Analysis of Implementation of GST on Petrol in India

Reshu Varshney

1

and Amrita Sahu

2

1

Barkatulla University, Bhopal, India

2

The Bhopal School of Social Sciences, Bhopal, India

Keywords: GST, VAT, Excise Duty.

Abstract: Goods and Services Tax (GST) was implemented on July 1st, 2017 in India. Except for alcohol intended for

human use, natural gas, petrol and its products, electricity, etc., all goods and services are subject to GST. The

Central Government is considering bringing petrol and petroleum products into the purview of the GST

regime. Currently, state tax is charged on petrol and petroleum-related products. The paper considers five

states and studies a change in petrol prices pre and post-GST. The paper concludes that GST on petrol and

petroleum products in India will reduce petrol prices and bring down inflation that will bring relief to the

common man but will cause huge revenue loss for the mentioned above State Governments. In the paper, we

have also discussed various tactics to combat this financial loss of the State Government.

1 INTRODUCTION

The Goods and Services Tax (GST) has replaced a

variety of other indirect taxes in India, such as the

value-added tax, excise tax, services tax, etc. The

Central Government is considering bringing petrol

and petroleum products into the purview of the GST

regime due to inflation, high gas prices in many states

and intense public demand to lower the price of petrol

and diesel. Currently, state tax is charged on petrol

and petroleum-related products.

A maximum GST rate of 28% may be imposed

on gasoline in addition to Cess, according to all the

discussions that have so far occurred between the

Center and the states during GST Council sessions. It

is still a topic of debate as States fear loss of revenue.

2 REVIEW OF LITERATURE

1) Gulati Neelam and Adhana Deepak, International

Journal of Trend in Research and Development

(April 30, 2018), Volume 5(2), ISSN: 2394-9333

Inducting Petroleum Products into GST: An Only

Solution to Rising Prices. This paper highlighted

the scenario of the existing tax structure on petrol

and diesel. It exhibited the petroleum products

price comparison with other countries. It also

mentioned the revenue generated through excise

duty and VAT on petrol products in the last four

years. This paper, in the end, depicted the projected

petrol and diesel price under the GST ambit.

2) S. Saravanakumar, Kiruba.S, (December 2019)

Petrol Price: Pre & Post Goods and Services Tax

(GST) in India. In this paper it is mentioned that

to protect the state's collected revenue, petrol was

excluded from the GST system. What is GST?

And other issues are answered in the current

study. What justifies not introducing GST on

petroleum? What will the cost of one litre of petrol

be after it is included in the GST? This research

focuses on a comparison between the current tax

rate on petrol and the rate at which petrol would

cost if it was included in the ambit of GST.

3) Bansal Ashima, Garg Mannu, Sidana Sumit,

International Journal of Research in IT and

Management (IJRIM) Vol. 11 Issue 8, August-

2021 ISSN(o): 2231-4334 | ISSN(p): 2349-

6517.What if Petroleum Products come under

GST? In this paper, they explained the concept of

GST. This study gave an overview of petroleum

products whereas the main idea of this study is

how the pricing of petroleum is done and how

profit is generated by the government through

petrol & diesel. So in the present study, they

concentrated on what are the benefits and

disadvantages of the addition of petrol and diesel

under GST.

834

Varshney, R. and Sahu, A.

Analysis of Implementation of GST on Petrol in India.

DOI: 10.5220/0012513000003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 834-837

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

4) Mukherjee, Sacchidananda and R. Kavita Rao,

May 2014, Designing GST for Indai inclusive of

Petroleum, Natural gas, and Electricity: Policy

Options. This paper stated that Natural gas, petrol,

diesel, aeronautics turbine energy, and electricity

are kept out of Goods and Services Tax (GST),

which would affect revenue for the State

Government. Introducing GST at advanced rates

would make the reform more delicate to apply.

The result of this knot lies in making reforms of

pricing of petroleum products coterminous with

the preface of the GST reforms. In all of the policy

options explored in the study, the estimated profit

neutral rate (RNR) is within the realm of

reasonable and doable, especially when compared

to the present rates of duty which are considered

as the criteria.

5) Saxena Anushree, Advances in Economics and

Business Management, (2018), GST and

Petroleum. —The research report shows why

crude oil and petroleum should remain subject to

the GST. Since then, this issue has been the

subject of several debates, criticisms, and

disputes. Petroleum is still exempt from the GST

coverage from previous years. One single present

tax policy—under which states are permitted to

impose taxes in accordance with their needs and

which is regarded as one of the primary sources of

revenue collection—is the primary reason why

states have refused to agree to include petroleum

in the GST. The Center had opposed exempting

natural gas and crude oil from the GST since it

would mean that the credit on capital goods and

input services would no longer be available. A

similar input, crude petroleum, is used to make

diesel and motor spirit, as well as other refined

goods like naphtha and lubricating oil base stock.

