TOWARDS A GENERIC FRAUD ONTOLOGY

IN E-GOVERNMENT

Panos Alexopoulos, Kostas Kafentzis

IMC Research, Fokidos 47, Athens, Greece

Xanthi Benetou, Tassos Tagaris

Institute of Communication and Computer Systems, National Technical University of Athens, Athens, Greece

Panos Georgolios

IMC Research, Fokidos 47, Athens, Greece

Keywords: Ontologies, e-Government, Fraud Detection.

Abstract: Fraud detection and prevention systems are based

on various technological paradigms but the two prevailing

approaches are rule-based reasoning and data mining. In this paper we claim that ontologies, an increasingly

popular and widely accepted knowledge representation paradigm, can help both of these approaches be

more efficient as far as fraud detection is concerned and we introduce a methodology for building domain

specific fraud ontologies in the e-government domain. The main characteristic of this methodology is a

generic fraud ontology that serves as a common ontological basis on which the various domain specific

fraud ontologies can be built. The methodology along with the generic fraud ontology consist a powerful

conceptual tool through which knowledge engineers can easily adapt ontology-based fraud detection

systems to virtually any e-government domain.

1 INTRODUCTION

Fraud is an issue with psychological, economic and

legal ramifications for both the public and private

sector spanning geographic regions. The last

EHFCN (European Healthcare Fraud and Corruption

Network – http://www.efhcn.org) conference

produced agreement among members on a common

definition of fraud: “Civil fraud is the use or

presentation of false, incorrect or incomplete

statements and/or documents, or the non-disclosure

of information in violation of a legally enforceable

obligation to disclose, having as its effect the

misappropriation or wrongful retention of funds or

property of others, or their misuse of purposes other

than those specified”.

Other definitions of fraud present it as a type of

co

rrupt conduct and risk for organizations which

cannot be eliminated. In broader terms fraud is the

deliberate and premeditated act perpetrated to

achieve gain on false ground. The effects of fraud

are economic (reduced operational effectiveness),

legal (depriving resources from rightful claimants)

and psychological (damage moral and reduce

confidence in government).

The consequences of e-government fraud are

num

erous. For example, in the healthcare domain

fraud causes the raise of the cost of health care

benefits for everybody. According to the Deputy

Health Minister of Scotland Lewis Macdonald

(http://www.scotland.gov.uk) the potential losses to

healthcare across Europe from fraud and corruption

are estimated to be at least 30 billion euros each year

and may be as high as £100 billion. For most

employers, fraud increases the cost of providing

benefits to their employees and, therefore, their

overall cost of doing business. That translates into

higher premiums and out-of-pocket expenses as well

as reduced benefits or coverage. Healthcare fraud,

can also impact the quality of the received care.

When dishonest providers put greed ahead of care,

269

Alexopoulos P., Kafentzis K., Benetou X., Tagaris T. and Georgolios P. (2007).

TOWARDS A GENERIC FRAUD ONTOLOGY IN E-GOVERNMENT.

In Proceedings of the Second International Conference on e-Business, pages 269-276

DOI: 10.5220/0002112602690276

Copyright

c

SciTePress

proper diagnosis and treatment may be ignored and

patients may be put at risk solely to generate higher

dollar claims.

For all these reasons, a number of fraud-fighting

organizations, consortia and networks have been

created. Such a network is the European Healthcare

Fraud and Corruption Network (EHFCN) which

coordinates and advances work to counter healthcare

fraud and corruption across Europe. The different

approaches EHFCN adopts for fighting fraud are

common between the various e-government domains

and include:

• The creation of anti-fraud and anti-corruption

culture among service providers, healthcare

suppliers, healthcare payers, healthcare users and

ultimately among citizens.

• The use of all possible presentational and

publicity opportunities to act as a deterrent to those

who are minded to engage in e-government fraud or

corruption

• The use of effective prevention systems so

that when fraudulent or corrupt activities are

attempted, they will fail.

• The professional investigation of all cases of

detected or alleged fraud and corruption.

• The imposition, where fraud and corruption is

proven, of appropriate sanctions – namely civil,

criminal and/or disciplinary processes. Multiple

sanctions should be used where possible;

• The seeking of financial redress in respect of

resources lost to fraud and corruption and the return

of recovered resources to the area of patient care or

services for which they were intended;

• The development of a European common

standard of risk measurement (baseline figures),

with annual statistically valid follow up exercises to

measure progress in reducing losses to fraud and

corruption throughout the EU.

