Role of Cash Flow in Determining the Success of a Firm: Review

Paper

Smitha Pillai, Binoy Arickal and Ashish Dilraj

Dept. of Commerce, Bhopal School of Social Sciences, Bhopal, India

Keywords: Cash Flow, Cash Flow Statement, Capital, Investment, Money.

Abstract: Cash flow plays an important role in the financial management within the firm. Cash flows widely used in

order to determine the shortage of liquidity of a firm. Sometimes cash flow is more important as compared to

the profit in order to determine the performance as well as success of a firm. Within the firm, cash flow is

utilizing for many purposes including daily-to-daily function, paying employee’s salari es as well as paying

taxes etc. The another advantage of the cash flow is that it can be easily interpret as compared to the other

financial statements such as profit. Overall effect of the cash flow within the firm is to manage the financial

activities in the more effective ways resulting in better performan ce of the firm. This review paper discussed

about the role of the cash flow in determining the success of a firm. The detailed overview of this paper gives

the new direction and scope for managing the cash flow in order to achieve the success of a fir m. However,

numerous studies have been carried out earlier in this field, but still there are vital possibilities of more

investigations in future to explore more in this field.

1 INTRODUCTION

Evaluations of capital structure are one of the main

issues for all firms who utilize separate financial

resources to conduct successful initiatives to create

revenue and maximize wealth. In this environment,

the economic prosperity of any company that

participates in commodity operations depends on

economically efficient inventory control both within

and without firm. Because a company is just

profitable, it is not financially solid (Permata 2019).

The financial results of an enterprise are governed by

strategies and cash flows and is assessed using asset

as well as equity, and the aim is to enable the

company to generate cash through operational

funding and investment activities. In addition, a

company's failure to properly manage operational

cash flows might reduce its effectiveness. Each

company should thus be able to control its cash flows

in order to achieve success.

The statement of cash flow is the accounting

document that identifies the cash inflows as well as

outflows of a company within a certain timeframe. It

is just as critical as the cash flow assessment financial

statements. It can be hard to get an exact picture of an

organization's growth without a cash flow statement.

The statement of revenue will show however much

interests people paid on a mortgage and how much

you owe the capital structure, but only the statement

of financial position tells people how much cash was

taken up to support the loan (Margasova 2019). The

report of earnings will document sales growth, but the

statement about the cash flow will warn if such sales

do not provide sufficient cash to pay the costs. Even

if a firm makes a profit by earning more income than

expenditures, its cash flow is properly managed to

succeed. The cash flows of a corporation are

connected to its operations or activities and

investments. The cash produced by a firm is linked to

its main businesses and offers the finest cash flow

management possibilities (Mazouz 2012).

Areas where operating cash flow is improved include

trade receivables, current liabilities, and stocks. If a

firm were arbitrarily to give credit without

establishing its clients' creditworthiness and without

following up on missed payments, this would impact

the project and less cash inflow and unpaid debts.

That’s why a leverage ratio and a follow-up on late

payments are vital. On the other side, it is a better way

to pay vendors later than sooner when it concerns to

the cash receipts. In addition, it is vital not to keep

greater cash in stock, but to have enough inventory on

hand to satisfy the company's urgent demands (Kent

790

Pillai, S., Arickal, B. and Dilraj, A.

Role of Cash Flow in Determining the Success of a Firm: Review Paper.

DOI: 10.5220/0012503700003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 790-796

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

2015). This review paper explores the role of the cash

flow in determining the performance of a firm.

Furthermore, the paper will cover various aspects of

the cash flow including the fundamental of cash flow,

analysis of cash flow as well as how the firms can

improve the cash flow. Moreover, the paper will also

provide detailed description of the significance of

cash flow in the business as well as its role in

determining the success of a firm.

