A

Secure Prepaid Wireless Micropayment Protocol

Supakorn Kungpisdan

1

, Bala Srinivasan

2

, and Phu Dung Le

3

1

School of Network Computing, Monash University

McMahons Road, Frankston, Victoria 3199, Australia

2

School of Computer Science and Software Engineering, Monash University

900 Dandenong Road, Caulfield East, Victoria 3145, Australia

3

School of Network Computing, Monash University

McMahons Road, Frankston, Victoria 3199, Australia

Abstract. In this paper, a secure prepaid micropayment protocol which is suit-

able for wireless networks is introduced. The proposed protocol employs a secure

cryptographic technique that reduces all parties’ computation and satisfies trans-

action security properties, including non-repudiation. This offers the ability to

resolve disputes among parties. Compared to existing micropayment protocols,

all parties’ secret information are well-protected. Finally, we perform an analysis

to demonstrate that the proposed protocol has better performance than existing

micropayment protocols. As a result, the proposed protocol can be well-operated

on limited capability wireless devices.

Keywords. Micropayment, mobile payment, mobile commerce, payment proto-

col, electronic commerce,

1 Introduction

Micropayments seem to be more widely accepted than other kinds of payments systems

for wireless networks because of their lightweight, lower setup cost,and lower transac-

tion cost. Moreover, most payment-related applications for wireless networks are con-

ducted with small-valued goods or services e.g. downloading ring tones, operator logos,

or electronic document.

Traditionally, micropayment protocols employ public-key operations and a chain of

hash values such as PayWord [6] or NetCard [2]. Although these protocols work well

for fixed networks, they are not suitable for applying to wireless networks due to a

number of limitations of wireless environments [3, 7].

Recently, a prepaid micropayment protocol called PayFair [8] offers the ability to

perform payment transactions on limited computational capability devices. It employs

symmetric-key operations and keyed hash functions which reduce the computation at

all engaging parties. However, PayFair lacks of transaction privacy since payment infor-

mation of engaging parties is sent in cleartext during transactions. Moreover, a message

sent from a client to a merchant in PayFair lacks of non-repudiation property. Further-

more, a bank is able to impersonate as its clients to perform transactions. In addition,

a payment token authorized by the bank is merchant-specific in that it is still can be

Kungpisdan S., Srinivasan B. and Dung Le P. (2004).

A Secure Prepaid Wireless Micropayment Protocol.

In Proceedings of the 2nd International Workshop on Security in Information Systems, pages 104-113

DOI: 10.5220/0002662701040113

Copyright

c

SciTePress

used to generate the coins to spend with only one specified merchant. Thus, the client

is required to request the bank to issue a new payment token every time she wants to

perform a payment transaction to a new merchant.

In this paper, we propose a prepaid micropayment protocol which employs a secure

symmetric cryptographic technique that not only the computation at all parties, espe-

cially at the client, is reduced, but the proposed protocol also satisfies transaction secu-

rity properties including non-repudiation [1]. Moreover, it offers the ability to resolve

disputes among parties. Furthermore, all parties’ private information such as payment

information and secret keys are well-protected.

In any prepaid payment system, a client has to purchase an electronic coupon which

contains spending credits and the amount paid by the client is transferred to a specified

merchant before a transaction. In our proposed protocol, we present an efficient method

to refund either un-spending credits or coupons. This offers the practicability to the

system. Moreover, the coupon in our protocol is general-purposed in that it can be split

into smaller value merchant-specific coupons to spend with many merchants.

We analyze the performance of the proposed protocol and compare with PayWord

[6] and PayFair [8]. The results show that our protocol has better performance than

others in terms of party’s computation and the numbers of message passes. Therefore,

the proposed protocol can be implemented in limited capability wireless devices with

higher performance than existing micropayment protocols.

Section 2 provides overviews of PayWord and PayFair protocols. Section 3 intro-

duces our proposed protocol. Section 4 discusses about security and performance of the

proposed protocol. Section 5 concludes our work.

