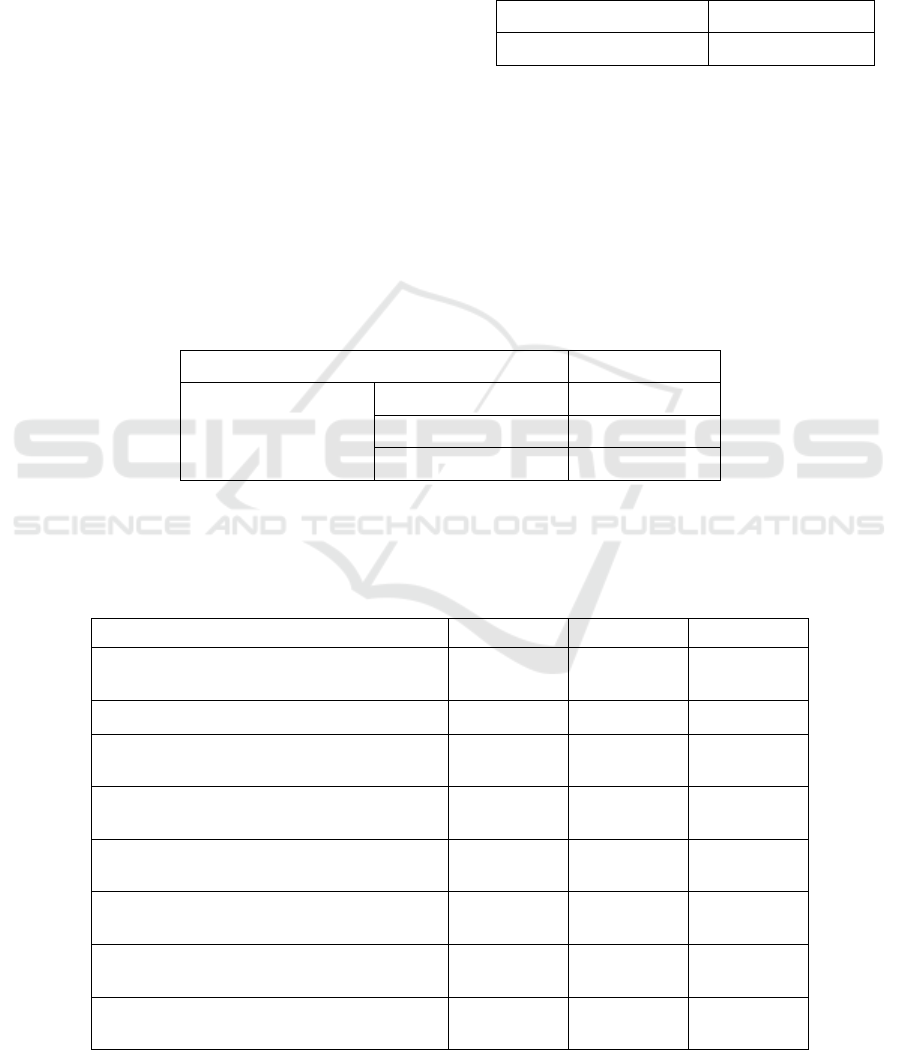

Table 1: Reliability Statistics of Operational aspect

Al

p

ha N

0.856 9

Source: Computed from primary data

Alpha value of 0.856 is more than 0.70 and it implies

a strong level of reliability for the scale used in the

analysis.

Construct validity- It is demonstrated significantly

with the help of alpha reliability value of 0.856 (More

than 0.70) and KMO value of 0.714 (Hair et al.,

1995).

Table 2: KMO and Bartlett's Test of Operational aspect.

Kaiser-Meyer-Olkin Measure

0.714

Bartlett's Test of

Sphericity

Chi-Square

3.674E3

df

36

Sig.

