Emotional Stability and Psychological Well Being of Investors: Role

of Stock Market Swings

Tarika Singh Sikarwar

*

, Harshita Mathur, Archana Kaushal, and Anubha Tripathi

Prestige Institute of Management & Research, Gwalior, India

Keywords: Social Analytics, Psychology, Behavioral Finance, Emotional Stability

Abstract: This research aimed to examine and validate the elements influencing investors' emotional steadiness and

psychological wellbeing during stock market fluctuations. It took into account the variables that affect

investor’s emotional steadiness and psychological health, and then utilized confirmatory factor analysis to

authenticate these determinants. The author has incorporated past research on behavioral finance to develop

society's comprehension of emotions, psychological well-being, and investment behavior. The report suggests

that policymakers and financial firms should pay greater attention to these aspects when devising promotional

strategies. This research can help investors understand the changes in price so they can make a wise decision

when investing in the stock market.

1 INTRODUCTION

Price fluctuation is defined as the variation in price

levels from one period to the next or the variation

between a stock's daily starting and closing prices.

Share prices fluctuate on the stock market every

second, and these variations are generated by supply

and demand for a certain share, similar to other market

product price fluctuations. Several prior studies show

that the stock market has a direct impact on human

psyche. Stock market movements have an impact on

people's behaviour, health, and personal lives. It can

produce a variety of issues such as anxiety, panic

disorder, or severe depression, as well as unhealthy

habits like as smoking and drinking alcohol. In certain

cases, an investor who consistently loses money may

resort to illicit actions. Individuals all throughout the

world are affected by stock market swings, whether

they are in India or another foreign nation. Stock price

fluctuations have an almost direct impact on investors'

physical health, with sharp price drops increasing

hospitalizations within the next two days. The effect is

especially strong for situations associated with mental

health, such as anxiety, implying that concern about

the future, as well as current, consumption shocks,

influence an investor's immediate perception of well-

being Another research, done in the United States in

2008, looked at how a stock market crash affected life

*

Corresponding author

satisfaction, mental discomfort, and elderly health

habits. According to the data, a market collapse had a

detrimental influence on hospitalisations, child

reported medical condition, sick days from school,

and emotional issues. Psychology has also been used

to better understand the decisions of traders. Early in

the 1970s, Kahneman and Tversky (1979) reexamined

how attitudes, emotions, and behavioral biases

generally affected the choices made by investors. One

of the most recent advancements includes the

application of psychology to explore how emotions

and sentiments influence the utility function choice

and perception of the environment as a whole.

According to this new development, affect rather than

logical calculation now controls behavior. Decision-

making must take into account feelings and

sentiments, Thaler (1993) further establishes that

psychological factors influence asset prices. Damasio

(1994) demonstrated the very next year how

individuals who have lost the use of the emotional part

of their brains may find it extremely difficult to make

decisions. Furthermore, Forgas (1995) demonstrates

that the calculations necessary to make investment

decisions are frequently intricate, abstract, and risky.

These characteristics are thought to lead people to

make decisions based more on emotion than reason.

Financial crises have also been explained in terms of

emotions (Tuckett and Taffler, 2008).

Sikarwar, T., Mathur, H., Kaushal, A. and Tripathi, A.

Emotional Stability and Psychological Well Being of Investors: Role of Stock Market Swings.

DOI: 10.5220/0012493800003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 557-562

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

557

1.1 Stock Market Fluctuations

For decades, stock markets have been the hub of

economies. Any instability or crisis that occurs in

these markets affects the economy either generally or

partially (Demir, 2019). The value of stocks and

debentures in the stock market may vary over time,

which can be seen by the differences in their values

between one period and the next or the gap between a

stock's opening and closing prices on a single day.

The price of stocks, just like any other commodity, is

determined by supply and demand. Prices increase

when the number of available shares is insufficient to

fulfill investor demand; they decline whenever few

investors are interested in purchasing stocks. Futher

(Al-Rimawi and Kaddumi, 2021) in their research

tried to explore the determinants of stock market

volatility, the findings of their study revealed that

foreign investments, interest rates, economic growth

rate and inflation are the major macroeconomic

factors influencing stock prices.

1.2 Emotions and Investors

The majority of decisions individuals make in

various facets of their lives are influenced by feelings,

many psychology experts now believe that feelings &

emotions are, for good or worse, the primary force

behind the majority of important life decisions.

