Productivity and Cost of Banking Employees: A Comparative Study

of State Bank of India and ICICI Bank Limited

Vinod Kumar Adwani and Mahendra Vishwakarma

2

1

Department of Commerce, BSSS College, Bhopal, India

2

Department of Management, BSSS College, Bhopal, India

Keywords: State Bank of India (SBI), Revenue Per Employee, ICICI Bank, Business Per Employee, Cost Per Employee.

Abstract: Since the commencement of 21

st

Century, Indian public and private sector banks have shown a strong growth

in the economy of the country. Both types of the banks are becoming an undivided part of valuable banking

industry of the country. State Bank of India, as the market leader in the public sector banks and ICICI Bank

Limited, as the fastest growing private sector banks is giving a challenge to each other in a healthy business

environment of India. Banking is the mental labour-based industry, as it is completely depending upon the

proficiency of its employees. This paper is an attempt to compare the cost and productivity of the employees

of these two banks (as a representative from public and private sector banks) by taking the data of last ten

financial years as an appropriate sample. To measure the cost and productivity of employees of these two

public and private sector banks, various parameters and ratios are used along with their appropriate analysis

and interpretation.

1 INTRODUCTION

Commercial banks are the suppliers of finance as the

vital component to the entire economy of the nation.

Deposits and credit facilities provided by the

commercial banks directly affect the output, income,

and employment level. Banking sector is one of the

largest labour or human resources-based service

sector, because the banks performance predominantly

depends upon the performance and efficiency of their

human resources. For the growth and survival of each

and every commercial bank, it’s all employees have

to give their positive contribution. The main

expenditure of the bank is the payment of the interest

to the depositors, after that second largest head of the

expenditure is the payment and provision for the

employees or employees’ cost. This head has the

significant impact on the profitability and the

operational performance of the bank. So, at the end of

a particular period, it is essential to assess the human

resources or employees’ productivity and cost of this

large service sector of the country.

Banking sector is completely depending upon its

employees working. In this way measurement of the

employee’s productivity of the banking sector is just

like measurement of productivity of entire banking

sector. Some parameters are specially developed for

the analysis of the productivity of employees of the

banking sector, such as Business Per Employee

(BPE), Revenues Per Employee (RPE), Profit Per

Employee (PPE) etc. With the analysis and

interpretation of these parameters we can easily

compare and assess their performance in a systematic

manner. These are very helpful to take any decision

regarding human resources management in banking

sector.

To produce the services like banking, finance, and

insurance more of mental labour is required. The

reward for the labour is in form of monetary or non-

monetary gains. Monetary gains include salary,

allowances, commission, bonus, and pension etc.,

while non-monetary gains include all the benefits,

perquisites, and social security schemes provide by

the employer to the employees. The amounts spend

by the employer on both monetary and non-monetary

gains are known as employees cost or employee

benefit expenses or compensation of employees.

This research paper aims to conduct a

comparative analysis of cost and productivity

between two banks: SBI and ICICI, one representing

the public sector and the other representing the

private sector. The analysis is based on data collected

over different financial years, which serves as a

592

Adwani, V. and Vishwakarma, M.

Productivity and Cost of Banking Employees: A Comparative Study of State Bank of India and ICICI Bank Limited.

DOI: 10.5220/0012498800003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 592-598

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

substantial sample for drawing meaningful

conclusions. This paper employs a multifaceted

approach to measure and analyze the cost and

productivity of employees in the two banks. This

approach involves using various parameters and

ratios.

2 LITERATURE REVIEW

● Chaudhary, Rangnekar and Barua (2013)

identified six factors determining the

effectiveness of HRM practices in Indian

manufacturing and service firms. The factors

identified were – Top Management Belief &

Commitment to HRM; Employee Development;

Autonomy, Openness & Authenticity; Rewards,

Performance & Potential Appraisals; Superior

Subordinate Relationship & Trust; and

Collaboration & Team Spirit.

● Gupta and Kaur (2013) in their study on

'productivity and performance of public sector

banks in India' on the basis of Branch

Productivity and Total Output Employee

Productivity for the period of 1991-2010

suggested that banks need to improve their

productivity Total Input apart to these

improvements in profitability, maintain

efficiency level and technology and exploring

available Similarly, in banking industry

productivity is defined as a cost-effective

solution.

● Jha and Mishra (2015) studied the impact of

HRM practices on performance of employees in

Indian banking industry. The authors concluded

that various remedial HRM measures can be

taken to improve the employee performance in

banks. The measures suggested include staff

meetings, brain storming sessions, study circles

and quality circles.