0.000

Source: Computed from primary data

Table 2 shows ‘KMO and Bartlett’s test of the

analysis and Bartlett’s test of sphericity. Here, p-

value of 0.000 (less than 0.05) is an indication to

proceed with factor analysis.

Table 3: Rotated Component Matrix of Operational aspect

1 2 3

O5 = There is always easy availability of raw

materials

.953

O6 = The industry provides good power facility

.933

O7 = There is easy availability of infrastructural

facilities

.914

O1 = The industry gets financial assistance from

b

ank.

.915

O8 = The industry maintains the easy loan

p

a

y

ment s

y

ste

m

.818

O3 = The procedures & formalities to avail

loans suit the industry

.682

O4 = There industry sticks to skilled and

technolo

gy

savv

y

work force

.945

O2 = The industry uses updated technology

machines used is u

p

to the mar

k

.936

Source: Computed from primary data

A Study on Effectiveness and Performance of Smes in Indian Society

515

Convergent validity is explained with high factor

loadings of ideally more than 0.60. (Table No-3)

Factor interpretation of Operational aspect-

Factor analysis explores three important factors-

‘Infrastructural facilities’, ‘Bank assistance’ and

‘Updated technology’. The First factor has three

loadings; second one is accounted for three factor

loadings. The third factor is accounted for two factor

loadings.

5.2 Management Aspects of

Performance Measurement

Techniques

Table 4: Reliability Statistics of Management aspect

Al

p

ha N

0.934 17

Source: Computed from primary data

It is clear that Alpha (0.934) is more than 0.70 and it

implies a strong level of reliability for the scale used

in the analysis.

Construct validity- Construct validity is

demonstrated significantly with the help of alpha

reliability value of 0.934 (More than 0.70) and KMO

value of 0.896.

Table 5: KMO and Bartlett's Test of Management aspect

Kaiser-Meyer-Olkin Measure

0.896

Bartlett's Test of

Sphericity

Chi-Square

7.116E3

df

136

Sig.

0.000

Source: Computed from primary data

KMO and Bartlett's Test measure of sampling

Adequacy is 0.896 signifies the accuracy of factor

analysis.

5.3 Financial Aspects of Performance

Measurement Techniques

Table 6: Reliability Statistics of Financial aspect

Alpha N

0.903 9

Source: Computed from primary data

It is clear that Alpha (0.903) is more than 0.70 and it

implies a strong level of reliability for the scale used

in the analysis.

Construct validity

Construct validity is demonstrated significantly with

the help of alpha reliability value of 0.903 (More than

0.70) and KMO value of 0.800

Table 7: KMO and Bartlett's Test of Financial aspect

Kaiser-Meyer-Olkin Measure of Sampling Adequacy.

.800

Bartlett's Test of Sphericity Approx. Chi-Square

5233.931

df

36

Sig.

.000

Source: Computed from primary data

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

516

KMO and Bartlett's Test measure of sampling

Adequacy is 0.800 signifies the accuracy of factor

analysis.

Table 8: Matrix of Rotated Bits of Financial Aspect.

1 2 3

F7= The industry is planning to avail

more finance to increase the sales and the

p

rofit

.936

F3= Payment to workers is satisfactory .917

F5= The industry is planning to reduce

the cost of production

.911

F8= Working capital structure of the

industry is satisfactory

.556

F1= There is proper diversion of working

capital funds for acquisition of fixed

assets

.942

F9= The revenue has increased as

compared to last three years

.921

F4= The profitability position is good .915

F2 = Rate interest of loans is duly paid .931

F6= There is proper planning to pay

creditors

.925

Source: Computed from primary data

Convergent validity is explained with high factor

loadings of ideally more than 0.60. (Table No-9)

Factor interpretation of financial aspect

Factor analysis explored three important factors-

‘Capital structure’, ‘Profitability’ and ‘Financial

Planning’. The First factor has four loadings; second

one has three factor loadings and the third has three

factor loadings.

