THE ROLE OF ASON AND GMPLS FOR THE

BANDWIDTH TRADING MARKET

Bandwidth Brokerage under the influence

of novel control plane technologies

Andreas Iselt, Andreas Kirstädter, Rayane Chahine

Siemens AG, Corporate Technology, Information & Communication

Munich, Germany

Keywords: Bandwidth Brokerage, ASON, GMPLS, SDH, WDM

Abstract: Bandwidth services as they have evolved over the last years can increasingly be seen as a commodity. Multi-

ple network operators have comparable offerings and compete for customers. This fuelled the foundation of

bandwidth brokerage and bandwidth trading companies in the late 90s. Unfortunately, their business models

where not very successful in the past. Besides the overall economic weakness at the moment we identify

some generic and technical reasons for this. Moreover we show that with novel automation technologies like

GMPLS or ASON/ASTN some of these problems can be alleviated. Possible operational models show how

future bandwidth brokers or traders could be organized.

1 INTRODUCTION

Communication networks have evolved over the last

decades into a highly structured system allowing

splitting the overall structure into parts, e.g. func-

tionally or geographically, that can be handled inde-

pendently. This separation supported the foundation

of organizations that focused on a subset of the

whole network. For example, an Internet Service

Provider (ISP) focuses on a single layer (the IP

layer), whereas a city carrier concentrates on a single

region. Obviously the structuring requires coopera-

tion of these organizations and at the same time en-

ables competition since the same service could be

offered by multiple parties.

A major role in this scenario is played by the trans-

port network layer having evolved over the last

years into an integrated Optical Network. It typically

consists of a traffic aggregation structure based on

synchronous time division multiplexing (e.g.

SONET/SDH/OTH) operated on a wavelength divi-

sion multiplexing infrastructure (WDM).

1.1 History

Initially, the bandwidth business was bilateral be-

tween network operators and their customers. In the

late 90's companies appeared that offered to trade or

broke bandwidth without operating their own net-

work. Unfortunately, with the continuous bandwidth

price decline and the weak economy the market did

not accept this at that time.

1.2 Analysis & Future

In this paper we first analyze the reasons for the

failure of the bandwidth broking and reselling model

in the past: Long delivery times dictating long term

bandwidth contracts in a volatile market showing a

steady decline of bandwidth prices, nonexistent

quality of service and interface standards, and miss-

ing usage of risk management tools. At a deeper

look it becomes clear that the introduction of

ASON/ASTN (resp. GMPLS) techniques will influ-

ence the economic basis of bandwidth reselling to a

great extent: Automatic signaling will allow short

term contracts (with also strongly reduced times to

close the contracts) since the transaction cost be-

come very small. The much shorter time frames re-

duce the financial risks the trading companies are

exposed to. Standardized Service Level Agreements

(SLA) and interfaces will allow bandwidth to be

treated like a commodity (with high liquidity) com-

plying with sets of unified quality standards in a

more transparent market. Although almost all band-

width traders stopped their activities at the moment,

306

Iselt A., Kirstädter A. and Chahine R. (2004).

THE ROLE OF ASON AND GMPLS FOR THE BANDWIDTH TRADING MARKET - Bandwidth Brokerage under the influence of novel control plane

technologies.

In Proceedings of the First International Conference on E-Business and Telecommunication Networks, pages 306-311

DOI: 10.5220/0001398103060311

Copyright

c

SciTePress

brokerage firms are emerging. They work as inter-

mediaries between buyers and sellers.

1.3 Overview

In the following sections of this paper we will give a

short introduction to transport networks and the new

control plane technologies GMPLS (generalized

multi protocol label switching) and ASON (auto-

matically switched optical networks). This is fol-

lowed by an in-depth description of the business

scenarios of bandwidth resellers and bandwidth

traders. Finally we will analyze these business mod-

els and show how automation by a control plane

may improve this business.

2 TRANSPORT NETWORKS

Transport networks are the basis for packet networks

(e.g. Ethernet, IP) as well as for TDM infrastructures

like the good old telephone networks. Therefore they

have to offer high levels of reliability and predict-

ability. This also contributes to the fact that the

transport network operators often are a little bit re-

luctant to employ new technologies like

ASON/ASTN.

