INHIBITING FACTORS FOR COMMUNICATION AND

INFORMATION TECHNOLOGIES USAGE

Five Colombian SMEs Study

Olga L. Giraldo V. and Eduardo Arévalo S.

Systems and Computing Engineering, Los Andes University, Calle 19 No 1-37 Este, Bogotá, Colombia

Keywords: Information and Communication Technology- ICT- inhibiting factors, ICT strategic use, small and medium-

sized enterprises –SME- in Colombia, SME competitiveness, ICT inhibiting factors in Colombian SMEs.

Abstract: Small-to-Medium sized enterprises, SMEs, are the main development engine of economy, particularly in

countries in development, as is the case in Colombia. SMEs must use information and communication

technologies, ICT, as strategic tools to find their place in the global market; nevertheless, this is not a

common situation for Colombian SME. In this work we present the results of a project that attempts to find

factors inhibiting five Colombian SMEs toward strategic usage of ICT. Through this study we have looked

at the structure and strategy of those enterprises, their value chains, ICT support to value chain activities -

how and where they exploit ICT-, managerial attitude toward technology, and appropriation of ICT into

business, looking for inhibiting factors. Results show that the most common inhibiting factors are: poor

organizational planning; inability to identify strategic use of ICT or no ICT leadership; no funding for ICT

projects; lack of ICT expertise and lack of proper ICT usage by final users; and lack of technical support.

Even though findings are not conclusive they show an existing trend, and highlight the main ICT inhibitor

factors-IF- to be surpassed to attain local sustainable industries.

1 INTRODUCTION

Currently Colombia is establishing free trade

agreements with its main commercial partners,

which is changing the local economic environment,

creating new threats and opportunities. Colombian

SMEs, Table 1, are not familiar with direct foreign

competition. A SME must find factors inhibiting

proper ICT utilization to build successful strategies.

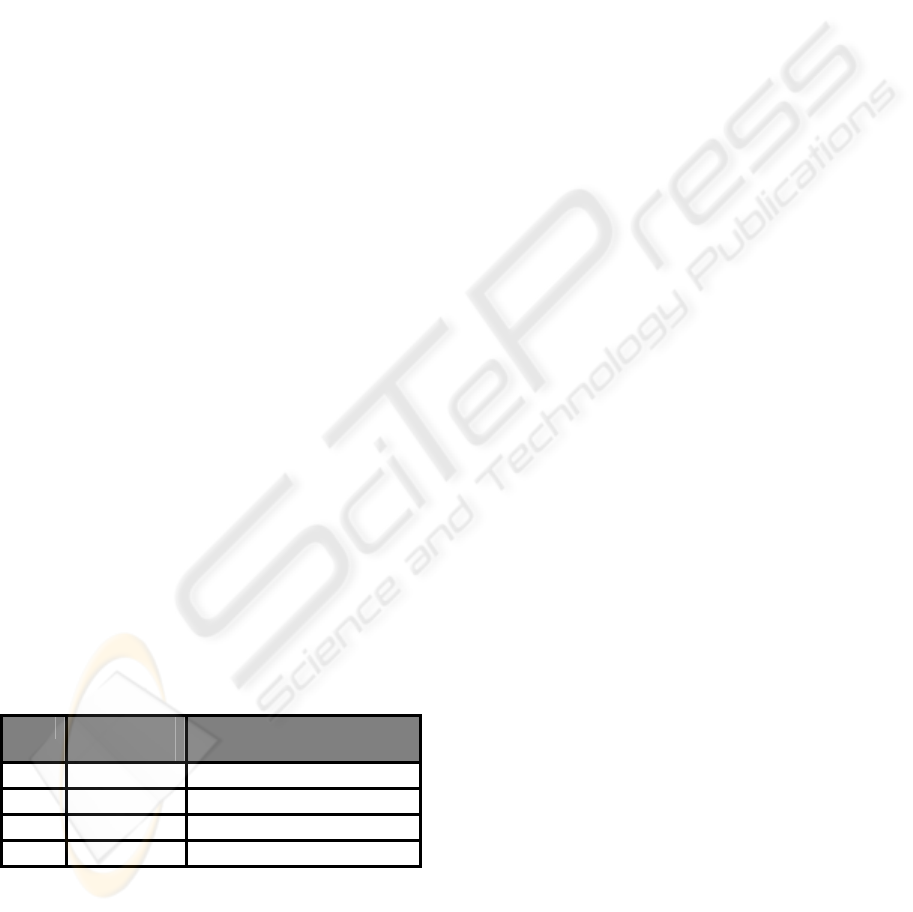

Table 1: Colombian enterprise classification.