2 CONCEPT OF CASH FLOW

AND STATEMENET OF CASH

FLOW

Cash flow, described by the word, is the flow of

money in and out of the business. The main input for

the business is the selling of commodities or services

to the customers, but be careful not to forget that the

input happens whenever people sell cash or get

receipts. The cash is what matters! Other types of

cash flows include money borrowed, capital spending

income and interest income from investments

(Anamaria 2015). Outflows are usually due to

payment expenditures for the firm. For instance

payment of staff wages, stock purchases of raw

materials, purchases of fixed assets, operational

expenditures, repayment of debts and taxes, include

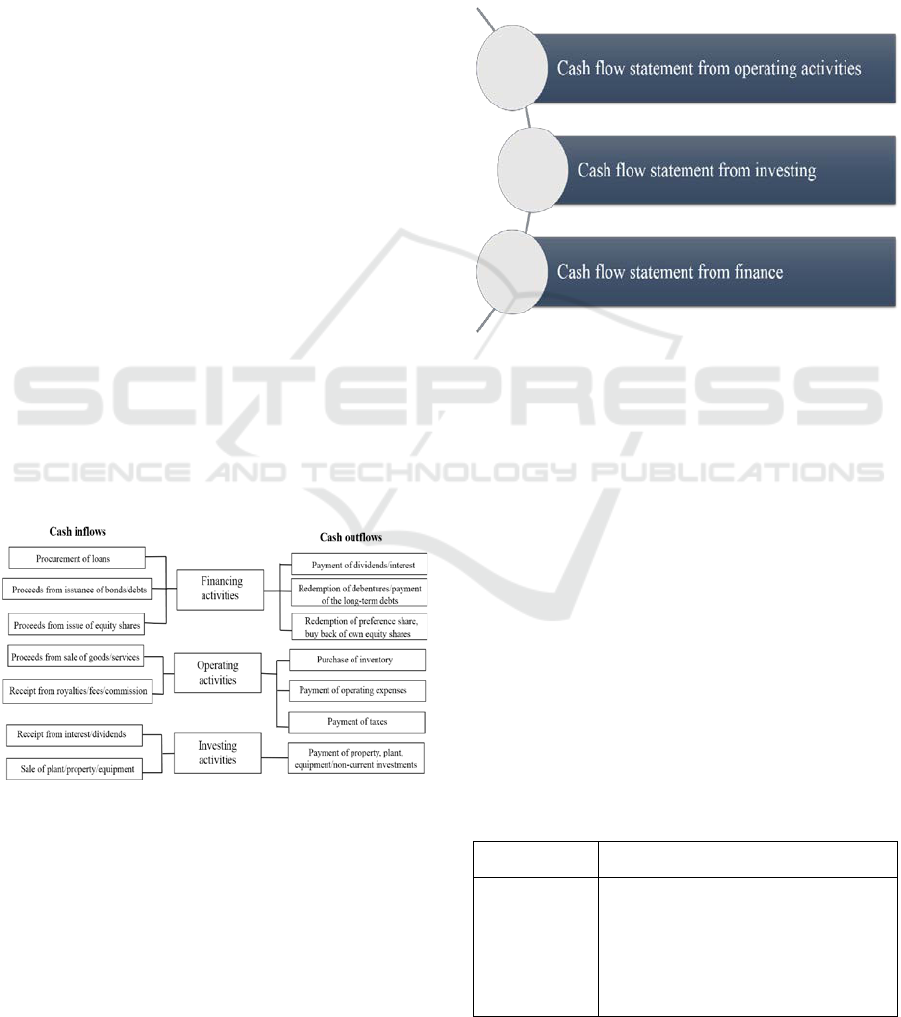

outflows of cash. The activities associated with the

cash inflows and outflows is illustrated in the Figure

1.

Figure 1: Illustrates the activities associated with the cash

inflows and outflows.

A statement of cash flow is a financial declaration that

offers cumulative statistics for all cash inflows from

current activities as well as foreign factors of

investment. It also covers all cash flows payable over

a certain time for company market and the impact.

