USING SHADOW PRICES FOR RESOURCE ALLOCATION IN A

COMBINATORIAL GRID WITH PROXY-BIDDING AGENTS

Michael Schwind

Institute of Information Systems, J. W. Goethe University

Mertonstrasse 17, D-60054 Frankfurt, Germany

Oleg Gujo

Institute of Information Systems, J. W. Goethe University

Mertonstrasse 17, D-60054 Frankfurt, Germany

Keywords:

Resource allocation, combinatorial auction, grid computing, agent-oriented programming.

Abstract:

Our paper presents an agent-based simulation environment for task scheduling in a distributed computer sys-

tems (grid). The scheduler enables the simultaneous allocation of resources like CPU time, communication

bandwidth, volatile, and non-volatile memory while employing a combinatorial resource allocation mecha-

nism. The resources are allocated by an iterative combinatorial auction with proxy-bidding agents that try to

acquire their desired resource allocation profiles with respect to limited monetary budget endowments. In order

to achieve an efficient bidding process, the auctioneer provides information on resource prices to the bidding

agents. The calculation of explicit resource prices in a combinatorial auction is computationally demanding,

especially if the the bid bundles exhibit complementarities or substitutionalities. We therefore propose a new

approximate pricing mechanism using shadow prices from a linear programming formulation for this purpose.

The efficiency of the shadow price-based allocation mechanism is tested in the context of a closed loop grid

system in which the agents can use monetary units rewarded for the resources they provide to the system

for the acquisition of complementary capacity. Two types of proxy-bidding agents are compared in terms of

efficiency (received units of resources, time until bid acceptance) within this scenario: An aggressive bidding

agent with strongly rising bids and a smooth bidding agent with slowly increasing bids.

1 INTRODUCTION

We present an agent-based simulation environment

for resource allocation in a distributed computer sys-

tem that employs shadow prices as an information en-

tity to optimize the allocation process. Our environ-

ment allows the simulation of a mechanism for the

simultaneous allocation of resources like CPU time,

communication bandwidth, volatile and non-volatile

memory in the distributed computer system. In con-

trast to traditional grid allocation approaches, our al-

location process considers production complementar-

ities and substitutionalities for these resources making

the resulting resource usage much more efficient. The

central scheduling instance of our system is compara-

ble to an auctioneer that performs an iterative com-

binatorial auction in which proxy-agents try to ac-

quire the resources needed in computational tasks for

the provision of information services and informa-

tion production (ISIP)

1

by submitting package bids

1

Examples for ISIP tasks are e.g. the provision of Web

services, the customized retrieval and replication of cus-

for the resource combinations. The proxy-agents’

willingness-to-pay (W2P) for these bundles is con-

straint by limited budgets of a virtual currency they

are endowed with. The allocation system simulates a

closed-loop grid economy in which the agents gain

monetary units for resources they provide to other

grid system participants via auctioneer. The earned

virtual currency can be used for the acquisition of

complementary resource capacity by submitting com-

binatorial bids. The simulation environment allows

the utilization and benchmarking of different proxy-

bidding strategies in various system load situations.

Two main bidding strategies are compared in this pa-

per:

• An aggressive bidding agent that submits combina-

torial bids while trying to achieve quick bid accep-

tance by using a fast inclining bid pricing strategy.

• A smooth bidding agent that submits multiple bid

bundles to the auctioneer waiting for bid accep-

tance of some of the alternative bids while increas-

tomized stock chart data or the broadcast of a public event

to viewers via TCP/IP protocol.

11

Schwind M. and Gujo O. (2006).

USING SHADOW PRICES FOR RESOURCE ALLOCATION IN A COMBINATORIAL GRID WITH PROXY-BIDDING AGENTS.

In Proceedings of the Eighth Inter national Conference on Enterprise Information Systems - SAIC, pages 11-18

DOI: 10.5220/0002461500110018

Copyright

c

SciTePress

ing the bid prices only slowly.

The bidding strategies are compared with each

other regarding their allocation-related efficiency,

which is measured in terms of received resource units

per virtual currency unit spent by the agents and in

terms of time to bid acceptance in the auction process.

2 COMBINATORIAL AUCTIONS

FOR RESOURCE ALLOCATION

IN DISTRIBUTED COMPUTER

SYSTEMS

Various auction protocols have been proposed for re-

source allocation in distributed computer systems in

the last decades. The transfer of economic principles

to resource attribution in grid systems, like the price

controlled resource allocation (PCRA)

2

used in our

scenario, allows flexible implementation of allocation

mechanisms in decentralized systems (Buyya et al.,

2001).

Combinatorial auctions are a suitable tool to allo-

cate interdependent resources because they can take

their substitutionalities and complementarities into

account. The production process for information ser-

vices in distributed systems comprises an allocation

problem with strong complementarities. For exam-

ple, if an information service such as the provisioning

of a video conference service via the web or the off-

line calculation of distributed database jobs has to be

processed on different computers and acquires CPU

time without obtaining communication network ca-

pacity between the computers at the same time, the

acquired CPU time is worthless. The application of

combinatorial auctions for resource allocation in dis-

tributed computer systems is still in its infancy despite

its excellent applicability to grid computing. A com-

binatorial auction-based mechanism for resource allo-

cation in a SensorNet testbed was presented by (Chun

et al., 2004) in a recent approach. The devices in

this mechanism feature different capabilities in vari-

ous combinations. The periodically performed com-

binatorial sealed-bid auction is implemented within

the microeconomic resource allocation system (MI-

RAGE). The system uses a very simple combinatorial

allocation mechanism to achieve sufficient real time

performance. MIRAGE users have accounts based on

a virtual currency enabling a bartering process for the

SensorNet resources. A consequent continuation of

this work is the grid computing environment Bella-

gio by (AuYoung et al., 2004). Each bidder has a

budget of a virtual currency available for task pay-

2

The price is used as a control variable for the schedul-

ing mechanism, requests with higher W2P are prioritized.

ment purposes. The assignment of the required re-

sources to the particular tasks is done by a combi-

natorial second-price auction, which comes close to

a strategy proof mechanism. In several experiments,

the system is tested for scalability, efficiency, and fair-

ness. Due to the simple greedy algorithm used in this

system, the efficiency of the resulting resource alloca-

tion is not satisfying.

