SECURE GRID-BASED MULTI-PARTY MICROPAYMENT

SYSTEM IN 4G NETWORKS

Manel Abdelkader

1

, Noureddine Boudriga

1

and Mohammad S. Obaidat

2

1

CN&S Res. Lab., University of November 7

th

at Carthage, Tunisia

2

Department of Computer Science, Monmouth University

W. Long Branch, NJ 07764, USA

Keywords: Micropayment, 4G networks, grid architecture, delegation, tracing payment, Network-based/Grid

Computing.

Abstract: Grids present an attractive type of distributed applications that can be efficiently developed on 4G networks.

They are characterized by large scale resource sharing and innovative distributed applications. The design

and deployment of a service in a 4G Grid platform can be done in real time without a prior knowledge of

any contributing node. It can be used efficiently to implement sophisticated applications while providing a

complete control. In this paper, we propose a new secure micropayment scheme based on the Grid concept.

Our scheme presents a solution to pay anonymous parties present on various 4G networks, while allowing

tracing payment operations.

1 INTRODUCTION

In the economic world, payment presents one of the

main mechanisms motivating individuals and

communities to share their goods. In general,

payment is based on exchanging amounts of

payment means for some required services or goods.

This exchange should be protected against the

misbehavior of the customer and the buyer as well as

against any external threat. For this purpose,

mechanisms with different levels of security are

employed according to the value of the transactions.

Further, trust third parties are defined to control

payment between involved entities (Gu et al., 2004),

(Buyya et al., 2005), (Buyya and Vazhkudai, 2001),

(Barmouta and Buyya, 2003), (Ho and Huang,1990),

(Crispo, 2001), (Rivest and Shamir, 1996),

(Manasse, 1995), (Micali and Rivest, 2002), (Yang

and Garcia-Molina, 2003), (Holzmann and Gerard,

1988), (Obaidat and Boudriga, 2007).

Nowadays, the majority of business transactions

are conveyed to the electronic world. Such evolution

induces the need to define economic models suitable

to the nature of the new world. The first proposed

mechanisms were based on macropayment

(Barmouta and Buyya, 2003). The latter is

characterized by the transfer of important amount of

electronic money on the networks. These

mechanisms do not allow a fine management of

payment when accessing a service. In addition, the

conclusion of transactions with high values requires

the establishment of strong security mechanisms and

on-line verification systems.

To respond to these requirements and refine

payments according to the nature of the offered

services, a second type of payment was defined

through micropayment (Rivest and Shamir, 1996),

(Manasse, 1995), (Micali and Rivest, 2002), (Yang

and Garcia-Molina, 2003), (Obaidat and Boudriga,

2007). The latter is based on small payment values

management. For this kind of payment, even if some

losses are tolerated, security remains a serious

concern. In fact, for both types of micropayment,

anonymous or related to the payer, security should

be guaranteed. For anonymous micropayment, there

is no relation between the payer and the payment

means or coins. In this case, the coins should be

protected by a third party which is in general a bank.

The latter should guarantee the integrity and the

authenticity of each coin defined in the network

which means also that every node wishing to verify

a coin should consult the bank.

The second type of payment is related to the

payer. In this case each payment mean or token

should include the identity of the first payer. Thus,

before accepting any payment mean, a node should

authenticate the first payer and verify that he owns

137

Abdelkader M., Boudriga N. and S. Obaidat M. (2007).

SECURE GRID-BASED MULTI-PARTY MICROPAYMENT SYSTEM IN 4G NETWORKS.

In Proceedings of the Second International Conference on e-Business, pages 137-148

DOI: 10.5220/0002115801370148

Copyright

c

SciTePress

the value of each payment mean. This verification

requires the involvement of a trusted third party. In

addition, the payee can directly redeem the payment

means or use the same token for another payment, if

the micropayment mechanism allows asking for a

delegation authorization. In this case, every payee in

the network should verify the chain followed by the

payment mean since it has to be spent by the first

payer (Obaidat and Boudriga, 2007).

Consequently, micropayment still requires the

definition of appropriate security measures, which

could become complicated according to the number

of the payers and the nature of the payment means

and payment chains. Further, it does not define

mechanisms allowing to conclude distributed

payment or pay distributed applications. This kind of

applications is widely needed in the 4G networks,

which are characterized by the inter-operability of

different heterogeneous access networks composing

different types of networks with diverse underlying

protocols. Therefore, when accessing a service

provided on 4G networks, a node can be served

simultaneously by various service providers

belonging to different networks. Further, resources

may vary dynamically during service provision

according to the requestor’s node and the service

provider’s mobility. The study of these issues

becomes more interesting when we know that a node

can not identify all the resources contributing to

service provision. Thus, all these factors should be

taken into account during the design of payment

protocols. A significant example of 4G distributed

applications can be built through the study of the

characteristics of GRIDs.

Grids present an attractive area of application

characterized by large scale resource sharing and

innovative distributed applications. They enable the

sharing and coordinated use of resources in dynamic

collaborations. Resource sharing is not limited to file

exchange; it can provide on-demand access to all

kinds of computational resources. For Grids, the

sharing of resources is highly controlled. In fact,

resource providers and consumers need to negotiate

in real time resource sharing arrangements including

the nature, the security and the policies of the share.

Thus, GRID presents an interesting dynamic

architecture. In fact, the construction of a service is

done in real time without a prior knowledge of any

contributing node. Further, the first requester ignores

the manner with which his request is handled.

However, a network administrator can retrace the

service architecture. These features could be found

in micropayment and thus they would be used in our

system.

In this paper, we propose a secure micropayment

scheme based on the Grid paradigm. Our scheme

takes into consideration the nature of the distributed

application and resources sharing. In fact, it defines

mechanisms allowing to freely manage

micropayment means at different nodes of the

network. Thus, a consumer may allow providers to

re-assign new values and re-use micropayment

means for other purposes. In addition, in Grid

environment, a consumer does not need to have

knowledge about resource providers or service

architecture. Consequently he cannot identify to

whom he should pay. In our scheme, we also present

a solution to pay unknown parties without using

anonymous means since we should be able to trace

payment operations. Further, we use the architecture

of GRID services to define a security model for

micropayment, which allows protecting the involved

parties in a distributed manner.

The remaining of this paper is organized as

follows: Section 2 presents the main features and

shortcomings of micropayment schemes. Section 3

introduces the multi-party micropayment scheme

and defines the generation and the distribution

mechanisms. Section 4 presents the related

verification and tracing mechanisms. Section 5

shows some applications of the micropayment

scheme. Section 6 generalizes the micropayment

scheme for other application fields. Section 7

discusses the security features of the proposed

scheme. Finally, Section 8 concludes the paper.

2 MICROPAYMENT SCHEMES

In this section, we will introduce the main

micropayment schemes proposed in the literature.

We will focus on the advantages and the drawbacks

presented by each method for payment efficiency

and security. Micro-payments schemes are useful in

all those scenarios where many payments of small

amount of money are expected. During the mid

nineties a significant amount of research has focused

on developing micro-payments protocols: Millicent

(Manasse, 1995), MicroMint and PayWord are

among the most famous examples (Rivest and

Shamir, 1996).

