ENHANCING THE SECURITY OF MOBILE E-COMMERCE

WITH A HYBRID BIOMETRIC AUTHENTICATION SYSTEM

Rachid Bencheikh, Luminita Vasiu

Wireless IT Research Centre, University of Westminster, 115 New Cavendish Street, London, UK

Keywords: Biometrics, Authentication, E-commerce, M-commerce, Wireless, Speech recognition.

Abstract: Mobile devices and wireless technologies seem destined to make a large and continuing impact on our lives.

Mobile devices especially have been widely used in the last few years, and recent developments in wireless

technologies have provided some new solutions to connectivity problems. Wireless technologies provide a

new channel for implementation of mobile payments systems, the potential of short-range wireless

technologies in commercial markets is enormous. Furthermore, as the popularity of m-commerce increases,

so does the need for protecting personal privacy and online data. Several user authentication schemes for

mobile e-commerce are starting to be introduced. This paper discusses some single factor and hybrid

authentication methods currently in use, or being planned, for e-commerce and m-commerce. It also

suggests a hybrid three-factor authentication scheme for mobile commerce, especially for voice-based

mobile commerce, that uses speech recognition and speaker verification technology. Some issues relevant to

such a scheme are also discussed.

1 INTRODUCTION

One outcome of the lack of user authentication in

electronic commerce (e-commerce) is a greater

incidence of identity theft and fraud. A notable

attempt to reduce these problems is Secure

Electronic Transactions (SET) (GPayments, 2002).

SET was supported initially by Mastercard, Visa,

Microsoft, Netscape, and others, SET attempts to

enable participants in an e-commerce transaction to

authenticate themselves to each other using public

key cryptography for creating digitally signed

documents that would be exchanged among the

participants. SET has not been successful to date for

a number of reasons, including high costs,

complexity related to the supporting Public Key

Infrastructure (PKI), interoperability problems, and

the fact that it requires consumers to install an

electronic wallet on their PCs to perform the

necessary cryptographic tasks.

Visa, Mastercard and American Express have

introduced some additional security measures to

protect against online credit card fraud. These

measures are largely based on knowledge of a

password or Personal Identification Number (PIN)

for user authentication during an online transaction.

Authentication based solely on knowledge or

“something you know”, such as a password, is

typically referred to as single factor authentication.

The possession of a smartcard, in addition to using a

password, introduces a stronger hybrid two-factor

authentication, since possession or “something you

have” is also required for authentication.

Three-factor authentication, which adds

“something you are”, would be an even stronger and

more secure form of authentication, and introduces

biometrics into the scene of authentication

technologies. At present, this level of security is not

generally available for online commerce (Corcoran,

2002). As the performance characteristics and costs

associated with biometrics becomes more widely

understood, and as the underlying technology gets

better, three-factor authentication could become

prevalent. One area in which three-factor

authentication might be especially useful is mobile

commerce, which is the term used to describe

commerce transactions conducted using a mobile

phone or other handheld wireless device. Although

not yet a widespread phenomenon in the UK, mobile

commerce transactions using a mobile phone may be

247

Bencheikh R. and Vasiu L. (2005).

ENHANCING THE SECURITY OF MOBILE E-COMMERCE WITH A HYBRID BIOMETRIC AUTHENTICATION SYSTEM.

In Proceedings of the Second International Conference on e-Business and Telecommunication Networks, pages 247-253

DOI: 10.5220/0001423902470253

Copyright

c

SciTePress

dependent on the additional security that three-factor

authentication can provide.

Perfect authentication would be a process where

every impostor is rejected, and every legitimate

person is correctly authenticated, even in the

scenario where the impostor knows all of the

person’s private information. Currently, no method

of perfect authentication exists (Basu, 2003). Some

methods of biometrics, such as a retinal scan, are

99.9% secure, but all biometric methods of

authentication are at risk in some ways. Other

methods include zero-knowledge proofs, and the use

of public key cryptography in synthesis with a

trusted, highly secure certification authority (Bolle,

2004).

