DEVELOPING AN INTRANET AND EXTRANET BUSINESS

APPLICATION FOR A LARGE TRAVEL AGENT

R. Shaw, A.S. Atkins

Faculty of Computing, Engineering and Technology, Staffordshire University, Octagon, Stafford, UK

Keywords: Intranet, Extranet, Strategy, Business applications

Abstract: This paper outlines an e-business strategy for a large independent Travel Agent with multiple sales channels

and business units. The present configuration does not provide a framework for the development of e-

business solutions for the travel company. The paper discusses the creation of an infrastructure for the

development of the company’s Intranet to integrate its separate business units with Extranet technology

using e-business applications. This strategy provides a stable platform and infrastructure capable of

supporting the traditional business functions and allowing for development of e-business operations. The

paper discusses a number of tools and techniques for strategic development to incorporate e-business sales

channels. The most appropriate tools for application to the travel industry are discussed and their application

has shown how the travel agent can develop competitive advantage through the use of strategic information

systems. The creation of a centralised e-business system, utilising a Virtual Private Network (VPN) is

outlined with a predicted cost savings of £1 million per annum. The application of a centralised e-business

system supported by the VPN has allowed Customer Relationship Management (CRM) to be evaluated. An

initial trial using a CRM system gave increased sales of £150,000, which if applied throughout the business

would increase sales by £1.2 million.

1 INTRODUCTION

A large retail company, which operates a locally

based Travel Agent business, has pursued a policy of

expansion by acquisition. The business consists of

three main business units: Retail (High Street),

Home worker and Call centre sales respectively.

The current IT infrastructure is hampering future

growth and the problem is compounded by the

existence within the business of a plethora of

holiday sales systems, inadequate network capability

and poor Management Information Systems (MIS).

