AN EFFICIENT NEGOTIATION STRATEGY IN E-COMMERCE

CONTEXT BASED ON SIMPLE RANKING MECHANISM

Malamati Louta, Ioanna Roussaki

School of Electrical and Computer Engineering, National Technical University of Athens, 9 Heroon Polytechneiou Str,

Athens, Greece

Lambros Pechlivanos

Department of International and European Economic Studies, Athens University of Economics and Business,

Athens,Greece

Keywords: Intelligent Agents, Negotiation Protocol & Model, Strategy, Ranking Mechanism

Abstract: Electronic commerce is expected to dominate the market if coupled with the appropriate technologies and

mechanisms. Mobile agents are one of the means that may enhance the intelligence and improve the

efficiency of systems in the e-marketplace. In this paper, we propose a dynamic multilateral negotiation

model and we construct an efficient negotiation strategy based on a ranking mechanism that does not

require a complicated rationale on behalf of the buyer agents. This strategy can be used to extend the

functionality of autonomous agents, so that they reach to an agreement aiming to maximise their owner’s

utility. The framework considers both contract and decision issues, is based on real market conditions, and

has been empirically evaluated.

1 INTRODUCTION

The last few years we have witnessed a rapid

expansion of business carried out online. Thus, e-

commerce has evolved to a field dominating present

and future transactions. While current e-commerce

systems offer advantages to both consumers and

merchants, it is often the case that they offer little

more than electronic catalogues on which credit card

payments can be arranged online. One of the major

changes expected in this environment is that

dynamic pricing and personalisation of offers will

become the norm for many transactions.

In order to harness its full potential and achieve

the degree of automation required, a new technology

is necessitated. Agent technology, which is already

involved in almost every aspect of computing, seems

to play a leading role, enabling a new, more flexible,

generation of e-commerce systems. In such systems,

automated software agents participate in trading

activities on behalf of their owner. This paper is

based upon the notion of interacting agents, which

exhibit properties such as autonomy, reactivation,

and pro-activation, in order to achieve particular

objectives and accomplish the goals of their owners.

Mobile intelligent agents can act as mediators in

five of the six e-commerce phases (He, 2003). This

paper explores the role and behaviour of agents in

the negotiation phase. Negotiation may be defined as

“the process by which a joint decision is made by

two or more parties. The parties first verbalise

contradictory demands and then move towards

agreement by a process of concession or search for

new alternatives” (Pruitt, 1981). In human

negotiations, the parties bargain to determine the

price or other transaction terms. In automated

negotiations, software agents adopt broadly similar

processes to achieve the same end. When building

an autonomous agent that is capable of flexible and

sophisticated negotiation, three broad areas need to

be considered (Faratin, 1998): (i) what negotiation

protocol and model will be adopted, (ii) what are the

issues over which negotiation will take place, and

(iii) what negotiation strategies will the agents

employ. The negotiation protocol defines the “rules

of encounter” (Rosenschein, 1994) between the

agents. Then, depending on the goals set for the

agents and the negotiation protocol and model, the

negotiation strategies are determined. Given the

18

Louta M., Roussaki I. and Pechlivanos L. (2004).

AN EFFICIENT NEGOTIATION STRATEGY IN E-COMMERCE CONTEXT BASED ON SIMPLE RANKING MECHANISM.

In Proceedings of the First International Conference on E-Business and Telecommunication Networks, pages 18-25

DOI: 10.5220/0001391400180025

Copyright

c

SciTePress

wide variety of possibilities, there is no universally

best approach or technique for automated

negotiations (Jennings, 2001), rather protocols and

strategies need to be set according to the prevailing

situation.

This paper concentrates predominantly on the first

issue, proposing a negotiation protocol to be

employed in an automatic multi-lateral, multi-step

negotiation model and on the third point by

providing an efficient negotiation strategy for the

electronic Business-to-Consumer marketplace (a

highly competitive environment). In this framework,

the roles of the negotiation agents may be classified

into two main categories that, in principle, are in

conflict. Thus, the negotiating agents may be divided

into two subsets: The Buyer Agents (BAs) and the

Seller Agents (SAs), which are considered to be self-

interested, aiming to maximise their owners’ profit.

The authors exploit a multi-round negotiation

mechanism, which demonstrates inherent

computational and communication advantages over

single step mechanisms in such complex

frameworks (Conitzer, 2003). In essence, the agents

hold private information, which may be revealed

incrementally, only on an as-needed basis. The

negotiation environment considered covers multi-

issue contracts and multiparty situations, while being

a highly dynamic one, in the sense that its variables,

attributes and objectives may change over time.

Considering the case where SAs and/or BAs face

strict deadlines, an effective negotiation strategy is

proposed assisting all agents to reach to an

agreement within the specified time-limits. In

comparison to a more simplified negotiation strategy

recently designed by the authors (Louta, 2004), the

strategy presented hereafter demonstrates improved

performance with respect to time and

communication resources required.

The rest of the paper is structured as follows. In

Section 2 the negotiation protocol & model adopted

are presented. Section 3 elaborates on the designed

negotiation strategy, which is adequate for cases

where the rationale of the BAs is limited. Finally, in

Section 4 conclusions are drawn and directions for

future plans are given.

2 NEGOTIATION PROTOCOL &

MODEL

In subsection 2.1, the negotiation protocol adopted is

presented, which does not employ the alternating

sequential offers pattern, but instead uses a contract

ranking mechanism. Subsection 2.2 elaborates on

the proposed negotiation model, which introduces

the decision issues concept. A more detailed version

of the proposed negotiation protocol and model is

presented in (Roussaki, 2004).

