AN E-TAX INTERNET FILING SYSTEM INCORPORATING

SECURITY AND USABILITY BEST PRACTICES

Prototype implementation of the best practices identified in government and

commercial E-tax filing websites in the USA for tax season of 2003

Aashish Sharma, William Yurcik

National Center for Supercomputing Applications,University of Illinois, Urbana-Champaign, USA

Keywords: security, usability, e-commerce,

online-tax filing websites.

Abstract: We describe a prototype system we have developed that incorporates best practices identified from a 2003

study of both public and private E-tax filing websites hosted in the USA. Our motivation is to investigate

the current low functionality and low penetration usage of online tax filing, an increasingly important web-

application. We identify critical security and usability features in current use on E-tax filing websites (and

use these features) as well as new features not found on these E-tax filing websites. We conclude that while

appropriate and correctly implemented technology will make a website secure, in practice it is the website

look-and-feel which has the most influence on a user’s perception of usability and security.

1 INTRODUCTION

Electronic Tax (E-tax) filing adds a significant

dimension to E-government initiatives by harnessing

the transaction speed and cost-effectiveness of the

Internet. Most of the states (38) in the U.S. have

started E-tax state revenue websites and in the last

few years online tax filing has experienced

substantial growth.

However, the majority of the tax filing

p

opulation is still reluctant to file their tax returns

via a computer. In this paper we posit and seek to

provide evidence that people perceive current E-tax

filing websites to be difficult to use and insecure.

Since average citizens are encouraged to use online

E-tax filing websites (IRS plans to get as much as

80% of tax returns filled electronically by 2007) the

need to make E-tax filing usable and secure for

untrained users has become critical.

At present there is a disp

arate use of usability

and security features in online E-tax filing websites.

To better understand these design decisions, we

studied 38 state websites and 15 private online E-tax

filing portals. Most of these websites are well

designed by general web standards and available

usability guidelines; however, we highlight flaws

that make many of these websites unusable and

perceived as insecure for this specific application.

domain (tax filing). We leverage previous work on

security usability to derive standards based on

design security usability features prevalent in these

websites. Lastly, the significant contribution of this

paper is taking the best practices we have identified

in this application domain and implementing them in

a working E-tax filing prototype for evaluation and

further testing.

The remainder of this paper is organized as

fo

llows: Section 2 documents related work in

security usability (we were unable to identify any

previous work specifically on E-tax filing websites).

We present the process of online E-tax filing in

Section 3. Section 4 focuses on the security

mechanisms and usability features employed by

state and private websites. We discuss prototype

implementation challenges in Section 5 followed by

a brief discussion on future work in Section 6. We

end with a summary and conclusions in Section 7.

2 RELATED LITERATURE

There has been substantial research done in the field

of security usability and creating trust on the Internet

[Adams, A. et al 1999] [Neilson, J. 2000]. [Whitten

A, Tygar J.D., 1999] describes the usability issues

with the Email encryption package PGP 5.0. While

one would expect security applications would be

hard to use by novices, this study shows experts also

257

Sharma A. and Yurcik W. (2004).

AN E-TAX INTERNET FILING SYSTEM INCORPORATING SECURITY AND USABILITY BEST PRACTICES - Prototype implementation of the best

practices identified in government and commercial E-tax filing websites in the USA for tax season of 2003.

In Proceedings of the First International Conference on E-Business and Telecommunication Networks, pages 257-262

DOI: 10.5220/0001388002570262

Copyright

c

SciTePress

found security applications hard to configure and

use. This study highlights a wide gap between

design perspectives and usage habits.

E-tax filing website designers have tried to

incorporate security features, however, users

misinterpret, overlook, and/or perceive these

features in unintended ways. [Princeton Survey

Research Associates, 2002] describes how users on

one hand desire obvious security mechanisms on the

websites where they wish to transact, but on the

other hand subvert these systems for usability and

often give up on applications out of desperation.