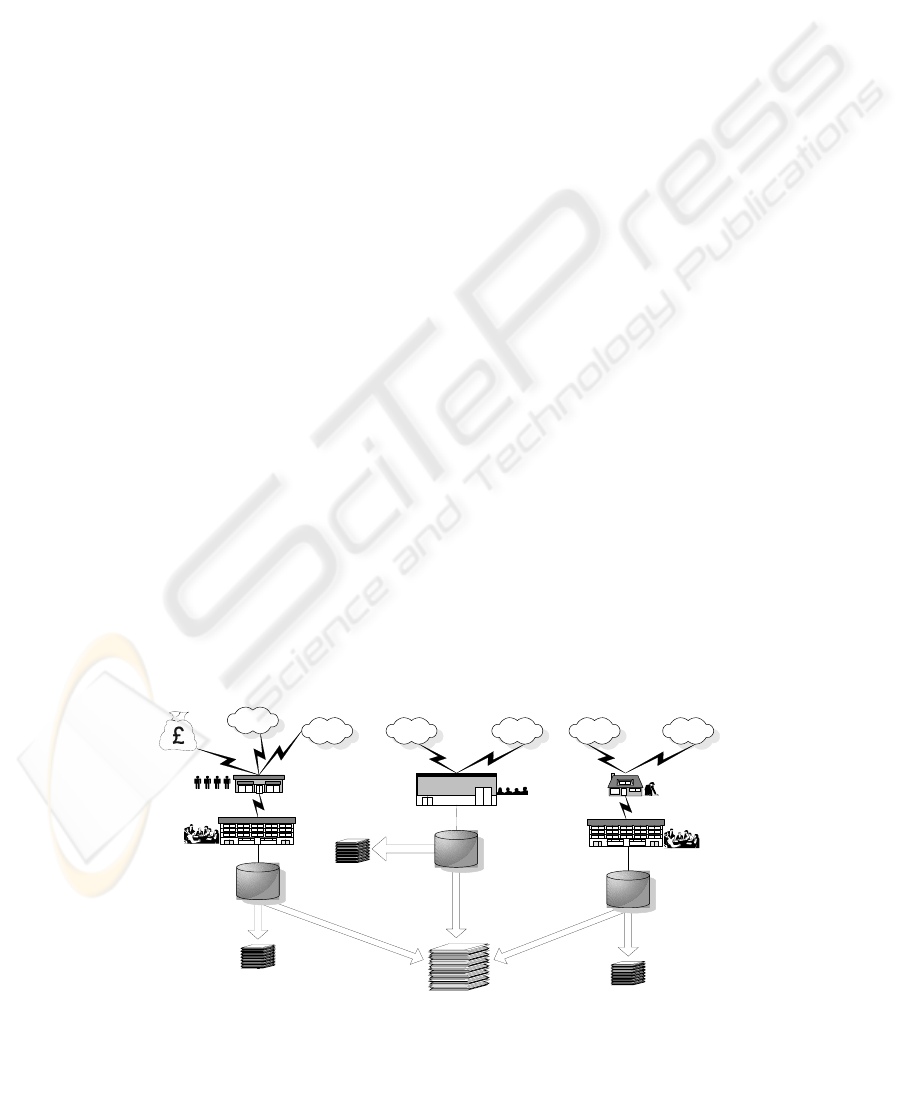

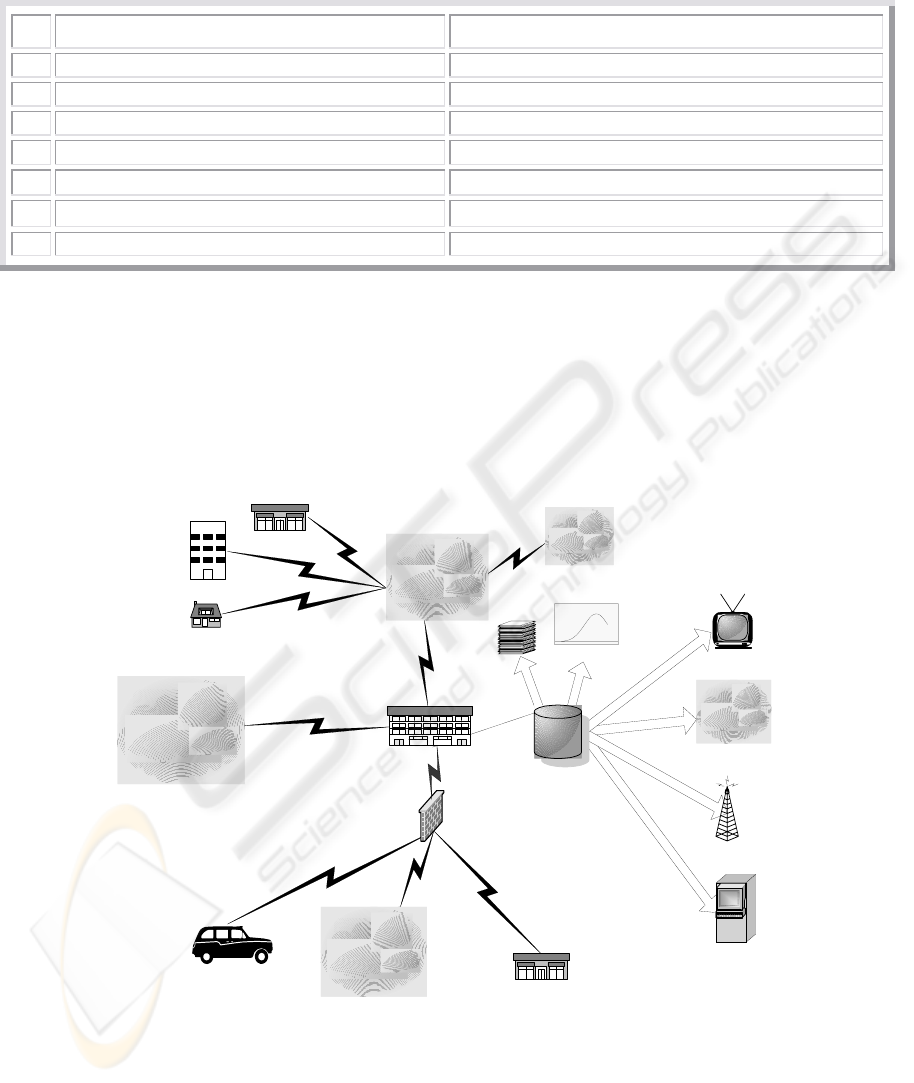

A conceptual diagram of the current system is

illustrated in Figure 1. Recently, a rollout of

corporate e-mail and Intranet services placed

considerable strain on the business ISDN based

network.

ViewData

WWW

Call Centre (x2)

WWW

ViewData

Sales System

Homeworker (x600)

Central Admin

Sales data

WWW

ViewData

Central Admin

Sales Data

Branch (x 100)

Managem ent

reports

Managem ent

reports

Group

reports

Management

reports

Clearing bank

Figure 1: Current systems – conceptual diagram

411

Shaw R. and S. Atkins A. (2004).