● Shashi (2015) stated that SBI Group Banks

must organize training and development

programmes to have more efficiency and better

productivity.

● Anand et al., (2016) analyzed the influence of

employee engagement practices on the

productivity of banks in Trichy region in India.

The results indicated that factors like co-

workers, department, rewards & recognition,

opportunities, team work and immediate

supervisor have a significant influence on the

productivity of employees.

● Ghosh, Rai, Chauhan, Baranwal and

Srivastava (2016) explored the potential

mediating role of employee engagement and

rewards to employees among private bank

employees in India. The results of the study

concluded that rewards & recognition to

employees was found to be a strong predictor of

employee engagement, finally leading to better

performance of banks.

● Mahila (2016) Found that the number of

branches and number of employees of are highly

influencing the productivity of banks.

● P. S. Aithal, Prasanna Kumar, & Mike Dillon

(2018) analyzed the business model and the

organizational strategy of Indian Banks in terms

of their business objectives, service planning,

target setting for the employees, employee

motivational factors, working strategies to

improve productivity and finally accountability

of every employee at different organizational

levels.

● Paul et al. (2021) investigated the effect of

banks' liquidity on its profitability, and

concluded that, the liquidity has a significant

effect on the profitability in the commercial

banking sector of Bangladesh. They suggested

that Bangladeshi banks to keep equality between

its liquidity and profitability.

3 RESEARCH HYPOTHESIS

(Ho1):“There is no significant difference between

Revenue Per Employee (RPE) of the State Bank of

India and ICICI Bank Limited from F.Y. 2012-13 to

2021-22.”

(Ho2):“There is no significant difference between

Cost Per Employee (CPE) of the State Bank of India

and ICICI Bank Limited from F.Y. 2012-13 to 2021-

22.”.

4 RESEARCH METHODOLOGY

The research paper employs a multifaceted approach

to measure and analyze the cost and productivity of

employees in the two banks. This approach involves

using various parameters and ratios. These

parameters and ratios are likely financial metrics that

shed light on different aspects of the banks'

operations.

Productivity and Cost of Banking Employees: A Comparative Study of State Bank of India and ICICI Bank Limited

593

4.1 Research Period and Sample Size:

This research study is based on the financial data of

SBI and ICICI Bank during the period of last ten

financial years from 1

st

April 2012 to 31

st

March

2022.

4.2 Data Sources:

This quantitative and analytical research study is

mainly based on secondary or published data. The

main source of data is the Annual Reports of SBI and

ICICI Bank for last ten financial years, along with

reports and publications of Reserve Bank of India

(RBI).

4.3 Analysis Methods and Tools:

As per the RBI guidelines following parameters are

applied to measure the productivity and cost of the

employees:

For Measurement of Employee Productivity:

(a) Business Per Employee (BPE)

𝐵𝑃𝐸 =

𝑇𝑜𝑡𝑎𝑙 𝐵𝑢𝑠𝑖𝑛𝑒𝑠𝑠

𝑇𝑜𝑡𝑎𝑙 𝑁𝑜. 𝑜𝑓 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠

Total Business = Total Deposit + Total Advances

(b)

Profit Per Employee (PPE)

𝑃𝑃𝐸 =

𝑁𝑒𝑡 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑃𝑟𝑜𝑓𝑖𝑡

𝑇𝑜𝑡𝑎𝑙 𝑁𝑜. 𝑜𝑓 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠

(c) Revenue Per Employee (RPE)

𝑅𝑃𝐸 =

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒

𝑇𝑜𝑡𝑎𝑙 𝑁𝑜. 𝑜𝑓 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠

For Measurement of Employee Cost:

(a) Cost Per Employee (CPE)

𝐶𝑃𝐸 =

𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒 𝐶𝑜𝑠𝑡

𝑇𝑜𝑡𝑎𝑙 𝑁𝑜. 𝑜𝑓 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠

(b) Employee Cost to Operating Expenditures

(ECOE)

𝐸𝐶𝑂𝐸 =

𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒 𝐶𝑜𝑠𝑡 𝑥 100

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐸𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒𝑠

(c) Employee Cost to Total Business (ECTB)

𝐸𝐶𝑇𝐵 =

𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒 𝐶𝑜𝑠𝑡 𝑥 100

𝑇𝑜𝑡𝑎𝑙 𝐵𝑢𝑠𝑖𝑛𝑒𝑠𝑠

(d) Employee Cost Ratio (ECR)

