SAT: A WEB-BASED INTERACTIVE ADVISOR FOR

INVESTOR-READY BUSINESS PLANS

Dietmar Jannach

Institute of Applied Informatics, Klagenfurt University, Universitätsstraße 65, Klagenfurt, Austria

Uffe Bundgaard-Joergensen

InvestorNet & Mermaid Venture, Scion-DTU, Diplomvej 381, Kongens Lyngby, Denmark

Keywords: Self-service applications, e-services, knowledge-based systems.

Abstract: The business plan is one of the essential tools for companies to attract investors and raise venture capital.

Getting a business plan "investor ready" in that context means that it has to be professionally prepared such

that it answers all questions of potential investors. This, however, requires in-depth knowledge of a typical

investor's expectations and viewpoints, a type of knowledge which in particular first-time entrepreneurs or

small companies do not dispose of. As a consequence, significant amounts of consulting hours are required

to get the business plan ready to be presented to investors.

The goal of the SAT project presented in this paper is to provide an in-depth business plan advisory service

over the Web. While current approaches in that area rely on static fill-out forms or checklists, the SAT tool is

based on personalized interactive dialogs, knowledge-based input analysis and feedback generation, as well

as on detailed financial calculations. Within the paper, we thus show how knowledge-based approaches can

serve as a technological foundation for such next-generation electronic services and how the corresponding

development and maintenance efforts can be minimized. The paper gives an overview on the general

knowledge-based architecture of the system, discusses the integrated graphical modelling environment, and

finally reports on experiences gained from the practical use of the tool.

1 INTRODUCTION

Getting a business plan "investor ready" is a

challenging task in particular for young entre-

preneurs or smaller companies with limited

experience and background in acquiring investor

capital. Although the importance of a business plan

as one of the essential tools for attracting investors is

widely known and lots of guides and further

literature are available, our year-long experience

shows that typical mistakes are still common. In the

context of the commercialization of e-Business

related innovations for instance, technological

aspects are in many cases overly emphasized. At the

same time, investors often complain that the

investor's view is not properly addressed in the

business plans they receive. Much too often aspects

like experience of the management team, the internal

return rate and exit scenarios for the investor, or

detailed statements on financials and uncertainty

factors are neglected. This has even lead to an EU

sponsored training initiative called "Master Classes"

where innovation professionals and entrepreneurs

are introduced to the world of "investor thinking".

Thus, these entrepreneurs or less-experienced

companies often chose to utilise professional advice

to increase their chances of raising capital for their

business ideas. Professional counselling however

requires highly-experienced advisors and hence

further increases the amount of in-advance

investments required for the planned commercializa-

tion.

The herein described S

AT (self assessment tool)

project was initiated with the goal to provide a new,

high-quality advisory service on the Web. The

resulting software solution should consequently be

deployed in the context of an EU-funded Web portal

for Business and Innovation Financing

(Gate2Growth), which aims at bringing together

entrepreneurs, innovation professionals and

investors.

When examining the existing sources of

information for entrepreneurs who search for

99

Jannach D. and Bundgaard-Joergensen U. (2007).

SAT: A WEB-BASED INTERACTIVE ADVISOR FOR INVESTOR-READY BUSINESS PLANS.

In Proceedings of the Second International Conference on e-Business, pages 99-106

DOI: 10.5220/0002109500990106

Copyright

c

SciTePress

innovation financing advice on the Web, one can

observe that these sources mostly exist in the form

of static fill-out forms or checklists. In contrast to

such static approaches, the S

AT tool in its vision

aims at providing a virtual advisor that simulates the

behaviour of an experienced business consultant in

different dimensions. This includes for instance that

both the characteristics of the entrepreneur as well as

the key aspects of the business idea are elicited in a

highly personalized interactive dialog or interview.

Technically, this means for instance that the

sequence of questions can not be a static one and the

system has to continuously react to the current user's

inputs. In addition, such a system should also

immediately react once it detects inconsistencies in

the user's answers or identifies situations, in which

additional hints or cross-references appear to be

useful. For a general overview of these

personalization opportunities in such e-service

applications, see also (Jannach & Kreutler, 2005).

As the provision of highly personalized

applications is known to be a knowledge-intensive

task (Kobsa et al. 2001), we have decided to follow

a knowledge-based software development approach

and base the S

AT tool on the ADVISOR SUITE

framework described in (Felfernig et al. 2007). The

main advantages that we expected from the decision

were as follows. First, the efforts for development

and maintenance should be minimized as domain

experts are given the opportunity to add and modify

individual pieces of knowledge by themselves. In

addition, by choosing a more general and domain-

independent framework as a basis, future

extensibility toward other types of online advisory

services on the Web portal should be guaranteed.

Based on an analysis of the particular challenges

and opportunities of a fully knowledge-based

approach the paper shall thus demonstrate how – on

the basis of a concrete example – these techniques

can serve as a basis for next-generation intelligent

electronic online services.

The rest of the paper is organized as follows. In

the next section, we will sketch how the end user

perceives the virtual advisor application and what

aspects are covered during the business plan analysis

phase. Next, we give an overview on technical

aspects, in particular how the different required

pieces of knowledge can be modelled within the

graphical S

AT knowledge acquisition environment.

The paper ends with a discussion of first experiences

both with respect to system development as well as

end user feedback and a comparison to similar

approaches.