2.1 Negotiation Protocol

In relative research literature, the interactions among

the parties mostly follow the rules of an alternating

sequential protocol in which the agents in turn make

offers and counter offers (e.g., Rubinstein, 1982).

This model requires an advanced reasoning

component on behalf of the BA as well as the SA. In

this paper we tackle the case where the BA does not

give a counter offer (which involves incorporating to

the model all BA’s trade-offs between the various

attributes) to the SA, but ranks the SA’s offers

instead. This ranking is then provided to the SA, in

order to generate a better proposal. This process

continues until a mutually acceptable contract is

reached. This is more efficient in cases in which the

BA is not able to extract all user requirements and

preferences in a completely quantified way, while

being capable of selecting, classifying or rating the

contract(s) proposed.

Once the agents have determined the set of issues

over which they will negotiate, the negotiation

process consists of an alternate succession of

N

contract proposals on behalf of the SA, and

subsequent rankings of them by the BA, according

to its preferences and current conditions. Thus, at

each round, the SA sends to the BA

N contracts

(i.e.,

N packets consisting of n -plets of values of

the

n contract issues), which are subsequently

evaluated by the BA, and a rank vector is returned to

the SA. These steps are repeated until a contract

proposed by the SA is accepted by the BA, or one of

the agents terminates the negotiation. We hereafter

consider the case where the negotiation process is

initiated by the BA who sends to the SA an initial

Request for Proposal (RFP) specifying the types and

nature of the contract issues and the values of all non

negotiable parameters.

2.2 Negotiation Model

In this section, an efficient dynamic negotiation

model is presented, based on the multi-issue value

scoring system introduced in (Raiffa, 1982), for

bilateral negotiations involving a set of quantitative

variables. Our aim is to incorporate this framework

into a multi-party, multi-issue, dynamic model. This

is important since multilateral negotiations are

common in the electronic marketplace. Based on the

designed negotiation protocol, the proposed model is

exploited by the SA to create subsequent contracts,

while used by the BA to evaluate and rate the

contracts offered.

It has been argued in the literature (e.g., Faratin,

1998), that Raiffa’s framework is based on several

implicit assumptions that, even though they may

lead to good optimisation results, they are

inappropriate for the needs of the e-marketplace,

such as: (i) privacy of information for the

AN EFFICIENT NEGOTIATION STRATEGY IN E-COMMERCE CONTEXT BASED ON SIMPLE RANKING

MECHANISM

19

negotiators is not supported, (ii) the utility function

models must be disclosed, (iii) the value regions for

the contract issues for both parties must be identified

in advance, (iv) the only parameters that determine

the utility of the contracts for the negotiators are the

values of the issues under negotiation.

However, there are usually several issues, that

even though their values are not under negotiation

and they are not included in the contract parameters,

they affect the evaluation of the values of the

contract issues. Without being exhaustive, such

issues may consist of: the number of competitor

companies, the number of substitute or

complementary products/services, the quantity of

product in stock, the number of current potential

buyers, the reputation/reliability of each party, the

time upon which the negotiation deadline is reached,

the resources availability and restrictions, etc. We

will refer to these issues as decision issues (DIs).

The values of the DIs may change overtime,

depending on the e-marketplace conditions and on

the Seller’s and Buyer’s state. The DIs not only

affect the evaluation of the contracts, but they also

have an impact on the generation of subsequent

offers. It is noted here that DIs’ values do not

necessarily depend on the actions of the negotiating

party they affect, while they may affect one or both

negotiators. The values of the DIs should have a

strong and direct influence on the behaviour of the

negotiating agents, as they must be able to evaluate

the utility of the contracts under the current

conditions in the e-marketplace and act accordingly.

From the above analysis, it is clear that optimal

solutions cannot be found in the e-commerce

domains, as computational and communication

resources usually impose non-zero negotiation

duration and time-varying issues may change the

conditions for both parties. Thus, we propose a

dynamic model for agents’ negotiation that can be

exploited by strategies in order to accelerate the

generation of contracts acceptable to all parties,

while maximising the agent’s own utility function.

The agents that represent Sellers will be denoted

by

{}

,...,

21

SSS =

and the ones that represent potential

Buyers will be denoted by

{}

,...,

21

BBB =

. For the

values of the DIs we will use the following notation:

j

d

,

mj ,...,1=

. Let

[

]

[]

1,0,: →

a

i

a

i

a

i

MmU

express the

utility that agent

BSa ∪∈

assigns to a value of

contract issue

i

in the range

[

]

a

i

a

i

Mm , of its

acceptable values. Let

a

i

w

be the importance of issue

i

for agent

a

. We assume the weights of all agents

are normalised to add up to 1, i.e.,

1

1

=

∑

=

n

i

a

i

w

. Using

the above notation, the agent’s

a

utility function for

a contract

{}

knkk

ccC ,...,

1

=

can be defined as follows:

()

()

∑

=

=

=

n

i

tt

jki

a

i

a

ik

a

k

dcUwCU

1

,

, where

k

tt

j

d

=

,

mj ,...,1=

, is

the value of decision issue

j

d

at the time

k

t

, when

contract

k

C

is proposed. Examples of utility

functions formulations (e.g. linear, polynomial,

exponential, quasilinear, ...) are evaluated in

(Roussaki, 2003).

