The Impact of Virus Attack Announcements on the

Market Value of Firms

Anat Hovav

1

and John D’Arcy

1

1

Temple University, MIS Department, Fox School of Business and Management,

1810 N. 13

th

Street, Philadelphia, PA 19122 USA

Abstract. The increase in security breaches in the last few years and the need to insure

information assets has created an intensified interest in information security and risk within

organizations. However, very little is known of the financial impact and the risk associated with

the various types of security breaches. This article reports the impact of virus attack

announcements on the market value of affected companies over a period of 15 years. The study

was conducted using event study methodology. The results show that in general the market

does not penalize companies that experience such an attack.

Keywords: information systems security, security breach, computer virus, event study

1 Introduction

Information Systems (IS) risk is a top concern for organizations [33]. These concerns

are due to the fact that the consequence of a security breach can be detrimental to a

company’s financial performance [13]. Thus, security strategies revolve around the

act of a security breach (or an attempt at one) and the need to minimize the financial

loss resulting from such a breach. Gordon et al. [15] proposed a framework to manage

cyber-risk. The antecedent activities involve the assessment of the risk involved in a

security breach. Subsequent steps involve the preventive measures necessary to avert

such an attempt. These measures are divided into technical or procedural measures

(i.e., access control, firewalls) and financial measures (such as buying cyber

insurance). The final step entails the maintenance of accepted level of risk.

The majority of current research on information security focuses on the preventive

measures required for reducing cyber-risk. There is a large body of research that

describes the technical aspects of security [14] such as encryption and secure

communications, access control, and intrusion detection. This research can help

managers select the technical preventive measures that best fit their organizational

needs. Similarly, research addressing the behavioral aspects of security breaches (e.g.,

[37]) can help managers understand procedural preventive measures. However, there

is a relatively small but growing body of academic research that can help managers

assess the economic threats and financial vulnerabilities caused by information

security breaches (for examples see [11, 14, 20, 26]). The goal of this paper is to add

to this body of knowledge by assessing the financial impact of virus attack

announcements on attacked companies.

In the following section, we describe the reasons for choosing market value as a

measurement of the economic impact of security breaches. Section 3 describes the

Hovav A. and D’Arcy J. (2004).

The Impact of Virus Attack Announcements on the Market Value of Firms.

In Proceedings of the 2nd International Workshop on Security in Information Systems, pages 146-156

DOI: 10.5220/0002668501460156

Copyright

c

SciTePress

characteristics of virus attacks and defines them as unexpected events. Section 4

introduces the financial measures of unexpected events. In Section 5, we detail the

methodology used. In section 6, we introduce and analyze the study’s results. In

section 7, we discuss the results, the study’s limitations, and future research.

2 Market Value

The economic impact of security breaches is of interest to companies trying to decide

where to place their information security budget [15]. As the characteristics of

security breaches change, companies continually reassess their IS environment for

threats [23]. In the past, Chief Information Officers (CIOs) have relied on FUD – fear,

uncertainty, and doubt – to promote IS security investments to upper management.

Recently, some insurance companies have created actuarial tables that they believe

provide ways to measure losses from computer interruptions and hacker attacks [34].

However, these estimates are questionable mostly due to the lack of historical data

[15]. Some industry insiders confess that the rates for such plans are mostly set by

guesswork [2]. As cited in Gordon et al., [15](p. 82): “These insurance products are

so new, that the $64,000 question is: Are we charging the right premium for the

exposure?” Industry experts cite the need for improved return on security investment

(ROSI) studies that could be used by the organization to justify investments in

security prevention strategies. However, assessing the financial loss from a potential

IS security breach is a difficult step in the risk assessment process for the following

reasons:

1. Many organizations are unable or unwilling to quantify their financial losses due to

security breaches (for additional information see [32])

2. Lack of historical data. Many security breaches are unreported. Companies are

reluctant to disclose these breaches due to management embarrassment, fear of

future crimes [19], and fear of negative publicity [31]. Companies are also wary of

competitors exploiting these attacks to gain competitive advantage [31].

3. Additionally, companies may be fearful of negative financial consequences

resulting from public disclosure of a security breach [16].

