MANAGING E-MARKET TRANSACTION PROCESSES

Exploring the limits of process management with a multiagent system

John Debenham

University of Technology, Sydney, Australia

Keywords: Multiagent systems, process management, datam

ining, electronic market transaction management

Abstract: Knowledge-driven processes are business proces

ses whose execution is determined by the prior knowledge

of the agents involved and by the knowledge that emerges during a process instance. They are characteristic

of emergent business processes. The amount of process knowledge that is relevant to a knowledge-driven

process can be enormous and may include common sense knowledge. If a process’ knowledge can not be

represented feasibly then that process can not be managed; although its execution may be partially

supported. In an e-market domain, the majority of transactions, including requests for advice and

information, are knowledge-driven processes for which the knowledge base is the Internet, andso

representing the knowledge is not an issue. These processes are managed by a multiagent system that

manages the extraction of knowledge from this base using a suite of data mining bots.

1 INTRODUCTION

In an experimental e-market, transactions

(Debenham, 2001) include: trading orders to buy

and sell in an e-exchange, single-issue and multi-

issue negotiations between two parties, requests for

information extracted from market data as well as

from news feeds and other Internet data. This

e-market is used at UTS for research and teaching.

In it every market transaction is managed as a

business process (Fisher, 2000). To achieve this,

suitable process management machinery has been

developed. To investigate what is ‘suitable’the

essential features of these transactions are related to

two classes of process that are at the ‘high end’ of

process management feasibility (van der Aalst et al.,

2001). The two classes are goal-driven processes

(Sec. 2) and knowledge-driven processes (Sec. 3).

The term “business process management” is

generally used to refer to the simpler class of

workflow processes (Fisher, 2000), although there

notable exceptions using multiagent systems

(Jennings et al., 2000). Sec. 4 describes the

relationship between the transactions themselves and

the contextual information extracted from the

Internet and from market data. Sec. 5 discusses the

single-issue and multi-issue negotiation transactions.

e-market transactions are described in Sec. 6.

2 GOAL-DRIVEN PROCESSES

A goal-driven process has a process goal, and

achievement of that goal signals the termination of

the process. The process goal may have various

decompositions into possibly conditional sequences

of sub-goals where these sub-goals are associated

with (atomic) activities and so with atomic tasks.

Some of these sequences of tasks may work better

than others, and there may be no way of knowing

which is which (van der Aalst et al., 2001). A task

for an activity may fail outright, or may fail to

achieve its goal in time. In other words, a central

issue in managing goal-driven processes is the

management of task failure. Hybrid multiagent

architectures whose deliberative reasoning

mechanism is based on “succeed/fail/abort plans”

(Rao et al., 1995) are well suited to the management

of goal-driven processes. Goal-driven processes are

a more powerful concept than production workflows

(or, called “activity-driven processes” in

(Debenham, 2000)). Activity driven-processes are

associated with possibly conditional sequences of

activities where performing that sequence is

assumed to “work always”.

Following (Rao et al., 1995) a plan for a goal-

di

rected process can not necessarily be relied upon

to achieve its goal even if all of the sub-goals on the

322

Debenham J. (2004).

MANAGING E-MARKET TRANSACTION PROCESSES - Exploring the limits of process management with a multiagent system.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 322-330

DOI: 10.5220/0002597203220330

Copyright

c

SciTePress

chosen path through that plan have been achieved.

The success condition (SC), described in

(Debenham, 2000), is a procedure whose goal is to

determine whether a plan’s goal has been achieved.

