BEST PRACTICES AGENT PATTERNS FOR ON-LINE

AUCTIONS

Manuel Kolp

*

, Ivan Jureta

*

, Stéphane Faulkner

+

*

University of Louvain, Information Systems Unit, Place des Doyens, 1, 1348 Louvain-la-Neuve, Belgium

+

University of Namur, Department of Management Sciences, Rempart de la Vierge, 8, 5000, Namur

Keywords: Agent patterns, On-line auctions

Abstract: Today high volume of goods and services is being traded using o

nline auction systems. The growth in size

and complexity of architectures to support online auctions requires the use of distributed and cooperative

software techniques. In this context, the agent software development paradigm seems appropriate both for

their modelling, development and implementation. This paper proposes an agent-oriented patterns analysis

of best practices for online auction. The patterns are intended to help both IT managers and software

engineers during the requirement specification of an on-line auction system while integrating benefits of

agent software engineering.

1 INTRODUCTION

The emergence and growing popularity of Internet-

based electronic commerce has raised the challenge

to explore scalable global electronic market

information systems, involving both human and

automated traders (Rachlevsky-Reich and al., 1999).

Online auctions are a particular type of Internet-

base

d markets, i.e., worldwide-open markets in

which participants buy and sell goods and services

in exchange for money. Most online auctions rely on

classical auction economics (see e.g., Bikhchandani

de Vries, Schummer and Vohra, 2001; Chakravarti

and al., 2002; Beam and Segev, 1998). “An auction

is an economic mechanism for determining the price

of an item. It requires a pre-announced

methodology, one or more bidders who want the

item, and an item for sale” (Beam and Segev, 1998).

The item is usually sold to the highest bidder. An

online auction can be defined as an auction which is

organized using a software system, and accessible to

participants exclusively through a website.

Recently, online auctions have become a popular

w

ay to trade goods and services. During 2002, the

leading online marketplace, eBay.com, provided a

trading platform for 638 million items of all kinds.

The value of all goods that were actually traded

amounted to nearly $15 billion (Ebay, 2002), which

represented, at the time, 30% of all online sales in

the US. In addition, auctions can be used as

underlying economic models for resource

management in peer-to-peer and grid computing

(Buyya, Stockinger, Giddy and Abramson, 2001),

making it possible to deploy patterns in other

domains.

This paper proposes an agent-oriented patterns

analysis of

best practices for online auction.

Providing agent-oriented patterns for such systems

can reduce their development cost and time, while

integrating benefits of agent-orientation in software

development. Agent-oriented development is a

modern software engineering paradigm for

analyzing and designing distributed and dynamic

systems (Ramchurn, Huynh and Jennings, 2004)

such as online auctions. An agent is an autonomous

software entity that is responsive to its environment,

proactive (in that it exhibits goal-oriented behavior),

and social (in that it can interact with other agents to

complete goals) (Mylopoulos, Kolp and Castro,

2001). Multi-agent systems involve the interaction

of multiple agents, both software and human, so that

they may achieve common or individual goals

through cooperative or competitive behavior.

Patterns of best practices in the online auction

d

omain will facilitate the development of new

188

Kolp M., Jureta I. and Faulkner S. (2005).

BEST PRACTICES AGENT PATTERNS FOR ON-LINE AUCTIONS.

In Proceedings of the Seventh International Conference on Enterprise Information Systems, pages 188-193

DOI: 10.5220/0002550401880193

Copyright

c

SciTePress

auction systems, by clearly showing the functional

and non functional aspects that are particularly

valued by auction participants. Patterns – which are

reusable solutions to recurring development

problems – for online auction have already been

proposed in the literature (see e.g., Re, Braga and

Masiero, 2001). However, these patterns have been

specified using object-oriented concepts.

Consequently, they do not show agents as

intentional, autonomous, and social entities. In

addition, the patterns usually do not integrate best

practices identified in current operating auction

systems on the Internet. (Kumar and Feldman,

1998) only provides a global architecture of a basic

online auction system in the context of object-

oriented software development. GEM (Rachlevsky-

Reich B. and al., 1999) provides system architecture

for developing large distributed electronic markets

but it only addresses the system’s basic

functionalities required to organize trading among

agents. It provides patterns without treating

intentional aspects, and uses agents at

implementation level.