We think that these problems can be avoided in

the online E-tax filing websites by a balanced

mixture of “visible” security mechanisms and

usability features. A perceptually secure website

will encourage website credibility and user trust in

online E-tax filing transactions. [Fogg, B.J., 2002]

reveals that unlike evaluation of other systems,

Internet users do not use rigorous evaluation

schemes but rather focus on general design,

appearance, structure and content in the order to

assess trust of websites. For instance, one way users

evaluate a website is by joining together two pieces

of information, one piece may be something specific

that catches their attention and the second piece may

be a judgment about its credibility. We believe users

of online E-tax filing websites adhere to this

prominence-interpretation theory.

Consumer WebWatch [Consumer WebWatch

2004] has many examples of inconsistent user

criteria for assessing websites. While users may

have ideal expectations before they arrive at a

website, demand for clear, specific and accurate

information is often sacrificed but it does not mean

that these users are always aggressive in seeking this

information.

Efforts have also been made in developing

community/group efforts for accessing websites by

creating reliable reputation reporting mechanisms

for online communities [Dellarocas, C., 2001].

[Yurcik, W. et al 2002] [Turner, C. et al 2001] have

also discussed factors that affect perceptions of

security of E-Commerce websites in their study.

In effort to further understand attitudes about

online privacy and security AT&T conducted a

study [AT&T] emphasizing categorization of some

data to be of more importance than other data. For

instance, users are less reluctant to provide their

postal address than their active email address than

their telephone numbers. This report also shows that

behaviour changes according to the application

domain. For example, attitudes for accepting cookies

differ with the type of website

3 E-TAX FILING SYSTEMS

There are two basic approaches to E-tax filing over

the Internet: (1) interactive filing and (2) batch

filing. In interactive filing, the taxpayer interacts

directly with a web-based application to complete

the tax filing online. We have observed that in

general these interactive filing websites vary from a

conversational question-and-answer format

customized to the taxpayer’s prior filing history

(pull-down selections) to a fill-in-the-blanks

application where a paper tax form is simply

reproduced on a web display. When the information

is complete, the taxpayer submits the data for

processing. Payment information, such as bank

accounts for direct debit payments or direct deposit

of refunds, or credit card information, may be

combined with the E-tax filing application.

Within the interactive method of Internet filing,

there are two alternative technologies: (1) the

taxpayer interacts directly with the web server

hosted by the tax authority or a third party (which is

generally an IRS authorized free-file-partner), with

only a web browser on the taxpayer’s machine; or

(2) the taxpayer downloads tax preparation software

from the website to the taxpayer’s machine. The

taxpayer completes the filing offline, then

reconnects to the host website to upload the

completed filing.

In batch filing, the Internet is simply used as the

network over which tax transaction is transmitted.

An offline data file is created by a software program,

which is either a generalized program such as a

spreadsheet, or a specialized tax preparation

package. Most taxing authorities also provide

copies of their forms, in downloadable format, on

the websites. Many offer online inquiry into the

status of individual income tax refunds. The more

advanced administrative uses of the Internet,

however, center on the areas of account maintenance

and customer service.

De facto standards for security of interactive

web-based applications include the use of PINs or

passwords, and the use of secured socket layer (SSL)

for sender-to-receiver encrypted transmission. PINs

are issued to taxpayers by an independent method

(usually hardcopy postal mail) and/or are verified

against a database by the Internet application.

Although SSL provides some measure of security

for Internet transmission, it does not authenticate the

sender. PINs can be stolen from the mail or lost or

compromised by the taxpayer.

ICETE 2004 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

258

4 SECURITY AND USABILITY

We used cognitive walk-through technique to review

the user interface and security mechanisms directly

on state and private websites and noted the security

mechanisms and usability features employed by

these websites. Cognitive walkthrough is a usability

evaluation technique modelled after the software

engineering practice of code walkthroughs. To

perform cognitive walkthroughs we step through

these websites as if we were novice users,

attempting to simulate transactions and identifying

errors, probable areas of confusion; and subjectively

interpreting the security cues.