The final sub-goal on every path through a plan is

the plan’s success condition. The success condition

is a procedure; the execution of that procedure may

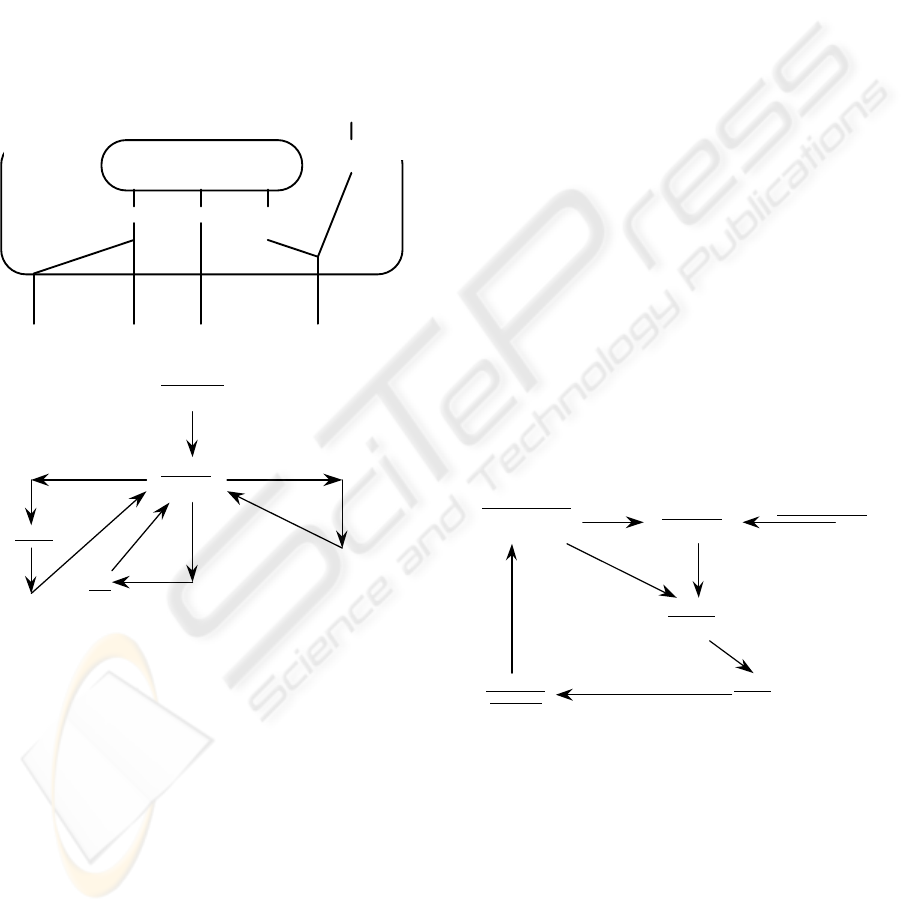

succeed(3), fail (7) or abort (A). If the execution of

the success condition fails then the overall success

of the plan is unknown (?). So the four possible

plan exits resulting from an attempt to execute such

a plan are as shown in Fig. 1. A plan body is

represented as a directed AND/OR graph, or state-

transition diagram, in which some of the nodes are

labelled with sub-goals.

SC

if(G)

if(~G)

?

p

lan for goal G

A

A

A

Figure 1: The four plan exits

Process Goal

(what we are trying

to achieve over all)

Next-Goal

(what to try to

achieve next)

Initialise

?not SC and not

activity goal?

Select

Identify

Back-up

Identify

?SC?

?activity

goal?

Activity

Do it

Select

Evaluate it

Plan

Figure 2: A simplified view of goal-driven process

management

The management of goal-driven processes is

shown in a simplified form in Fig. 2. There, starting

with the overall process goal, repeated

decomposition of plans and goals is performed until

either the next goal is a success condition or is an

activity goal—ie: a goal for which there is a hard-

coded procedure. Fig. 2 is simplified because it does

not show what happens if the success condition

returns fail “7”, or what happens if a plan is aborted.

Further it does not show the mechanism for selecting

plans for goals. For goal-driven processes there is,

in general, no ex ante ‘best’ choice of plan.

3 KNOWLEDGE-DRIVEN

PROCESSES

A second class of process, whose management has

received little attention, is called knowledge-driven

processes. Process knowledge is all the knowledge

that is relevant to a process instance. It includes

common-sense knowledge, knowledge that was

available when an instance is created, and

knowledge acquired during the time that that

instance exists. A knowledge-driven process may

have a process goal, but the goal may be vague and

may mutate. In so far as the process goal gives

direction to goal-driven—and activity-driven—

processes, the process knowledge gives direction to

knowledge-driven processes. The body of process

knowledge is typically large and continually

growing—for example, it may include common

sense knowledge—and so knowledge driven

processes are seldom considered as candidates for

process management. They are typically supported,

rather than managed, by CSCW systems. But, even

complex knowledge-driven processes are “not all

bad”—they typically have goal-driven sub-processes

that may be handled as described above.

Knowledge-base processes are a special type of

knowledge-driven process for which the process

knowledge can be represented and accessed by a

process management system. This proves to be a

useful concept for managing e-market transactions.

Process Goal

(the current over

all goal)

Process Knowled

g

e

(knowledge of all that

is relevant to the

process instance)

Next-Goal

(what to try to

achieve next)

Activity

(what should happen next)

Decompose

(in the context of the

process knowledge)

Do it —

(until termination

condition satisfied)