• The use of detection systems that will

promptly identify occurrences of healthcare fraud

and corruption

Our interest towards fraud detection lies into the

technological aspect of fraud fighting and in

particular in the area of fraud detection systems. In

this area organizations and agencies seek multiple

layers of fraud detection methods and tools ranging

from rule-based systems (Belhadji and Dionne 1997)

to predictive modelling (Zukerman and Albrecht

2000) approaches. We believe that in all these

methods and approaches, ontologies can play a

significant role as they have a lot to offer in terms of

interoperability, expressivity and reasoning.

In this paper we intend to illustrate a

methodology for building domain specific fraud

ontologies that are to be used by various ontology-

based fraud detection systems. This methodology is

accompanied and supported by a generic fraud

ontology which acts as a reference framework and a

basis for building such specialized ontologies.

The rest of the paper is organized as follows. The

next section discusses the way ontologies can be

used for detecting fraud. Section 3 illustrates our

proposed methodology for building domain specific

fraud ontologies while section 4 provides an

analytical description of the structure and

architecture of the generic fraud ontology that we

propose. Finally, section 5 highlights the

applicability of our methodology and fraud ontology

to specific case studies that cover a wide range of e-

government domains and section 6 summarizes our

approach.

2 ONTOLOGY BASED FRAUD

DETECTION IN THE

E-GOVERNMENT DOMAIN

2.1 Technological Approaches in the

Fraud Detection Domain

In general, the IT fraud detection systems in the e-

government domain fall into two main categories:

those that detect fraudulent activities the minute

these take place and those that identify fraud by

discovering suspicious behavioural patterns within

batches of data. The first are usually based on rules

and prediction models while the latter utilize data

mining techniques (

Hand et al, 2001). Rules

practically contain already known fraud patterns and

identify fraudulent activities through comparison to

these patterns.

Similarly, in predictive modelling, historical data

is used to build profiles of fraudulent behaviour in

order to detect future occurrences of the same

behaviour based on the similarity to the existing

profiles.

However, rule-based systems and predictive

modelling can only defend against known (or

predicted) fraud types. Data mining systems, on the

other hand, utilize large datasets in order to discover

unknown patterns of suspicious or fraudulent

behaviour. Those systems are used in conjunction

with large data warehouses that store information

relevant to the fraud detection domain. Additionally,

data mining systems provide the foundation of

predictive modelling. As data mining reveals

anomalous behaviour patterns, those cases are

ICE-B 2007 - International Conference on e-Business

270

investigated in greater detail and from those that are

found to be fraudulent, new fraud profiles are built.

2.2 The Importance of Ontologies

Ontologies can play a vital role in both the rule-

based and data mining fraud detection approaches.

Apart from the rules, a really important component

of a rule-based system is its knowledge base. An

important issue in knowledge bases is the knowledge

representation paradigm they adopt as the latter

influences the type and quality of reasoning that can

be made within the knowledge-based system. In the

Knowledge Representation literature there can be

found a number of different knowledge

representation schemas and languages including

first-order logic (Hodges, 2001), defeasible logic

(Nute, 1994), modal logic (Blackburn et al, 2003)

etc.

A family of these languages are Description

logics (DL) (Baader et al, 2003) on which in turn

ontologies are based. Ontologies are knowledge

models that represent a domain and are used to

reason about the objects in that domain and the

relations between them (Gruber 1993). Thus, a

knowledge base may use an ontology to specify its

structure (entity types and relationships) and its

classification scheme. In such a case, the ontology,

together with a set of instances of its classes

constitutes the knowledge base.

The use of ontologies and ontology-related

technologies for building knowledge bases for rule-

based systems is considered quite beneficial for two

main reasons:

• Ontologies provide an excellent way of

capturing and representing domain knowledge,

mainly due to their expressive power.

• A number of well established methodologies,

languages and tools (

Gomez-Perez et al 2004)

developed in the Ontological Engineering area can

make the building of the knowledge base easier,

more accurate and more efficient, especially in the

knowledge acquisition stage which is usually a

bottleneck in the whole ontology development

process.

