DESIGN AND EVALUATION OF AGENT-BASED

NEGOTIATION HEURISTIC FOR ONLINE NEGOTIATIONS

Kaushal Chari, Manish Agrawal

University of South Florida, 4202 E Fowler Avenue, CIS 1040, Tampa, FL 33620-7800, USA

Ke

ywords: Software agents, electronic markets, automated negotiations.

Abstract: This paper presents a negotiation heuristic for software agents that enable agents to learn about the

opponent’s behavior and use market information while conducting online negotiations. The heuristic is

tested in a pilot experimental study, where the performance of agents is evaluated with respect to human

negotiators in a simulated electronic market. Preliminary results indicate that agents may have the potential

to do better than humans in multi-issue negotiation settings.

1 INTRODUCTION

Software agents (Chari and Seshadri 2004) have the

potential to act as effective surrogates of their

human principals during automated negotiations due

to their ability to overcome the cognitive and

information processing limitations of humans in

negotiation tasks. Although many research

prototypes have been developed to enable software

agents to negotiate (see Section 2), to our

knowledge, they all suffer from some weaknesses as

pointed out in Section 2. In the quest for developing

software agents that are more robust and effective

for online negotiations, we propose a learning

heuristic for software agents, implement this

heuristic in a multi-issue negotiation setting (i.e., an

electronic marketplace), and evaluate its

effectiveness compared to humans using a pilot

experimental study.

The context of agent-based negotiations is an

electronic marketplace with a finite open time

window for completing transactions. Buyer and

seller agents register in the e-marketplace and

transact a given quantity of an item within the

predefined time window. Both buyer and sellers are

cognizant of the market values and use this

information during negotiations. An agent can

negotiate with multiple opponents sequentially to

transact the required quantity, since a single seller

for example, may not be able to meet the entire

demand of a buyer agent. These conditions are

similar to trading in a commodity exchange

(Chicago Board of Trade 1998). A transaction is

completed successfully when an agreement is

reached on all issues under consideration such as

price, delivery terms, etc. The preference structure

of human principals are elicited and stored in their

surrogate agents as utility functions. The agents

negotiate on behalf of their principal until either an

agreement is reached or the time window expires.

2 LITERATURE REVIEW

Business negotiations have been studied from

various perspectives including game theory,

economic, socio-psychological, and intelligent

approaches. Game theoretic approaches make fairly

restrictive assumptions about opponent behaviors,

thereby rendering them somewhat impractical in

real-life negotiation settings (

Kraus and Wilkenfeld

1993).

Economic approaches (Zeuthen 1968) treat

negotiations as a finite sequence of offers and

counter offers that could converge to an agreement

if an agreement zone exists, deriving subsequent

offers based on expectations about the opponent’s

behavior. Intelligent approaches, based on artificial

intelligence and/or statistical techniques, can

facilitate learning of an opponent’s behavior,

provide efficient search of the negotiations solution

space for an agreeable solution, and automate the

negotiations process. Examples of intelligent

approaches include case-based reasoning, heuristic-

searches, automated learning, Bayesian techniques,

92

Chari K. and Agrawal M. (2004).

DESIGN AND EVALUATION OF AGENT-BASED NEGOTIATION HEURISTIC FOR ONLINE NEGOTIATIONS.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 92-97

DOI: 10.5220/0002604500920097

Copyright

c

SciTePress

and genetic algorithms. Case-based approaches,

which match previous recorded instances of

negotiations from the case history to the current

situation (e.g., PERSUADER system (

Sycara 1990)),

are not effective when existing cases in the case

history database do not match the current

negotiation situation. Genetic algorithms pit one

negotiation strategy against another, and use the

outcome to produce improved strategies from

subsequent generations in an evolutionary manner

(

Oliver 1996). However, they often require a very

large number of generations to refine the negotiation

strategy. Heuristic techniques search a multi-

dimensional space for a point that is agreeable to all

negotiating entities. Bayesian approaches provide

the ability to learn during negotiations using

probability update rules (

Zeng and Sycara 1998);

however, such probabilities are difficult to define ex

ante and may sometimes be inaccurate.