New Process

Knowledge

Add to

Revise

Select

Initial process Goal

Initialise

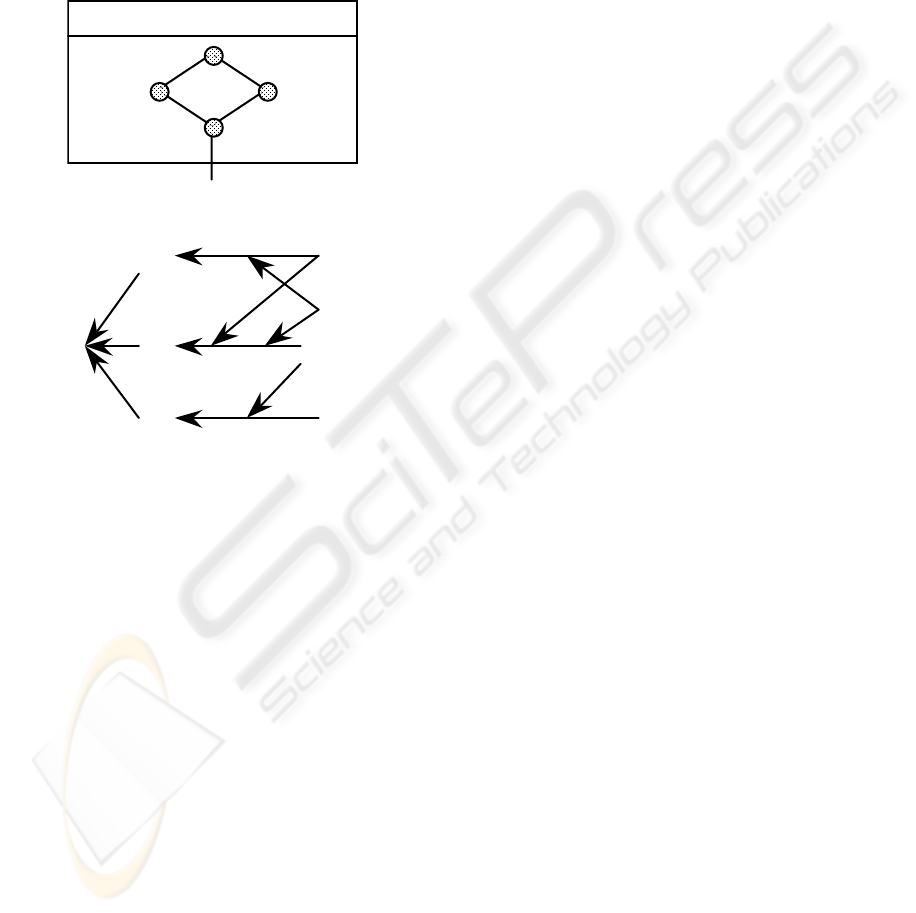

Figure 3: A simplified view of knowledge-driven process

management

The management of goal-driven and knowledge

driven processes are radically different. Goal-driven

processes may be managed by a goal/plan

decomposition process (see Fig. 2), and knowledge-

driven processes are managed by continually

reviewing the growing corpus of process

knowledge—this is illustrated in Fig. 3. That Figure

is deceptively simple in that the business of

managing the process knowledge and of revising the

process-goal andnext-goal in the light of that

growing body of knowledge is far from trivial in

MANAGING E-MARKET TRANSACTION PROCESSES: Exploring the limits of process management with a multiagent

system

323

even simple examples. In general this problem will

be intractable. But in some cases, including the

majority of e-market transactions, smart tools may

be used to do this. This is discussed in the next

section.

4 E-MARKET TRANSACTIONS

AND CONTEXTUAL

INFORMATION

E-market transactions include: trading orders to buy

and sell in an e-exchange (single-issue and multi-

issue negotiations as described above), requests for

market data as well as requests for information

extracted from news feeds and other Internet data.

In an experimental e-market, all e-market

transactions are managed as constrained knowledge-

driven processes.

Sec. 5.1 discusses single-issue one-to-one

negotiation. Single-issue negotiation also takes

place in exchanges, for example a ‘buy’ trading

order to “buy a chair and a desk for less than $100”.

This is represented (see Fig. 4) as a naive plan with

goal [G, c] = [desk and chair have been purchased,

cost < 100]. This plan has sub-goal SG

1

= ‘chair

and desk selected’, [SG

2

, c

2

] = [chair purchased,

cost < 30], [SG

3

, c

3

] = [desk purchased, cost < 50],

and [SG

4

, c

4

] = [desk and chair delivered, cost <

20]. The management of this purchase order is

represented as a plan whose goals have monetary

constraints.

An example of a request for information is “find

out all you can about ABC Corp within five

minutes”. This triggers a process to locate, extract,

validate, condense and combine information from

the Internet. The location and extraction tasks are

achieved by data/text mining bots that are described

in [7]. A handcrafted plausible inference network

combines contradictory information. The use of

belief nets that can be trained “off line” is very

tempting and is currently being investigated [8].

The data/text mining bots produce output in the form

[ data, belief ]—ie: some data and a measure of the

belief held in the validity of that data. A request for

information is first represented as a goal/constraint

pair: [ find_info_about(‘ABC Corp’):

time_upper_limit = now + 5mins ]. Given a

goal/constraint pair, a plan (see Fig. 4) is selected

for it—the mechanism for selecting a plan is

described in Sec. 6. A plan for a goal/constraint

pair is a possibly conditional state-chart of sub-goals

over which constraints are distributed as described in

Sec. 6. For a ‘find_info_about’process, the plan

uses a Dempster-Shafer network (see Fig. 5) to

combine results [D

i

, b

i

], in the form [ data, belief ],

extracted from the Internet by a suite of data/text

mining bots. The network actually does more than

combine information. If the level of belief, b

R

, in a

result, R, derived by the network is below a set

threshold then a ‘reverse calculation’ identifies

‘inputs’ whose belief levels are responsible for the

low level of belief in R. Then further data/text

mining is initiated in an attempt to raise this level of

belief at least for future calculations if not for the

present calculation.

A three-year research project commencing in

2002 at UTS, is investigating the mechanisms

required to support the evolutionary process in

e-markets (Debenham, 2001). It is presently funded

by four Australian Research Council Grants;

awarded variously to the author and to Dr Simeon

Simoff:

http://www-staff.it.uts.edu.au/

~emrktest/eMarket/

Market evolution is linked to innovation and

entrepreneurship (in its technical, economic sense).

Present plans for the three year project are: (1) to

build an e-marketplace trader’s workbench that, in

principle, enables a trader to operate without

external information, (2) to assist a trader to identify

arbitrage opportunities triggered by the occurrence

of rare events, (3) to assist a trader to identify

innovative forms of trade, and, possibly, (4) to

understand somethingof the evolutionary process

itself.

