A MEASURE FOR THE COMPETITIVE ADVANTAGE IN THE

INTERNET ERA

Guendalina Capece

Department of Business Engineering, University of Rome “Tor Vergata”, Via del Politecnico 1, 00133 Rome, Italy

Keywords: Distinctive competencies, e-business, metric, parameters, decision making, distinctivity.

Abstract: The drive to introduce this new parameter arose when we asked ourselves two crucial questions about

capabilities to obtain and maintain distinctivity in the Internet era. The first question is: “how can nowadays

an e-business idea be inimitable, non-substitutable, non-transferable and innovative and different from the

existing ones?”. While the second question is: “how this can be measured?”. In this paper we propose an

answer to these questions by defining a metrics and a parameter, called e-distinctivity, that quantitatively

measures the fundamental distinctivity aspects of an e-business idea. To evaluate the e-distinctivity of an e-

business idea we used a reference user panel. The assessments and results on the parameter have been

evaluated on a panel of eighteen e-business enterprises, taken as reference examples of successful

implementation of e-business ideas. At the end of the paper we finally discuss the results and underline the

advantages of this methodology.

1 INTRODUCTION

In this paper we propose a new metrics in order to

support the feasibility evaluation of an e-business

idea through a new parameter created “ad hoc”,

named “e-distinctivity”.

This original metrics aims to quantitatively

support the selection phase of a new e-business idea

in order to evaluate its distinctivity in the actual e-

business arena. In order to do that, we introduce the

new parameter, “e-distinctivity”, that aims to

evaluate how much a new e-business idea is difficult

to imitate, difficult to substitute, difficult to transfer

and how much is innovative&different with respect

to the existing competitors. This approach aims to

extend to the e-business the concepts of “distinctive

competencies” as key factors to gain a competitive

advantage that have been widely discussed in the

literature in the strategic management (Teece, 1998).

The e-distinctivity parameter extends the model

proposed in a previous paper for the evaluation of e-

business ideas where we identified two parameters

called “Conceptual Accessibility” and

“Technological Accessibility” (Capece, 2006). The

first parameter, the “Conceptual Accessibility”, aims

to evaluate how much the new e-business idea is

close to known and common e-business concepts

and ideas. The goal is to give a measure of how

much the new idea will be promptly understood and

accepted given the existing cultural background of

the expected users. The second parameter, the

“Technological Accessibility”, aims to evaluate how

much the new e-business idea implementation will

require the use of well-known and wide-spread

technological instruments.

In the e-business environment the assessment of

the soundness of a new idea not only requires the

traditional tools of business analysis, but also the

evaluation of the aspects specifically related to the

media that will be used to bring the idea to the final

users. In our analysis we will refer to an e-business

idea as a business idea which derives its

distinctiveness and competitiveness from two key

factors:

• it is proposed to the target users through

internet;

• its realization would not be possible without the

internet support.

It is necessary to clearly identify the motivations

behind the idea, the user target of the idea and the

aspects of innovation and differentiation that should

drive the idea towards success with respect to the

existing business scenario.

A widely accepted approach in evaluating a new

idea is based on a detailed analysis of the existing

293

Capece G. (2007).

A MEASURE FOR THE COMPETITIVE ADVANTAGE IN THE INTERNET ERA.

In Proceedings of the Second International Conference on e-Business, pages 293-300

DOI: 10.5220/0002108202930300

Copyright

c

SciTePress

environment i.e. it depends on the capability to

identify and anticipate the needs of defined users

targets and thus on the capability to offer solutions

that will satisfy these needs. In the e-business

specific scenario then we need to adapt those

categories to take into account the used media (i.e.

the Internet).

Following the classic marketing literature, to be

successful a business idea must be innovative,

attractive, competitive, pursuable and capable to

generate revenue (Kottler and Scott, 1991).

The most recognized methods for the evaluation

of new ventures are the feasibility analysis and the

cost/benefit analysis. In the literature the typical

phases of the development of venture projects are

defined as: ideation, selection, preparation,

evaluation and actuation (Kottler and Scott, 1991).

In this paper we will concentrate on the

feasibility analysis during the selection phase for e-

business ideas.