Many agent systems have been developed for

automated/semi-automated negotiations. One of the

pioneering systems is the Kasbah agent system,

which uses a simple negotiation heuristics based on

pre-defined price decay or increment functions

(

Chavez and Maes, 1996). Kasbah agents do not learn

and therefore do not adapt to the negotiation

environment. Agents developed in the Bazaar

project (

Zeng and Sycara 1998) use Bayesian update

rules to learn and form beliefs about the opponent’s

behavior. As stated before, this approach is limited

by the difficulty in assessing various probabilities

used in Bayesian update rules. Faratin et al. (1998)

use families of polynomial and exponential

functions to model opponent concession behaviors

during negotiations (e.g., boulware, conceder and

imitative behaviors) and combine them using

weights to create a negotiation strategy. This

approach requires human intervention to assign

weights for alternative negotiation strategies and

does not provide agents with any learning

capabilities. Chari and Bhattacherjee (2002) present

a heuristic for agent negotiations that learns from

the opponent’s behavior. However, this heuristic

suffers from unrealistic requirements such as the

need for agents to know the market demand supply

ratio, and the lack of robustness for various

negotiation settings.

The review of the above literature indicates

that: 1) there is no research prototype that is

intelligent and robust enough to support automated

negotiations in real world negotiation settings, and

2) No research has investigated the performance of

existing agents with respect to humans in live e-

marketplace negotiations. The current research aims

to address these limitations by building a learning-

based negotiation heuristic that uses market values

in determining bids in real time. We also present

results of a pilot experimental study that compares

the performance of agents with humans.

3 NEGOTIATION HEURISTIC

A negotiation heuristic determines the scheme for

making offers/bids (hence forth referred to as simply

offers) during negotiations. Negotiations involving

multiple issues (such as price, financing rate,

delivery term etc) require the two negotiation

partners to agree on all the issues. We present a

negotiation heuristic that supports multiple issue

negotiations. This heuristic uses the utility function

as well as the reservation values of various issues

while making offers. The utility functions are

generated by eliciting preferences from the human

principal of an agent. The heuristic learns from the

opponent’s behavior, uses market conditions in

making offers and handles multiple threads

sequentially within a limited time window. We

make the following assumptions: (a) bilateral

negotiations; (b) the negotiators are always in

conflict over each issue; (c) the utility value of an

offer for any issue never exceeds the utility value of

an earlier offer for that issue.