Refineries would have a very difficult time

allocating the credit on capital goods, input

services, and inputs if diesel and motor spirit were

excluded from the scope of the GST.

3 RESEARCH METHODOLOGY

In this paper two types of Research Methodology are

followed:

3.1 Quantitative Research

Through the collection of measurable data and the

operation of statistical, fine, or computer styles,

quantitative exploration is the methodical analysis of

marvels. Through the use of slice ways and the

distribution of online questionnaires, pates, and

checks, for case, quantitative exploration gathers data

from current and implicit guests. This can be

represented numerically. A product or service's future

can be prognosticated using these data, and changes

can also be made as necessary.

3.2 Analytical Research

Analytical research is a particular kind of research that

calls for the use of critical thinking abilities and the

assessment of data and information pertinent to the

project at hand. Analytical research is used by a range

of people, including students, doctors, and

psychologists studies to locate the most pertinent data.

4 INFERENCES &

INTERPRETATION

We have taken a sample of five states i.e. Delhi, MP,

Assam, Karnataka and Gujrat for this study.

4.1 Sampling Method

Data Collection method: In this paper, only secondary

data has been used for analysis. All data has been

collected from various reports, discussion papers,

blogs, websites, newspapers, Union budget reports,

GST council reports, mycarhelpline.com,

www.godigit.com, www.petrolpricetoday.com,

Dainik Bhaskar, etc.

In this study we are going to find out what will be

the changes on petrol prices before and after the

implementation of GST for that we have taken data of

5 states of India.

Table 1.

States

Tax

Delhi

Madhya

Pradesh

Assam Karnataka Gujrat

Price charged to

dealers

Rs 57.35

per Litre

Rs 57.35

per Litre

Rs 57.35

per Litre

Rs 57.35

per Litre

Rs 57.35

per Litre

Excise duty

(Levied by the

Central

Government)

- - - - -

Average dealer

commission

Rs 3.8 per

Litre

₹ 7.78 per

litre

₹ 5.47 per

litre

₹ 3.5 per

litre

₹ 3.89 per

litre

VAT (Levied by

the State

Government)

- - - - -

GST @28% 17.122 18.2364 17.5896 17.038 17.1472

Retail selling

price

78.272 83.3664 80.4096 77.888 78.3872

Sources: Petrol price breakup of various states,

https://www.godigit.com/fuel/taxes/

Analysis of Implementation of GST on Petrol in India

835

Note: We are taking highest slab of GST i.e. 28% for

computation of GST on petrol.

The above table gives an overview of the retail

selling price of petrol after the implementation of

GST. After the implementation of GST, VAT and

Excise Duty on petrol will be scrapped. We can

observe that after applying GST on petrol the price

per litre of petrol is in Delhi Rs.78.272, in MP

Rs.83.3664, in Assam Rs.80.4096, in Karnataka

Rs.77.888 and Gujrat Rs.78.3872.In MP the rate of

petrol is highest due to the levy of huge dealers'

commissions.

Table 2.

States

Petrol

Price

Delhi MP Assam Karnataka Gujrat

Pre

GST

96.72 109.7 97.32 101.92 96.93

Post

GST

78.272 83.3664 80.4096

77.888 78.3872

Sources: Petrol price breakup of various states,

https://www.godigit.com/fuel/taxes/

It can be seen from the above figure that the price of

petrol will fall in the GST regime. In Delhi the price

will fall upto Rs.18.448 per litre (96.72-78.272), in

MP the price will fall upto Rs.26.3336 per litre

(109.7- 83.3664), in Assam, the price will fall upto Rs

16.9104 per litre (97.32-80.4096), in Karnataka, the

price will fall upto Rs.23.5328 per litre (101.92-

78.3872) and in Gujrat, the price will fall upto

Rs.18.5428 per litre (96.93-78.3872).