5.4 Model Fit Summary of SEM

Chi-square value of 3504.503 with positive d.f of 55

indicates that the model is over identified. As chi-

square value is sensitive to large sample size, the

fitness of the model needs to be judged based on other

indices. Other measures of goodness of fit are

illustrated below.

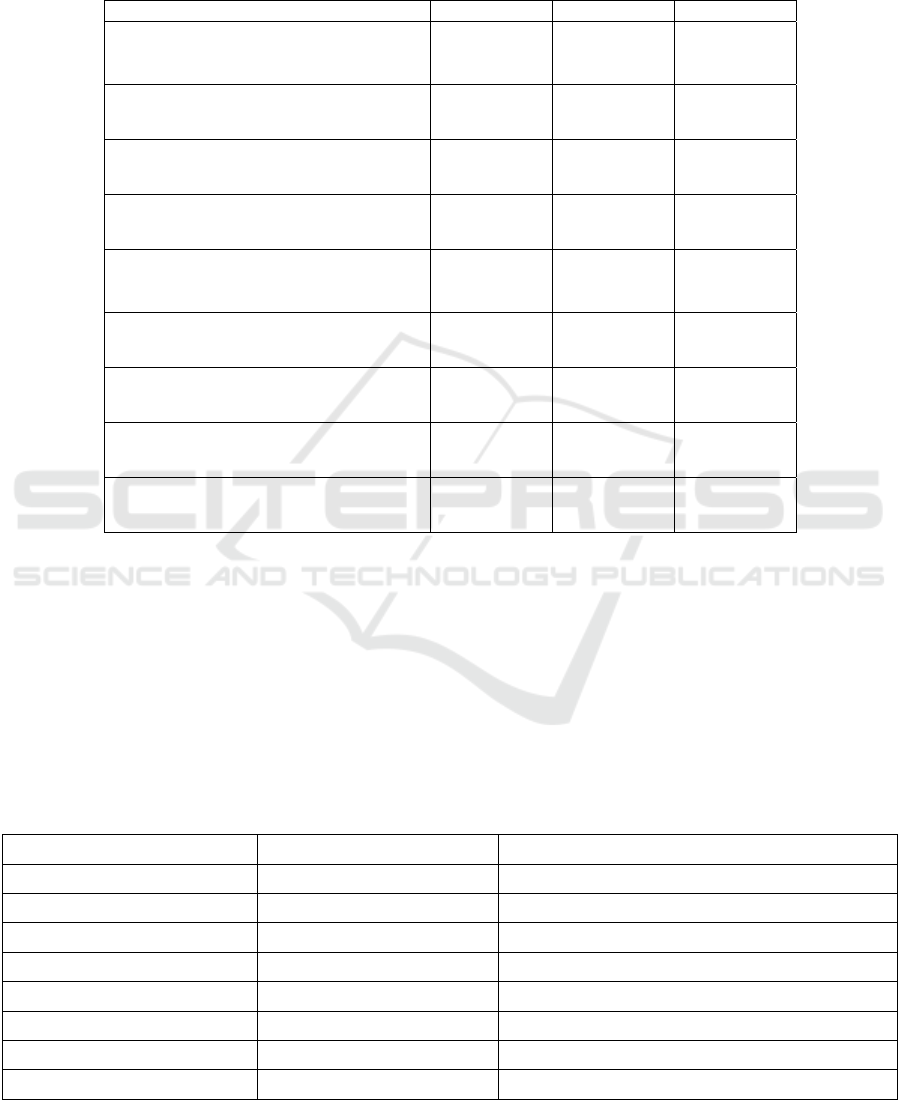

Table 9: Model –I Fit Summary.

