UTILIZATION OF CASE-BASED REASONING IN AUDITING

Determining the Audit Fee

Robert Zenzerović

Faculty of Economics and Tourism “Mijo Mirković, PhD” Pula,Universit of Rijeka, Preradovićeva 1/1, Pula, Croatia

Keywords: Audit fee, case-based reasoning, decision making.

Abstract: Case-based reasoning represents a method for solving problems and decision making support which is based

on the previous business experience. It uses cases from the past to solve new problems. Case can be defined

as conceptualized piece of knowledge representing the experience that teaches a lesson fundamental to

achieving the goals of the decision maker and it usually incorporate input (situation part of the case) and

output features (solution part of the case). Many studies tried to explain types and impact of different factors

that determine audit fees. Mostly all authors concentrate their research on the impact of following

determinants: auditee size, auditee complexity, auditee profitability, ownership control, timing variables,

auditor location and auditor size. In paper all mentioned factors are described except auditor size and

location since these factors are not significant in Croatian audit service market. All significant audit fee

determinants will be appropriately quantified in order to build a case-based reasoning model for determining

audit fee for smaller and mid sized auditing firms in Croatia but also for the same firms in the other,

particularly transition, countries too.

1 INTRODUCTION

The transitional period in Croatia started at the

beginning of nineties. In that time social ownership

left its place to private owned companies what

meant that the financial statement auditing will

become obliged very soon. Couple of years later,

precisely in 1993., The Accounting and Auditing

Acts were brought. According to The Accounting

Act all big companies, and medium companies

1

if

they are organized as joint stock companies, have to

audit their financial statements once a year. Once in

a tree years small companies, if they are organized

as a joint stock companies, have to make the review

of financial statements. Other companies don’t have

a legal obligation to audit financial statements but

they sometimes do that because of creditors

requesting. Considering the fact that Croatia is still

transitional economy, Croatian companies are

looking on auditing mainly as a legal obligation

which has to be fulfilled. According to mentioned

they are looking for auditing firms which will offer

1

Company size is measured by their assets, revenues

and number of employees according to the

Accounting Act.

the lowest price for performing financial statement

audit.

Today, in Croatian audit market operate about

200 audit firms. During the past 11 years the

competition on audit service market was strong

mainly because many of small auditing firms were

founded. Like in other countries most of banks and

biggest companies are audited by “Big four”

2

auditing firms. Other companies are audited by

smaller auditing firms and the competition is

particularly strong in this segment of audit market.

This “non big four” auditing firms are faced with

problem of determining the audit fee when

competing for new client. During informal

interviews with audit partners in smaller and

medium size auditing firms it was found that

problem of determining the audit fee when bidding

for new clients often occurs. The motivation of this

article is to develop a model based on case-base

reasoning which can be useful for smaller and

medium size auditing firms when biding for a new

client. Article is structured in the following way: at

the start the characteristics of case-based reasoning

are explained after what determinants of audit fee

are described. Application of case-base reasoning

2

Deloitte & Touche, Ernst & Young, KPMG and

PriceWaterhouseCoopers

182

Zenzerovi

´

c R. (2006).

UTILIZATION OF CASE-BASED REASONING IN AUDITING - Determining the Audit Fee.

In Proceedings of the Eighth International Conference on Enterprise Information Systems - AIDSS, pages 182-188

DOI: 10.5220/0002439301820188

Copyright

c

SciTePress

model in auditing when determining the audit fee is

explained at the end.

2 CASE-BASED REASONING

During the last decade different methods of

transforming data into business intelligence have

emerged. Information systems like OLAP systems,

rule based systems, case-based reasoning, neural

networks, fuzzy logic has found different

applications in management, auditing, finance and

many other areas as a very helpful management

tools. Case-based reasoning represents a method for

solving problems and decision making support

which is based on the previous business experience.

It uses cases from the past to solve new problems.