2 THE END USER'S VIEW

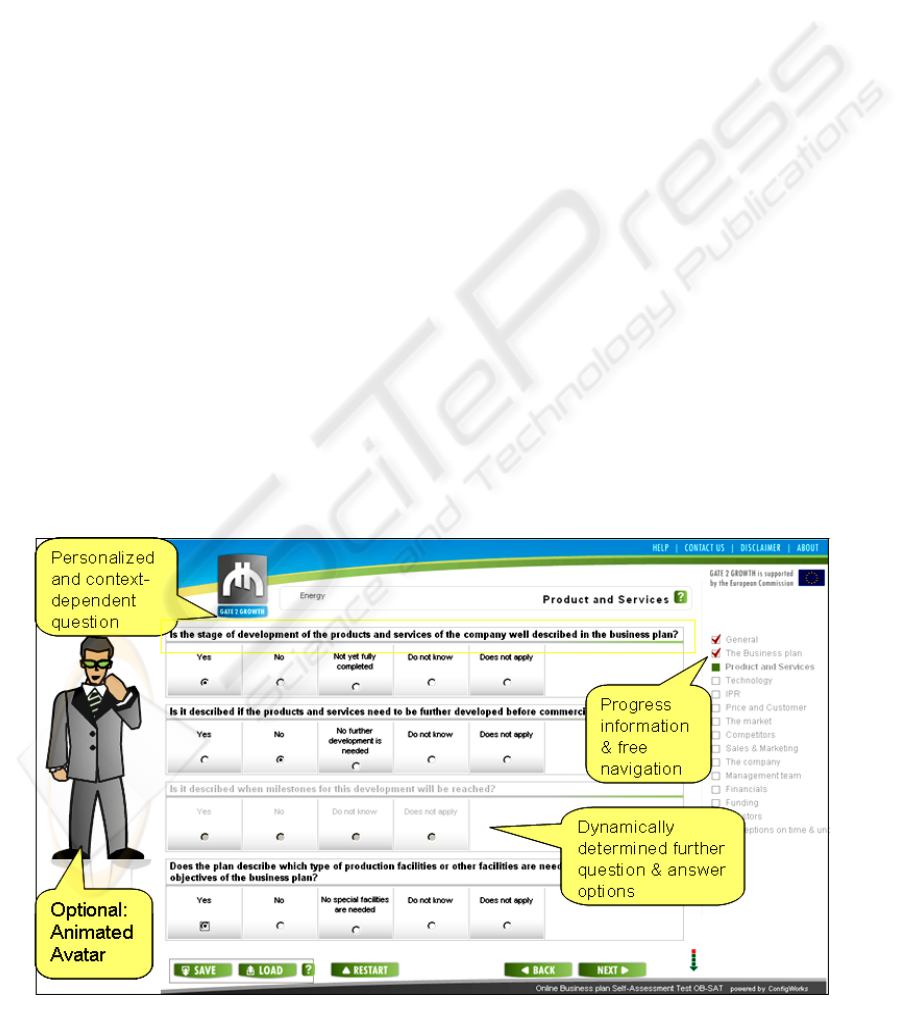

Fig.1 depicts how the profile of the online user is

interactively elicited. The system, which is

optionally personificated by an animated avatar,

guides the entrepreneur through a series of

personalized questions. Throughout this system-

driven dialog, the user inputs are constantly

monitored and the virtual advisor chooses the next

questions to be asked based on the current state of

the dialog. Depending on the current context, for

Figure 1: An interactive dialog page.

ICE-B 2007 - International Conference on e-Business

100

instance, unnecessary questions may also be fully

left out or specific textual variant might be asked

when the user seeks for investors in a certain

industry sector. When the system identifies

(obviously) conflicting user statements, the question

and answer dialog is interrupted and opportunistic

hints and explanations are provided.

In order to give the user appropriate feedback

about the progress, the dialog is structured into

phases, see also the right hand side of the screen.

Note that not all these phases are mandatory, i.e.,

when no detailed financial analysis is desired,

individual parts of the dialog are automatically

skipped (in contrast to more static approaches).