The financial statements of a firm provide an

overview of all activities in the business for investors

and analysts, which contribute to their success in

every transaction. The cash flow report is considered

to become the most obvious of all financial

information, as it tracks the cash produced by the

company in diverse ways such as expenditure and

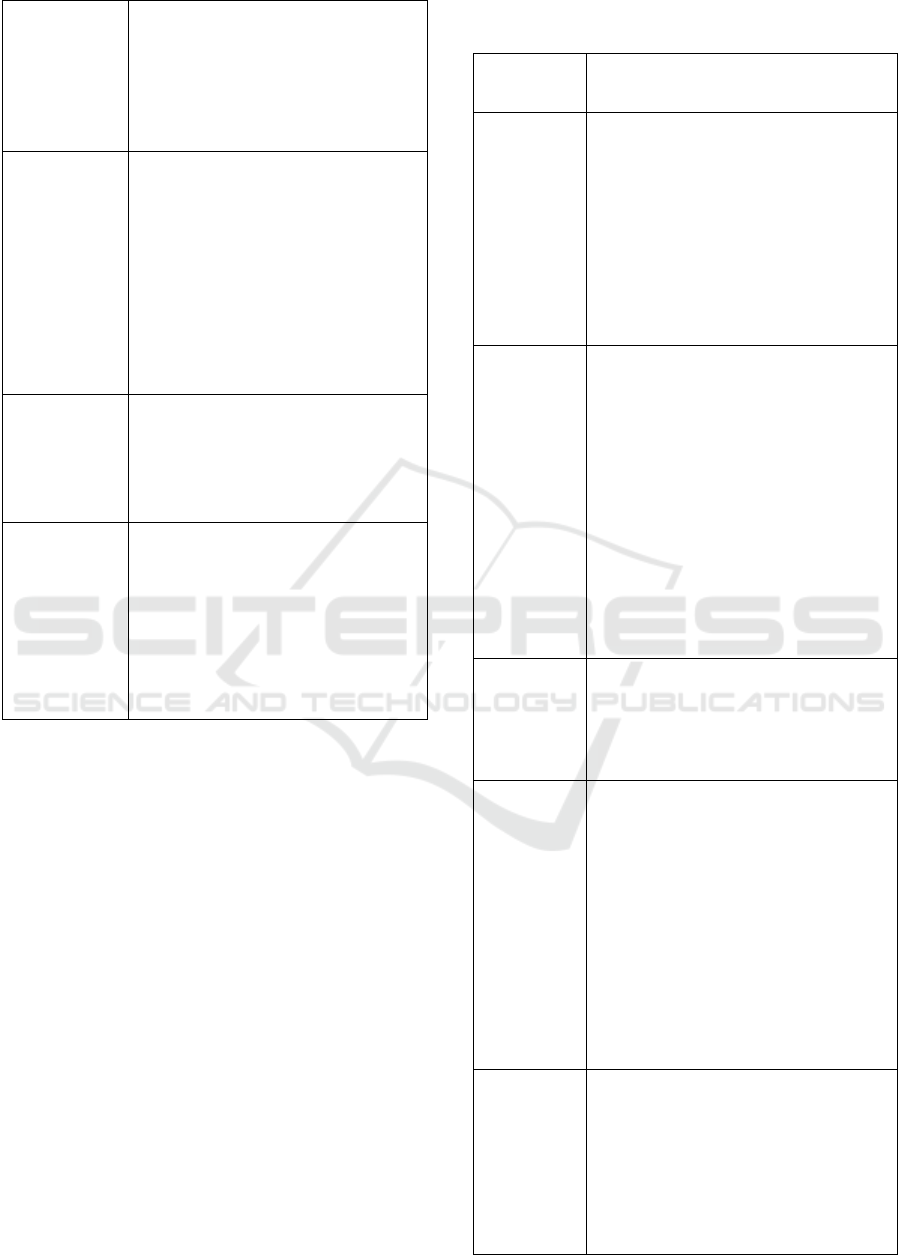

funding (Fawzi 2015). Net cash flow is called the sum

of these components. The cash sources and the cash

utilization are separated into three groups, as shown

in the Figure 2.

Figure 2: Schematic Illustration of the Categories of the

Cash Flow Statement under Different Financial Activities.

2.1 Analysis of Cash Flow

The more quickly firms understand how to handle

their cash flow, the more likely people are to survive.

In addition, firm can maintain their reputation and

prepare firm for long-term better performance

(Eisdorfer 2007). The first step towards controlling

the cash flow of the firm is to evaluate the

components of their flows from both side. A detailed

study of these elements will uncover issue areas

resulting in the firm to cash flow shortages. Reducing

or even shutting these loopholes is essential to the

management of cash flow (Li 2020). The fundamental

components for analyzing the cash flow are discussed

in the Table 1.

Table 1: Detailed Description of the Components for

Analyzing the Cash Flow.