These types of decision making systems are based

on the fact that in many cases a new problem is

partly known to decision maker because it often

reflects situations experienced in the past. Therefore,

if problem was successfully solved in the past the

same experience can be used to solve the current

problem. Otherwise, if solution of an old problem

was inappropriate than that kind of solution should

be avoided in the current problem. As the main

advantages of case-based reasoning systems

following could be pointed out:

1. it solves problem quickly by retrieving

similar cases, rather than generate solutions

from the scratch,

2. it can solve problems in domains that are

not understood completely

3. it can remember past mistakes and warn

users not to repeat these mistakes

4. it can use past cases to determine which

parts of a problem to focus on

5. it can create justification for proposed

solution by comparing and contrasting new

problem with the old problem (Morris,

2002., p. 1).

First step in case-based reasoning process is

introduction of a new problem which has to be

solved. The problem is represented as a target case

which consists of features that describes the situation

decision maker is interested in matching. When

solving a new problem case-based reasoning system

firstly finds similar case from the past. After that

system adjust old solution and for any difference

between old and new case, and provide solution for

the new problem. At the end system stores the new

case and its solution into data base, from which it

can be retrieved and used in solving the future

problems.

Central point in the system represents cases.

Case is conceptualized piece of knowledge

representing the experience that teaches a lesson

fundamental to achieving the goals of the decision

maker. Cases have to be represented in a way which

enables effective usage by the reasoner. They

usually incorporate input feature and output feature.

Input feature represent important attributes of cases

that effect decision making. Some authors point out

that input features form so called situation part of the

case (Dhar, Stein, 1997., p. 151). Before entering

cases into case base it is important that input features

names and values are defined. Input features value

can take different forms, like numeric value, yes or

no value, text value, etc. On the other hand output

features describe solution part of the problem.

Once, when target case is inputted in the system

with its input features, case-based reasoning system

has to retrieve the most similar cases from the case

base. Retrieving case from the case base represents a

very important step in the case-based reasoning

working cycle. Retrieval of relevant cases depends

on indexing of cases. The easiest way to do indexing

is to a priori set important features for the problem

solution. That set of selected features represents a

probe that is sent in the case base in order to find

similar cases, cases which have selected features.

In order to do match and retrieval of the similar

cases from the case base there must be used some

similarity assessment method because decision

maker should not expect perfect match (in most

situation values of the selected features for old and

new case will not be the same). Therefore, it is

necessary to define some similarity metrics. An

example of such metrics is nearest neighbor method

which works well in situations where features have

numerical value. After the most similar case is

retrieved from the case base it can be used for

finding interesting information and after that

reasoner can adjust and send a new probe with

different features for retrieving of new case. On the

other hand case-based reasoning system can be

designed to make automatic adjustments in solution

part of the case on the base of differences in

situation part of the cases, providing the solution for

the new case.