In order for the utility function of any contract

issue

i

for any negotiator to lie within the range

[

]

1,0

, the value

i

c of issue i must lie within the

range of its acceptable values. To ensure this, we

introduce the notion of value constraints, that is

expressed as follows:

a

ii

a

i

Mcm ≤≤

. In case the value

constraints hold for all contract issues, the utility

function can be used to measure the satisfaction of a

negotiator as far as the proposed contract is

concerned. Nevertheless, often, the value constraints

are not met for some contract issues, thus

constituting the contract completely unacceptable,

regardless of the utility level. In this case, there is

not much value in using the above specified utility

function to measure the satisfaction degree of this

negotiator. In that sense, agents exhibit

lexicographic preferences. Thus, we may introduce a

value constraint validity vector:

[]

a

i

a

VCVVCV =

,

ni ,...,1

=

, where

{

}

1,0∈

a

i

VCV

, depending on whether

the value constraint for negotiating party

a

is met

for contract issue

i

(i.e.,

1=

a

i

VCV

) or not (i.e.,

0=

a

i

VCV

).

As already mentioned in subsection 2.1, the BA

ranks the contracts proposed by the SA. For the

simplest ranking function, the ranks that may be

assigned to any contract proposed are boolean

variables, i.e. one instance of the set

{}

rejectaccept,

.

In a more sophisticated approach, the ranks lie

within a range

[

]

rr

Mm ,

, where any contract rated

with less than

r

M

is not acceptable by the BA,

while, when a contract is rated with

r

M

, then the

negotiation terminates as the proposed by the SA

contract is accepted by the BA. In order to signal the

case where at least one value constraint is not met

for the BA for a certain contract, we introduce

another parameter called contract value constraints

validity that will be denoted by

a

k

CVCV

for contract

k

C

and is given by the following equation:

∏

=

=

n

i

a

ki

a

k

VCVCVCV

1

. Based on the previous analysis,

in case all value constraints are met for contract

k

C

,

it stands that

1=

a

k

CVCV

. On the other hand, in case

at least one value constraint is not valid for contract

k

C

, it stands that

0=

a

k

CVCV

, and then the particular

contract is definitely rejected.

In order to introduce the time parameter in our

negotiation model, we represent by

{

}

t

N

tt

CCP ,...,

1

=

the vector of the

1≥N contracts proposed by the

Seller Agent

S to the Buyer Agent

B

at time

t

, by

ICETE 2004 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

20

{

}

t

kn

t

k

t

k

ccC ,...,

1

= the vector of the n contract issues

values proposed by

S to

B

at time

t

for the k -

contract of this proposal (

Nk ,...,1= ), and by

t

ki

c

(

ni ,...,1= ) the value of issue i proposed by S to

B

at time

t

for the k -contract of this proposal. Let

now

{

}

t

N

tt

rrR ,...,

1

= be the vector of ranking values

that

B

assigns at time t to the previous contracts

proposal made by

S , and

t

k

r ( Nk ,...,1= ) be the

rank that

B

assigns at time

t

to the k -contract of

this proposal.

A contract package proposal is accepted by

B

when at least one contract is rated with

r

M , while

the negotiation terminates either in case the agent(s)

deadline is reached or in the case where a boolean

variable expressing the wish of the agents to quit the

negotiation is set to true. If an agreement is finally

reached, then we call the negotiation successful,

while in case one of the negotiating parties quits it is

called unsuccessful. In any other case, we say that

the negotiation thread is active.

3 THE PROPOSED

NEGOTIATION STRATEGY

Our focus is laid on the rationale of the SA, since its

adopted strategy will define the outcome of the

negotiation, while rather simplified assumptions

regarding BA’s logic are made. As already stated, a

negotiation is successful, if a mutually acceptable

contract is generated within reasonable time. Since

an exhaustive exploration of the possible contract

space may form a computationally intensive task for

the SA, it should be able to infer the acceptable

contract space for the BA until a predefined

deadline. In our approach, SAs are provided with a

mechanism enabling them to find good (near

optimal) solutions in reasonable time, by means of

computationally efficient algorithms. The rest of this

section is structured as follows. In subsection 3.1 the

negotiation problem is formally described, while in

subsection 3.2 an innovative negotiation strategy is

thoroughly presented.

3.1 Negotiation Problem Description

The objective of our problem is to find a contract

final

C },...,,{

21 nfinalfinalfinal

ccc= that maximises the

Seller’s overall utility function

)(

final

S

CU , i.e., the

Seller’s satisfaction stemming from the proposed

contract, while the constraints on the acceptable

value ranges, the utility reservation values and the

negotiation deadlines for both the BA and the SA are

satisfied. Thus, based on the selected protocol and

the proposed model, designing a negotiation strategy

can be reduced to a decision problem that can

formally be stated as follows:

Given: (i) two negotiating parties: an SA that may

provide a specific good (i.e. service or product) and

a BA that is interested in this good’s acquisition, (ii)

n contract issues (index: ni ,...,1= ) defined by the

negotiators and the acceptable for the SA ranges

[

]

S

i

S

i

Mm , within which their values must lie, (iii)

m

decision issues and their current values

j

d ,

mj ,...,1

=

, (iv) a deadline T up to which the SA

must have completed the negotiation with the BA,

(v) the vector

{

}

lll

t

N

tt

CCP ,...,

1

= of the N contracts

{

}

lll

t

kn

t

k

t

k

ccC ,...,

1

= ( Nk ,...,1

=

) proposed by the SA to

the BA during the previous round

l , (vi) the vector

{

}

lll

t

N

tt

rrR ,...,

1

= of the ranking values

l

t

k

r ( Nk ,...,1= )

that the BA assigns to the previously made by the

SA contract proposal at the negotiation round

l , and

(vii) the value constraint validity vector

{

}

B

ki

B

k

VCVVCV = (

ni ,...,1

=

) for at least one of the

contracts proposed, find the vector

{

}

111

,...,

1

+++

=

lll

t

N

tt

CCP of the N contracts

{

}

111

,...,

1

+++

=

lll

t

kn

t

k

t

k

ccC ( Nk ,...,1

=

) that should be

proposed by the SA to the BA at the next round

1

+

l , in order to eventually reach to an acceptable

(near optimal) agreement between the two parties,

while the SA aims to maximise its individual utility

of the agreed contract under the SA’s constraints,

i.e.,

{

}

1==

S

ki

S

k

VCVVCV ( ni ,...,1

=

), )(

1+l

t

k

S

CU ≥

S

Acc

U

min

and

Tt

l

≤

, and subject to the existent resource and

computational limitations.