2 SINGLE FACTOR

AUTHENTICATION

Credit card companies are beginning to introduce

single factor authentication schemes based on

information known to a cardholder in order to help

reduce fraudulent online credit card transactions.

Visa International has introduced 3-D Secure, which

requires users to first register their Visa cards for the

service. During enrolment, users select a password

to be used when shopping online. During the

purchase transaction, users enter their Visa card

numbers as well as their passwords, which provides

the additional layer of security. Mastercard has a

somewhat different version, called Secure Payment

Application (SPA), which requires that a kind of

electronic wallet be downloaded to a user’s machine

(Shi, 2004 ). This wallet is a “thin” client and is

different from the wallet required by SET in that it is

not part of a PKI, and does not perform

cryptographic computations. When a user visits

websites that have been enabled to handle SPA

payments, the wallet pops up on the user’s screen,

and a user ID and password must be provided for

authentication. This information is encrypted by the

browser and sent to the card issuer for

authentication. Once the user is authenticated to the

wallet, transaction specific information as well as

credit card and customer information is exchanged

between the wallet, the merchant’s site, the card

issuer’s site, and the acquirer’s site (i.e., the bank

that processes the merchant’s credit card

transactions). This goes a step beyond 3-D Secure in

that the user does not have to specifically provide

credit card and shipping information to the

merchant, since this is provided by the SPA.

Authentication is performed once per session with

SPA. Once the user is authenticated to the wallet, no

further authentication is required if purchasing at

different Websites.

3 TWO-FACTOR

AUTHENTICATION

A two-factor authentication scheme, based on

possession of a smartcard, has been introduced by

American Express with their Blue card (GPayments,

2002). Visa and Mastercard also have smartcard

payment schemes in the works. Since the Blue card

has an embedded chip, users must have an

appropriate card reader attached to their PCs. This

approach is similar to the single factor Private

Payments process in that users are provided with a

one-time card number to use for each purchase

transaction. The difference is that, in addition to a

password, the user’s Blue card must be inserted in

the card reader in order to be assigned the one-time

number. While providing a greater level of security,

this two-factor authentication scheme has the

drawback that a card reader must be available.

4 MOBILE COMMERCE AND

USER AUTHENTICATION

E-commerce needs not be restricted to PCs only. As

mobile phones become more ubiquitous, and their

designs become increasingly more sophisticated, it is

inevitable that they will be used for more than voice

communication. In Japan, according to some

estimates, over 32 million mobile phone users

subscribe to NTT DoCoMo’s i-mode Internet access

service (Sharaf, 2004). This service enables users to

do everything from sending and receiving text

messages, to making online banking and stock

trading transactions, to downloading images. While

Asia may be leading the world in non-voice uses for

mobile phones, in the UK the uptake for these types

of applications is less significant. In the UK, internet

access using a mobile phone is largely based on

Wireless Access Protocol (WAP), a precursor to the

envisioned 3G broadband wireless network. WAP

has slow downloading speeds and lacks of

compelling applications.

There are probably several reasons for the

unpopularity of WAP-enabled Internet applications

ICETE 2005 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

248

in the UK. Most users are used to high speed internet

access via PC-based web browsers, which are not as

common in Japan. So there may be less interest

generally in web access via mobile phone. The low

data speeds available using today’s circuit switched

wireless networks are probably a factor, although the

emerging always-on, packet-switched 3G wireless

systems are supposed to provide bandwidths up to 2

Mbps. Another possibility is the user interface itself.

Having to negotiate multiple tiny screens to

complete simple Web transactions is clumsy and

uncomfortable for many users. Screens on i-mode

mobile phones are usually somewhat larger. In any

case, it is a fact that in the UK, mobile phones are

largely perceived as devices intended for voice

communications rather than for data applications.