Ontologies are also very important to the data

mining area as they can be used to select the best

data mining method for a new data set (Tadepalli et

al 2004). When new data is described in terms of the

ontology, one can look for a data set which is most

similar to the new one and for which the best data

mining method is known, this method is then applied

to the new data set. In this way, there is no need for

trying out every known method on the new data set,

but the one (or few) that is most promising can be

directly selected.

2.3 The Importance of Existing

Ontologies and Standards

Creating a knowledge model for a given domain

from scratch is most of the times a very difficult and

time/resource consuming task especially as far as the

knowledge acquisition process is concerned.

Therefore, in any such effort, the existence of

already established and commonly accepted

standards, classification schemes and ontologies

regarding this domain should always be taken in

mind. Of course the degree of existence and

reusability of such standards depends largely on the

given domain.

For example, in the healthcare domain, existing

medical classifications, terminologies and

taxonomies, which we used for the TSAY case study

that we describe in section 5, include the

International Classification of Diseases ICD)

(http://www.who.int/ classifications/icd), the ATC

system (http://www.whocc.no/atcddd) and the

SNOMED CT system (http://www.snomed.org). The

ICD classification is an international standard

diagnostic classification for all general

epidemiological and many health management

purposes. The Anatomical Therapeutic Chemical

(ATC) system is a system for classification of

medicinal products according to their primary

constituent and to the organ or system on which they

act and their chemical, pharmacological and

therapeutic properties. Finally, SNOMED

(Systematized Nomenclature of Medicine) is a

system of standardized medical terminology

developed by the College of American Pathologists

(CAP).

Apart from such domain specific classifications

like ATC or SNOMED, attempts for building fraud

ontologies for certain domains and fraud types have

also been made. Examples include financial fraud

(Leary et al, 2003) and e-mail based fraud

(Kerremans et al, 2005).

3 METHODOLOGY FOR

BUILDING FRAUD

ONTOLOGIES

The methodology we propose for building fraud

detection ontologies is based on the suggestion that

fraud is actually an operational risk for an

TOWARDS A GENERIC FRAUD ONTOLOGY IN E-GOVERNMENT

271

organization and as such it should be treated through

a risk management process. Risk management (RM)

(

Crockford, 1986) (Lam, 2003) is the process

whereby public organizations may methodically

address the risk associated to their activities with the

goal of achieving a sustained benefit within each

activity and across their portfolio of activities. The

focus of RM is to identify, measure and treat these

risks in order to reduce their probability of

happening.

In a similar fashion, our methodology defines a

process for identifying, measuring and treating fraud

in the context of e-government services. This

process comprises three steps; a) establishment of

the fraud context, b) identification of fraud within

this context and c) transformation of this information

into an ontological model.

Establishment of the fraud context within an

organization involves defining the type of fraud the

organization wishes to fight and identifying the

business processes fraud occurs upon. This is done

through a business process modelling procedure

which records the fraud susceptible business

processes of the organization and their context. On

the other hand, fraud identification involves the

description of potential fraud cases that could occur

within the organization and of corresponding

detection methods. This identification is done in two

ways, namely by acquiring organizational

knowledge regarding fraud from experts and by

utilizing data mining methods in order to extract

unknown fraud patterns.

The final step of the methodology involves

transforming the knowledge derived from the two

previous steps into an ontology so that it can be

utilized by fraud detection systems. This step usually

requires following some formal knowledge

engineering procedure.

Obviously, these three steps should be repeated

for each different domain or case study meaning that

the proposed methodology is an iterative procedure.

In order to minimize the effort required in each

iteration we created a generic fraud ontology which

acts as the basis for building domain specific fraud

ontologies.

4 FRAUD ONTOLOGY

The fraud ontology is practically a generic

framework for defining domain and case specific

fraud ontologies which are to be used in ontology-

based fraud detection systems. Among others, this

framework should be easily adaptable and

extendible to different domains and types of fraud.

This was made possible through a multi-layer

architectural design of the fraud ontology which

makes the latter adaptable, extendible and to a

significant degree reusable.