The feasibility analysis aims to define the

viability of the realization of the e-business idea and

to give to the decision makers the information

needed to confirm the start of the project realization

and therefore the needed investments. The feasibility

study for e-business is an important instrument to

ensure an effective use of the ICT tools and in the

economic effectiveness of the ventures. It also

increases the awareness of the investment decision

and therefore helps in evaluating the expected

benefits vs. the required costs. In this way it

contributes to decrease the projects risks and it

represents an instrument to manage the complexity

of the projects.

2 THE REFERENCE USER

PANEL

In order to tune the parameter and to execute all the

needed evaluations a user panel has been provided

by a database in which there was a list of 240 people

names and phone numbers. This list has been used in

order to perform the interviews. The database

containing the users’ information has been selected

in order to represent the expected target of a new e-

business idea being evaluated. Contact was made

with 188 customers; 52 were unreachable. Of the

188 customers contacted, 138 agreed to participate

in the questionnaire. The survey instrument included

questions on demographic information. All the panel

components of the database are European people,

that frequently access the Internet both for work and

for leisure. In particular the panel consists of 138

people aged between 20 and 50. Seventy percent of

the panel components have a bachelor degree or are

university students. Forty percent uses ICT and

internet specifically for work purposes and all the

components use it also for study and other personal

interests.

3 THE REFERENCE

ENTERPRISE GROUP

The assessments and results on the parameters have

been evaluated on a panel of eighteen e-business

enterprises, taken as reference examples with respect

to the e-business idea definition given in section 1.

All the components of the enterprise reference group

are examples of successful implementation of e-

business ideas, although they are very different from

each other for strategy and user proposition:

Abebookes, Amazon, AOL, Apple, Dell, eBay,

Expedia, Google, Internet Movie Database, iTunes,

Nike, Million dollar homepage, Motorola, Paypal,

Ryanair, Skype, SuperEva, and Yahoo.

The identified parameters have been evaluated

on the components of the enterprise reference group

to ensure their soundness with respect to existing

successful e-business ventures.

4 E-DISTINCTIVITY

PARAMETER

The necessity to create this new parameter arose

when we asked ourselves two crucial questions

about capabilities to obtain and maintain

distinctivity in the Internet era:

1. how can nowadays an e-business idea be

inimitable, non-substitutable, non-transferable

and innovative and different from the existing

ones?

2. how this can be measured?

We tried to find an answer to these questions by

defining a metrics and a parameter in order to

measure the fundamental aspects that describe the

distinctivity of an e-business idea. After that we

decided to apply the identified metric to a panel of

successful business idea to assess its soundness and

accuracy though the found results. As said the e-

distinctivity parameter aims to evaluate how much

the new e-business idea is difficult to imitate,

ICE-B 2007 - International Conference on e-Business

294

difficult to substitute, difficult to transfer and

innovative&different from existing competitors.

As first step four aspects have been identified to

give a quantitative evaluation to the e-distinctivity:

inimitability, non-substitutability, non-transferability

and innovation&differentiation with respect to the

existing competitors. For each of these four aspects

two characteristics have been pointed out in order to

better specify and evaluate the parameter and its

significance. They have to be defined carefully to

determine the importance and significance of the e-

distinctivity attribute. All these eight characteristics

interact and contribute to the final value of the

parameter.

For the first one, inimitability, the two

characteristics we wished to evaluate are:

1. how much the idea is protected by license,

patents or intellectual property;

2. how much the information about the idea are

exposed;

For the second one, non-transferability, the two

characteristics we wished to evaluate are:

1. how much the idea is influenced by the local,

regional or context forces;

2. how many information, and thus knowledge,

about the definition of the idea are tacit and non

codified when investigated by an external analysis.

For the third one, non-substitutability, two

characteristics we wished to evaluate are:

1. how much the use of the idea fosters customers’

loyalty;

2. how much the idea is customized or

customizable by the final users.

For the fourth one, innovation&differentiation with

respect to the existing competitors, the two

characteristics we wished to evaluate are:

1. how many complementary and successful ideas

exist;

2. how much the approach is different from the

existing ones.