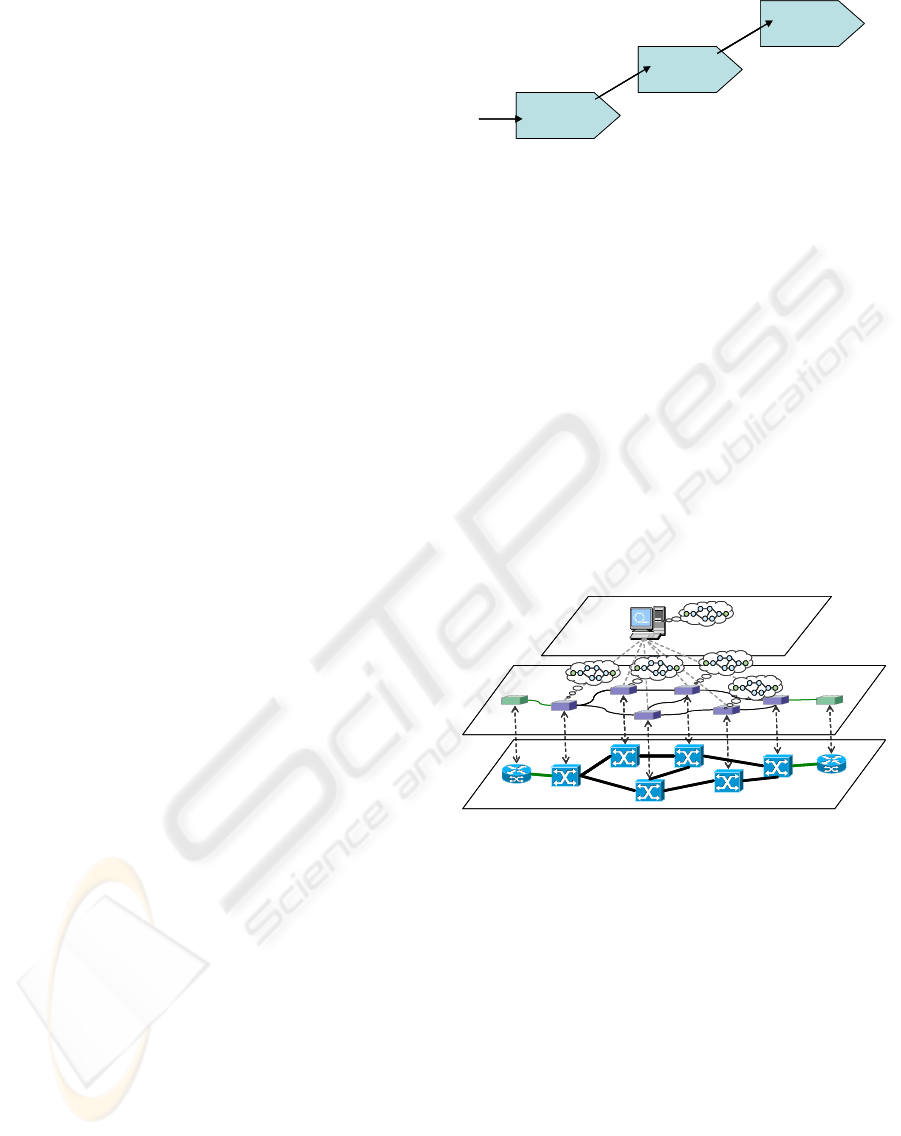

2.1 Business Interaction

Transport network operators often have to buy or

lease optical fibers from transport and utility compa-

nies as the basis of their network infrastructure. The

fibers themselves often are quite abundant in today’s

infrastructures. Only their equipping with TDM

(SDH/SONET) or WDM nodes at the endpoints and

corresponding network management systems defines

the value. The generated bandwidth is sold to carri-

ers that themselves sell bandwidth in the form of

SDH and or packet transfer to customers and retail-

ers, as shown in Figure 1.