Variable Value ( Model I) Suggested value

“CHI-SQUARE” 3504.503, d.f =55

“CMIN/DF” 63.718 “less than 3 ( Daire et al., 2008)”

“GFI”

.554

“More than 0.90 ( Hair et al.,2006)”

“AGFI” .367 “More than 0.90 ( Daire et al., 2008)”

“CFI” .012 “More than 0.90 ( Hu and Bentler,1999)”

“RMR” .261 “Less than 0.08 ( Hair et al.,2006)”

“RMSEA” .351 “Less than 0.08 (Hair et al.,2006)”

“P-CLOSE’ .000 “More than 0.05( Hu and Bentler,1999)”

Source: Computed from primary data

A Study on Effectiveness and Performance of Smes in Indian Society

517

‘CMIN/DF’, ‘AGFI’, ‘P-CLOSE’and ‘RMR’ do not

lie within the suggestive range and an improvement

in the model is tried out through modification of

indices. Model-II was developed to fit the indices to

the suggested model.

Figure 1: Path Diagram of Model.

Model–II is developed with the co-variance of factor

scores having higher modification index as evident

from path diagram of model-VII.

Table 10: Model –II Fit Summary.

Variable Value(Model-VII)

“CHI-SQUARE” 88.271, d.f = 32

“CMIN/DF” 2.758

“GFI”

.973

“AGFI” .934

“CFI” .984

“RMR”

.056

“RMSEA” .055

“P-CLOSE’ .151

Source: Computed from primary data

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

518

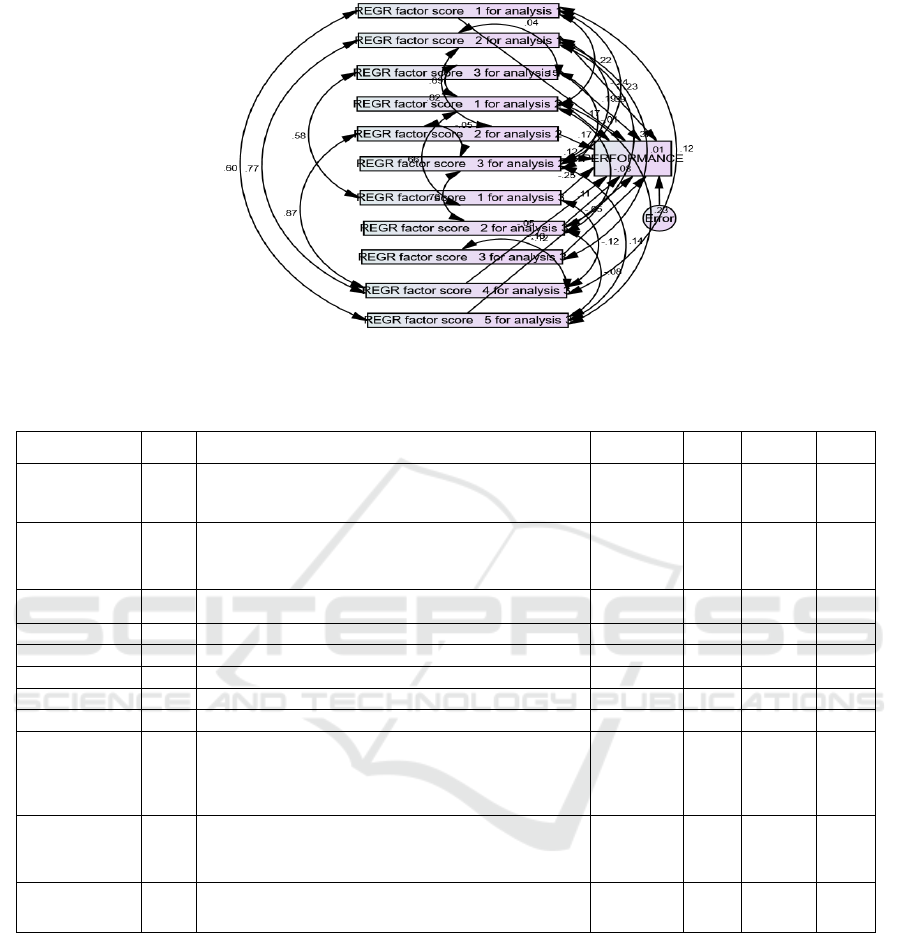

Figure 2: Path diagram of Model-II.