The rest of this text is organized as follows.

Section 2 discusses the i* agent framework we have

used to represent the patterns. Section 3 describes

the best practices agent patterns we have analysed in

the domain of online auctions. Section 4 concludes

the text and discusses some further work of our

research.

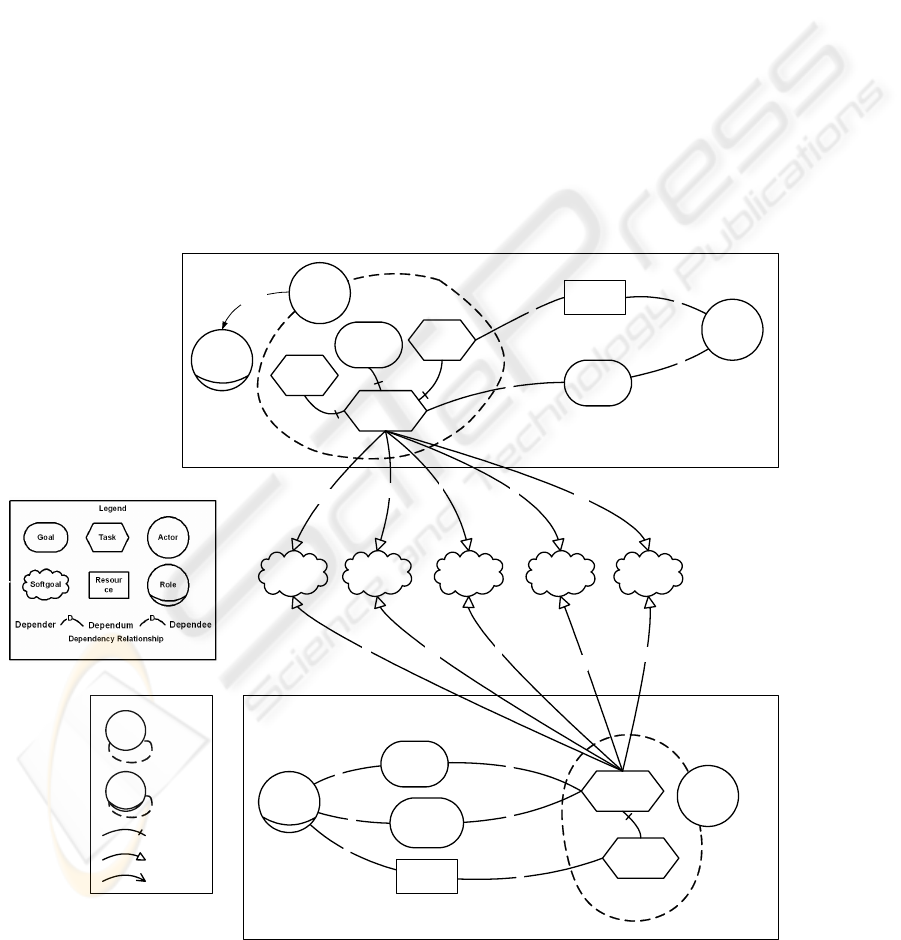

2 THE I* FRAMEWORK

In the following, we analyse each pattern using the

i* framework (Yu, 1994). i* is an agent-oriented

modelling framework used to support the early

phase of requirements engineering, during which the

analyst represents and understands the wider context

in which the system will be used. The framework

focuses on intentional dependencies that exist

among actors, and provides two types of models to

represent them: a strategic dependency (SD) model

used for describing processes as networks of

strategic dependencies among actors, and a strategic

rationale (SR) model used to describe each actor’s

reasoning in the process, as well as to explore

alternative process structures.