5 NEGOTIATION

TRANSACTIONS

Negotiation is a process whereby two or more agents

reach an agreement on a set of issues. One-to-one

negotiation, in which there are just two negotiating

agents, is sometimes called bargaining, or

informally “haggling” or “dickering”. An issue is

any good or service that one agent can provide to

another, including money. The issue set is the

range of possible issues that may be considered

during a negotiation. An issue set may be fixed; for

example, in a single-issue negotiation where the

only issue on which agreement is sought is an

amount of money. An open issue set may contain

any issue. In alimited issue set, the issues that may

be included in an offer is limited to those chosen

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

324

from a set agreed to by the negotiating agents. An

issue—for example, “period of warranty”—is

normally associated with some value—for example,

“two years”. An offer consists of a particular set of

issues chosen from the issue set, together with

values for those issues. During a negotiation with an

open or limited issue set the collection of issues in

an offer may mutate although in practice it tends to

be moderately stable.

[G, c]

[SG

1

, c

1

]

[SG

3

, c

3

]

[SG

2

, c

2

]

[SG

4

, c

4

]

Figure 4. A plan for goal [G, c]

[D

1

, b

1]

[D

2

, b

2]

[D

n

, b

n]

[R, b

r

]

Figure 5. Belief network combines informatio n

A negotiation mechanism specifies how a

negotiation may proceed; they are sometimes called

“interaction protocols” in multiagent systems work

(Weiss, 1999). Two forms of negotiation

mechanism have received a considerable amount of

attention in the economics literature, and in

e-Markets research. First, single issue negotiation

for one or moreitems being offered either to a set of

buyers or to a set of sellers; see, for example, the

extensive work on forward and reverse auction

mechanisms (Klemperer, 2000), and second, one-to-

one negotiation, or bargaining, mechanisms.

Management of the negotiation process in an

e-Market—both for negotiation through e-exchanges

and through single- and multi-issue one-to-one

negotiation—includes a continual investigation of

the negotiation context as well as the construction,

evaluation and revision of offers. For example, the

bone fide of the opponent may require verification,

the quality of the goods should be confirmed,

alternatives should be investigated, and so on. In the

experiments described here this information is

assumed to be available on the Internet. A good

e-market negotiator should conduct these contextual

investigations as an integral part of the negotiation

process (Debenham et al., 2002). “Good

negotiators, therefore, undertake integrated

processes of knowledge acquisition combining

sources of knowledge obtained at and away from the

negotiation table. They learn in order to plan and

plan in order to learn” (Watkins et al., 2002). In the

management of the negotiation process described

here, the information and the offers develop in

tandem; they both feed off each other. The term

“e-marketplace” is used here to acknowledge this

duality between offers and contextual information.

An e-Marketplace is a market in which trading can

be conducted over the Internet, and for which

sufficient information to trade “well” is available

over the Internet. This information may be derived

from on-line market data, for mining historic market

data, from text-mining news feeds and so on. The

Sydney Stock Exchange is an example of an

e-marketplace.

Figure 4: A plan for goal [G,c]

5.1 Single-issue negotiation

Single-issue negotiation is the most common form

of negotiation, in particular where the issue is price.

The number of issues in any form of negotiation,

including single-issue, can be increased if one of the

negotiating parties offers “kick backs”. For

example, an offer of two free bottles of wine for

every dozen bought provided that you have spent

more than $500 with that merchant in the previous

twelve months. This sort of offer changes what was

initially a single-issue negotiation to a multi-issue

negotiation. In this Section it isassumed that the

negotiation is strictly single-issue and that both

parties understand the meaning of the issue. For

example, such an issue could be an amount of

money. It is argued that single-issue negotiation is

appropriately managed as a knowledge-driven

process. From a process management perspective

this is interesting because the management of “real

life”knowledge-driven processes is usually

unfeasible.

Figure 5: Belief network combines information

Two important classes of bargaining

mechanisms are alternating offers mechanisms and

single-round, “one-hit” mechanisms that may be

used when the agents have determined private

valuations in advance. For example, (Myerson et

al., 1983) shows that a one-hit“split the difference

between bid and ask” mechanism should be

preferred by both buyer and seller to any other

mechanism ex ante—that is, before their private

MANAGING E-MARKET TRANSACTION PROCESSES: Exploring the limits of process management with a multiagent

system

325

valuations are actually determined. Alternatively, an

agent’s valuations may be refined as the negotiation

proceeds—in which case an alternating offers

mechanism is which information is tabled as

appropriate—this is the focus here.

The negotiation protocol used is a time-

constrained, unbounded alternating offers protocol

(Kraus et al., 2001). In this protocol two bargaining

agents exchange offers until either one agent accepts

an offer from the other agent, one agent rejects an

offer and withdraws without penalty, or one agent

exceeds an agreed time constraint on making an

offer. So negotiation using this protocol could, in

principle, proceed indefinitely—hence the

description unbounded.

Consider a transaction to purchase something.

Suppose that this transaction can be appropriately

managed by: identifying a need, selecting a good to

satisfy that need, choosing a supplier for that good

and negotiating terms for that good from that

supplier. A sequential procedure basedon this would

not be appropriate for purchasing all classes of

goods; it could, however, be suitable for purchasing

a technical book. The appropriateness of this

“purchasing procedure” is not of concern here.

Suppose further that we wish to select the “most

appropriate” good, to choose the “best supplier” and

to negotiate “acceptable” terms. In an e-marketplace

sufficient information to trade successfully in this

sense is assumed to be available on the Internet.

The use of “software bots” to assist the buying

process by extracting contextual information from

the Internet is commonplace. For many classes of

goods, bots that do some of this work are freely

available: http://www.botspot.com/

— viz: the

sections “Shopping Bots” and “Commerce Bots”.