Justifying investments in IS security using ROSI measures is difficult to accomplish.

If the security measures work, the number of security incidents is low and there are no

measurable returns. Accounting based measures such as ROSI are also limited by the

lack of time and resources necessary to conduct an accurate assessment of financial

loss when companies’ IT resources are devoted to understanding the latest

technologies and preventing future security threats [25]. In addition, potential

intangible losses such as “loss of competitive advantage” that result from the breach

and loss of reputation [8] are not included in ROSI measures because intangible costs

are not directly measurable. Therefore, there is a need for a different approach to

assess the economic impact of security breaches. One such approach is to measure the

impact of a breach on the market value of a firm. A market value approach captures

the capital market’s expectations of losses resulting from the security breach. This

approach is justifiable because often companies are impacted more by the public

relations exposure than by the attack itself [16]. Moreover, managers aim to maximize

147

a firm’s market value by investing in projects that either increase shareholder value or

minimize the loss of shareholder value. Therefore, in this study we elected to use

market value as a measure of the economic impact of security breach (virus attack)

announcements on companies. In the following section we define a security breach as

an unexpected event and discuss the characteristics of virus attacks.

3 Virus Attacks and their Reported Impact

An IS security breach is a violation of an information system’s security policy. While

security has long been a concern for IS managers, reports of serious security breaches

have become more frequent in today’s networked environment. The explosion of the

World Wide Web (WWW) and the subsequent growth of e-commerce increase the

exposure of organizations to external security breaches. Evidence of the current state

of Internet security can be found in a recent CSI/FBI Computer Crime and Security

Survey [32]. In the last four years, Internet connectivity has been cited as the primary

source of attacks (78%). The most commonly reported security breaches are virus

attacks [32]. Virus attacks reportedly cause billions of dollars in damage and have

been accelerating in their scope and severity. Thus, we selected to study the financial

impact of virus attacks as an upper bound exemplar of security breaches.

A virus is a small piece of self-replicating computer code that attaches itself to a

larger, legitimate program [27]. While acknowledging the potential existence of

harmless or even productive viruses (as described in [7]), the discussion in this paper

is limited to viruses that are created with the purpose of causing damage. Early

viruses were static pieces of code that copied themselves from program to program or

diskette to diskette [29]. These viruses were easily contained – causing limited

damage. Today’s viruses are significantly more complex, which makes detection and

removal more difficult. The most common types of viruses include macro viruses, e-

mail viruses, trojan horses, and worms. In our discussion we term them all viruses.

While the threat of viral attacks was evident in the early 1980s, the first widely

seen viruses did not occur until later in the decade. By 1988, virus attacks against

IBM PCs, Apple II computers, and Macintosh computers had been reported [17]. The

emergence of computer networks and the Internet in particular has created a new

means for spreading computer viruses. Robert Morris is responsible for the first

known viral attack against the Internet [35], which infected nearly 6,200 individual

machines (about 7.3% of the Internet’s computers at the time) and caused 8 million

hours of lost access and an estimated $98 million in losses [26]. Since the Robert

Morris worm, the Internet has been the victim of numerous viral attacks (such as

Jerusalem, Chernobyl, and Michelangelo). However, until the mid 1990’s access to

the Internet was limited by the “Acceptable Usage Agreement”, thus limiting the

potential impact of virus attacks. Only after the commercialization of the Internet in

1994 was the Internet available to the general public, leading to an increasing number

of virus attacks that infected a large number of commercial organizations and caused

accelerated financial damage. For example, in March 1999, the Melissa virus forced a

number of large companies to shut down their e-mail systems, causing an estimated

$80 million in damages [5]. In May 2000, the LoveLetter worm (i.e., the I Love You

virus) caused an estimated $100 million in damage by infecting some 1.27 million

148

computer files worldwide, with nearly 1 million in the United States [18]. In July

2001, the Code Red worm spread at an unprecedented rate, doubling its infestation

rate every 37 minutes, eventually infesting over 350,000 hosts [28] and causing an

estimated $2 billion in damage [30]. In January 2003, the Slammer worm infected

about 90% of all vulnerable hosts on the Internet [28]. In August 2003, the Blaster

worm affected nearly 500,000 computers in its first week [6]. ICSA labs estimated

remediation costs (including hard, soft, and productivity costs) of $475,000 per

company for the Blaster worm.