The main modelling constructs of the i*

framework are Actors, Roles, Goals, Softgoals,

Resources, and Tasks (See Figure 1). Both the SD

and SR models can represent dependencies among

Actors or Roles. A dependency describes an

“agreement” (called dependum) between two actors:

the depender and the dependee. The depender is the

depending actor, and the dependee, the actor who is

depended upon. The type of the dependency

describes the nature of the agreement. Goal

dependencies represent delegation of responsibility

for fulfilling a goal; softgoal dependencies are

similar to goal dependencies, but their fulfilment

cannot be defined precisely; task dependencies are

used in situations where the dependee is required.

Actors are represented as circles; dependums –

goals, softgoals, tasks and resources – are

respectively represented as ovals, clouds, hexagons

and rectangles; dependencies have the form

depender → dependum → dependee.

In i*, software agents are represented as Actors.

Actors can play Roles. A Role is an abstract

characterization of the common behaviour of an

Actor in some specific context (e.g., a consumer, a

salesman, a buyer, a seller, etc.).

3 BEST PRACTICES PATTERNS

Online auctions are highly dynamic processes which

involve numerous participants. Their structure

changes rapidly to reflect the entry and exit of

bidders as well as the impact of their behaviour on

the price of the item being auctioned. The most

common mechanism for on-line sales are the

“English”, “Vickrey”, “Dutch”, and “first-price

sealed bid” auctions (Beam and Segev, 1998;

Papazoglou, 2001). We briefly describe them below.

English Auction. Each bidder sees the highest

current bid, can place a bid and update it many

times. The winner of the auction is the highest

bidder who pays the price bid, i.e. the final auction

bid that this bidder placed. An example is eBay.com

(Ebay, 2004). English auctions are by far the most

popular auction type and their success lies most

probably in the familiarity of English auctions as

well as in the entertainment they provide to

participants (in the form of bidder competition)

(Beam and Segev, 1998).

First-Price Sealed Bid Auction: Each bidder

makes a single secret bid; the winner is the highest

bidder, and the price paid is the highest bid. An

example is The Chicago Wine Company

(tcwc.com).

Vickrey Auction: Each bidder makes a single

secret bid; the winner is the highest bidder.

However, the price paid is the amount of the second

highest bid. Some online auction systems propose it

as an option (e.g., iauction.com).

Dutch Auction: The seller steadily lowers the

price of the item over time. The bidders can see the

current price and must decide if they wish to

purchase at that price or wait until it drops further.

BEST PRACTICES AGENT PATTERNS FOR ON-LINE AUCTIONS

189

The winner is the first bidder to pay the current

price. An example is klik-klok.com.

Today’s online auction offer features more

complex to those that automate the traditional

auction mechanisms (e.g. user authentication,

auction setup, auction item search, bidding, … (Re,

Braga and Masiero, 2001, Wurman, 2003). In

addition to enhancing the user experience, these

additional features are essential to the commercial

success of an online auction. This paper focuses on

best practices to better understand and build these

features. The analysis is applicable on any type of

auction as far as the participant type is concerned:

both the seller and buyer may be either customer

and/or business. It is independent of the auction

mechanism (english, vickrey, dutch, …), as long

as it involves a single seller and many buyers.

Some of the features can be introduced in the

system in several ways, requiring comparison and

evaluation. To select the most adequate alternative,

we represent relevant system qualities (e.g., security,

privacy, usability, etc.) as softgoals and use

contribution links to show how these softgoals are

affected by each alternative, as in the Non-

Functional Requirements framework (Chung, Nixon,

Yu and Mylopoulos, 2000).

Proxy Bidding. Online auctions can last for

several days, making it impossible for human buyers

to follow the auction in its integrity, as is the case in

traditional ones. Proxy bidding allows buyers to

specify their maximum willingness to pay. A

procedure is then used to automatically increase

their bid until the specified maximum is reached, or

the auction is closed (Wurman, 2003, Kurbel K. and

Loutchko I., 2001). Proxy bidding can be introduced

in the basic online auction in several ways in terms

of responsibility assignment. Two alternatives are

shown in Figure 1.