3 AN AGENT-BASED

SIMULATION ENVIRONMENT

FOR COMBINATORIAL

RESOURCE ALLOCATION

Our combinatorial grid scheduling environment, real-

ized in JADE 3.3, goes beyond the recent approaches

in several points:

• The system allows the usage of several winner de-

termination algorithms like simulated annealing,

genetic programming, and integer programming

methods according to the users’ requirements in

terms of allocation quality and computation time

3

.

• The simulator provides tools to investigate various

bidding behaviors of the proxy agents in the re-

sources acquisition process. We will concentrate

on this aspect in this paper.

• The framework can simulate changing resource ca-

pacities to test the combinatorial grid scheduler’s

response with respect to allocation efficiency and

system stability.

3.1 Scenario for a PCRA in a

Combinatorial Grid Scheduler

This section gives a brief overview on the resource al-

location scenario for ISIP provision used in our work.

The scenario includes four resource types:

• Central processing units (CPU) that are mainly re-

sponsible for the data processing in the ISIP tasks.

• Volatile memory capacity (MEM) which is neces-

sary to store short-term processing data for the cen-

tral processing units.

• Non-volatile storage capacity (DSK) which is nec-

essary to keep mass data on databases and to pro-

vide program codes for the execution of the ISIP

processes.

3

For algorithm description see (Schwind et al., 2003).

ICEIS 2006 - SOFTWARE AGENTS AND INTERNET COMPUTING

12

(Distributed-)

Market

Mediator(s)

Task

Agent 1

Task

Agent 4

Task

Agent 3

Task

Agent 2

MEM

CPU

NET

DSK

MEM

CPU

NET

DSK

MEM

CPU

NET

DSK

MEM

CPU

NET

DSK

Resource

Agent 1

Resource

Agent 4

Resource

Agent 3

Resource

Agent 2

MEM

CPU

NET

DSK

MEM

CPU

NET

DSK

MEM

CPU

NET

DSK

MEM

CPU

NET

DSK

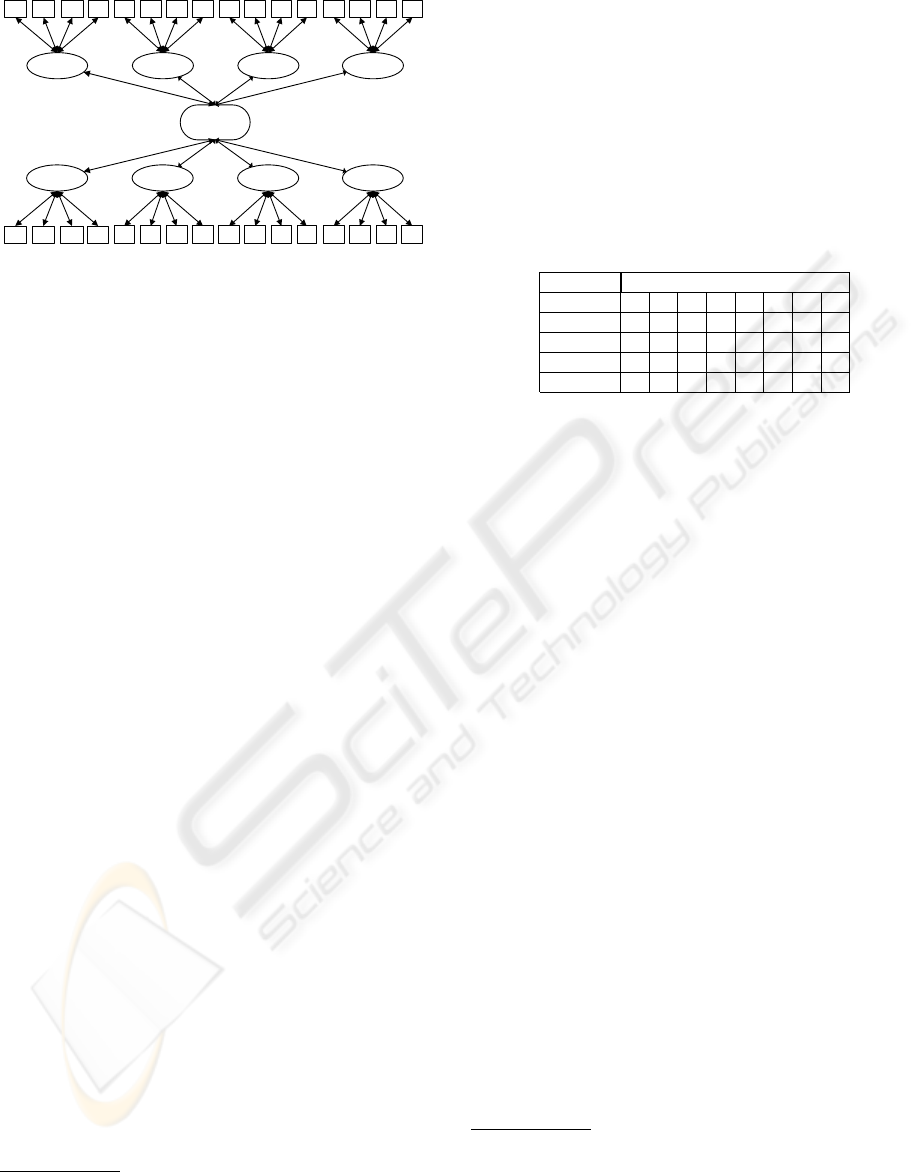

Figure 1: Scenario for the allocation of ISIP resources.

• Network bandwidth (NET) that is required for data

interchange among the grid computer units

4

.

The general PCRA scenario used within the com-

binatorial grid simulator is constructed as follows:

• Task agents (bidders) are engaged in acquiring the

resources needed to process the ISIP task in the dis-

tributed computer system on behalf of real world

clients. They do this by bidding for the required

resource combination via the mediating agent.