The entire problem considered here lies beyond the

capacity of most off-the-shelf bots that at best

recommend rather than decide. Although the use of

demographic data, collaborative filtering, clustering,

or previously expressed user preferences can deliver

reasonable performance in choosing the “most

appropriate” good for the user. With current

technology it could be reasonable to give the

authority to a bot to select, order and pay for paper

stock for photocopiers, but many would be reluctant

to permit a bot to select, order and pay for a book on

Bayesian Nets, for example.

Satisfy a need N [ Need N is satisfied ]

start

need N identified

good G selected for N

supplier S chosen for G

terms T accepted for G

d

a

t

a

&

t

e

x

t

m

i

n

i

n

g

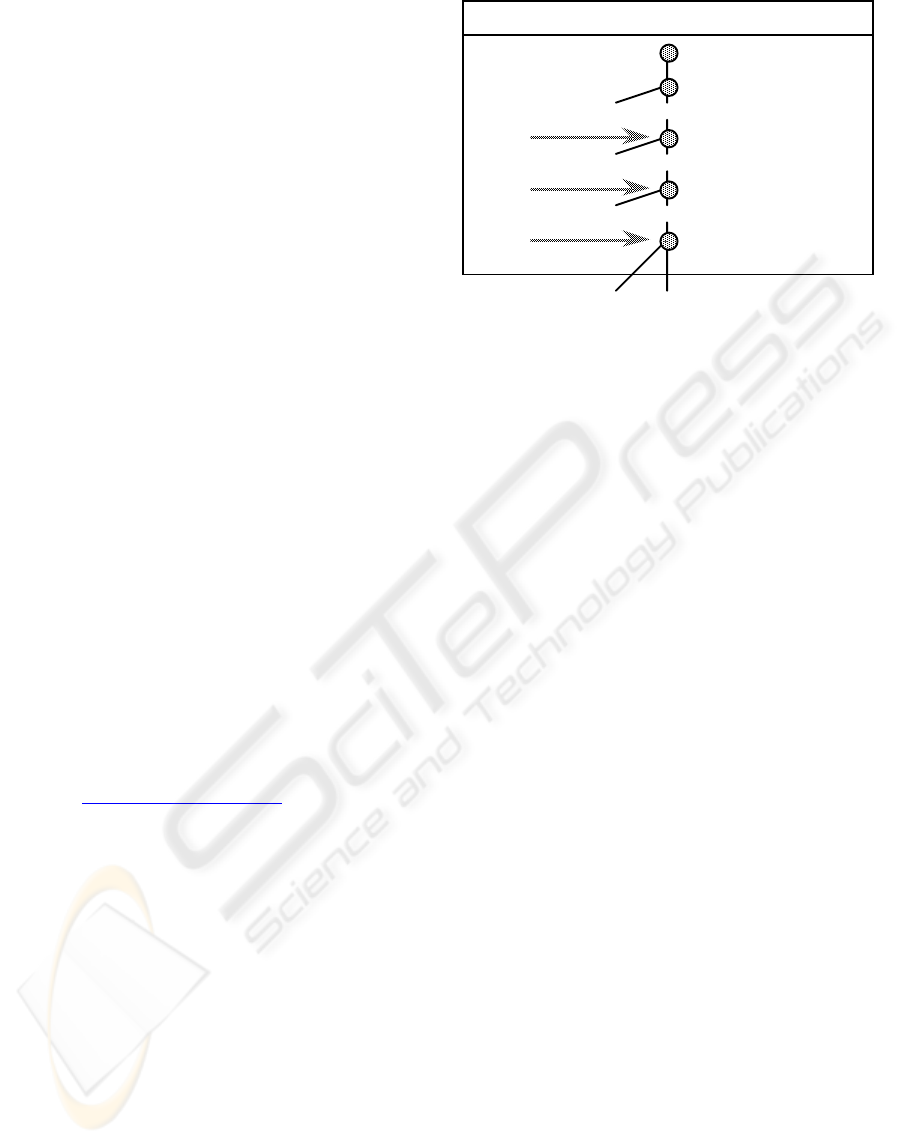

Figure 6: A goal-driven plan to satisfy a need based on

“succeed / fail” plans

In this project the contextual information from

the Internet is first extracted by a range of data and

text mining bots mostly written by undergraduates at

UTS. Some of these bots read reviews of products

in an attempt to determine the comparative inherent

quality of a good as well as its basic attributes. This

in general leads to a collection of contradictory

evidence that is combined to give coherent advice.

The approach taken to plausible inference is

described in Sec. 4

A simple, double (ie: succeed / fail) branching

plan to manage a “purchase something” transaction

is shown in Fig. 6. That plan treats the process

sequentially in that, for example, once the good is

selected then its appropriateness is not reconsidered.

This may be appropriate when the whole transaction

can be resolved quickly, but could otherwise lead to

poor decision making. That plan relies on

information from data and text mining bots to

support the decision making in the achievement of

three of its sub-goals. [Plans for those three sub-

goals are not shown here.] Despite the vital role of

the bots, that plan manages the transaction as a goal-

driven process. The management of the same

transaction as a knowledge-driven process is

described below. This is achieved by feeding the

contextual information into the reactive “abort”

conditions in the plans.

To simplify the following discussion the

operation of the data and text mining bots is hidden

in the following predicates: INeed( N ) that means:

“I need an N”, Satisfy( N, G ) that means: “good G

is the most appropriate good that satisfies need N”.

Calculation of values to satisfy these predicates may

take some time.