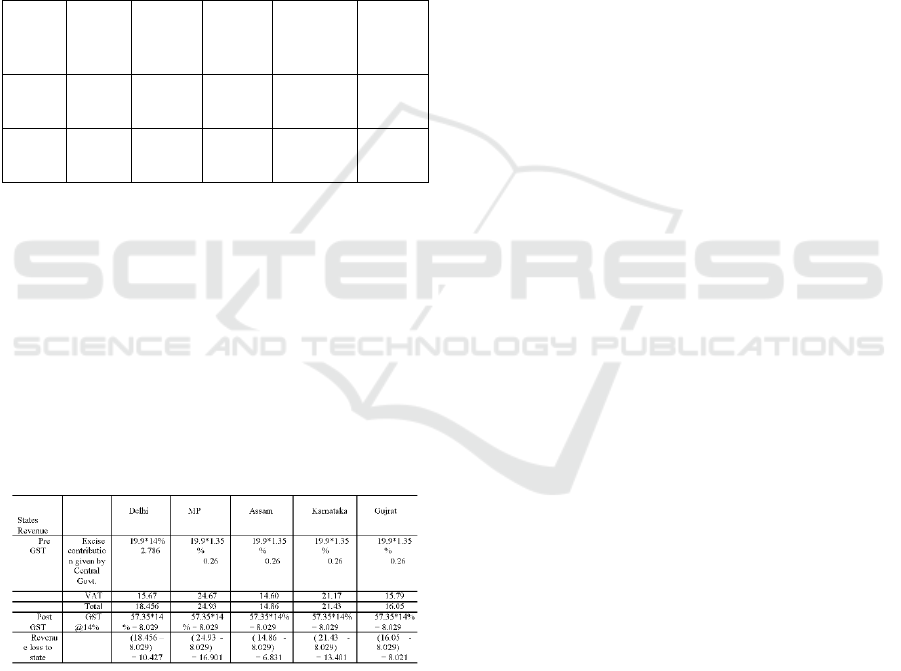

Table 3.

Sources: Petrol price breakup of various states,

https://www.godigit.com/fuel/taxes/

Note: The above rates are based on Annexure 4

(STATEMENT SHOWING STATE-WISE

DISTRIBUTION OF NET PROCEEDS OF UNION

TAXES AND DUTIES FOR 2022-23) which is given

on the Union Budget website.

The above graph is depicting revenue loss of the

State revenue collection by comparing pre and post

GST.From the above figure we can conclude that

there will be revenue loss to all the five states if GST

is implemented on petrol in these five states. In Delhi

the revenue loss will be Rs. 10.427 per litre (18.456 –

8.029), in MP the revenue loss will be in Rs. 16.901

per litre (24.93 - 8.029), in Assam the revenue loss

will be Rs. 6.831 per litre (14.86 - 8.029), in

Karnataka the revenue loss will be Rs. 13.401 per litre

(21.43 - 8.029), in Gujrat the revenue loss will be Rs.

8.021 per litre (16.05 - 8.029).

5 RESULTS

Through the above findings, we can conclude that

after the application of GST, the price of petrol per

litre will decrease, but it will cause a huge revenue

loss for the mentioned above State Governments

though the highest slab of GST is applied in this

research. By this, we can also conclude that a huge

proportion of petrol price is inclusive of taxes before

the implementation of GST on petrol.

5.1 Suggestions

GST on petrol and petroleum products in India will

reduce petrol prices and bring down inflation that will

bring relief to the common man doing so Central

Government must compensate for the revenue loss of

the State Government but it is not a temporary loss

and it can cause financial crises in States. The

following measures can be taken to reduce the

revenue loss of states.

The state can be compensated by levying GST

Cess (extra charge on premium fuels) or fuels used by

luxury and sports vehicles.

Central Government can increase its revenue

distribution percentage to States for a few years.

The state can increase state taxes on alcoholic

liquor for human consumption and on tobacco and

tobacco products and products which are luxurious in

nature.

GST Cess can be applied to petrol and petroleum

product for years to combat revenue loss for a few

years.

State Government should cut down unnecessary

expenses to meet the crises.

5.2 Limitation of Study

In this study major shortcoming is that it is taking

consideration into only five states because of lack of

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

836

available data. A study can be done while considering

every State to confirm the revenue generation from

each State. Also, there may be a chance that instead

of revenue loss there can be revenue gain in some

states due to low VAT and excise duty

REFERENCES

Gulati, N and Adhana D. 2018. Inducting Petroleum

Products into GST: An Only Solution to Rising Prices,

International Journal of Trend in Research and

Development, Volume 5(2), ISSN: 2394-9333.

Saravanakumar,S & Kiruba ,S.R.2019. Petrol Price: Pre &

Post Goods and Services Tax (GST) in India, IJRTE,

Volume-8 Issue-4S3.

Bansal, A & Garg, M, & Sidana, S.2021. What if Petroleum

Products come under GST? , IJRIM, Vol. 11 Issue 8.

Mukherjee, S & Rao,K.R. 2014. Designing GST for India

inclusive of Petroleum, Natural gas and Electricity,

NPFP Policy, One pager, 006.

Saxena A.2018. GST and Petroleum, AEBM, Volume 5,

Issue 1.

Ibrahim,A & Shimin, S.2018. Why India Demands

Inclusion of Petroleum Products Under GST, IJMITE,

Vol. 8, Issue 1.

S. Mahendrakumar.T, Vasudeva, 2018. Expected Impact of

GST on Oil and Gas Industry, JETIR, Volume 5, Issue

4

Ramya. S. R, 2021. Taxing Petroleum Products,Which Is

The Right Way?

Indirect Taxation - Customs/Excise/Service Tax, Indian

Journal of Law and Legal Research.

https://www.indiabudget.gov.in/

https://gstcouncil.gov.in/gst-council-meetings

Analysis of Implementation of GST on Petrol in India

837