4 Financial Impact of Unexpected Event

Following the taxonomy of computer security incidents developed by Howard and

Longstaff [21], a virus attack can be classified as a single computer and network

security event involving an action directed against a specific target. In this case, the

action is a virus attack and the target is a particular computer or a network of

computers. Within the taxonomy, not all events are considered likely or even possible

to occur. Therefore, we consider an Internet security breach (such as a virus attack) to

be a negative computer security event that is not expected to occur on a regular basis.

Prior research has assessed the financial impact of various unexpected events using

both market-based measures and accounting-based measures of performance.

However, the more popular research approach has been the event study. The event

study examines the stock market reaction to the public announcement of a particular

event and is based on the efficient market hypothesis [10]. According to the semi-

strong form of the efficient market hypothesis, the market price of a firm fully reflects

all publicly available information [12]. Therefore, an abnormal stock return associated

with an unexpected event should be observed and measurable if the event has

information content [22]. Previous research suggests that public news of an event that

is generally seen as negative will cause a drop in a firm’s stock price (e.g., [1]).

Sprecher and Pertl [36] found that firms experiencing a loss from a catastrophic event

sustained an immediate adverse effect on their stock price. Overall, prior studies of

negative, unexpected events indicate that the market penalizes announcing firms in

the first few days following the public disclosure of the negative event. However, it is

unclear if firms suffer similar penalties following an announcement of a virus attack.

Despite the impact of IS security breaches on organizations and the heavy financial

impact reported in trade magazines, there have been very few academic studies on the

topic. Ettredge and Richardson [11] assessed the market risk associated with

electronic commerce (e-commerce) activity. They performed a study to measure the

spillover effect in the stock market response to a series of Denial-of-Service (DOS)

attacks against several of the best-known Websites in February 2000. Results showed

that investors do perceive risk in e-commerce activities as the DOS attacks had a

larger negative spillover market impact on Internet firms than on non-Internet firms.

Hovav and D’Arcy [20] found that DOS attacks have little effect on the market value

of attacked companies. However, these attacks have a larger impact on E-commerce

companies whose core business depends on their Web presence than on non-Internet

specific companies. McAfee and Haynes [26] conducted the only study to estimate

the impact of virus attacks. They calculated the damage of the Robert Morris worm

149

using accounting-based measures including direct programmer costs, indirect labor

and burden costs, and indirect costs such as lost machine down time and user lost

access time. Given the increase in the number of virus attacks over the last 15 years

and the increase in their severity, it is imperative to evaluate the economic impact of

these attacks. As described above, prior research found that public announcements

that contain negative information cause an abnormal drop in the stock value of

affected companies. Therefore, we anticipate that virus attack announcements will

have a negative impact on the stock value of attacked companies.

H1: An announcement of a virus attack of a company j will result in negative

abnormal returns on stock j for the day of the announcement.

Traditional event studies look at the distribution of the cumulative standardized

abnormal returns (CSAR) of all affected companies. The virus attacks are expected to

have a negative impact on the CSAR of the sample (i.e., the total of the actual returns

<< total expected returns).

H2: The cumulative standardized abnormal returns for the entire sample during the

event period are significantly negative.

The following section depicts the methodology used. The data collection and

analysis conform to the conventional procedures used in event studies.

5 Methodology

A procedure for sample selection similar to the method used by Subramani and

Walden [38] and Im et al. [22] was followed in this study. We collected data on virus

attacks using a search of business news in the Lexis-Nexis database. The search

consisted of all public announcements of virus attacks between 1988 and 2002

resulting in 224 announcements. The initial list was then refined and evaluated based

on the following criteria:

1. Only announcements by firms publicly traded on either the New York Stock

Exchange (NYSE) or the NASDAQ stock exchange were included.

2. Announcements that might be confounded by other key firm notices such as

mergers, acquisitions, earnings, stock splits, dividends, etc. within five days of the

virus attack announcement were excluded.

3. To remove event day uncertainty [9], we triangulated our Lexis-Nexis search

results with additional Web searches and information from financial publications.