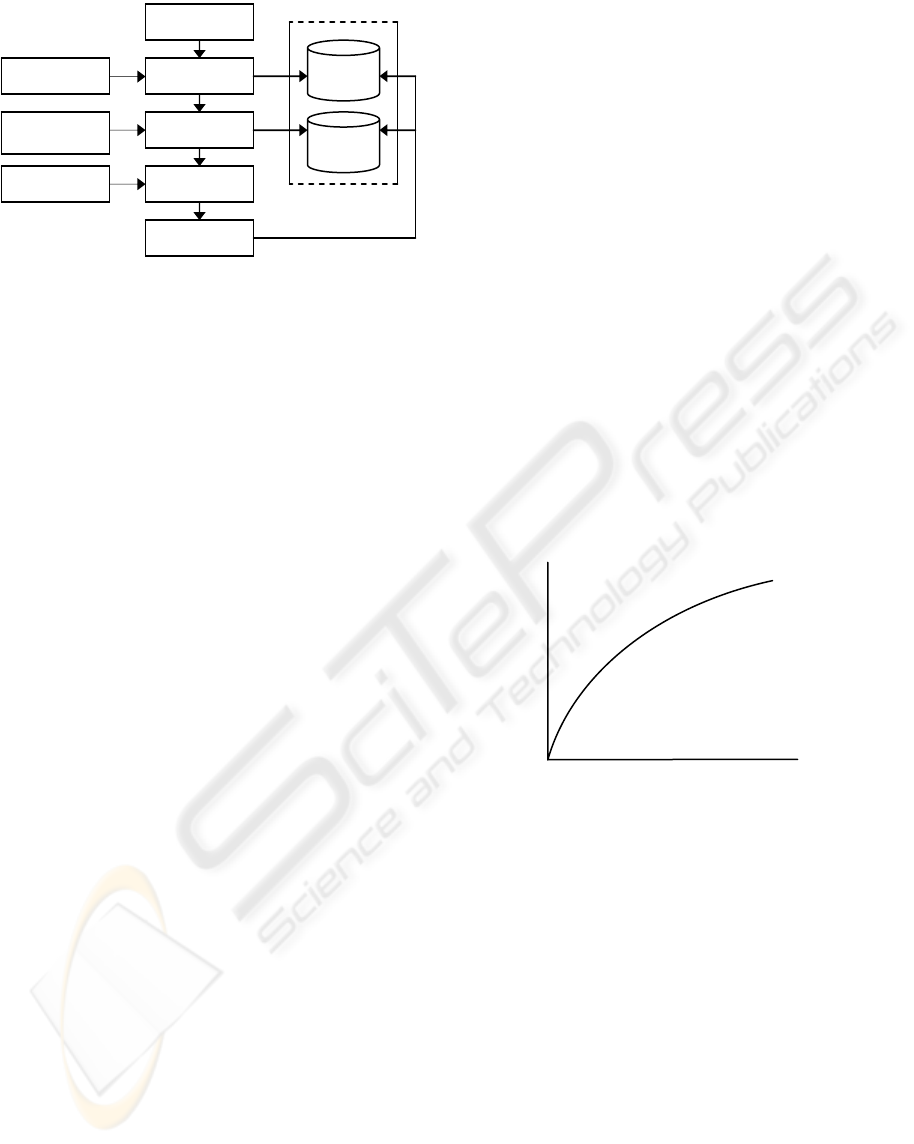

Case-based reasoning process is illustrated in

Figure 1 where case-based reasoning steps are

shown (Hwang, Shin, Han, 2004., p. 25.).

UTILIZATION OF CASE-BASED REASONING IN AUDITING - Determining the Audit Fee

183

Figure 1: Case-based reasoning process.

Case-based reasoning systems have different

areas of business applications. According to some

authors until 1997 there was developed more than

100 CBR systems (Lopez de Mantaras, Plaza, 1997.,

p. 21). As an example of using case-based reasoning

in auditing, system called SCAN is developed in

order to provide audit recommendations (Morris,

2002., p. 10 - 11).

3 DETERMINANTS OF AUDIT

FEES

Many authors tried to explain types and impact of

different factors that determine audit fees. They

found that the same factors have different impact

depending on the size of audit service market and

the impact of some of them is not precisely known.

But mostly all of them concentrate on researching

the impact of following audit fee determinants:

auditee size, auditee complexity, auditee

profitability, ownership control, timing variables,

auditor location and auditor size. Each determinant

is explained except auditor size considering the fact

that the article is focused on developing the case-

based reasoning model for determining audit fee for

non big four firms so the size of auditor is not

important. Auditor location is not considered too

according to fact that it is the determinant which

depends on characteristics of each audit services

market. For example, in United Kingdom auditor

location is important variable because audit staff

costs are higher in Southeast than in other region

while in Croatia, and in most transitional countries,

there is no significant difference between regions.

This determinant can be used in other countries

depending on the characteristics of their audit

services market.

3.1 Auditee Size

Researches have found that auditee size is the most

significant explanatory variable in determining audit

fee. Auditee size can be measured by total assets and

by total revenues. Most of researches used total

assets as measure of auditee size and it is suitable

particularly when audit approach is balance sheet

based. Factors like the age profile of assets and

chosen accounting policy can make the total assets

measure different between similar companies.

Auditee size measured by total revenues is better

approach when auditor has a transaction based

approach to the audit. For building the model total

revenues will be used as the measure of auditee size.