• A mediating agent (auctioneer) receives the re-

source bids and calculates an allocation profile for

the available resources managed by the resource

agents according to the allocation mechanism. Af-

ter a successful auction process, bidders are in-

formed about the acceptance of their bids.

• Resource agents collect information about avail-

able resources on their particular host IT systems

through a network of distributed computers and

provide this information to the market mediator.

The resource agents offer the available capacities to

the task agents via the mediating agent. If a bid is

accepted via the auctioneer, the acquired resources

are reserved for the corresponding winning agent

in advance.

Figure 1 depicts the ISIP allocation scenario. Re-

source agents administrate available MEM, CPU,

NET, and DSK capacities on their particular host

computers systems on the supply side. On the de-

mand side, task agents collect the required resource

combinations including MEM, CPU, NET, and DSK

capacity needed to accomplish their production tasks.

Between resource and task agents, there is a mar-

ket mediator that allocates the resources employing

a combinatorial auction. For the formal representa-

tion of the bids, a two-dimensional bid-matrix (BM)

4

Network connections themselves exhibit complemen-

tarities due to their peering character. For simplicity rea-

sons, we assume that NET capacity can be managed as one

single system resource.

is used. One dimension of the BM describes the

time t ∈{1,...,T} at which the resource is required

within the request period T

5

. The other dimension

r ∈{1,...,R} denotes the resource types MEM,

CPU, NET, DSK. The request for a quantity of an in-

dividual resource r at time t is then denoted by a ma-

trix element q(r, t). A price p is assigned to each BM

expressing the agent’s W2P for the resource bundle.

Table 1: Example for a structured bid matrix BM submitted

by a task agent.

BM

struc.

Time Slot t

Resources 1 2 3 4 5 6 7 8

r

1

2 2 3 3 3

r

2

1 1 1

r

3

2 2 1 1 1 1

r

4

3 3 2 2

In addition to the BM , two other matrix types play

an important role within our grid simulation frame-

work:

• The allocation matrix (AM) describes the awarded

allocation q(r, t) for resources r and time slots t

within the following ISIP provision period T .

• The constraint matrix (CM) expresses the maxi-

mum quantity q

max

(r, t) of resource r the auction-

eer can assign to the task agents at time t. The max-

imum possible resource load of the CM represents

the aggregated resource availability for the follow-

ing time slots.

q

bmax

denotes the maximum resource load that can

be requested by a bidder for a single BM element

q

i,j

(r, t). In our matrix instances each entry in a BM

is occupied with probability p

tso

.

3.2 The Combinatorial Scheduling

Auction

In the following paragraph, the course of the com-

binatorial grid auction is described in the light of an

UML sequence diagram based on the FIPA definition

of the English auction (steps are denoted in )

6

:

1. The auctioneer requests the resource agents to eval-

uate the available resource capacities and informs

the bidders about the bidding terms. Then he an-

nounces the start of the auction. Additionally,

the auctioneer awards an initial budget to the task

agents.

5

Time period T is divided into equidistant intervals

(time slots t) within the simulation model. The time pe-

riod T is identical to a following production time span t

pro

at which the ISIP provision takes place.

6

See foundation for intelligent physical agents www.

fipa.org/specifications/fipa00031D.

USING SHADOW PRICES FOR RESOURCE ALLOCATION IN A COMBINATORIAL GRID WITH

PROXY-BIDDING AGENTS

13

2. Following the auctioneer’s call-for-proposal, the

task agents create their bids according to the de-

sired resource combination. Bidders compute the

associated bid price dependent on their actual pric-

ing policy, their budget level, and the latest re-

source prices.

3. The auctioneer receives the bids and calculates the

return-maximizing combinatorial allocation. He

informs the task agents about any bid accep-

tance/rejection and requests the resource agents to

reserve the awarded resources.

4. Resource agents inform the auctioneer about the

status of the task execution.

5. The auctioneer propagates any task status informa-

tion to the task agents, and the agents’ accounts

are debited with the bid prices of the awarded bids.

Then a call-for-proposal for the next round is is-

sued.

6. Task agents can renew their bids in the next round

in case of non-acceptance or non-execution. The

agents’ bid pricing follows rules defined in the sub-

sequent paragraph.

7. The process is repeated until the auctioneer an-

nounces the end of the auction.

In the following, the three crucial elements of the

combinatorial grid scheduling system are described in

more detail: the budget management mechanism, the

combinatorial auctioneer, and the task agents’ bidding

behavior.

3.2.1 The System’s Budget Management

Mechanism

Each of the task agents a

i

holds a monetary budget

BG

i

that is initialized with a fixed amount BG

ini

of

monetary units (MUs) at the start of the system. At

the beginning of each round k, the task agents’ bud-

gets are refreshed (see figure 2, 1) with an amount

of MUs enabling them to acquire the resource bun-

dles b

i,j

required for their ISIP provision task. The

agents’ budget refill can be done in two ways in our

grid economy:

• A fixed amount BG

inc

that is defined by the system

user is added to the agents’ budgets independently

of the production capacity they provide to the grid

system. This case, where task agents only behave

as consumers, is denoted as an open grid econ-

omy. The resource agents which own the resources

act independently from the task agents providing

only resource availability and resource usage in-

formation to the auctioneer. The resource agents

are compensated by the auctioneer for the capacity

provided proportionately to the auctioneers income

Inc

acc

.

auctioneer

resource agent

request-resource-info 1

provide-resource-info

X

X

not-understood (m>0)

task agent

inform-start-of-auction

initAuction ()

n1

n

1

n

call-for-proposal 1

computeBidPrice ()

createBids ()

X

not-understood (m>0)

propose

computeAllocation ()

computeResourceCap ()

request-resource

bookResource ()

executeTask ()

inform-task-execution

X

not-understood / task-failure (m>0)

l

nl

n

m

l

m

l

l

m

n

l

l

l

X

reject-proposal

accept-proposal

l

X

inform-end-of-auction

call-for-proposal 2

n

n

initBudget ()

refreshBudget ()

debitBidPrice ()

request-resource-info 2

n

1

2

3

5

7

4

6

Figure 2: FIPA AUML diagram for the iterative combinato-

rial scheduling auction.