Component

Description

Inventory

Inventory indicates the additional

goods or supply your company

maintains a position to satisfy

consumer needs. The usage of

capital that could be utilized for

additional cash outflows can harm

Role of Cash Flow in Determining the Success of a Firm: Review Paper

791

your cash flow via inventory

levels. Instead of what they can

realistically sell, too many

businessmen acquire stock based

on hope and fantasies. Keep as

small as feasible their inventory.

Accounts

receivable

Accounts receivable indicate sales

not yet retrieved in monetary form.

When firm

send anything for a

customer and give for their

commitment to return at a later

period, firm

establish a deferred

revenue balance sheet. The longer

it takes their

consumers to settle

their accounts, the less impact

their cash flow will have.

Credit

policy

A credit policy is a plan

firm employ to extend the loan to a

consumer. The right credit strategy

is essential for a good cash flow,

either too tight or too liberal.

Credit

terms.

Credit conditions are the time

constraints firm

establish to pay

for their

clients. The timing of

their

financial inflows is affected

by credit conditions. A

straightforward manner in which

consumers may enhance the cash

flow is to make payments faster.

2.2 Way to Improve Cash Flow in a

Firm

Even prosperous firms may have issues with cash

flow when they owe their obligations before they

raise sufficient cash from sales to settle their

accounts. Consider establishing new rules to ensure

firm control their cash flow, such as providing

incentives to early paying clients, setting up a

purchase partnership with other companies and using

electronic payments for settlements (Wu 2019). Firm

may also bargain better terms with their providers,

enhance their billing operations and test higher prices

to increase your cash flow. The list of the possible

ways for improving the cash flow is discussed in the

Table 2.

Table 2: List of the Possible Ways for Improving the Cash

Flow and Their Description.

Possible

way

Description

Utilize

electronic

payments

Firm may wait that long of the

day when firm pay online for a bill

that would allow payment. This time

buying enhances their

cash flow.

Firm may also use a credit card,

because some people provide a

three-week time limit, which can

help boost the cash flow. Firm may

even receive some cash back. But

don't stack up the debt too high.

Improve

inventory

Consider an inventory check. Make

a note of the goods firm purchase

that do not fit with the other goods.

A greater

cash is attached and

their

financial flow might harm

firm. Instead of

purchasing more,

even if firm

have to sell it at a

discounted, get rid of it. It is difficult

to go away from the items that

firm love so that it will be able to

observe an increasing demand one

day, but that is rarely never the case.

Be amiable, not emotional.

Increase

pricing

Price growth is a topic which

frightens many businesspeople.

They are concerned that sales will

be diminished. But it's okay to try

prices to find the right number.

Evaluate

buyer

credit

checks

If firm don't want a consumer to

pay in cash, make sure firm verify

their

credit, especially before

signing them up. If the customer has

low credit, firm

might infer that

firm

are not paying on time. The

missed payments damage the firm

cash flow just as much as

firm

would desire to sell. If

firm choose a sales solution despite

any dubious loan, make sure that the

sales price is high.

Go for

lease

Since leasing materials, machinery

and property are often costlier than

purchasing, it may appear

paradoxical for anybody who pays

only consideration to the lowest

possible level or who pays off the

income after spending. However, if

your business doesn't have a cash

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

792

stream, firm will want to have a cash

stream for everyday business.

Leasing helps enhance the cash flow

and firm pay in tiny increments. An

additional advantage is that rental

payments constitute a commercial

cost, and the taxes can therefore be

deducted.

3 IMPORTANCE OF

STATEMENT OF CASH FLOW

The statement of cash flow determines the flow of

cash in terms of inflow as well as outflow that

considered for a particular period of time. The

information associated with the cash available or cash

position of a firm is not just important for the finance

managers in order to plan long as well as short term

goals but also important for evaluating the financial

investment needed for the firm. (Fazzari 2008). The

fundamental significance of statement of cash flow is

discussed in the Table 3.

Table 3: Detailed Description of the Significance of

Statement of Cash Flow.

Importance

Description

Make

effective

financial

decisions

Firm will recognize

accurately amount of cash

firm accounts at particular time

if organization have precise

statement of the cash flow. The

information becomes more

critical because all the plans of

the firm depending upon the

precise data of the cash flow. If

firm

don't finally perform the

flow of cash, the risky decisions

can put firm in danger.