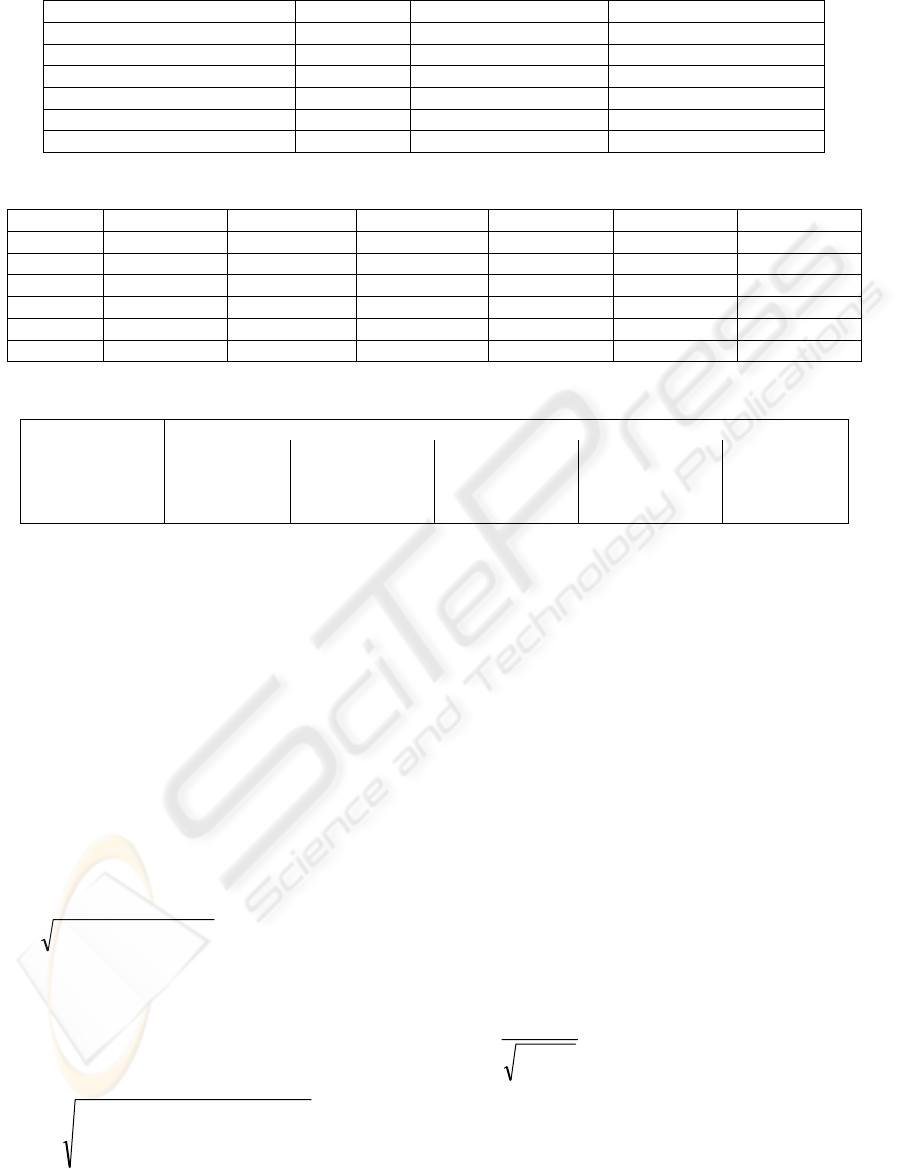

When considering the relationship between auditee

size and auditor fee it must be noticed that it is not

linear. The studies have shown that proportionate

increase in audit fee is decreasing function of

auditee size what can be explained by presumption

that the bigger the auditee is the strongest internal

control procedures it will have. This relationship is

represented in the Figure 2.

Figure 2: Relationship between audit fee and auditee size.

3.2 Auditee Complexity

When auditing complex companies auditors are

faced with much more work to be done. Complex

companies are considered those with many

subsidiaries, dislocated business units, companies

with big numbers of unusual transactions, and

different internal controls, companies with particular

balance sheet composition and companies that have

subsidiaries which are operating in different

branches. They deserve much more attention and

request much more time when auditing what usually

result in higher audit fee. When auditing companies

with many subsidiaries auditor has to charge higher

fee because he or she has to audit separate financial

statements and if the subsidiaries are situated in

foreign country costs became even higher. Auditor

has to pay attention on intra-group transactions,

Audit fee

Auditee size

Feature Indexing

Feature

weighting

Adaptation Rule

New Problem

Indexing Cases

Case Retrieval

Case Adaptation

Solution

Knowledge Base

Case

Indexes

Case

Base

ICEIS 2006 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

184

taxation and pricing policies. If the subsidiaries are

operating in different branches (the business is

diversified) auditor has to get specific knowledge

about business and the costs became higher again.