Despite the lack of mobile commerce activity

today, there are several industry initiatives that seek

to address the problem of secure financial or

commerce transactions from a mobile phone or other

mobile wireless devices. Among these are

(Radicchioi, 2002 ): Visa Mobile 3D-Secure,

Mastercard Secure Payment Application, Global

Mobile Commerce Interoperability Group, Mobile

Electronic Transactions (MeT), Mobey Forum,

Mobile Payment Forum, Paycircle. These initiatives

focus on the larger questions of mobile payment

alternatives, without focusing specifically on user

authentication. The concept of a mobile wallet is

important in many of these mobile payment

alternatives. The mobile wallet allows the storage of

information about a purchaser, such as shipping

address, as well as information about multiple credit

cards (Corcoran, 2002). Unlike PC-based wallets,

mobile wallets provide a value-added service to a

mobile user, since they eliminate the need to provide

credit card and shipping details via the limited

interface capabilities of the mobile phone. A mobile

wallet can reside either on a mobile phone itself, or

at a remote wallet server accessible over the internet.

There are several advantages to a server-based

wallet, including efficiencies related to upgrades and

additional functionality that can be added by the

service provider. A server-based wallet can also be

accessed by more than one mobile phone.

4.1 Two-Factor User Authentication

Two-factor authentication for mobile commerce may

be based not only on a PIN or password, but also on

user possession of a token. A specific mobile phone

that has previously been registered with a mobile

wallet could act as the token. Shi et al (Shi, 2004)

suggests that a mobile phone’s Mobile Station ISDN

Number (MSISDN) might be used to identify a

particular phone. For GSM mobile phones

containing a SIM card holding identifying

information such as a phone number, it is actually

the SIM card that acts as the token. The

authentication process would require that not only

the password or PIN, but also the identifying

information contained on an internal chip or SIM

card in the mobile phone, be passed to the server-

based mobile wallet.

A mobile phone might also contain an internal

chip containing the wallet, or it might have a slot

into which a smartcard containing the wallet can be

inserted. The Mobey Forum, whose members are

mainly European banks and other international

companies, endorses a scheme based on a bank-

issued chip card that can be inserted into the mobile

device. Embedded within the chip is a wallet

containing payment and fulfilment (i.e., shipping)

information. Users would authenticate themselves to

the wallet using a password, but possession of the

mobile phone containing the wallet itself would act

as the second security factor.

Radicchio is another international consortium

(Radicchioi, 2002 ) concerned with secure mobile

commerce. The Radicchio approach is based on a

wireless PKI, which ensures that mobile commerce

transactions satisfy several important security-

related criteria. These are: integrity, authentication,

confidentiality and non-repudiation. PKI is based on

establishing trusted relationships between

participants, and involves the use of a private key by

which an authorised user can encrypt a message that

can only be decrypted with the corresponding public

key. This establishes the user’s digital signature.

However, the authentication part of the PKI

paradigm depends on a mechanism, which ensures

that only the correct party can gain access to their

private key. Radicchio uses a two-factor approach to

authentication. Private keys are stored on a smart

card that must be in the possession of the authorised

user. This smart card may be in the form of a SIM

card for GSM mobile phones, or a larger card that

can be inserted into a slot. The private key is then

unlocked using a PIN.

ENHANCING THE SECURITY OF MOBILE E-COMMERCE WITH A HYBRID BIOMETRIC AUTHENTICATION

SYSTEM

249

4.2 Three-Factor User

Authentication

Three hybrid factors taken together: something you

know, something you have, and something you are,

are generally acknowledged to provide the most

secure form of user authentication. The first factor

would correspond to a PIN, the user could either

speak the digits of the PIN, or enter it via the

keypad. The second factor “something you have”

would correspond to a token possessed by the user,

which would be the user’s mobile phone or SIM

card. During the authentication process, the mobile

phone would have to transmit a unique identifier to

the application performing the authentication. This

identifier might correspond to the telephone number

assigned to the phone, and (for GSM phones) would

be contained within the phone’s SIM card. This

scheme implies that users must initially enroll their

token (i.e., mobile phone or SIM card) with the

authenticating system.