4.1 Fraud Ontology Layered

Architecture

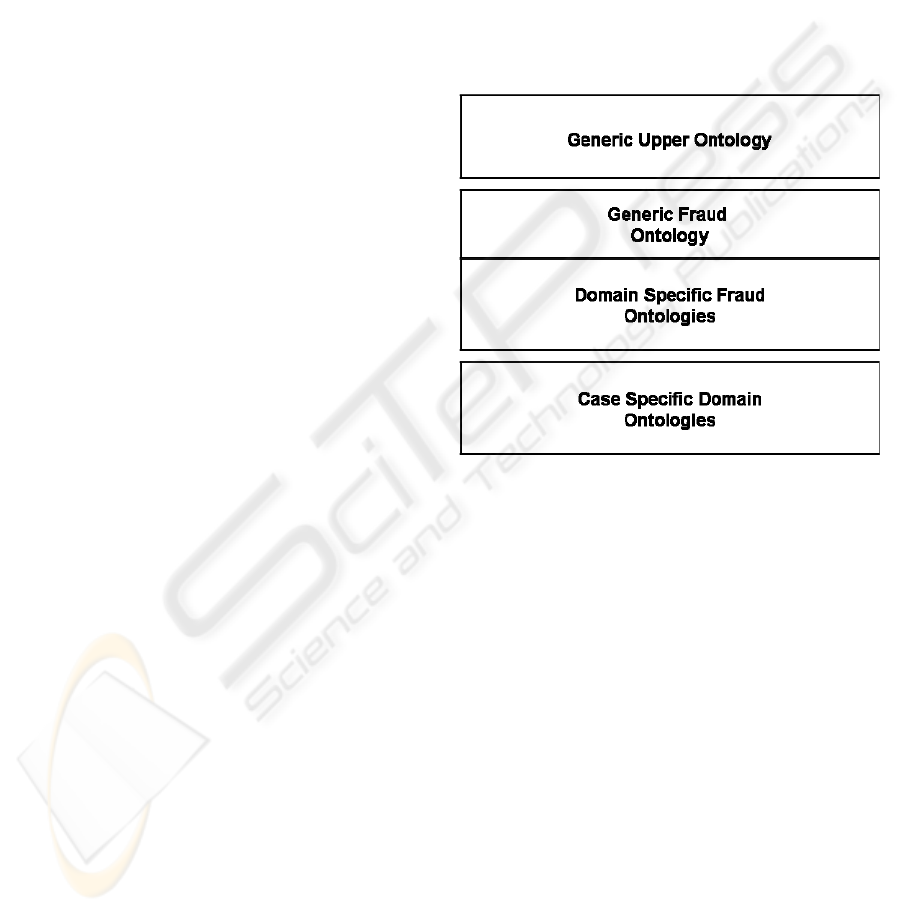

The overall architecture of the fraud ontology

consists of three independent but interconnected

layers each one defining its own set of ontologies

(see Fig. 1).

Figure 1: Fraud Ontology Layered Architecture.

The bottom layer (or case specific layer) consists

of domain ontologies which model the business

processes of the specific cases that are examined for

fraud, e.g. a specific organization in social security.

The concepts and relations contained in these

ontologies are practically derived from the business

process analysis of the particular case and from the

knowledge of the corresponding domain experts.

The main purpose of the case specific layer is to

provide the basic knowledge on which fraud

detection rules or data mining techniques are going

to be based on. Reusability of existing ontologies is

applicable nut only in the sense of best practices

transfer from one case to another.

The middle layer (or fraud domain layer)

comprises of ontologies which model fraud related

knowledge such as fraud types and fraud detection

processes. The content of these ontologies reflects

the knowledge of fraud domain experts and it is

primarily used as the basic means for expressing the

fraud detection rules that these experts provide.

ICE-B 2007 - International Conference on e-Business

272

5 CASE STUDIES

The middle layer could be considered as having

two sublayers, a domain-specific one and a generic

one. The domain-specific sublayer models the fraud

characteristics of the domain at hand, e.g. social

security or public procurement. The generic sublayer

provides more abstract and generic knowledge that

constitute the basis for applying knowledge-based

approaches into virtually any fraud susceptible field.