Plays

D

D

D

D

D

D

Buyer

Auction

Manager

New High

Bid

Notification

Check

Current

Price

Specify

Max

Price

Automatically

Place New

Bid

Automati-

cally Input

New Bid

Privacy

++

Security

-

Reliability

-

Speed

--

Workload

++

D

D

Buyer

Automatically

Place New

Bid

Automati-

cally Input

New Bid

Check

Buyer

Max Price

D

Max Price

Preference

--

+

+

++

--

Auction

Manager

ALTERNATIVE 2

ALTERNATIVE 1

CONTRIBUTIONS

OF EACH

ALTERNATIVE TO

SOFTGOALS

Obtain User

Authorization

for Proxy

Bidding

D

Obtain Buyer

Authorization

for Proxy

Bidding

Legend

Contribution to

softgoal

Means-ends link

Actor

Actor and

actor

boundary

Role and role

boundary

Role

Task-Decompo-

sition link

User

Figure 1: Two alternative responsibility assignments of the Proxy Bidding. Positive (favorable) (+) and negative (not

favorable) (-) contributions of each alternative structure aid in selection

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

190

Each one is represented as a simple Strategic

Rationale model. A series of softgoals have been

selected as criteria for alternative comparison –

Privacy, Security, Reliability, Speed, and Workload.

These are non-functional requirements (Chung,

Nixon, Yu and Mylopoulos, 2000) for the

information system and have been selected

according to issues often raised in e-commerce

system design (e.g., (Mylopoulos, Kolp and Castro,

2001), online auction design (e.g., Wurman, 2003;

Kumar and Feldman, 1998), etc.

The first alternative seems more adequate. The

responsibility of managing proxy bidding is

allocated to the Buyer agent. Several reasons support

this choice:

− When the Buyer manages proxy bidding, price

preferences are not communicated to outside

agents. Consequently, Privacy is higher than in

the second alternative which requires the transfer

of price preferences to the Auction Manager.

− Workload of the system is lower, since automatic

bidding is distributed among multiple Buyer

agents participating in the auction. We consider

that system Workload is much higher when all

proxy bidding activity in one auction is

centralized at the Auction Manager.

− We consider that Security of data transfers

between the Buyer and Auction Manager is not of

high priority in an English online auction, since

the bid made by the Buyer is made publicly

available by the Auction Manager.

Reliability concerns the probability of error in

terms of e.g., a new proxy bid not being taken into

account by the Auction Manager. This probability is

higher when proxy bidding is distributed among

multiple Buyers. Finally, it is probable that speed of

bid input is higher when proxy bidding is

centralized, since there are no data transfers between

the Auction Manager and Buyer agents.

Based on this discussion, we select the first

alternative on Figure 1. Consequently, proxy bidding

is introduced in the system as a service that a User

agent playing Buyer role can provide to the human

user, and requires the human user to specify the

maximum price that he/she is willing to pay. In

addition, the Buyer agent needs to obtain an

authorization from the user in order to initiate proxy

bidding.

Reputation management. In classical exchanges

where buyers and sellers actually meet, trust results

from repeated buyer-seller interactions, from the

possibility to inspect items before the purchase, etc.

In online auctions, sellers and buyers do not meet,

and little personal information is publicly available

during the auction. In addition, product information

is limited to information provided wilfully by the

seller. In such a context, a mechanism for managing

trust should be provided in order to reduce

uncertainty in transactions among auction

participants.

According to (Ramchurn, Huynh and Jennings,

2004), “trust is a belief an agent has that the other

party will do what it says it will (being honest and

reliable) or reciprocate (being reciprocative for the

common good of both), given an opportunity to

defect to get higher payoffs.” Trust can be favoured

in an on-line auction through a reputation

mechanism, which should satisfy specific

requirements (Ramchurn, Huynh and Jennings,

2004): it should be costly to change identities in the

community; new entrants should not be penalised by

having a initial low reputation rating; participants

with low ratings should be able to rebuild reputation;

it should be costly for participants to fake reputation;

participants with high reputation should have more

influence on reputation ratings they attribute to other

participants; participants should be able to provide

more qualitative evaluations than simply numerical

ratings; and finally, participants should be able to

keep a memory of reputation ratings and give more

importance to the latest ones. Such reputation

mechanism can reduce the hesitancy of new buyers

and sellers when using the online auction for the first

time, as it implicitly reduces the anonymity and

uncertainty among trading partners.