Emotion is a person's reaction to an external

stimulation that influences their judgment and

conduct and contains both physical and psychological

components (Aren and Hamamci, 2020). In the

context of finance, Standard finance theories presume

that investors in stock markets typically act

"rationally." The rational behavior hypothesis states

that investors' decision-making entails gathering

relevant details from business financial statements

and other sources and objectively evaluating them

using time-tested investing techniques and models.

However, over the past few decades, it has been

repeatedly demonstrated that human "emotions" are

just as crucial as reasoning in making educated

investing decisions (Saxena and Yadav, 2017).

2 PSYCHOLOGICAL WELL

BEING

In recent decades, both the scientific and general

literatures have shown a strong interest in the idea of

well-being. The term "psychological well-being"

refers to both intra- and inter-individual levels of

beneficial functioning, such as “interpersonal

connectivity” and “self-referential attitudes” such as

self-mastery and personal development (Burns,

2017). Consequently, Hasnain et al. (2014) defined

psychological well-being as a mental state devoid of

mental diseases. From the standpoint of positive

psychology, this may include a person's capability to

live a good life and create a balance amid living

activities and efforts to acquire psychological

resilience. Psychological well-being is crucial in

terms of how we operate and adapt, as well as whether

or not our lives are fulfilling and productive.

Psychological well-being is how people assess their

life, these judgments, according to (Diener and Suh,

1997) might take the shape of cognitions or feelings.

3 RELATIONSHIP BETWEEN

EMOTIONAL STABILITY AND

PSYCHOLOGICAL WELL

BEING

(Frijter et al., 2014) conducted a study that looked

into the influence of stock market movements on the

subjective well-being and health of Australians and

found that stock market improvements yielded a

substantial yet moderate increase in life satisfaction

and mental health. In the similar context (Sarwar et

al., 2016) investigated investors of the London Stock

Exchange and determined that there was no strong

association between gender and investment decisions,

yet found a significant correlation between monthly

salary level and investment and concluded that

psychological factors have a more significant

influence than economic factors. Further Gayar et al.

(2021) investigated the effects of investor sentiments

and herding on the volatility of the stock market in

Egypt and found that investor sentiment indicators

have a direct and indirect influence on stock market

volatility, mediated by herding behavior. In the

similar Context (Naseem et al., 2021) in their research

examined the investor’s psychology and stock market

behavior amid covid-19 pandemic, as generally the

psychological attitude of investor’s both favorable

and unfavorable with regards to the stock market can

alter the way economy is perceived, they particularly

employed principal component analysis to identify

the same, the overall findings revealed that

psychology of investor’s was found to be adversely

linked to the stock market, fear and anxiety and

pessimism cause companies to draw out their

investments from the share market, resulting in lower

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

558

share market returns. Based on the reviews done

following objectives were formulated:

4 OBJECTIVES

1. Analyze and confirm the factors that

contribute to psychological well-being.

2. Analyze and confirm the factors that

contribute to emotional stability.

5 RESEARCH METHODOLOGY

The investigation was exploratory in character. The

population of the study targeted investors from

Gwalior region. An individual investor was chosen as

the sampling element and data was collected from

200 respondents through a non-probability sampling

technique.

Tools Used of Data Analysis. The exploratory Factor

Analysis was employed to investigate the various

elements influencing Emotional stability and

Psychological Well-being, while Confirmatory

Factor Analysis was utilized to corroborate the factors

affecting both variables.

6 RESULTS AND DISCUSSIONS

a) Reliability Analysis

The Cronbach alpha value for all variables being

greater than or almost equal to 0.7 shows that the

questionnaire was highly reliable and can be used for

further investigations.

b) Sample Adequacy

The KMO Measure of Sampling Adequacy values for

individuals' emotional stability and psychological

well- being were 0.832 and 0.812, suggesting that the

sample size was adequate for conducting exploratory

factor analysis.

c) Description of factors Emotional Stability

1. Overconfidence: This determinant came out as

the most crucial determinant accounting for

37.281 % of variances in the research.

2. Optimism: This determinant emerged as the

second most influential factor, accounting for

10.971 percent of total variances.