Sometimes firms are performing

excellent in their business but the

statement of cash flow provide

the accurate information

regarding the how much cash

received by the firm in a specific

time duration. This might be

because of statement that firm

doesn’t send out bills to

their

clients. Whatsoever, firm

will certainly not decide any

capital investments at particular

duration if firm have an updated

statement of cash flow.

Secure

business

relationships

If company is having cash

flow difficulties, firm could not

be wealthy enough to pay its

vendors since firm don't even

have adequate money. This may

affect their economic

relationship with customers as

well as its common impression.

Create contractual conditions to

ensure that the customers may be

paid by the company. Planning in

the future is essential so that

firm

don't have many debts or

invoices to deal with

simultaneously.

Expand the

business

The company's growing and

developing is exciting. It greatly

expands into emerging

businesses, recruiting new

workers and boosting revenues.

If the business expands at the

right time or in the incorrect way,

the company would have more

difficulty in the long term. A big

quantity of money is required by

growth. The goods are bought,

the facilities are leased,

personnel are recruited and

machines are acquired before the

money begins. If it has no funds

to meet the expansion, it will

have problems. You can

det

ermine if the business is

effective in managing its cash

flow when the timing is suitable.

Creating

surplus cash

The urge to generate a gain

motivates every company.

Revenue subsidies for cash

generation, but alternative ways

are also accessible. These

strategies may be

found and

implemented by focusing on the

statement of cash flow.

For a financial advisor, cash flow figures are quite

important. The data in a cash flow statement can aid

managers in short-term financial management and

financial reporting. The predicted cash flow

statements reveal if there is a cash surplus or shortfall

ahead of time. This facilitates the placement of excess

funds in bank accounts or short-term investments in

current assets. If there is a cash shortfall, a plan might

Role of Cash Flow in Determining the Success of a Firm: Review Paper

793

be made to raise a bank loan or sell current liabilities.

Cash-flow statements are extremely helpful in

making debt liquidation, plant and capital expenditure

replacements, and other actions involving cash

outflow from the firm since they give details about

the company's cash-generating capabilities. When the

cash flow statement for a given year is compared to

the budgeting for that year, it shows how closely the

actual sources and uses of cash corresponded to the

budget. This activity aids in the future refinement of

the planning process. Compared to other companies

in the industry, a temporary and inter-corporate

comparison with the cash flow statement provides a

summary in a firm's liquidity situation. It may

function as a remedy if it is noted that the

management of cash flow is not efficient. In brief

financial analyses the cash-flow statement is far

greater helpful than in cash flow statement, since in

the near term it is more valuable cash than capital

investment for the implementation of plans.

4 SIGNIFICANCE OF CASH

FLOW IN DETERMINING THE

PERFORMANCE OF A FIRM

Cash inflow is the company' lifeline and originates

from such streams as client payments, borrowings,

financial infusions from an investor, or economic

rewards interest. Cash is vital, too, because eventually

it becomes the compensation for the business's

activities, costs like equipment or raw materials, staff,

rent and other operational costs. Positive cash flow is

of course preferable. Cash flows mean that your

company works effectively (Da 2009). High positive

cash flow is much better and will enable firm to invest

and expand the company further. For a new firm, it is

very important to have information into the cash flow

of your organization. When a company initially opens

its gates, it generally has considerable costs to get the

business up and running, but does not have enough

sales and collections to pay back the money. If such

is the case, obtaining third-party funding to create

work capital that will protect and sustain the company

in the first phases might be essential for a new firm.

Many young firms slip into a 'negative cash flow' with

no supportive funding when their expenditures

exceed the cash they receive. This is among the most

frequent reasons for an early failure of a new firm.

Cash flows are important since they are highly

significant information when it comes to the

implementation of economic choices in a business.

The importance of cash flow cannot be overstated.

For example, a company's investors typically need

information about a company's future financial

predictions (Galvao 2018). The reason is that the

value of their present value investment is an

indication of how much they will be worth in the

future. Also, the capacity of a company to amass cash

flows typically reflects the worth of the company. In

a cash flow, the info is very much important to stock

prices of the companies listed on the stock market. As

a result, a future estimate of a firm's cash flows has

enabled new investors and existing investors to

projected stock values with confidence. Regarding

the evaluation of investment choice, an investment

survey indicated that they had considerably enhanced

their appreciation of the significance of cash flow

information.