2.2 Market

The transport network bandwidth market is in-

fluenced by the following main tendencies:

Network operators are merging. Either in the form of

virtual companies (to extend their reach) or in the

form of real merger and acquisition processes.

Each market player tries to reduce its operational

and capital expenditures by delaying network exten-

sions and new investments, by using novel and

bandwidth-saving resilience mechanisms, or by re-

designing its business processes.

Figure 1: Value System of Network Operators.

3 GMPLS/ASON/ASTN

Optical transport networks are currently operated by

centralized network management systems (NMS).

These systems enable operators to carry out opera-

tion, administration and maintenance tasks, e.g. fault

management, configuration management including

maintenance of the network (e.g. software updates),

as well as provisioning services from a central point.

Though these network management systems are well

approved, they have some significant limitations.

Service provisioning, e.g. for leased lines or virtual

private networks (VPNs) may take several weeks

since the provisioning processes require a consider-

able amount of manual configuration and human

communication.

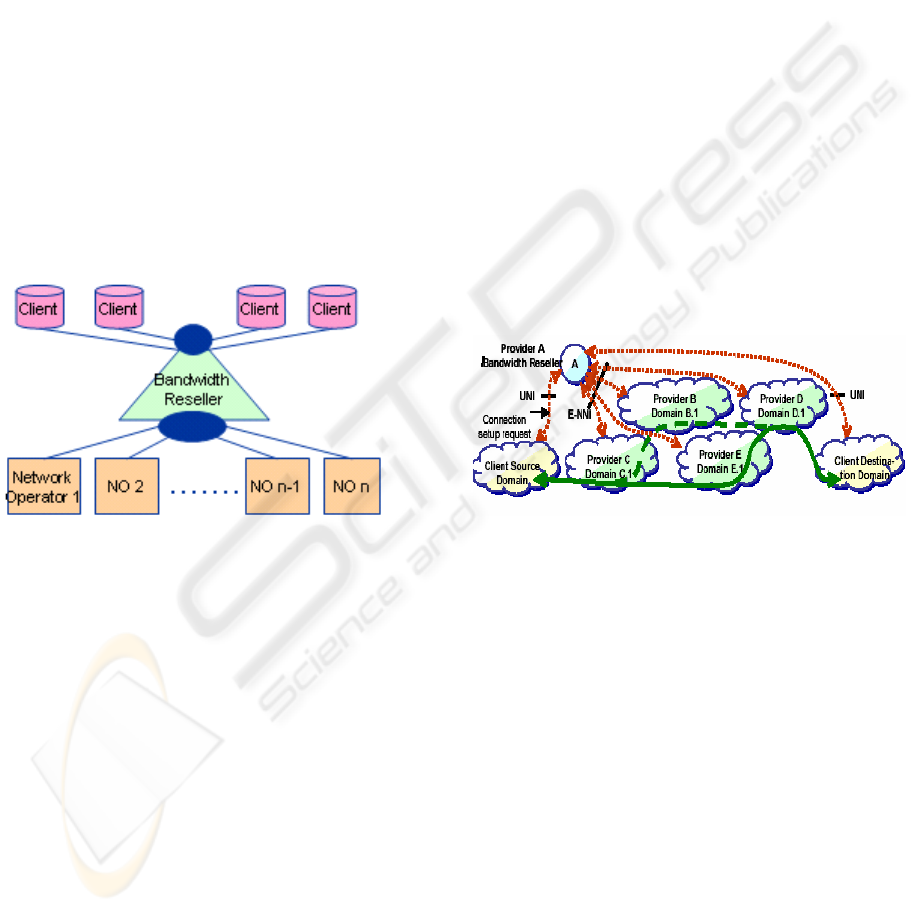

Figure 2: Architecture of control plane-based networks

To overcome the problems of central network man-

agement systems the introduction of a control plane

has been proposed. This is currently followed by

several standardization activities in the ITU-T, OIF

(Optical Internetworking Forum) and the IETF

(Internet Engineering Task Force).