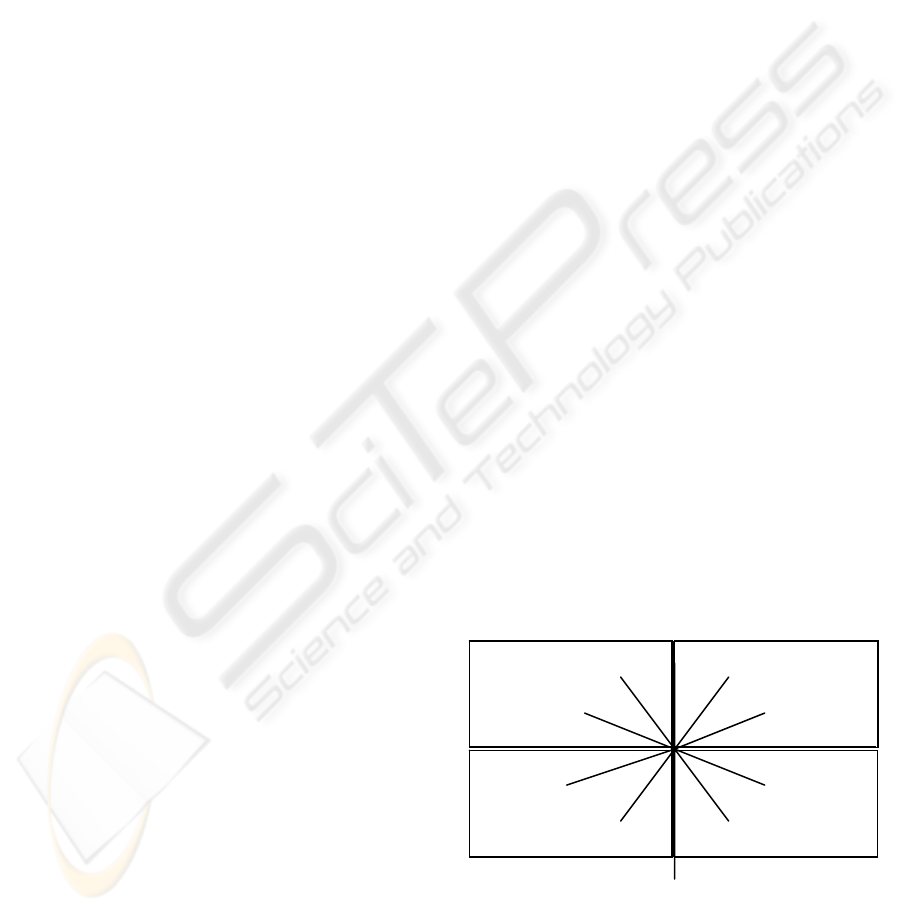

Once the idea has been explained to the

reference user panel, the four aspects have been

evaluated by measuring each of the eight

characteristics. The measure of each characteristic is

realized by answering to a specific statement with a

value between 1 (low) and 5 (high). The results for

each e-business idea can then be visualized in a two

dimensional radar consisting of four principal zones

each representing one of the e-distinctivity aspects.

The radar graph allows to represent the results in

a form that will be simpler to understand. It is

immediate to recognize, through the radar graph,

which is (are) the aspect(s) of the e-distinctivity that

is (are) crucial for the success of the business idea.

Indeed, the zone(s) in which there is a larger graph

area is (are) the most meaningful one(s) and this

means that the two characteristics are the most

important and competitive ones. It is also easy to

point out the aspect(s) that must be improved in

order to enhance the e-distinctivity of the e-business

idea. Indeed, the zone(s) in which there is a smaller

graph area is (are) the ones in which the

characteristics must be strengthen to become a

strong point. The radar graph is also useful to

evaluate different e-business ideas in order to

understand the one that has a strategic position in

comparison with the others. Indeed, the idea that has

the larger radar graph in every zone, also has the

best characteristics and, as a consequence, the

greater e-distinctivity value as key factor to gain a

competitive advantage.

Once the idea has been explained to the

reference panel, the eight characteristics have to be

evaluated one by one by the reference panel

components that have to give to each characteristic a

value in the established range. To implement a

synthetic representation of the results on the radar all

the results from the same characteristic have been

averaged. The value assumed by a given e-business

idea on each characteristic is set as arithmetic mean

of the values obtained for that characteristic from all

the components of the reference user panel

The shape of the radar for an e-business idea is

then delineated by the mean values of its

characteristics.