2 Overviews of Existing Micropayment Protocols

In this section, we outline two existing micropayment protocols: PayWord [6] and Pay-

Fair [8]. In section 2.1, PayWord is presented to provide an idea about how a micropay-

ment protocol with public-key operations works. In section 2.2, PayFair is outlined to

show how to secure transactions using symmetric-key operations.

2.1 PayWord

PayWord [6] is a postpaid micropayment protocol based on public-key cryptography.

Three parties are involved in the system: client, merchant, and bank. The client and

the merchant establish accounts with the bank. At the beginning of the protocol, the

bank issues the client a PayWord certificate which contains authorized amount CL that

the client is allowed to make a payment to each merchant. To make a payment to a

merchant, the client generates a set of coins c

0

, ..., c

n

, where n = CL. The set of c

i

is

generated as follows: c

i

= h(c

i+1

), where i = 1, ..., n − 1.

In the first payment, the client sends the merchant a commitment, which contains the

PayWord certificate and c

0

, digitally signed by the client. Later on, in each payment,

the client sends the coin c

i

to the merchant. The merchant can infer the value of the

coin by applying a number of hash functions to c

i

. At the end of the day, the merchant

sends the highest value of c

i

together with the commitment to the bank. The bank then

105

deducts the money from the client’s account and transfers the money to the merchant’s

account.

However, PayWord is not suitable for applying to wireless environments because

it has high client’s computation due to public-key operations. Moreover, a certificate

verification process leads to additional communication passes [3]. In addition, payment

information, c

0

and c

i

, is readable by any party who holds the client’s public key. Thus,

any party is able trace the client’s spending.

2.2 PayFair

PayFair [8] is a prepaid micropayment protocol which employs symmetric-key opera-

tions and hash functions. The details of PayFair are shown as follows:

Phase A: Prepaid Phase

C → B : ID

C

, O

C

, h(O

C

, K

C

) (a)

B → C : {{N, RN}

SK

, R T }

K

C

, N, h({N, RN }

SK

, N, O

C

, K

C

) (b)

Where SK is the secret known only to the bank. K

C

is shared between the client

and the bank. The client requests the bank by sending order number O

C

contain-

ing the requested amount. The bank returns the message containing a payment token

{N, RN}

SK

, which is later used to generate coins. RN is a random number generated

from the serial number N and the secret SK

RN

known only by the bank. The client

generates a set of coins w

i

, i = 0, ..., n, where w

n

= {N, RN }

SK

, from the process:

w

i

= h(w

i+1

).

Phase B: Micropayment Phase

C → M : w

0

, N, h(w

0

, ID

M

, K

C

) (c)

M → B : w

0

, N, ID

C

, R

M

, h(w

0

, ID

M

, K

C

) (d)

B → M : w

0

, ID

C

, ID

M

, Y ES, h(w

0

, ID

C

, K

M

, R

M

, Y ES) (e)

The client sends the message (c) containing w

0

to the merchant. The merchant then

forwards h(w

0

, ID

M

, K

C

) with relevant information to the bank in (d). After receiv-

ing the message, the bank can generate w

n

from w

0

, N, and its own RN and SK. It then

transfers the amount n to the merchant’s account and sends the response to the merchant

in (e). The client can start a payment transaction with the merchant as follows:

C → M : w

i

w here i = 1, ..., n (f)

However, in PayFair, the problem about revealing payment information occurred in

PayWord still exists since, in the messages (c) and (f), w

0

and w

i

are sent in cleartext.

In addition, although Yen [8] claimed that payment token w

n

is general-purposed, it is

still merchant-specific when used, that is, although the coins is merchant-independently

generated, they are still can be used to pay only one specific merchant. Thus, the client

needs to request the bank for a new payment token every time she wants to make a

payment to a new merchant. Moreover, in (c), the bank can impersonate as the client to

perform transactions with the merchant.