DEVELOPING AN INTRANET AND EXTRANET BUSINESS APPLICATION FOR A LARGE TRAVEL AGENT.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 411-417

DOI: 10.5220/0002595504110417

Copyright

c

SciTePress

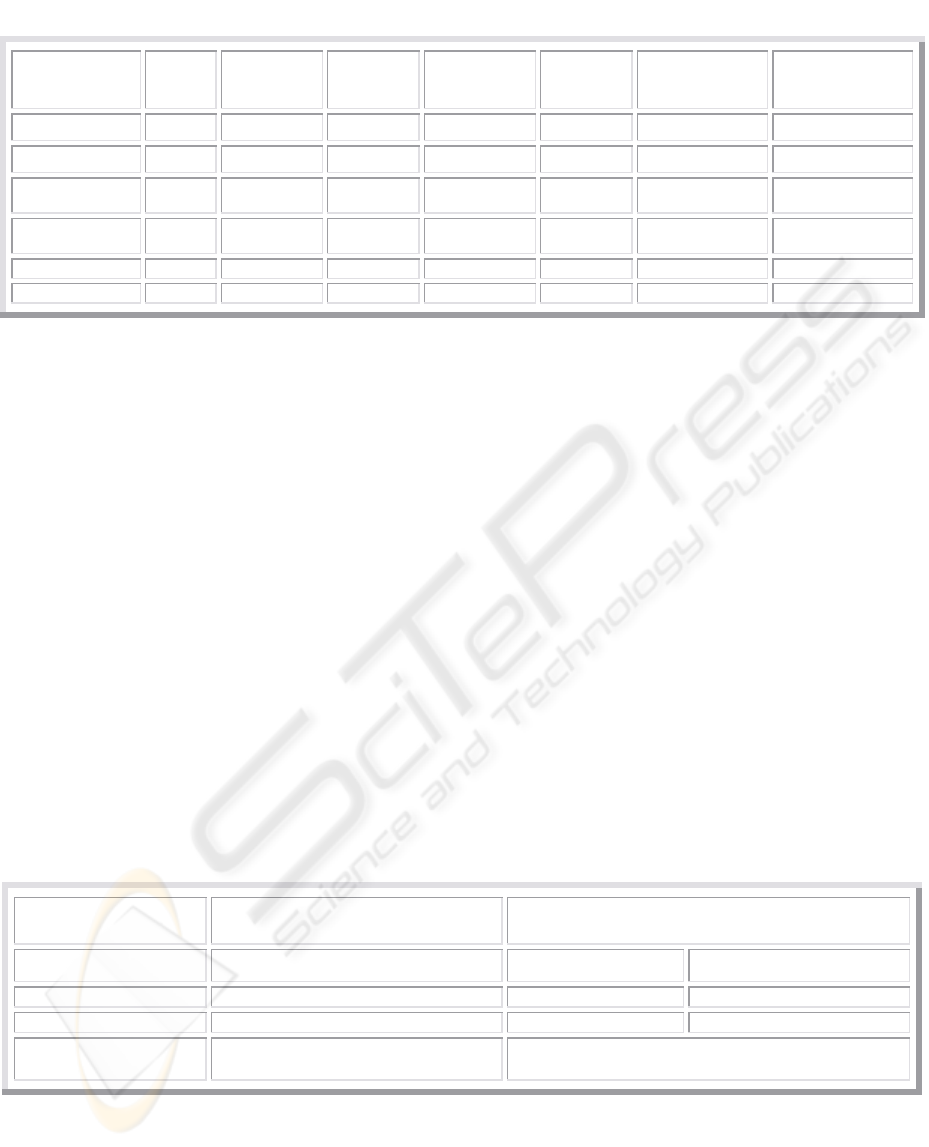

Technology Force

Business Direction

Customer/Market

Force

Convential Radical

Figure 2: Depiction of forces affecting different business unit direction

The Travel agent therefore requires an IS/IT

strategy that will allow the business to increase

market share, remove the barriers to growth and

allow it to achieve its strategic business strategy

which is summarised as follows: -

◊ Integration of their acquisitions.

◊ Consolidation of their market share.

◊ Development of new sales channels.

◊ Introduction and development of Customer

Relationship Management (CRM)

techniques.

One of the main difficulties facing the Travel

Agent is that each business unit is driving, or being

driven, in different directions. The Retail sector,

which historically was the core of the business, now

represents only 40% of overall profit because rapid

expansion in home working business and call centre

acquisition. The home worker and call centre

business see the Internet and Digital TV as means of

generating new business, whilst the retail business

see these as eroding their business and look to areas

such as kiosks and interactive customer focused

technologies (brochures and CD) as driver of

business opportunities. Figure 2 depicts the effects

of business direction, technological development

and market forces on the different business

operations. The difficulties caused by the divergence

of the business units can be summarised as follows: -

◊ Multiple sales systems.