At the end of the evaluation, we have a single

value for each characteristic for every e-business

idea considered for our study. Every quadrant

represents a selected aspect of the e-distinctivity

parameter. In each quadrant there are two axis that

indicate the characteristics to evaluate for the aspect.

See figure 1 presented next:

Figure 1: The radar graph area with the four crucial

aspects and the two characteristics for each quadrant

As explained before each respondent gave an

evaluation of each aspect by responding to a specific

question.

Difficult

to imitate

Difficult

to transfer

Innovation&

Differentation

Difficult

to substitute

A MEASURE FOR THE COMPETITIVE ADVANTAGE IN THE INTERNET ERA

295

In order to make the evaluation needed for our

work, we asked to answer to each question with a

value from 1(low) to 5(high) and we gave to each

value a specified meaning.

For the first aspect, “inimitability”, regarding the

first characteristic, “how much the idea is protected

by license, patents or intellectual property”, we have

to identify how much licenses, patents or intellectual

property provide protection against the imitation of

an idea. These resources offer rights for exclusive

use by the owner and can keep imitators at bay. The

degree of their power is also in other external

factors, such as regulations, that can try to block or

al least limit the invent-around alternatives from the

competitors.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: the idea is completely protected by license,

patents or intellectual property;

4: the idea has all the key aspects protected by

intellectual property;

3: the idea has some key aspects protected by

intellectual property;

2: the idea has some non-key aspects protected by

intellectual property;

1: the idea is completely unprotected.

For the first aspect, “inimitability”, regarding the

second characteristic, “how much the information

about the idea are exposed”, we have to explain the

concept of observability. The observability of the

technology or the organization is an important factor

for imitation and plays a crucial role.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: in order to implement the idea it is not necessary

to expose any part of the idea itself to the final

user;

4: in order to implement the idea it is necessary to

expose only the non-key aspects of the idea itself

to the final user;

3: in order to implement the idea it is necessary to

expose some key aspects of the idea itself to the

final user;

2: in order to implement the idea it is necessary to

expose some key and non-key aspects of the idea

itself to the final user;

1: in order to make use of the idea it is necessary to

completely expose the idea itself to the final

user.

For the second aspect, “non-substitutability”,

regarding the first characteristic, “how much the

idea is influenced by the local, regional or context

forces”, we have to underline how some ideas can be

influenced by local, regional or context forces.

Firm’s capabilities are deeply shaped by these

factors. Porter (1990) in fact attests that differences

in local product market, local factor market and

institutions play an important and strategic role in

shaping competitive capabilities. This means that

replication and imitation in a different geographical

context may then be difficult and costly in terms of

time and money. Understanding the idea, the

processes, the production and even the management

is a key factor in order to improve because an

enterprise cannot develop what it does not deeply

and accurately understand and know.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: the idea can be implemented only by leveraging

on local, regional or context forces;

4: some key aspects of the idea are implemented by

leveraging on local, regional or context forces;

3: some non-key aspects of the idea are

implemented by leveraging on local, regional or

context forces;

2: the idea is negligibly influenced by the local,

regional or context forces;

1: the idea is not influenced at all by the local,

regional or context forces.

For the second aspect, “non-substitutability”,

regarding the second characteristic, “how many

information, and thus knowledge, about the

definition of the idea are tacit and non codified when

investigated by an external analysis”, we have to

explain the concepts of tacit and codified

knowledge. Tacit knowledge (Teece, 1981) is

difficult to articulate in a way that is meaningful for

the others. This means that the more a given item of

knowledge has been codified, the more it can be

transferred. This is an important and crucial property

that depends on the ready availability of channels of

communication suitable for the transmission of well-

codified information. Uncodified or tacit knowledge

is slow and costly to transmit or reproduce.

Ambiguities and error of interpretation can occur in

the process. The first ones can be overcome only

when communications take place in a manner that is

the most similar to a face-to-face dialogue. The

second ones can be corrected only when there is a

meaningful and appropriate system of feedback.