In general, there may be a significant amount of

computations associated with the optimal solution of

the negotiation problem presented above. Exhaustive

search (i.e., algorithms scanning the entire contract

space) should be conducted only in case the solution

space is not prohibitively large. The cost of the

respective solutions is evaluated and finally, the best

solution is maintained. The complexity of the

negotiation problem is increased with regards to the

number of the contract issues involved and the range

of their acceptable values. In this respect, the design

of computationally efficient algorithms that may

provide good (near-optimal) solutions in reasonable

time is required.

3.2 Negotiation Strategy

In this section an efficient negotiation strategy that

fully exploits the potential of the designed

negotiation model is described. This strategy is

designed based on the following focal assumptions.

First, the SA and the BA will reach to an agreement,

only if a contract is found, whose contract issues

values lie within the acceptable ranges for both

negotiating parties, while their individual utilities are

above a minimum acceptable threshold. Second, it is

AN EFFICIENT NEGOTIATION STRATEGY IN E-COMMERCE CONTEXT BASED ON SIMPLE RANKING

MECHANISM

21

assumed that the values of all decision issues are

invariable and equal to

{}

0

0

t

j

t

dd =

for the maximum

possible duration

T

of the negotiation procedure

between the SA and the specific BA, where

0

t is the

initiation time of the specific negotiation thread.

Third, the duration

ll

tt −

+1

of each negotiation round

l is considered to be almost constant. Thus, the

maximum number of rounds within which the SA is

authorised to complete the negotiation with the BA

is:

))/((

1 ll

ttTINTL −=

+

.

The rest of the section is structured as follows.

The first subsection provides the general concepts

underlying the negotiation strategy designed for the

SA, the second describes the ranking mechanism of

the BA, while the last subsection presents in detail

the SA’s negotiation strategy.

General Negotiation Strategy Elements on the

Seller Side

As already presented in the negotiation protocol

analysis, we consider the case where the negotiation

process is initiated by the BA who sends to the SA

an RFP specifying the types of the contract issues

and the values of all non negotiable parameters.

Based on this RFP, the SA proposes an initial

contract

{

}

000

,...,

1

t

n

tt

ccC = to the BA at

0

tt = , setting

all contract issues at the values that maximise the

Seller’s utility (i.e. if

(

)

[

]

0,

0

>∂∂

i

t

k

S

cdCU , then the SA

sets

S

i

t

i

Mc =

0

, while in case

(

)

[

]

0,

0

<∂∂

i

t

k

S

cdCU , then

the SA sets

S

i

t

i

mc =

0

). The utility of the initial

contract

0

t

C

for the SA will be denoted by:

(

)

0

0

0

,

max

,

tS

t

t

S

UdCU = , as

0

,

max

tS

U is the maximum utility

that can be achieved for the Seller, given the values

of the decision issues

{

}

0

0

t

j

t

dd = at time

0

tt = .

The proposed negotiation strategy is designed so

that the number

N of the contracts proposed by the

SA to the BA at each negotiation round is equal to

the number

n of the contract issues, i.e. the

following equation holds:

nN = . The general idea

of the proposed approach is that all contracts

l

t

k

C

(

nk ,...,1= ) of a negotiation round l are generated

by the same “source” contract that will be hereafter

denoted as

l

t

C

0

. All contracts of the same round are

generated so that they present equal utilities for the

Seller, given the values of the decision issues

0

t

d at

the beginning of the negotiation, i.e.

(

)

(

)

00

,,

'

t

t

k

S

t

t

k

S

dCUdCU

ll

= ,

{}

nkk ,...,1', ∈

∀

, Ll ,...,1

=

∀ .

Contract

0

t

C is the “source” contract of the first

complete negotiation round (

0=l ), i.e.

0

1

0

t

t

CC = .

If an agreement is not reached until round

1

−

l ,

then at the next round

l , the SA will make a

compromise (concession), reducing its utility by a

certain quantity

(

)

(

)

00

1

,,

t

t

k

S

t

t

k

S

t

dCUdCU

lll

−=Θ

−

. As

only the results and not the formulation of the

designed negotiation strategy depend on the exact

value of

l

t

Θ , without loss of generality, we may

assume that

l

t

Θ is constant, i.e.

0

tt

l

Θ=Θ ,

Ll ,...,1

=

∀

. Hereafter, we consider that upon the

Seller’s deadline, the SA concedes up to its

reservation value. Thus, the following stand:

(

)

0

0

0

,

max

,

tS

t

t

S

UdCU = and

(

)

S

Acc

t

t

k

S

UdCU

L

min

0

, = . Using

these two equations we may define quantity

0

t

Θ as

follows:

L

UU

S

Acc

tS

t

min

,

max

0

0

−

=Θ

. This means that at each

negotiation round, all contracts proposed by the SA

will present Seller utility reduced by

0

t

Θ , with

regards to the contracts of the previous round.