Diversification can be measured by Herfindahl index

∑

=

=

n

i

i

SH

1

2

(1)

where S

i

represent turnover of the i-th segment as a

proportion of total revenue of the auditee. Dislocated

business units have influence on price too. Auditor

has to visit all those locations what usually make

audit more expensive. Big numbers of unusual

transactions and complex system of internal controls

takes more time for testing and put the pressure on

costs too. Companies with particular balance sheet

composition include companies which have big

proportion of inventory and debtors in total assets.

Mentioned items are more difficult to audit then for

example cash or fixed assets and it can result in

higher fee. For building model the complexity will

be represented by scale from 0 to 10 where 0 means

low complexity of auditee and 10 very complex

companies. Auditor usually makes estimation on

complexity considering the factors like: number of

subsidiaries, location of subsidiaries and business

units, Herfindahl index which measure

diversification, number of different branches in

which company is operating, and two ratios:

inventory/total assets and debtors/total assets.

3.3 Auditee Profitability

The impact of auditee profitability on audit fee is

more important when auditee is facing financial

problems than when it is generating profit. Auditee

profitability may cause changes in audit fee in two

ways. When auditee has financial problems it is

trying to control all overhead costs which might

result in lower fee. But on the other hand, financial

distresses put in front of auditor need to focus more

directly on valuation of assets, the status of a auditee

as a going concern, possible breaches of loan

covenants etc. what may rise the audit fee. In

building the model return on equity (ROE) will be

used as a ratio which represents auditee profitability.

3.4 Ownership Control

Development of financial statements audit is the

result of divorcement between ownership and

control (management) of the company. Diverse

ownership structure requires more extensive and

higher quality audit than in the case of auditee

owned by only couple of shareholders with

relatively high shareholdings so it is logical to

expect that the extent of audit services demanded

will be a function of ownership control which will

be measured by the number of shareholders.

3.5 Timing Variables

Auditing is a quite seasonable activity with busy

season which start at January and lasts till June.

Auditors often charge a premium for performing

audit in this period of year what can be a result of

shifting the audit emphasis to pre year end testing

with higher audit costs or auditor has to engage new

human resources. Another timing variable is auditee

request for audit report i.e. time which past from the

end of accounting year to the date of audit report.

Shorter the period is the audit fee is expected to be

higher as it is possible that auditor has to engage

new work force to audit financial statements. For

building a model it will be used the period from the

end of accounting year to the issuance date of audit

report measured by number of weeks.