Figure 2 shows the principle architecture of a control

plane based network. The switching functionality in

the transport plane is controlled by the control plane

instances that are part of every network element. The

network management system allows carrying out

management functionalities based on interactions

with the control plane. The bubbles indicate that the

control plane instances in the network elements have

an overview of the network domain they reside in.

The connection setup is initiated via standardized

network work interfaces: the user-network interface

(UNI) on the customer side and the network-net-

Transport Network

Operator

Customer

/ Retailer

Carrier

e.g. Fibers

Bandwidth

(e.g. SDH)

Bandwidth

(e.g. SDH or Packet)

Transport Network

Operator

Customer

/ Retailer

Carrier

e.g. Fibers

Bandwidth

(e.g. SDH)

Bandwidth

(e.g. SDH or Packet)

Management Plane

Control Plane

Transport Plane

Management Plane

Control Plane

Transport Plane

THE ROLE OF ASON AND GMPLS FOR THE BANDWIDTH TRADING MARKET - Bandwidth Brokerage under the

influence of novel control plane technologies

307

work-interface on the interconnection points to

neighboring network operators.

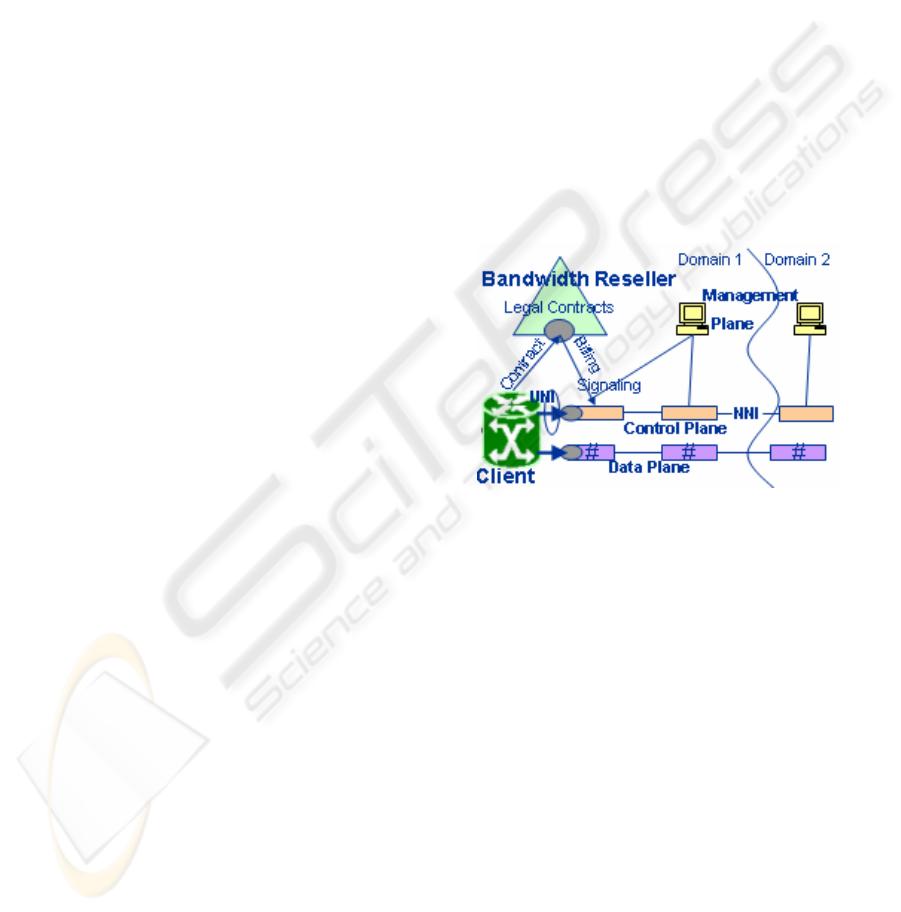

4 BANDWIDTH RESELLER

4.1 Business Idea

Generally spoken, a bandwidth reseller is a company

having contracts with different network operators. It

buys bandwidth from network operators and resells

it to clients (retailing); it could also act only as a

broker and just manage bandwidth contracts be-

tween buyers and sellers. Customers and carriers

contact the bandwidth reseller that will allocate them

the best connection specific to their needs instead of

contacting many individual network operators to set

up the single connection elements. The bandwidth

reseller does not necessarily have its own network

infrastructure; it cooperates with many intercon-

nected local regional and global network operators

and carriers (Figure 3).