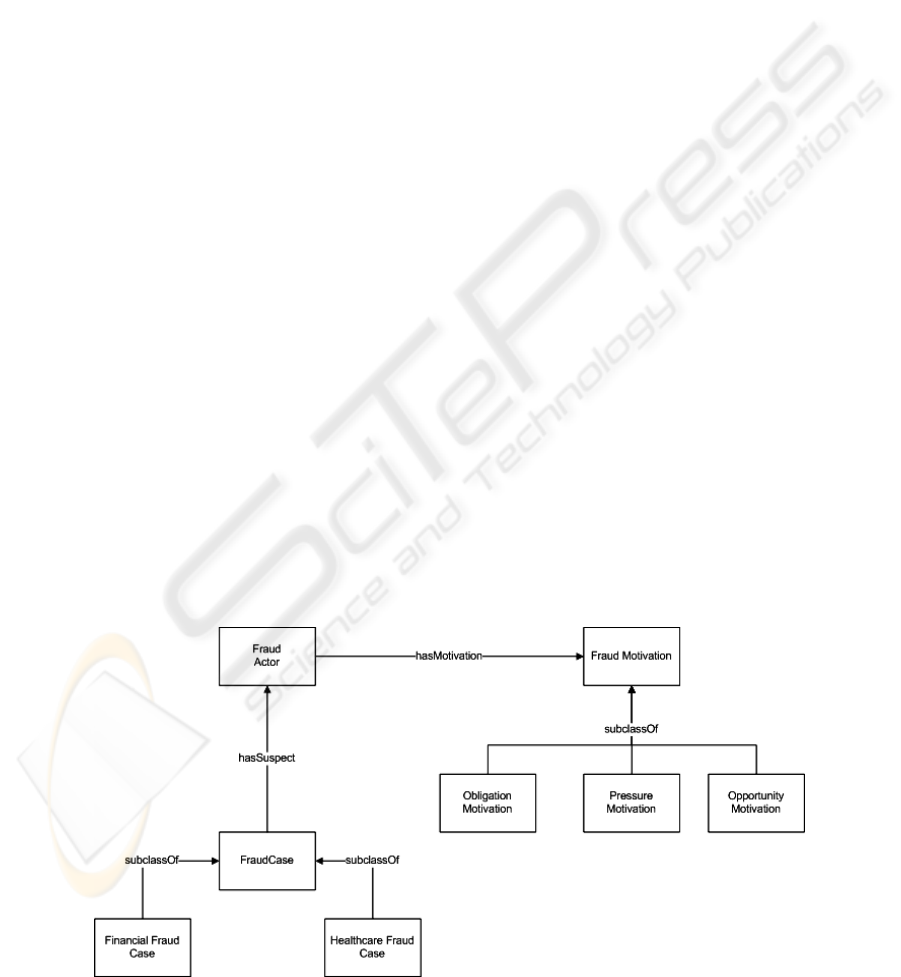

A small fraction of the generic fraud ontology is

depicted in figure 2. As it can be seen from this

diagram the fraud ontology contains concepts

representing fraud actors, fraud cases etc and

relations linking actors with motivations and cases

with actors.

5.1 The Case of TSAY, a Greek Social

Security Fund

TSAY is the insurance body of all healthcare

professionals in Greece and its main focus

concerning healthcare fraud is detected in the

prescription reimbursement domain. Since TSAY is

a health insurance body organization, one of the

most common services it offers to its members is the

payment of the drugs they consume. This payment

has mainly the form of reimbursement meaning that

a TSAY’s member purchases the drugs s/he needs

from a pharmacist paying only a percentage of the

actual cost and then the pharmacist claims the rest of

the money from TSAY.

Finally, the upper layer, namely the Generic

Upper Ontology, captures generic and domain-

independent knowledge that helps minimize

redundancy and duplication of knowledge within the

overall ontology.

However, it is often the case that the

prescriptions TSAY is asked to reimburse contain

erroneous or deliberately inaccurate data so that

larger sums of money can be claimed or

inappropriate drugs can be prescribed. Or, it is

possible that prescriptions contain data which when

viewed isolated do not indicate fraud but when

considered along with other prescriptions they form

some suspicious pattern of misbehaviour.

The most important of the advantages such a

layered architecture provides, are the following:

• Modularity: When a large-scale ontology is

composed out of smaller ontologies then its

development and maintenance are easier and more

efficient.

• Reusability: When the independent parts of

the ontology are well defined and separated then it is

highly possible that these parts can be reused in

other similar applications.