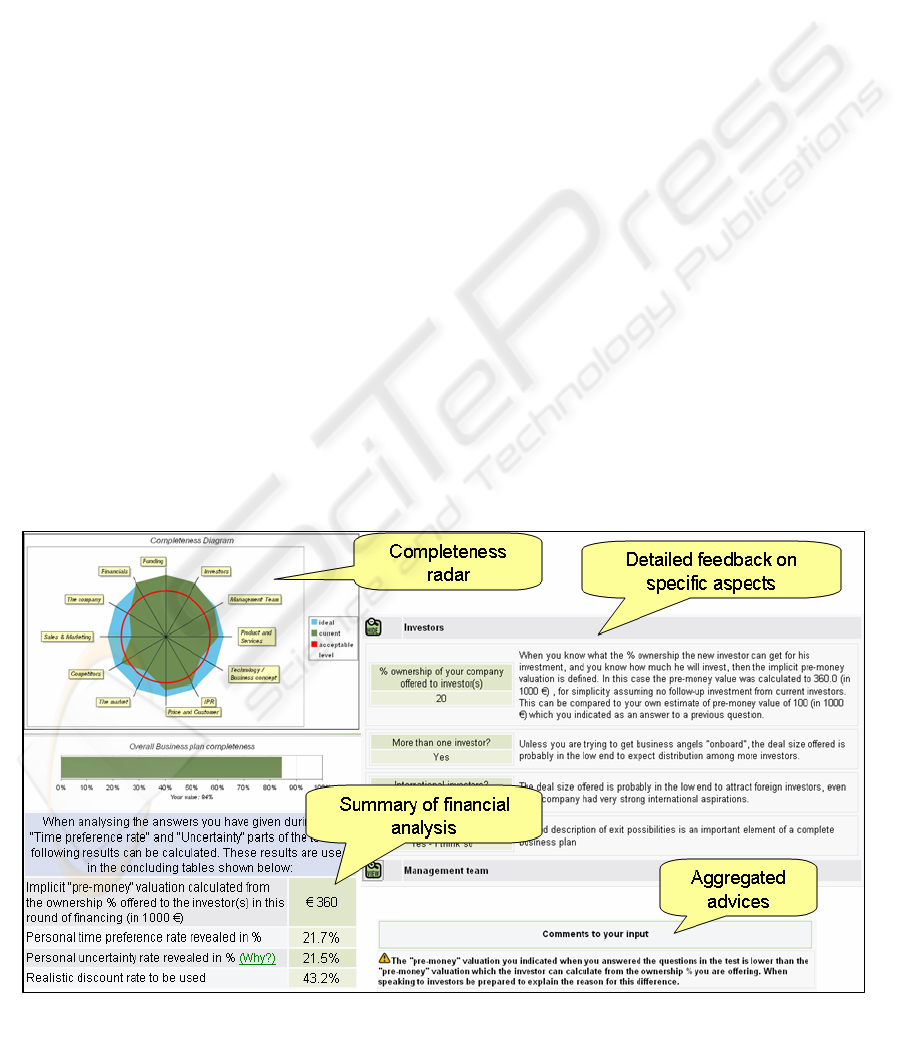

Once enough details have been provided, the

system generates different types of feedback for the

entrepreneur. The integrated analysis of the business

plan given by the system has various facets (Figure

2). First, the completeness of the business plan

content is evaluated based on a scoring mechanism

along twelve different dimensions like management

team, products and services, sales and marketing and

so forth. The results of this scoring are visualized

and summarized in terms of a "completeness radar"

as shown in Figure 2. In the detailed feedback

section, a comprehensive review of the user's

statements and characteristics is given. For each of

the twelve different subsections, about five to ten

comments, explanations, or suggestions are

proposed to the end user. Next, the "investor's view"

is summarized, which is based on an in-depth

analysis of various factors. The influence factors

include the user's statements about financial aspects

like expected profit and loss within the next years,

an estimate of internal return rates, or funding-

related issues like the percentage of ownership

offered to the investor. The feedback given is split

into a section in which key indicators for investors

are calculated and a section which explains and

comments how these indicators will be interpreted

by the investors. The individual statements are then

also condensed into compact aggregated advices

(see also Figure 2).

Finally, the S

AT system provides a detailed

statement about the entrepreneur's attitude toward

time preferences and uncertainty aspects: In this

section, the given financial numbers are compared

with the user's feedback on his estimate of future

developments and preferred investment scenarios.

One of the goals of this feedback section is thus to

cross-check the plausibility of user responses.

3 KNOWLEDGE-BASED SYSTEM

DEVELOPMENT

As can be seen from the short system description in

the previous section, the application is knowledge-

intensive, i.e., significant amounts of domain

expertise have to be encoded in the background,

from business plan analytics, over dialog

management, to investor-specific financial

calculation schemes. Consequently, aspects of

knowledge acquisition and maintenance have to be

in the centre of system design considerations: On the

one hand the knowledge in the field constantly

evolves while at the same time on the other hand the

Figure 2: In-depth investor readiness analysis.

SAT: A WEB-BASED INTERACTIVE ADVISOR FOR INVESTOR-READY BUSINESS PLANS

101

system should be continuously improved based on

usage experiences or user feedback. In the

subsequent sections, we will thus discuss how the

different pieces of knowledge can be captured with

the help of the S

AT Modeling Environment and how

knowledge acquisition and maintenance efforts can

therefore be kept at a manageable level.