Although our analysis is most accurately

described as a cognitive walkthrough, it also

incorporates aspects of another technique called

heuristic evaluation [Nielsen, J., 1994]. In this

technique, the user interface design is evaluated

against a specific list of high-priority usability

principles and desirable features that we have

identified on these websites. Our evaluation also

draws on our experience as security researchers and

additional background in educating novice computer

users. Some of the features we identified by this

combined process of cognitive walkthrough/

heuristic evaluation/experience of these websites are

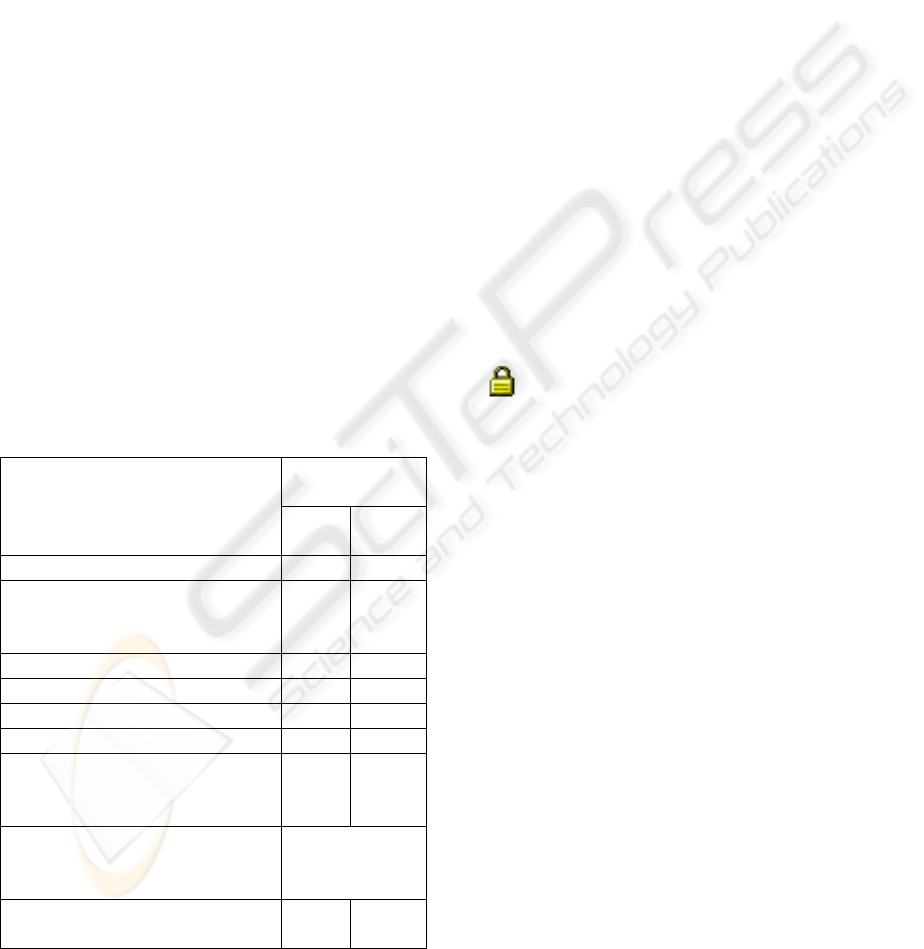

listed in the Table 1.