As already mentioned, contract

0

t

C for which it

stands

(

)

0

0

0

,

max

,

tS

t

t

S

UdCU =

is the “source” contract of

the first complete negotiation round (

0=l ), i.e.,

0

1

0

t

t

CC = . The core concept of the proposed SA’s

strategy is to propose

N contracts at each

negotiation round

l , which yield the same utility

concession

o

t

Θ with respect to the source contract

l

t

C

0

. That is the utility of the contracts proposed is

equal to

(

)

(

)

0

00

,,

0

t

t

t

S

t

t

k

S

dCUdCU

ll

Θ−= , while

(

)

(

)

00

1

,,

0

t

t

S

t

t

k

S

dCUdCU

ll

=

−

, nk ,...,1=

∀

. According to

the previous analysis, we have the following:

(

)

0

0

0

,

max

,

tS

t

t

S

UdCU = and

(

)

S

Acc

t

t

k

S

UdCU

L

min

0

, = . It is

noted that in case an agreement between BA and SA

is feasible, our approach will succeed in reaching

within the negotiation thread upon an agreement due

to the assumption that as its deadline approaches, the

SA concedes up to its reservation value

S

Acc

U

min

.

As already described in the negotiation model

analysis, at each negotiation round

l , the SA

provides the BA with a contract proposal

{

}

lll

t

n

tt

CCP ,...,

1

= . The BA in return, sends to the SA

the ranking vector

{

}

1

,...,

1

t

n

tt

rrR

ll

= for the respective

contract package proposal along with the value

constraint validity vector

{

}

ll

tB

i

tB

VCVVCV

,,

= ,

ni ,...,1

=

, for the “source” contract

l

t

C

0

of the round,

where

{

}

1,0

,

∈

l

tB

i

VCV , depending on whether the

value constraint of the BA is met for issue

i (i.e.,

1

,

=

l

tB

i

VCV ) or not (i.e., 0

,

=

l

tB

i

VCV ) for this

contract. In the above approach, obviously, in case

0

,

=

l

tB

i

VCV , i.e., the value of contract issue i set by

the SA to the “source” contract

l

t

C

0

does not lie

within the acceptable range

[

]

B

i

B

i

Mm , of the BA,

then the rank of the contracts generated by

l

t

C

0

will

be equal to zero, as they are rejected by the BA.

ICETE 2004 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

22

The ranking mechanism of the Buyer

The strategy proposed in this paper considers the

case where the BA returns to the SA an

identification sign of the “best contract” comprised

in the contract package proposal

{

}

lll

t

N

tt

CCP ,...,

1

= in

the context of each negotiation round

l . In essence,

the BA in such a case may only identify the contract

that better satisfies his/her needs, requirements and

constraints and not provide a specific rank as a

measure of his/her satisfaction stemming from the

proposed contracts. Therefore, the BA rationale may

be quite simple, but the SA task is still quite difficult

due to the limited information provided. The best

contract

l

t

k

C at each negotiation round l is identified

by a rank signal

BC (i.e.,

{

}

llll

t

N

t

k

tt

BCR 0,...,,...,0

1

= ),

whereas in case a contract

l

t

k

C is accepted to form

the final agreement between the negotiating parties

the specific rank provided at the respective contract

position of the ranking vector

l

t

R

is set equal to 1

(i.e.,

{

}

llll

t

N

t

k

tt

R 0,...,1,...,0

1

= ). At this point it should be

noted that in case all contracts proposed present a

value constraint violation (i.e., if for

l

t

ki

c ,

ni ,...,1

=

,

Nk ,...,1=∀

, it stands that 0

,

=

l

tB

k

VCV ), the ranks

comprised in the ranking vector

l

t

R

returned to the

SA are set equal to 0 (i.e.

0=

l

t

k

r ,

Nk ,...,1=∀

).

The Contract Generation Mechanism of the

Seller

The basis for the proposed negotiation strategy for

the Seller is the first subsection, describing the

general negotiation elements on the seller’s side. As

already mentioned, contract

0

t

C for which it stands

(

)

0

0

0

,

max

,

tS

t

t

S

UdCU = is the “source” contract of the first

complete negotiation round (

0=l ), i.e.

0

1

0

t

t

CC = .

With respect to this initial contract

0

t

C two distinct

cases may be identified. First, no value constraint

violation exists and the contract

0

t

C is ranked by the

BA with a rank signal

BC (i.e., BCr

t

=

0

). Second,

value constraint violation occurs, in which case

0

0

=

t

r , and the BA provides also its value constraint

validity vector

0

,tB

VCV . In case the initial contract

0

t

C presents a value constraint violation, the SA, as

a first step, tries to acquire a contract that respects

BA’s value constraints. We will refer to this step as

negotiation phase I. To this respect, until a non

value constraint violating contract

l

t

C is acquired

(thus,

l

t

r

0≠ ), at each negotiation round 1>l only

one new contract is generated on the basis of the

contract

1−l

t

C proposed at negotiation round 1

−

l

(which in essence forms the source contract

l

t

C

0

, i.e.,

l

t

C

0

=

1−l

t

C ). This generation mechanism considers

that the

l

t

C contract will in principle have all

contract issues values equal to the ones of the

“source” contract

l

t

C

0

, except from the value(s)

l

t

i

c

0

of contract issue(s)

i , for which a constraint

violation has occurred, (

0)(

,

=

ll

ttB

i

CVCV ). For

example, in case contract issue

k of the “source”

contract

l

t

C

0

violates the value constraints, the new

contract proposal would be

{

}

llllll

t

n

t

k

t

k

t

k

tt

cccccC

0)1(00)1(001

,...,,',,...,

+−

= . The value(s) of

contract issue(s)

k ,

l

t

k

c

0

' , are selected so that the

utility of contract

l

t

C for the SA is equal to:

(

)

(

)

0

00

,,

0

t

t

t

S

t

t

S

dCUdCU

ll

Θ−= , where

(

)

=

−

0

1

,

t

t

S

dCU

l

(

)