For individual firms’ stock market data, we relied on the database of the Center for

Research in Security Prices (CRSP). We included in the sample only virus attack

announcements for which stock return data was available. These sampling criteria

yielded 186 virus attack announcements (events). The impact of announcements of

virus attacks on common stock prices is computed using event study methods

commonly employed in the accounting and finance literature [10]. The event of

interest in this study is the public announcement of a virus attack by either the

attacked firm or some other media outlet. If an announced virus attack contains new

information, it should cause the markets to revalue the firm. Determining whether

these events affect a firm’s stock price requires that we estimate what the firm’s stock

price would have been had there been no announcement. We then calculate the

150

standardized abnormal returns. Under the null hypothesis of zero expected abnormal

returns, Z is approximately unit normally distributed (see [24]). For a more detailed

discussion of analytical techniques employed in event studies, see Campbell et al. [4].

6 Analysis and Results

To test hypothesis 1, we calculated the mean abnormal return for each individual

company, analyzed the results, and assessed the impact. Table 1 summarizes our

findings. Overall, the results indicate that the virus announcements did not result in

negative abnormal returns over any of the five event periods for our sample of

attacked companies, as the mean abnormal return for each event period was positive.

Thus, hypothesis 1 was not supported. However, there is partial support for

hypothesis 1 as almost half of the firms experienced negative abnormal returns (Table

1) for a period of 25 days after the announcement.

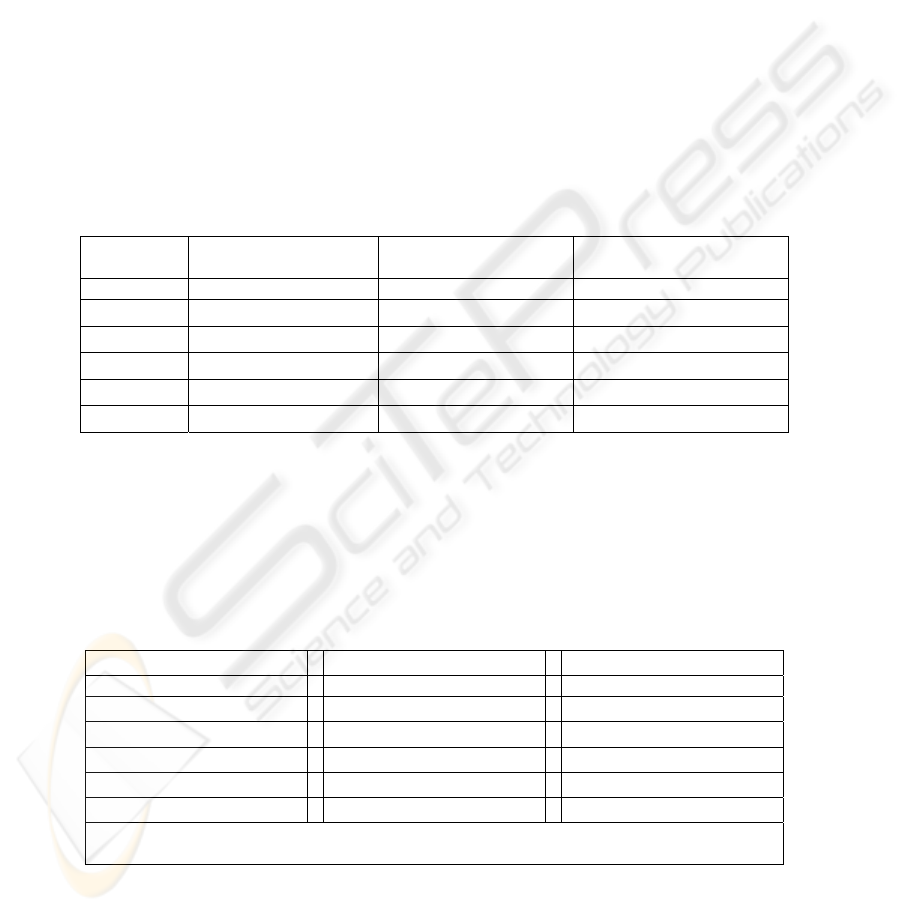

Table 1. Mean Abnormal Returns and Number of Negative Returns for Attacked Companies