• Task and resource agents act as a unit of consumer

and producer both owning the resources of their

peer system. This means a task and a resource

agent reside simultaneously on each peer computer

in the grid. The resource agent does the reporting of

resource usage and provisioning for the task agent

owning the peer computer resources (see figure 2,

1,4)

7

. The agents on the peer computer are com-

pensated for the resources provided to the system.

The compensation process is organized by the auc-

tioneer. Starting with the initial budgets BG

ini

the

amount of MUs circulating in the system is kept

constant for the closed grid economy.

The accounting of the agents’ budgets in the grid sys-

tem is done by the combinatorial auctioneer (see fig-

ure 2, 1,5).

3.2.2 The Combinatorial Auctioneer

The combinatorial auctioneer controls the iterative al-

location process of the grid system. For this purpose,

the auctioneer awaits the XOR-bundled bids b

i,j

that

have been submitted by the task agents a

i

for the cur-

rent round. The bids that are submitted in the form

of BM s are shown in Table 1. They represent the

task agents requests for resource capacity q

i,j

(r, t) at

7

In Figure 1 this implies that resource agent 1 and task

agent 1 reside on the same peer computer.

ICEIS 2006 - SOFTWARE AGENTS AND INTERNET COMPUTING

14

a particular point of time t. After having received

all alternative BM s submitted by the task agents,

the auctioneer has to solve the combinatorial auc-

tion problem (CAP) which is NP-hard (Parkes and

Ungar, 2000; Fujishima et al., 1999). The CAP is

often denoted as the winner determination problem

(WDP), according to the traditional auctioneers task

of identifying the winner. The formal description of

the CAP could be considered as a special variant of

the weighted set packing problem (WSPP) (Vries and

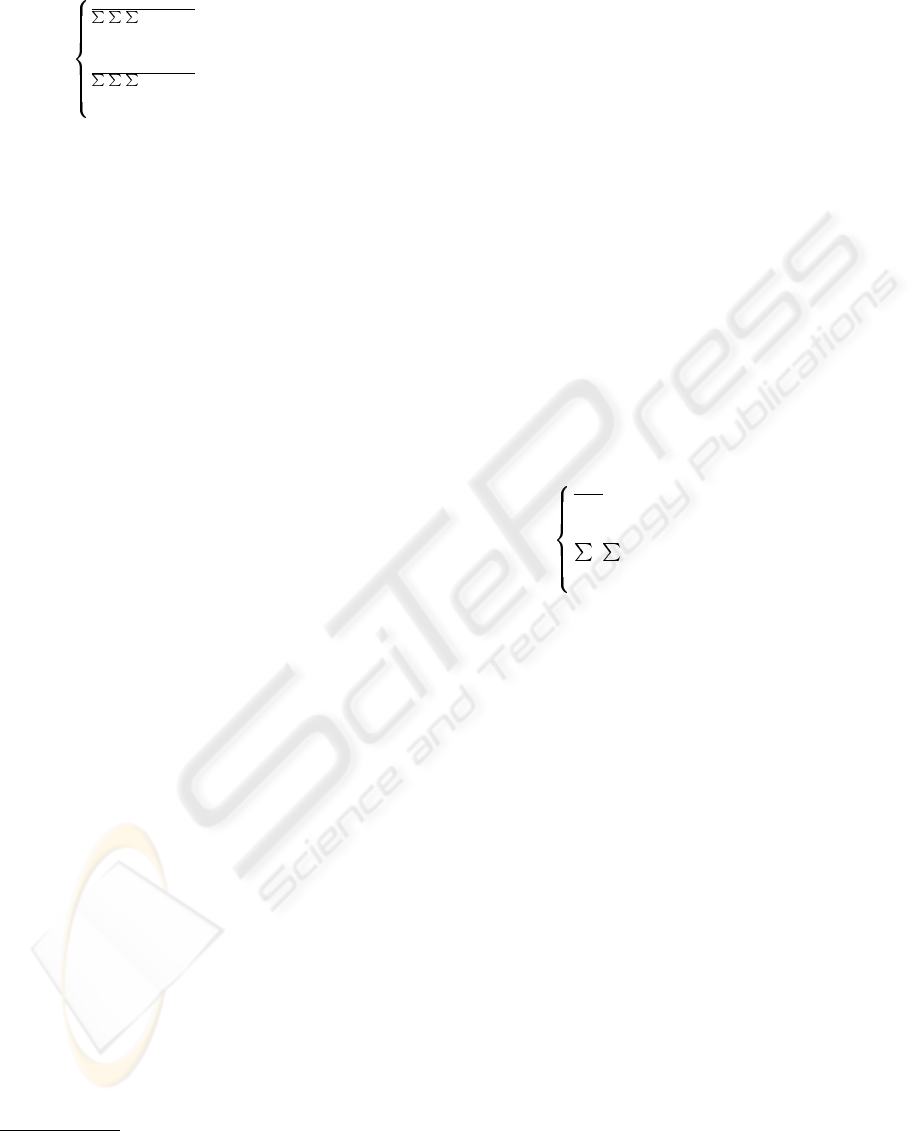

Vohra, 2001) and is formulated as:

max

I

i=1

J

j=1

p

i,j

x

i,j

subject to

I

i=1

J

j=1

q

i,j

(r, t) x

i,j

≤ q

max

(r, t),

where r ∈{1,...,R},t∈{1,...,T} and

J

j=1

x

i,j

≤ 1, where i ∈{1,...,I}.

(1)

Resources: r ∈ N

Time slots: t ∈ N

Resource requests: q

i,j

(r, t) ∈ N

Price for bid b

i,j

: p

i,j

∈ R

+

Acceptance variable: x

i,j

∈{0,1}

Bid j of agent i: b

i,j

∈ B

Income for all accepted bids: Inc

acc

∈ R

+

The goal is to maximize the auctioneers income.

q

max

(r, t) is the maximum capacity of resources at

time t available to the auctioneer and B is the set of

all bids b

i,j

. Furthermore, we refer to the set of ac-

cepted bids as I

+

(with I

+

⊆ B).