The central idea behind the heuristic is as

follows. An agent implementing the heuristic

estimates the number of iterations required to reach

the market value by estimating the opponent’s

concession curve by fitting the best curve on the

opponent’s observed offer points. Using this

information as well as information on market

values, the agent estimates the target value that it

should strive to reach at the last iteration of the

negotiations thread. The agent then determines the

concession rate to move from its last offer to the

target offer for an issue in the remaining iterations

and then accordingly makes an offer subject to some

constraints. Notations used in the heuristic are

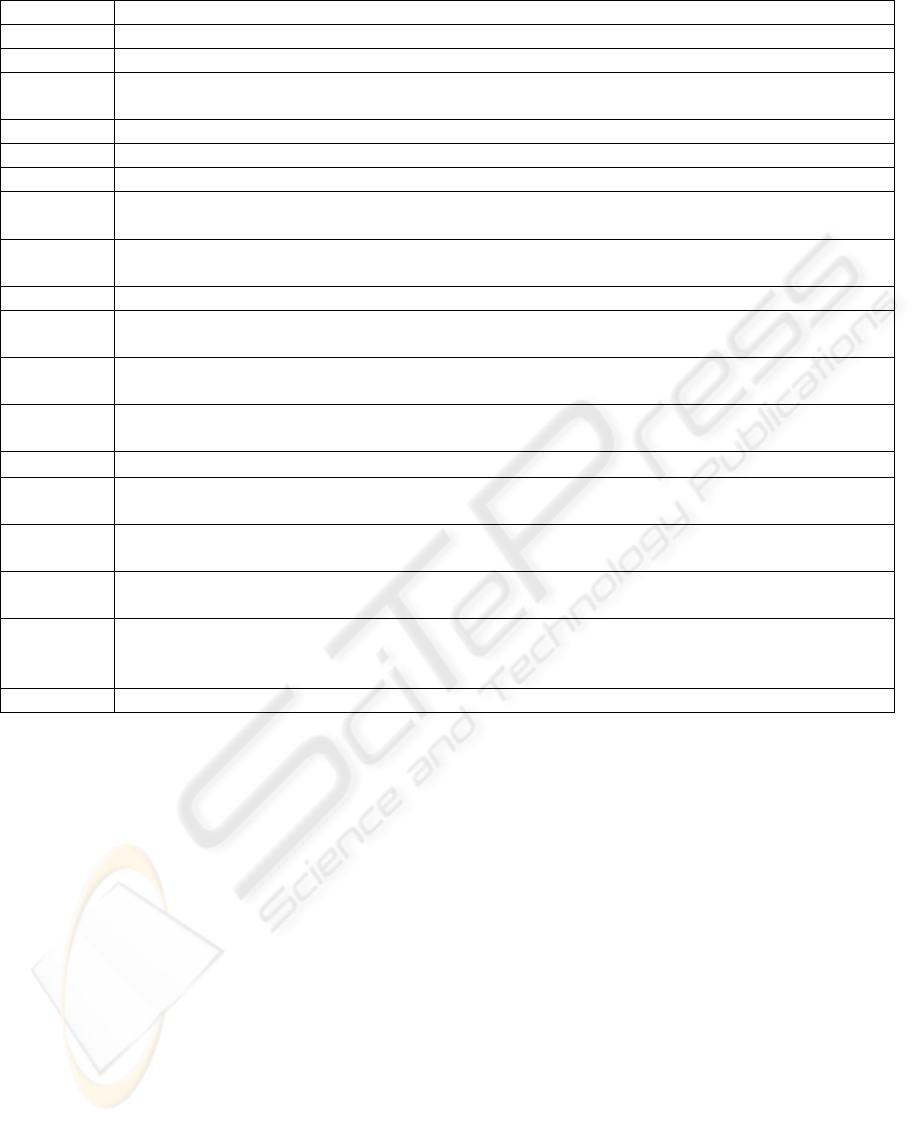

given in Table 1.

Before an agent enters into negotiations with an

opponent, its human principal provides: (a) a bound

on the maximum number of iterations for that

thread, tmax

is

, (b) own reservation values, and c)

starting bid values for all issues.

DESIGN AND EVALUATION OF AGENT-BASED NEGOTIATION HEURISTIC FOR ONLINE NEGOTIATIONS

93

Table1: Notations used in negotiation heuristic

Symbol Description

y

lk

Market value of issue k, i.e., value of k for last the successful transaction in the marketplace.

x

ij

= [x

ij1

,,…,x

ijn

] is the vector of n issue values proposed by agent i at iteration j.

Tmax

i

Total time available to agent i for negotiations. Typically the length of the time window of the

market place.

u

i

(x

1

,..,x

n

) Utility function of agent i as a function of n issue values.

Q

i

Quantity required to be transacted by agent i during Tmax

i

r

i

=[r

i1

,…, r

in

]

reservation value vector of agent i containing reservation values for n issues.

τ

ij

= [

τ

ij1

,…,

τ

ijn

] is the vector of target values of n issues for agent i at iteration j, that agent i

strives to achieve as the agreed solution.

cr

ij

= [cr

ij1,…,

cr

ijn

] is the vector of concession rates of agent i at iteration j across n issue

dimensions.

s

ij

= [s

ij1,…,

s

ijn

] is the vector of step sizes of agent i at iteration j across the n issue dimensions.

t

ijk

Number of additional iterations estimated by agent i at iteration j for issue k in the current

thread.

mn

jk

Estimate at iteration j of the minimum value for issue k that the opponent uses in making

offers. This value is used in (1).

mx

jk

Estimate at iteration j of the maximum value for issue k that the opponent uses in making

offers. This value is used in (1).

tmax

is

Bound on the maximum number of iterations of agent i in thread s. tmax

is

≥

j + max

k

(t

ijk

).

q

s

Quantity transacted during negotiation thread s when an agreement is reached with the

opponent.