In recent years, a strong need for new payments

proposals has given new energy to the micro

payment concept. Micali and Rivest have revisited

the PayWord protocol and the Rivest's Lottery

approach (Micali and Rivest, 2002), solving some

existing problems. In fact, one of the major

problems with payments of small amounts is that the

bank's processing cost can be much higher than the

transferred value. The most convincing solution is to

aggregate small payments in fewer larger payments.

Other problems, such as the computational time

ICE-B 2007 - International Conference on e-Business

138

needed to perform signature operation, are no longer

important as it was some years ago, because of the

deployment of powerful processors and the ongoing

improvement of the signature technology itself.

Another important issue, in peer-to-peer

applications, is that there is no clear distinction

between merchants and customers: there are simply

peers, which can be merchants, customers or both. In

such a context, the idea of transferable coins was

introduced, and PPay was one of the approaches

based on it, (Yang and Garcia-Molina, 2003),

(Obaidat and Boudriga, 2007).

Yang and Garcia-Molina (Yang and Garcia-

Molina, 2003) proposed a protocol (PPpay) that does

not involve any broker for each peer's transaction.

The concept of floating and self-managed currency

is introduced. The payment means or coins can flow

from one peer to another, and the owner of a given

coin manages the currency itself, except when it is

created or cashed, which means that the user

manages all the security features of the owned

coin(s). As other micropayments systems, PPay coin

fraud is possible. PPay considers that frauds are

detectable and malicious users can be punished.

Moreover, it assumes that a fraud can be operated

only over small amounts of money, and risk is

higher than benefit.

A study of the available approaches distinguishes

the following characteristics of micropayments:

The knowledge of the path between the sender

and the receiver is required. In fact, before

defining the cost of packets’ transmission, a node

should negotiate all the charges defined by nodes

present in the path. Then, the sender or the

requester can choose the path with the reduced

cost.

The definition of two major means for payment

is witnessed: cash or through the use of on-line

connections to a third party.

The assignment of fixed values to the

micropayment tokens does not allow a fine

management of payment means.

The re-use of the whole value of a micropayment

mean is authorized when delegation is possible.

The payee can only manage for whom the

micropayment mean will be transmitted during

the next payment.

To develop a micropayment scheme, different

conditions should be fulfilled. First, efficiency

should be guaranteed. In fact, the cost of the

communication and processing related to

micropayments should be kept as low as possible;

otherwise, it may exceed the value of the payment

itself. The importance of this feature should not

greatly affect other properties related to security and

fairness. Second, a micropayment system should

protect the rights of payers and payees. For this

purpose, security mechanisms should be included in

this system. Among the main security threats against

which a micropayment system should be protected,

we can mention the double spending, the forgery and

theft of coins. Third, a micropayment system should

be scalable and flexible. It should support the

augmentation of the number of transactions and be

independent from the nature of payment.

Even if the schemes proposed for micropayment

may differ, common features can be defined.

Practically, each scheme should define a technique

for money generation and money redemption. In

addition, it should propose techniques for payment

verification. Other features should be present for

distributed applications related to dynamic and

flexible management and payment traceability.

3 GRID BASED

MICROPAYMENT SYSTEM

In this section, we introduce a novel micropayment

system. The contribution of our work is the study of

micropayment based on GRID application concept.

In fact, in most existing approaches, the payment

should be done through predefined accounting

system in which users are defined by accounts.

In our approach we will foresee the case where a

customer will pay the first service provider he

knows. The latter will spend the received tokens

without the need for redeeming at the broker. The

next node that receives those tokens can use them

and so on. The tokens continue to be spent on the

network until a node remarks that the token will

expire, then it will redeem it at the broker. The latter

contains the accounts of the customer and the

service providers.

Another new feature introduced in our work is

related to coins distribution. In fact, as far as we

know, there is no proposition that allows the

subdivision of the value of a micropayment token

into smaller values assigned to other tokens. In this

paper, we present the subdivision procedure which is

performed by the involved nodes without returning

to the broker. In the following subsections, we

present the micropayment algorithm and the related

tracing process. Three main actors are defined in our

scheme; they are: a) the customer C, who is

identified by ID

C

and defined as the service

requestor and payer; b) the broker B, who is

identified by ID

B

and is responsible for the

generation and the protection of the micropayment

tokens; and c) the service providers

P

i

, 1 i n

,

SECURE GRID-BASED MULTI-PARTY MICROPAYMENT SYSTEM IN 4G NETWORKS

139

identified by ID

Pi

. In fact, service providers,

i

P

,

should be able to re-use the micropayment tokens

without getting back to the broker.

The micropayment algorithm is depicted as

follows.

Micropayment Algorithm

1. The consumer generates an unbalanced one way

binary tree UOBT, as presented in (Ho and

Huang,1990). For this purpose, C chooses a random

value A

NT

, two integers N and T, and two hash

functions H

1

and H

2

. A

NT

denotes the value associated

to the tree root.

C starts by applying H

1

N times to A

NT

. This operation

results in the construction of a backbone hash chain

(A

NT

, A

(N-1)T

,…, A

1T

) where A

kT

=H

1

(A

(k+1)T

) for 1≤k<N.

Each A

kT

with 1≤k≤N forms a secret root of a sub-

chain derived from the application of the second hash

chain H

2

. In fact, for a given A

kT

, 1≤k≤N, C applies H

2

T times.

Then, the resulted sub-chains (A

kT

, A

k(T-1)

,…,A

k1

)

where A

kt

=H

2

(A

k(t+1)

) for 0≤t<T are defined.

After the generation of all the sub-chains related to the

backbone hash chain, C defines the anchor vector A=

(A

10

, A

20

,…,A

N0

) where each A

k0

, 1≤k≤N is the anchor

value of a sub-section.

2. The user C forwards a signed message that consists of

the anchor vector A=(A

k0

)

1≤k≤N

with the length of the

sub-chains and the value assigned for each anchor

value, to obtain a broker commitment. Let V=(v

i

)

1≤i≤N

be the vector containing the values corresponding to

the anchor vector.

Then, a token request, defined by

{}

V,,ID

C

A

, is

signed by C and sent to B, while keeping A

NT

secret.

3. B generates a signed commitment corresponding to

each anchor value in A (The procedure followed by B

in this step will be detailed in the sequel). Then, B

sends the commitments to C.

4. C requires the total cost for accessing a service

offered by a provider

i

P

. According to this cost, C

selects the suitable commitment to be used for

micropayment tokens generation.

5. C and

i

P

sign a contract defining the parameters of

the micropayment.

6. C generates micropayment tokens and sends them to

i

P

according to the terms of the signed contract.

7.

i

P

verifies the integrity of the received tokens.

Verification is done off-line (without returning to B).