Type Employees

number

Assets in minimum

present established wage

Micro 1-10 Lees than 501

Small 11-50 Between 501 and 5000

Mediu

m

51-200 Between 5001 and 3000

Big 201 or more

More than 3000

To achieve competitiveness in an open economy,

proper ICT usage is mandatory. Most SMEs are not

analyzing their business, neither strengths nor

weaknesses, to find sources of competitive

advantage to maintain present benefits and create

new ones. Instead they are trying to maintain

artificial barriers to protect their market.

Huang and Brown (1999) found that there has

not been much research of SME´s problems,

although there is an increasing interest in developed

countries (Majocchi and Zucchella 2003; Bell et al.

2004; Williams and Chaston 2004; Fukugawa 2005;

Gray and Mabey 2005; McKeiver and Gadenne

2005). Research in Latin American SME behavior

cover topics as financial, human resources, culture,

regulation, and ICT condition (Berry 2002;

Finquelievich 2003; Zevallos 2003; FUNDES 2004),

but none specialize in ICT use. Hunter (2004)

suggests as an interesting research subject the

application of information systems in SMEs

particularly for countries in development. Kyobe

(2004) found as main IF of IT usage in South

African SMEs: lack of top management vision;

failure to keep up with new technologies, lack of

computer expertise and usage; lack of economic

scale in IT use; lack of technical support; and, poor

planning and inability to identify strategic use of IT.

We begin this paper describing the present

situation of Colombian SMEs emphasizing their

main problems. Afterwards, section 3 and 4, present

111

L. Giraldo V. O. and Arévalo S. E. (2007).

INHIBITING FACTORS FOR COMMUNICATION AND INFORMATION TECHNOLOGIES USAGE - Five Colombian SMEs Study.

In Proceedings of the Ninth International Conference on Enterprise Information Systems - HCI, pages 111-116

DOI: 10.5220/0002360201110116

Copyright

c

SciTePress

the methodology we use and a vision of each

company studied. Section 5 analyzes, for each

company, factors causing proper or improper ICT

use. Finally, section 6, exposes our conclusions and

future works.

2 COLOMBIAN SME BUSINESS

ENVIRONMENT

After a long period of economic crisis, Colombian

SMEs have once again flourished. They are

significant employment generators and efficient

redistributors of wealth.

2.1 SME Significance in Colombia

Semana (26 May 2003, pp. 73-74) points out that in

2002, Colombian micro enterprises and SMEs

comprise 96% of local industry, generate about 40%

of gross product, 34% of added value, 60% of

industrial employment, and 25% of non traditional

exports. According to the Administrative National

Department of Statistics, DANE, Encuesta Anual de

Manufactura (annual manufacturing survey), 75% of

manufacture establishments are SMEs, which

generate about 34% of the gross product, 45% of

employment and 28% of added value. On the other

hand, Rodríguez (2003) shows that in 2001 out of all

the Colombian SMEs 37% were services companies,

34% were retailers, 22% were industrial, and 6%

were agro industries; 87% had 6 years or more since

their creation; during 2002 and 2003, 60% of them

decreased their annual utilities; 50% of management

have been working in the same business for more

than 15 years; 72% of them have undergraduate

studies, 16% postgraduate; and 66% of managers are

aged between 25 and 45 years.

2.2 Main Problems of Colombian SME

The main problems found by Rodríguez (2003) for

Colombian SME are: economic and public order

instability; low access to financial markets; legal

issues; difficult access to marketplaces; no

governmental support; low human resource quality;

bad transport infrastructure and public services;

gremial and SME incompatible interests; and

difficult access to technology. Rodríguez (2003) also

discovered as main issues delaying SME access to

technology: high costs; low public or private

funding; no capacity or high cost for customization;

low access to ICT products and information

services; and high costs of external consulting

services. However, 66% of SME have invested in

technology in the last two years: 30% on IT; 28% in

business equipment; 12% in product improvement;

and 10% in management decision support systems.

Managers claim that the main benefits of these

investments are: time savings, quality product

improvement, and cost reduction.

