A STRATEGYPROOF AUCTION MECHANISM FOR GRID

SCHEDULING WITH SELFISH ENTITIES

V. Hastagiri Prakash

Indian Institute of Science

Bangalore - 560012, India

Y. Narahari

Indian Institute of Science

Bangalore - 560012, India

Keywords:

Grid computing, Grid scheduling, Resource management, procurement auctions, parallel flow, selfishness,

rationality, incentives, VCG Mechanisms.

Abstract:

With major advances in computing technology and network performance, grid computing is strategically

placed to become the future of enterprise and even personal computing. One of the most important issues

concerned with grid computing is that of application scheduling. The type of scheduling algorithm used will

depend on the type of the application. In a global grid setting, the individual users must be provided with an

incentive to offer their resources. The situation becomes non-trivial because of the fact that these entities are

intelligent, rational and selfish resource providers who, for strategic reasons, may not provide truthful infor-

mation about their processing power and cost structure. In this scenario, apart from optimality of the algorithm

used, strategy-proofness of the underlying mechanism becomes important. This paper presents a strategyproof

mechanism based scheduling algorithm for parallel flow type applications in the form of a reverse auction.

1 INTRODUCTION

Started as a new computing infrastructure, grid com-

puting is now becoming a mainstream technology for

large scale resource sharing and system integration.

With the power and presence of the grid computing

systems poised to increase with time, fast, efficient

and truthful mechanisms are needed to exploit the

power of the grid to the fullest. For a detailed in-

troduction to grid computing, see (Foster and Kessel-

man, 2002). Various design and operational issues ex-

ist in this paradigm of computing, chief among them

being scheduling and resource management. For a de-

tailed survey on grid scheduling systems and issues,

the reader is referred to (Zhu, 2003). Due to the dis-

tibuted, heterogeneous and selfish nature of the partic-

ipating entities, market based models have long been

advocated as a panacea to the issue of grid schedul-

ing, examples of which are (Buyya, 2002), (Wolski

et al., 2002). The participating resource providers and

consumers, being selfish, rational and intelligent, will

attempt at tampering with the existing mechanisms as

much as the rules allow them in order to optimize their

profit or execution time. This scenario, though possi-

bly profitable for the individuals, tends to bring down

the overall efficiency of the grid system as a whole. In

order to address this issue, we need to develop robust

mechanisms which ensure efficiency in the presence

of selfish and rational agents.

1.1 Motivation

Consider an enterprise with a number of branches

spread geographically. Now the central administra-

tion needs to use a grid system to process data, col-

lected from each of these branches, by a fixed dead-

line. Though there might be dependencies between

the sub-jobs from a single branch, there lie no depen-

dencies between jobs from different branches. So, the

central authority can schedule these equal jobs inde-

pendently. The authority would like to schedule the

jobs on different sites on the grid for quick execu-

tion. But, when the job is actually given out, the

sites may not disclose the true details of their spec-

ifications thereby leading to a sub optimal allocation

both in terms of cost and time.

In the grid scenario, we often have jobs which can be

split into a number of sub-jobs each of them being

almost equivalent in terms of their resource require-

ment and the expected time of completion. This slight

variation from the parameter sweep type scheduling

gives the problem a new structure and helps us model

178

Hastagiri Prakash V. and Narahari Y. (2006).

A STRATEGYPROOF AUCTION MECHANISM FOR GRID SCHEDULING WITH SELFISH ENTITIES.

In Proceedings of WEBIST 2006 - Second International Conference on Web Information Systems and Technologies - Internet Technology / Web

Interface and Applications, pages 178-183

DOI: 10.5220/0001255301780183

Copyright

c

SciTePress

it uniquely. To the best of our knowledge, this type of

application specific economic scheduling mechanism

is not proposed anywhere in literature. The setting

and solution for the problem inherently invokes game

theoretic modeling with auctions as our choice of im-

plementation.