◊ Distributed customer and sales data.

◊ Unreliable overnight data downloads.

◊ Rising usage and costs of ISDN based

network.

◊ Heterogeneous MIS/sales systems.

◊ ViewData connection required for each

sales location.

◊ Separate business units.

It is suggested that there are two different

approaches to developing a business strategy namely

a prescriptive and emergent approach (Lynch 2000;

IBM 2000; Mintzberg 1987; Jauch and Glueck

1988). A prescriptive approach is where business

strategy development is viewed as a linear process,

following up the core areas in a systematic process.

It starts with a review of the current state of the

business (where-we-are-now) and develops a

strategy from there. Essentially the objective is

pre-defined and the elements are already in place

before the strategy commences. In the later case an

emergent approach is where business strategy

development is viewed as an organic function and

where the strategy adapts and develops over time.

Its final objective may be unclear and elements

supporting the strategy are developed as the strategy

proceeds and evolves.

2 STRATEGIC ANALYSIS TOOLS

AND TECHNIQUES

There is an overabundance of tools and techniques,

together with modifications to take account of the

impact on business of the Internet, which can be

used to create or, at the very least, direct, a strategy

for a business’ IS/IT (Ward and Griffiths 2000;

Porter 1980, 1985, 1996; Earl 1989; Tozer 1995).

Whilst the depth and breadth of this strategy will

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

412

vary, dependant on the type of business, its industry

and the market it operates in, a number of aspects

will be similar:

◊ Need for the business strategy to direct the

IS/IT strategy.

◊ Need for a comprehensive audit of

incumbent systems and technology.

◊ Need to be aware of the current

environment.

◊ Need to be aware of likely future

environmental changes.

Not only the choice of tool, but the number of

methods/tools to use is also important. The use of a

minimum of two tools, namely SWOT analysis

together with a further tool, has been recommended

(Robson 1997). Further, using every tool or

technique available can lead to problems of

conflicting interpretation. The business could take

so long in analysing and developing a strategy, that

the business could find itself having to implement

too many options, with no overall coherent strategy

and miss opportunities that may present itself in the

short term. The business will effectively be “Stuck

in the Middle” (Porter 1985).

A review of some of the more common

techniques available and their relevance to particular

planning stages has been carried out, based on initial

work by Tozer, 1995. (Tozer 2002). From

knowledge and experience of the Travel Industry the

tools and techniques most appropriate for the

analysis are outlined in Table 1.

3 TECHNOLOGY REVIEW

The current infrastructure with multiple sales

systems, an ISDN based network, and aged

hardware is hampering any progress towards e-

business and customer relationship management.

The current technology infrastructure is

incapable of allowing for the implementation of new

technologies and developments within the industry,

particularly IP based ViewData.

An analysis of the network infrastructure shows

that the implementation of a Virtual Private Network

(VPN) is required. Analysis of costs shows a

predicted saving of over £0.7 million per annum as

illustrated in Table 2.

Table 2: Comparison of current and predicted communication costs for the branch network

No. of branches Current branch sales system operating

costs per annum

Predicted centralised sales system operating costs

per annum

ISDN Based ISDN based VPN based

1 £ 2,400* £ 13,700** £ 4,000

92 £ 220,800 £ 1,260,400 £ 483,200***

* Includes ViewData costs of £1,700 ** Includes ISDN rental and ViewData costs

*** Includes an initial, one off installation cost of £105,200

Note 1: ISDN “call” costs taken at the national call rate of 6.73p per minute (ex. VAT). Assumptions are 9 hours connection, 6 days a week, 52 weeks of the year.

Note 2: Supply of IP ViewData, is included within the overall rental price of the VPN solution.

Technique Business

Planning

Business

requirements

definition

Information

architectures

Current status

assessment

Application

strategy

selection

Application portfolio

assessment

Technical strategy

and architecture

Technology Review

9 9 9

9

Strategic Impact Grid

9 9 9

SWOT

Analysis

9

9

Critical Success

Factors

9

9

Porters Five Forces 9

Agile Infrastructure 9

Table 1: Selected analysis tools after Tozer 1995, modified by authors

DEVELOPING AN INTRANET AND EXTRANET BUSINESS APPLICATION FOR A LARGE TRAVEL AGENT

413

High

Importance

to Future Business

Low

Cri ti cal

Systems

"Hygiene

Systems"

Low Hi gh

Importance to Past & Present business

STRATEGIC -

Business critical

TURNAROUND

High Potential

SUPPORT -

Disi nvest

FACTORY -

Key Operational

VPN

Single Sales System

CRM

e-Sales

Cooperative ventures

Allow independant

specialists into the

business' VPN,

ViewData and

"Lates" feed.