3.2.3 Shadow Price Calculation

For an efficient bidding process it is necessary to pro-

vide preferably exact information about the actual

auctioneer’s valuation of the resources to the proxy-

agents. However, it is not possible to calculate unam-

biguous prices (anonymous prices) for the individual

resources in a combinatorial auction due to the non-

linearities in the bidders’ valuations (Xia et al., 2004).

In many cases, explicit resource prices can only be

calculated for each individual bid. (Kwasnica et al.,

2005) describes a pricing scheme for all individual

goods in a combinatorial auction by approximating

the prices in a divisible case based on a linear pro-

gramming (LP) approach first proposed by (Rassenti

et al., 1982). Like in a similar approach by (Bjørndal

and Jørnsten, 2001), they use the dual solution of the

relaxed WDP which is used to calculate the shadow

prices (SP). In our simulation model we adopt the

dual LP approach of (Kwasnica et al., 2005) including

accepted bids as well as rejected bids

8

:

min z =

r t

q

max

(r, t) · sp

r,t

(2)

subject to

r t

q

i,j

(r, t) · sp

r,t

= p

i,j

∀b

i,j

∈ I

+

(3)

r t

q

i,j

(r, t) · sp

r,t

+ δ

i,j

≥ p

i,j

∀b

i,j

∈ I

−

(4)

Accepted bid set: I

+

⊆ B

Rejected bid set: I

−

⊆ B

Reduced cost: δ

i,j

∈ R

+

0

Shadow price acceptance: sp

r,t

∈ R

+

0

We use the primal solution of the LP problem deliv-

ered from open source LP solver LPSOLVE 5.5

9

to the

appointment of sets I

+

and I

−

. As described above,

our matrix has R × T elements, i.e. for every resource

r ∈ R there are T time slots. We group the results as

follows:

SP

r

(k)=

T

t=1

sp

r,t

∀r ∈ R (5)

Shadow price: SP

r

(k) ∈ R

+

0

In general bid prices are not assumed to be linear in

our framework. This means that shadow prices SP

cannot be calculated by the auctioneer for each round,

i.e. there is no solution to the LP problem, or reduced

costs equal to zero for a number of bids (Bjørndal and

Jørnsten, 2001). In such cases we rely on an approx-

imate shadow price calculation based on pricing his-

tory (H

sp

)

10

:

SP

r

(k)=

h

sp

|H

sp

|

∀h

sp

∈ H

sp

(6)

h

sp

=

SP

r

(k) if SP

r

(k) =0 ∧ k =1

0 if k =1

(7)

Now we can investigate the market value of a resource

unit while we use the shadow prices and form the

sums of each resource r ∈ R and each time slot t ∈ T

for all accepted bids:

8

The result of the following formula is denoted as re-

duced shadow prices. By omitting the rejected bids in

the calculation of dual prices, the result would be higher

(Bjørndal and Jørnsten, 2001).

9

http://www.geocities.com/lpsolve/

10

(Xia et al., 2004) propose an iterative price adaption

process for those cases to achieve an approximate solution

anyway. Due to time criticality of our system we stick to

the pricing history solution.

USING SHADOW PRICES FOR RESOURCE ALLOCATION IN A COMBINATORIAL GRID WITH

PROXY-BIDDING AGENTS

15

v

r

(k)=

SP

r

(k)

t

i j

q

i,j

(r,t)

∀b

i,j

∈ I

+

if I

+

=0

∧ SP

r

(k) =0,

h

sp

t

i j

q

i,j

(r,t)

∀b

i,j

∈ I

+

if I

+

=0,

0 otherwise

(8)

Market value of a resource unit: v

r

(k) ∈ R

+

0

3.2.4 The Task Agents’ Bidding Model

The task agents’ bidding behavior is determined by

two factors:

• At each round, o new bids b

i,j

are generated for

each task agent a

i

. The structure of the new gen-

erated BM s varies according to the matrix types

defined in section 3.1. The proxy-agents a

i

have

the possibility to submit bids b

i,j

as exclusively el-

igible bundles. The eligibility is defined such that

mBMsare treated as XOR bids

11

.

• Task agents repeat bidding for rejected bids in the

following round while changing the W2P with re-

spect to the actual resource supply/demand situa-

tion.

In our simulation environment we use different

types of new BM s generated by the task agents

12

.

The BM s used in this paper have a structured pat-

tern: bidder agents require resources with the same

intensity for a longer period of time (up to t

max

slots).

This results in continuous bids of varying lengths that

are close to realistic demand structures in distributed

ISIP systems.

Based on the resource occupancy q

i,j

(r, t) in

the BM s that are requested by the ISIP provision

process, the proxy-agents have to formulate their as-

sociated W2P for the bids. Two cases have to be dis-

tinguished (see equation 10):

• In the first round, no estimation of the prices can

be given to the bidders. For this reason, bidders

formulate the W2P for their first bids with respect

to the initial budget BG

i

and their bidding strategy.

This is done by calculating a mean bid price that

guarantees the proxy bidder’s budget to last for the

next l rounds if o bids are added in each round.

• In the following rounds, the task agents’ calculate

their W2P for the new submitted bids employing

market values for the resources given in equation

8. A factor P

ini

i

is included into the calculation of

11

For the definition of OR, XOR, and other variants

of bid connections within bidding languages see (Nisan,

2005).