Figure 3: Bandwidth reseller concept.

In traditional networks, global network operators

have to interact with regional ones to reach the end

customers. Setting up the connection takes a large

amount of time (up to 6 weeks). These results not

only from the fact that the interfaces are not stan-

dardized - relying on human work to make connec-

tion. Also, the internal routing has to be set up - in-

ternal interfaces being also a problem. Setting up a

connection between different domains, faces com-

patibility problems and requires several agreements

and contracts between the players operating different

domains. This proves to be time consuming, labor

requiring, and expensive.

Therefore, a more efficient way is needed to make

this process faster and automated. Through the in-

troduction of standardized interfaces, new control

plane technologies like GMPLS/ASON/ASTN aim

to make this possible. However two types of stan-

dardization are required:

Physical standards, making the technologies of dif-

ferent domains and operators compatible.

Service level agreement (SLA), a service contract

between a customer and a service provider specify-

ing the service the customer should receive and it

makes sure that, in case of non compliance, the ser-

vice provider pays damages fees.

Then operators using Bandwidth Reseller con-

nectivity based on GMPLS/ASON/ASTN technolo-

gies would deliver fast and flexibly with reduced

cost over wide geographical and different regions.

Since the bandwidth reseller uses the connection

provisioning services of several network operators, it

can flexibly select the best offer to suit a specific

connection request. The customers can change easily

from one network provider to another looking for

better service quality or lower costs connections.

Using the UNI signaling, the connections can be torn

down and new connections can be set up without the

need for negotiations and long provisioning time.

This means that service holding times (time where a

client has a connection through a certain provider)

will progressively become shorter, from years and

months down to days and even hours. Also, time to

service (time for connection set up) will also be get-

ting shorter (few seconds) in order to maintain ser-

vice profitability.

Figure 4: Network model for bandwidth reseller.

Figure 4 describes a scenario where a source client

would like to get connected to a destination client.

The client contacts the bandwidth reseller by its UNI

and requests a connection setup via the bandwidth

reseller. There are two path alternatives for the con-

nection between the client source domain and the

client destination domain. One path is through pro-

vider C, provider E and provider D whereas the sec-

ond path goes through provider C, provider B, and

provider D. If one of the network operators B or E

can offer a better interconnection in terms of cost

and quality of service QoS, then the path containing

that network operator is chosen.

The customer has only a business relation to the pro-

vider A. The signaling information between the

bandwidth reseller and its customer may be sent out-

of band over an external IP or Ethernet network. The

network connectivity must be known to be able to

route the connections request to the client destina-

tion domain.

ICETE 2004 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

308

Comparable models are already established in the

energy business, where a company acts as a general

contractor. The core competencies of such a general

contractor are the customer relations management

and connectivity service retail. Given the successful

trading of gas, electricity and power in the energy

industry, it is time for the telecommunication indus-

try to enter this world; and definitely the Bandwidth

Reseller will be one of the most attractive business

opportunities.

4.2 Basic Interactions

Interaction between Bandwidth Reseller and Net-

work Operators

The bandwidth reseller buys bandwidth in large

scale from network operators. It has framework con-

tracts with those network operators; meaning that it

guarantees them that it will buy a certain amount of

bandwidth every time period. These framework con-

tracts allow getting the bandwidth for low prices

because of volume discount rates the single opera-

tors are willing to offer for monthly assured sales of

bandwidth.

In another functional model the bandwidth reseller

could only be a broker, acting as an intermediary

between buyers and sellers. Network operators just

contact it offering bandwidth for sale. The role of

the broker then would be to find clients for these

offers. It is a sort of bandwidth matchmaker that

negotiates bandwidth contracts. Counterparties then

contract with each other. When the deal is done, the

broker earns a commission directly from counter-

parties.