1.2 The Problem

In this paper, we develop a scheduling algorithm

and payment mechanism for the type of application

scheduling problem discussed above. We set up the

problem in the form of a reverse auction. If we were

to have truthful information about the capabilities and

costs of the resource providers, the scheduling prob-

lem can be cast as an optimization problem. We pro-

vide an efficient scheduling algorithm along with a

payment structure that ensures truthful elicitation of

valuations from the bidders. The grid user whose job

is to be scheduled has a deadline which is known only

to him. He then proceeds to conduct an auction invit-

ing bids for single units of the job. The bids represent

the valuations of the resource providers for a unit of

the job when working at a given percentage of their

capacity. In development of the scheduling algorithm,

we assume that we have obtained truthful values for

the valuations which is in turn ensured by the payment

mechanism we propose.

1.3 Related Work

Market based mechanisms for distributed computing

had been initially suggested in (Hogg et al., 1992)

when they applied market principles to scheduling in

a distributed system.Though the research precedes

the popular advent of grid computing, Spawn was the

first implementation of a distributed computational

economy that acted as a precursor to many of the

market based models that were developed later.

One very important work in this area was the

dissertation work of Buyya (Buyya, 2002). In

this work he identified the key requirements of

an economic-based Grid system and developed a

distributed computational economy framework called

the Grid Architecture for Computational Economy

(GRACE), which is generic enough to accom-

modate different economic models and maps well

onto the architecture of wide area distributed systems.

Nisan et al (Nisan et al., 1998) suggested an eco-

nomic model for grids called POPCORN for trading

online CPU time among distributed computers. In

their system a virtual currency called ”popcoin” was

used as the unit of trade between buyers and sellers.

The market was an auction based one and the social

efficiency and price stability were studied using the

Vickrey auction theory.

Some general classes of scheduling problems along

with auction protocols for the same were studied

in (Wellman et al., 1998). Decentralized economic

protocols were suggested for scheduling. They had

also compared direct revelation mechanisms to the

market based methods.

Various game theoretic models, mechanisms and

auction models were applied in grid scheduling

issues in Grosu et al (Grosu et al., 2002), (Grosu

and Chronopoulos, 2003), (Grosu and Chronopoulos,

2004), (Das and Grosu, 2005). These works dealt

with mechanisms and models to cope with selfishness

of the grid users and designed strategy-proof mecha-

nisms and auction algorithms for generic scheduling

on the grid.

Most of the work discussed dealt with distributed

scheduling using a game theoretic approach or mar-

ket based models. They did not look at specific prob-

lems arising in grid computing. Grid computing with

its characteristic flow models and implementation is-

sues is completely different from a conventional dis-

tributed system. Works propounding actual schedul-

ing algorithms for the grid fail to take into account

the selfish nature of the entities involved. It is this

research gap that this paper attemps at addressing.

1.4 Our Contributions

The primary focus of this work is to ensure schedul-

ing efficiency in the presence of rational and self-

interested users and resource providers. We initially

design the auction for the scheduling problem. As-

suming that the bids received were truthful, we then

formulate the auction assignment as an optimization

problem. The specific structure of the problem allows

us to develop an algorithm for effiecient deadline-

based scheduling for parallel-flow type applications.

In order to counter the degradation of efficiency due to

actions of selfish agents, we propose a payment mech-

anism based on the famed Groves’ Mechanism from

the Vickrey-Clarkes-Groves(VCG) stable. As a result

of this application of VCG mechanism, the payment

mechanism induces the bidders to bid their true valu-

ations thereby enabling the algorithm to calculate the

optimal allocation.

1.5 Organization of the Paper

The paper is organized as follows: We give a very

brief introduction to auctions and mechanism design

in Section 2. We explain the model and formulate the

A STRATEGYPROOF AUCTION MECHANISM FOR GRID SCHEDULING WITH SELFISH ENTITIES

179

problem in Section 3. Assumptions and limitations

with respect to the model chosen are also presented in

this section. In section 4, we develop the optimal al-

location algorithm followed by the design of the pay-

ment mechanism. Finally, in section 5, we present our

conclusions and scope for future research.