𝐸𝐶𝑅 =

𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒 𝐶𝑜𝑠𝑡 𝑥 100

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒

For Testing of Hypothesis:

Student’s t-Test t =

∗

∗

5 FINDINGS AND ANALYSIS

5.1 Employee Productivity

Accepting deposits and granting loans are the core

activities of all the commercial banks. Commercial

bank (From F.Y. 2012-13 To 2021-22) (In. INR

Million) banks are used to accept deposits from the

public in order to arrange the funds to be distributed

as advances to the needy customers. In the same

manner the interest earned on the loans distributed is

the main source of the revenue of the commercial

banks. So, we can measure the productivity of the

employees of SBI and ICICI on these basic

parameters through the following table:

Analysis

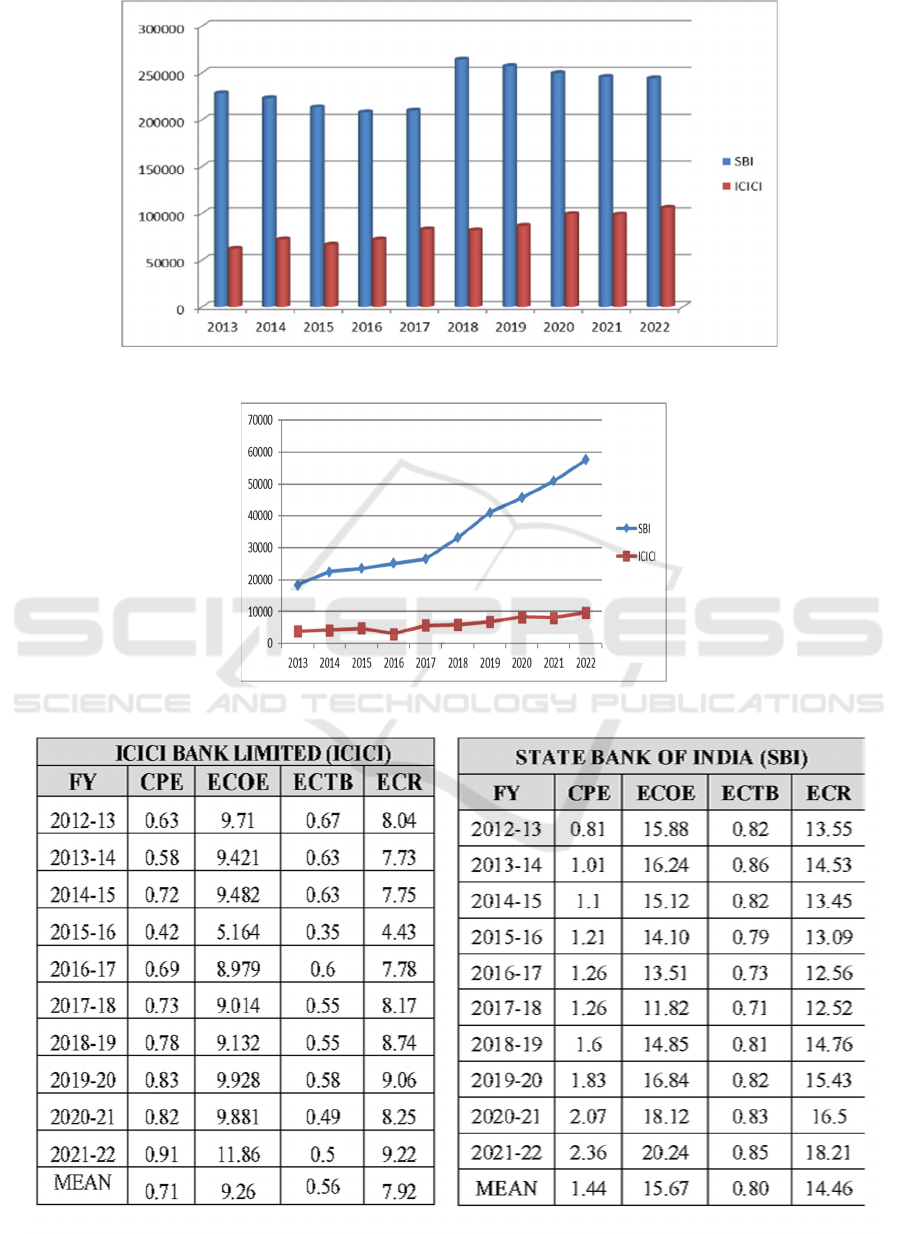

● In the terms of the BPE, the SBI is leading as

compare to ICICI. The mean BPE of SBI is

around Rs. 180 million, but for ICICI it is

around Rs.130 million. However, in the terms

of the CAGR the SBI is also considerably ahead

of ICICI with 4.5% margin.