Table 11: Regression Weights.

Variable Variable Estimate S.E. C.R. P

Performance <--- FAC2_1- Bank assistance -.340 .183 -1.852 .064

Performance <--- FAC3_1- Updated technology .278 .089 3.113 .002

Performance <--- FAC1_2- Capital structure .238 .102 2.322 .020

Performance <--- FAC2

_

2- Profitabilit

y

.245 .187 1.310 .190

Performance <--- FAC3

_

3- Em

p

lo

y

ee En

g

a

g

ement -.073 .065 -1.122 .262

Performance <--- FAC1

_

1- Infrastructural facilities .214 .084 2.550 .011

Performance <--- FAC4_3- Good Incentives -.064 .145 -.444 .657

Performance <--- FAC2_3- Inter

p

ersonal Relationship .156 .094 1.656 .098

Performance <--- FAC1_3- Performance Appraisal and Training -.354 .090 -3.949 ***

Performance <--- FAC3_2- Financial planning .172 .118 1.462 .144

Performance <--- FAC5_3- Team work -.167 .079 -2.102 .036

Source: Computed from primary data

Table No. 12 demonstrate the significance of the path

with a 95% level of assurance. Similar to this, the P-

value with (***) denotes the significance of the

regression weights. A more positive impact on the

variable is indicated by a higher regression weight

value. Updated technology has a favourable and

significant regression weight when compared to

capital structure and infrastructure facilities for

"overall performance of SMEs." Thus, it can be said

that "updated technology" has a larger degree of good

impact on "overall performance of SMEs" whereas

"capital structure" and "infrastructure facilities" have

comparatively lesser degrees of positive impact.

Similar to this, "Team work" has a lower degree of

negative influence on "overall performance of SMEs"

whereas "Performance Appraisal and Training" has a

higher degree of negative impact. Thus, the variables

"Updated technology" and "Infrastructure facilities"

of the "Operational aspect" and the factor "Capital

structure" of the "Financial aspect" are approved.

As such, the effect of 'Updated technology'

(supported by Tech Grimsholm & Poblete, 2010;

Adeola, 2016) and Gaziasayed, Najmussaharsayed,

2018), 'Capital structure' (supported by SIDBI

A Study on Effectiveness and Performance of Smes in Indian Society

519

(2001); Farooqi, Sibghatullah, 2002; Turyahebwa,

2013 and Maheshkar & Soni, 2022), 'Infrastructural

facilities' (supported by SIDBI, 2001; Farooqi,

Sibghatullah, 2002) are positive and significant on

'Overall performance of SMES'.

6 CONCLUSION

SMEs are the primary forces behind economic

development in all countries on earth and have a big

impact on India's GDP growth. In India, SMEs are the

second-largest sector in terms of job generation and

supporting equitable regional growth, after only

agriculture. This sector accounts for more than 90%

of all national industries, highlighting the

significance of SMEs as the backbone of the Indian

economy. These companies support big industries as

auxiliary units and significantly contribute to

inclusive growth in India. The social welfare of

billions of people is influenced by SMEs. Therefore,

it is clear that the business might generate

employment prospects, especially for low and semi-

skilled employees. The sector provides work that is

substantially more intense. MSMEs provide a

substantial contribution to the country's development,

but neither governmental organisations nor financial

institutions provide them with the necessary backing.

However, problems with infrastructure, financing,

and rising automation are reducing the sector's

productivity.