Event

Windows

Mean Abnormal

Return

Median Abnormal

Return

Number of Negative

Abnormal Returns

[ 0, 0 ] 0.0032 0.0019 79 (42%)

[ 0, 1 ] 0.0029 0.0010 81 (44%)

[ 0, 5 ] 0.0013 0.0016 79 (42%)

[ 0, 10 ] 0.0012 0.0013 82 (44%)

[ 0, 25 ] 0.0005 0.0007 84 (45%)

To test hypothesis 2, we calculated the CSAR for the entire sample. Table 2 lists

the mean CSAR for each event window as well as the results of the z-tests to test the

significance of the CSAR. Average CSARs for each of the event periods are positive,

indicating that the virus attack announcements did not result in lower abnormal

returns for the sample over any of the time periods. These results are contrary to what

was expected, and therefore we reject hypothesis 2.

Table 2. Cumulative Standardized Abnormal Returns (CSAR) for Attacked Companies

Event Windows Mean CSAR Z-value*

[ 0, 0 ] 0.1196 1.6317

[ 0, 1 ] 0.0787 1.0730

[ 0, 5 ] 0.0554 0.7550

[ 0, 10 ] 0.0380 0.5183

[ 0, 25 ] 0.0134 0.1829

* Z- statistic to compute the significance of the average abnormal return over each event period

under the null hypothesis that the average abnormal return is zero.

151

To further test hypothesis 2, we divided the virus announcements into industry sub-

samples by the SIC (Standard Industrial Classification) code of the attacked company.

Similar results were found analyzing the sample by industry (i.e., there is no industry

impact on the results of the analysis). These results are displayed in Appendix A.

7 Discussion

Overall, the above results did not demonstrate that there is a significant impact of

virus attack announcements on the share price of the attacked companies. Mean

abnormal returns were positive for each of the event periods studied. In addition,

CSARs were not significantly negative (for the total sample or by industry) over any

of the five event periods, whereas viruses were associated with negative stock returns

for about 44 - 45% of the attacked companies. These unexpected findings are

contradictory to the increasing financial impact reported by trade magazines and may

be due to one of the following: (1) the market anticipates the virus attacks and

incorporates the projected losses into the stock value of companies; or (2) there is

little awareness in the general public as to the real damage caused by virus attacks,

thus the market does not react to such announcements; or (3) the financial damage

reported in trade magazines is inflated and the above market analysis reflects a more

rational view of the actual damages.

Our findings demonstrate that the market does not penalize firms when they are

exposed to virus attacks which results in little incentives for managers to demand

improved security in current Information Systems (i.e., trustworthy computing) from

IT vendors

1

. This also supports Blumenthal’s [3] assertion that IT vendors take little

action to increase information technology security due to lack of demand from their

users. Thus, the assumption that market forces can be used as means to control

security breaches and to increase the trustworthiness of computer systems might be

false.

The above discussion suggests the need for further research in this area. First, there

is a need to better understand the actual economic and financial impact of security

breaches and their reflection on the market. Second, it is unclear if other types of

attacks will have a more significant impact on shareholders’ value. For example,

recent legislation places legal liability on companies that expose private information

to unauthorized entities (e.g., HIPAA, California’s Database Breach Notification

Security Act –SB 1386). Liability lawsuits may introduce new costs that could be

perceived (by the market) as more substantial than the cost to recover from a virus

attack. Therefore, it is possible that security breach announcements that involve the

exposure of private information will result in more significant negative abnormal

returns. Taxonomy of security breaches and the extent of their impact will allow

managers to concentrate their efforts and allocate security budgets towards breaches

1

For example, Microsoft’s trustworthy computing initiative is estimated to cost $200 million

and already delayed the launch of Server 2003 by several months. These additional costs will

ultimately be transferred to the customer. Given that virus attacks do not reduce shareholder

value, managers will have little incentive to demand increased security from IT vendors,

which will only increase firms’ IT costs.