BDI- ACOPI- DNP (1997) shows that the main

problems are: lack of knowledge about ICT potential

advantages; negative attitude of managers towards

new technologies; and, lack of economic scale to

invest in research, appropriation or transfer ICT.

3 METHODOLOGY

In order to assess what factors inhibit the

appropriation and use of adequate ICT in SMEs we

researched five enterprises. The study was divided in

four stages: theoretical investigation; selection,

analysis and diagnosis of individual SMEs; search

for IF, if any; and development of a strategic

proposal for ICT appropriation at individual

enterprises.

During the first stage we identified previous

studies (Huang and Brown 1999; Berry 2002;

Finquelievich 2003; Kyobe 2004; Gray and Mabey

2005; Fukugawa 2005) to discover frequent IF of

ICT usage in SMEs. To understand SME current

situation, we want to identify organizational

structure; internal drivers and strategy- mission,

vision, values; value chain- VC-, products and

services; distribution channels; and ICT

infrastructure, architecture and applications.

The second stage began with choosing

enterprises to be studied. We decided not to

concentrate in a specific industry, neither a typical

size, nor a particular composition; companies were

randomly selected: different sectors, sizes and

characteristics, but all of them have in common an

interest in this research. We took this decision to

avoid having a bias on our first approach. The only

pertinent attribute was that they were SME. Later we

found other common features: they are less than 12

years old, have no export profiles and low export

potential, and are family owned companies. Their

sectors are: Services S-, Commercialization C, and

Manufacture M.

The main data collection methods were: review

of company internal documentation particularly the

web site if available, in site observation, and

personal interviews with management and

employees. We identified strategy, structure and

VC: strategy was inferred from declared objectives

ICEIS 2007 - International Conference on Enterprise Information Systems

112

matched with business units’ tactics; structure was

built based on corporate resource distribution,

decision making processes, and information flow

and relationships; VC was depicted by us when they

did not have one. ICT data was used to identify how

it supports VC activities (Porter 1998) and its level

of appropriation in business according to (Andreu et

al. 1996; Laudon and Laudon 2004; Kyobe 2004).

As a result we had an “instant photo”, a mirror

image, of each company. No reflection or

suggestions were made at this point; management

approval was required to begin the diagnosis.

Table 2: SMEs studied.

Specific Industry

Direct

employees

C1

Automotive, aeronautical

and industrial paints

15

S1 Civil engineering consulting 20

S2

Public services consumption

measurement

66

M1

Construction material

supplier

75

M2

Retailer communication’s

software & hardware

11

Meanwhile we moved to the next stage, seeking

recurring IF using organizational visions to obtain

manager attitude toward ICT strategic usage and IF.

Finally, after manager’s feedback, we designed

an ICT adoption proposal for each company to

aggregate value to participating SMEs; results are

outside of the scope of this paper.

4 CASE STUDIES: FIVE SME

DEPICTED

This section describes the five companies we

studied, emphasizing on ICT support to VC

activities, to find ICT utilization inhibitors factors.

4.1 C1: Automotive, Aeronautical and

Industrial Paint Retailer

C1 is a family owned company that provides paints

for automotive, aeronautical and industrial sectors,

and technical advisory services about their use. C1

wants to be the distribution leader for its main

provider.