I

i

Set of negotiation issues such that the utility value of agent i is non-decreasing with respect to

increasing issue values. For example, interest free payment period in case of a buyer.

D

i

Set of negotiation issues such that the utility value of agent i is non-increasing with respect to

increasing issue values. For example, price in case of a buyer.

δ

I

Constant between 0 and 1 that denotes the fraction of the market value that could be reduced

from (denoted by index i = 1), or added to (denoted by index i = 2), the market value in

determining the settlement target.

round(x) Rounds x to the nearest value in the domain of x.

The opponent’s maximum number of iterations for a

given thread is estimated by learning from the

opponent’s behavior. We use the exponential

function proposed in (

Faratin et. al. 1998) to model

the entire range of concession behaviors of the

opponent. According to this function, the

opponent’s offer at iteration j for issue k can be

computed by (1) as follows.

x

ojk

={mn

jk

+

α

jk

.(mx

jk

– mn

jk

) for k

∈

D

o

(i.e., I

i

)

mn

jk

+(1-

α

jk

)(mx

jk

– mn

jk

) for k

∈

I

o

(i.e., D

i

)

where

α

jk

= exp((1 – min(j, tmax

k

)/tmax

k

)

β

jk

ln k

jk

),

β

jk

> 0 and 0 < k

jk

< 1 (1)

In (1) the parameter

β

jk

captures the type of

negotiations behavior: boulware (

β

jk

<1), conceeder

(

β

jk

> 1) etc; k

jk

is the estimate at the j

th

iteration for

the starting value of

α

jk

. While parameters

β

jk

, t

maxk

,

mn

jk

(for

k

∈

I

o

), mx

jk

(for k

∈

D

o

) and k

jk

can be

estimated by fitting a curve through opponent’s

observed offer points till iteration j: x

o1k

,…, x

ojk

,

while minimizing the least squared error, only

parameter t

maxk

is used by the heuristic. Note that the

reservation value of opponent can be estimated from

parameters mn

jk

(for

k

∈

I

o

), mx

jk

(for k

∈

D

o

),

however the agent uses the market value instead of

the opponent’s reservation value estimates in

making bids. The estimate of the number of

additional iterations at iteration j to reach an

agreement on issue k is given by (2). Note that the

total number of iterations in a thread is subject to the

bound set by the user of the agent.

t

ijk

=max( min( tmax

k

, tmax

is

) – j, 1) (2)

A target value is computed for each issue based

on the market conditions according to (3). This is

the value at which agent i, strives to reach an

agreement.

τ

ijk

= min(max ((1-

δ

1

)y

lk

, r

ik

), x

ij

-1

k

) for k

∈

I

i

;

max(min((1+

δ

2

)y

lk

, r

ik

), x

ij

-1

k

) for k

∈

D

i

(3)

For example, when

δ

2

= 0.05, and issue k is

price, then target is set to 105% of the current

market value for price, subject to bounds set by own

reservation price and previous offer made. The

target value is approached at a rate given by the

concession rate in (4).

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

94

cr

ijk

= (

τ

ijk

– x

ij

-1

k

)/ t

ijk

(4)

The concession rate is then used to compute the

step size for the move from the previous offer as:

s

ijk

= cr

ijk

∆

j

(5)

Note that

∆

j

=1. Agent i’s offer can then be

computed as follows:

x

ijk

=

{max(min (round(x

ij

-1

k

+ s

ijk

), x

ij

-1

k

),

τ

ijk

, r

ik

,

x

ojk

) for k

∈

Ii ;

min(max(round(x

ij

-1

k

+ s

ijk

), x

ij

-1

k

),

τ

ijk

, r

ik

, x

ojk

)

for k

∈

D

i

} (6)

To reduce the computation time for estimating

the opponent’s concession curve in order to

determine tmax

k

, a limited enumeration can be

performed. The range of values for each parameter

of the opponent’s estimated concession curve to be

searched is bounded by opponent’s offer and other

parameters.

The heuristic for agent i is summarized below.

1. Get the weights w

k

for the utility function u

i

(x)

of the human principal.

2. Get value of Q

i

3. Set s=0, t

′

= 0 and q

′

= 0.