106

3 The Proposed Protocol

3.1 Overview of the Proposed Protocol

There are three parties involved in our protocol: client, merchant, and bank. At the

beginning of the protocol, a client requests a bank for an authorization to perform mi-

cropayment transactions. The bank checks the validity of the client’s account and issue

a Bank Coupon containing the amount requested by the client.

To make payment to a merchant, the client generates a Merchant Coupon containing

the value specified to the merchant. The value of the merchant coupon must not exceed

the value of the bank coupon. This coupon has to be validated by the bank. To validate

the merchant coupon, the client generates a set of coins, attaches them into the merchant

coupon, and sends to the bank. After the validation, the bank transfers the money with

the requested value from the client’s account to the merchant’s account. The client then

can make payments to the merchant up to the amount specified in the merchant coupon.

In our protocol, a bank is trusted by its clients to generate correct numbers and values

of coins for coin validation purpose, but it is not trusted to create payment initialization

requests to merchants by itself. This is because the bank itself can generate the sets of

coins. It is possible to generate fake requests on behalf of its clients.

Our proposed protocol is composed of 6 sub-protocols: Setup, Payment Initializa-

tion, Payment, Extra Credit Request, Coupon Cancellation, and Coin Return protocols.

Section 3.2-3.7 demonstrate the details of the protocols.

3.2 Setup Protocol

A client C requests a bank B for an authorization on making a micropayment transac-

tion with the amount CL

T

as follows:

C → B : ID

C

, CL

T

, T

CP

, h(CL

T

, T

CP

, Y ) (1)

Note that CL

T

stands for total credits that the client is allowed to spend in the sys-

tem. T

CP

is the timestamp when generating the request. h(CL

T

, T

CP

, Y ) is used to

protect the integrity of the message. The bank checks the validity of the client’s account

and then deducts the amount CL

T

from the client’s account. Bank then sends the client

a Bank Coupon that can be used to perform transactions as follows:

B → C : {CL

T

, T

T

, T

CP

, SN, c}

Y

(2)

The bank coupon has unique serial number SN assigned by the bank and contains

authorized credits CL

T

. T

T

stands for timestamp when issuing CL

T

, and c is a random

number generated by the bank used for generating coins. With this bank coupon, the

client can make payments to many merchants repeatedly up to CL

T

. After running out

of the credits, the client needs to run this protocol to request the bank for a new CL

T

again.

107

3.3 Payment Initialization Protocol

To make a payment to a merchant M, the client generates a set of coins c

i

, i = 0, ..., n,

where n = CL

T

, as follows:

c

n

= {c, T

G

}

c

i

= h(c

i+1

) where i = 0, ..., n − 1

The client specifies the amount CL

M

to spend with the merchant. The client at-

taches the coins and CL

M

into a Merchant Coupon, and sends it to the bank:

C → B : h(c

0

, T

G

, CL

M

, X), h(ID

M

, c

0

, T

G

, CL

M

, CL

T

, T

T

, SN, Y ), T

G

(3)

Where T

G

stands for the timestamp when generating a set of coins c

0

, ..., c

n

. Note

that the client can either spend the whole credits to only one merchant or spend some

credits to a merchant and spend the rest to other merchants. We can see that h(c

0

, T

G

,

CL

M

, X) is the payment request from the client to the merchant which is unreadable

by the bank. The bank retrieves CL

T

and CL

M

from h(ID

M

, c

0

, T

G

, CL

M

, CL

T

, T

T

,

SN, Y) and checks whether CL

T

< CL

M

. If so, it rejects the request. If CL

T

> CL

M

,

the bank calculates the client’s remaining credits CL

T R

, where CL

T R

= CL

T

−CL

M

.