Its main focus is customer satisfaction

maintaining acceptable profits for shareholders and

employees. The company builds their external

reputation with honesty, loyalty, and respect to

stakeholders and clients. Its strategy is continuously

improving customer painting processes through

direction and consulting: advice on better utilization

to improve final paint quality and training staff; this

service is supported by software developed in-house,

Syscolor and Sphera. They have no distribution

channels other than a direct sales force. The VC,

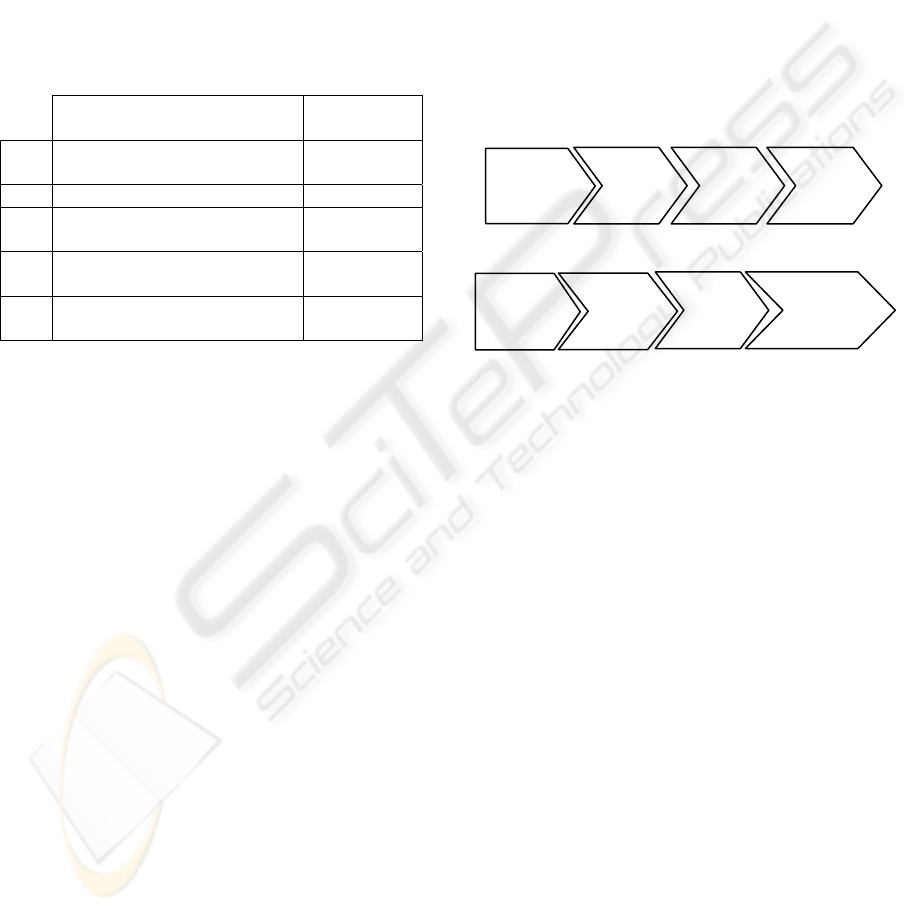

figure 1, shows that the main value creating

activities are those related to Syscolor and Sphera:

starting with software installation at customer

location to gather data about paint utilization;

afterwards, performing periodical data collection

and analysis to generate knowledge about costumer

painting practices; and finally, giving advice and

training to achieve enhanced paint usage.

Figure 1: C1 Value Chain.

Internal IT infrastructure and information

systems are small enough to support primary

activities of its VC; financial and human resource

processes are outsourced. Inbound logistic,

production, and outbound logistic, are partially

outsourced but are well supported according to

management. Post sales are very well supported by

Syscolor. The software was developed by the

manager’s son and associate. He has fundamental

skills in software development and deep business

knowledge. Four years ago, when the company was

running out of business, he entered the company; at

this time they decided to provide a new service to

their customers as a strategy to gain preference.

Syscolor gathers data from salespeople visits; the

system is not connected to the Internet. Nowadays

they are planning an upgrade to improve service.

4.2 S1: Civil Engineering Consulting

Created in 1993, S1 offers consulting services in

engineering development of public or private

infrastructure. Its main values are generating

positive social impact and benefits for the

community, and customer satisfaction. Their 5-year

Order

process

Product

deliver

Sphera

analysis

Primar

y

p

rocesses

Cus

t

omer

order

re

q

ues

t

Syscolor

data

g

atherin

g

Syscolor

consulting

& trainin

g

Post sale

p

rocesses

Syscolor

installation

Syscolor

data

anal

y

sis

INHIBITING FACTORS FOR COMMUNICATION AND INFORMATION TECHNOLOGIES USAGE - Five

Colombian SMEs Study

113

vision is to be recognized due to the benefits

delivered to communities.

S1 offers consulting for infrastructure design,

and construction project execution and control. The

company strategy is to create customer satisfaction

based on best practices; frequently benchmarking is

done, but, paradoxically, performance measurement

criteria are not clearly defined. They do emphasize

in effective use of technological consulting tools. By

2003, S1 obtained the System & Services

Certification, SGS, quality certification on all of

their services.