8. If the verification result is positive, then

i

P proceeds

in one of the following three different manners:

a) Send the token to B to be redeemed. The

micropayment process will then end.

b) Reassign the same token and re-use it for other

purposes. In this case,

i

P

asks C to allow him to

re-use the token. For this purpose, a delegation

procedure is followed and C states that a specific

token can be freely used by

i

P

.

c) Subdivide the value of the token to other smaller

values defined in different tokens. In this case,

P

i

will ask C to allow him the subdivision of a token

into "sub-tokens" which could be used for different

and independent purposes.

In the following we will detail the generation and

distribution processes introduced by the

micropayment algorithm.

3.1 Generation Process

The generation process is composed of two basic

steps: (i) the generation of a generic proof of

possession of a global amount of money. This step is

performed between

C and B; and (ii) the generation

of micropayment tokens, which are generated by

C

to pay services offered by provider

P

i

.

Step (1): Customer C has an account at the broker

B. When C spends an amount of electronic money,

the distributed sum should be reduced from his

account. To prove electronic money possession,

C

requires a commitment signed by the broker for each

element present in the anchor vector

A. A signed

request sent by

C should contain:

{

}

Cbysigned

C

V,A,ID

,

On requesting a commitment,

C authorizes the

broker to block the amount of money present in the

commitment. The amount is defined by the value of

every element of vector

V and is assigned to an

anchor value in

A. For each anchor value of the

vector,

B generates the corresponding commitment.

Let

G={G

i

, 1≤i≤N} denotes the set of the generated

commitments and let commitment G

i

be defined by:

{}

Bbysigned

iiiBCi

v,A,s,ID,ID=G

0

where s

i

is a unique serial number allowing to

identify each commitment at B and assigning the

generated tokens to the suitable commitment. Then

B sends the signed commitments to C.

Step (2): Token generation depends on the payment

policy defined by each service provider. Among

many clauses, the policy indicates the approved

procedures with which a given service could be paid.

These procedures define a set of recognized

distribution functions

{}

Dd,f

d

≤≤1

defined as the

functions allowing the subdivision of the global cost

into different sub-values paid consecutively. These

functions vary according to the nature and the

demand of the required resource.

When C contacts the first service provider

P

1

, he

will ask for the global cost

K required for service

provision, the distribution functions

ICE-B 2007 - International Conference on e-Business

140

required

)1( Dd,f

d

≤≤

, the nature of the tokens

(purchasable or distributable) and the value

1

k of

the first token. Upon receiving a response, C

chooses the commitment

i

G

with which he will

make the payment. Then, he presents a first version

of a contract to

P

1

under the following form:

{

}

Cbysigned

di

1

PC

PC

d,f,G,ID,ID=C

−

,

where

}{

1,0∈d

. If

0=d

, then C will generate

purchasable tokens (i.e., tokens that can be only

changed into currency at B). If not, C will generate

distributable tokens (i.e., tokens that could be used

by

P

1

for other payments). Then,

P

1

verifies the

signature of the broker on

i

G and the amount

assigned to

0i

A

(

Kv

i

≥

).

If the result of the verification is negative,

P

1

asks

for other commitments. With a positive result,

1

P

signs

PC

C

−

to construct the final contract:

{

}

1

)(

Pbysigned

Cbysigneddi

1

PCPC

d,f,G,ID,ID=C

−

Then, it sends it back to

C.

According to the chosen distribution functions,

C

can consider the set of redeemable

values

{

}

nj,k

j

≤≤1

, where k

j

is defined by

()

ijdj

Af=k

. We note that knowing

d

f and the

first value

k

1

, one can deduce the number n of

tokens that should be delivered from

C to

1

P .

Consequently,

C, B and

1

P know that n elements of

the sub-chain corresponding to G

i

would be used as

well as the value assigned to each element.

C generates and sends to

1

P the micropayment

tokens during service provision. A purchasable

token has the following form:

{

}

)1( −jii

1

PCj

A,s,ID,ID=t

.

While a distributable token has the form:

{

}

Cbysigned

jjii

1

PCj

d,k,A,s,ID,ID=t

)1(

'

−

.

where

d states that C delegates the right of token

distribution to

1

P . Thus,

1

P is not able to change

j

t' into currency.

3.2 Distribution Process

Distribution is based on the accountability

delegation protocol presented in (Crispo, 2001),

assuming that a delegator can transfer accountability

when he transfers his own rights to the delegated

node. It has been formally shown that accountability

is provable to third parties, even if the given

property has been transferred by means of

delegation. Using accountability delegation protocol

in our micro-payment scheme means that:

• When

C authorizes a service provider P to

distribute a token, he also transfers the right of

distributing it to another peer or changing the

token into currency.

• When

C transfers to P the right of distributing or

changing the token into currency, he also

transfers to

P the accountability for exercising

such a right. In other words, if

P commits a

fraud with the distributed token, the link

between

P and his actions could be established.

• If

C is not the valid owner of the given token, P

can refute distribution after the verification of the

token validity.

Now, we describe the case where

C assigns a token

to

1

P

and allows him to distribute it. The delegation

procedure begins when

C asks provider

1

P

about the

nature of the token he wants. When

1

P

chooses

distributable tokens,

C generates and signs an

authorization token. An authorization token includes

information about C,

1

P , and the transfer of the

accountability. Upon authorizing

P

1

to distribute a

token, C becomes no longer responsible of this

token. The authorization token serves as a proof at

the broker and the other peers to whom

P

1

will

distribute the related micropayment token. We

define an authorization token as:

{

}

Cbysigned

diji

1

PC

k,f,A,s,ID,ID=θ

1

.

After receiving the two tokens (micropayment

and distribution authorization),

P

1

could make other

micropayment based on

C's micropayment token. In

fact, from a micropayment token,

P

1

could derive m

tokens such that:

{

}

1

11)1(1

1,

P

j,jii

1

RCj,

dθ,,k',A,s,ID,ID=t

−

{

}

1

22)1(1

2,

P

j,jiiR2Cj,

dθ,,k',A,s,ID,ID=t

−

…..

{

}

1

)1(

P

mmj,jii

m

RCmj,

dθ,,k'm,,A,s,ID,ID=t

−

with

ID

R

i

is the identifier of the resource, θ is the

authorization token and

j 1

m

k'

i,j

k

i

.

Re-assignment presents a special case of

distribution. It refers to the transfer of the ownership

SECURE GRID-BASED MULTI-PARTY MICROPAYMENT SYSTEM IN 4G NETWORKS

141

of a micropayment token to another entity. In this

transfer, the token keeps the same value and the new

owner cannot modify it. In this case, we consider

that the distribution function chosen by the entity

who receives the distributed token is constant.

Therefore, the whole value of the token is

transferred to the same entity.