4 DESIGNING THE CBR MODEL

FOR DETERMINING THE

AUDIT FEE

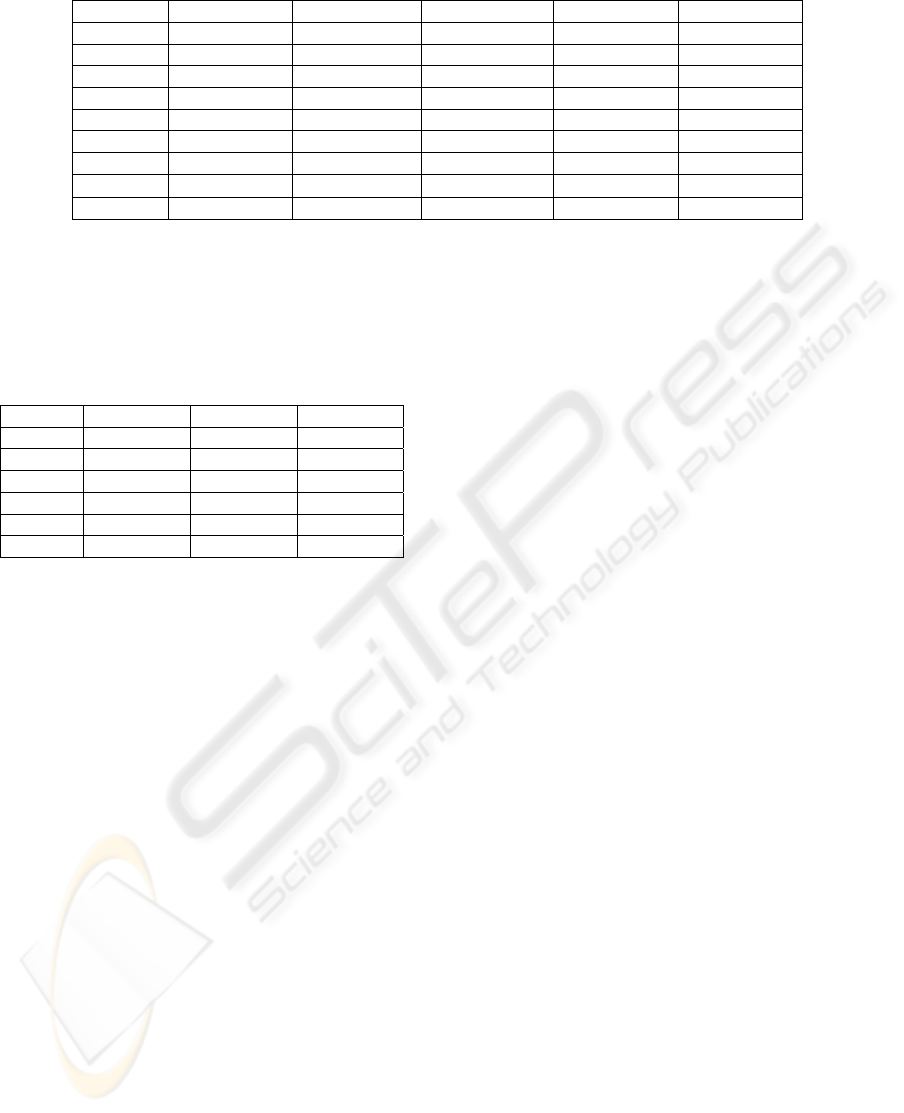

In order to design case-based reasoning model it is

necessary to define feature names and values at the

start. In order to keep model simple and easy for

understanding six features shown in Table 1 are

used. It should be pointed out that first five features

represent input features or situation part of the case

and the last feature (audit fee) represents output

feature or solution part of the case. On the basis of

the previous experience and business data it is

necessary to build data base that will contain cases

from the past. The easiest way to build such data

base is to find records on all the clients from the

past. After that for each client feature values must be

determined and inputted into the data base (case

base). On the basis of such approach in building data

base it will be assumed that the data shown in Table

2 is included into data base of auditing firm.

UTILIZATION OF CASE-BASED REASONING IN AUDITING - Determining the Audit Fee

185

Table 1: Features and their characteristics.

Feature Type Measurement unit Feature value span

Auditee size - Revenue Numerical Money units (MU) 0 - 100.000.000

Auditee complexity Numerical Number 0 - 10

Auditee profitability - ROE Numerical Number -0,5 - 0,5

Number of owners Numerical Number 1 - 500

Timing variable - Weeks Numerical Number 5 - 25

Audit fee Numerical Money units (MU) 10.000 - 100.000

Table 2: Model of case-based reasoning data base.

Case Size (MU) Complexity Profitability Ownership Time Fee (MU)

A 18.000.000 2 0,47 8 23 2.890

B 28.000.000 3 0,21 2 14 4.475

C 31.500.000 3 0,19 9 25 6.000

D 37.900.000 2 0,31 5 8 18.700

E 56.700.000 4 -0,02 35 7 19.870

F 69.900.000 7 -0,05 78 17 53.290

Table 3: Probe input features for the clients X, Y and Z.

Features Probe case -new

client Size (MU) Complexity Profitability Owners Time

x 21.900.000 3 0,17 3 7

y 42.970.000 5 0,21 13 18

z 62.700.000 7 0,35 29 9

In the situation when a new client is analyzed in

order to determine auditing fee, case-based

reasoning model requires setting up a probe that is

send to data base. It should contain values of

relevant input features in order to find the most

similar case in the data base. It can be assumed that

potentially new clients have the features presented in

Table 3.