The third factor “something you are” would

correspond to the user’s voice biometric, or

voiceprint. Although voice seems like a natural and

obvious biometric to use when speaking on a mobile

phone, it is now possible to use mobile phones that

have an embedded fingerprint reader or a camera.

While that remains a possibility, we will focus only

on voice biometrics here. During enrolment, the user

creates one or more voiceprint templates that will be

matched later with voiceprints generated during the

authentication process. There are also security issues

involved with the enrolment process itself, such as

making sure that the correct person is being enrolled,

but these will not be addressed here.

A user authentication scenario for voice-enabled

mobile commerce might therefore work like this:

User wishes to order cinema tickets from his

mobile phone. He dials into his voice browser, and

asks to buy tickets for a particular event. His phone

number or other unique identifier associated with a

chip or smartcard inside phone, is automatically

transmitted to mobile wallet, via the browser.

Suppose that for this particular mobile phone,

only two users are authorised to use it for secure

financial or commerce transactions. Therefore,

associated with this phone number, a small set of

valid PINs and associated voiceprint templates have

been pre-registered. The wallet recognises the

mobile phone number, and retrieves the

corresponding PINs and templates. User is prompted

to supply PIN.

User speaks the digits of my PIN. The digits are

recognised by the speech processing application, and

a comparison is made against the stored voice

template associated with this phone number. The

PIN matches that stored against user’s name, and

serves to identify him.

User is prompted to speak his name. The name is

recognised as an authorised user by the system, and

the voiceprint of user’s name corresponds to the

voiceprint on file for this PIN and mobile phone

number. User’s identity has now been authenticated

to the financial/commerce wallet.

This is an example of a text dependent approach,

since it is based on the user providing a fixed

password or PIN. A few permutations on this

scheme are possible. Instead of speaking the PIN, a

user could enter it on the phone’s keypad, which

would prevent someone else from overhearing it.

Another possibility is that no PIN needs to be

entered in this way. Instead, the user utter a secret

phrase, which has two purposes. The words of the

phrase constitute a password, and the computed

voiceprint is matched against a stored template of

the user’s utterance of the phrase during enrolment.

If the words of the phrase and the voiceprint match,

again a hybrid three-factor authentication has taken

place.

5 REPLAY ATTACKS

One weakness of this type of authentication is the

possibility of replay attacks. In a replay attack, the

attacker records the response of a valid user, and

then replays it back to the system at a later time. If

the quality of a voice recording is very good, a

speaker verification system may not be able to tell

the difference between the recording and a live

response (Basu, 2003). One way around this

problem is to use a rotating challenge/response

scheme that helps to ensure real time authentication.

Such a challenge/response design would require the

user to respond to a challenge that changes each

time. This would tend to discourage replay attacks,

since the attacker presumably would have difficulty

recording all possible responses. For instance,

during enrolment the user might be asked to provide

the answers to a number of questions known only to

the user. During authentication, a challenge would

prompt for the answer to one of these questions.

Another way to overcome the possibility of a replay

attack is with a text prompted approach. For

example, a user may be prompted to utter a

ICETE 2005 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

250

randomly chosen string of digits. The voiceprints of

the user speaking these digits would be matched

against templates provided during enrolment (CCIR)

(Pearce, 2000).

6 CONVENIENCE VERSUS

SECURITY

During authentication, a matching algorithm is used

to compare the voiceprint(s) of the person seeking to

be authenticated, with those templates stored during

enrolment. Since the voiceprint created during

authentication will never exactly match the

templates of a legitimate user created during

enrolment, a threshold must be defined for

determining what is an acceptable match. If the

matching algorithm produces a measure greater than

the threshold, the user is accepted, if not, the user is

rejected (Roussos, 2004). This leads to two types of

errors: the false acceptance of an imposter, and the

false rejection of a legitimate user. The frequency of

occurrence of the first type of error is known as the

False Acceptance Rate (FAR), whereas the

frequency of the second type of error is known as

the False Rejection Rate (FRR) (Bolle, 2004).