4. If((q

′

< Q

i

)∧ (t

′

<Tmax

i

) then select an

opponent with public information (Q

o

, x

o1

) such

that (Q

o

/(Q

i

-q

′

))(u(x

o1

)) is the highest across all

non-busy opponents, set s = s+1, j=1; else stop.

5. Get values for the following: r

i

, tmax

is

, x

i1

6. If (x

i1

= x

o1

), agreement is reached, stop thread,

transact min(Q

o

, (Q

i

- q

′

)), set q

′

= q

′

+ min(Q

o

,

(Q

i

- q

′

)), go to Step 4.

Repeat Steps 7- 16 for iteration j of thread s

7. Set j = j+ 1. Get offer x

oj

from the opponent.

8. If (x

ij

-1 = x

oj

), agreement is reached, stop

thread, transact min (Q

o

, (Q

i

- q

′

)),

set q

′

= q

′

+ min(Q

o

, (Q

i

- q

′

)), go to Step 4.

9. If (j

≥

4) then

for each k such that (x

ij

-1

k

≠

x

ojk

),

using x

o1

,..,x

oj

, estimate tmax

k

,

β

k

, mn

k

,

mx

k

, by fitting a curve of the form given

by (1) and minimizing the sum of squared

errors. Use user-supplied bounds while

enumerating parameters to search for the

best curve and then use tmax

k

in (2) to

compute t

ijk

.

10. If (j <4) then for all k set t

ijk

= tmax

is

- j.

11. If (t

ijk

> 0) then compute

τ

ijk

using (3), cr

ijk

using (4), s

ijk

using (5), and x

ijk

using (6).

12. For all k such that (x

ij

-1

k

= x

ojk

) set x

ijk

= x

ij

-1

k

.

13. If(x

ij

= x

ij

-1

≠

x

oj

)

then for all k

∈

I

i

such that ( x

ijk

> y

lk

)

set x

ijk

= max(y

lk

, r

ik

, x

ojk

)

for k

∈

D

i

such that ( x

ijk

< y

lk

)

set x

ijk

= min(y

lk

, r

ik

, x

ojk

)

14. If(x

ij

= x

oj

), agreement is reached, stop thread,

transact min (Q

o

, (Q

i

- q

′

)), set q

′

= q

′

+ min(Q

o

,

(Q

i

- q

′

)), go to Step 4.

15. If (((x

ij

= x

ij

-1)

∧

(x

oj

= x

oj

-1)) then

if (

∀

k( ( x

ojk

≥

r

ijk

) when k

∈

I

i

and ( x

ojk

≤

r

ijk

) when k

∈

D

i

then x

ij

= x

oj

and reach

an agreement,

else stop thread, no agreement reached,

go to Step 4.

16. If(((x

ij

= x

ij

-1 = r

i

)

∨

(j= tmax

is

))

∧

( (Q

i

- q

′

)/

Q

i

)/( (Tmax

i

- t

′

)/ Tmax

i

) > 1) then

if (

∀

k( ( x

ojk

≥

r

ijk

) when k

∈

I

i

and ( x

ojk

≤

r

ijk

) when k

∈

D

i

then x

ij

= x

oj

and reach

an agreement;

else stop thread, no agreement reached,

go to Step 4.

Else stop thread, no agreement reached, go to

Step 4.

In Step 1, the weights w

k

assigned to the

negotiation issues (i.e., price and period in the

current paper) are obtained from the human

principal and then incorporated in a commonly used

additive utility function of the form u(price, period)

= w

price

u

1

(price) + w

period

u

2

(period), where u

1

and

u

2

are normalized linear functions of price and

period respectively. The quantity to be transacted by

the agent in the market place is then specified to the

agent in Step 2. In Step 3, the time counter t

′

is

started. The value of t

′

is constantly updated by a

clock. The thread count, s as well as the quantity

transacted, q

′

are also initialized to zero in Step 3.