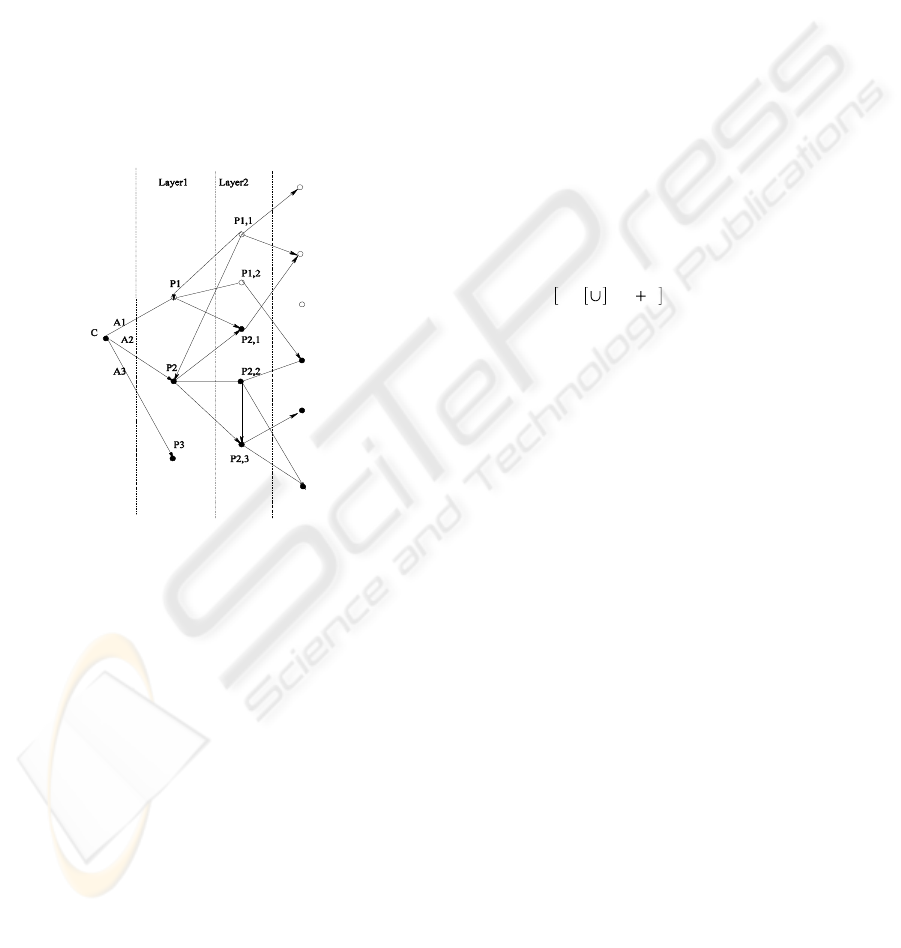

Figure 1 illustrates the use of tokens for

micropayment. In fact, C uses three different UOBT

sub-chains: A

1

to pay P

1

, A

2

to pay P

2

and A

3

to pay

P

3

. C generates purchasable tokens for P

3

. The latter

can only redeem those tokens at the broker.

However, C generates distributable tokens for P

1

and

P

2

. Thus, P

1

derives other micropayment tokens and

use them to pay P

1,1

and P

1,2

. We show also in the

figure that P

2

can receive a distributed token from

P

1,1

derived from a micropayment token originating

from C.

Figure 1: Distributed micropayment scheme.

4 MICROPAYMENT

VERIFICATION AND

TRACING

In this section, we define the verification

procedure followed by a node receiving a

micropayment token. Then, we present a

tracing method allowing the reconstruction of a

micropayment operation.

4.1 Verification Procedure

Verification procedure depends on the nature of the

received token. We distinguish two types of

verification.

Purchasable tokens: The first type is related to

purchasable tokens. The verification procedure

involves three steps.

First, P

1

verifies the first version of the contract.

This implies the verification of the signature of the

broker on the commitment and the assigned value,

which should cover the cost required for service

provision. A positive verification is concluded by

the signature of the final version of the contract.

Second, P

1

verifies tokens as long as he provides the

service. In fact, each micropayment token is

accompanied with a verification procedure, which is

related to the hash value received in each token.

Therefore, for the

j

th

token, the receiver verifies

that

.

21)(

)(AH=A

ijji −

The chain of hash values proves the correctness

of the payment. In the case where a token is lost or

does not reach the provider, the provider should

notify customer

C. Then, C drops the value assigned

to the lost token and affects it to the next token.

Thus, the set of the tokens becomes (

A

ik

) where k

belongs to

1,j j,n 1

, j refers to the lost token

and

()

)1(

1

−ji

+j

dj

Af=k

. In addition, C notifies the

broker about the loss to be considered during

redeeming.

Third, B verifies the tokens before purchasing. In

fact, to be purchased P

1

only presents the last

received token with the contract to

B, who verifies

the authenticity of the contract and gives the total

sum corresponding to the addition of the values

assigned to the different tokens given to

1

P .