Fig. 7 shows one of a sequence of linked plans

for the “purchase something”transaction. In that

Figure “d t m” denotes information that is acquired

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

326

from the Internet and databases by data and text

mining bots and combined into coherent advice by a

plausible inference network. That plan is more

intricate than the previous goal-directed version.

Even so this sequence is flawed in that the process

may now continue indefinitely; this difficulty is

addressed by constraints in Sec. 6 below. They

include reactive abort triggers that redirect the

course of the transaction if any prior decision ceases

to be valid. The direction, and possible redirection,

of this transaction is governed entirely by the

contextual information received, and repeatedly

reconfirmed, from the data and text mining bots.

This plan is useful but is not particularly noteworthy

in itself. What is of note, from a process

management perspective, is that this is a fully

managed knowledge driven process, despite its

presentation in a goal / plan framework. It is a

knowledge-base driven process where the

knowledge base is the Internet and market data, the

query mechanism is the bots, and the reactive ‘abort’

exists are used to modify the direction of the process

when necessary.

Buy G for N [ good G bought for N ]

start

good G selected for N

G bought from S

A

[ ¬INeed( N ) ]

A

[ ¬Satisfy( N, G ) ]

A

[ ¬INeed( N ) ]

d

t

m

d

t

m

Figure 7: Knowledge-driven plans to satisfy a need based

on “succeed / fail / abort” plans

5.2 Multi-issue negotiation

The discussion in Sec. 5.1 on the management of

single-issue negotiation is rather simplified in that it

assumes that the single-issue in which the offers are

expressed is unambiguously understandable. In

practice negotiation is more complicated than this.

For example, when the issue is money then an

amount expressed in dollars is readily understood,

but when and where the payment has to be made

may not be. If the issue set contains things like an

“unconditional warranty” then it would be prudent

to clarify quite what this really means. So the

feature of multi-issue negotiation that is explored

here is the opponent as a source of information, used

to clarify the meaning of an offer or otherwise.

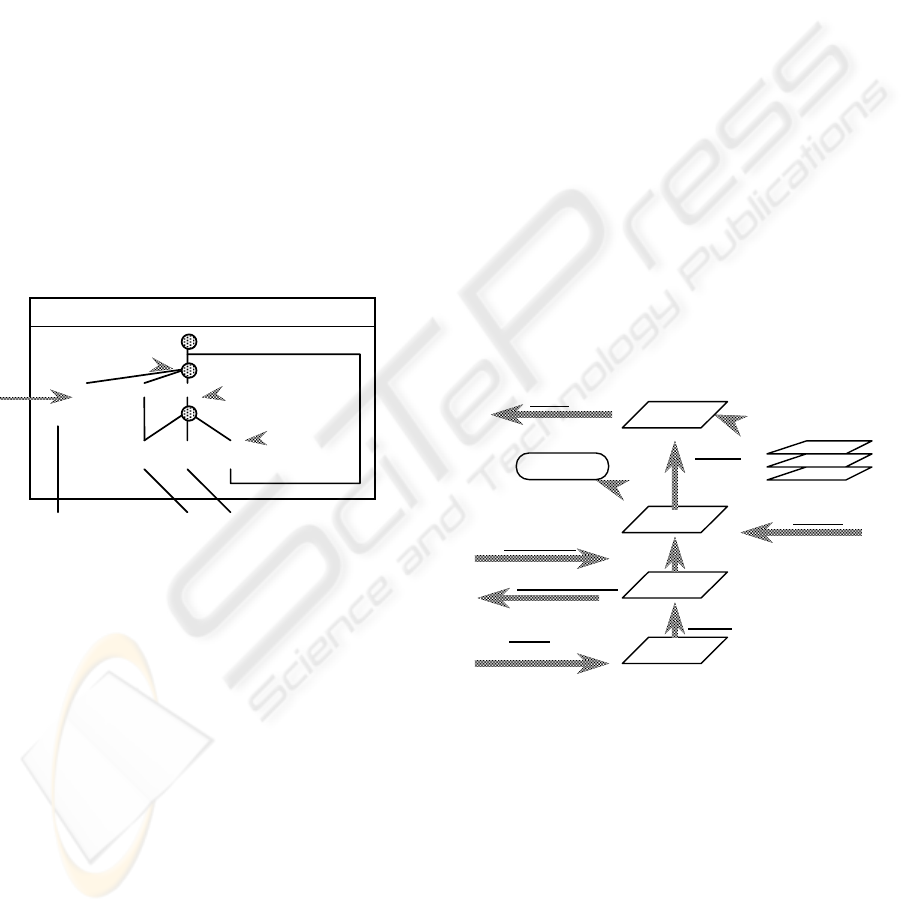

A negotiation process with fairly minimal

functionality is shown in Fig. 8. There the process is

triggered by the arrival of an offer from the

opponent. This is analysed to ensure that the

meaning is clear—to uncover the “fine print”— and

to detect any inconsistencies. Then the offer is

evaluated to determine what it is “worth”—this can

lead to acceptance or outright rejection, or to the

development of a counter offer. Another context for

the generation of the counter offer is the history of

offers received in this negotiation—this enables an

assessment to be made of“where are the opponent is

at”. Eg: “is she about to give in?” The process

illustrated in Fig. 8 can seen as an attempt to satisfy

the high level goal “attempt to negotiate a

satisfactory outcome”. But the direction that the

process takes is determined by the flow of

information—from the offer itself, the data and text

mining bots, the opponent and from the growing

history of offers. So this is a knowledge-driven

process. At present the evaluation function is

available from the bots as described above. At the

time of writing the rest of the machinery is not yet

available, but plans are to achieve this by the end of

2002. There is much to be done, for example the

detection of inconsistencies in an offer is not trivial

even if the terms of the offer are represented in Horn

clause logic.