In Step 4, an available opponent is selected for

negotiations with the highest value for the metric

(Q

o

/(Q

i

-q

′

))(u(x

o1

)) which is the product of the ratio

of opponent’s quantity and the quantity remaining to

be transacted, and the utility value of the starting bid

of the opponent. This metric enables the agents to

select an opponent in the pool, who has large

quantity to transact as well as an attractive starting

bid that gives high utility value to the agent. In Step

4, an opponent is only selected if some quantity still

remains to be transacted (i.e., q

′

< Q

i

) and the time

window has not expired (t

′

<Tmax

i

). In Step 5, the

agent obtains its human principal’s reservation

values along with the bound on the number of

iterations for negotiations for the current negotiation

thread as well as the starting bid from its human

principal. Step 6 is needed to check if an agreement

is reached in the very first iteration.

When iterations are four or higher, then offer

points available from the opponent are adequate to

run a curve fitting procedure in order to estimate the

number of iterations the opponent is targeting. In

Step 9, the curve-fitting procedure is run based on

the exponential curve in (1) to estimate tmax

k

. When

the iterations are less than four, the number of offer

points of the opponents is not adequate to compute

good estimates of tmax

k

. In this case, the total

number of iterations is estimated as tmax

is

, the initial

bound that is set by the human principal of the

DESIGN AND EVALUATION OF AGENT-BASED NEGOTIATION HEURISTIC FOR ONLINE NEGOTIATIONS

95

agent. The number of iterations remaining is tmax

is

– j, where j is the number of iterations that has

elapsed. As long as the number of iterations

remaining is one or more, settlement target,

concession rate, step size and the new bid is

computed in Step 11. For negotiation issues for

which agreements have been reached, the last bid

value is the current bid value as seen in Step 12.

If the current bid is the same as the last bid and

is not equal to the opponent’s bid (Step 13), then the

current bid value is set to the market value subject to

the bounds set by own reservation value and

opponent’s bid. If now an agreement is reached

(Step 14), then quantity can be transacted. If the

current bid is the same as the previous bid and the

opponent’s current bid is also the same as his/her

previous bid, then an agreement can be reached if

the reservation value constraints are satisfied (Step

15). Finally in Step 16, if the current bid is the same

as the previous bid and equals own reservation

values, or if the total number of iterations planned

tmax

is

, is exhausted, and there is a sense of urgency

as given by the metric: ((Q

i

- q

′

)/ Q

i

)/( (Tmax

i

- t

′

)/

Tmax

i

), when its value is greater than 1, then an

agreement with the opponent can be reached if the

own reservation value constraints are met.

Otherwise negotiations are terminated.

4 THE RESEARCH HYPOTHESIS

AND EMPIRICAL STUDY

Both human and agent buyers constantly learn from

and adapt to each other’s behaviors and/or engage in

strategic moves in response to opponent behavior.

We however conjecture that automated agents

implementing our heuristic are likely to have an

upper hand in this negotiation process, by virtue of

their ability to quickly and accurately estimate

uncertain negotiation parameter such as the number

of opponent moves. Estimation of such parameter

often places substantial cognitive demands on

humans. The performance gap between humans and

agents will tend to magnify with increasing

complexity of the negotiation process, such as the

number of negotiation issues. Hence we

hypothesize:

H1: Electronic agents will perform significantly

better than human negotiators when negotiations

involve multiple issues

To test the above hypothesis and the

performance of agents, we conducted a pilot

experiment to identify the differences between

performance and efficiencies achieved by humans

and electronic agents while trying to buy fixed

quantities of goods. The experiments involved

buyers and sellers negotiating over two issues: price

and the number of months of interest free payment

period. The dependent variable in the experiments

was negotiation performance, i.e., the utility gained

by the settlement over the utility of own reservation

values. The objective of each negotiator was to buy

or sell at values that maximize his/her utility.

To make the negotiation environment as

realistic as possible, we created experiments similar

to a commodities exchange (Chicago Board of

Trade 1998). Specifically, to model price discovery,

the price of the last trade was displayed to all buyers

along with the financing period. All sellers were

electronic and used a hybrid Boulware/Conceder

algorithm (different from the current heuristic) to

make offers. Seller agents used negotiation

parameters based on current market values. Human

subjects played the role of buyers.

To conduct the experiments, we sought subjects

with prior experience or coursework on

negotiations. Subjects received token cash

incentives based on their negotiation performance

based on their utility metric. We elicited weights for

utility functions from human subjects. The utility

functions used were the commonly used linear

additive function of the form presented in Section 3.