It is difficult to construct a reputation system that

satisfies all of these requirements. Seller reputation

can be established through feedback of buyers on the

behaviour of sellers during the trade settlement

which follows the closure of the auction (Ebay,

2002; Resnick and Zeckhauser, 2002). As a result of

buyer feedback in repetitive sales, a seller receives a

rating which is indicative of the trust that the trading

community has in him/her.

In order to enable the management of trust in the

on-line auction, we introduce in Figure 2 an

additional agent: Reputation Manager, which is a

specialization of the Information Brokering Agent

(Papazoglou, 2001). Informally, its responsibility is

to collect, organize, and summarize reputation data.

The Reputation Manager depends on the winning

Buyer of each auction to provide feedback on the

Seller after the trade settlement. Reputation

Manager uses Qualitative (textual) and Quantitative

(numerical) Feedback on Seller to establish

reputation ratings of Users that have played the role

of Sellers in auctions. As information on reputation

is valuable to any User of the on-line auction, any

User depends on the Reputation Manager to

Manage Feedback Forum, in which the feedback

BEST PRACTICES AGENT PATTERNS FOR ON-LINE AUCTIONS

191

and rating information is contained and organized.

Each Buyer depends on the Reputation Manager to

provide summarized Seller Reputation Information,

so that the Buyer can have an indication on the trust

he/she can put into the relationship with the Seller.

The Seller can post replies on feedback provided by

Buyers. Finally, the Seller depends on the

Reputation Manager to Manage Reputation Rating.

D

D

D

D

D

D

D

D

D

D

D

Seller

Reputation

Manager

D

Buyer

Manage

Reputation

Rating

Qualitative

Feedback

on Seller

Reply on

Buyer

Feedback

Plays

User

Plays

Seller

Reputation

Information

Manage

Feedback

Forum

Quantitative

Feedback

on Seller

Figure 2: Reputation Management pattern

This pattern satisfies all but one of the

requirements specified above: it does not make it

costly for participants to change identities. For

example, eBay (Ebay, 2004) deals with this problem

by requiring each seller to provide a valid credit card

number.