Distributed tokens: In this case, the receiver should

verify, in addition to the presented commitment and

the contract, the authorization and the payment

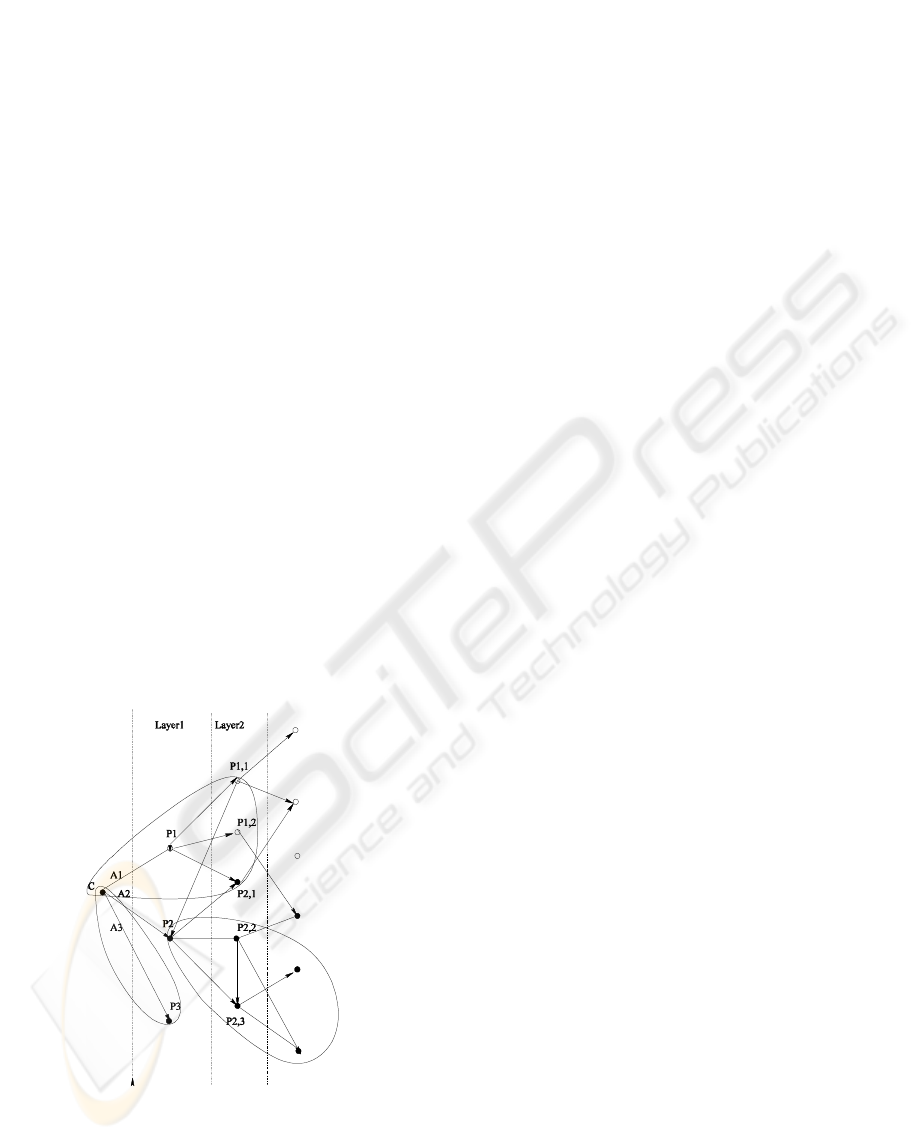

tokens. In this paragraph, we reach the two layers of

the distribution procedure. As depicted in Figure 2,

the nodes participating in the verification procedure

are encircled. We consider customer

C, the first

service provider

1

P

who is present in the layer 1 of

the distribution architecture and the service

providers

t

P

1,

present in layer 2 receiving distributed

tokens. Verification proceeds as follows:

First,

1

P

verifies the micropayment token. This

includes the verification of the chain of hash values

as it was previously shown, the verification of the

assigned value and the validation of

C’s signature. In

addition,

1

P

verifies the authorization token related

to this micropayment token.

ICE-B 2007 - International Conference on e-Business

142

Second, every

t

P

1,

checks the distributed tokens that

he receives from

1

P

. The verification is performed as

follows. First, verification is done between layer 2

and layer 1 of the distribution architecture.

t

P

1,

verifies every distributed token and the

authorization token given by C to

1

P

.

In the case where the check succeeds, the

verification becomes between layer 2 and

C.

t

P

1,

sends the received distributed tokens to

C, who

verifies that the sum of the distributed tokens values

does not exceed the value of the original token. For

this purpose,

C maintains a counter for each

distributable token. Each time a

P

1,t

sends a

distributed token,

C reduces the value of that token

from the original value; and so on, until all the value

of the token is spent. If a token arrives after the

value has been spent, C rejects the token and

informs its source that any process where the token

is involved should be stopped.

This procedure is followed in the same manner

between layers n and

n-2, for all n, in the

distribution architecture, as depicted in Figure 2,

where, following this process, we can reconstruct the

nodes participating in each verification procedure.

Thus, the set containing {C, P

1

, P

1,1

, P

1,2

, P

2,1

} is

defined for the verification of the distributed tokens

generated by C and paid to P

1

. However, the set {C,

P

3

} refers to the verification of purchasable tokens

paid to P

3

.

Figure 2: Verification Procedure.

Therefore, to ensure verification, we have

introduced a visibility of two layers for the different

nodes receiving distributed tokens. Visibility

guarantees that a node present at layer

n-1 cannot

spend more than the amount assigned to a

distributable token. Furthermore, verification should

be concluded by B before purchasing a distributed

token. For this, B verifies the authorization and the

distributed token. Then he redeems its value. Thus,

authorization tokens serve as a proof in case of

dispute or need for tracing. For this purpose, they

should be kept by the network nodes involved in

token distribution.

4.2 Tracing Micropayment

We present here a tracing method that allows

retrieving the different tokens distributed by a

consumer

C. Distribution and re-assignment are used

to resolve dispute and detect attacks. To execute a

job in the GRID context, a node launches the request

in the network and waits for a suitable response. A

response should contain the resource able to execute

the job, the

QoS required by the requester, and the

amount of money needed to accomplish the job. In a

traditional GRID, there are predefined proxies in

each network. When a node wants to access to the

GRID, it allows the proxy to act on its behalf when

searching or using resources, since the GRID has a

prior knowledge of service provision in the network.

In our micropayment scheme, every node

performing distribution is considered as a proxy. To

reconstruct the distribution architecture, B should

identify all nodes that have performed a distribution

process. A broker or an auditor starts to reconstruct

the distribution architecture from a received token

mentioning the first originator of the token and the

related anchor. From the signature present on the

token, the broker deduces the sender. He asks then

for the authorization token, the distribution function

and the original token. The broker verifies the

distribution procedure followed by the token. Then,

he continues by verifying whether the token is

distributed by the first customer or by an

intermediate entity. In the second case, he asks for

the distribution materials (i.e., authorization token,

distribution function, and the original token) to be

verified. This procedure is followed by the broker

until he reaches the first entity that had generated the

token. Thus, the broker can reconstruct the history of

any token presented to him to be purchased or

verified. However, it has not yet found the

distribution architecture of a special token. To fulfill

this criterion, we should require that the node

making distribution should keep track of the

contracts and authorization token.

SECURE GRID-BASED MULTI-PARTY MICROPAYMENT SYSTEM IN 4G NETWORKS

143

5 MICROPAYMENT

APPLICATION FOR GRID

In this section, we consider the application of our

micropayment scheme on GRID environment

defined for 4G networks. Two approaches can be

addressed. In the first, micropayment can be

considered as a GRID application accessible in a 4G

network. In the second, the proposed mechanism can

be used to pay 4G resources involved in GRID

services provision. In fact, as it was presented

before, our scheme allows delegating and

distributing micropayment tokens in the 4G network.

Both methods are useful in 4G distributed

applications, since our scheme allows an entity to

purchase through different providers, using the fact

that a token includes the identities of the first

originator and the final node possessing the token,

despite access networks heterogeneity.

5.1 Micropayment for GRID

When revising the characteristic of GRID as a 4G

distributed application, we can denote the existence

of different common features with our

micropayment scheme. In fact, a service requester

has no knowledge about the nodes contributing to a

GRID service provision and so about the structure of

the paths to these nodes. A more complex payment

computing protocol should be defined in function of

resources nature. The first assumption is to use our

micropayment scheme to pay GRID resources. This

feature was considered by our scheme when a node

transfers the accountability to another and allows

him to distribute the micropayment tokens.

In addition, if we consider the GRID, we notice

that resources are not allocated uniformly to all

service requesters and that each resource is free to

define its policies and its requirements. This feature

is considered in our scheme since we have defined

different distribution functions and we allow to all

service providers to adopt suitable payment

functions according to the nature of their resources

and the offered QoS. Further, micropayment starts

only when the payer and the payee agree on the

distribution function and the first paid amount. For

GRID, these functions allow to respond to the

payment policies defined by the resources. The

second assumption is to implement the

micropayment scheme as a GRID application. For

this purpose some analogies should be noticed:

• The first customer

C is considered as a GRID

client who will ask for a service. The service in

our case is considered as micropayment.

• The first service provider

P

1

is considered as

the first proxy known by

C. In this analogy, we

will consider the case where

P

1

asks for

distributable tokens. Thus,

C will generate

authorization tokens which are considered as the

proxy certificates that are used by the proxy to

act on behalf of the user in the network. This

point presents some difference with the GRID. In

fact, whereas a simple user will wait for job

execution,

C can no longer be present; his broker

will take his place.