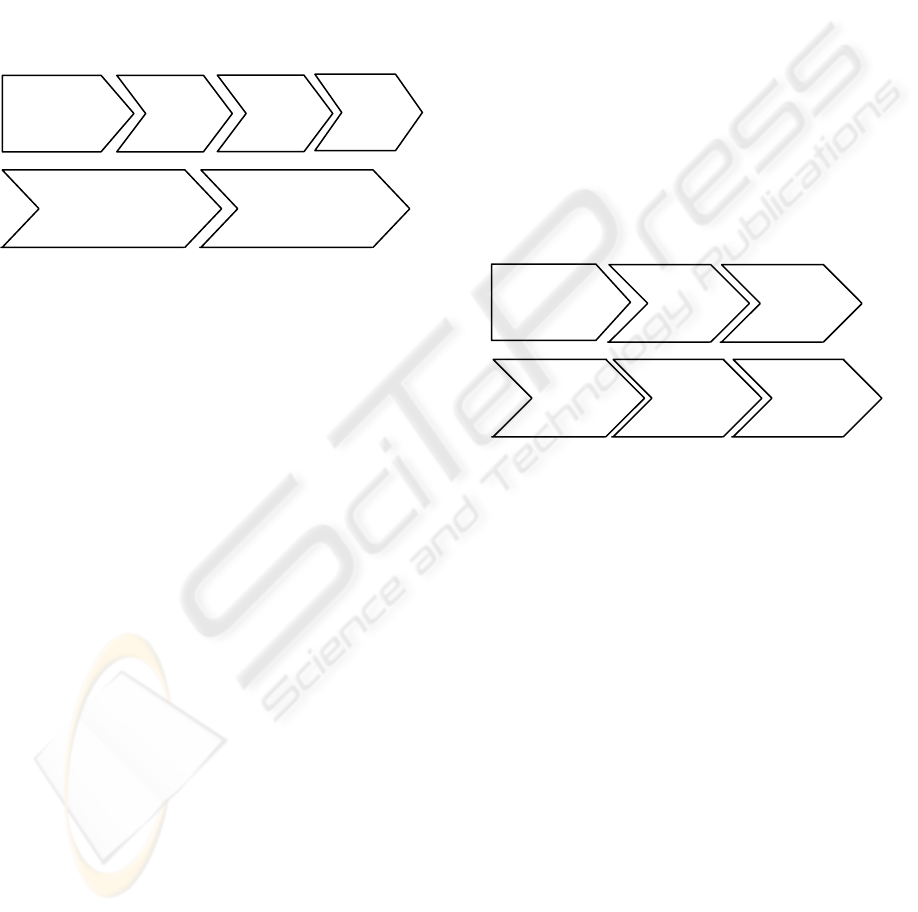

Figure 2: S1 Value Chain.

Project quality is sensible to technical skills of

the team, and methodology and tools used. ICT

supporting primary activities, figure 2, focuses on

team selection and project execution; elicitation and

financial control activities are not supported.

The company’s financial and inventory activities

are supported by HELISA, a local ERP; desktop

applications support project documentation;

Microsoft Project is used for project management;

and specialized applications are used for technical

activities during project execution.

4.3 S2: Measurement of Public Service

Consumption

S2’s services are consumption measurement and

courier delivery for public service companies. We

elaborated its organizational chart and VC; the VC is

not yet approved by management, so is not presented

here. At present time, its main client is Gas Natural,

the biggest natural gas local distributor.

Its strategic objective for 2010 is to have 5% of

the Colombian market offering high quality services

and specialized human skills. Currently they do not

have information about market share; neither do they

have clear criteria about selection of commercial

goals. Management is aware of their lack of a

strategy, and is searching for an external consultant

to develop a marketing plan.

Financial data processing is done using HELISA.

Consumption measurement of Gas Natural uses

SAL, a proprietary software; data is entered in

mobile terminals, and then transferred to the

customer’s database; client measurement reports and

billing source are done using Microsoft Excel.

4.4 M1: Construction Materials

Supplier

M1, a family owned company, produces and

commercializes construction materials. Its mission is

to become the first option in ceramic glues in the

local market. Its strategy is centered on innovation,

based on market trends, knowledge and technology.

It has two business units: ceramic glues and indoor

paints. Its commercial objective for 2010 is to reach

30000 gallons of paint and 30000 tons of ceramic

glues sales per year. Their main distribution

channels are a proprietary sales force, alliances with

strategic business partners and arrangements with

corporate clients.