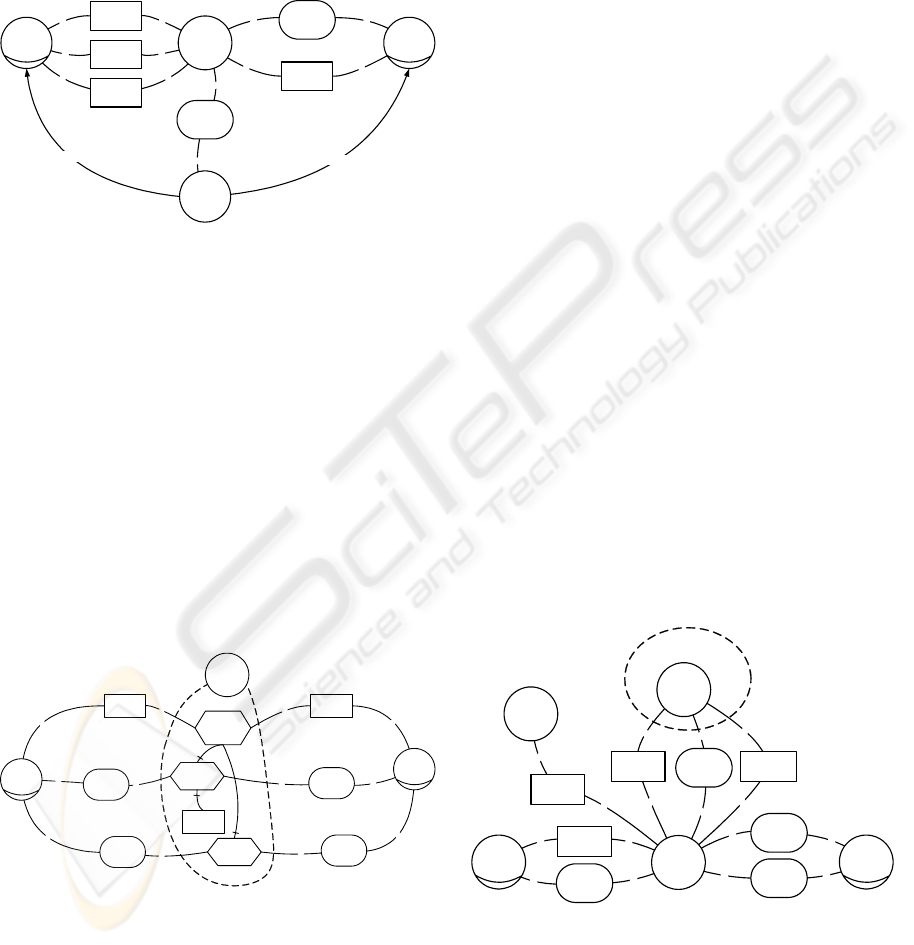

Dispute Resolution (Figure 3). The trade

settlement that follows the closure of the auction

may not be successful for many reasons (e.g., late

deliveries, late payment, no payment). It then results

in dispute that can require mediation by a third party

in order to be resolved. It (here, a Negotiation

Assistant) can be a software agent that manages an

automated dispute resolution process or a human

mediator (Squaretrade, 2004).

D

D

D

D

D

D

D

D

D

Seller

Buyer

D

Buyer

Argument

D

Seller

Argument

Collect

Buyer and

Seller

Arguments

Select

Solution

Solutions

Knowledge

Base

Post Argu-

ments

Make

Arguments

Visible

D

Make

Arguments

Available

Suggest

Solution

Suggest

Solution

Negotiation

Assistant

Figure 3: Strategic Rationale model of the Dispute

Resolution pattern with focus on Negotiation Assistant

agent rationale

The Negotiation Assistant collects Buyer and

Seller Arguments, and makes them available to both

parties. On the basis of these Arguments and its

Solution Knowledge Base, the agent Selects Solution

– both the Buyer and the Seller depend on the agent

to Suggest Solution to their dispute.

Payment. Payment can be accomplished in

numerous ways in the context of an online auction.

They can be either managed (in part) through the

online auction – e.g., credit card based transactions –

, or outside the scope of the online auction

information system (OAIS) – e.g., cash, checks, etc.

The payment choice of auction participants is not

repetitive and differs according to the payment cost,

convenience, and protection (Li, Ward and Zhang,

2003).

In the Payment pattern, the Payment Agent

(specialization of the Negotiating and Contracting

Agent (Papazoglou, 2001)) mediates the payment

interaction between the Seller and the Buyer. This

agent depends on the Account Manager for data on

Users, which is then used in providing Payment

Details to the Payment System. In addition to user

identification, Payment Details should also contain

transaction-related data. The Payment Agent

depends on the Payment System to Realize Payment

and to provide Money Transfer Confirmation, which

is used to Confirm Money Transfer to the Seller. The

Payment System is outside the boundary of the

online auction. Upon closure of the auction, the

Seller depends on the Payment Agent to Invoice

Buyer. The Buyer depends on the Payment System to

provide Invoice and in return, the Buyer is expected

to Authorize Transfer

. The pattern structure in

Figure 4 is adapted to PayPal (Paypal, 2004) and all

common credit card based payment systems. Any of

these payment systems intervenes in the pattern as

the Payment System specialized in money transfers.

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

SellerBuyer

Payment

Agent

Invoice

Buyer

Invoice

Payment

System

Payment

Details

Authorize

Transfer

Realize

Payment

Confirm

Money

Transfer

OUTSIDE OAIS

BOUNDARY

Money

Transfer

Confirmation

Account

Manager

User Details

Figure 4: Payment pattern

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

192

4 CONCLUSION

Online auctions have become increasingly popular

in e-business transactions (Wurman, 2003).

Companies require such systems to be developed on

tight budgets and in short time, in order to deploy

auctions in managing relationships with their

suppliers and clients. Patterns of best practices of

online auctions can provide significant aid in the

development process of such systems.