Of course, the cases targeted for detection do not

necessarily constitute fraud from a legal point of

view because it might be that the inaccurate data are

due to human error or that the objectionable

misbehaviour can be explained by reasons that are

not obvious. However, even then, the need for

detection remains strong since fraud in this case can

be considered to be synonymous to waste in the

form of monetary losses from the reimbursement of

inappropriate prescription.

• Extensibility: With the layered architecture,

and more specifically with the generic ontologies, it

is far easier to extend the ontology so that it can

cover domains of application other than the existing

ones.

Figure 2: Generic Fraud Ontology.

TOWARDS A GENERIC FRAUD ONTOLOGY IN E-GOVERNMENT

273

5.1.1 TSAY Fraud Context and Fraud

Identity

In the case of TSAY the fraud domain is that of

prescriptions. According to our methodology the

first required step was the establishment of the

fraud context namely the description of the

prescription domain. Thus, a business process

modelling procedure was performed and a

complete business process model of the

prescription domain was developed. The high level

processes contained in that model were:

• The issuance of prescription booklets to

TSAY members by the Fund

• The issuance of prescriptions by doctors to

patients that own these booklets

• The inspection of prescriptions by the

ministry of health.

• The filling of members’ prescriptions by the

pharmacists

• The reimbursement process of TSAY for

filled prescriptions.

According to the business process analysis,

prescription issuance, inspection and filling occur

outside the organization and TSAY has no control

over the events that take place there. This meant

that these processes could not be a part of TSAY’ s

fraud detection mechanism. On the other hand, the

prescription reimbursement process was

considered perfect for applying fraud detection

methods and rules.

These methods and rules (the TSAY fraud

identity or the second step of the methodology)

were provided by people involved in the

prescription process, namely doctors, pharmacists,

TSAY’s inspectors (patients could also be

included).

The rules identified comprised two main

categories, namely auditorial rules and medical

rules. Auditorial rules try to detect incomplete

prescriptions and invalid or miscalculated data

while medical rules try to detect prescriptions in

which the data are inconsistent from a medical

point of view.

An example of an auditorial rule is when a

prescription contains no diagnosis at all for the

drugs that it prescribes and an example of a

medical rule is when the diagnosis written on the

prescription is not included in the indications of the

prescribed drugs.