2 A PRIMER ON MECHANISM

DESIGN

In this section, we give a brief introduction to the con-

cepts of mechanism design with focus on VCG mech-

anisms. Most of the material in this section is adapted

from (Narahari and Dayama, 2005).

Consider a set of agents (grid users or service

providers) N =1, 2, ..., n with agent i having a type

set Θ

i

. The type set of an agent represents the set

of perceived values of an agent. In the case of grid

computing, the type set of an agent refers to the cost

structure and deadline information of the users. Let

Θ be the cartesian product of all the type sets of all

the agents. Let X be the set of all outcomes. In our

sense, an outcome refers to a possible allocation of

jobs to providers and the associated payment made to

them. A social choice function is a mapping from Θ

to X which associates an outcome for every type pro-

file. With respect to grid scheduling, the social choice

function corresponds to an efficient way of allocating

jobs to service providers. Let S

i

denote the action set

of agent i, that is S

i

is the set of all actions available

to the agent in a given situation. A given strategy s

i

is a mapping from Θ

i

→ S

i

. In a Grid setting, the

strategy of the resource providers is the information

they release about their cost structure. Suppose S is

the cartesian product of all the strategy sets. A mech-

anism is then a tuple (S

1

,S

2

, ..., S

n

,g(.)), where g is

the mapping from S to X. That is, g(.) maps every

strategy profile into an outcome. A game with incom-

plete information can be associated with every mech-

anism. This game is called the game induced by the

mechanism.

We say that a mechanism µ =(S

1

,S

2

, ..., S

n

,g(.))

implements a social choice function f if there is an

equilibrium strategy profile (s

∗

1

(.),s

∗

2

(.), ..., s

∗

n

(.)) of

the game induced by µ such that

g(s

∗

1

(θ

1

),s

∗

2

(θ

2

), ..., s

∗

n

(θ

n

)) = f (θ

1

,θ

2

, ..., θ

n

)

for all possible type profiles (θ

1

,θ

2

, ..., θ

n

). That

is, a mechanism implements a social choice function

f(.) if there is an equililibrium of the game induced

by the mechanism that yields the same outcomes as

f(.) for each possible profile of types. Based on

the type of equilibrium, two common types of imple-

mentations are dominant strategy implementation and

bayesian Nash implementation. For a more detailed

view of these concepts the reader is reffered to (Mas-

Colell et al., 1995).

We now give some of the desirable properties of a

mechanism:

Efficiency A general criterion for evaluating a mech-

anism is Pareto efficiency, meaning that no agent

could improve its allocation without making at

least one other agent worse off. Another metric of

efficiency is allocative efficiency which is achieved

when the total value of all the winners is maxi-

mized.

Individual rationality A mechanism is individual ra-

tional if its allocation does not make any agent

worse-off than had the agent abstained from par-

ticipating in the mechanism.

Incentive compatibility A mechanism is incentive

compatible if the agents maximize their expected

payoffs by bidding true valuations for the goods.

It is desired that truthful bidding by agents should

lead to a well defined equilibrium such as domi-

nant strategy equilibrium or Bayesian Nash Equi-

librium.

Strategy proofness A mechanism is said to be strat-

egy proof if it is incentive compatibile and imple-

ments the desired social choice function in domi-

nant strategies. This is a very strong concept and

is a highly desirable property of a mechanism but

because of its stringent requirements, is not present

in most occasions.