This means that messages and therefore knowledge

can better be transferred if they are structured in a

codified form.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: the greatest part of the information and

knowledge of the idea are tacit;

4: most of the key aspects of the information and

knowledge of the idea are tacit;

3: some key aspects of the information and

knowledge of the idea are tacit;

ICE-B 2007 - International Conference on e-Business

296

2: the non-key aspects of the information and

knowledge of the idea are tacit;

1: the greatest part of the information and

knowledge of the idea is not tacit.

For the third aspect, “non-transferability”,

regarding the first characteristic, “how much the use

of the idea fosters customers’ loyalty”, we have to

investigate the reasons that allow a firm aim to gain

customers’ loyalty.

Factors that determine that consumers make

most of their transactions in the same place are very

important in order to avoid substitutability.

Retaining customers is a financial imperative for any

e-commerce or e-business enterprise, especially as

attracting new customers is considerably more

expensive than for comparable, traditional, brick-

and-mortar stores. Understanding how to determine

a sense of loyalty in the final user remains one of the

crucial management issues. The development,

maintenance, and enhancement of customer loyalty

represent a fundamental marketing strategy for

attaining competitive advantage (Gould, 1995;

Kotler, 1988; Reichheld, 1993). It is important that

the partners of an economic relationship are

prepared to work at preserving it because it must

continue indefinitely (Morgan and Hunt, 1994).

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: customers’ loyalty is always fostered by the use

of the idea;

4: customers’ loyalty is fostered in most of the

cases by the use of the idea;

3: customers’ loyalty is fostered only under certain

conditions or due to particular sales promotions;

2: customers’ loyalty is fostered only during the

first period of the utilization by the final user;

1: customers’ loyalty is not fostered at all by the

use of the idea.

For the third aspect, “non-transferability”,

regarding the second characteristic, “how much the

idea is customized or customizable by the final

users”, we have to better specify the concept of

“customization”. The term mass customization was

coined by Stan Davis (1997) who predicted that the

more a company was able to deliver customized

goods on a mass basis, relative to their competition,

the greater would be their competitive advantage, a

view supported by Pitt, Bertham and Watson (1999),

and Duray and Milligan (1999). Pine, Victor and

Boynton (1993) describe the synergy of mass

customization and continuous improvement as a

‘new’ competitive strategy to challenge ‘old’

strategies such as mass production. Hart and Taylor

(1996) offer an operational definition: ‘Mass

customization is the use of flexible processes and

organizational structures to produce varied and often

individually customized products and services at the

price of standardized, mass produced alternatives’.

The concepts of flexibility, timeliness and variety

are essential to the notion of mass customization. It

is determining what the customer really needs and

attempting to respond quickly with an offering

which costs to the customer relatively little more

than standardized, mass produced alternatives’

(Duray & Milligan, 1999). So mass customization is

a firm’s ability to meet specific customer

requirements en masse, yet at a low cost, which

rivals mass production capabilities.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: the idea can be deeply customized by the final

user;

4: the idea can be customized in many key aspects

without restrictions by the final user;

3: the idea can be customized in a restricted and

fixed number of key aspects;

2: the idea can be customized only in a restricted

and fixed number of non-key aspects;

1: the idea is not customized not even customizable

by the final user.

For the fourth aspect, “innovation &

differentiation with respect to the existing

competitors”, regarding the first characteristic, “how

many complementary and successful ideas exist”,

we have to determine if an idea could have the

possibility to gain a competitive advantage. To do so

it has to be compared with the other ideas in the

same economic field. The greater the number of

competitor is, the most difficult could be to emerge

in a specified market. This is enhanced above all if

the complementary ideas are successful ones. It is

not simple to gain a slice of the market if many

similar and successful ideas exist.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: it does not exist any similar idea;

4: a number between one and two of successful

similar ideas exist;

3: a number between three and six of successful

similar ideas exist;

2: a number between six and eight of successful

similar ideas exist;

1: many similar and successful ideas exist.