ISDN Based Network

Figure 3: Strategic impact grid analysis

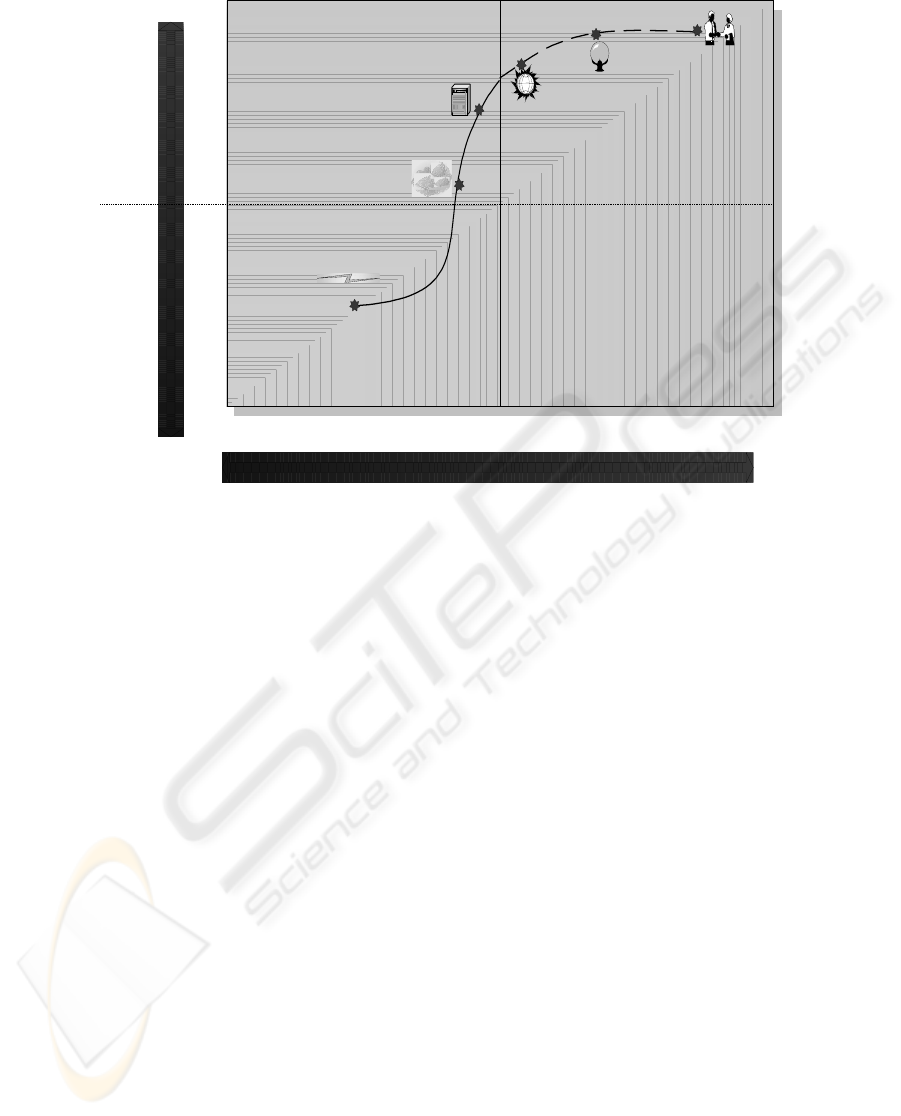

4 STRATEGIC IMPACT ANALYSIS

Figure 3 shows a number of discrete steps that are

required to develop strategic systems and

competitive advantage for the Travel Agent.

It is clear that, on a cost basis alone, the current

ISDN based network is hampering any IS/IT

supported initiatives the business wishes to develop.

A stable network will allow for the introduction of a

“single feed” for ViewData, Late Availability

Holidays (“Lates”) and credit card authorisation by a

Clearing House. It will also allow for a single,

managed link to the Internet for the whole business.

The second major problem for the business is the

existence of multiple sales systems, particularly

within the retail business unit. The removal of these

two impediments is seen as a priority for the

business.

With the implementation of a reliable network

and a homogeneous sales system, the Travel Agent

will then be able to develop the e-Commerce arm of

its business. The sales system will be able to accept

orders/booking from any web site the business

develops and a single feed for ViewData and

“Lates” will provide the Travel Agent with the

means to direct particular holidays and offers

directly along the e-Sales channel.