Interaction between Bandwidth Reseller and End

Customers

Prior to connection setup, a contract agreement must

be set in place. The end customer and the bandwidth

reseller establish a framework contract. Via this con-

tract they specify the allowable range of requests

and the bandwidth constraints the client is author-

ized to ask for in his connections.

Once this paper work is done, the client is granted

permission to access the network. It signals its re-

quests towards the control plane of the transport

network. The signaling is done through the UNI in-

terface running between the client and the control

plane and allows the user to request connections.

The UNI allows the client to perform a number of

functions such as Connection Create, Connection

Delete, Connection Modify and Status Enquiry.

After verifying its right to utilize the network and

the correct type of connection, access to the trans-

port network is granted and a connection is es-

tablished with the parameters necessary for the cli-

ent’s application. In this process the client only has a

business relation with the Bandwidth Reseller, and

does not know which network operator is actually

supplying the bandwidth for his connection.

From the above description of the interaction be-

tween the different players, we notice three possible

access points: The access point to the bandwidth

reseller (for legal contract agreement between client

and bandwidth reseller), the access point to the con-

trol plane (for signaling), and the access point to the

transport plane (for sending and receiving data).

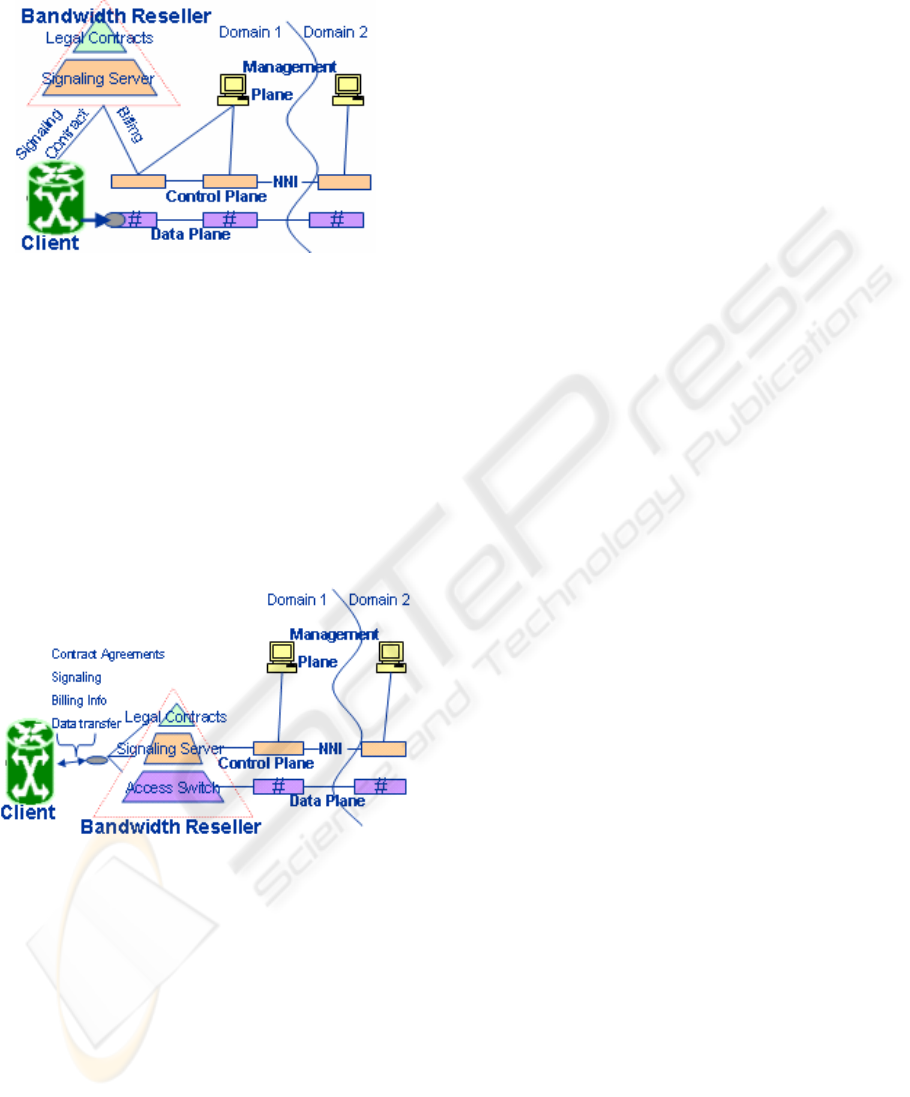

4.3 Ownership Models

Given the three access points, a bandwidth reseller

company may show three different ownership mod-

els:

Model 1

Figure 5: Ownership model 1.

The bandwidth reseller handles only legal agree-

ments with clients. It is only responsible for buying

large amounts of bandwidth from network operators

and selling them to customers. The company itself

could be a small office, where only few people are

needed because the main task would revolve around

legal work and contract making. In this case the

Bandwidth Reseller is not concerned with the con-

trol plane operation or any access switch that con-

nect clients to the network.

The client would directly signal to a control plane

operated by the first network operator. In this case

the bandwidth reseller would have compensated the

network operator for running the signaling access

point.

THE ROLE OF ASON AND GMPLS FOR THE BANDWIDTH TRADING MARKET - Bandwidth Brokerage under the

influence of novel control plane technologies

309

Model 2

Figure 6: Ownership model 2.

The bandwidth reseller is not only responsible for

legal agreements but also for operation of the access

part of the control plane running it own signaling

server.

On the one hand this requires extra work to be done