0

,

0

t

t

S

dCU

l

. Thus, the main concept of the proposed

strategy remains the same. In order to reach a non

violating contract within a limited number of

negotiation rounds, it is assumed that the concession

degree

0

t

Θ is shared equally amongst the contract

issues whose value is not acceptable to the BA. The

exact values of contract issues are determined in

accordance with the following formulae:

l

t

i

c

0

' :

(

)

(

)

=−

00

,',

00

t

t

i

S

t

t

i

S

dcUdcU

ll

S

i

t

n

k

tB

k

w

VCV

l

0

1

,

1 Θ

⋅

∑

=

(1)

This process continues till a non value constraint

violating contract

l

t

C is acquired (i.e.,

l

t

r

0≠ ), in

which case the Seller’s strategy is modified in order

to acquire a mutually acceptable contract within

reasonable time. Specifically, this contract becomes

the “source” contract for the next negotiation round,

during which the SA provides the BA with a

contract package proposal comprising

nN

=

contracts. The negotiation round upon which the

first negotiation phase ends (hence, the strategy of

the Seller is modified) will be hereafter denoted as

fs

nr . It is noted that in any negotiation round

fs

nrl > ,

due to the specific approach adopted (i.e., sequential

utility concession by quantity

0

t

Θ

), no contract

proposed may present any value constraint violation.

Moving now to negotiation phase II, concerning

the generation process of the “source” contract

l

t

C

0

of a negotiation round

fs

nrl > , the current version of

this study considers the simplest possible

assumption, that is the “best contract” proposed to

the BA at the negotiation round

1−l , as determined

by the ranking vector

l

t

R

returned to the SA, forms

the “source” contract for negotiation round

l .

Alternatively, for the specification of the source

contract

l

t

C

0

, the SA could employ exploration

techniques.

Up to this point, we have not yet presented the

way the

=

Nn contracts of any negotiation round

fs

nrl > are generated by the round’s “source”

contract

l

t

C

0

. The contract generation mechanism, is

based on the idea that in any

1+l

t

k

C the SA at each

negotiation round

1

+

l will in principle concede

AN EFFICIENT NEGOTIATION STRATEGY IN E-COMMERCE CONTEXT BASED ON SIMPLE RANKING

MECHANISM

23

mostly with respect to the contract issue which have

been on the previous negotiation round

l preferred

by the BA, while through the modification of one

additional contract issue up to a certain amount the

SA infers the direction towards which should move

in order to reach to an agreement with the BA.

Considering the first negotiation round

l of

negotiation phase II (i.e., 1+=

fs

nrl ), the SA

proposes

n contracts which will in principle have

all contract issues values equal to the ones of the

“source” contract

l

t

C

0

, except from the value

l

t

kk

c of

contract issue

ki = , i.e.

{

}

llllll

t

n

t

k

t

kk

t

k

tt

k

cccccC

0)1(0)1(001

,...,,,,...,

+−

= . The value

l

t

kk

c is

selected so that the utility of contract

l

t

k

C for the SA

is equal to:

(

)

(

)

0

00

,,

0

t

t

t

S

t

t

k

S

dCUdCU

ll

Θ−= . This way,

the SA explores what is the impact of the value

concession of each one of the contract issues.

Following the presented approach, one may observe

that for the “best contract”

l

t

k

C indicated by the BA,

the same SA utility reduction

0

t

Θ due to adjustments

on the value

l

t

kk

c of contract issue ki = , is valued

higher by the BA. On the other hand, in case any

contract

l

t

k

C is not indicated as the “best contract”

on negotiation round

l (where all Seller utility

reduction

0

t

Θ is due to adjustments on the value

t

kk

c

of contract issue

ki = ), this indicates that contract

issue

ki = is not very important for the BA. In

accordance with the proposed approach, in the

context of the next negotiation round, the SA

exploits the “best contract”, as indicated by the BA

in the

l

t

R

vector, which forms the “source” contract

for the next round. Thus, in case this contract is

l

t

k

C

(i.e.,

1

0

+

=

ll

tt

k

CC ), it does “worth” it for the SA to

propose during the next negotiation round

1

+

l a

contract package proposal, whose main

characteristic is that a high percentage of the total

Seller utility reduction

0

t

Θ is due to adjustments on

the value

1

0

+

=

ll

t

k

t

kk

cc of contract issue ki = .

We hereafter introduce with respect to each

contract issue

i a variable called utility concession

degree, denoted as

)(iucd , representing the

percentage of the total Seller utility reduction

0

t

Θ

due to the adjustment of the contract issue

i value. It

holds

)(iucd ]1,0[∈ . The n contracts constituting the

contract package proposal considered in negotiation

round

1+l may be generated as follows. The first

contract is created by modifying only the value

1

0

+l

t

k

c

of

k contract issue, whose adjustment on the

previous negotiation round

l was preferred by the

BA. Thus, the Seller’s utility reduction

0

t

Θ is

introduced only by adjusting

1

0

+l

t

k

c in the source

contract. The value

1+l

t

kk

c may be calculated by means

of the following equation

1+l

t

kk

c :

(

)

(

)