For highly secure financial and commerce

applications, it would be critical to allow an

imposter to gain access. Such systems would need to

have a very low FAR. On the other hand, a system

that requires less stringent security might

occasionally grant access to an unauthorised person,

but should almost never reject a legitimate user. For

instance, authentication of valid ticket holders to a

sporting event might fall under this category. Such a

system would therefore require a very low FRR.

Ideally, authentication schemes should have both

very low FARs and FRRs.

Figure 1: False Rejection Rate (FRR) vs False Accept

Rates

A diagram (Figure 1) of the error rate versus

threshold illustrates the tradeoff between security

and convenience. As Figure 1 shows, there is an

inverse relationship between FAR and FRR. As the

threshold becomes larger, FAR decreases, while

FRR increases. As the threshold becomes smaller,

the opposite is true. There is thus a certain threshold

where FRR equals FAR. The error rate at which the

FAR equals the FRR is known as the equal error

rate, and is often used as a performance measure for

speaker verification systems.

7 LIMITATIONS OF VOICE

RECOGNITION

One problem with using voice recognition is the

robustness of this biometric technique to variable

environmental conditions and to impersonation. It is

possible to reduce the effect of these factors

considerably by employing face and voice

recognition concurrently and co-operatively. Such

multimodal systems can be shown to be less

sensitive to variations in speech patterns of a

particular individual, to background noise, poor

transmission conditions in remote applications and

to determined attacks by impostors. Furthermore, the

human voice may sound different under different

circumstances, such as sickness for instance.

Background noise is also a problem, since it can

affect the voiceprint, although algorithms able to

subtract noise from speech signals are being

developed. Voiceprints are sensitive to differences in

microphones used during enrolment and

authentication. In addition, the quality of the

transmission channel between the microphone and

the voice processing application may degrade or

distort the speech signal, resulting in an inferior

voiceprint (Varshney, 1997).

Speaker verification via mobile phones is

vulnerable to these problems. Several approaches

can be adopted for combining the different

modalities. The two main approaches are called

feature fusion and decision fusion; also called early

and late fusion respectively. The term layered

biometric is also used to describe forms of late or

decision fusion. Each layer is one biometric

modality and these can be combined to alter the

performance parameters of the overall system (FRR,

FAR) .

A simple approach to decision fusion will be to

treat the two modalities independently. For example,

Threshold

Erro

r

Rate

FAR

FRR

Equal Error Rate

ENHANCING THE SECURITY OF MOBILE E-COMMERCE WITH A HYBRID BIOMETRIC AUTHENTICATION

SYSTEM

251

in an access control application, voice verification

can be performed and if successful face verification

can follow. If the latter is also successful then access

can be granted. In such a sequential layer

arrangement the latter layers will only be invoked if

the earlier verification layers are successful. In this

way the combined FAR of the system is the product

of the FAR of each of the layers (Varshney, 1997).

Alternatively, both biometric technologies can be

invoked, possibly concurrently, in a parallel-layered

system. The system can be arranged so that if the

any of the modalities produce an acceptance then the

user is accepted and the other layers need not be

invoked. In this way the FRR is reduced to be the

product of the FRR of all the layers. It is also

possible to have a logical operation performed at the

final stage to combine the decisions at the parallel

layers. In a layered approach several modalities of

biometric information may be integrated.