12

See (Schwind et al., 2003) for the BM type definitions.

the initial bids. By setting P

ini

i

to e.g. 0.8, task

agents are prompted to submit initial bids slightly

lower than resource market price or above market

level for e.g. P

ini

i

=1.2. For the rejected bids,

task agents show the following behavior. The ac-

tual price for a bid b

i,j

of task agent a

i

in the actual

round of a bid is calculated by using the market val-

ues of the resources derived from the shadow prices

of the preceding round. In order to control the price

adaption process, a price acceleration factor ∆P is

introduced rising P

inc

i

by multiplying ∆P with the

actual number of rounds of the particular bid b

i,j

:

P

inc

i

= P

ini

i

+(round of bid · ∆P ) (9)

The bidding for rejected bids is repeated for the

following production time span t

pro

for the next l

rounds until the bid is accepted, otherwise the bids

are discarded. The agents bidding behavior is lim-

ited by the task agents’ budget. If the agents budget

is exhausted, no further bids are formulated until

the budget is refreshed in the next round k.

p

i,j

(k)=

BG

i

l·o

for k =1

S

r=1

N

t=1

v

r

(k − 1) · q

i,j

(r, t) · P

inc

i

for k>1

(10)

The bidding behavior of the task agents can be

modified by varying parameters like ∆P, o, l and m.

4 TESTING DIFFERENT

BIDDING STRATEGIES

In this section we will have a closer look at two differ-

ent economically motivated bidding strategies defined

by the task agents’ parameters described above. The

bidding strategies evaluated in this paper only differ

in ∆P:

• An aggressive bidding agent that submits combi-

natorial bids while trying to achieve the bid accep-

tance by using a fast inclining bid pricing strategy.

The economic motivation of this behavior can be

a proxy agent that bids for the execution of time

critical tasks in an ISIP provisioning system. A

good example of this is the performance of a video

conference in the distributed system. The confer-

ence is scheduled for a narrow time window. The

proxy agents have to bid for a prompt fulfillment

of the resource usage tasks. Therefore, it is useful

that proxy agents quickly raise their bids to market

level.

ICEIS 2006 - SOFTWARE AGENTS AND INTERNET COMPUTING

16

0,50 1,00 1,50

delta price increment

1,00

1,25

1,50

1,75

2,00

a

c

c

e

p

t

a

n

c

e

t

i

m

e

a

g

e

n

t

2

0,50 1,00 1,50

delta price increment

1,00

1,25

1,50

1,75

2,00

a

c

c

e

p

t

a

n

c

e

t

i

m

e

a

g

e

n

t

1

delta price increment

1,30,90,50,10

mean round time

2,0

1,8

1,5

1,3

1,0

0,50 1,00 1, 50

delta price increment

1,00

1,25

1,50

1,75

2,00

p

r

i

c

e

p

e

r

u

n

i

t

r

e

s

o

u

r

c

e

2

0,50 1,00 1, 50

delta price increment

1,00

1,25

1,50

1,75

2,00

p

r

i

c

e

p

e

r

u

n

i

t

r

e

s

o

u

r

c

e

1

delta

p

rice increment

1,30,90,50,10

mean resour ce price

2,0

1,8

1,6

1,4

1,2

1,0

,8

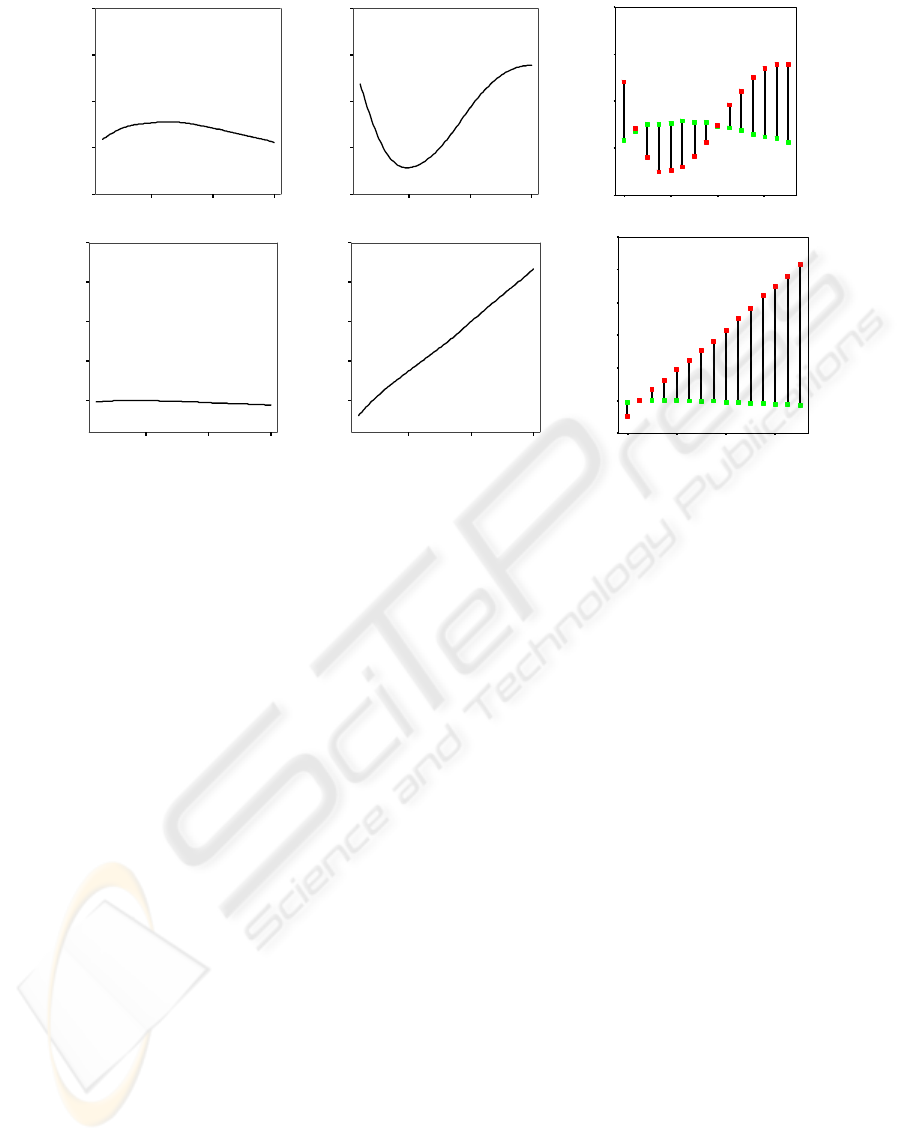

Figure 3: Mean round time (up) and price per resource unit (below) for smooth (agent 2) and aggressive bidder (agent 1) in

dependency of price increment ∆P .