5.2 Case Study

In this section we take the case of alternative

operators exploiting the resources of the 4G

networks. We show how the GRID can help such

applications. For this, we need to discuss the role of

an alternative operator.

The main feature characterizing an alternative

operator is the absence of predefined infrastructure

or private resources in 4G networks. In fact, the

functions offered by these operators are based on the

use of independent resources present on the

heterogeneous access networks to construct a service

and respond to requests.

The case of the alternative operators presents

different similarities to a 4G GRID application. In

fact, when a requester wants to access a service (e.g.,

a call establishment), he asks his network operator to

act on behalf of him. From this stage, the service

architecture and the functions defined in the network

are hidden to the final user. The provision presented

by the alternative operator is that he has not a prior

knowledge of the architecture of the service or the

structure of the network allowing the establishment

of this service. An alternative operator should be

able to discover, schedule, and allocate the needed

resources.

For alternative operators, flexible and scalable

payments present a great concern. A payment

system should not only be able to support a variety

of different payment mechanisms but it must be

capable of efficiently handling payments to third-

party partners as well as gathering call data to ensure

that the financial relationship with the actual

network owner is monitored effectively. This is

where the complexity really starts to mount for

companies seeking to interconnect all parties

involved in a payment scheme by themselves. While

payment systems can be complex when only basic

voice services are involved, alternative operators

need to be able to mix and match different packages

of services and tariffs in creative ways. Further,

services increasingly interact with the IP Multimedia

Subsystem, which induces that service provision and

ICE-B 2007 - International Conference on e-Business

144

payment should be handled in real time. From the

customer point of view, this complexity must remain

safely hidden and service requests must be fulfilled

as instantaneously and transparently as possible. In

such environments, the multiparty micropayment

protocol presents a good solution to overcome these

constraints.

Let us take the case where a customer

communicates with an alternative operator

1

ASP

and asks for a given service. To provide such a

service,

1

ASP

will search (and find) the resources at

2

ASP

and

3

ASP

. Each provider will assign the

resources required by

1

ASP

based on other networks

provisions. For this example,

1

ASP

only knows the

two alternative operators, the remaining part of the

service architecture is hidden to him. Consequently,

1

ASP

does not know how the partition of the

resource is done.

To this end, the customer generates the payment

tokens and the authorization of distribution and

sends them to

1

ASP

. Then,

1

ASP

distributes the

tokens to pay

2

ASP

and

3

ASP

, who will verify

distribution process with the customer. If the

verification succeeds, each operator distributes the

received tokens to the networks owning the real

resources. At the end of this chain, each payee can

communicate with the broker to redeem its tokens or

spend them for other purposes.

6 GENERIC PAYMENT SCHEME

In this section, we show how we can adapt the

micropayment scheme for the payment of important

amounts independently of the nature of the

supporting networks. This adaptation allows

handling the various requirements of applications

linked to 4G networks. In fact, to ensure inter-

operability between the different types of 4G

networks during service provision, a generic

payment scheme should be defined.

In the following, we first present briefly the

requirements of a payment operation. Then, we

present the adequate modifications that we should

introduce to our scheme to become suitable for

payment purposes.

6.1 Payment Requirements

Compared to the micropayment, macropayment

schemes transfer larger amounts. Consequently,

these schemes require rigorous security measures.

Generally, the approaches adopted by payment

schemes use public key cryptography for

authentication and for the protection of the privacy

and the integrity of the transactions.

Besides, payment schemes need an on-line

connection to the broker. In fact, before accepting

any payment transaction, a service provider connects

to the broker to verify the authenticity of the

received payment means. The verification also

allows preventing double spending. E-cash is an

example of payment schemes. It requires service

provider's broker and customer's broker to be on-line

to verify payment transactions. In our scheme, a

high level security for the payment transactions is

guaranteed. In addition, we lighten the

communications in the network by reducing the on-

line connection to the broker.

6.2 Payment Scheme

For the payment scheme, we notice that we no

longer need the use of hash values since amounts

with important values would be spent for each

transaction. Consequently, we only define the

payment amount and introduce the re-assignment

and distribution ability. The generic payment model

is described as follows.

In response to the customer’s request, the bank

guarantees the possession of an amount of money.

The difference from the micropayment approach

consists in the value blocked by the bank which will

be in this case more important. Also, the customer

will not use the UOBT scheme which induces the

modification of the structure of the first

commitment. In fact, the broker signs the following

new structure

{}

Bbysigned

iBC

V,S,ID,ID

.

After that and before making a payment, the

customer will present the commitment to the service

provider and require the nature of the payment. We

keep in this model the ability of the service provider

to choose between receiving purchasable or

distributable payment means. Then,

C and P sign a

contract fixing the nature of the payment means and

the amount to be transferred. The payment is made

when

C signs a "check" in which he indicates

whether he is directly purchasable or distributable.

In the latter case,

C generates an authorization

credential to be used by the payee during

distribution.

The verification is done in the same way as

defined for the micropayment. In addition to the

verification of the paid amount and the authorization

to credential, the two-layer verification process is

employed. In fact, an entity receiving a sub-amount

will refer to the entity who had given the

SECURE GRID-BASED MULTI-PARTY MICROPAYMENT SYSTEM IN 4G NETWORKS

145

authorization to the payer. This operation allows

checking that the payer possesses the paid amount.

By this way, the broker is only consulted for a final

redemption.

In our scheme, we have protected the payment

transactions through the use of the digital signature

for a simple or a distributed payment. In addition,

we have introduced an autonomous verification

mechanism in the distributed architecture.

6.3 Validation Scheme

Validation refers to check the micropayment

protocol specification such that it will not get into

protocol design errors like deadlock or unspecified

receptions (Holzmann and Gerard, 1988). The

validation scheme concentrates on verifying the

aliveness and safety properties and correctness of the

protocol specification. To verify logical consistency,

a formal finite state machine (FSM) model of the

protocol is constructed. The model specifies a set of

asynchronous, communicating finite state machines

(FSM). The individual behavior of an asynchronous

FSM is defined by a finite set of local machine states

and local state transitions. The system as a whole is

defined, minimally, by the integration of all

individual process states and the combination of all

simultaneously enabled local state transitions.