2.1 Vickrey-Clarke-Groves

Mechanisms

The simplest model of this group of mechanisms is

the second price sealed bid auction (Vickrey auction)

for a single item. The Vickrey auction is shown to

be incentive compatible in dominant strategies (strat-

egy proof). Clarke mechanisms and Groves mecha-

nisms provide a broader class of incentive compatible

mechanisms. All these mechanisms are collectively

referred to as VCG (Vickrey-Clarke-Groves) mecha-

nisms. These mechanisms induce truth revelation by

providing a discount to each winning buying agent on

his actual bid. This discount which is called the Vick-

rey Discount is actually the extent by which the total

revenue to the seller is increased due to the presence

of this bidder. If the agents are selling agents, then we

have Vickrey surplus which is the additional amount

given to a selling agent over and above what he has

quoted. The VCG mechanisms are highly attractive

because of the fact that generally they are allocatively

efficient, individual rational, weakly budget balanced,

and incentive compatible. But they are limited in their

WEBIST 2006 - INTERNET TECHNOLOGY

180

application by the fact that they assume quasi-linear

utilities for the participating agents.

2.1.1 Groves Mechanism

A Groves mechanism is a direct revelation mecha-

nism M =(Θ

1

, Θ

2

, ..., Θ

n

,f(.)) in which the func-

tion f (θ)=(k

∗

(θ),t

1

(θ), ..., t

n

(θ)) satisfies two

properties:

1. Allocative efficiency

∀θ ∈ Θ∀k ∈ K,

n

i=1

v

i

(K

∗

(θ),θ

−i

)) ≥

n

i=1

v

i

(k, θ

−i

) (1)

2. ∀i ∈ N , the payment received by agent i is of the

form

t

i

(θ)=t

i

(θ

i

,θ

−i

)=h

i

(θ

−i

)+

j=i

v

j

(k

∗

(θ),θ

j

) (2)

where h

i

(θ

−i

) is any arbitrary function h

i

:

Θ

−i

→for each i ∈ N

2.1.2 Clarke’s Mechanism

This is a special case of Groves mechanism when the

h

i

(θ

−i

) function is of a particular intuitive form

h

i

(θ

−i

)=−

j=i

v

j

(k

∗

−i

(θ

−i

),θ

j

) (3)

3 THE MODEL

We consider a grid user in a grid computing system

who is about to submit a job to be processed on the

grid. The nature of the job is such that it can be

parallelized into n approximately equal sub-jobs that

can be executed in parallel without any dependencies.

The user has a deadline d by which the entire job is

to be completed. The user is ready to pay for the ser-

vices of resource providers. Without loss of general-

ity, the de facto mode of payment can be considered

to be grid dollars G$ (Das and Grosu, 2005). It is

to be noted here that a single resource provider can

take up many sub-jobs. We consider a buyer-operated

marketplace where the mechanism used is a procure-

ment auction. The buyer sends out the specifications

of the jobs on the grid broadcast system without actu-

ally revealing the deadline. The buyer then proceeds

to invite bids from the resource provider for execution

of a single sub-job in the following format.

(t

i

,T

i

,C

i

,c

i

)