3. Self-Image: The third most significant factor

in explaining a total variance of 9.285 is Self-

Image.

d) Describing Factors of Psychological

Well-Being

1. Healthy & Energetic: This emerged as most

important factor in explaining 30.800 percent

of the total variance.

2. Anxiety: This attribute has been identified as

the second most significant determinant,

accounting for 18.994 percent of the total

variance.

3. Stressed: This attribute has been identified as

the third most important determinant

explaining total variance of 9.468 percent.

4. Depressed: Depression has been identified as

the fourth most influential factor in

explaining 6.787% of the total variance.

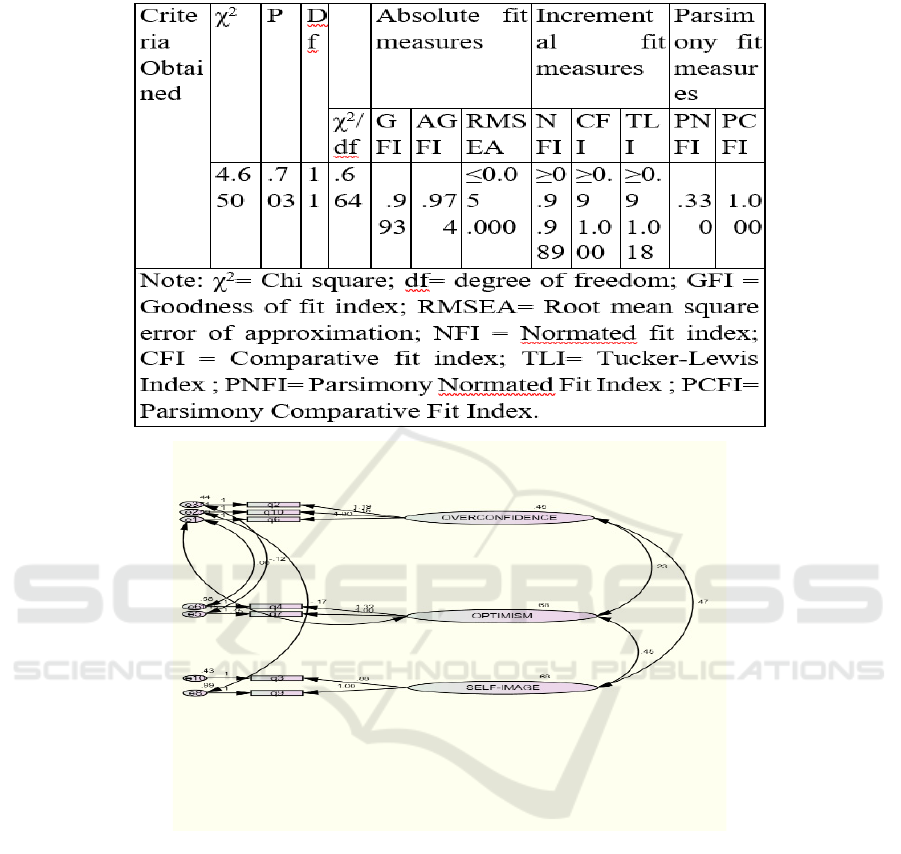

e) Confirmation of Factors

e.1) Emotional Stability: Confirmatory factor

analysis was used on both variables of the study to

confirm the factors that emerged from EFA.

Emotional Stability was measured using a 12 items

instrument. Further Exploratory Factor Analysis

resulted into three factors for Emotional Stability,

these factors were further confirmed using CFA

which resulted in 6 model out of which 6

th

model was

found to have good fit.

Final Model of Emotional Stability.

Model 6 gave

an excellent match as indicated by the results of the

first-order confirmatory test. The χ2 statistic was

4.650 (degrees of freedom = 712, p 0.001), and the

χ2/df ratio was 0.664 which was below 2.0, a sign of

a good fit. The Goodness of Fit Index

Table 1:

Reliability Analysis

Table 1: Reliability Analysis.

S.

No.

Variable

Name

Cronbach’s

Alpha

No. of

Items

1. Emotional

Stability

.847 12

2. Psychological

well being

.828 15

(AGFI) was .974. The Comparative Fit Index (CFI)

was 1.000, and the Tucker-Lewis coefficient (TLI)

was 1.018, both exceeding 0.9. The Root Mean Square

Error of Approximation (RMSEA) was 0.000, which

is lower than 0.05, indicating a very good fit. Thus, the

values from the table analysis demonstrate that Model

6 is a good fit.