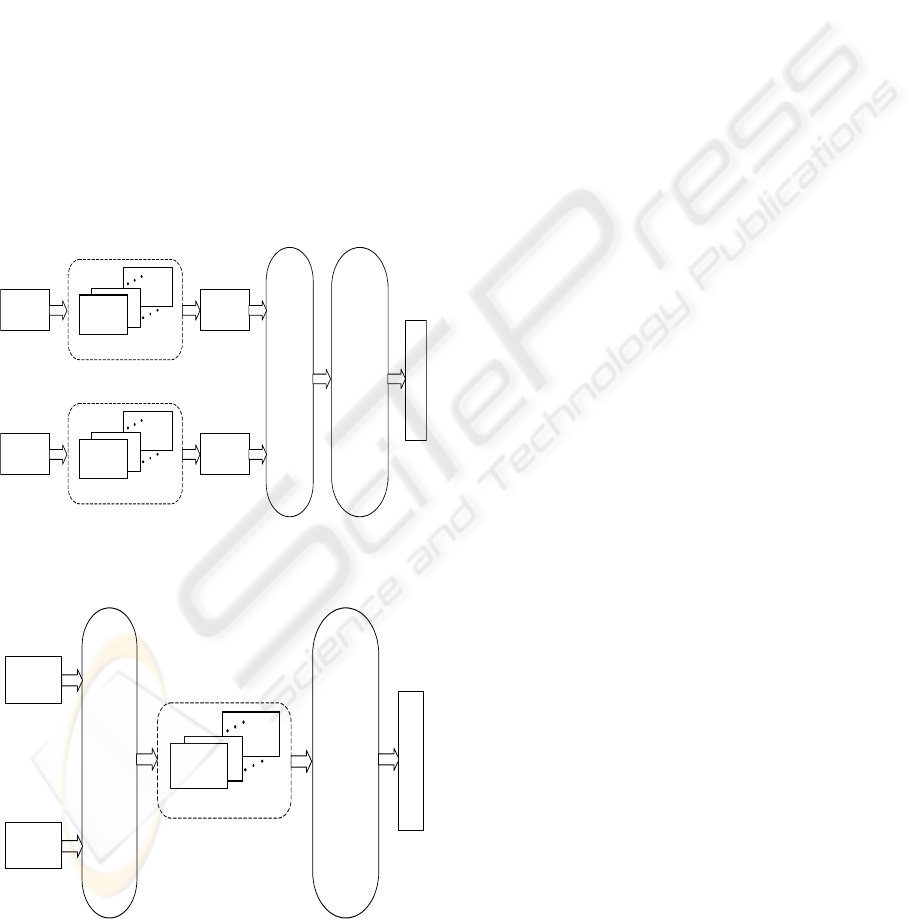

Figure 2: An example of a decision fusion system

Figure 3: An example of feature fusion system

A more sophisticated version of decision fusion

will hold information about the performance of

individual classifiers; their strengths and weaknesses

in identifying/verifying particular individuals or

under particular circumstances. When it comes to

combining the decisions from the different

classifiers these additional performance information

is combined in an optimal way to give appropriate

weighting to the different biometric modalities.

Figure 2 shows an example of this multimodal

biometric configuration.

Alternatively in feature fusion the feature vectors

obtained from the live samples are used together to

train a combined classifier. This has the advantage

that all the feature information is present at the

classification stage; the disadvantage is that the

classification stage becomes very sensitive to

training data. Figure 3 shows an example of a

feature fusion system .

The issue of efficient and effective combination of

biometric modalities is still outstanding and attracts

significant research attention.

8 CONCLUSION

Although single factor and two factor user

authentication schemes for mobile commerce are

under consideration by several emerging bodies

concerned with mobile payment options, a well-

designed three factor scheme that combines a

biometric with a PIN and an enrolled mobile phone

acting as a token would offer the most security. A

speaker’s voiceprint is a natural biometric to

consider when envisioning secure payments being

made from a mobile phone. The ability to distribute

some of the speech processing functions to the

mobile phone itself offers a way to alleviate some of

the potential problems with speaker verification used

in conjunction with a mobile phone, including noise

reduction and problems related to the transmitting a

speech sample over a wireless mobile phone

network.

REFERENCES

Basu, A., Muylle, S., 2003. Authentication in e-commerce,

Communications of the ACM archive, Volume 46 ,

Issue 12 (December 2003), Mobile computing

opportunities and challenges, Pages: 159 – 166, ACM

Press New York, NY, USA.

Bolle, R. , Connell, J. and S. Pankanti, 2004. Guide to

Biometrics, Springer Professional Computing

Publishers, New York.