On the basis of the send probe into the data base

the case-based reasoning system will find the most

similar case using similarity metrics. For the

simplicity of the model nearest neighbor method is

used. It calculates the geometric distance between

probe and the all cases from the base. Geometric

distance (GD) for each feature can be defined by the

following formula:

()

2

2

probecaseoldGD −= (2)

After geometrical distance is calculated for each

feature j case-based reasoning system must calculate

total geometrical distance (TGD) for each old case i

and each feature j. Total geometrical distance can be

calculated, by using the following formula (Babić,

1997., p. 42):

()

[]

2

n

1j

2

iji

probecaseoldwTGD

∑

=

−= (3)

Where j represents feature (j= 1…n) and i old case

(i=1...m).

For the simplicity of this paper it will be assumed

that all features have the same importance and

weights (w) of features can be excluded from the

calculations. But if reasoner is not valuing all

features by the same importance than a priori

features weights have to be defined. Research of

importance of each audit fee determinant is opened

and some results can be potentially useful in

improving this model. Since calculation of total

geometrical distance requires adding geometrical

distances of each feature arises the problem of

different measurement scales of features. In order to

deal with that problem all values in data base must

be normalized. Among different approaches of

normalization so called vector normalization will be

used. Vector normalization procedure requires that

each feature value must be divided by the feature

norm. Normalized values r

ij

are calculated from

original values x

ij

by using the following formula

(Babić, 1997., p. 24):

2

2

ij

ij

ij

X

x

r

∑

= (4)

Normalized data calculated on the basis of the

previous formula and original data from the Table 2.

are presented in the Table 4.

ICEIS 2006 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

186

Table 4: Model of normalized case-based reasoning data base.

Case Size Complexity Profitability Ownership Time

A 0,170370 0,179605 0,504183 0,162255 0,564003

B 0,265020 0,269408 0,225273 0,040564 0,343306

C 0,298147 0,269408 0,203819 0,182537 0,613047

D 0,358723 0,179605 0,332546 0,101409 0,196175

E 0,536665 0,359211 -0,021455 0,709865 0,171653

F 0,661603 0,628619 -0,053636 1,581984 0,416872

x 0,207283 0,269408 0,182364 0,060846 0,171653

y 0,406711 0,449013 0,225273 0,263664 0,441394

z 0,593455 0,628619 0,375455 0,588174 0,220697

In the case of clients X, Y and Z case-based

reasoning system would calculate the total

geometrical distance scores for each old case which

are presented in Table 5.

Table 5: Total geometrical distance scores.

Case TGD for x TGD for y TGD for z

A 0,526514 0,481191 0,834537

B 0,187219 0,334259 0,757870

C 0,467284 0,283815 0,751118

D 0,236220 0,415752 0,704340

E 0,761134 0,598065 0,500557

F 1,662868 1,383325 1,102228

On the basis of all previous calculations and

usage of nearest neighbor method based on the

geometrical distances case-based reasoning system

would finish matching procedure finding that the

most similar case in comparison to client X is old

case B. Namely, old case B has the smallest total

geometrical distance score (0,187219). On the basis

of such finding reasoner would check data base and

find that auditing fee for old client B is 4.475 MU.

Therefore, amount of 4.475 MU represents starting

point in establishing the final fee for the new client

X. In the same way one can notice that the most

similar cases to clients Y and Z are cases C and E.

According to audit fee charged for cases C and E

reasoner is able to conclude that the starting point

for making decision on audit fee for client Y is 6.000

MU, and for client Z 19.870 MU. In the more

advanced mode of working, case-based reasoning

system for determining audit fee might take into

consideration

differences among cases B and X input features in

order to make adjustments to the solution part of the

problem, i.e. audit fee amount, or the auditor can

adjust audit fee according to his previous

experience.

5 CONCLUDING REMARKS

Case base reasoning, as a method for solving

problems and decision making support based on the

previous business experience, can be useful

instrument in making decision about audit fee. New

problems often are not completely new but consist

of situations which are partly known to decision

makers and in that sense case-based reasoning can

be very helpful tool. The advantages of case-based

reasoning, like velocity in solving problems by

retrieving similar cases, simplicity, solving problems

in domains that are not understood completely and

remembering past mistakes and warning users not to

repeat these mistakes, resulted in use of case base

reasoning systems in different area of business

applications like bank lending, employee tax status,

audit recommendations etc. In order to be accurate

and flexible this method, which transform data into

business intelligence, depends on the number and

diversity of cases stored in the case base. The

probability that the new problem will be

appropriately solved would be higher if the case-

based reasoning model has more cases.