152

that have larger effect. Third, there is a need to understand the impact of viruses on IT

vendors and the factors that will drive the IT industry to create more secure

information systems. In addition, future research can examine the impact of virus

attacks on small and private organizations that may not have the resources to quickly

recover from such attacks.

This study has several limitations. First, our sample contained two time clusters

involving the Melissa virus in March 1999 and the LoveBug virus in May 2000. Time

clusters can increase the significance of the results [9]. We repeated the analyses

without the announcements involving these two virus events and the overall results of

the study did not change. Second, the sample consists of only publicly traded

companies. Therefore, the results cannot be generalized to non-publicly traded

companies. Finally, many of the attacks caused a short downtime. Therefore, it is

possible that the stock value was down during the day but closed normal once the

problem was fixed and the affected systems were functioning again. This is referred

to as intra-day stock movement.

8 Conclusions

Reports of security breaches in the popular business press suggest that computer

viruses cause substantial financial damage to attacked companies. In this paper, we

assessed the impact of virus announcements on attacked companies over a period of

15 years using event study methodology. Our results indicate that in general the

market does not penalize companies who are victimized by virus attacks. These

results are contradictory to findings in prior research, which indicates that the market

penalizes companies involved in events containing negative information. These

results also suggest that market forces cannot be used as a means of controlling

security breaches nor can they be used to entice IT vendors to increase the

trustworthiness of computer systems. Further research is required to understand the

risk associated with security breaches. In addition, recent legislation suggests the need

to better understand the factors that will reduce security risks and lead to a

trustworthier Information Technology environment.

References

1. Baginski, S. P., R. B. Corbett, et al. (1991). "Catastrophic Events and Retroactive

Liability Insurance: The Case of the MGM Grand Fire." The Journal of Risk and

Insurance 58(2): 247-260.

2. Berinato, S. (2002). Finally, a Real Return on Security Spending. CIO: The

Magazine for Information Executives. 15: 42-52.

3. Blumenthal, M. (1999). "The Politics and Policies of Enhancing Trustworthiness

for Information Systems." Communication Law & Policy 4(4): 513-555.

4. Campbell, J. Y., A. W. Lo, et al. (1997). Event Study Analysis. Chapter 4 in The

Econometrics of Financial Markets. Princeton, NJ, Princeton University Press.

153

5. Chen, C. Y. and G. Lindsay (2000). Viruses, Attacks, and Sabotage: It's a

Computer Crime Wave. Fortune. 141: 484-487.

6. Chen, T.M., (2003). “Trends in Viruses and Worms.” The Internet Protocol Journal

6(3): 23-33.

7. Cohen, F (1984). Computer Viruses: Theory and Experiments. Proceedings of the

Second IFIP International Conference on Computer Security, Toronto, Ontario,

Canada.

8. D'Amico, A. (2000). What Does A Computer Security Breach Really Cost?, The

Sans Institute. 2000.

9. Dyckman, T., D. Philbrick, et al. (1984). “A Comparison of Event Study

Methodologies Using Daily Stock Returns: A Simulation Approach.” Journal of

Accounting Research 22: 1-30.

10.Etebari, A., J. O. Horrigan, et al. (1987). "To Be or Not To Be - Reaction of Stock

Returns to Sudden Deaths of Corporate Chief Executive Officers." Journal of

Business Finance & Accounting 14(2): 255-279.

11.Ettredge, M. and V. J. Richardson (2001). Assessing the Risk in E-Commerce.

Twenty-Second International Conference on Information Systems, New Orleans,

LA.

12.Fama, E., L. Fisher, et al. (1969). "The Adjustment of Stock Prices to New

Information." International Economic Review 10: 1-21.

13.Glover, S., S. Liddle, et al. (2001). Electronic Commerce: Security, Risk

Management, and Control. Upper Saddle River, NJ, Prentice Hall.

14.Gordon, L.A. and M.P. Loeb (2002). “The Economics of Information Security

Investment.” ACM Transactions on Information and Systems Security 5(4): 438-

457.

15.Gordon, L.A., M.P. Loeb, et al. (2003) “A Framework for Using Insurance for

Cyber-Risk Management.” Communications of the ACM 46(3): 81-85.

16.Hancock, B. (2002). “Security Crisis Management - The Basics.” Computers &

Security 21(5): 397-401.