Figure 3: M1 Value Chain.

M1´s primary activities, Figure 3, start with sales

and commercialization. Production and purchase

plans use historical sales data, monthly sales

forecasts and product stock data. The main value

creating activity is post-sale customized attention.

Internal IT infrastructure and architecture is

small, but supports several primary value chain

activities. Financial processes are supported by

SIIGO, another local ERP. The acquisition of SIIGO

had as main purpose organizing financial processes;

the production and sales modules were not

appropriately parameterized. Nowadays, M1 is not

effectively exploiting the ERP’s capabilities because

they do not have technical support or help desk for

SIIGO.

4.5 M2: Retailer of Software &

Hardware for Communication

M2, also a family owned company, develops and

commercializes software and hardware for retailer

telecommunication activities. M2’s objective is to be

the market leader in telecommunication solutions

Primar

y

p

rocesses

Public/private

elicitation search

Elicitation

response

Contract

sign

Team

selection

Project management,

execution and control

Project delivery and

postmortem

Primar

y

p

rocesses

Sales &

Commercializat

ion

Production

planning

Production

Purchase

planning

Distribution

& delivery

Pos

t

sale

service

ICEIS 2007 - International Conference on Enterprise Information Systems

114

but does not have an explicit business strategy or

business plan. Through observation we defined its

strategy as “Product innovation to seize market

opportunities at competitive prices”. Customer

satisfaction and quality are not internal drivers.

Their products are: SETTI, a billing system for

communication rooms and Internet cafes; SETTI

Upgrade, that fixes some of the product’s bugs; and

SIFRA, a back office Internet based system to

control geographically distributed communication

rooms and Internet cafes. Its distribution channels

are a proprietary sales force and external commercial

agents; recently M2 opened commercially

autonomous operations in Peru and Ecuador, but

they do not have a clear strategy for expansion.

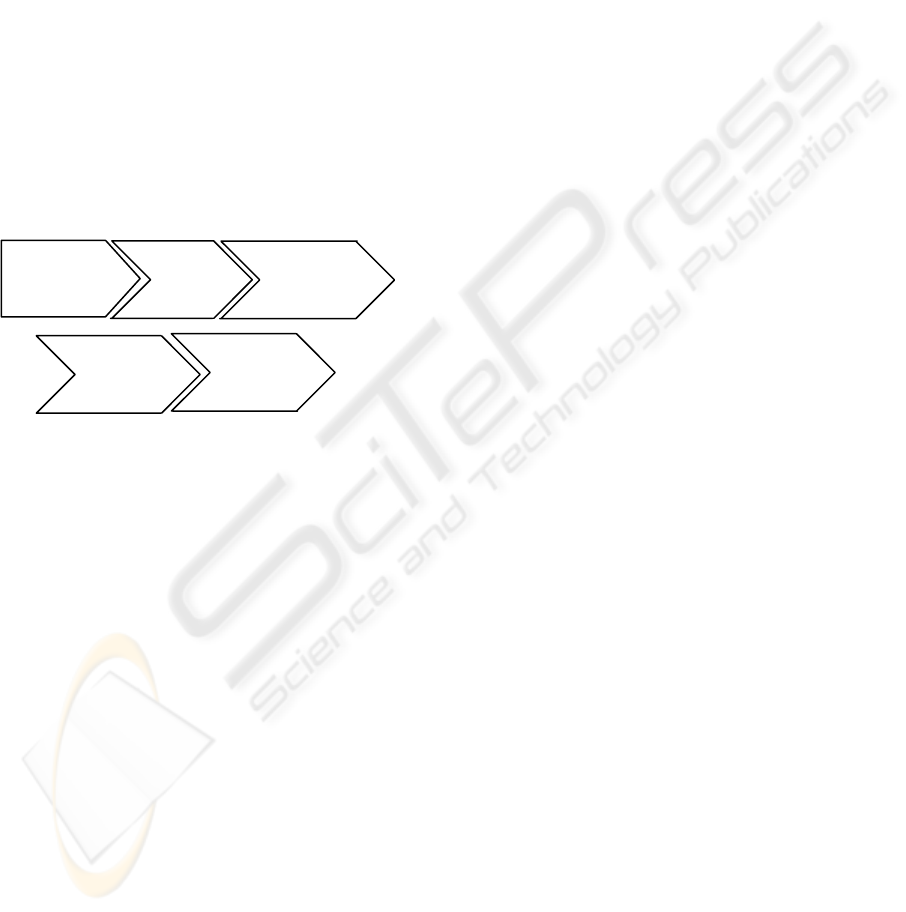

Technology development, figure 4, is the value

chain’s main process. No standards are used for

product design and development, thus bugs are

frequently found by customers during use.