Au di o

Features

Audio Model s

Dec i si on

Log i c

F

U

S

I

O

N

Vi deo

Features

Video Model s

Dec i si on

Log i c

D

E

C

I

S

I

O

N

L

O

G

I

C

I

D

E

N

T

I

T

Y

Au di o

Features

F

U

S

I

O

N

Vi d e o

Features

Audio / Video Models

D

E

C

I

S

I

O

N

L

O

G

I

C

I

D

E

N

T

I

T

Y

ICETE 2005 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

252

CCIR - Center for Communication Interface Research,

2000. Large Scale Evaluation of Automatic Speaker

Verification Technology, University of Edinburgh.

URL:

http://spotlight.ccir.ed.ac.uk/public_documents/techno

logy_reports/Verifier_report.pdf

Chen, J. J., Adams, C. , 2004. Short-range wireless

technologies with mobile payments systems,

Proceedings of the 6th international conference on

Electronic commerce, Delft, The Netherlands, ACM

International Conference Proceeding Series; Vol. 60.

ACM Press New York, NY, USA.

Corcoran, D., Sims, D., Hillhouse, B., 2002. Smartcards

and Biometrics: Your Key to PKI, URL:

http://www.biowebserver.com/downloads/Smartcards.

pdf

Fui-Hoon Nah, F., Siau, K., Sheng , H. , 2005. The value

of mobile applications: a utility company study,

Communications of the ACM, February 2005, Volume

48 Issue 2, ACM Press.

GPayments, Ltd., 2002, Visa 3-D Secure vs. MasterCard

SPA: A Comparison of Online Authentication

Standards, URL:

http://www.gpayments.com/pdfs/GPayments_3-

D_vs_SPA_Whitepaper.pdf

Pearce, D., 2000. Enabling New Speech Driven Services

for Mobile Devices: An Overview of the ETSI

Standards Activities for Distributed Speech

Recognition Front Ends, AVIOS 2000, May 22-24,

2000, San Jose CA, URL:

http://portal.etsi.org/stq/kta/DSR/Avios DSR paper.pdf

Radicchio White Paper, 2002. Wireless PKI

Opportunities, Version 1.00 URL:

http://www.radicchio.org/downloads/smd_002.pdf

Ravi, S., Raghunathan, A., Kocher, P., Hattangady, S.,

2004. Security in embedded systems: Design

challenges. ACM Transactions on Embedded

Computing Systems, Volume 3 , Issue 3 (August 2004)

Pages: 461 – 491, ACM Press New York, NY, USA.

Roussos, G. , Moussouri, T., 2004. Consumer perceptions

of privacy, security and trust in ubiquitous commerce,

Personal and Ubiquitous Computing Volume 8 , Issue

6 (November 2004) Pages: 416 – 429, Publisher

Springer-Verlag London, UK.

Schwiderski-Grosche S. and Knospe, H., 2002. Secure

Mobile Commerce, In: C. Mitchell (editor): Special

issue of the IEE Electronics and Communication

Engineering, Journal on Security for Mobility,

Volume 14 Number 5, pages 228-238, October 2002.

Sharaf, M. A., Chrysanthis, P. K., 2004. On-demand data

broadcasting for mobile decision making, Mobile

Networks and Applications, Volume 9 , Issue 6

(December 2004) Pages: 703 - 714 2004. Publisher

Kluwer.

Shi, Y., Cao, L., Wang, X., 2004. A security scheme of

electronic commerce for mobile agents uses

undetachable digital signatures. Proceedings of the 3rd

international conference on Information security,

Pages: 242 – 243, ACM Press New York, NY, USA.

Tarasewich, P., 2003. Designing mobile commerce

applications, Mobile computing opportunities and

challenges, Pages: 57 – 60. ACM Press New York,

NY, USA.

Varshney, P. K., 1997, Multisensor Data Fusion.

Electronics and Communications Engineering Journal,

IEE, pp 245-253, December 1997.

ENHANCING THE SECURITY OF MOBILE E-COMMERCE WITH A HYBRID BIOMETRIC AUTHENTICATION

SYSTEM

253