If these options are implemented, tools such as

CRM will provide the Travel Agent with a means to

develop customer loyalty, possibly with such

techniques as discount/loyalty cards, air miles

bonuses, etc.

Finally a stable, integrated system will allow the

Travel Agent to develop cooperative alliances, by

allowing external businesses access to its network

resources. Businesses such as taxi firms, for

example, could allow a two-way transfer of

passenger information, specifically for airport

transfers. It would also be possible to allow small

independent specialist travel agents, access to the

network based ViewData and “Lates” feed,

strengthening both the Travel Agent’s “Specialist”

sales and the specialist travel agent’s “General”

sales, with benefits to both businesses.

5 FIVE FORCES

The bargaining power of suppliers is low,

compounded by the independence of the Travel

Agent under review. Buyers bargaining power is

also relatively low for package holiday buyers,

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

414

though somewhat stronger for specialists. The risk

of new entrants is relatively high, particularly in the

specialist market, though some barriers do exist.

The threat of substitutes is virtually nil, competitive

rivalry is very high and competition for customers is

fierce. The analysis has been performed on the

business “as-is”. However, the effects of the

Internet (Porter 2001) need to be taken into account,

as illustrated in Figure 4.

New market

entrants

Substitute products

& services

Suppliers

Customers

Industry competitors

Industry

2

Industry

3

Industry

4

Industry set

Industry

1

Lower supplier bargaining power due to:

(-) readily available alternates (substitutes)

(-) numerous suppliers

(-) agents not capable of absorbing price rises

(-) agent is independent

(+) suppliers can act as agents, but

with limited capacity

Effect of Internet:

(+) Ease acccess of Tour Operators to customers

Lower buyer bargaining power due to:

(-) large number of buyers

(-) buyers cannot act as agents

(-) prices set by supplier "as-is"

(+) some "expert" buyer knowledge

(+) low switching costs

(+) can negotiate limited "add-ons"

(+/-) finite "shelf-life", but prices reduced by

supplier

Effect of Internet:

(+) increase in number of sales channels

Minimal threat of substitutes, but high

risk of alternate destinations:

(-) no possible substitute

(+) alternate destination easily found

Effect of Intertnet:

(+) Increase number of "substitute

destinations"

Highly competitive market due to:

(+) recent expansion by travel agent

(+) slowly growing market

(+) product differentiation difficult

(+) selling F.E. to competitors customers

Effect of Internet

(+) Reduction of differentiation

Medium-high risk of new entrants

due to:

(-) expert knowledge of product required

(-) buyer confidence in established

businesses

(+) no economies of scale

(+) low switching costs

(+) new entrants create own channels

Effect of Internet:

(+) Decrease barriers to entry

Figure 4: Diagrammatic representation of five forces analysis

Note (+) denotes increase in force, (-) denotes decrease in force

6 SWOT ANALYSIS

Primarily, the problems with the infrastructure and

sales systems need to be addressed. The business

needs a homogenous sales system, supported by a

stable, manageable network, addressing the threat of

rising costs. This will then allow the business to

utilise its strengths, particularly with its current mix

of sales channels. An integrated network will allow

the business to develop a single connectivity

solution (with built in-redundancy for business

continuity in the event of supplier/network failure)

for its ViewData, “Lates” feed and Clearing House

transactions, addressing the threat of loss of

connection to external suppliers/systems.

Once such links have been developed, this will

assist the business in developing cooperative

alliances with other firms, specifically “specialist”

Travel Agents, addressing the weakness within the

business and possibly reducing the threat of vertical

integration. Further, an integrated sales system will

allow the business to build on its strengths of

existing sales channel mix and geographical

coverage, providing a “one-stop, Multi-outlet”

service to its customers. This can be further

developed as new e-Sales channels are created and

brought on-line. This will provide a central data

repository of customers that can be used to develop

customer loyalty, using such tools as CRM.

7 CRITICAL SUCCESS FACTOR

DETERMINATION

Since the final strategy plan needs to be aligned to

the business strategy plan, those Critical Success

Factors (CSF’s) with relevance to the IS/IT strategy

need to be extracted from the business strategy.

Following discussions with senior and operational

managers a number of business objectives and

CSF’s have been identified. The evaluation of the

IS/IS strategy plan against these CSF’s is to be

completed once the plan has been developed as

illustrated in Table 3.