It then maintains the table of CL

T R

to prevent over-spending problem. At this stage,

the bank transfers CL

M

to the merchant’s account. Then the bank sends the following

messages to the client and the merchant:

B → M : {c

0

, T

G

, SN, CL

M

, h(ID

M

, SN, CL

T R

, T

T R

, Y )}

Z

,

h(c

0

, T

G

, CL

M

, X) (4)

B → C : h(ID

M

, SN, CL

T R

, T

T R

, Y ), T

T R

(5)

Where T

T R

stands for timestamp when the bank updates CL

T R

. Note that T

T

is

updated to T

T R

after calculating CL

T R

. The merchant retrieves c

0

and CL

M

from the

encrypted message. She knows that the client has requested to make the payment to her

from h(c

0

, T

G

, CL

M

, X), and the client’s request has been authorized by the bank from

the message encrypted with Z shared between the bank and herself. After receiving the

message (5), later on, the client can use {CL

T R

, T

T R

} to make payment to another

merchant.

3.4 Payment Protocol

After completing payment initialization, the client can start the payment to the merchant

by sending the coin as follows.

C → M : c

j

(where j = 1, ..., n ) (6)

The merchant verifies the requested amount by comparing with c

0

. After the ver-

ification, she provides goods or services to the client. After each payment, CL

M

is

deducted. The client is allowed to make the payments up to CL

M

without any payment

108

authorization from the bank. If the remaining credits are not enough to make another

payment, the client can request the bank for extra credits by running Extra Credit Re-

quest Protocol.

3.5 Extra Credit Request Protocol

Normally, when a client spends the credits up to CL

M

, she needs to run Setup Protocol

to issue a new bank coupon. In our protocol, we reduce the frequency of doing this

process by running Extra Credit Request (ECR) Protocol instead. With ECR Protocol,

the numbers of message passes are reduced. Before the next payment, the client checks

whether j > CL

M

. If so, she still can purchase the goods but she needs to request for

extra credits from the bank. The client realizes that, if her request has been approved,

her total credits CL

T R

will be deducted by CL

M

. To request for extra credits, the client

sends the following message:

B → M : c

j

, CL

M

, h(ID

M

, CL

M

, T

G

, SN, CL

T R

, T

T R

, Y ) (7)

At this stage, CL

M

stands for new credits to spend with specified merchant. The

merchant retrieves CL

M

and forwards the following message to the bank:

M → B : ID

M

, h(ID

M

, CL

M

, T

G

, SN, CL

T R

, T

T R

, Y ) (8)

The bank retrieves CL

T R

and CL

M

, and then calculates a new CL

T R

, where

new CL

T R

= currentCL

T R

− CL

M

. The bank transfers CL

M

to the merchant’s

account, and then sends the response to the merchant as follows:

B → M : h(ID

M

, SN, CL

T R

, T

T R

, Y ), T

T R

, Y ES, h(Y ES, CL

M

, T

T R

, Z)

if approved

( or Rejected if client has not enough credits ) (9)

The merchant checks whether the authorized CL

M

in h(Y ES, CL

M

, T

T R

, Z) is

equal to CL

M

received from the client in (7). If so, the merchant sends the client the

following message:

M → C : h(ID

M

, SN, CL

T R

, T

T R

, Y ), T

T R

(10)

The client expects to receive the updated CL

T R

, where updatedCL

T R

= current

CL

T R

−CL

M

. She calculates CL

T R

and compares with the received CL

T R

. If they are

matched, the client can infer the updated bank coupon from CL

T R

. The above message

is considered as a notification of the client’s remaining total credits. Note that, to make

the payment to a new merchant, the client repeats Payment Initialization Protocol with

the updated bank coupon without running Setup Protocol as that in existing protocols.