• A smooth bidding agent that submits multiple bid

bundles to the auctioneer waiting for bid accep-

tance of some of the alternative bids while increas-

ing the bid prices slowly. The economic rationale

for this type of proxy agent strategy can be the fact

that it bids for resources required for the fulfillment

of an ISIP task that is not time-critical. An exam-

ple of this may be the computation of large time-

consuming database jobs on a distributed system

that have to be done in a very relaxed time win-

dow. A plausible strategy for the proxy bidding

task agent is then to try to acquire the required re-

source capacity bundles at low market values with

bids with slightly increasing W2P.

For construction of the closed-loop grid economy

in our experiments we assumed the same produc-

tion function for all task agents leading to equal

payoff Inc

acc

/I of the auctioneer’s income Inc

acc

(BG

ini

= 200MUs). The applied strategy was either

increasing the ∆P for the rejected bids by a constant

0.2 as described in equation (9) for the smooth bid-

ding agents or varying the bidding strategy in a range

from ∆P =0.1 to 1.5 (see Table 2) for the aggressive

bidding agents. Beginning with one bundle contain-

ing three XOR bids (m =3) in round one, both types

of agents generated three additional bids (o =3)in

each further round k. The bids were held and in-

creased by ∆P over a maximum of l =5rounds in

case of non-acceptance. The pattern of the new gener-

ated bids was identical to the structured BM type de-

scribed in Table 1 (q

bmax

=3,p

tso

=0.333,t

max

=

4). The auctioneer could allocate a maximum load of

q

max

=8per resource while T was ten time units

for the length of the AM . Figure 3 shows the results

of the strategy simulations, 100 runs for each ∆P in

0.1 steps. The aggressive bidder competes fiercely

against three smooth bidders. In the upper part of Fig-

ure 3, the mean round time until bid acceptance can be

seen, whereas the lower part depicts a mean of budget

spending per acquired resource unit. For an increas-

ing aggressive agent the mean acceptance time

¯

k

acc

aggr

is reduced by 0.25 for ∆P =0.4, 0.5 and 0.6 com-

pared to, the average acceptance time

¯

k

acc

smoo

of the

smooth bidder (See Table 2.). While rising ∆P , the

average acquisition price ∆¯p per resource unit (over

all resource types) increases linear for the aggressive

bidder (See Figure 3 lower part.). As illustrated in Ta-

ble 2, the optimal strategy for the aggressive bidder

is a price increment of ∆P =0.4 resulting in

¯

k

acc

aggr

reduced by ∆

¯

k

acc

=0.25 with an average resource

price increment of ∆¯p =0.12 if the agents’ utility is

defined by U

aggr

= −

¯

k

acc

− 0.1 · ∆¯p yielding 0.23.

U

aggr

is a trade-off between fast bid acceptance and

high resource costs in favor of short acceptance time.

5 CONCLUSION

We presented an agent-based simulation environment

for a grid scheduler that enables the simultaneous al-

location of resources in a grid-like computer system.

USING SHADOW PRICES FOR RESOURCE ALLOCATION IN A COMBINATORIAL GRID WITH

PROXY-BIDDING AGENTS

17

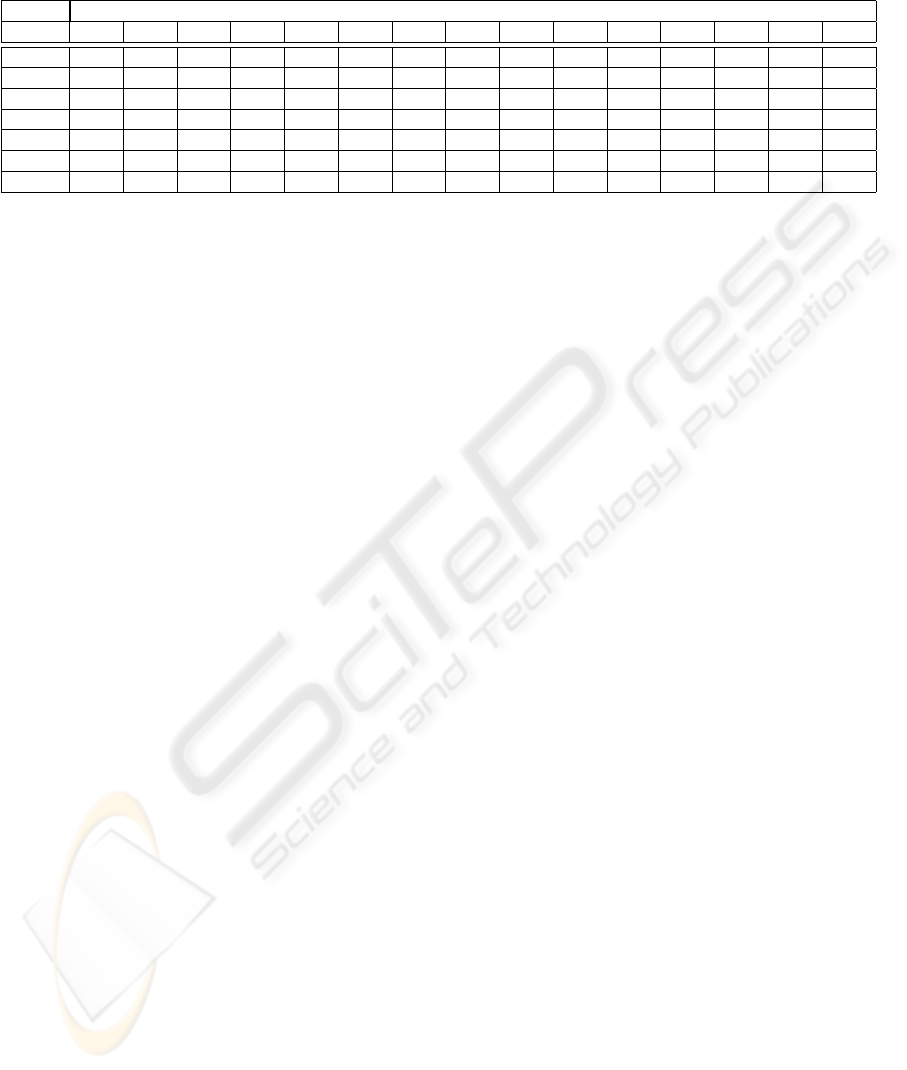

Table 2: Efficiency of two competing bidding strategies (smooth, aggressive) in terms of mean price per acquired resource

unit ¯p and average round time

¯

k

acc

until bid acceptance.