=−

+

0

1

0

,,

t

t

kk

S

t

t

kk

S

dcUdcU

ll

⋅)(kucd

S

k

t

w

0

Θ

, where

1)(

=

kucd . The rest 1

−

n contracts are generated by

modifying at each contract the value

1

0

+l

t

j

c of one

more issue

j

( kj

≠

) in the source contract, up to a

certain degree

)( jucd , while the utility concession

degree

)(kucd of the k contract issue is properly

adjusted, so that

1)()( =

+

kucdjucd . This way, the

impact of the combined Seller’s utility reduction

with respect to both modified contract issues is

explored. The contracts which are specified in

accordance with this concept will be hereafter called

“exploration” contracts. The values

1+l

t

kk

c and

1+l

t

jj

c of

contract issues k and

j

respectively may be

acquired by means of equation (1). It stands

that

∑

=

Θ=−⋅

+

kji

t

t

t

ii

S

t

t

ii

SS

i

dcUdcUw

ll

,

0

0

1

0

)],(),([ , which

indicates that the Seller’s utility of the

n

contracts

of negotiation round

1

+

l is less than the Seller’s

utility of the negotiation round

l by the quantity

0

t

Θ , which is fully consistent with the presented

approach. In the experiments conducted (Roussaki,

2003), for the generation of the 1−n “exploration”

contracts,

)(kucd

is set equal to 0.7, while

)( jucd

equals 0.3, as it is believed by the authors that 30%

is adequate for exploration purposes.

In case the BA ranks higher the introduction of

the modification of contract issue

j

with respect to

the value adjustment of contract issue

k , as a next

step, the respective utility concession degrees

)( jucd and )(kucd are modified so that the relative

preference of the BA for contract issue

j

is

introduced in the generation process of the next

negotiation round

2

+

l . Specifically, considering the

next negotiation round contract generation, the

utility concession degree of contract issue

j

is

increased, while the utility concession degree of

contract issue

k is decreased as we consider that the

SA should concede mostly with respect to contract

issue

j

. Thus, )( jucd is set equal to 0.7, while the

rest 0.3 portion of the utility concession quantity

0

t

Θ

is at each contract assigned to each one of the

contract issues

m in a manner similar to the

“exploration” policy introduced above. Following

the presented approach, it may easily be deduced

that at each negotiation round

l , the contracts

generated from the source contract

l

t

C

0

modify the

values of two contract issues, where the contract

issue preferred by the BA during the previous

negotiation round

)1(

−

l is attributed with utility

concession degree that is equal to 0.7, while a 0.3

percentage is assigned to each one of the contract

issues at each negotiation round. In order to make

the proposed contract generation mechanism more

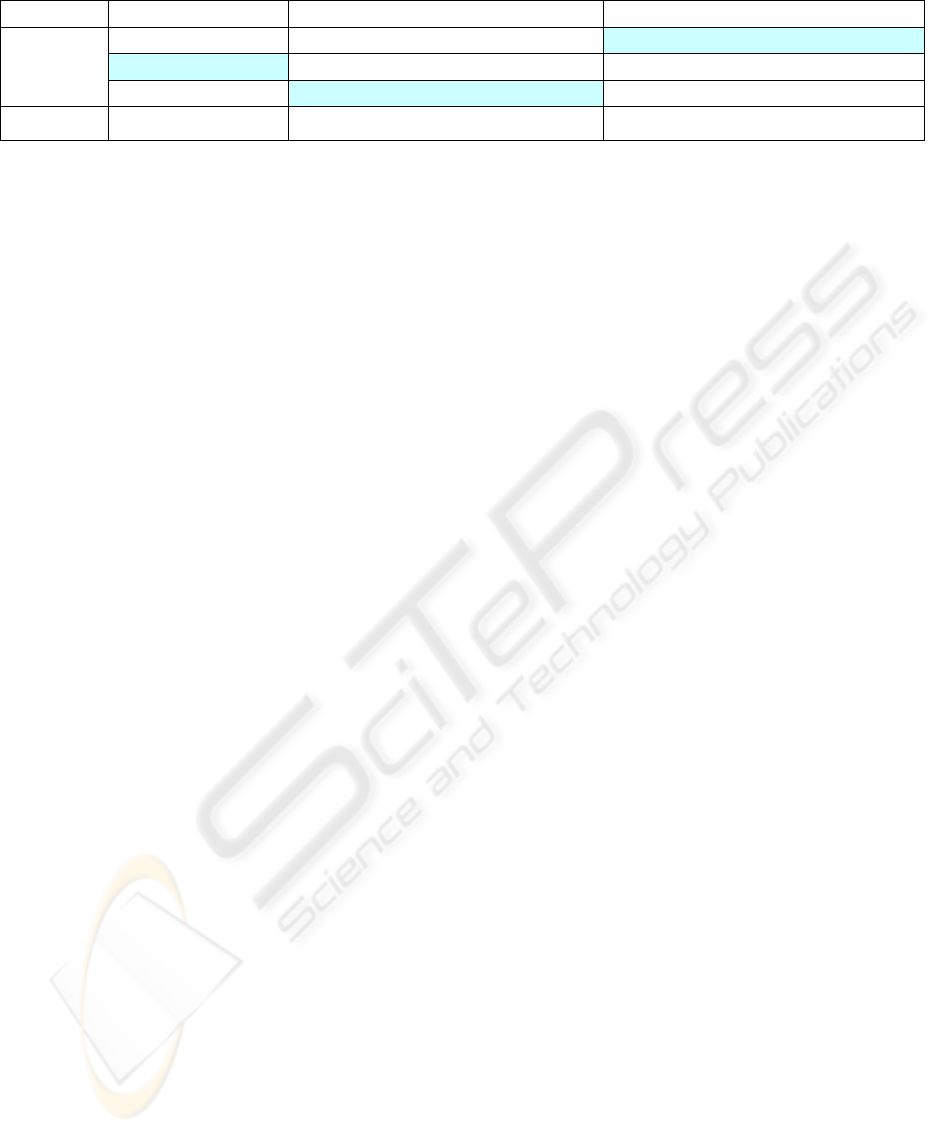

comprehensive to the reader, in Table 1 we present

ICETE 2004 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

24

the logic underlying by means of a simple

example, considering the case of three contract

issues.