109

3.6 Coupon Cancellation Protocol

In our protocol, a client is able to refund an un-used bank coupon previously purchased

from a bank by sending the following message to the bank:

C → B : SN, T

CR

, h(SN, CL

T

, T

T

, T

CR

, Y ) (11)

Where T

CR

is timestamp when requesting for coupon cancellation. The bank re-

moves the coupon with the serial number SN from its database. This coupon will be no

longer used in the system. The bank transfers the amount CL

T

to the client’s account

and sends the response of the client’s request to the client as follows:

B → C : CancelOK, (CancelOK, SN, T

CR

, Y ) (12)

3.7 Coin Return Protocol

In some situation, a client may want to end transaction with a merchant after spending

some credits and request merchant to return her the un-spending credits. This process

can be done in the proposed protocol as follows:

C → M : c

j

max

, T

G

, h(ID

M

, c

0

, T

G

, Y ) (13)

Where c

j

max

is the highest-value coins currently spent to the merchant. The mer-

chant checks whether the received c

j

max

is equal to c

j

max

that she has. If they are

matched, the merchant forwards the following message to the bank:

M → B : ID

M

, c

j

max

, T

G

, h(ID

M

, c

0

, T

G

, Y ) (14)

The bank retrieves c

j

max

and c

0

and calculates returned amount, where returned

Amount = CL

M

− j

max

. Bank then transfers the returned amount to the client’s ac-

count and updates the client’s bank coupon with the new CL

T R

, where updatedCL

T R

= currentCL

T R

+ returnedAmount. The bank updates the entry in the list at the

record containing T

G

and c

0

, and then sends the acknowledgement to the merchant.

B → M : h(retur nedAmount, ID

M

, c

0

, T

G

, CL

T R

, T

T R

, Y ),

h(retur nedAmount, ID

C

, c

0

, T

G

, T

T R

, Z), T

T R

(15)

The merchant is notified that the returned amount has been withdrawn and trans-

ferred to the client’s account from h(returnedAmount, ID

C

, c

0

, T

G

, T

T R

, Z). Also,

she is notified that the set of coins starting with c

0

is no longer valid. The merchant then

sends the following message to the client.

M → C : h(retur nedAmount, c

0

, T

G

, CL

T R

, T

T R

, Y ), T

T R

(16)

The client expects to receive the updated CL

T R

, where updatedCL

T R

= current

CL

T

+ returnedAmount, and returnedAmount = CL

M

− j

max

. The client com-

pares CL

T R

with the received one. If they are matched, she can infer the updated

110

CL

T R

. Later on, the client can use the bank coupon with the updated CL

T R

to make a

payment to another merchant.

4 Discussions

4.1 Transaction Security Properties

In this section, we show that the simple cryptographic technique applied to our pro-

posed protocol satisfies the above transaction security properties. The following mes-

sage demonstrates how the technique works:

B → M : {c

0

, T G, SN, CL

M

, h(ID

M

, SN, CL

T R

, T

T R

, Y )}

Z

,

h(c

0

, T

G

, CL

M

, X) (4)

We can see that all transaction security properties for payment systems [1, 5] are

satisfied as follows:

1. Party authentication is ensured by symmetric encryption and Y shared between

the client and the bank. The encryption ensures that either the bank or the merchant

has originated the message, and Y ensures that the bank is the originator of the

message.

2.

Transaction privacy is guaranteed by symmetric encryption.

3.

Transaction integrity is guaranteed by h(c

0

, T

G

, CL

M

, X) forwarded from the

client.

4. Non-repudiation of transactions is ensured by h(ID

M

, SN, CL

T R

, T

T R

, Y ) in

that the bank cannot denythat it did not generate {c

0

, T

G

, SN, CL

M

, h(ID

M

, SN,

CL

T R

, T

T R

, Y )}

Z

since it is the only party that holds both Z and Y.

4.2 Dispute Resolution

Our proposed protocol provides offers the ability to resolve disputes among engaging

parties in both direct and indirect manners. According to direct dispute resolution, con-

sider the message (5) in Payment Initialization Protocol, we can prove that bank is the

originator of this message since h(ID

M

, SN, CL

T R

, T

T R

, Y ) can be retrieved by only

the client and the bank, but the client does not have the secret Z. Thus, the client is not

the originator of the message. However, some messages provide indirect dispute reso-

lution. Consider the message (10) sent from the merchant to the client in Extra Credit

Request Protocol, although the client can generate this message by herself, she cannot

modify the content of the message since it will be later detected by the bank.