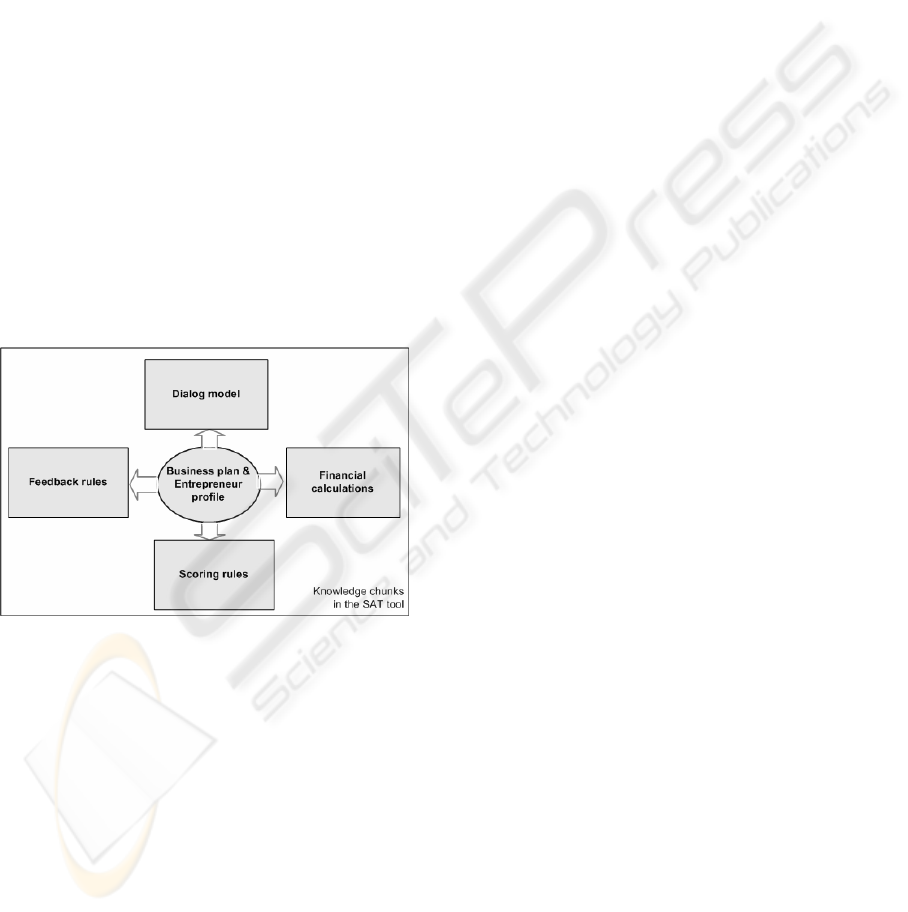

3.1 The Business Plan Profile

The business plan and entrepreneur profile is the

central element in the system's knowledge base and

it is used to capture the key characteristics of the

entrepreneur and the corresponding business plan to

be analyzed. Technically, the profile consists of a set

of variables V, each of them with a defined domain,

which can be a finite enumeration of values or a

scalar data type like integer or real. Each variable

can also be set-valued, i.e., multiple values can be

assigned to a variable at the same time. The actual

values for a business plan analysis session are

determined either by directly questioning the user

(Figure 1) or by internally deriving the value based

on defined business rules, for instance based on

scoring functions.

Figure 3 sketches how the business plan profile (BP)

is related to the other pieces of knowledge in the

S

AT tool. When values for BP should be directly

acquired, the variables are referenced from the

dialog model, in which the interactive elicitation

process is defined.

The variables of BP are of course also the

starting point for defining the feedback generation

process. First, they serve as an input to the internal

derivation of additional values based on financial

calculations or scoring rules. In addition, the

variables of BP are to be used in the definition of

feedback rules that determine the set of analytical

statements and hints to be displayed to the

entrepreneur (see Figure 2).

3.2 Feedback Rules

The knowledge base of feedback rules (KBFR) about

the various aspects of the business plan to be

analysed is the largest piece of domain expertise

encoded in the system. Currently, the S

AT tool

comprises more than 450 of these statements.

In the S

AT system, a feedback rule FR is represented

as a tuple

<ID, Group, Text, Order, Expression, Lang>.

Each feedback rule has a unique ID, belongs to a

group, and has an associated multi-lingual,

parameterizable textual statement as well as an

optional order of display. The selection of

appropriate feedback statements for a given business

plan profile is determined by an expression over the

variables of BP. An example for such a feedback

rule that also includes derived variables from the

financials module could be as follows.

"The discount rate of $

proposed_discount_rate$ you

have proposed to be used for the 'net present value'

calculations is higher than the "time preference

rate" you have revealed from answering other

questions during the test (…)."

The corresponding rule could be for instance

Display when

proposed_discount_rate >

computed_time_preference_rate"

The symbols proposed_discount_rate and

computed_time_preference_rate are variables from

the Business plan Profile BP; the expression

language used in the S

AT tool comprises standard

arithmetic and relational operators as well as logical

operators like and, or, and not. The definition of

feedback rules including the display conditions can

be fully done with the help of graphical editors (see

later sections). At run-time, the conditions are

automatically evaluated by the system in the context

of the current user session as to determine the subset

of feedback texts to be displayed.