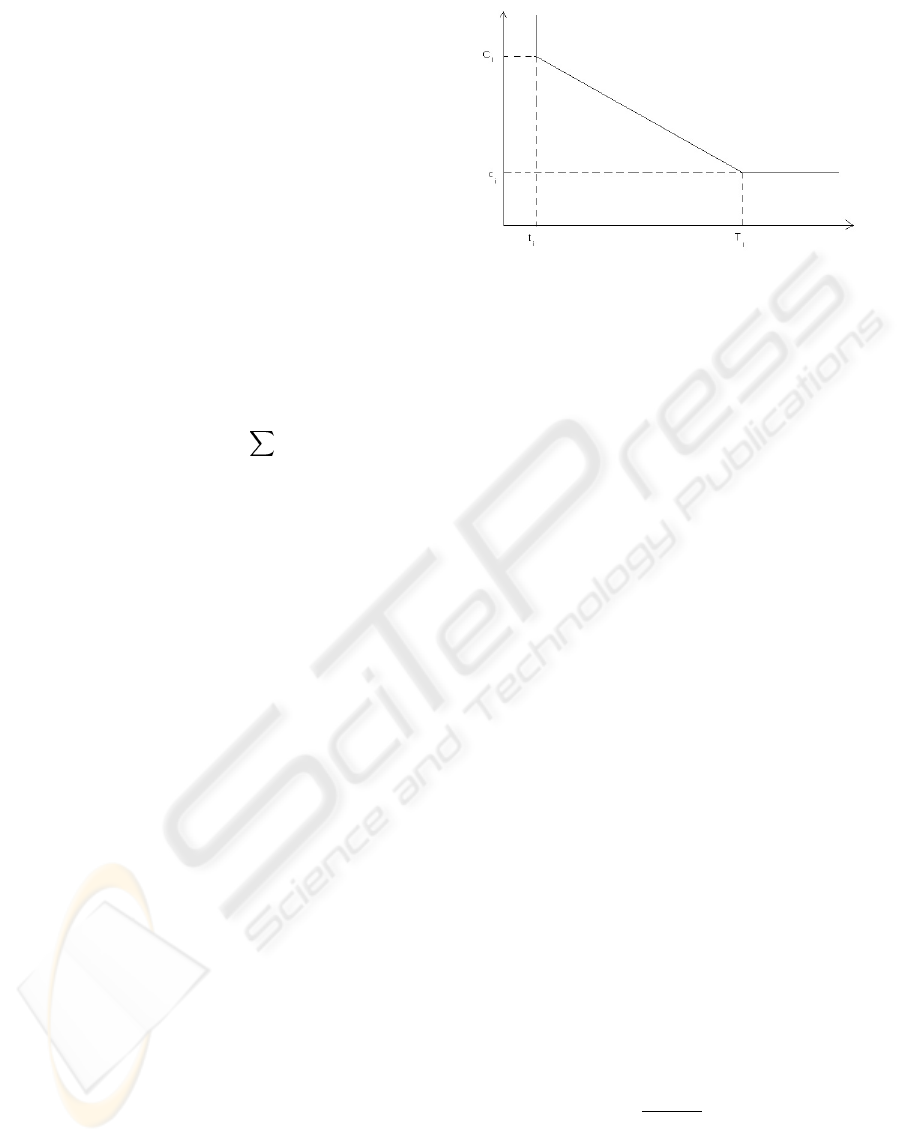

Figure 1: Cost Curve of a Resource Provider.

where t

i

is the minimum time required by the i’th user

to complete the sub-job at cost C

i

and T

i

is the time

beyond which the cost is constant at c

i

. Between t

i

and T

i

, the cost is assumed to be linear.

Now the problem for the buyer is to find upto n re-

source providers to whom the sub-jobs may be com-

mitted for execution. The grid user in addition to

meeting his deadline would also like to minimize his

total expenditure. Because the resource providers are

selfish and rational and are thus looking to maximize

their profit, they will not report their true cost curves.

So, the buyer, in order to find the optimal alloca-

tion, has to employ an incentive compatible payment

mechanism to elicit truthful bids from the resource

providers. As soon as the user receives the bids, he

can eliminate all bids with t

i

>dwhich removes re-

source providers whose processing power does not al-

low them to meet the deadline.

4 PROBLEM FORMULATION

AND OPTIMAL ALLOCATION

ALGORITHM

Assume that the user is left with m bids after elimi-

nation as explained in the previous section. Given the

structure of the grid and the number of users present,

we can safely assume that m>n.

Define,

λ

i

=

C

i

− c

i

T

i

− t

i

(4)

where λ

i

becomes the slope of the cost curve for bid-

der i.

Now the user is aware of his deadline and sets up the

allocation problem as a non-linear integer program-

ming problem as follows:

A STRATEGYPROOF AUCTION MECHANISM FOR GRID SCHEDULING WITH SELFISH ENTITIES

181

lmin

m

i=1

c

i

+max T

i

−

d

x

i

, 0 ∗ λ

i

∗ x

i

(5)

s.t

m

i=1

x

i

= n

x

i

∈ N

where x

i

is the variable which indicates number of

jobs allocated to resource provider i. Though the so-

lution of this integer programming problem is diffi-

cult, the structured nature of this problem leads to an

elegant and efficient algorithm.