Figure 4: M2 TDP Value Chain

ICT applications are: HELISA to support

financial process; SAS, an in-house developed tool,

to manage customer requests; and SAE, currently

under development, to improve internal process, but,

on the one hand, users do not input required data

and, on the other hand, development is continuously

interrupted.

5 FACTORS AFFECTING

PROPER ICT USE

All the companies we analyzed, except C1, use ICT

to sustain VC support activities, not to be

competitive.

C1’s main catalyst factor is the manager’s ability

to identify strategic use of ICT. When business was

decreasing, they created a software product and a

training service for clients. Nowadays, big industrial

consumers choose C1 due to these services. The

manager declares that funding ICT projects is not a

problem because they have skills to develop them or

to negotiate service and fair prices with providers.

Presently, they are elaborating corporate plans

oriented to new ICT based business services.

S1, the civil engineering consulting company has

as explicit strategy benchmarking, not innovation;

they imitate the best qualified consulting companies

in the market. Its manager is always busy searching

for new projects and controlling those in execution,

thus has no time for strategic activities. There is no

ICT leadership, neither are there resources,

particularly monetary, for ICT projects. Skilled

professionals are hired for specific projects;

knowledge and expertise on ICT, when acquired, is

lost. Organizational planning, if any, is reactive and

not shared. S1 is not aware of the value of

knowledge appropriation, and thus, this is not a

regular activity.

S2 has been unable to identify a strategic use of

ICT for business activities. Although research in

mobile applications is an important trend, S2 is

currently not investing in it. Its competitors are

offering fraud management and public service

reconnection services, but they do not. During our

work, S2’s management team realized that they do

not have an organizational plan; now they are

searching for professional advice. Their operative

employees have enough expertise for a proper

tactical use of ICT; nevertheless they do not have

technical support to improve their performance.

M1’s manager says he has a short term plan, but

he does not share it, and frequently changes it; his

main priority is to find new products; he has no time

to identify strategic use of ICT, and does not care.

ICT employees always work to achieve the

manager’s changing plan; not to satisfy business

activities, to take advantage of ICT, or to be ICT

leaders.

M2, a software and hardware retailer company,

paradoxically, does not have proper ICT support.

They are able to identify strategic use of ICT, fund

ICT projects, have ICT expertise and technical

support, but are unable to use it for themselves. Its

main IF is poor organizational planning. The R&D

division is not aligned with its internal plan and

management does not care; they are looking for

opportunities.

6 CONCLUSIONS AND FUTURES

WORK

The very first obstacle for ICT strategic usage, we

discovered, is that companies frequently do not have

an ICT strategy, or have a vague definition of an

Technolo

gy

develo

p

ment

p

rocess -TDP:

Client needs &

market trends

analysis

Produc

t

design

Product

development

Distribution

& delivery

Sup

p

ort &

maintenance

INHIBITING FACTORS FOR COMMUNICATION AND INFORMATION TECHNOLOGIES USAGE - Five

Colombian SMEs Study

115

ICT strategy, or it is not written nor shared with

employees.

A recurring inhibitor factor is the inability, of

both management and technological staff, to identify

strategic use of ICT and lack of ICT leadership.

Another negative factor is that there is no

funding for ICT projects, frequently because of: lack

of economies of scale for ICT use; difficulties to

access financial markets; and short vision about ICT

benefits and strategic impact.

One more recurring factor is the lack of ICT

expertise in staff and users, making hard the

appropriation and transfer of new ICT services. The

roots of this inhibitor factor, we believe, are low

wages and no investment in staff training.

The lack of technical support, internal or external

staff based, was another recurrent factor.

But the most important IF we found is poor or no

organizational planning, no sharing of organizational

plans, or short term or reactive planning. Within this

frame any effort or investment on ICT is lost.

Future works include extending this work for a

larger sample, and proposing guidelines for ICT

selection, implementation and use in strategic

activities, support and new business creation.