● In the terms of the RPE, the position of SBI and

ICICI is almost equal, as the mean RPE of SBI

is Rs. 9.86 million, but for ICICI it is Rs. 8.98

million. However, in the terms of growth rate

again the SBI is significantly ahead of ICICI

with 6% margin.

● In the terms of the Profit Per employee (PPE),

The ICICI is well ahead of SBI. The mean PPE

of ICICI is Rs. 1.28 million, but for SBI it is only

Rs. 0.67 million. It means the PPE of ICICI is

91% greater than the SBI. The growth rate of

PPE of ICICI is almost equal to SBI. There were

certain fluctuations in the PPE of SBI and ICICI

during the research period.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

594

Figure 1: Number of Employees of SBI and ICICI (From F.Y. 2012-13 to 2021-22)

Figure 2: Employees Cost of SBI and ICICI (From F.Y. 2012-13 to 2021-22) (In INR Million)

Productivity and Cost of Banking Employees: A Comparative Study of State Bank of India and ICICI Bank Limited

595

5.2 Employee’s Cost

Payments and provisions for the employees or

employees’ cost is one of the major operating

expenses of all the commercial banks. We can

measure the cost of the employees of SBI and ICICI

on these basic parameters through the following table:

Analysis:

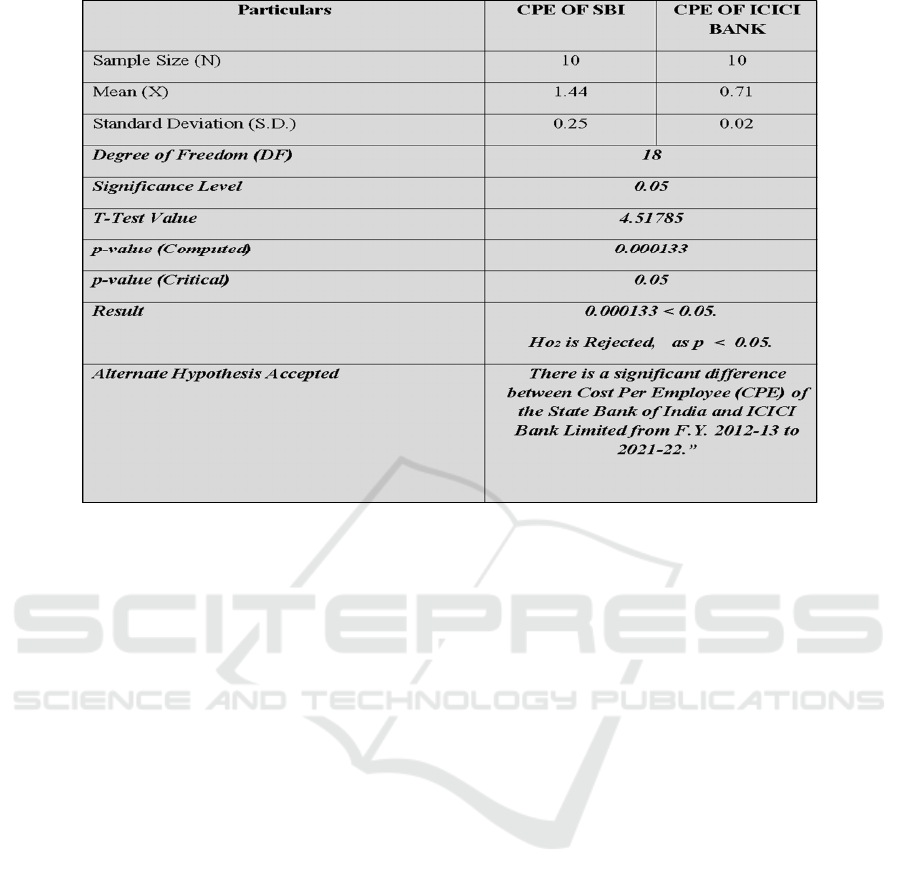

● In the terms of the CPE, the SBI is leading as

compare to ICICI. The mean CPE of SBI is Rs.