4.1 Optimal Allocation Algorithm

Knowing the deadline, d, the metric r

i

is computed

by the user as follows:

r

i

=

λ

i

,T

i

>d

0,T

i

<d

(6)

Then the prices charged by each of the bidders for

execution time d are computed using the formula

p

i

= c

i

+(T

i

− d)r

i

. With these prices for a single

sub-job execution, n minimum cost providers are

selected initially. Then, using an iterative search, the

optimal allocation is found among these n bidders.

It is to be noted that we have assumed truthful and

correct values of the bids in order to compute the

optimal assignment. This assumption is justified by

the payment mechanism which ensures this.

The winners determination algorithm can be summa-

rized as follows:

compute p

i

= c

i

+(T

i

− d) ∗ r

i

∀i =1, 2, ..., m

Choose P

(1)

,P

(2)

, ..., P

(n)

from sorted

order P

(1)

,P

(2)

, ..., P

(m)

Allocate one sub-job to each of these

n providers

set last=n

loop for i=1 to last

loop for j=last to 1 and j = i

if deadline is met and cost does

not increase

increase allocation to i by 1

decrease allocation to j by 1

if j=0,remove j from list,last--

4.2 Coping with Selfishness

This algorithm produces an optimal solution to the

scheduling problem assuming that the bids received

were truthful. But this is not generally the case

when the system consists of self-interested, rational

resource providers. Now, this can be ensured by de-

vising an appropriate payment scheme which incen-

tivises the bidders to bid truthful values. On the lines

of the famed VCG mechanisms, the payment to a re-

source provider is computed by giving a surplus to

the winning bidder that is equal to the overall value

the bidder adds to the revenue of the auctioneer.

Recall that the VCG mechanisms can be applied to

scenarios in which the agents have quasi-linear utili-

ties, or utilities of the form:

u

i

(x, θ

i

)=v

i

(k, θ

i

)+(m

i

+ t

i

) (7)

where u

i

is the utility function, x is an outcome in the

game, θ

i

is the private valuation of player i, v

i

is the

cost incurred by player i in participating in this mech-

anism, k is the allocation vector, m

i

is some form of

endowment or participation fee and t

i

is the payment

received by player i.

It can be immediately seen that the model we have

proposed clearly falls in this category because the util-

ity to a resource provider is the difference between his

cost of execution of the job using his resources mi-

nus the payment he recieves for completing the job.

Hence, the VCG mechanisms can be applied directly

in this setting.

Recall from section 2, the structure of the incentive

to be given to an agent in the Clarke’s mechanism

h

i

(θ

−i

)=−

j=i

v

j

(k

∗

−i

(θ

−i

),θ

j

) (8)

This simply means that the loss to the grid user,

who submits a job, due to the absence of each of the

resource providers must be given back to the resource

provider as an incentive to induce him to reveal his

true valuation. This means that this calculated value

must be given to the selected resource providers over

and above their bid for the tasks. It is very simple

to see that if a resource provider was not part of

the final allocation as determined by the winners

determination algorithm, then their incentive value is

0, while for those providers who were part of the final

allocation this is simply the difference between the

total payment made with and without that particular

node in the bidding process. This means we have

to run the winners determination algorithm k more

times (k ≤ n). Though this adds to the overall

complexity of the process, considering the truthful

values it induces, it is but a small price to pay.

WEBIST 2006 - INTERNET TECHNOLOGY

182

4.3 Complexity Analysis

The complexity determining step in the above algo-

rithm is the operations within the two loops which

takes Θ(m

2

) steps. Step 2 which involves sorting of

m elements would take only Θ(mlogm) time. Since

m>nand the other steps are linear time computable,

the entire algorithm is Θ(m

2

) time solvable. But,

the application of payment rule according to Clarke’s

mechanism demands that the algorithm be run max-

imum of n+1 times which adds a factor of m to the

overall complexity of the process thereby yielding a

Θ(m

3

) complexity.