For the fourth aspect, “innovation&differentiation

with respect to the existing competitors”, regarding

the second characteristic, “how much the approach

is different from the existing ones”, we have to

observe the approach of the idea and to compare it

with the other approaches that characterize the other

A MEASURE FOR THE COMPETITIVE ADVANTAGE IN THE INTERNET ERA

297

existing ideas. To gain competitive advantage the

new idea has to be different form the others. If in the

market there are many successful and similar ideas,

the only way to survive is to present something

different in order to capture the attention and the

interest of the customers.

To evaluate this characteristic we decided to assign

the meanings to the different values as follows:

5: the idea is substantially different from the other

existing ones;

4: the idea is different in many key aspects;

3: the idea is different in a restricted number of key

aspects;

2: the idea differs only in a restricted number of

non-key aspects;

1: the idea does not considerably differ from the

other existing ones.

After the definition of the e-distinctivity parameter

and all its characteristics, the next step is to define

how to visualize the results of an e-business idea. To

implement the representation of the results we made

use of a radar graph and every e-business idea has

been considered separately. In this way, for each e-

business idea, we will obtain a value for each axis of

the radar, and this means that we will have eight

assessments. In the following we will show the final

radar for a chosen e-business idea taken into

consideration for our study, just as an example of its

final shape.

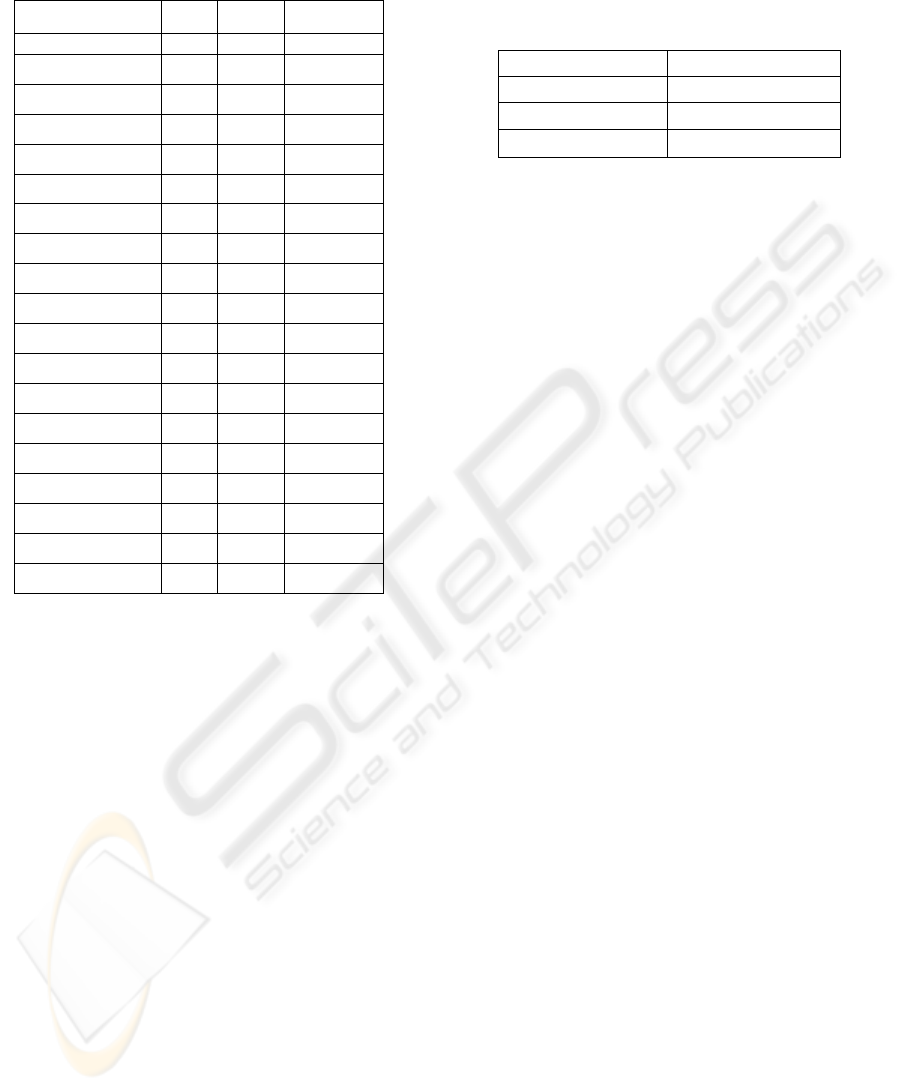

Figure 2: Final radar for a chosen e-business idea taken as

an example.