on the other hand the compensation to the network

operator is reduced. The client would the directly

signal its transmission request to the bandwidth re-

seller.

Model 3

Figure 7: Ownership Model 3

The Bandwidth Reseller is responsible for legal con-

tract agreements with clients, operation of the con-

trol plane server and its own access switches con-

necting the clients to the transport network. Having

its own access switches, the bandwidth reseller

would establish connections of remote regions to the

network.

More work forces are needed in this case: People to

run the contract agreements, people to operate the

signaling server, and people for the installation, and

maintenance of the switches.

5 BANDWIDTH TRADING

MARKET EVOLUTION

The following chapters describe and analyze the first

wave of bandwidth broking taking part from the mid

90’s until the beginning of this century.

5.1 Bandwidth Trading Market Rise

In mid 90‘s new group of companies that combined

telecom expertise with experience of utility market

started offering brokerage and trading services.

In 1997 Band-X pioneered the idea of trading band-

width, followed in 1998 by RateXchange who of-

fered to link buyers and sellers anonymously. Later

in May of that year, Enron announced to the world

that it was creating a new market for trading band-

width. By the end of 1999 other energy brokers be-

gan to create their own bandwidth market desk, such

as Skura Dellcher, and formed The Association of

International Telecommunications Dealers (AITD).

In December of that year, Enron completed the

world‘s first bandwidth trade. By the beginning of

2000, many carriers were greeting a new era of

commodity bandwidth trading. Reluctant at the be-

ginning, deep pocketed energy utility companies

Williams, Dynegy, El Paso and Aquila decided to

enter the trading market. In May 2000, the first

comprehensive index to measure telecommunica-

tions bandwidth prices was launched. By September

2000, it was estimated that the BW trading market

should will $441 billion by 2005.

5.2 Bandwidth Trading Market Fall

Year 2001 was the beginning of the fall: In January,

TeleExchange suspended its operation and in March

2001 a 25-30% decrease of BW prices since January

2001 was listed. In June 2001, Bandwidth.com

ceased its trading activities and converted to a bro-

ker. Since October 2001, 17 companies, with a com-

bined market capitalization of $96 billion went

bankrupt. December 2001 was the major turnover:

Enron filed Chapter 11 bankruptcy. Seeing Enron

falling, other energy merchants ceased trading BW

in 2002 and returned to their core businesses: elec-

tricity and gas. By March 2002, brokers continued to

match buyers and sellers but ceased any trading ac-

tivity. In October 2002, 47 carriers went bankrupt,

trying to compete on bandwidth prices. By Decem-

ber 2002, prices had fallen 44% from January 2001

and weren‘t likely to rise anytime soon.