17.Hayes, F. (2003). The Story So Far. Computerworld. 37: 26-27.

18.Hinde, S. (2000). "Love Conquers All?" Computers & Security 19(5): 408-420.

19.Hoffer, J. A. and D. W. Straub (1989). "The 9 to 5 Underground: Are You Policing

Computer Crimes?" Sloan Management Review (Summer 1989): 35-43.

20.Hovav, A. and J. D’Arcy (2003) “The Impact of Denial-of-Service

Announcements on the Market Value of Firms.” Risk Management and Insurance

Review, 6(2): 97-121.

21.Howard, J. D. and T. A. Longstaff (1998). A Common Language For Computer

Security Incidents. Pittsburgh, PA, CERT Coordination Center at Carnegie Mellon

University: 1-33.

22.Im, K. S., K. E. Dow, et al. (2001). “A Reexamination of IT Investment and the

Market Value of the Firm: An Event Study Methodology.” Information Systems

Research 12(1): 103-117.

23.Kelly, B. J. (1999). "Preserve, Protect, and Defend." Journal of Business Strategy

(September/October 1999): 22-26.

24.Loderer, C. and D. C. Mauer (1992). “Corporate Dividends and Seasoned Equity

Issues: An Empirical Investigation.” Journal of Finance 47(1): 201-225.

25.Lyman, J. (2002). In Search of the World's Costliest Computer Virus,

www.newsfactor.com/perl/story/16407.html. 2002.

154

26.McAfee, J. and C. Haynes (1989). Computer Viruses, Worms, Data Diddlers,

Killer Programs, & Other Threats To Your System. New York, New York, St.

Martins Press.

27.Montana, J. C. (2000). "Viruses and the Law: Why the Law is Ineffective." The

Information Management Journal 34(4): 57-60.

28.Moore, D., G.M. Voelker, et al. (2001). “Inferring Internet Denial-of-Service

Activity.” Proceedings of the 10

th

USENIX Security Symposium, Washington,

D.C.

29.Nachenberg, C. (1997). "Computer Virus - Antivirus Coevolution."

Communications of the ACM 40(1): 46-51.

30.Panko. R.R. (2003). “Slammer: The First Blitz Worm.” Communications of the

Association for Information Systems. 11: 207-218.

31.Power R. (2001). “2001 CSI/FBI Computer Crime and Security Survey.”

Computer Security Issues and Trends 7(1): 1-18.

32.Power, R. (2003). “2003 CSI/FBI Computer Crime and Security Survey.”

Computer Security Issues and Trends 9(1): 1-20.

33.Salierno, D. (2001). Managers Fail to Address E-risk. The Internal Auditor. April

2001: 13.

34.Salkever, A. (2000). Who Pays When Business Is Hacked?,

www.businessweek.com/bwdaily/dnflash/may2000/nf00523d.htm.

35.Spafford, E. (1999). "Crisis and Aftermath." Communications of the ACM 32(6):

678-687.

36.Sprecher, R. and M. Pertl (1988). “Intra-Industry Effects of the MGM Grand Fire.”

Quarterly Journal of Business and Economics 27: 96-16.

37.Straub, D.W. and R.J. Welke. (1998) “Coping With Systems Risk: Security

Planning Models for Management Decision Making.” MIS Quarterly 22(4):

441-469.

38.Subramani, M. and E. Walden (2001). “The Impact of E-Commerce

Announcements on the Market Value of Firms.” Information Systems Research

12(2): 135-154.