Emotional Stability and Psychological Well Being of Investors: Role of Stock Market Swings

559

Table 2: CFA Table for Emotional stability

Figure:1.

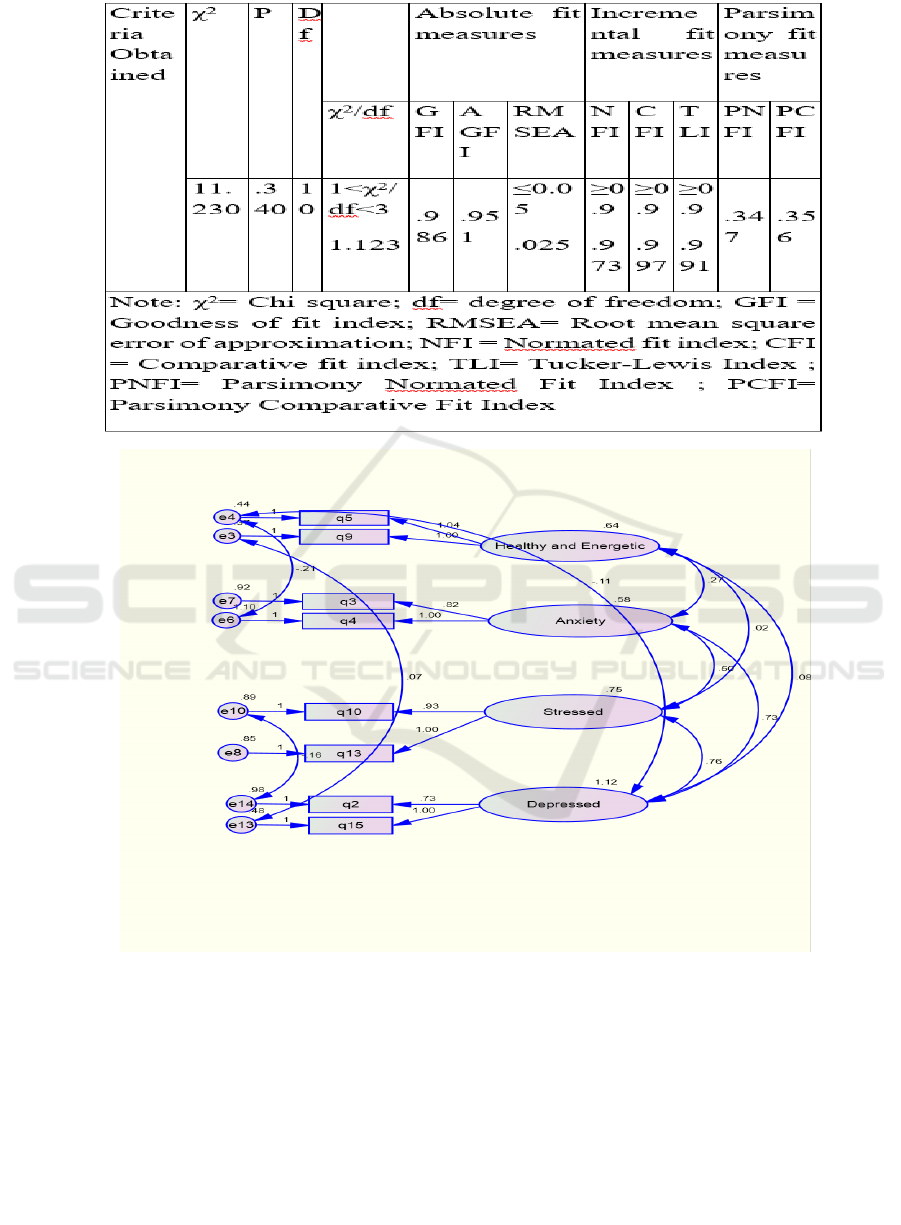

e.2) Confirmation of Factors of Psychological

Well Being: The 14-item test was created to assess

psychological well-being. Exploratory Factor

Analysis was used to investigate the elements

influencing psychological well-being, yielding four

factors. Further CFA was used to confirmed these

factors, Statistical testing resulted in 8 models out

of which 8

th

model was found to have good fit.