4.3 Private Information

In any payment system, the information that is known only by relevant parties such

as secret keys, bank account information, price, or goods descriptions is considered as

Private Information [4]. Revealing such information offers the opportunity to perform

various kinds of attacks or to trace the client’s spending behavior.

111

In our proposed protocol, c

0

and c

j

max

are sent in encrypted forms compared to

signed messages in PayWord and cleartext in PayFair. Moreover, only c

j

is sent from

the client to the bank over the air. The bank can infer c

0

from c

0

= h(c, T

G

), where

n stands for the current CL

T R

and later sends c

0

to the merchant in the message (4).

Therefore, the secrecy of the requested amount is preserved.

4.4 Performance Analysis

To demonstrate the practicability of the proposed protocol, we compare our protocol

with PayWord [6] and PayFair [8] in terms of performance by focusing on the compu-

tation and the numbers of message passes of engaging parties.

Considering the party’s computation, we mainly focus on the numbers of crypto-

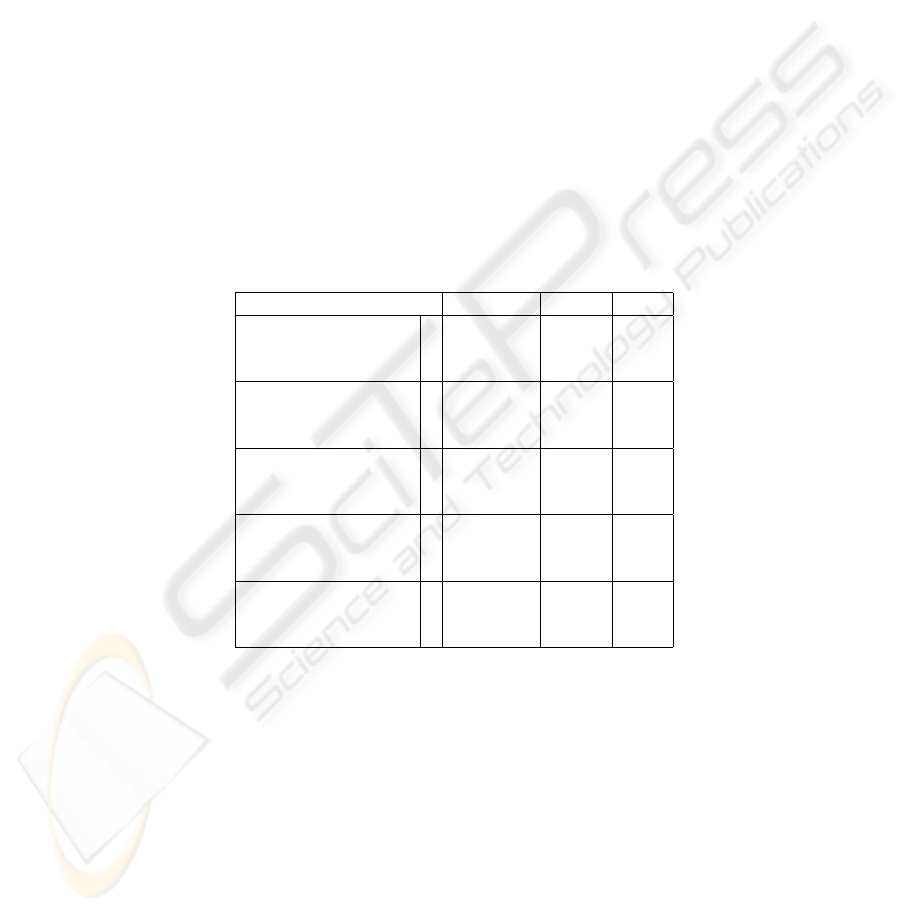

graphic operations applied to engaging parties. Table 1 demonstrates the numbers of

cryptographic operations applied to our protocol, PayWord, and PayFair, respectively.