As explained this method has been firstly applied

to the enterprise reference group to see if the

obtained results are sound with the reality of some

well-known reference e-business ventures.

We have to underline the results of the test we

made: every e-business idea from the enterprise

reference group has obtained values quite high in

two or more quadrants of the radar and this result is

consistent with the fact that all the chosen

enterprises are well known and have a great success

in their business.

We analyzed the results and we compared them

in order to find significance for further applications.

This method can be used in order to comprehend if a

new e-business idea has the sufficient distinctivity to

be a successful one. This means that a new e-

business idea, on the one hand, can be compared

with a group of different and successful ideas to

understand which is its strategic position in

comparison with the others and, on the other hand,

can be compared with different new e-business ideas

in order to make easier for the enterprise the choice

of the idea to put on the market.

In order to give an additional interpretation of

the found results we calculated the total sum of the

values considering all the four quadrants of the

radar, the mean value and the variance. These three

numbers can give us additional insights to analyze

the e-distinctivity of the e-business ideas.

At first step of our work (Capece, 2006b), we

had a panel of one hundred people and we

considered ten e-business enterprises as reference

example for e-business ideas. The results have been

quite interesting even though the two reference

panels were too modest. In table 1 the results of our

first study are shown.

Table 1: The table results of our first study with ten

enterprises.

Results Value

Sum >20

Mean >2,5

Variance <1,6

We decided to improve the reference user panel

and the reference enterprise group to test the first

results and to achieve a more stable and defined

measurements. According to this goal, we made a

new study and we now show the latest results. These

can be considered the definitive ones, because in a

third phase of our study we considered twenty-six

enterprises and the results of the sum, mean and

variance didn’t change. The sum value changed

from 20 to 18. The mean value changed from 2,5 to

2,25. The variance value didn’t change. We can

therefore think that in table 2, showed below, the

definitive results of the sum, mean and variance are

shown.

ICE-B 2007 - International Conference on e-Business

298

Table 2: The sum, mean and variance values for the

eighteen enterprises considered.

Enterprise Sum Mean Variance

Google 24 3

1,166667

Amazon 30 3,75

0,416667

Ebay 30 3,75

0,416667

iTunes 31 3,875

1,0625

Expedia 26 3,25

0,083333

Yahoo 22 2,75

1,583333

AOL 22 2,75

0,75

SuperEva 21 2,625

1,229167

Skype 28 3,5

0,166667

MDHP 24 3

5,333333

Dell 24 3

0,75

IMDB 23 2,875

0,615

Motorola 24 3

0,25

Paypal 25 3,125

0,61

Nike 25 3,125

0,186

Ryanair 18 2,25

0,69

Abebooks 21 2,625

0,48

Apple 25 3,125

0,41667

The results of the sum underline the position of

Ebay, Amazon and iTunes. They obtained the

highest values, 30 and 31, while the lowest value

belongs to Ryanair, 19, Supereva and Abebooks, 21.

All the chosen enterprises obtained a value that is

higher than the mean value of the sum (18) and this

lead us to a first consideration: in order to be

successful, a new e-business idea should have a sum

value of the e-distinctivity parameter higher than 18.

Through the observation of the mean values we

also observed that all the eighteen enterprises have a

value that is higher than the median. This leads us to

a second consideration: in order to be successful a

new e-business idea should have the median value

higher than 2,25, which is the lowest value and is

therefore taken as a reference rate for the mean

value.

The variance is the third value we considered for

our study and gave us another important

information: the variance in our study is a value

between 0 and 5,333. Anyway, excluding the

Million Dollar Home Page, the range is reduced to 0

and 1,6. Considering the peculiarities of the business

case for MDHP this leads us to a third consideration:

in order to be successful a new e-business idea

should have the variance value lower than 1,6. In

table 3 the results of our study are shown.

Table 3: The target values of our study.