Table 1: E-Filing Security Mechanisms

Percentage

present

SECURITY MECHANISMS

State

(38)

Privat

e(15)

SSL Encryption (https) 100% 100%

authentication mechanism

a. IRS PIN + password

b. login + password

56%

54%

third party trust symbols 0% 100%

affiliation with IRS 100% 100%

Secure and insecure zones 0% 20%

Security and Privacy policy 100% 100%

Reverse Turing Test (RTT)

for protection from

automated attacks

0% 0%

post submission data

handling policies and

acknowledgements

no mention

statements/disclaimer on

the site availability

10% 0%

4.1 Security Mechanisms

4.1.1 Security Connections

SSL was employed on all the websites (state and

private) for the secure communication and is notably

highlighted on all the sites. Users invariably assume

that establishing a SSL connection makes their data

secure, however, it only guarantees the identity of

the other machine to which the user is connecting.

There have been many cases where users/browsers

are fooled to connect to a malicious site. In our

prototype we have also created our own certificate

authority and issued our own certificates. Browsers

like Microsoft Internet Explorer and Netscape

Navigator show the certificate to the user. With a

more sophisticated attack like DNS (domain name

service) spoofing, a user is presented with a

certificate for a “secure” SSL connection and yet

transparently redirected to a malicious third-party

server. Thus reliance only on SSL for security is

dangerous – a multilevel security approach is

preferred.

In our prototype we have taken the approach of

creating zones to help users build a mental model for

establishing secure connection.

The https protocol provides a padlock symbol

(

) at the bottom of the browser’s window but this

is small and often goes unnoticed. We were unable

to find any websites that encrypt cookies along with

an SSL connection.

4.1.2 Authentication mechanism

In order to restrict access to an E-filing transaction

to legitimate users each website employed differing

authentication mechanisms. Most of these

authentication mechanisms were keyed primarily on

a Social Security Number However, we also

observed some sites allowing a user to choose a

username of choice or supply a PIN printed on their

tele-file pamphlet they receive in mail (in addition to

Social Security Numbers).

In our prototype we have required the users to

register with the online E-tax filing program. We

allow them to create their own password to log on

with social security number and a pin supplied to

them by IRS.