DEVELOPING AN INTRANET AND EXTRANET BUSINESS APPLICATION FOR A LARGE TRAVEL AGENT

415

Table 3: Relationship between business objective and critical success factors

Business Objective CSF

1 Increase the number of sales channels Create new markets and increase market share

2 Protect the core business Maintain % share of core business unit

3 Reduce operating costs Reduce comms costs by 10%

4 Enhance sales reporting/M I S Provision of integrated reporting function.

5 Reduce duplication of IT systems Single sales system for each business unit.

6 Encompass new technology Setting up IT review and evaluation procedures.

7 Improve service to customers Develop increased product knowledge

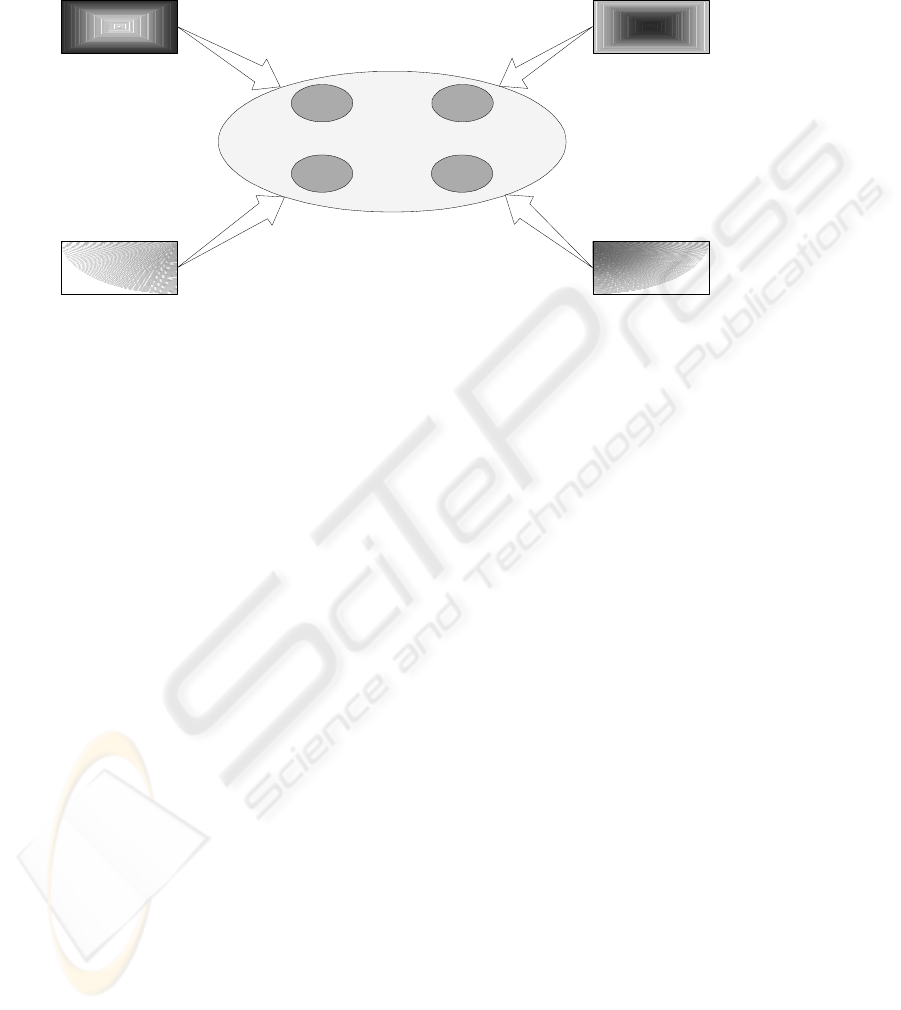

With the advent of the Internet, new businesses

have entered the marketplace based almost

exclusively on electronic sales channels – “e-

Business”. Given the frequency with which this “e-

Market” can change, such that businesses have to

adopt new processes and models, the business needs

to ensure it is flexible enough to cope with these

changes. To ensure this, the systems upon which the

business relies, needs to have an infrastructure that is

also flexible. IBM classes this as “Infrastructure

Agility” (IBM 2000).

An agile infrastructure will allow the business to

swap technologies in and out of the IS function as

requirements change. The infrastructure therefore

needs to ensure it has sufficient “reactive sites” that

will allow technologies to be activated. A cross

between a catalyst and “Plug and Play”, which is

illustrated in Figure 5.