Results Value

Sum >18

Mean >2,25

Variance <1,6

Considering the success records of the enterprise

reference group, these values can be considered as

targets when evaluating the e-distinctivity of a new

e-business idea.

5 CONCLUSIONS

In this paper we proposed a new metrics in order to

support the feasibility evaluation of an e-business

idea and quantitatively sustain the selection phase of

a new e-business idea The new approach is different

from the existing ones because we identified an

original parameter to be evaluated on a given e-

business idea in order to provide a quantitative

measure of its distinctivity. To be applied the

method requires only a detailed description of the

idea; therefore it is easy to compare many different

alternative ideas during the feasibility phase and

have quantitative data to evaluate them without

requiring huge investments.

Another advantage of this method is that the new

proposed idea can be easily compared with other e-

business ideas through the comparison of the

parameter value. A panel of eighteen successful e-

business ideas has been evaluated towards the

parameters and it can then be used to assess how a

new idea compares to them. Our results confirm the

soundness of this evaluation parameter. The study

provided three important properties that a new e-

business idea must have in order to be successful in

terms of distinctivity: the first one is that the new e-

business idea should have a sum value of the e-

distinctivity parameter higher than 18; the second

one is that a new e-business idea should have the

mean value higher than 2,25; the third one in that a

new e-business idea should have the variance value

lower than 1,6. However, this parameter is not

intended to be sufficient for an exhaustive

assessment of the feasibility of an e-business idea. It

is necessary to continue the investigation in order to

determine other parameters and evaluation tasks in

order to improve the accuracy of the model. Our aim

is to support the selection phase of new

A MEASURE FOR THE COMPETITIVE ADVANTAGE IN THE INTERNET ERA

299

e-business idea with the aid of new parameters that

integrate the traditional methods of business

analysis.

Further developments will be necessary for the

definition of an extended set of parameters

specifically designed for a complete assessment of

an e-business ideas.

REFERENCES

Capece, G., 2006. “Definition and utilization of a series of

parameters to evaluate an e-business idea”,

Proceedings of the 6th IBIMA Conference.

Capece, G., 2006b. “E-distinctivity parameter to evaluate

an e-business idea”, Proceedings of the 7th IBIMA

Conference, Brescia, december 14-16, 2006.

Davis, S. M., 1987. Future perfect. Reading, MA:

Addison-Wesley.

Duray, R., Milligan, G., 1999. Improving customer

satisfaction through mass customization. Quality

Progress, 32(8).

Gould, G., 1995. Why it is customer loyalty that counts

(and how to measure it), Managing Service Quality

5(1), pp. 15-19.

Hart, C.W., Taylor, J.R., 1996.Value creation through

mass customization. Achieving competitive advantage

through mass customization,University of Michigan

Business School seminar

Kottler, P., 1988, “Marketing Management Analysis,

Planning and Control”, 6

th

Edition, Prentice-Hall,

Eglewood Cliffs, CA.

Kottler, P. and Scott, W. G., 1991. “Marketing

Management. Analysis Planning Implementation and

Control”, Seventh Edition, Prentice Hall International.

Morgan, R. M. and Hunt, S. D., 1994. The Commitment-

trust theory of relationship marketing, J. Marketing 58,

pp. 20-38.

Pine II, B.J. and Victor, B., Boynton, A.C. 1993b.

Makingmass customization work. Harvard Business

Review, 71(5), 108} 121.

Pitt, L., Bertham, P. and Watson, R., 1999. Cyberserving:

Taming service marketing problems with the world

wide web. Business Horizons, 42(1), 11.

Porter M., 1990. “The Competitive Advantage of Nations”,

New York, NY: Free Press.

F.F.Reichheld, 1993. “Loyalty-based Management”,

Harvard Business Review 71, pp. 64-73.

Teece D., 1981. The Market for Know-how and Efficient

International Transfer of Technology, Annuals of the

American Association Of Political and Social

Sciences, pp. 81-86.

Teece D., 1998. “Capturing Value from Knowledge

Assets: The New Economy, Markets for Know-how,

and Intangible Assetes”, California Management

Review, Vol. 40 n.3, pp. 55-79.

ICE-B 2007 - International Conference on e-Business

300