This paper explores such patterns, by analysing

some advanced online auctions functionalities

through the lens of the agent paradigm. Compared to

the literature, our approach is innovative in several

respects: we consider that multi-agent systems are

particularly adapted to modelling and implementing

online auction systems; we provided the i* agent-

oriented modelling perspective of each pattern we

consider and we focused on specifying best practices

in current online auction systems.

There are limitations to our work. We have not

provided other dimensions than the i* (social and

intentional) ones for the patterns. This is well

beyond the scope of this paper as it requires much

more time and space. As future work, the patterns

will be modelled using UML-based notations as well

as formally specified with the Z language.

REFERENCES

Amazon (2004). http://www.amazon.com.

Beam C. and Segev A. (1998) Auctions on the Internet: A

Field Study. Working Paper 98-WP-1032, University

of California, Berkeley, USA.

Bikhchandani S., de Vries S., Schummer S. and Vohra

R.V. (2001) “Linear Programming and Vickrey

Auctions”. In Dietrich B., Vohra R.: Mathematics of

the Internet: E-auction and Markets. Springer.

Buyya R., Stockinger H., Giddy J. and Abramson D.

(2001) “Economic Models for Management of

Resources in Peer-to-Peer and Grid Computing”, In

SPIE International Symposium on The Convergence of

Information Technologies and Communications

(ITCom 2001), Denver, USA.

Chakravarti D., and al. (2002). “Auctions: Research

Opportunities in Marketing”. Marketing Letters 13,

281–296.

Chung L.K., Nixon B.A., Yu E. and Mylopoulos J. (2000)

Non-Functional Requirements in Software

Engineering. Kluwer.

Ebay (2002) Ebay 2002 Annual Report,

http://www.ebay.com.

Ebay (2004) http://www.ebay.com.

Kumar M. and Feldman S.I. (1998) “Internet Auctions”

Proceedings of the 3rd USENIX Workshop on

Electronic Commerce, Boston.

Kurbel K. and Loutchko I. (2001) “A Framework for

Multi-agent Electronic Marketplaces: Analysis and

Classification of Existing Systems”. Proceedings of

International Congress on Information Science

Innovations (ISI'2001), Dubai, U.A.E.

Li H., Ward R. and Zhang H. (2003) Risk, Convenience,

Cost and Online Payment Choice: A Study of eBay

Transactions. Georgia Institute of Technology

Working Paper.

Mylopoulos J., Kolp M. and Castro J. (2001) “UML for

Agent-Oriented Software Development: The Tropos

Proposal”. Proceedings of the Fourth International

Conference on the Unified Modeling Language

(<<UML>> 2001), Toronto, Canada.

Papazoglou M.P (2001) “Agent-Oriented Technology in

Support of E-Business”. Communications of the ACM

44-4, pp. 71-77.

Paypal (2004) http://www.paypal.com.

Rachlevsky-Reich B. and al. (1999) “GEM: A Global

Electronic Market System”. In Information Systems

24, pp. 495-518.

Ramchurn S.D., Huynh D. and Jennings N.R. (2004)

“Trust in Multi-Agent Systems”. The Knowledge

Engineering Review.

Re R., Braga R.T.V. and Masiero P.C. (2001) “A Pattern

Language for Online Auctions Management”.

Proceedings of the 8th Conference on Pattern

Languages of Programs (PLoP'2001).

Resnick P. and Zeckhauser R. (2002) “Trust Among

Strangers in Internet Transactions: Empirical Analysis

of eBay’s Reputation System”. In Michael R. Baye

(ed.) Economics of the Internet and E-Commerce,

Elsevier.

Squaretrade (2004) http://www.squaretrade.com.

Wurman P.R. (2003) “Online Auction Site Management”.

In The Internet Encyclopedia,

http://www.csc.ncsu.edu/wurman/Wur-article.pdf

Yahoo (2004) http://auctions.shopping.yahoo.com.

Yu E. (1994) Modelling Strategic Relationships for

Process Reengineering. Ph.D. thesis, Dept. of

Computer Science, University of Toronto.

BEST PRACTICES AGENT PATTERNS FOR ON-LINE AUCTIONS

193