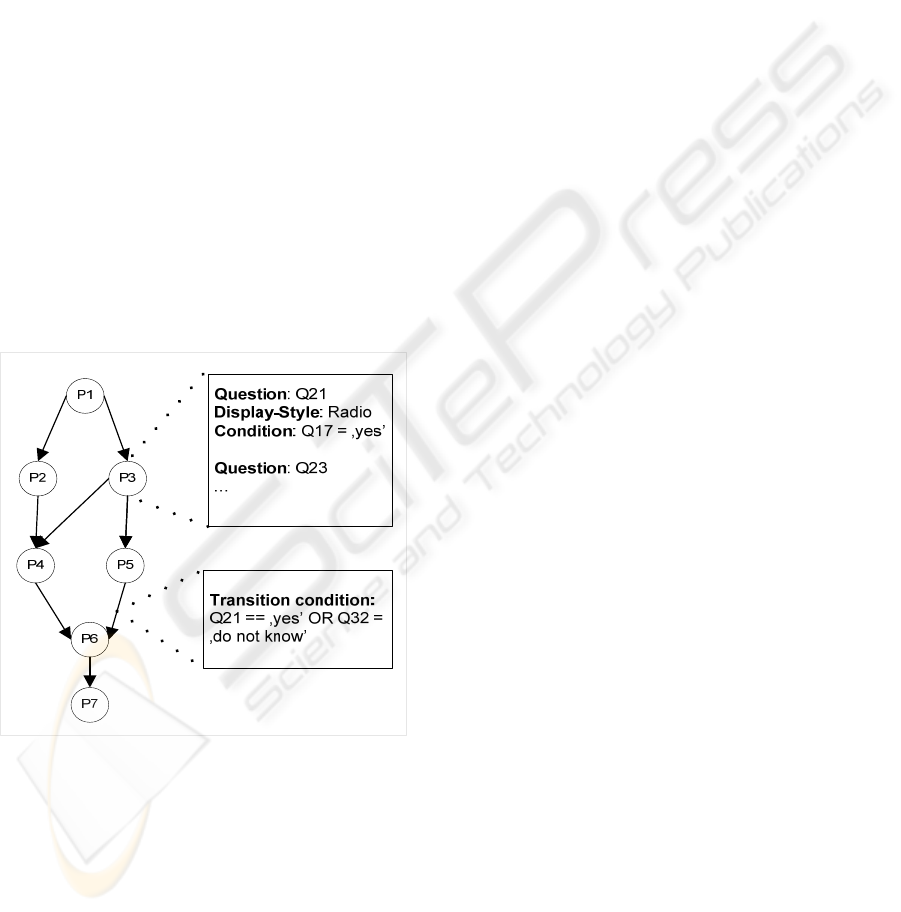

3.3 The Dialog Model

In contrast to the above-mentioned feedback rules,

the definition of the dialog model describing for

instance, which questions have to be displayed under

what circumstances, is more complex.

In the S

AT system, the possible flow of the system-

user dialog is modelled as a predicate-based finite

state automaton (van Noord & Gerdemann, 2001).

The main advantage of this common dialog

modelling approach is mainly that the resulting

models can be easily understood and modified by

using a corresponding graphical editor. Note that

this aspect is of particular importance in the context

Figure 3: Knowledge chunks in the SAT tool.

ICE-B 2007 - International Conference on e-Business

102

of our work, in which we aim at enabling the domain

expert himself to update the knowledge base as far

as possible.

Within the described S

AT system, the nodes and

edges of graph can be annotated as follows (see

Figure 4). As the nodes of the automation

correspond to dialog pages (Figure 1), we define the

set of questions to be displayed on that page and also

specify how each question should be rendered.

Furthermore, we can make the display of a particular

question (or answer option) dependent on previous

user inputs in order to reach a more dynamic

behaviour. The questions themselves again

correspond to variables from the central Business

plan Profile (BP), i.e., when variables from BP

should be directly elicited by asking the user, these

variables are annotated beforehand with appropriate

text fragments, both for the question itself, the

answer options, and optional explanations.

The second type of annotation is that for transition

conditions which specify how the dialog shall

proceed. Syntactically, these conditions are again

expressions over variables of BP which we

consistently use in the modelling environment. Note

that the system does not allow for indeterminism in

the dialog graph.

In order to support the user when modelling the

dialog, the underlying A

DVISOR SUITE system

comprises a novel, built-in diagnosis mechanism

(Felfernig et al., 2006) for finding inconsistencies or

unreachable paths. Also in the dialog model, the

domain expert can specify when conditional hints

should be displayed, if for instance the user has

given inconsistent answers during the dialog. A

detailed description of these features is omitted in

this paper for sake of brevity. The development

cycle of the S

AT tool with regard to the dialog model

is as follows. Once the dialog model has been

completed or modified, a user interface generation

task is initiated in which dynamic HTML pages

(Java Server Pages in our case) are generated based

on the definitions in the knowledge base. Thus, also

the maintenance process for the personalized

graphical user interface is supported in the

modelling environment. Further details on this

specific code generation process can be found in

(Jannach & Kreutler, 2004).

3.4 Scoring Schemes

The evaluation of "investor readiness" of the

business plan along different dimensions is based on

a standard scoring mechanism and visualized by

means of a completeness diagram (see Figure 2).

Thus, for each of the twelve dimensions (like

Marketing & Sales, Technology and so forth) a

scoring function has to be defined. In the S

AT

modelling tool, each dimension is therefore

associated with a set of variables from the business

plan profile BP and for each possible value of a

variable a numerical and normalized score from 0 to

10 is defined. The definition of this score value can

be either done by assigning concrete numbers for

enumerated domains as well as by means of a

mapping function for variables with continuous

domains.

At run time, the actual values in the BP are

evaluated and an overall cumulative scoring value

per dimension is determined based on a Multi-

Attribute-Utility-Theory calculation (von Winterfeld

et al, 1986). Note that the scoring dimensions

themselves are again treated as variables in BP,

which means that one can also define expressions in

personalization or feedback rules that take the

current value of the scoring result into account.