Note that n stands for the computations for generating a set of coins.

Table 1. The number of cryptographic operations of SET, iKP, and KSL protocol at client, mer-

chant, and payment gateway, respectively

Cryptographic Operations

Our Protocol

PayWord

PayFair

1. Signature

C

-

1

-

M

-

-

-

B

-

1

-

2. Signature verifications

C

-

1

-

M

-

2

-

B

-

1

-

3. Symmetric operations

C

1

-

1

M

1

-

-

B

2

-

2

4. Hash functions

C

n

n

n

M

n

n

n

B

n

n

n

5. Keyed-hash functions

C

4

-

3

M

1

-

4

B

3

-

5

From Table 1, we can see that in our protocol, only symmetric-key operations and

hash functions are applied, compared to public-key operations in PayWord [6]. It infers

that our protocol has better performance than PayWord. Compared to PayFair [8], the

proposed protocol also has less party’s computation. Moreover, in PayFair, a client is

required to contact a bank for issuing a new coupon and generate a new set of coins

every time she runs out of credits whereas the coupon in our proposed protocol is issued

only once and can be used to make payments with many merchants. This greatly reduces

the computational load at the client. These features result in better performance than

PayFair.

112

B

MC

B

MC

1 2

2

1

2

3

B

MC

1

(1)

(2) (3)

Fig.1. The numbers of message passes in Payment Initialization Protocol of (1) the proposed

protocol, (2) PayFair, and (3) PayWord

According to the numbers of message passes, from Fig.1, we can see that the pro-

posed protocol has less numbers of message passes than PayFair which infers better

performance. Compared to PayWord, the proposed protocol has higher numbers of mes-

sage passes. However, PayWord is operated in postpaid mode which a client does not

require any payment authorization from a bank in Payment Initialization Protocol.

5 Conclusion

We pointed out the problems of existing micropayment protocols when applied to wire-

less environments due to poor performance and security flaws. We then proposed a

prepaid micropayment protocol for wireless networks which solves the above prob-

lems. We applied symmetric cryptographic technique which not only reduces parties’

computation, but also satisfies transaction security properties. We also performed per-

formance analysis to show that our protocol has better performance than PayWord [6]

and PayFair [8] which results in more applicable to limited capability wireless devices.

As our future works, we aim to extend the proposed protocol to perform postpaid

micropayments and compare the its results with existing postpaid micropayment proto-

cols including PayWord [6].

References

1. Ahuja, V.: Secure Commerce on the Internet. Academic Press (1996)

2.

Anderson, R., Manifavas, C., Sutherland, C.: NetCard - A Practical Electronic Cash System.

Lecture Notes in Computer Science, Vol. 1189 (1995)

3.

Kungpisdan, S., Srinivasan, B., Le, P.D.: Lightweight Mobile Credit-Card Payment Protocol.

Lecture Notes in Computer Science, Vol. 2904 (2003) 295–308

4.

Kungpisdan, S., Permpoontanalarp, Y.: Practical Reasoning about Accountability in Elec-

tronic Commerce Protocols. Lecture Notes in Computer Science, Vol. 2288 (2002)268–284

5.

Park, D.G., Boyd, C., Dawson, E.: Micropayments for Wireless Communications. Lecture

Notes in Computer Science, Vol. 2015 (2000) 192–205

6.

Rivest, R., Shamir, A.: PayWord and MicroMint: Two Simple Micropayment Schemes. Cryp-

tobytes, Vol. 2(1) (1996) 7–11

7. Romao, A., da Silva, M.: An Agent-based Secure Internet Payment Systems. Lecture Notes

in Computer Science, Vol. 1402 (1998) 80–93

8. Yen, S.M.: PayFair: A Prepaid Internet Micropayment Scheme Ensuring Customer Fairness.

IEE Computers and Digital Techniques, Vol. 148(6), (2001) 207–213

113