For the actual negotiation sessions, all subjects were

assigned identical reservation values (80 for price

and 3 months for period) and were required to buy

identical quantities (20 units) of the commodity.

Parameters δ

1

and δ

2

were set to 0.05. Experiments

were conducted under two market configurations. In

the first set of negotiations, market supply was half

the total demand. In the second set, supply was

twice the actual demand. To make the most efficient

use of subjects’ time, two rounds of negotiations

were conducted for each market configuration. Half

the subjects in each round used their surrogate

agents implementing the heuristic presented in this

paper, and the other half negotiated on their own. In

the second round, subjects that used agents in the

first round negotiated without agents, while subjects

that did not use agents, now used surrogate agents in

the second round to buy in the market place. We

had eight subjects for the experiments and the

supplies were appropriately calibrated for the two

market configurations.

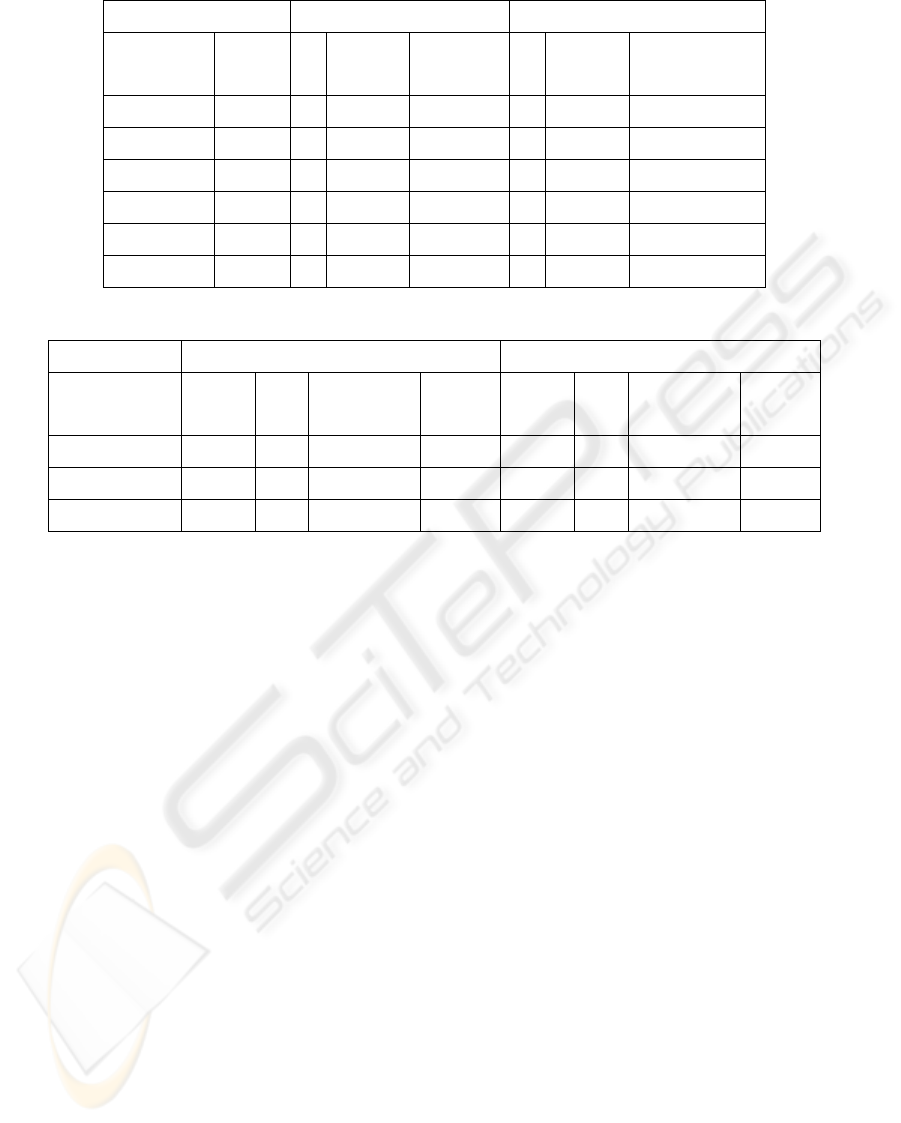

The results for successful transactions during

the experiments are shown in tables 2 and 3.