o

p

p

o

n

e

n

t

d

t

m

trigger

offer received

offer

analyse

offer

seek clarification

clarification

offer

evaluate

history

of offers

counter offer

accept / rejec

t

OR

develop

return

Figure 8: High-level view of the negotiation process

6 TRANSACTION CONSTRAINTS

All e-marketplace transactions are assumed to be

constrained by time constraints and possibly by cost

constraints or success constraints. Time constraints

may be the maximum (or minimum) time by which

a deal must be struck and/or by which the goods

should be delivered. The cost constraints could be

constraints on the cost of the transaction, the cost of

the goods or a combination of the two. Success

constraints may be constraints on the outcome of the

MANAGING E-MARKET TRANSACTION PROCESSES: Exploring the limits of process management with a multiagent

system

327

deal; for example, “I must have a car for the

weekend, get the best deal you can”.

The e-marketplace transaction management

system attempts manage transactions to “deliver the

best it can whilst satisfying the constraints”. To do

this it selects plans to achieve goals on the basis of

expected time and cost estimates. Further, if actual

performance differs significantly from these

estimates then estimates for subsequent plans are

adjusted leading, possibly, to a revised plan. This

will occur if network performance is unexpectedly

degraded, for example. To derive time and cost

estimates for each plan it gathers performance

measurements on each plan and sub-system, such as

an information gathering bot, and maintains running

estimates of future expected performance. It then

adjusts these estimates when measurements are

observed outside expected limits. For example, if

the network is slow when gathering data from New

York, then time estimates for extracting data from

London may be adjusted to some extent.

Time and cost performance measurements are

made for each plan and for each atomic sub-system

whenever it is used. These measurements enable the

transaction management system to choose a plan for

a goal (G in Fig. 4) and to determine the constraints

({c

1

,..,c

4

} in Fig. 5) for each sub-goal in that plan.

A plan’s performance estimate is the expected time

“t” and cost “c” to satisfy the plan’s goal. These

estimates will be calculated from performance

estimates for each atomic sub-system. The

parameters t and c are assumed to be normally

distributed—this is a wild assumption—but it

provides a framework for identifying measurements

that abnormal. Given a parameter, p, that is

assumed to be normally distributed, an estimate, µ

p

,

for the mean of p is revised on the basis of the i’th

observation ob

i

to µ

p

new

=

(1 - α) _ ob

i

+ α _ µ

p

old

which, given a starting

value µ

p

initial

, and some constant α, 0 < α < 1,

approximates the geometric mean \f(

\O(

Σ,

i=1

,

n

) α

n-i

_ ob

i

, \O(Σ,

i=1

,

n

) α

n-i

) of the set

of observations {ob

i

} where i = n is the most recent

observation. In the same way, an estimate, σ

p

, for

\r(\f(2,π)) times the standard deviation of p is

revised on the basis of the i’th observation ob

i

to

σ

p

new

= (1 – α) _ | ob

i

– µ

p

old

| + α _ σ

p

old

which, given a starting value σ

p

initial

, and some

constant α, 0 < α < 1, approximates the geometric

mean \f( \O(

Σ,

i=1

,

n

) α

n-i

_ | ob

i

–

µ

p

|,\O(Σ,

i=1

,

n

) α

n-i

) . The constant α is chosen

on the basis of the stability of the observations. For

example, if α = 0.85 then “everything more than

twenty trials ago” contributes less than 5% to the

weighted mean.

Given a transaction and its constraints

(expressed in terms of t and s), the transaction

management system makes two decisions. First it

selects a feasible plan for that transaction’s goal.

Second it determines the constraints on each sub-

goal in that plan. Then further plans are selected for

those sub-goals, and so on. Each time a plan for

goal G is used measurements are made of t and c for

each sub-goal in that plan. Further each of those

sub-goals may be invoked by other plans. So the

estimates of the mean and standard deviation of t

and c for those sub-goals may be expected to be

more accurate than the estimates for goal G. So

each time a plan is considered, the t and c estimates

for its goal are re-computed from those on the

estimated costliest path through the plan.

Plan A for goal [G, c] is feasible if

c > µ

A

+ κ _ σ

A

, where c is expressed in terms of t

and c, µ and σ are expressed likewise, and κ is a

constant usually > 1. If c < µ

A

– κ _ σ

A

then the

plan is not expected to achieve its goal within

constraint c. This enables the constraints to be

relaxed on each sub-goal so that the estimated

costliest path through the plan satisfies c. If a sub-

goal SG

i

of plan P for goal Gis not achieved within

its constraint c

i

then first another plan is sought for

SG

i

and for any other as-yet-unsatisfied ‘down

stream’ sub-goals, for which an allocation of

constraints in P is feasible, and second the whole

plan P fails and another plan is sought for G with

tighter constraints than c.

Given a goal G with constraints c the

transaction management system first identifies a set

of feasible plans for G. Then from this set the

system selects a plan for a given goal G using the

stochastic strategy: the probability that a plan is

selected is the probability that that plan is the “best”

plan. This strategy has been found to work well for

managing high level processes [6]. Here best may

mean “the most likely to satisfy the constraints on

G” or some other criterion such as “the plan likely to

deliver the best quality advice” as discussed below.