Starting 2003, people are expecting for bandwidth

prices to stabilize. Some even predict positive num-

bers in the next few years.

ICETE 2004 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

310

6 ANALYSIS

6.1 Reasons for Bandwidth Trading

Failure

As a summary it can be said that the following ef-

fects contributed to the collapse of the BW trading

market:

The decline in the Bandwidth prices induced a glut

(i.e. supply exceeding demand) in the bandwidth and

made it a product of very low liquidity. This all,

made it hard to be considered and treated like trad-

able commodity.

In addition, the collapse of Enron Corp. in fall 2001,

made all other utility companies take out themselves

from the bandwidth trading market.

The bad economical situation made it worse and

induced little credit worthy buyers and sellers, carri-

ers expected a price saving of 15% to 20% before

going to broker, other reluctant carriers also feared

to loose by selling the excess capacity at bargain

prices. Another important reason were the long term

bandwidth contracts that service providers were

stuck to and the very long time to close a contract -

usually 60-90 days and more.

Also, technical incompatibilities between network

operators were a major problem due to the nonexis-

tent unified set of quality of service standards.

Finally, telecommunication companies didn‘t use

risk management tools analyzing their exposure to

risks and determining how to best handle such expo-

sure This made them blind to the risks of such a

volatile market with huge price movements.

6.2 Improvements Expected by

ASON

Looking a little bit deeper into the matter it becomes

clear that the introduction of ASON/ASTN (respec-

tively GMPLS) techniques will change a lot the eco-

nomic basis of bandwidth reselling:

Automatic signaling will allow short term contracts

since the transaction cost become very small. Also,

the time to close a contract will be reduced heavily.

The much shorter time frames reduce the financial

risks the trading companies are exposed to.

Standardized Service Level Agreements (SLA) will

allow bandwidth to be treated like a commodity

complying to sets of unified quality standards: It will

be more interchangeable between different operators

making it possible to buy bandwidth through future

contracts. This will greatly increase the liquidity of

bandwidth (i.e. the ability to be converted into cash

quickly and without any price discount

). The conse-

quence is a more transparent market in which cur-

rent trade

and quote information is readily available

to the public

and the price of bandwidth is subject to

supply and demand. Finally, common standardized

interfaces will also assure technical compatibilities

between network operators.

7 SUMMARY

Although almost all bandwidth traders stopped their

activities at the moment, brokerage firms are emerg-

ing. They work as intermediaries between buyers

and sellers. Waiting for the market and bandwidth

prices to stabilize, it is only a matter of a few years

that capacity trading will catch up again and this

time not only energy traders will be involved but all

telecom companies will want to be part too, and the

control plane technologies like GMPLS and

ASON/ASTN will definitely be key players in the

technology behind this huge market.

To analyze the Bandwidth Trading business idea, a

market study and analysis is necessary. The Band-

width market evolution during the past few years

gives us an indication on how transaction of capacity

would be like in the future.

This enables new services, giving the opportunity to

consider new business ideas, such as service on de-

mand, dynamic bandwidth provision, and a virtual

bandwidth market place. In the future, the virtual

market places will enable selling and leasing of

bandwidth making room for bandwidth brokerage in

the telecommunication industry.

REFERENCES

Kirstädter A., Iselt A., Schupke D., Prinz R., Edmaier B.,

“Cost Structures of Transport Networks”, ITG VDE

NetWorkshop 2003, Gladbeck, Germany, Sept. 29,

2003.

Glasner J.: Enron: A Bandwidth Bloodbath,

November 2001.

Josh Long: Brokers Regroup after Traders Call it Quits,

Trading Desk, March 2002.

Josh Long: Energy Merchants cease Bandwidth Trading,

Trading Desk, February 2002

THE ROLE OF ASON AND GMPLS FOR THE BANDWIDTH TRADING MARKET - Bandwidth Brokerage under the

influence of novel control plane technologies

311