In the following, we use this method to validate

the micropayment protocol. For this purpose, we

define the actors in the different protocol phases and

present the FSM model for each one. In the

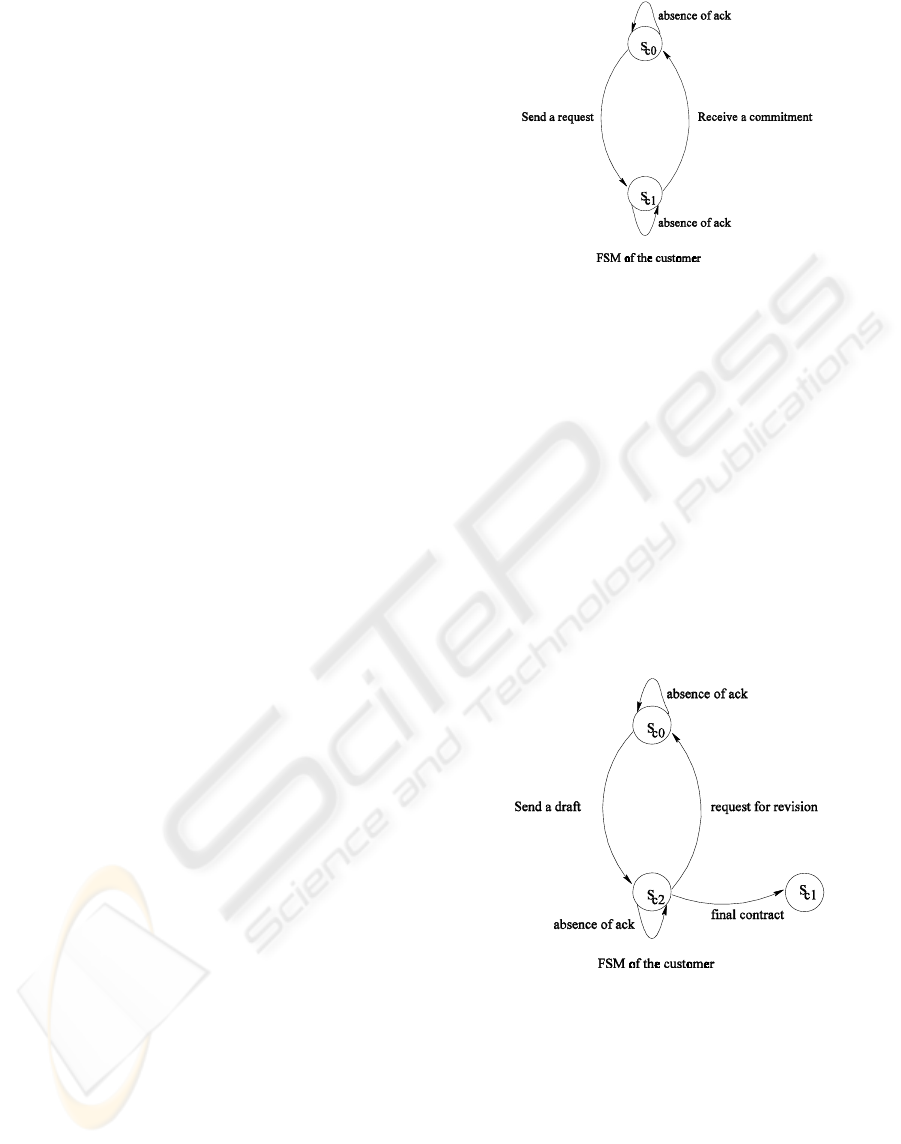

micropayment protocol, we define two main phases,

the initiation phase and the payment phase.

Initiation phase: During this phase two procedures

are concluded. The fist is realized between the

customer and the broker when generating the

original commitment. For this,

C defines two states:

:

CO

S C has generated Anchor vectors, already sent

Commitment to B, and C is now waiting for

the reception of the signed commitment

:

1C

S C is Waiting for a commitment and preparing

for the following request

BO

S : B Waiting for anchor vectors

1B

S : Anchor vectors already sent by B

Figure 3 shows the finite state machine (FSM)

related to the customer. In Figure 3, the circles

indicate the states and the arrows show the

transactions done to move from a state to another.

The second procedure is done between the

customer and the service provider. During this

procedure, both involved entities agree on a contract

defining the payment parameters.

Figure 3: The customer FSM.

For this phase, the customer and the service provider

define the following states.

=

CO

S C has sent a draft of the contract to P1.

=

1C

S C has received a final version of the contract

from P1

=

2C

S C waits for a response from P1

=

1P

S P has received a first version of contract sent

by C.

=

2P

S P has sent a response to C

The FSM of the customer is presented in Figure 4. It

shows the end of the initiation phase when arriving

at state

S

C1

.

Figure 4: Customer FSM related to contract conclusion.

Payment phase. The second phase is defined for the

payment procedure. In this phase, two cases are

studied according to the nature of the spent tokens:

Payment without distribution property: In this case,

the customer will present the suitable commitment

and the related tokens. The states known by the

customer are “C has sent the token, C waits for the

required service”. However, the service provider

defines two states “P1 has received the tokens, P1

ICE-B 2007 - International Conference on e-Business

146

provides service to C”. For an abnormal

functionality, other states appear for both

participants like “payment is stopped, service

provision is interrupted, or tokens are lost”.

Payment with distribution property: Three actors are

defined presenting three layers of the payment

architecture. We denote them by

P

j

,

P

j 1

and

2+j

P

. The states defined for

P

j

are:

-

P

j

has sent authorization token to

1+j

P

-

P

j

has sent payment token to

1+j

P

-

P

j

waits distribution information from

2+j

P

-

P

j

has sent distribution verification result

to

2+j

P

”.

For

P

j 1

we define:

-

P

j 1

has receives an authorization token

from

P

j

-

P

j 1

has received payment tokens from

P

j

-

P

j 1

has sent distributed tokens to

2+j

P

-

P

j 1

waits for

2+j

P

to provide him a service

For

P

j 2

, the defined states are:

-

P

j 2

receiving distributed tokens

P

j 1

-

P

j 2

sending verification request to

P

j

-

P

j 2

waiting for verification result

-

P

j 2

provides a service

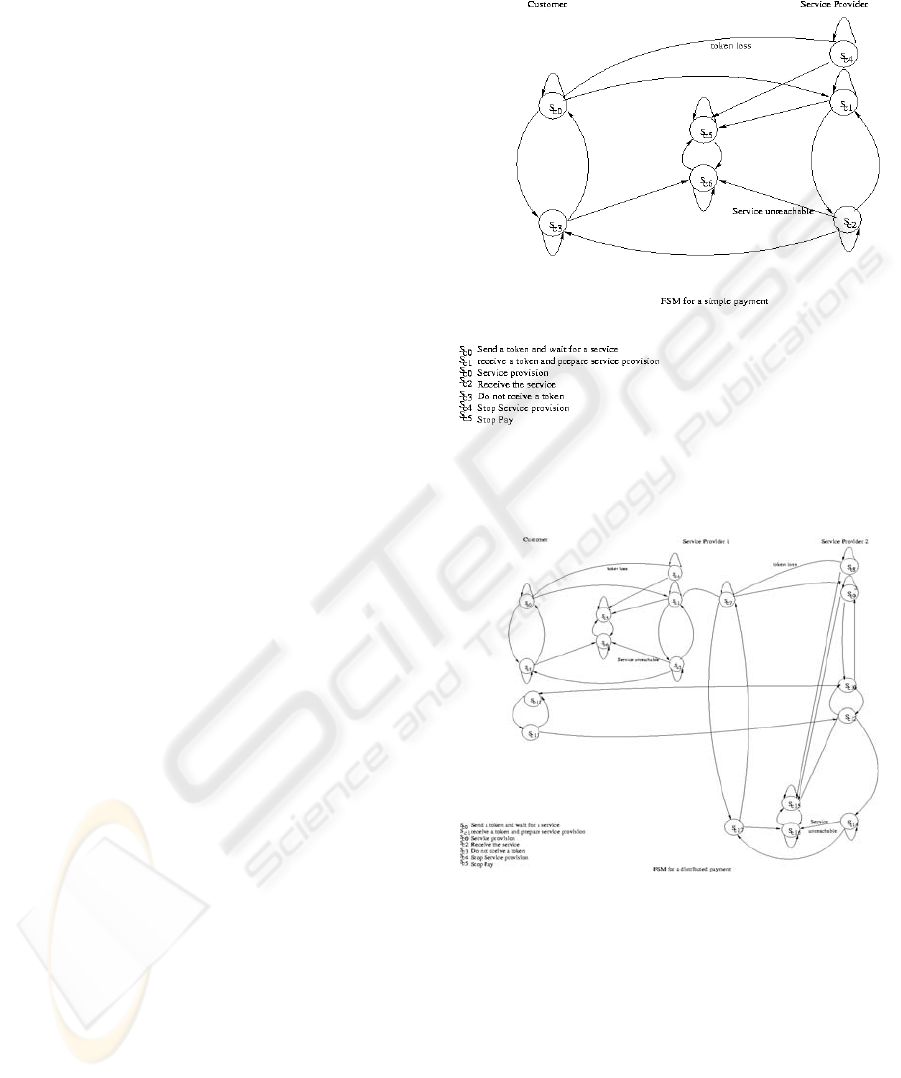

The FSM models presented in the appendix detail

the different transitions that the system executes

when applying our micropayment protocol in the

case of purchasable token and distributable token as

shown in Figures 5 and 6, respectively. The two

FSM models allow validating the correctness and

consistency of the protocol.

7 SECURITY PROVISION

In this section, we present the security measure of

the proposed scheme. In fact, we prove the how our

scheme is protected against the two main attacks that

threaten a payment systems, forging and double

spending.

7.1 Forging Prevention

This attack is defined when a non-authorized user

generates false tokens to be purchased from accounts

of other entities without obtaining their approval.

The proposed payment scheme prevents this attack

through the definition of security measures at

different levels. First, the protocol defines a

commitment signed by the broker which proves that

the user has a blocked amount for payment. Second,

it requires the establishment of a contract signed by

the payer and the payee. This contract induces that

the payer and the payee approve payment

transaction. Third, the protocol distinguishes

between two cases. The first one consists of the use

of non distributable tokens. In this case, the hash

micropayment tokens are not signed by the

customer. However, the use of one-way and

collision-resistant hash functions protects against the

generation of false tokens by other entities different

from the payer.

Thus, a receiver cannot compute the antecedent

of a hash value during the lifetime of a token. The

second case refers to distributable tokens. The

distribution process is accompanied by the signature

of the original and derived tokens. In addition, the

use of the authorization tokens allows verifying the

legitimacy of the distribution procedure and

authenticating the origin of the distribution

architecture.

7.2 Double-spending Prevention

The second attack consists of the illegal use of the

same token for different times and for different

purposes in the network. To prevent double-

spending, the protocol defines a serial number for

each blocked amount present in the bank. All the

delivered tokens should refer to the corresponding

amount. For micropayment, our scheme adds the

identifier of the hash branch from which the hash

values will be distributed through the different

tokens.

The second measure taken by the protocol is the

use of non-anonymous model. In fact, we can notice

that the different micropayment tokens include the

identifier of the payer, the payee, the amount and the

distribution function. The latter allows determining

in advance the number and the values of the

micropayment tokens at the level of the payee and at

the level of the bank during redemption.

Further, the definition of authorization token and

the two-layer verification for distributable tokens,

allows the follow-up of tokens spending by the

authorizing entity. Also, this procedure allows a

payee to verify that his payer has not exceeded the

authorized distributable amount and that he has not

use the same value for different purposes.

SECURE GRID-BASED MULTI-PARTY MICROPAYMENT SYSTEM IN 4G NETWORKS

147

8 CONCLUSION

In this paper, we have introduced the notion of

multi-party micropayment system and we propose a

micropayment scheme based on Grid application.

Our scheme takes into consideration the nature of

the distributed application and resource sharing. We

also define new mechanisms to allow a tight handle

of the payment means and a better management of

payment operations. In addition, the proposed

mechanism defines new security measures allowing

real-time verification of micropayment in a

distributed manner.

REFERENCES

X. Gu, K. Nahrstedt, and B. Yu, "SpiderNet: An integrated

peer to peer service composition framework", 13th

IEEE Int. Symp. on High-Performance Distributed

Computing (HPDC-13), Hawaii, USA., 2004

R. Buyya, D. Abramson, and S. Venugopal, “The Grid

Economy”. Special Issue on Grid Computing,

M. Parashar and C. Lee (Eds). IEEE Press, New

Jersey, USA, Mar 2005.

R. Buyya and S. Vazhkudai, “Compute power market:

Towards a market-oriented grid”, The 1

st

IEEE/ACM

Int. Symposium on Cluster Computing and the Grid

(CCGrid 2001), May 2001. Brisbane, Australia.

A. Barmouta and R. Buyya, GridBank, “A Grid

Accounting Services Architecture (GASA) for

Distributed Systems Sharing and Integration”.

Proceedings of Int. Parallel and Distributed Processing

Symp. (IPDPS'03). Nice, France, 2003

Yen, L. Ho and C. Huang, “Internet Micropayment Based

on Unbalanced One-way Binary Tree”, Proc.

CrypTEC 99, pp.155-62, July 1999, Hong Kong.

B. Crispo. “Delegation protocols for electronic

commerce”. In Proc. of the 6th IEEE Symp. on

Computers and Communications (ISCCS01). July

2001. Hammamet, Tunisia.

Ronald L. Rivest and Adi Shamir. “Payword and

micromint: Two simple micropayment schemes”.

CryptoBytes, vol 2(1), RSA Laboratories, 1996.

M. Manasse. “The millicent protocols for electronic

commerce”, In Proc. 1st USENIX Workshop on

Electronic Commerce, July 1995, New York, USA.

S. Micali and R.L. Rivest., “Micropayments revisited”. In

CT-RSA, pages 149-163, 2002

B. Yang and H. Garcia-Molina, “Ppay: micropayments for

peer-to-peer systems”. In Proc. of the 10th ACM

Conf. on Computer and communication security, pp.

300-310. ACM Press, 2003, Washington, USA.

J. Holzmann, J. Gerard, “An Improved Protocol

Reachability Analysis Technique”, Software Practice

& Experience, pp. 137-161, Feb. 1988, John Wiley &

Sons

M. S. Obaidat and N. Boudriga,” Security of e-Systems

and Computer Networks,” Cambridge University

Press, Cambridge, UK, 2007.

APPENDIX

Figure 5: FSM model for purchasable token.

Figure 6: FSM model for distributable token.

ICE-B 2007 - International Conference on e-Business

148