3.5 Financial Calculations

An integrated evaluation of a business plan with

respect to attractiveness to potential investors

requires an in-depth analysis of financial aspects and

accompanying uncertainty factors. Such calculations

are based on various inputs such as estimated profit

and loss figures for the upcoming years, a projection

of these numbers for subsequent years, or time

points and amounts of future investments. From

these and other inputs, the "investor's view", i.e., an

assessment of the financial opportunities and risks of

the investment, is derived. The typical figures on

which investors’ base their decisions with respect to

financials are for instance Internal Return Rate,

Price Earnings Ratio, or the Net Present Value of

investments. The values need to be above a certain

Figure 4: Annotated state diagram.

SAT: A WEB-BASED INTERACTIVE ADVISOR FOR INVESTOR-READY BUSINESS PLANS

103

"hurdle rate" which depends on risk and maturity of

the case in hand.

When such calculation schemes are to be made

explicit and formalized in some software system, we

observe that for many domain experts the preferred

way of doing this is by means of a spreadsheet

program. As the opportunities of this form of end

user programming for specific tasks are well known

(see for instance Nardi & Miller's paper from 1990),

we decided to adopt such a knowledge acquisition

approach also in the S

AT system. Thus, the domain

expert can formulate and update the calculation

schemes with a standard spreadsheet program. At

run time, the S

AT system directly interacts with this

spreadsheet service: The values of the variables in

BP serve as inputs to the financial calculations and

computed values are automatically transferred back

to standard BP variables, on which further

expressions - like in feedback rules - can be defined.

The only prerequisite for this tight integration of

external spreadsheet logic is a defined mapping

between BP variables and spreadsheet cells.

3.6 Overall Architecture &

Development Cycle

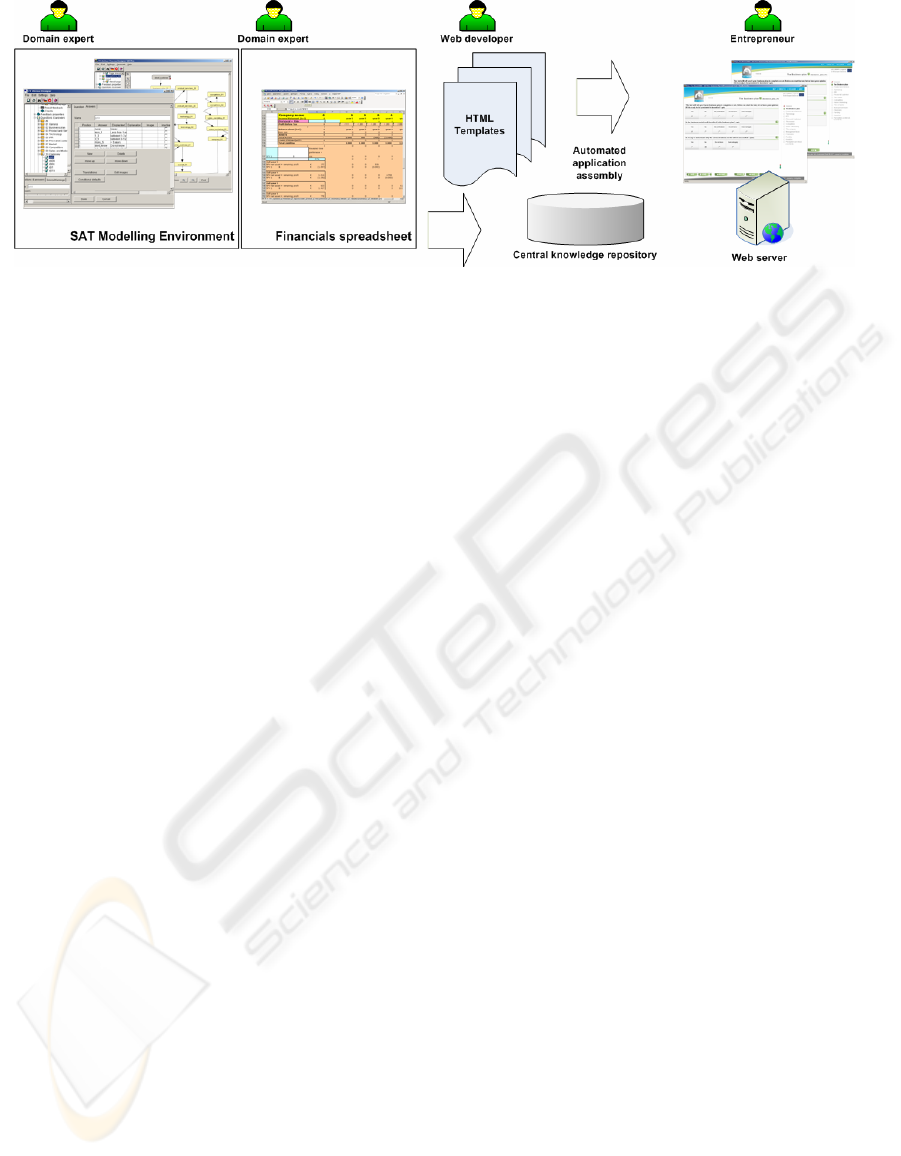

Figure 5 summarizes the overall architecture,

stakeholder roles, and process flow of the SAT tool,

see also (Felfernig et al. 2007) and (Jannach &

Kreutler, 2004) for technical details of the

underlying A

DVISOR SUITE framework. During

design time, the domain expert – optionally together

with a knowledge engineer – constructs or modifies

the required business logic like the feedback rules or

financial calculation schemes. All definitions except

for the spreadsheet calculations are stored in a

central knowledge repository. In parallel, a Web

developer defines and maintains the HTML

templates, which the framework uses for the

generation of a corresponding Web application in an

automated application assembly process. Once the

resulting Web application is deployed on a Web

server, it is ready for use for the entrepreneurs. The

run-time components of the framework comprise

among others a personalization agent which handles

the interaction with the end user based on the

definitions in the central knowledge repository, i.e.,

it for instance evaluates the current state of the

interaction and determines the further flow of the

dialog.