5.1.2 TSAY Domain Specific Fraud

Ontology and TSAY Case Specific

Domain Ontology

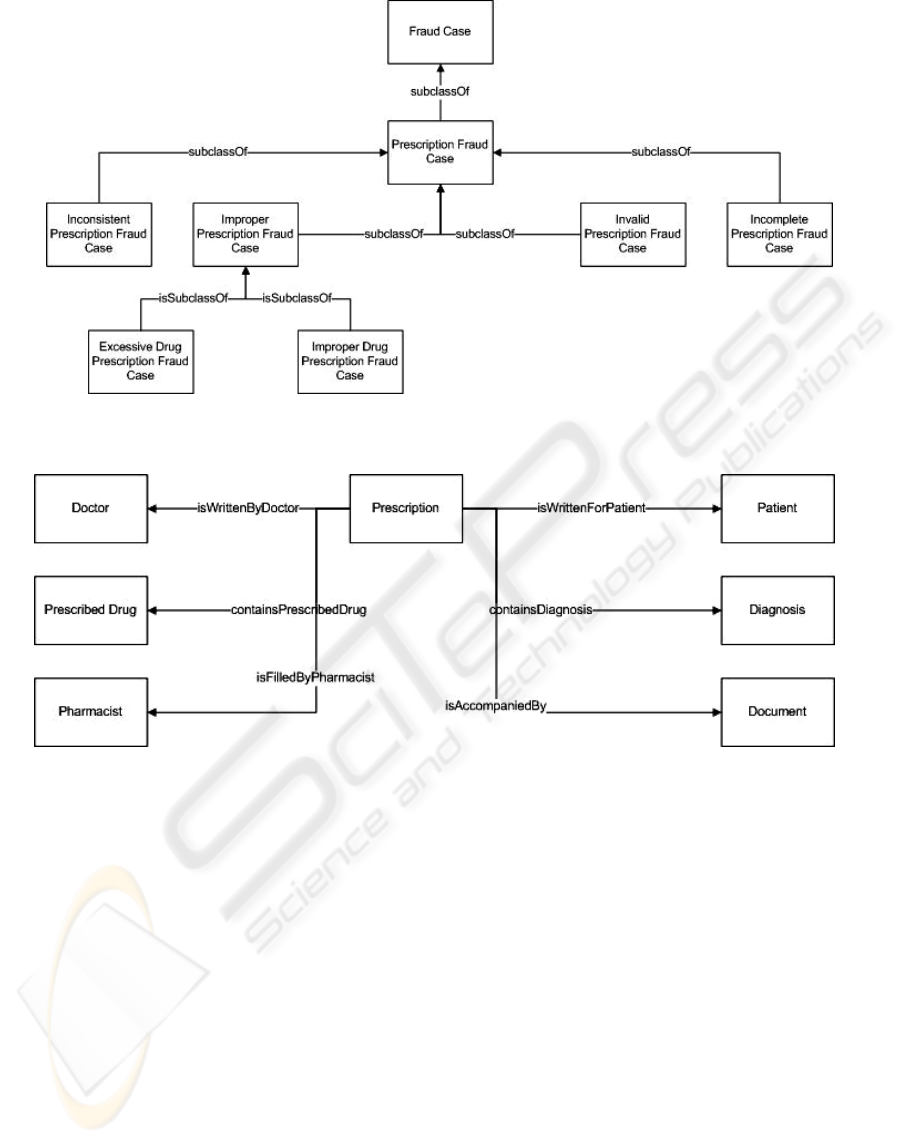

The third step of applying our methodology was

the actual building of the TSAY specific

ontologies. As described in section 4 these

ontologies are the TSAY domain specific fraud

ontology and the TSAY case specific domain

ontology.

The first contains the knowledge regarding the

prescription domain and utilizes the business

process model created in the previous steps. The

second models the fraud types and fraud detection

methods and rules for the prescription domain and

utilizes the knowledge derived from the domain

experts. Both are built under the generic upper and

fraud ontologies so that the development effort and

knowledge redundancy are minimized. Figures 3

and 4 present fractions of these two ontologies.

Figure 3 depicts the refinement and

specialization of a generic fraud case to the social

security domain and especially to prescription

related fraud. Several fraud cases identified in step

2 of the methodology are represented as concepts

in the domain ontology.

Figure 4 presents the representation of a

prescription as viewed by TSAY experts. The

different concepts – entities, their characteristics

and their relationships are depicted in the

ontological model. It is clear from the figure that

even this particular part of the TSAY case specific

ontology can be transferred and applied to another

organization that faces a similar increased risk in

its prescription process with minor adaptation.

5.2 Other cases

In order to illustrate and test the generic character

of our approach, we applied our methodology and

the generic fraud ontology to three more cases and

domains apart from that of TSAY’s.

The first one concerned one of the largest

cardiothoracic centre in the UK and part of NHS

Trust, which provides specialist services for

patients of all ages from across the UK, including

Scotland and Wales. The centre’s interest in fraud

detection involved the identification of conflict of

interest in the process of procurement of goods and

services within the Trust.

ICE-B 2007 - International Conference on e-Business

274

Figure 3: TSAY Domain Specific Fraud Ontology.

Figure 4: TSAY Case Specific Domain Ontology

Our approach to facilitating the detection of such

kind of fraud was similar to the one we followed in

the TSAY case. Thus, at first a business process

model describing the way the procurement process

performed within the centre was created and then a

number of potential conflict of interest cases were

identified along with corresponding fraud detection

rules. All this knowledge was transformed

correspondingly into the centre’s Domain Specific

Fraud Ontology and Case Specific Domain

Ontology. The centre’s experts evaluated the final

ontology and found it adequate to cover the fraud

detection process described during the first step of

the methodology.

The second case concerned customs control and

particularly fraud regarding tax evasion during the

movement of goods between countries of the EU

which originate from non-EU countries or pass

through non-EU countries. Again, we followed the

same procedure and we managed to create a

complete ontological model of this kind of fraud.

Finally, we applied our methodology in the field of

Public Administration for assisting the General

Inspector Office of Public Administrations to detect

corruption and any other potential fraudulent

activities that take place within the government. In

both cases the final ontology for the particular

organizations and domains was developed in a short

period of time by applying the methodology and

refining the generic ontology. The results were

judged as satisfactory by organizations’ experts.