Furthermore, it was suggested by a Financial

Advisory Board that the publishing of a firm's

financial data may help company's financial users

examine a company's future cash flows. With regard

to these concerns, cash flows have now become

evidently extremely important. In the interest of

forecasting the future cash flows of a company, most

of the studies have tried to examine a company's

predictive capacity in respect of earnings based on

accrual income and cash flows. In comparison to the

actual cash flows, income is a stronger predictor of

the cash flow resulting from a company(Chay 2009).

However, previous investigations in the same field

showed equivocal findings. A lot of additional

findings from study have apparently concluded that

they exceed the revenues generated by cash flows,

when it comes to the predictive capacity of a firm's

revenues. Rather, certain research show that cash

flows are a superior means of anticipating future cash

flows. However, there are conflicting results (Al-

Nasser 2020).

On the other hand, the conclusions of earlier

investigations appear to have been refuted by a study

conducted by academics. The author stated,

alternatively, that a company's profitability and cash

flows were not good instruments to anticipate the

future cash flow of a company. A lot of studies also

wanted to highlight a variety of factors, such as

earnings elements involving information about

accumulating accounting, as well as cash flow data

above and beyond single variable testing (Afrifa

2018). In order to evaluate the relationship between

future revenues and the accruing aspects of the

companies' income, the authors used a small model

time series. These authors concluded that each of the

different components of accrual earnings accounts

provided varied information about future cash flow

forecasts.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

794

5 DISCUSSION

Information on a company's cash flows is helpful in

giving financial report consumers a basis for

assessing the company's capacity to create cash as

well as equivalent to cash, and the company's require

to utilize these flow of cash. The monetary judgments

given by managers involve a valuation of a company's

capability to generate cash as well as equivalents to

cash and the timeframe and certainty of production.

The Standard deals by way of a cash flow report that

classifies cash flows over the period of operation,

investment and funding, in order to get information

about the evolutionary process in cash and the

equivalent of cash of the firm. Users of the budgetary

accounts of a company are interested in how the

company produces and utilizes cash. This is the case

irrespective of the severity of the operations of the

business and if cash, as may be the case with a

financial business, may be seen as the product of the

business.

Corporations require cash, but their main revenue-

producing activities may vary, for basically the same

reasons. They require funds to operate, pay their

liabilities and repay to their investors. The Cash Flow

Statement reports that facilitates organizations to

assess changes in a firm's net assets, its economic

position, as well as its opportunity to change cash

flow levels and times to adapt it to shifting conditions

and opportunities, when used in conjunction with

other financial statements. In analyzing the

company's capacity to create cash and cash

equivalents, cash flow information is valuable and

helps users to construct models that monitor and

measure the present value of cash flows from

different companies. It also improves the

comparability of operating performance reporting by

other companies, as it eliminates the impact of

differing accounting procedures for the same

transactions and occurrences.

6 CONCLUSION

Every business has the capability to generate a

positive cash flow for its future financing and

existence. Cash flow helps reduce the organization's

dependency on external money, duty service and

obligations, financial investment and an appropriate

dividend policy for investors. Any economic

decisions and the economic performance of the

business may also be evaluated using the cash flow

statement. The decisions based on cash flow

expectations can be taken and more information on

cash can be reviewed at any moment. When a

company produces more cash inflows than outflows,

it is the greatest way to assess the company's

performance. The essence of a management business

is the attraction and use of resources to obtain

products for which customers pay more than their

initial costs. Historical information on cash flow is

typically used as a measure of the quantity, timing

and safety of future cash flows. The extent to which

prior evaluations of future cash flows were assessed

and the link between profitability and net cash flow

and the effect of pricing changes is also valuable.

Since, the performance of any firm is greatly depends

on the financial statement of the cash flow that is why

it is very important to analyze the statement very

carefully. In many cases, firms are facing cash flow

issues while doing their business, sometime financial

statement goes into the negative cash flow. Under this

condition, firm may face financial issues in order to

perform their daily-to-daily operations. In order to

overcome such challenges, it is recommended that

financial managers must analyze the cash inflow and

outflow on daily basis so that the balance can be

maintain. Although, multifarious investigations have

been carried out earlier in this field but still there is a

pragmatic scope of more investigations in future to

explore the full potential of this field.