Given two plans A and B for the same goal G, if the

constraint on G is represented by a parameter p (in

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

328

terms of t and c) that is assumed to be normally

distributed then the probability that plan A is “better

than” plan B is the probability that (p

A

– p

B

) > 0.

Using elementary statistics, an estimate for this

probability is given by the area under the normal

distribution with:

mean = µ

A

– µ

B

[ where µ

A

and µ

B

are

estimates of the means of p

A

and p

B

]

standard

deviation = \r(\f(π,2) _ (σ\O(

2

,

A

) + σ\O(

2

,

B

))) [

where σ

A

and σ

B

are estimates of \r(\f(2,π)) times

the standard deviations of p

A

and p

B

] for x > 0.

This method may be extended to estimate the

probability that one plan is better than a number of

other plans.

The measurement of the quality, q, of work in

any business process is seldom available to the

management system except through subjective

assessment. This issue complicates the “optimal”

management of all business processes. In the

experimental e-market some information sources

may reasonably be given quality estimates. For

example, subjective estimates of the mean and

variance may be attached to text by a particular

journalist in a news feed. If these estimates are

available then the notion of “best” may be extended

to include quality. However, if “best” is to mean

some combination of q, c and t then these

parameters may need to be measured in the same

units, such as some monetary value.

The adjustment of estimates in the light of

measurements that fall outside expected ranges is

achieved using the geometric weighted mean

method used to estimate s and t. These multipliers

υ

ij

mean: if measurement m

i

of service i lies outside

the expected range then multiply the estimate for

service j by \F( m

i

,µ

i

) _ υ

ij

. This is crude but in

a sense these multipliers are no cruder than the

estimates that they are adjusting. What is known is

the network topology and so too potential causal

links between components’ performance. The use

of some form of belief net [8] is appealing in that the

learning mechanism has a scientific basis, although

here the nets will need to represent conditional t and

c estimates rather than conditional probabilities.

This is presently being investigated.

7 CONCLUSION

Two classes of business process are goal-driven

processes and knowledge-driven processes. Goal-

driven processes may be managed but they are

inherently unpredictable. The management of

knowledge-driven processes that involve human

agents is seldom feasible due to the size of the

process knowledge base. A significant class of

knowledge-driven processes is e-market transactions

in which the process knowledge base is the Internet.

These are managed using a multiagent system that is

supported by a suite of data and text mining bots

whose output is combined using a belief network.

The proactive component of these agents is specified

by plans. For goal-driven processes the proactive

‘succeed’ exit leads the way, and for knowledge-

driven processes the reactive ‘abort’ exit is used to

determine the process’ direction as knowledge is

revealed.

REFERENCES

Debenham, JK. Supporting the actors in an

electronic market place. In proceedings Twenty

First International Conference on Knowledge

Based Systems and Applied Artificial

Intelligence, ES’2001: Applications and

Innovations in Expert Systems IX, Cambridge

UK, December 2001, pp29-42.

Fischer, L. (Ed). Workflow Handbook 2001. Future

Strategies, 2000.

van der Aalst, W. & van Hee, K. Workflow

Management: Models, Methods, and Systems.

MIT Press (2001).

Jennings, N.R., Faratin, P., Norman, T.J., O’Brien,

P. and Odgers, B. (2000) Autonomous Agents

for Business Process Management. Int. Journal

of Applied Artificial Intelligence 14 (2) 145-189.

Rao, A.S. and Georgeff, M.P. “BDI Agents: From

Theory to Practice”, in proceedings First

International Conference on Multi-Agent

Systems (ICMAS-95), San Francisco, USA, pp

312—319.

Debenham, JK. Supporting knowledge-driven

processes in a multiagent process management

system. In proceedings Twentieth International

Conference on Knowledge Based Systems and

Applied Artificial Intelligence, ES’2000:

Research and Development in Intelligent

Systems XV, Cambridge UK, December 2000,

pp273-286.

MANAGING E-MARKET TRANSACTION PROCESSES: Exploring the limits of process management with a multiagent

system

329

Debenham, JK and Simoff, S. Investigating the

Evolution of Electronic Markets. In proceedings

Sixth International Conference on Cooperative

Information Systems, CoopIS 2001, Trento,

Italy, September 5-7, 2001, pp344-355.

Cowell, RG, Dawid, AP, Lauritzen, SL and

Spiegelhater, DJ. Probabilistic Networks and

Expert Systems. Springer-Verlag, (1999)

Weiss, G. (ed) (1999). Multi-Agent Systems. The

MIT Press: Cambridge, MA.

Klemperer, P. (Ed). The Economic Theory Of

Auctions. Edward Elgar Publishing (2000).

Debenham, JK and Simoff, S. Designing a Curious

Negotiator. In proceedings Third International

Workshop on Negotiations in electronic markets

- beyond price discovery - e-Negotiations 2002,

September 2002, Aix-en-Provence, France.

Watkins, M. Breakthrough Business Negotiation—A

Toolbox for Managers. Jossey-Bass, 2002.

Myerson, R. & Satterthwaite, M. Efficient

Mechanisms for Bilateral Trading. Journal of

Economic Theory, 29, 1–21, April 1983.

Kraus, S. Strategic Negotiation in Multiagent

Environments. MIT Press, 2001.

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

330