VPN

Corporate WAN

WWW

ViewData

Central Admin

Branch

New sales channel

Firewall

Call centre

Homeworker

Sales

system

Management

reports

WAP

DigitalTV

Kiosk

Internet

Specialist

Travel Agent

Taxi Company

Mar ket ing

Sales

Figure 5: Proposed infrastructure

8 CONCLUSION

The Travel Agent under review has three main

business units, namely Retail (high street stores),

Call centre and Home worker. Following a rapid

organic growth, the Travel Agent has a number of

disparate sales systems. This, coupled with an ISDN

based network infrastructure, is hampering the future

development of the business. The business suffers

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

416

from data corruption problems, failure in data

transfer schedules and software version

management. With little centralised sales data, the

business’ management rely on an amalgamation of

separate reports to manage the business. The rising

network communications (comms) costs, coupled

with the increased usage of e-mail and Internet

access, is a further problem for the business. The

business has expressed a desire to develop e-

Commerce and to introduce such techniques as

Customer Relationship Management (CRM).

From the analysis of the large Travel Agent, a

strategic plan has been developed to provide a way

forward for the three business units and the

administration unit. The plan covers five main areas

namely the sales system, network, sales channels,

customer loyalty and cooperative alliances.

It is clear there are two main areas that are

holding back the Travel Agent from developing its

business. These are the disparate sales systems, and

the ISDN based network. A centralised sales

system, coupled with a stable manageable network,

will allow the Travel Agent to develop strategic

initiatives to strengthen the business/market share.

Increasing usage of corporate e-mail, Intranet

and growing Internet access have caused an increase

in comms costs. To control these costs a leased line

Virtual Private Network (VPN) solution has been

proposed. Based on current and predicted costs,

savings of approximately £0.7 million will be

achieved. This will allow controlled access to the

Internet and a centralised ViewData service for all

business units.

With a centralised system supported by a stable

network, the Travel Agent will be able to develop

new sales channels, building on the existing

strengths within each business unit. The use of a

“Pick and Choose” web site, kiosk and the

development of a targeted WAP facility should

allow the Travel Agent to increase sales and market

share. Though in early development, the proposed

infrastructure will be capable of supporting Digital

Television.

Recent trials with CRM techniques have

suggested that an increase in sales for the retail

business unit of £1.2 million would be achievable.

This can be further enhanced by combining data

from all of the three business units.

With a stable network, capable of supplying

access to all external (to the business) systems and

processes, it will be possible for the Travel Agent to

create new alliances with other businesses.

As the majority of customers require transport

from home to airport and airport to home, it is

possible to allow taxi firms access to this

time/destination data, providing a new revenue

stream to the taxi firm and allowing the Travel

Agent to give added service to their customers.

The Travel Agent is perceived as weak in the

selling of “Specialist” holidays. Allowing specialist

travel agents controlled access to the VPN would

give the Travel Agent access to the “Specialist”

market, albeit in a limited way. Further cooperation,

such as the development and provision of CD based

brochures, selling of “Specialist” holidays using the

Travel agents e-channels (e.g. via kiosks) and

mobile technology are also possible areas for

development.

The proposed IS strategy has been evaluated for

its alignment to the business strategy by the use of

Critical Success Factor (CSF) analysis. Seven

objectives were extracted from the business strategy

and for each one a CSF was created. The match of

CSF (and hence business strategy) against the IS

strategy was checked and a good alignment has been

shown.

REFERENCES

Earl, M.J., 1989. Management Strategies for Information

Technology, Prentice Hall.

IBM 2000. Infrastructure Agility,

www.ibm.com/e-

Business/uk.

Jauch, L.R., Glueck, W., 1988. Strategic Management and

Business Policy, McGraw-Hill Education.

Lynch, R., 2000. Corporate Strategy, 2

nd

edition, Prentice

Hall.

Mintzberg, H., 1987. Crafting Strategy, Harvard Business

Review, July-Aug.

Porter, M.E., 1980. Competitive Strategy: Techniques for

Analysing Industries and Competitors, The Free Press.

Porter, M.E., 1985. Competitive Advantage. Creating and

Sustaining Superior Performance, The Free Press,

New York.

Porter, M.E., 1996. What is Strategy?, Harvard Business

Review, Nov-Dec.

Porter, M.E., 2001. Strategy and the Internet, Harvard

Business Review, March, Vol. 79, Issue 3, p62-79.

Robson, W., 1997. Strategic Management and Information

Systems, 2

nd

edition, Pitman

Tozer, E.E., 1995. Strategic IS/IT Planning, Butterworth-

Heinemann.

Tozer, E.E. 2002. Personal communication with author.

Ward, J., Griffiths, P., 2000. Strategic Planning for

Information Systems 2

nd

edition, Wiley and Sons.

DEVELOPING AN INTRANET AND EXTRANET BUSINESS APPLICATION FOR A LARGE TRAVEL AGENT

417