6 CONCLUSIONS

In this paper we presented a methodology for

building fraud ontologies across domains spanning

the area of e-government. Fraud ontologies are

TOWARDS A GENERIC FRAUD ONTOLOGY IN E-GOVERNMENT

275

usually part of rule-based or predictive modelling

fraud detection systems but they can also be utilized

in data mining systems that try to discover

fraudulent behaviour among seemingly irrelevant

data. Our methodology is supported by a generic

ontological framework (called fraud ontology) that

can be used during the building of the domain

specific fraud ontologies for increasing the

efficiency of the whole ontology development

process.

In essence, our methodology and generic

ontology are tools that can be used by any

knowledge engineer who needs to build a domain

ontology for a fraud detection application in the field

of e-government. The methodology provides the

engineer a roadmap of how s/he should proceed with

acquiring the required knowledge for the application

while it leaves him/her free to choose the knowledge

engineering tools and methods s/he wishes. On a

second level, the fraud ontology provides the

engineer useful insights of how the ontology should

look like and helps him/her do the knowledge

modelling more accurately, efficiently and with less

effort.

ACKNOWLEDGEMENTS

The work presented in this paper is funded by the

European Commission under Grant FP6-2004-IST-

4-028055.

REFERENCES

Baader F., Calvanese D., McGuinness D. L., Nardi D.,

Patel-Schneider P.F.: The Description Logic

Handbook: Theory, Implementation, Applications.

Cambridge University Press, Cambridge, UK, 2003.

Belhadji, B. & Dionne, G., 1997. Development of an

Expert System for Automatic Detection of Automobile

Insurance Fraud, Ecole des Hautes Etudes

Commerciales de Montreal- 97-06, Ecole des Hautes

Etudes Commerciales de Montreal-Chaire de gestion

des risques.

Blackburn, Patrick, Maarten de Rijke, and Yde Venema

(2001) Modal Logic. Cambridge Univ. Press

Gomez-Perez Asuncion, Oscar Corcho, Mariano

Fernandez-Lopez (2004) Ontological Engineering.

Springer-Verlang London Limited

Crockford, Neil (1986). An Introduction to Risk

Management (2nd ed.). Woodhead-Faulkner. 0-85941-

332-2

Gruber TR (1993) A translation approach to portable

ontology specification. Knowledge Acquisition

5(2):1999-220

Hand D., Mannila H., Smyth P. (2001). Principles of Data

Mining. MIT Press, Cambridge, MA

Kerremans, Koen, Tang, Yan, Temmerman, Rita and

Zhao, Gang (2005). Towards Ontology-based E-mail

Fraud Detection. In: C. Bento, A. Cardoso and G.

Dias, (eds.) Proceedings of EPIA 2005 BAOSW

Workshop of 12th Portuguese conference on AI,

Covilha, Portugal, p. 106-111.

Lam, James (2003). Enterprise Risk Management: From

Incentives to Controls. John Wiley. ISBN-13 978-

0471430001

Leary, R. M., VanDenBerghe, W. and Zeleznikow, J.

2003. Towards a financial fraud ontology. A legal

modeling Approach. ICAIL’03 Workshop on Legal

Ontologies and Web-based Legal Information

Management

Noy N. F., D. L. McGuinness (2001). Ontology

development 101: A Guide to Creating Your First

Ontology. Stanford Knowledge Systems Laboratory

Technical Report KSL-01-05 and Stanford Medical

Informatics Technical Report SMI-2001-0880, March

2001.

Nute D. (1994). Defeasible logic. In

Handbook of logic in

artificial intelligence and logic programming

, volume

3: Nonmonotonic reasoning and uncertain reasoning,

pages 353-395. Oxford University Press.

Tadepalli S., A.K. Sinha, N. Ramakrishnnan (2004).

Ontology driven data mining for geosciences.

Proceedings of 2004 AAG Annual Meeting, Denver,

USA, 2004.

Zukerman I., D.W. Albrecht (2000). Predictive statistical

user models for user modeling. User Modeling and

User-Adapted Interaction 11(1-2), 5-18

Hodges W, 2001, "Classical Logic I: First Order Logic,"

in Lou Goble, ed., The Blackwell Guide to

Philosophical Logic. Blackwell.

ICE-B 2007 - International Conference on e-Business

276