At the moment, the definitions in the knowledge

base are static in a sense that they do not change

automatically over time based, e.g., on the

experiences gained from previous advisory sessions.

The incorporation of such learning techniques is

however part of our current and future work.

4 DISCUSSION

4.1 Modelling and Technology Aspects

For the SAT tool, a knowledge-based, integrated-

modelling approach has been chosen due to the

anticipated complexity of the business logic to be

implemented. Currently, there are for instance more

than 450 feedback fragments and accompanying

selection rules stored in the knowledge base. The

business plan profile comprises more than 120

possible direct questions, of which of course only a

part is actually asked in one single dialog as all those

questions are left out that are not relevant in the

current context. The dialog model describing the

different pages and the interaction flow (see Figure

4) is comparably small and contains about 40

different interaction states. Note, that one such node

can comprise several questions; in addition,

individual questions are dynamically dimmed out

based on personalization rules. Thus, the graphical

dialog model remains at a manageable size.

Compared to other ways of interaction modelling

like dialog grammars (see, e.g., Bridge 2002),

however, our state diagram approach is somewhat

limited and static as all possible dialog paths have to

be explicitly modelled. Still, from the perspective of

Figure 5: Architecture and development, stakeholders and development cycle.

ICE-B 2007 - International Conference on e-Business

104

modelling complexity, we claim that state diagrams

are more comprehensible to users with limited IT

background, given the declarative and implicit

nature of grammar-based approaches. In future

releases of the S

AT modelling environment,

however, we plan to incorporate the possibility of

modelling sub-graphs in order to provide additional

structuring mechanisms for complex graphs.

In general, the task of selecting appropriate

feedback texts based on an interactively acquired

user model can be accomplished by a conversational

recommender system (see, e.g., Thompson et al.,

2004) and a rule-based filtering approach. In

contrast to previous work in this area, however, the

S

AT tool and the underlying ADVISOR SUITE system

aim at providing not only algorithms for problem

solving but also a comprehensive modelling

environment which also includes domain-specific

extensions like financial calculation schemes.

To the best of our knowledge, Ernst & Young's

IPO Navigator (see a report by Quittner, 1999) is the

only other approach toward providing a comparable

web-based electronic advisory service for

entrepreneurs. While there exist some similarities

between the IPO Navigator and the S

AT tool from

the end-user perspective, no reports on the internal

implementation and the technological foundations of

this tool are available.

Ernst & Young's IPO Navigator is part of a

larger set of electronic self-service tools developed

within the company's broader e-service initiative.

Comparably, the S

AT modelling environment aims at

providing a common technological basis for such

types of applications as the internal mechanisms

like, e.g., scoring or rule-based feedback, can be also

applied to various other types of decision support

and advisory problems. Up to now, two further

related advisory applications not described in the

paper (an entrepreneur personality check and

another financials tool) have been built based on

S

AT technology.

4.2 First Practical Results

Currently, there are two versions of the SAT tool are

in productive use. SAT LIGHT is a free, smaller

version of the business plan advisory system which

mainly covers the aspect of feedback rules and

scoring. Furthermore, the questionnaire and the

evaluation are not as detailed as in the full S

AT PRO

version, which also includes the detailed financial

calculations. The S

AT framework itself comprises a

comprehensive logging component in which all user

interactions are monitored and stored in the central

repository. Thus, from the light version, which is

online since spring 2005, first empirical results

about the usage of the system are available. Up to

now, about one thousand successful advisory

sessions have been registered, in which an online

user has fully stepped through the series of about 25

questions. From the overall usage statistics we see

that from all users that go through the first five

questions, about 50 percent make it to the final

recommendation. We interpret this as a promising

sign with respect to the end user acceptance and

usability of the system, given the fact that online

users in our opinion not easily accept such long

"click-distances" on the Web, see also the study of

(Smyth and Cotter, 2002) in the context of mobile

portals. From our point of view, the more interesting

type of information contained in the usage logs is the

knowledge about common shortcomings of business

plans or the typical characteristics of the

entrepreneurs. On the importance of such aspects in

the domain see for instance (Carswell & Asoka

Gunaratne, 2005). Although a variety of books and

online guides exist about how to write effective

business plans, to the best of our knowledge no

statistical evidence is yet available about common

mistakes and in particular about correlations along

the different dimensions. Given such information,

we hope that an in-depth analysis, which is part of

our current research, can be a valuable contribution

in particular in the area of entrepreneurship

education.

At the moment, such an evaluation has not been

done yet, mainly because the sample size of the

more detailed S

AT PRO tool is not yet sufficient.