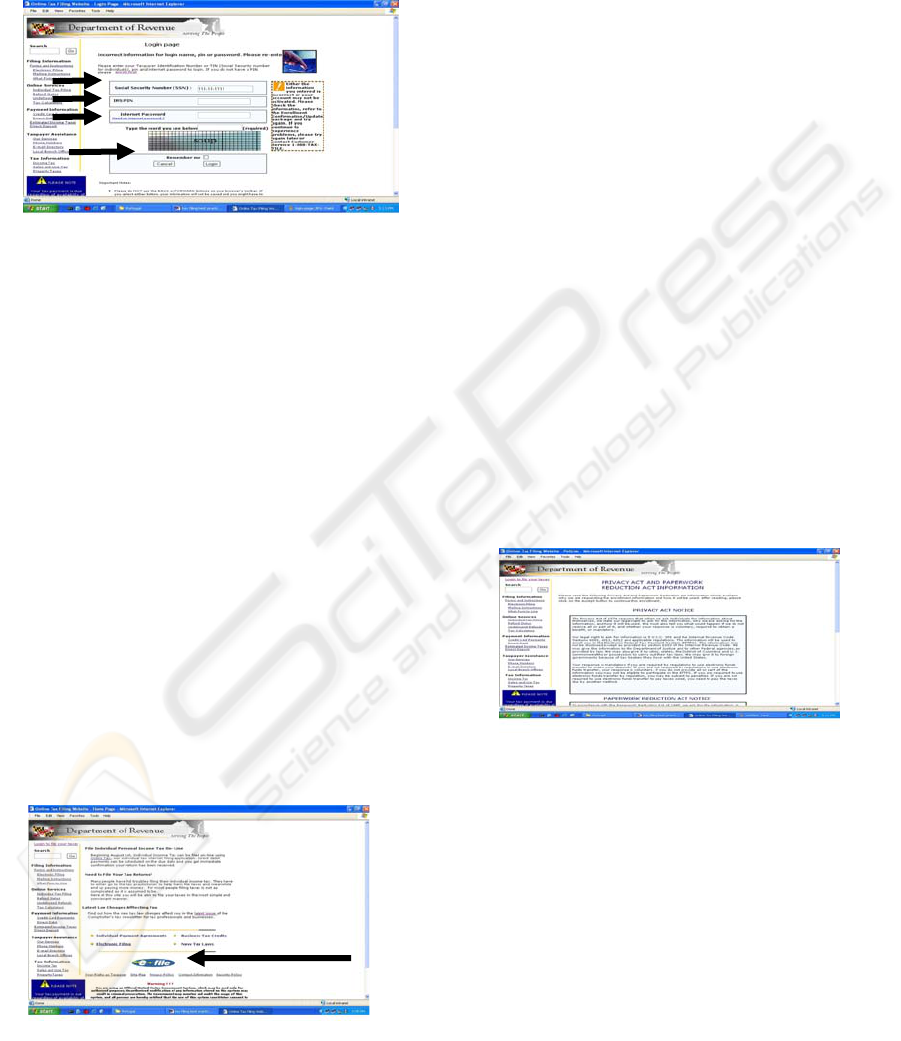

As shown in Figure 1, our prototype incorporates

a Reverse Turing Test (RTT) to deter automated

brute force dictionary password attacks on our

authentication mechanism. RTT requires a distorted

but human-recognizable word or phrase embedded

in a graphic be input after supplying a wrong

password a given number of times [Ahn, L. 2004]

[Kavassalis, P. et al 2004]. RTT is employed by E-

AN E-TAX INTERNET FILING SYSTEM INCORPORATING SECURITY AND USABILITY BEST PRACTICES -

Prototype implementation of the best practices identified in government and commercial E-tax filing websites in the USA

for tax season of 2003

259

commerce websites such as Paypal and Yahoo mail

to ensure a human user is attempting authentication

as opposed to a machine. We feel strongly that E-

Tax filing websites should adopt RTT as a security

mechanism to stop automated brute force attacks.

Figure 1: A Reverse Turing Test along with authentication

mechanism on the prototype E-Tax Filing Website.

4.1.3 Third party trust symbols

Third party trust symbols are not an accurate

security gauge for several reasons. The foremost

reason is that most websites using trust symbols

have placed these symbols along with

advertisements that users tend to ignore. We have

also found misuse of third party symbols that are

completely superficial (graphic image with no

verification links). Third party trust symbols are

more prevalent on private tax filing websites as

compared to government websites. The most logical

explanation is that government websites carry

credibility of their own.

In a particularly important instance, the IRS has its

own “e-file” picture and has encouraged its partners

in the free-file-alliance to use this graphic as a trust

symbol. This graphic lacks the verification system

and anyone can copy this image and put it on their

website - there is virtually no way to determine if the

IRS has approved usage of the symbol on a

particular website.

Figure 2: “e-file” 3rd party symbol issued by the IRS

We have refrained from using third party symbols

on our prototype. Instead we have encouraged links

to the authoritative web pages on the official IRS

website which describes its free-file-alliance. This

makes a cross-site verification with the IRS website.

This particular system would also stop any abuse of

the “e-file” graphic symbol issued by IRS.

4.1.4 Privacy Policies

[Fogg B.J., 2002] in their study also note that users

tend to aggressively look for a privacy policy on a

website, however, this does not necessarily mean

that users also read them. All of the states and

private tax websites have stated privacy and security

policies. We have, however, found some

discrepancies in the system of privacy policies. In

certain E-tax filing websites, multiple subcontractors

are handling tax-data collection, tax data

submission, and help desk responsibilities - with

each subcontractor having their own privacy

policies.

SSN

In our prototype we have provided a direct link to

both a privacy and security policy. We have also

provided a link to the applicable privacy/security

laws for the appropriate jurisdiction. We feel that

government websites have an opportunity to

leverage on access to legislation in order to

distinguish themselves from private contractors and

thus attract more people to use their website.