price increment ∆P

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5

¯p

smoo

0.99 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.99 0.99 0.98 0.98 0.98 0.98 0.97

¯p

aggr

0.90 1.00 1.07 1.13 1.19 1.25 1.31 1.36 1.43 1.51 1.57 1.64 1.70 1.76 1.83

¯

k

acc

smoo

1.30 1.34 1.38 1.38 1.38 1.40 1.39 1.39 1.37 1.36 1.35 1.33 1.31 1.30 1.28

¯

k

acc

aggr

1.60 1.36 1.20 1.13 1.13 1.15 1.21 1.28 1.37 1.48 1.56 1.63 1.67 1.69 1.69

∆¯p -0.09 0.0 0.07 0.12 0.19 0.25 0.31 0,36 0.43 0.52 0.58 0.66 0.72 0.79 0.86

∆

¯

k

acc

0.31 0.01 -0.18 -0.25 -0.25 -0.25 -0.18 -0.11 0.0 0.12 0.21 0.30 0.36 0.39 0.41

U

aggr

-0.29 -0.01 0.16 0.23 0.21 0.20 0.12 0.04 -0.09 -0.22 -0.33 -0.43 -0.51 -0.55 -0.59

Allocation is done by a combinatorial auction in our

economically inspired approach where proxy-agents

try to acquire optimal resource bundles with respect

to limited budgets. The system allows the provi-

sion of price information for the resources required

to perform various information services and informa-

tion production tasks in the grid. This is done by

calculating shadow prices in connection with solving

the NP-hard winner determination problem of the

combinatorial auction by an integer programming ap-

proach. The efficiency of the shadow price-based al-

location was tested in a closed loop grid system where

the agents can use monetary units rewarded for the

resources they provide to the system for the acqui-

sition of complementary capacity. Two types of bid-

ding agents have been compared in terms of efficiency

(average resource price payed and waiting time until

bid acceptance): An aggressive bidding agent with

strongly rising bids and a smooth bidding agent us-

ing low bid increments. While searching the strategy

space by varying the bidding behavior of the aggres-

sive agent from smooth to very aggressive in a com-

petitive environment with multiple smooth bidders, it

turns out that there is a bidding strategy where trade-

off between bid acceptance time and average resource

price paid is optimal. Future research will address

system behavior in resource failure situations and the

question of incentive compatible bidding. Addition-

ally, the question of alternative definitions of the util-

ity function for the different agent types should be dis-

cussed.

REFERENCES

AuYoung, A., Chun, B. N., Snoeren, A. C., and Vahdat,

A. (2004). Resource allocation in federated distrib-

uted computing infrastructures. In Proceedings of the

1st Workshop on Operating System and Architectural

Support, San Francisco, USA.

Bjørndal, M. and Jørnsten, K. (2001). An analysis of a com-

binatorial auction. Technical Report 2001-11, Depart-

ment of Finance and Management Science, Norwe-

gian School of Economics and Business Administra-

tion, Bergen, Norway.

Buyya, R., Stockinger, H., Giddy, J., and Abramson,

D. (2001). Economic models for management of

resources in peer-to-peer and grid computing. In

Proceedings of the SPIE International Conference

on Commercial Applications for High-Performance

Computing, Denver, USA.

Chun, B. N., Buonadonna, P., AuYoung, A., Ng, C., Parkes,

D. C., Shneiderman, J., Snoeren, A. C., and Vahdat, A.

(2004). Mirage: A microeconomic resource allocation

system for sensornet testbeds. In Proceedings of the

2nd IEEE Workshop on Embedded Networked Sensors

(EmNetS-II); Sidney, Australia.

Fujishima, Y., Leyton-Brown, K., and Shoham, Y. (1999).

Taming the computational complexity of combinato-

rial auctions: Optimal and approximate approaches.

In Proceedings of the 16th International Joint Confer-

ence on Artificial Intelligence 1999 (IJCAI-99), Stock-

holm, Sweden, pages 548 – 553.

Kwasnica, A. M., Ledyard, J., Porter, D., and DeMartini,

C. (2005). A new and improved design for multi-

objective iterative auctions. Management Science,

51(3):419–434.

Nisan, N. (2005). Bidding languages. In Steinberg, R.,

Shoham, Y., and Cramton, P., editors, Combinatorial

Auctions. MIT-Press.

Parkes, D. C. and Ungar, L. H. (2000). Iterative combina-

torial auctions: Theory and practice. In Proceedings

of the 17th National Conference on Artificial Intelli-

gence (AAAI-00), pages 74–81.

Rassenti, J. S., Smith, V. L., and Bulfin, R. L. (1982). A

combinatorial auction mechanism for airport time slot

allocation. Bell Journ. of Economics, 13(2):402–417.

Schwind, M., Stockheim, T., and Rothlauf, F. (2003). Op-

timization heuristics for the combinatorial auction

problem. In Proceedings of the Congress on Evolu-

tionary Computation CEC 2003, pages 1588–1595.

Vries, S. D. and Vohra, R. (2001). Combinatorial auc-

tions: A survey. INFORMS Journal on Computing,

15(3):284–309.

Xia, M., Koehler, G. J., and Whinston, A. B. (2004). Pricing

combinatorial auctions. European Journal of Opera-

tional Research, 154(1):251–270.

ICEIS 2006 - SOFTWARE AGENTS AND INTERNET COMPUTING

18