What can be reported from the S

AT LIGHT tool yet

are basic figures on individual numbers in the

profile. So for instance more than a half of the online

users had a combined practical management

experience of less than four years, which indicates

that most users of the tool are first-time

entrepreneurs. Still, more than 70 percent are sure at

the beginning of the analysis that their business plan

is very clear about how the company will make

money with its products and services. Even more,

users also stated it would be easy to understand for

investors why customers will pay for exactly their

products, which indicates a common trend toward

overestimation of the advantages and marketability

of the new product. Another example would be the

description of investor exit opportunities in the

business plan, which is fully missing in 40 percent

of the cases and which thus indicates that the

"investor's view" is commonly not properly taken

into account. Compared with our own practical

experience, the examples nicely reflect our

observations of entrepreneurial attitude and investor

SAT: A WEB-BASED INTERACTIVE ADVISOR FOR INVESTOR-READY BUSINESS PLANS

105

perception during individual coaching sessions. The

findings area also in line with the feed back received

from more than 400 participants in the 30 Master

Class seminars held throughout Europe during 2006

and 2007. Although it is too early yet to make well-

founded statements based on these statistics, the

examples above should give a first impression about

possible types of information contained in the

interaction logs.

5 CONCLUSION

In this paper we have presented SAT, an interactive

online advisory system in the area of technology and

innovation commercialisation. The challenges with

respect to the formalization of comprehensive

domain expertise and the need for personalized user

interactions have been discussed and we have shown

how knowledge-based approaches can be exploited

to minimize system development and maintenance

efforts. In a broader view, we thus see our work also

as a real-world case study of how such technologies

can serve as an enabler of new e-business self-

service applications.

A first usage analysis indicate that such a system

will be accepted by end users and as an alternative to

classical means of information gathering and

business plan evaluation like possibly expensive

expert counselling. The “How to attract investors”

Master Classes are all structured around the S

AT-

tool. More than 30 Master Classes have been held in

12 European countries. Practical experiences from

contacts with more than 400 participants in these

classes indicate that the tools also have a strong

potential user base among innovation professionals.

The tools thus provide an adequate structured

approach to advising and coaching services offered

to entrepreneurs by innovation professionals.

ACKNOWLEDGEMENTS

The work presented herein has been developed as

part of the Gate2Growth Initiative, in particular the

InvestorNet activities. It as been supported by the

European Commission, D.G.Enterprise, see also

www.gate2growth.com.

InvestorNet and the development of the SAT-tool

have been supported by the European Commission,

DG Enterprise.

REFERENCES

Bridge, D., 2002, Towards Conversational Recommender

Systems: A Dialogue Grammar Approach, Workshop

in Mixed-Initiative Case-Based Reasoning, Workshop

Programme at the 6th European Conference in Case-

Based Reasoning, pp. 9-22.

Carswell, P., Asoka Gunaratne, K., 2005, Exploring the

role of entrepreneurial characteristics in determining

the economic growth potential of an innovation,

International Journal of Entrepreneurship and

Innovation Management , 5(5/6), pp. 441 – 453.

Felfernig, A. and Shchekotykhin, K., Debugging User

Interface Descriptions of Knowledge-based

Recommender Applications, in Paris, C. and Sidner,

C. (Eds): Proceedings of ACM International

Conference on Intelligent User Interfaces, Sydney,

Australia, ACM New York, 234–241, 2006.

Felfernig, A., Friedrich, G., Jannach, D., Zanker, M.,

2007, An Integrated Environment for the Development

of Knowledge-Based Recommender Applications, Intl.

Journal of Electronic Commerce, Special issue on

Recommender Systems, 11(2), pp. 11-34.

Jannach D., Kreutler G., 2005, Personalized User

Preference Elicitation for e-Services. In: Cheung W.,

Hsu J. (Eds.): The 2005 IEEE International conference

on e-Technology, e-Commerce and e-Service, Hong

Kong, IEEE Computer Society 2005, pp. 604-611.

Jannach D., Kreutler G., 2004, A Knowledge-Based

Framework for the Rapid Development of

Conversational Recommenders. Springer LNCS, 3306,

pp. 390-402.

Kobsa, A., Koenemann, J., and Pohl, W., 2001,

Personalized Hypermedia Presentation Techniques for

Improving Online Customer Relationships, The

Knowledge Engineering Review, 16 (2), pp. 11-155.

Nardi, B., Miller, R., 1990, The spreadsheet interface: A

basis for end-user programming, Third Interational

Conference on Human-Computer Interaction, pp. 977-

983.

Quittner, J., 1999, Testing Your IPO-Readiness on the

Web, Business Week, November 25, 1999.

Smyth, B. and Cotter, P., 2002, Personalized adaptive

navigation for mobile portals. Proceedings of the 15th

European Conference on Artificial Intelligence, Lyon,

France, pp. 608-612.

Thompson, C.A., Göker, M.H., and Langley, P., 2004, A

Personalized System for Conversational

Recommendations, Journal of Artificial Intelligence

Research, 21, pp. 393-428.

van Noord, G., and Gerdemann, 2001, D., Finite State

Transducers with Predicates and Identities. Grammars

4(3), pp. 263–286.

von Winterfeldt, D., and Edwards, W., Decision Analysis

and Behavioral Research. Cambridge University Press,

Cambridge, UK, 1986.

ICE-B 2007 - International Conference on e-Business

106