Thus the payment mechanism ensures truthful bids

and the optimal allocation algorithm ensures an ef-

ficient and reasonably fast allocation of the sub-jobs.

5 CONCLUSION

The Algorithm developed in the paper computes

an optimal allocation of jobs to resource providers

and the payment mechanism which is inspired by

the VCG mechanism ensures truthful dissemination

of information. The Mechanism is highly robust

because of its allocative efficiency and strategy

proofness. The allocation algorithm and payment

structure works optimally within the limitations and

assumptions discussed in this paper. The optimal

algorithm presents a clever way of circumventing

the problems associated with the inherent non-linear

integer programming formulation.

We have considered one model of application

scheduling on the grid. Such strategy proof mecha-

nisms must be developed for more models if we have

to truly unleash the power of grid computing. A nec-

essary improvement would be to estimate the effi-

ciency of this mechanism by comparitive simulation

with other scheduling mechanisms. Only through ex-

tensive simulations can we conclude that this mech-

anism would work in a grid setting. Another im-

provement would be to relax the assumption that all

the sub-jobs are of equal size. One more relaxation

could be made to the linear cost model of the re-

source providers, replacing it with a piece-wise linear

model. Procurement auctions of the type involving

piece-wise linear cost models can be studied in (Eso

et al., 2001)

REFERENCES

Buyya, R. (2002). Economic-based Distributed Resource

Management and Scheduling for Grid Computing.

PhD thesis, School of Computer Science and Software

Engineering, Monash University, Australia.

Das, A. and Grosu, D. (2005). Combinatorial auction-based

protocols forresource allocation in grids. In IPDPS05.

Eso, M., Ghosh, S., Kalagnanam, J., and Ladayani, L.

(2001). Bid evaluation in procurement auctions

with piece-wise linear supply curves. Technical re-

port, IBM Research Division, Yorktown Heights, NY

10598.

Foster, I. and Kesselman, C. (2002). The Grid: Blueprint for

a new computing infrastructure. Morgan kaufmann

publishers.

Grosu, D. and Chronopoulos, A. (2003). A load balancing

mechanism with verification. In IPDPS03.

Grosu, D. and Chronopoulos, A. (2004). Algorithmic mech-

anism design for load balancing in distributed sys-

tems. In IPDPS04.

Grosu, D., Chronopoulos, A., and Leung, M. (2002). Load

balancing in distributed systems: An approach using

cooperative games. In IPDPS02.

Hogg, W. C., T., Huberman, B., J., K., and Stornetta, W.

(1992). Spawn: a distributed computational econ-

omy. IEEE transactions on software engineering,

18(2):103–117.

Mas-Colell, A., Whinston, M., and Green, J. (1995). Mi-

croeconomic Theory. Oxford University Press, New

York.

Narahari, Y. and Dayama, P. (2005). Combinatorial auc-

tions for electronic business. Sadhana, 30(2-3):179–

211.

Nisan, N., London, S., Regev, O., and Camiel, N. (1998).

The popcorn market-online markets for computational

resources. In First International conference on Infor-

mation and Computational Economies.

Wellman, M., Walsh, W., Wurman, P., and MacKie-Mason,

J. (1998). Some economics of market based distrib-

uted scheduling. In ICDCS98.

Wolski, R., Plank, J., Brevik, J., and Bryan, T. (2002). G-

commerce: Market formulations controlling resource

allocation on the computational grid. In AAMAS 2002.

Zhu, Y. (2003). A survey on grid scheduling systems. Tech-

nical report, Department of Computer Science, Hong

Kong University of Science and Technology, Hong

Kong.

A STRATEGYPROOF AUCTION MECHANISM FOR GRID SCHEDULING WITH SELFISH ENTITIES

183