Figure 3. US Federal Privacy Act along with

privacy/security policies of local site

4.1.4 Post tax-filing procedures

It is mandatory by US Federal law for the IRS and

other tax filing websites to acknowledge the receipt

of the returns filed by the taxpayer. If the taxpayer

does not get a receipt, taxes are not officially

considered as “filed”. The standard way of

acknowledging receipt of the tax data is via Email

but in our prototype we supplement an

acknowledgment Email with additional information

including links to important FAQs and contact

information. Email sent should not be flashy or give

the feel of a spam to the users. The purpose is to

RTT

PIN

password

ICETE 2004 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

260

provide feedback in order to facilitate taxpayer

confidence in the system.

4.2 Usability features on the websites

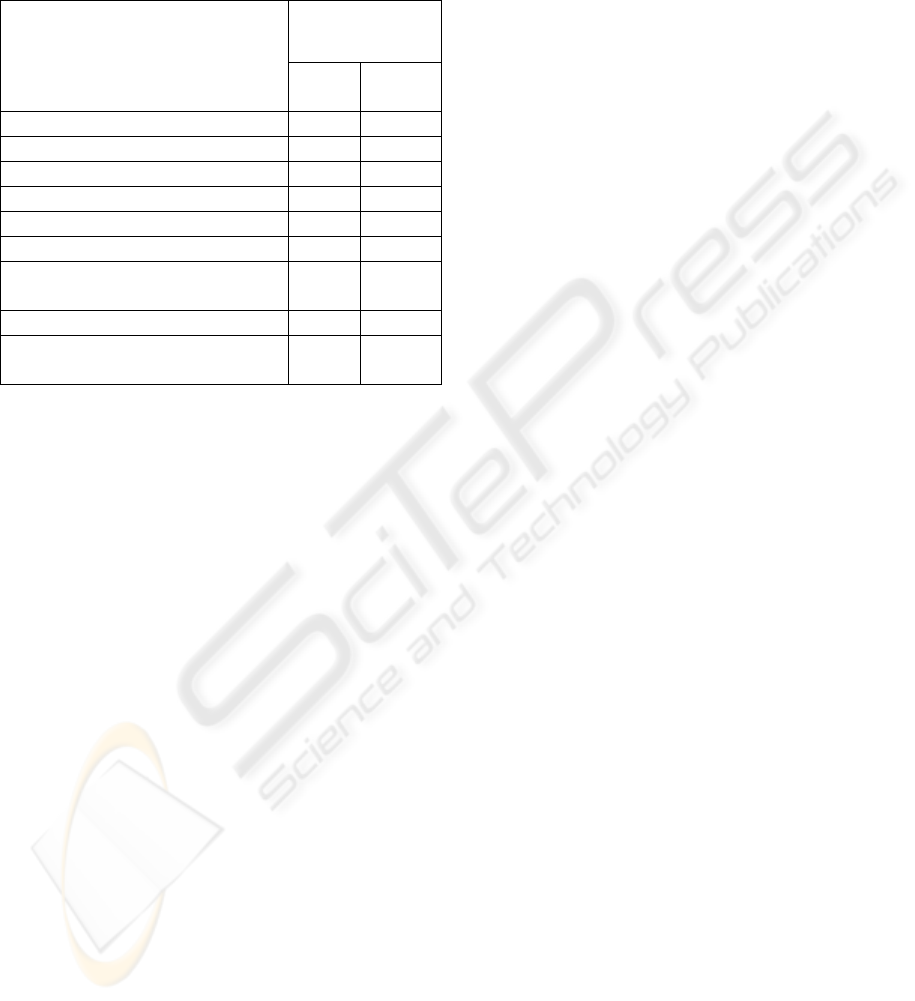

Table 2. E-Tax Usability Features

Percentage

present

USABILITY FEATURES

State

(38)