REFERENCES

Permata, A. H. and Madyan, M., “Disaggregate earning as

a means to predict future cash flows in businesses,”

Opcion, vol. 35, no. Special Issue 23, pp. 1590–1604,

2019.

Margasova*, V., Muravskyi, O., Vodolazska, O.,

Nakonechna, H., Fedyshyn, M., & Dovgan, L. (2019).

Commercial Banks as a Key Element in Regulating

Cash Flows in the Business Environment. In

International Journal of Recent Technology and

Engineering (IJRTE) (Vol. 8, Issue 4, pp. 4537–4543).

Blue Eyes Intelligence Engineering and Sciences

Engineering and Sciences Publication - BEIESP.

https://doi.org/10.35940/ijrte.d8465.118419

Mazouz, A., Crane, K. and Gambrel, P. A., “The Impact of

Cash Flow on Business Failure Analysis and

Prediction,” Int. J. Business, Accounting, Financ., vol.

6, no. 2, pp. 68–83, 2012.

Kent, R. A. and Bu, D., “The importance of cash flow

disclosure and cost of capital,” Account. Financ., vol.

60, no. S1, pp. 877–908, 2020, doi: 10.1111/acfi.12382.

Anamaria Morar, 2015. "The Importance Of Cash Flow In

Underlining Companies Financial Position," Annals -

Economy Series, Constantin Brancusi University,

Faculty of Economics, vol. 6, pages 216-220.

Role of Cash Flow in Determining the Success of a Firm: Review Paper

795

Fawzi, N. S. Kamaluddin, A. and Sanusi, Z. M.,

“Monitoring Distressed Companies through Cash Flow

Analysis,” Procedia Econ. Financ., vol. 28, pp. 136–

144, 2015, doi: 10.1016/s2212-5671(15)01092-8.

Eisdorfer, A., “The importance of cash-flow news for

financially distressed firms,” Financ. Manag., vol. 36,

no. 3, pp. 33–48, 2007, doi: 10.1111/j.1755-

053X.2007.tb00079.x.

Li, Z., “Construction and Empirical Research of

Comprehensive Financial Analysis Index System

Based on Cash Flow,” J. Contemp. Educ. Res., vol. 4,

no. 10, 2020, doi: 10.26689/jcer.v4i10.1566.

Wu, M., Ohk, K. and Ko, K., “Are cash-flow betas really

bad? Evidence from the Greater Chinese stock

markets,” Int. Rev. Financ. Anal., vol. 63, pp. 58–68,

2019, doi: 10.1016/j.irfa.2019.03.004.

Fazzari, S., Ferri, P., and Greenberg, E., “Cash flow,

investment, and Keynes-Minsky cycles,” J. Econ.

Behav. Organ., vol. 65, no. 3–4, pp. 555–572, 2008,

doi: 10.1016/j.jebo.2005.11.007.

Da, Z., “Cash flow, consumption risk, and the cross-section

of stock returns,” J. Finance, vol. 64, no. 2, pp. 923–

956, 2009, doi: 10.1111/j.1540-6261.2009.01453.x.

Galvao, A. F., G. Montes–Rojas, J. Olmo, and Song, S.,

“On solving endogeneity with invalid instruments: an

application to investment equations,” J. R. Stat. Soc.

Ser. A Stat. Soc., vol. 181, no. 3, pp. 689–716, 2018,

doi: 10.1111/rssa.12313.

Chay, J. B. and Suh, J., “Payout policy and cash-flow

uncertainty,” J. financ. econ., vol. 93, no. 1, pp. 88–107,

2009, doi: 10.1016/j.jfineco.2008.12.001.

Al-Nasser Abdallah, A., Abdallah, W. and Saad, M.,

“Institutional characteristics, investment sensitivity to

cash flow and Tobin’s q: Evidence from the Middle

East and North Africa region,” Int. Financ., vol. 23, no.

2, pp. 324–339, 2020, doi: 10.1111/infi.12366.

Afrifa, G. A. and Tingbani, I., “Working capital

management, cash flow and SMEs’ performance,” Int.

J. Banking, Account. Financ., vol. 9, no. 1, pp. 19–43,

2018, doi: 10.1504/IJBAAF.2018.089421.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

796