Specifically, Table 3 contains results from t-tests for

differences. As can be seen from Table 3, fewer

transactions were made when supplies were limited.

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

96

Table 2: Summary Statistics

Demand/Supply= 2 Demand/Supply = 0.5

TYPE N Mean Std.

Deviation

N Mean Std. Deviation

Close price Agent 4 74.1700 3.28996 9 73.0667 4.35895

Human 9 75.7667 5.13323 7 72.7814 4.32834

Close period Agent 4 4.5425 .50704 9 4.4344 .89605

Human 9 3.7733 .61640 7 3.4571 .40766

Iterations Agent 4 7.50 3.697 9 4.44 1.236

Human 9 9.44 2.128 7 5.14 1.345

Table 3: t-test results

Demand/Supply =2 Demand/Supply = 0.5

Variable t Df Sig

(2-tailed)

mean

diff

T Df Sig

(2-tailed)

mean

diff

Close price -0.67 9 0.52 -1.60 0.13 13 0.9 0.29

Close period 2.36 7 0.05 0.77 2.91 11 0.01 0.98

Iterations -0.98 4 0.38 -1.94 -1.07 12 0.31 -0.7

The results indicate that there were no

significant differences between humans and agents

in prices. However, agents performed significantly

better than humans on negotiating the duration of

the financing period. The difference was significant

across market conditions, supporting Hypothesis 1

regarding the superiority of agents in multi-issue

negotiations. This result also suggests that agents

should be preferred when negotiations involve

multiple issues.

An obvious limitation of these results is the

small sample size of the pilot. In our experiments

following this pilot, we will address this limitation

by performing more experiments with human

subjects. Also, we will vary the number of issues to

ascertain the performance of agents with respect to

humans as the number of issues change. Some

subjects were uncomfortable with the monotonic

nature of the negotiations and suggested that they be

allowed to lower their offer prices in return for

conceding on period. We also plan to improve the

human interface based on subject feedback and

refine the heuristic further based on the

experimental results.

REFERENCES

Chari, K., & Seshadri, S. (2004). Next Generation B2B

Commerce Using Software Agents. Intelligent

Enterprises of the 21

st

Century, Idea Group

Publishing, Hershey, PA 17033.

Chari, K., & Bhattacherjee, A. (2002, December). Multi-

Thread Automated Negotiations Using Learning

Agents. Proceedings of the Workshop on Information

Technologies and Systems (WITS), Barcelona, Spain.

Chavez, A., & Maes, P. (1996, April). Kasbah: An agent

marketplace for buying and selling goods.

Proceedings of the First International Conference on

the Practical Application of Intelligent Agents and

Multi-Agent Technology, London.

Chicago Board of Trade (1998), Commodity Trading

Manual, Chicago, IL.

Faratin, P., Sierra, C., & Jennings, N. R.

(1998). Negotiation Decision Functions for

Autonomous Agents. Robotics and Autonomous

Systems, 24 (3-4): 159-182.

Kraus, S., & Wilkenfeld, J. (1993). A Strategic

Negotiation Model with Applications to an

International, Crisis. IEEE Transaction on Systems

Man and Cybernetics, 23(1), 313-323.

Oliver J.R. (1996, Winter). A Machine Learning Approach

to Automated Negotiation and Prospects for Electronic

Commerce, Journal of Management Information

Systems, 13, 3 126-164.

Sycara K., (1990). Negotiation Planning: An AI approach.

European Journal of Operational Research, 46, 216-

234.

Zeng D., & Sycara, K. (1998). Bayesian Learning in

Negotiation. International Journal of Human-

Computer Studies, 48, pp. 125-141.

Zeuthen, F. (1968). Problems of Monopoly and Economic

Warfare, Routledge and Kagan Paul, London.

DESIGN AND EVALUATION OF AGENT-BASED NEGOTIATION HEURISTIC FOR ONLINE NEGOTIATIONS

97