Private

(15)

eligibility criteria 100% vague

hw/sw requirements detailed 100% 100%

usage guidance provided 50% 10%

demonstration present 30% 20%

FAQ listed 80% 50%

contact information listed 100% 100%

post-submission data

handling policies

0% 0%

site availability statement 20% 0%

all prices quoted with no

hidden costs

100% 10%

4.2.1 Application usage and eligibility

criteria

The tax system in the United States is one of the

most complex and hence it is difficult to provide

universal GUI interfaces for E-Tax filing – there are

multiple categories a taxpayer may use. Eligibility

criteria, thus, becomes important. Taxpayers would

reject a website that would not notify the user about

eligibility before inputting a substantial amount of

data. We found that eligibility criteria has not always

been placed at visible locations, with some websites

putting it in an FAQ section assuming that everyone

accessing the website reads the FAQs first before

starting.

In our prototype we have emphasize eligibility

criteria. The most visible place seems to be the

initial user enrollment forms and the login screen.

4.2.2 Demonstration Present

It is common for humans to loose sense of direction

or location in a hypertext environment due to

additional effort and concentration necessary to

maintain several tasks simultaneously - cognitive

overload. A demonstration is an important part of E-

Tax filing websites since this application is new to

most of users. In addition, users have a general

curiosity about how exactly the system works. Some

people want to find out how the system works before

deciding to use it.

The advantage of a demonstration is that it

facilitates mental models about the application. It

helps users create a mental navigation map and

supports an ability to keep conscious track of the

links. Upon seeing a demonstration a user can

become aware of what to expect when actually using

the online E-Tax website to file taxes.

4.2.3 FAQs

Users, especially first time users, have questions

about the entire system process. FAQs on the

website helps bolster confidence by providing

answers to anticipated questions. Another advantage

is the reduction in customer support calls. Most E-

Tax websites have an FAQ section. Often the

information is available elsewhere on the website

but the redundancy is outweighed by the benefit of

answers to common questions in one place. As a

warning of what to avoid, we have observed some

websites with detailed FAQs in one large html file

with no subsections or categorization such that it is

virtually unsearchable.

The FAQ section is an important component of

an E-Tax website (similar to an address book is for

an email application), however, the FAQ should be

designed based on topical relevance. A proper

categorization of information with an effective

search mechanism is required. Lastly, the FAQ link

should be placed prominently.

5 IMPLEMENTATION

CHALLENGES

Due to a heterogeneous user base, creating user

awareness and training are difficult tasks. The same

effect can be accomplished by standardizing the E-

Tax filing mechanisms, content organization, and

GUI look-and-feel. Our prototype is a first attempt

in this direction.

Another challenge is the capability of supporting

a variety of user hardware/software configurations,

as well as the capability to update the host

application at will without concern for what version

is on the taxpayer’s machine.

Availability is another big challenge for the E-

Tax filing websites. As the deadline for submission

nears, the number of people trying to access these

websites is going to increase exponentially.

Due to the importance and nature of the E-Tax

filing application, these websites are a high potential

target for cyber attacks such as denial of service

attacks and identity theft.

Finally, it should be noted that the Internet is not

reliable, that is, there is no guarantee that any

AN E-TAX INTERNET FILING SYSTEM INCORPORATING SECURITY AND USABILITY BEST PRACTICES -

Prototype implementation of the best practices identified in government and commercial E-tax filing websites in the USA

for tax season of 2003

261

particular message will reach its destination. For this

reason, it is imperative that the E-Tax filing websites

build some form of acknowledgement mechanism

into all transactions. The taxpayer should be

educated to understand that the tax filing has not

been completed until the confirmation number or

acknowledgment is received in return.