In this paper case base reasoning model was built

using the most important audit fee determinants -

auditee size, auditee complexity, auditee

profitability, ownership control and timing variable.

All these determinants (input features) combined

with appropriate audit fee which has been charged in

the past (output feature) represent a case stored in a

case base. Problem of determining audit fee to the

potentially new client case-based reasoning model is

able to solve by finding a similar case with similar

input features and suggesting the audit fee that can

be charged. In order to find adequate case in case

base, model use similarity assessment method called

nearest neighbor method. Considering the fact that

all input features have the same weights the future

work can be focused on estimating the weights for

each feature and finding new features i.e. audit fee

UTILIZATION OF CASE-BASED REASONING IN AUDITING - Determining the Audit Fee

187

determinants. Perfect matching of old cases and new

problem usually does not occur so there can be used

different methods for making adjustments to audit

fee considering the differences among input features

of old and new case what can be used for improving

the model in the future work. On the other hand, the

auditor can decide to make adjustments to audit fee

according to his previous experience. The key

accuracy factor of this model is appropriate case

base. More cases it has, more accurate the solution

i.e. audit fee will be. This model can be useful for

small and medium size auditing firms in competing

for new clients as a guideline for making decision on

audit fee. Its implementation and theoretical

development will probably result in different

improvements which will be helpful for auditors in

making more precise decisions.

REFERENCES

Arditi, D.O.B., Tokdemir, O.B., 1999. Comparison of

Case-Based Reasoning and Artificial Neural

Networks. Journal of Computing in Civil Engineering.

July

Babić, Z., 1997. Osnove teorije odlučivanja. Faculty of

Economics Split.

Chan, P., Ezzamel, M., Gwilliam, D., 1993. Determinants

of audit fees for quoted UK companies. Journal of

Bussines Finance & Accounting. 20 (12):765-786.

Choobineh, J., W. Lo, A., 2004. CABSYDD: case-based

system for database design. Journal of Management

Information Systems. 20 (3):281-314.

Dhar, V., Stein, R., 1997, Seven methods for transforming

corporate data into business intelligence, New Jersey:

Prentice Hall.

Frangou, A. J.,Wan, Y.,Antony, J.,Kaye, M., 1998. ESAS:

A case-based approach to business planning and

monitoring. Expert Systems. August.

Geiger, M. A., Rama, D. V., 2003. Audit fees, nonaudit

fees, and auditor reporting on stressed companies.

Auditing: A Journal of Practice & Theory. 22 (2):53-

69.

Hwang, S.S., Shin, T., Han, I., 2004. CRAS-CBR: Internal

control risk assessment system using case-based

reasoning. 21 (1):22-33.

Jubb, C. A., Houghton, K. A., Butterworth, S., 1996.

Audit fee determinant: the plural nature of risk.

Managerial Auditing Journal. 11 (3):25-40.

Lee, J. K., Kim, J. K., 2002. A case-based reasoning

approach for building a decision model. Expert

Systems. 19 (3):123-135.

Morris, B., 2002. Applicability of case-based reasoning

for business problems: A study of three system.

www.accountingeducation.com/subsites/ecias/2002/cb

r.Study ofThreeSystems.pdf, 24.03.2004.

Lopez de Mantaras, R., Plaza, E., 1997. Case-based

reasoning: an overview. AI Communications 10.

Pervan, I., Pervan, M., 2002. Application of the rule based

systems in defining business relations with customers.

In Proceedings of 1

st

International Conference "An

Enterprise Odyssey: Economics and Business in the

New Millennium". (Sharma, S., Galetić, L., Eds.),

Graduate School of Economics and Business, Zagreb.

Reich, Y., Kapeliuk, A., 2004. Case-based reasoning with

subjective influence knowledge. Applied Artificial

Intelligence 18:735-760.

Simunic, D. A., 1980. The pricing of audit services:

Theory and evidence. Journal of Accounting

Research. 18 (1):161-190.

ICEIS 2006 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

188