ACKNOWLEDGEMENTS

We would like to thank Eduardo Frías, Diana

Angélica Forero, Diego Sánchez, and Diana Velasco

for their participation in this study; Martha Inés

Cifuentes and Andrea Herrera for their support and

advice; and Nicolás López for his aid reviewing the

paper.

REFERENCES

Andreu, R, Ricart, JE, & Valor, P 1996, Estrategia y

Sistemas de información, 2nd edn, McGraw-Hill,

Barcelona.

Bell, J, Crick, D, & Young, S 2004, ‘Small Firm

Internationalization and Business Strategy: An

Exploratory Study of ‘Knowledge-Intensive’ and

‘Traditional’ Manufacturing Firms in the UK’,

International Small Business Journal, vol. 22, no. 1,

pp. 23-56.

Berry, A 2002, ‘The Role of SME Sector in Latin America

and Similar Developing Countries’, Seton Hall

Journal of Diplomacy and International Relations,

vol. 3, no. 1, pp. 104-119.

BID- Banco Interamericano de Desarrollo, ACOPI -,

Asociación Colombiana para la Pequeña y Mediana

Empresa & DNP- Departamento Nacional de

Planeación 1997, Políticas: Desarrollo de la PyME en

Colombia, BID, Bogotá, pp. 14-42.

DANE, Encuesta Anual de Manufactura, Bogotá, viewed

5

th

October, 2006,

http://www.dane.gov.co/index.php?option=com_conte

nt&task=section&id=17&Itemid=40

Finquelievich, S 2003, ‘ICT and economic development

in Latin America and the Caribbean’, in World Summit

of Cities and Local Authorities on the Information

Society, 4-5 December 2003, Lyon.

Fukugawa, N, 2005 ‘Characteristics of Knowledge

Interactions between Universities and Small Firms in

Japan’, International Small Business Journal, vol. 23,

no. 4, pp. 379–401.

FUNDES 2004, Entorno empresarial. Indicadores del

entorno de la pequeña y mediana empresa de PyME

en los países Fundes, viewed 8

th

Mars 2004,

http://colombia2.fundes.org/.

Gray, C & Mabey, C 2005, ’Management Development:

Key Differences between Small and Large Businesses

in Europe’, International Small Business Journal, vol.

23, no. 5, pp. 467–485.

Huang, Z & Brown, A 1999, ‘An Analysis and

Classification of Problems in Small Business’,

International Small Business Journal, vol. 18, no. 1,

pp. 73-85.

Hunter, G 2004, ‘Information Systems & Small Business:

Research Issues’, Journal of Global Information

Management, vol. 12, no. 4, Editorial Preface, pp i-v.

Kyobe, ME 2004, ‘Investigating the Strategic Utilization

of IT Resources in the Small and Medium-Sized Firms

of the Eastern Free State Province’, International

Small Business Journal, vol. 22, no. 2, pp. 131-158.

Laudon, KC & Laudon, JP 2004, Management

Information Systems. Managing the Digital Firm, 8th

edition, Prentice Hall, New Jersey.

Majocchi, A & Zucchella, A 2003, ‘Internationalization

and Performance: Findings from a Set of Italian

SMEs’, International Small Business Journal, vol. 21,

no. 3, pp. 249–268.

McKeiver, C & Gadenne, D 2005, ‘Environmental

Management Systems in Small and Medium

Businesses’, International Small Business Journal,

vol. 23, no. 5, pp. 513–537.

Porter, ME 1998, On Competition, Harvard Business

Review Book, Boston.

Rodríguez, AG 2003, La Realidad de la Pyme

Colombiana, Desafío para el Desarrollo, Fundes

Internacional, Colombia.

Semana 2003, ‘PyMe, tiempo de crecer’, Revista Semana,

May 26

th

, ed. 1099, pp 72-84.

Williams, J & Chaston, I 2004, ‘Links between the

Linguistic Ability and International Experience of

Export Managers and their Export Marketing

Intelligence Behaviour’, International Small Business

Journal, vol. 22, no. 5, pp. 463-486.

Zevallos, E 2003, ‘Micro, pequeñas y medianas empresas

en América Latina’, Revista de la Cepal, no. 79, pp.

53-70.

ICEIS 2007 - International Conference on Enterprise Information Systems

116