REFERENCES

Ahamed, I. S. B. (2019). An Empirical Research on the

Problems and Prospects Perceived by the Small Scale

Entrepreneurs in Salem District, International Journal

of Innovative Technology and Exploring Engineering,

9(2),473-476

Adeola A (2016) Impact of external business environment

on organisational performance of small and medium

scale enterprises in Osun State, Nigeria. Scholedge, Int

J Bus Policy Gov 3(10):155.

https://doi.org/10.19085/journal.sijbpg031002

Bagale, G. S., Vandadi, V. R., Singh, D., Sharma, D. K.,

Garlapati, D. V. K., Bommisetti, R. K., Gupta, R. K.,

Setsiawan, R., Subramaniyaswamy, V., & Sengan, S.

(2021). https://doi.org/10.1007/s10479-021-04235-5

Farooqi, S., (2002), Small Scale Industries: Facing Acute

Crisis. Kurukshetra, 51(1), November, pp. 39-42

Gade, S. (2018). MSMEs’ Role in Economic Growth – a

Study on India’s Perspective, International Journal of

Pure and Applied Mathematics Volume, 118(18),

1727-1741

Gaziasayed, & Najmussaharsayed, (2018). Challenges

Faced By Micro, Small and Medium Enterprises of

Mumbai - An Empirical Study, Journal of Business and

Management, 63-75

Gyampah, K.A. and Boye S.S., (2001). Operations Strategy

in an Emerging Economy:

The Case of the Ghanaian Manufacturing Industry, Journal

of Operations Management, Vol 19, 59-79.

Grimsholm & Poblete, (2010). Internal and External factors

hampering SME growth. Accessed 8 June 2013.

http://uu.diva-

portal.org/smash/get/diva2:323837/FULLTEXT01.pdf

.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C.

(1998). Multivariate data analysis. 1998. Upper Saddle

River.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E.

(2014). Exploratory factor analysis. Multivariate data

analysis, 7th Pearson new international ed. Harlow:

Pearson.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E.

(ed.). (2010). Multivariate data analysis - A global

perspective (7thed.). New Jersey: Pearson Education,

Inc.

Harvie, C. and Charoenrat, T. (2015). SMEs and the Rise

of Global Value Chains. In Integrating SMEs into

Global Value Chains: Challenges and Policy Actions in

Asia. 1–26. Manila and Tokyo: Asian Development

Bank and Asian Development Bank Institute

Islam, S., Ganguly, D. Mediating effect of utilisation in the

relation between loans services from PSBs and capital

formation of MSMEs: a study of Purba and Paschim

Medinipur districts of West Bengal. J Glob Entrepr

Res 9, 57 (2019). https://doi.org/10.1186/s40497-019-

0181-3

Khatri, P. (2019). A Study of the Challenges of the Indian

MSME Sector, IOSR Journal of Business and

Management, 21(2). 05-13

Mageswari, U. T. & Bhuvaneswari, G, (2019). A Research

on the Opportunities Available for SMEs in Tamil

Nadu in Procuring Funds for their Business Operations,

International Journal of Innovative Technology and

Exploring Engineering (IJITEE), 9(1) ,3291-3294,

DOI: 10.35940/ijitee.A4573.119119

Maheshkar, C. & Soni, N. (2022), Problems Faced by

Indian Micro, Small and Medium Enterprises

(MSMEs), 48(2),

https://doi.org/10.1177/09708464211064498

Sarma, G. C. (2016). Performance of MSME’s in India -

problems & prospects, International Journal of Social

Science and Humanities Research 4(3), (23-30)

Sivakami, P. (2012). Micro Small and Medium Enterprises

- Problems and Prospects, Salem: MSK Publication

SIDBI (2001), Report on Small Scale Industries Sector,

Small Industries Development

Bank of India, Government of India, New Delhi

Shaf M, Liu J, Ren W (2020) Impact of COVID-19

pandemic on micro, small, and medium-sized

Enterprises operating in Pakistan. Res Glob 2:100018.

https://doi.org/10.1016/j.resglo.2020.100018

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

520