6 FUTURE WORK

We feel that in order for an Internet E-Tax system to

be successful, there is a strong need for large-scale

authentication. The IRS and several states have

piloted Public Key Infrastructure (PKI) applications

with some success, but they have also reported

concerns regarding the ability to correctly install and

manage digital certificates. Some tax authorities are

considering becoming certificate authorities

themselves, and assigning key pairs to taxpayers at

no charge. These keys may reside on a server or

personal computer, or they may reside on a card or

some form of token, which must be read at every

transaction. Biometric forms of security and

authentication, such as a fingerprint or retinal scan,

will become inexpensive and widely used.

There is also a need for incorporating

sophisticated logging and auditing capabilities for

user feedback, error detection, error recovery, and

forensic investigation.

Another approach that remains to be tested for E-

Tax filing is allowing the taxpayer to download tax

preparation software from a website to the

taxpayer’s machine. The taxpayer completes the

filing offline, then reconnects to the host website to

upload the completed filing. Advantages of this

method include the ability of the taxpayer to store

the filing on the taxpayer’s machine for future

reference. Disadvantages include the need to

accommodate various versions of the software to

match taxpayer hardware/software configurations,

and the need for customer assistance staff to support

the download and installation processes.

7 CONCLUSIONS

Online E-Tax filing is gaining acceptance in society

but there is still a long way to go. Most tax filing

systems are complex with traditional filing by paper

through the postal mail. Internet filing is a

fundamental change and the reluctance of people to

use such a new system is to be expected. However,

there are features that can be addressed immediately

and effectively in the design of an E-Tax filing

website to encourage security and usability.

In this paper we studied many Internet E-tax

filing websites and identified best practices for

security and usability. We highlighted the

discrepancies between security and usability in E-

Tax filing websites and then addressed the problems

we found by building a prototype E-Tax filing

application to simulate and test our solutions. We

conclude with the primary observation that visible

security mechanisms most effectively bolster user

trust with multiple instances highlighted within our

analysis and prototype.

REFERENCES

Adams, A., Sasse, M. A., December 1999, Users Are Not

the Enemy, Comm. of ACM, Vol 42/No 12.

Ahn, L. V., Blum, M., Langford, J., February 2004, How

Lazy Cryptographers Do AI, Comm. of the ACM, Vol

47/No.2.

AT&T Labs-Research, Beyond Concern: Understanding

Net User’s Attitudes About Online Privacy, Technical

Report, TR 99.4.3

Consumer WebWatch

http://www.consumerwebwatch.org/

Dellarocas, C., 2001, Building Trust On-Line: The Design

of Reliable Reputation Mechanisms for Online Trading

Communities. http://ebusiness.mit.edu

Fogg B.J., 2002, Stanford-Makovsky Web Credibility

Study 2002 Investigating What Makes Web Sites

Credible Today.

Kavassalis, P., Lelis, S., Rafea, M., Haridi, S., February

2004, Telling Humans and Computers Apart

Automatically, Comm. of ACM, Vol 47/No 2.

Nielsen J. Security and Human Factors. Jakob Nielsen’s

Alertbox, November 2000.

http://www.useit.com/alertbox/20001126.html

Nielsen, J., 1994, Heuristic Evaluation In Usability

Inspection Methods, John Wiley & Sons, Inc.

Princeton Survey Research Associates, 2002, A Matter of

Trust: What Users Want From Web Sites, Research

Report.

Turner, C., Zavod, M., and Yurcik, W., 2001, Factors That

Affect The Perception of Security and Privacy of E-

Commerce WebSites, 4th Intl. Conference on

Electronic Commerce Research (ICER-4), Vol 2, pp.

628-636.

Whitten A, Tygar J.D., 1999, Why Johnny Can’t Encrypt:

A Usability Evaluation of PGP 5.0, 9

th

USENIX

Security Symposium.

Yurcik, W., Sharma, A., Doss, D., 2002. False

Impressions: Contrasting Perceptions of Security as a

Major Impediment to Achieving Survivable Systems,

IEEE/CERT/SEI 4th Information Survivability

Workshop (ISW).

ICETE 2004 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

262