Final Model of Psychological Wellbeing. The

results of the eighth order confirmatory test, which

consists of multiple components, is illustrated in the

figure and table below. The χ2/df ratio was 1.123

which is lower than 2.0, implying a strong fit. The

χ2 statistic was 11.230 with 712 degrees of freedom

and a p value of 0.001. The Goodness of Fit Index

(GFI) was 0.986 and the Adjusted Goodness of Fit

Index (AGFI) was 0.951, while the Tucker-Lewis

coefficient (TLI) was 0.991 and the Comparative Fit

Index (CFI) was 0.997. All of these values exceed 0.9,

which is considered an acceptable result. The Root

Mean Square Error of Approximation (RMSEA) was

0.025, less than 0.05, indicating a good fit. Therefore,

we may conclude that the eighth model has a

satisfactory fit.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

560

Table 3: CFA table for Psychological-Wellbeing.

Figure:2.

7 CONCLUSION

The primary objective of this research was to

explore and confirm the determinants of “Emotional

Stability” and “Psychological Wellbeing” of

individuals. Initially reliability was checked using

the Cronbach alpha value, further Exploratory

Factor Analysis was applied wherein, three

components emerged for emotional stability namely

overconfidence, optimism, and self-image, and four

factors emerged for psychological wellbeing which are

healthy and energetic, anxiety, stressed, and depressed.

Further CFA was used on both variables to corroborate

the components that emerged from EFA. Confirmatory

factor analysis revealed six models for emotional

stability. Models 1–5 did not meet the specifications,

Emotional Stability and Psychological Well Being of Investors: Role of Stock Market Swings

561

but the last model did. For psychological wellbeing

8 CFA models were constructed with 1 to 7 models

failing to meet requirements and the 8th model

proving to be a good fit. As per 2012 WHO research

report states that a person's capacity to make daily

judgements and choices depends largely on their

mental health. The capacity to control one's

thoughts, feelings, behavior, and relationships with

others is ultimately what determines one's mental

health and well-being.

Investors should analyze market and economic

indicators before making any decisions because

they have an impact on how well shares perform on

the market. Instead of focusing on just one

environmental factor, investors should evaluate all

of them. To reduce risks and increase returns,

investors should also diversify their holdings by

building a portfolio of investments. This research

may help other researchers gain a deeper

understanding of the variables that affect

psychological health and emotional stability.

Behavioral finance may explain complex

difficulties that traditional finance theory and

classic economic theory are unable to explain by

integrating finance theory and practice

REFERENCES

Cotti, & Simon. (2016). The Impact of Stock Market

Fluctuations on the Mental and Physical Wellbeing of

Children, Department of Economics Working Paper

Series. 1-35.

Alam, N., Arshad, S., & Rizvi, S. A. R. (2016). Do

Islamic stock indices perform better than

conventional counterparts? An empirical

investigation of sectoral efficiency. Review of

Financial Economics, 31, 108-114.

Aren, S., & Hamamci, H. N. (2020). Relationship

between risk aversion, risky investment intention,

investment choices: Impact of personality traits and

emotion. Kybernetes.

Nurfadilah, D., & Samidi, S. (2017). Factors that

influence stock market volatility: A case study from

Malaysia. International Journal of Business Studies,

1(1), 15-21.

Demir, C. (2019). Macroeconomic determinants of stock

market fluctuations: The case of BIST-100.

Economies, 7(1), 8.

El-Gayar, A., Metawa, S., & El-Hayes, I. (2021). The

Impact of Investor Sentiment and Herding Behavior

on Stock Market Liquidity "An Empirical Study on

the Egyptian Stock Exchange".

Nagy. (2017). Behavioural Economics and effect of

psychology on the stock marketwong, lee, Ho, Li, Ip,

& Chow. (2017). Stock Market Fluctuations and Self

Harm among Children and Adolescent in Hong Kong.

Nurfadilah, D., & Samidi, S. (2017). Factors that influence

stock market volatility: A case study from Malaysia.

International Journal of Business Studies, 1(1), 15-21.

Vincent, & Bamiro. (2013). Fluctuations in Stock Market

Prices: What went wrong, its Implications to Nigerian

Economy. American Journal of Theoretical and Applied

Business , 3(3), 43-53.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

562