According to the proposed approach, in case the

resulting value

1+l

t

kk

c of a contract issue k in contract

1+l

t

k

C ends up to lie outside the acceptable range of

the SA, then if

S

k

t

kk

mc

l

< (or

S

k

t

kk

Mc

l

> ), the value

selected is

S

k

t

kk

mc

l

= (or

S

k

t

kk

Mc

l

= ), while the

remaining utility is equally “distributed” among the

rest of the contract issues that have not yet reached

their limit values.

4 CONCLUSIONS

This paper presented a multiparty, multi-issue,

dynamic negotiation model and an effective strategy,

to be exploited by mobile intelligent agents in an e-

commerce environment, in case the disclosure of

information is not acceptable, possible, or desired.

Additionally, the efficiency of the proposed

framework is due to the fact that the Buyer agent

adopts a flexible and light reasoning component,

which does not necessitate the explicit statement of

all preferences and requirements on behalf of the

Buyer in a completely quantified way. A ranking

mechanism replaces the counter-offer complicated

scheme, while potential decision issues are

considered. Thus, it supports an evaluation of the

contracts proposed, based not only on the values of

the issues under negotiation, but also on the e-

marketplace conditions and the negotiators’ state.

The proposed negotiation strategy is adequate for the

simple ranking function. It demonstrates exceptional

efficiency in cases where the buyer is not able to

provide all his/her requirements and preferences in a

completely quantified way, while being capable of

selecting the contract that best satisfies his/her

needs. Besides its inherent computational and

communication advantages, its efficiency is due to

the fact that an agreement between Buyer and Seller

is reached in any situation it is feasible, before the

predefined deadline expires.

The negotiation framework designed has been

adopted by self-interested autonomous agents and

has performed well on the generation of subsequent

offers and the ranking of the contracts proposed,

always converging to a mutually acceptable contract,

if any. Initial results indicate that the designed

framework produces near optimal results, in case the

number of the negotiation issues is quite high.

Future plans involve its extensive empirical

evaluation against existent models and strategies and

against the optimal solution of the negotiation

problem.

REFERENCES

Conitzer V., Sandholm T., 2003, “Computational

criticisms of the revelation principle”, AAMAS03,

Workshop on Agent Mediated Electronic Commerce

V, Melbourne, Australia.

Faratin P., Sierra C., Jennings N. R., 1998, “Negotiation

Decision Functions for Autonomous Agents”, Int.

Journal of Robotics and Autonomous Systems, vol.

24, no. 3-4, pp. 159-182.

He M., Jennings N. R., Leung H., 2003, “On agent-

mediated electronic commerce”, IEEE Transactions on

Knowledge and Data Engineering, vol. 15, no. 4, pp.

985-1003.

Jennings N. R., Faratin P., Lomuscio A. R., Parsons S.,

Sierra C., Wooldridge M., 2001, “Automated

Negotiation: Prospects, Methods, and Challenges”, Int.

Journal of Group Decision and Negotiation, vol. 10,

no. 2, pp. 199-215.

Louta M., Roussaki I., Pechlivanos L., 2004, “An effective

Negotiation Strategy for boolean buyer response in E-

commerce environment”, submitted to IS'04, IEEE

International Conference on Intelligent Systems.

Pruitt D.G., 1981, “Negotiation Behavior”, Academic

Press Inc..

Raiffa H., 1982, “The Art and Science of Negotiation”,

Harvard University Press, Cambridge, USA.

Rosenschein J. S., Zlotkin G., 1994, “Rules of Encounter:

Designing Conventions for Automated Negotiation

among Computers”, Massachusetts: The MIT Press,

Cambridge, MA, USA.

Roussaki I., Louta M., 2003, “Efficient Negotiation

Framework and Strategies for the Next Generation

Electronic Marketplace”, MBA Thesis.

Roussaki I., Louta M., Pechlivanos L., 2004, “An Efficient

Negotiation Model for the Next Generation Electronic

Marketplace”, in MELECON 2004, 12

th

IEEE

Mediterranean Electrotechnical Conference 2004.

Rubinstein A., 1982, “Perfect equilibrium in a bargaining

model”, Econometrica, vol. 50, pp. 97-109.

Neg. Round

1+=

fs

nrl

1

+

l

2+l

),,'(

321

lll

ccc

,

1)1( =ucd

),','(

1

3

1

2

1

1

+++ lll

ccc

,

7.0)2(

=

ucd

,

3.0)1(

=

ucd )',,'(

2

3

2

2

2

1

+++ lll

ccc

,

7.0)3( =ucd

,

3.0)1(

=

ucd

),',(

321

lll

ccc

,

1)2( =ucd

),',(

1

3

1

2

1

1

+++ lll

ccc

,

1)2(

=

ucd

)',',(

2

3

2

2

2

1

+++ lll

ccc

,

7.0)3( =ucd

,

3.0)2(

=

ucd

Contracts

Proposed

)',,(

321

lll

ccc

,

1)3( =ucd

)',',(

1

3

1

2

1

1

+++ lll

ccc

,

7.0)2(

=

ucd

,

3.0)3(

=

ucd )',,(

2

3

2

2

2

1

+++ lll

ccc

,

1)3( =ucd

Source

Contract

),,(

321

lll

ccc

),',(

321

lll

ccc

,

1)2(

=

ucd

)',',(

1

3

1

2

1

1

+++ lll

ccc

,

7.0)2( =ucd

,

3.0)3(

=

ucd

Table 1: An example of the proposed negotiation strategy

AN EFFICIENT NEGOTIATION STRATEGY IN E-COMMERCE CONTEXT BASED ON SIMPLE RANKING

MECHANISM

25