155

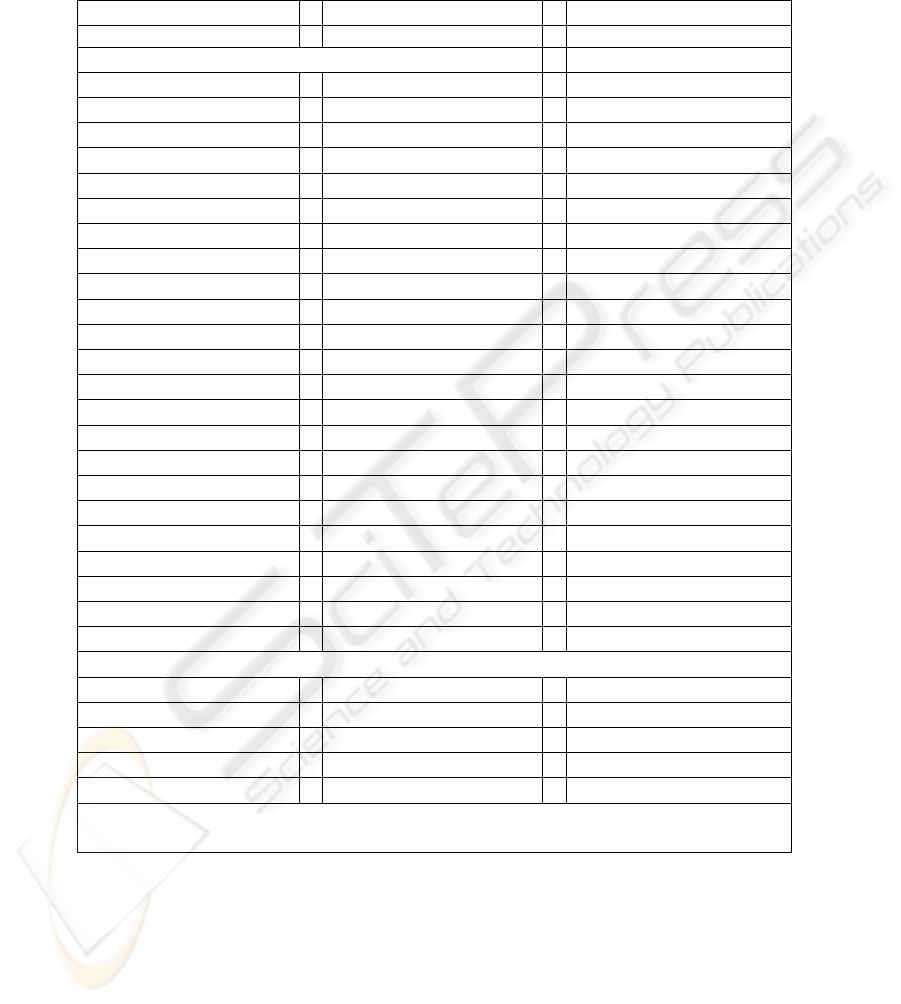

Appendix A. Cumulative Standardized Abnormal Returns (CSAR) for Attacked Companies

by Industry

Event Windows Mean CSAR Z-value*

Finance, Insurance, and Real Estate (n=25)

[ 0, 0 ] 0.0919 0.4596

[ 0, 1 ] 0.1260 0.6300

[ 0, 5 ] 0.1309 0.6546

[ 0, 10 ] 0.0061 0.0303

[ 0, 25 ] -0.0261 -0.1305

Manufacturing(n=78)

[ 0, 0 ] 0.0911 0.8047

[ 0, 1 ] 0.0835 0.7374

[ 0, 5 ] 0.0242 0.2136

[ 0, 10 ] 0.0233 0.2062

[ 0, 25 ] 0.0100 0.0883

Retail Trade (n=6)

[ 0, 0 ] 0.2835 0.6944

[ 0, 1 ] -0.1170 -0.2866

[ 0, 5 ] 0.0440 0.1077

[ 0, 10 ] 0.0412 0.1009

[ 0, 25 ] 0.0436 0.1067

Services (n=35)

[ 0, 0 ] 0.1462 0.8649

[ 0, 1 ] 0.0692 0.4094

[ 0, 5 ] -0.0393 -0.2325

[ 0, 10 ] -0.0116 -0.0687

[ 0, 25 ] -0.0139 -0.0821

Transportation, Communications, Electric, Gas and Sanitary Services (n=42)

[ 0, 0 ] 0.1436 0.9306

[ 0, 1 ] 0.0774 0.5017

[ 0, 5 ] 0.1488 0.9641

[ 0, 10 ] 0.1251 0.8110

[ 0, 25 ] 0.0617 0.3999

* Z statistic to compute the significance of the average abnormal return over each event period

under the null hypothesis that the average abnormal return is zero.

156