1.44 million, but for ICICI it is Rs.0.71 million. It

means SBI is spending Rs. 1,20,500 per month per

employee, while ICICI is spending Rs. 59,167

only. Thus, per employee cost for SBI is just

double of ICICI. In the terms of the percentage,

The CPE of SBI is increased by 78%, while CPE

of ICICI is increased by only 44%. During this

period, employees of SBI are increased by only

7%, while the employees of ICICI are increased

by 71%.

● However, in the terms of the CAGR of CPE, for

SBI it is 12.72% and for ICICI it is 4.17%, means

the SBI is well ahead of ICICI.

● In the terms of ECOE, ECTB and ECR same

position is visible i.e., in all these terms the

parameters of SBI is significantly greater than the

ICICI. Out of the total operating expenditures

1/6

th

part of expenditures of SBI is for the

employees, while in case of ICICI it is only 1/11

th

part. In other terms the employee cost of SBI is

50% grater as compare to the ICICI. In the terms

of the revenue, payment to employees by SBI

is almost double of the ICICI. In the terms of the

Business, employee cost of SBI is 50% greater

than the ICICI.

5.3 Test of Hypothesis

(Ho1): “There is no significant difference between

Revenue Per Employee (RPE) of the State Bank of

India and ICICI Bank Limited from F.Y. 2012-13 to

2021-22.”

(Ho2): “There is no significant difference between

Cost Per Employee (CPE) of the State Bank of India

and ICICI Bank Limited from F.Y. 2012-13 to 2021-

22.”

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

596

6 CONCLUSIONS

On-going through the analysis of the employee’s

productivity and cost of SBI and ICICI Bank with the

appropriate parameters and test of hypothesis we can

easily observe a significant variation. The

comprehensive analysis of productivity and cost

reveals that:

● In the terms of the BPE and RPE, the growth rate

of SBI is higher than the ICICI. For ICICI, the

PPE is higher, for SBI the BPE and RPE is

significantly higher. So, the growth in the

productivity of SBI is well ahead of ICICI. The

employees’ productivity of ICICI Bank is also

significantly higher than the SBI in terms of the

PPE, due to the problem of NPAs in SBI.

● Such variation is also visible in average CPE, as

average per employee cost for SBI is just double

of ICICI. In the terms of ECOE, ECTB and ECR

same position is visible i.e., the employee cost for

the SBI is significantly greater than the ICICI. It

means SBI is spending more amounts on their

employees in form of their salary and allowances

etc. So, banking sector is one of the few service

sectors in our country where salaries offered

public by sector banks is significantly higher than

the private sector.

● The employees and management of SBI are

required to improve their efficiency. They

suggested to work on the issue of NPAs and to

introduce innovative credit products for better

utilization of the bulk deposits available. The

effective utilization of advance technology will

helpful for them to improve their HRM efficiency

to achieve greater profit per employee. ICICI

Bank is also suggested expand the business to

every corner of this large country, for that they

require to open their new branches in untapped

rural and semi urban area. So that they can collect

their huge amount of such savings for the credit

generation.

REFERENCES

B. Janki (2002) Unleashing Employees Productivity: Need

for a Paradigm Shift, Indian Banking Association

Bulletin Vol. CXIV No. 03, March, 7-9

Souza D. (2002) “How well have public sector banks done?

A Note”, Economic and Political Weekly, 245-256.

CRISIL (2002) Profitability of Banks: A Study Report

Sharad K., S. Sriramulu (2007) RBI Occasional Papers Vol.

8, No. 3

Sirbu A (2012) “EVA –Main Indicator in measuring the

Value Creation of the Target Corporation Inc. Romania”,

IJRRAS

Jani, M. J., Raval, B. M., (2012) An analytical study of

employee's Productivity in some selected nationalized

Productivity and Cost of Banking Employees: A Comparative Study of State Bank of India and ICICI Bank Limited

597

banks in India “Indian Journal of Applied Research”,

19-20

Chaudhary, R., Rangnekar, S., Barua M. (2013) Human

resource development climate in India: Examining the

psychometric properties of HRD climate survey

instrument, Vol 17(1), 41–52

P. S. Aithal, Prasanna Kumar, Mike Dillon (2018) How to

Improve the Employee Productivity of Banking System

in India – a Theory of Accountability Based Analysis,

“International Journal of Technology, management and

social Sciences”, Vol.3, No.2

State Bank of India (Annual Reports- 2012-13 to 2021-22)

ICICI Bank Ltd. (Annual Reports- 2012-13 to 2021-22)

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

598