TOWARDS COOPERATION AMONG COMPETITIVE TRADER

AGENTS

Paulo André Lima de Castro

1,2

and Jaime Simão Sichman

2

1

Technological Institute of Aeronautics, São José dos Campos, São Paulo, Brazil

2

Intelligent Techniques Laboratory, University of São Paulo, São Paulo, Brazil

Keywords:

Multiagent systems, automated trading, multiagent architecture.

Abstract:

In order to manage their portfolios in stock markets, i.e., to determine buy and sell signals, human traders use a

set of algorithms created by economists, which are based on stock prices series. These algorithms are usually

referred as technical analysis. However, traders prefer to use a combination of several algorithms as indica-

tors, rather than choosing a single one. The several signals provided are used to determine the trader order to

buy or sell some stocks, or even to decide to not submit any order. In the last years, some researchers have

tried to create new algorithms with learning skills in order to produce autonomous automatic traders, some of

them using AI techniques. Inspired by the human traders´ decision processes, our architectural approach com-

poses heterogeneous autonomous trader agents in a competitive multiagent system. This architecture allows

the use of several algorithms, based on different technical analysis indexes to manage portfolios. We have

implemented this architecture and we have performed a set of simulation experiments using real-data from

NASDAQ stock market. The experimental results were compared to the performance of single agents playing

alone, and a better global performance was observed when traders compete with each other for resources.

These preliminary results indicate that competition among agents, as proposed here, may reach very good

results, even among agents created to act alone in this kind of market.

1 INTRODUCTION

In this paper, we propose an architecture based on

autonomous agents to model the behavior of au-

tonomous stock trading. The architecture uses sev-

eral trader agents, each one with its own indepen-

dent strategy. These agents are permanently assessed

and resources may be transferred to agents with better

performance. This approach allows adaptation in the

agent society behavior, because agents with more al-

located resources have a greater influence on the over-

all system performance.

2 RELATED WORK

Stock prices prediction or autonomous stock trading

management is a common problem and there is a lot

of work in the literature about it. This work may be

basically divided in two big groups: using a single

autonomous agent, which may be based on many ap-

proaches like neural networks, reinforcement learn-

ing, fuzzy sets, bayes networks, etc or using a mul-

tiagent system, where specialized agents perform the

multiple tasks that compose the decision process in

stock trading.

In the first group, agents usually trade with a spe-

cific stock and use a simple decision process (Sher-

stov and Stone, 2004) (Kearns and Ortiz, 2003).

Agents strategies are based on well known tech-

niques from the financial market, like MACD (Ap-

pel, 2005) or use some AI techniques, as reinforce-

ment learning (Sherstov and Stone, 2004; Yu and

Stone, 2000). Some interesting work of this class are

performed within PLAT (Penn-Lehman Automated

Trading) project(Kearns and Ortiz, 2003) (Subrama-

nian et al., 2006), which consists of an investigation

of algorithms and strategies for automated trading in

financial markets. This project uses an exchange sys-

tem simulator called PXS that delivers real data from

Nasdaq exchange at real time to trader agents.

138

André Lima de Castro P. and Simão Sichman J. (2007).

TOWARDS COOPERATION AMONG COMPETITIVE TRADER AGENTS.

In Proceedings of the Ninth International Conference on Enterprise Information Systems - SAIC, pages 138-143

DOI: 10.5220/0002388101380143

Copyright

c

SciTePress

It is important to note that managing many stocks

with one agent for each stock, without either infor-

mation exchange among agents or a global vision is

not considered as a good idea: domain experts point

out that using the natural complementarity among

stocks is a good way to reduce risks and achieve more

predictable results. In other words, the cooperation

among (specific) traders is really important and com-

mon for humans traders. In the second group (mul-

tiagent systems), most of the work (that we know)

in multiagent systems for automated trading (Decker

et al., 1997) (Yuan Luo and Davis, 2002) use prede-

termined roles for each agent in the system. These

roles are based on specialized tasks, such as techni-

cal analysis, decision making, fundamental analysis,

communication, etc. In this approach, the adaptation

in buying/selling strategy becomes harder and possi-

bly slow down the decision making process, because

all (or almost) agents are involved in each decision.

Our approach differs from the first group because

it is based on multiagent systems and differs from the

second group, because it uses a set of trader agents

that (in contrast to the first group) are able to redis-

tribute money and stocks among themselves in order

to achieve better global performance. This approach

is built over a flexible architecture that can use inde-

pendent work based on autonomous agents and incor-

porate them in a competitive multiagent society, with-

out serious changes in the deliberation mechanism of

such agents.

The rest of the paper is organized as follows. In

section 3, we briefly describe important indexes used

in stock market. We present our architecture in sec-

tion 4. We show some simulation results in section 5.

Finally in section 6, we present our conclusions and

suggestions for future work.

3 STOCK MARKET ANALYSIS

TECHNIQUES

In this section, we present some different technical

analysis techniques that are used by human operators

when deciding about actions in stock markets. These

techniques, briefly outlined here, will be used by the

agents of our architecture, described in section 4.

• Relative Strength Index (RSI): it was created in

1978 by J. Welles Wilder and became the most

known and popular oscillator used by stock mar-

ket. The RSI is calculated using the positive and

negative variations of price.

• Stochastic Index: It is based on the hypothesis

that one stock is in high trend, when its biggest

prices are observed in the end of an observation

period. Similarly, the stock is in down trend, when

its smallest prices happen in the end of the period.

• Moving Average (MA): It tries to identify trends

in stock prices. The average is defined by an ob-

servation period, usually defined between 14 and

60 days, and a calculation method that can be

simple average (sum of all prices and divide it

by the number of values) or exponential average

to give more relevance to newer quotation rather

than older quotations. The moving average is in-

terpreted using graphics with lines of moving av-

erage and prices. The moving average line is a

resistance for high trends and down trends. When

prices are in high trend (or down trend) and quo-

tations line crosses the moving average line, it

means a warning to trend reversal.

• Moving Average Convergence/Divergence

(MACD): It is a trend following momentum

indicator that shows the relationship between

two moving averages of prices. The MACD is

calculated by the difference between a 26-day

and 12-day exponential moving average. A 9-day

exponential moving average of the MACD, called

the "signal" line is plotted on top of the MACD to

show buy/sell signals (Appel, 2005).

• Price Oscillator: It is similar to the MACD, but

the Price Oscillator can use any two user-specified

moving averages. (The MACD always uses 12

and 26-day moving averages, and always ex-

presses the difference in points). It is calculated

by the difference between the moving averages

divided by the shorter-term moving average and

present usually as a percentage. There is a buy

signal when the Price Oscillator rose above zero

and sell signal when the indicator fell below zero.

4 ARCHITECTURE PROPOSAL

In the following subsections, we will briefly describe

the general architectural guidelines, and the three

kinds of agents that compose the proposed architec-

ture: trader, coach and conflict solver agents. Fi-

nally, A short explanation about two assistance ser-

vices used by agent society are presented.

4.1 General Guidelines

The main guidelines observed in the proposed archi-

tecture are the following: (i) adaptability: the archi-

tecture must allow high adaptability, (ii) simple trader

agents: the traders must be as simple as possible to

TOWARDS COOPERATION AMONG COMPETITIVE TRADER AGENTS

139

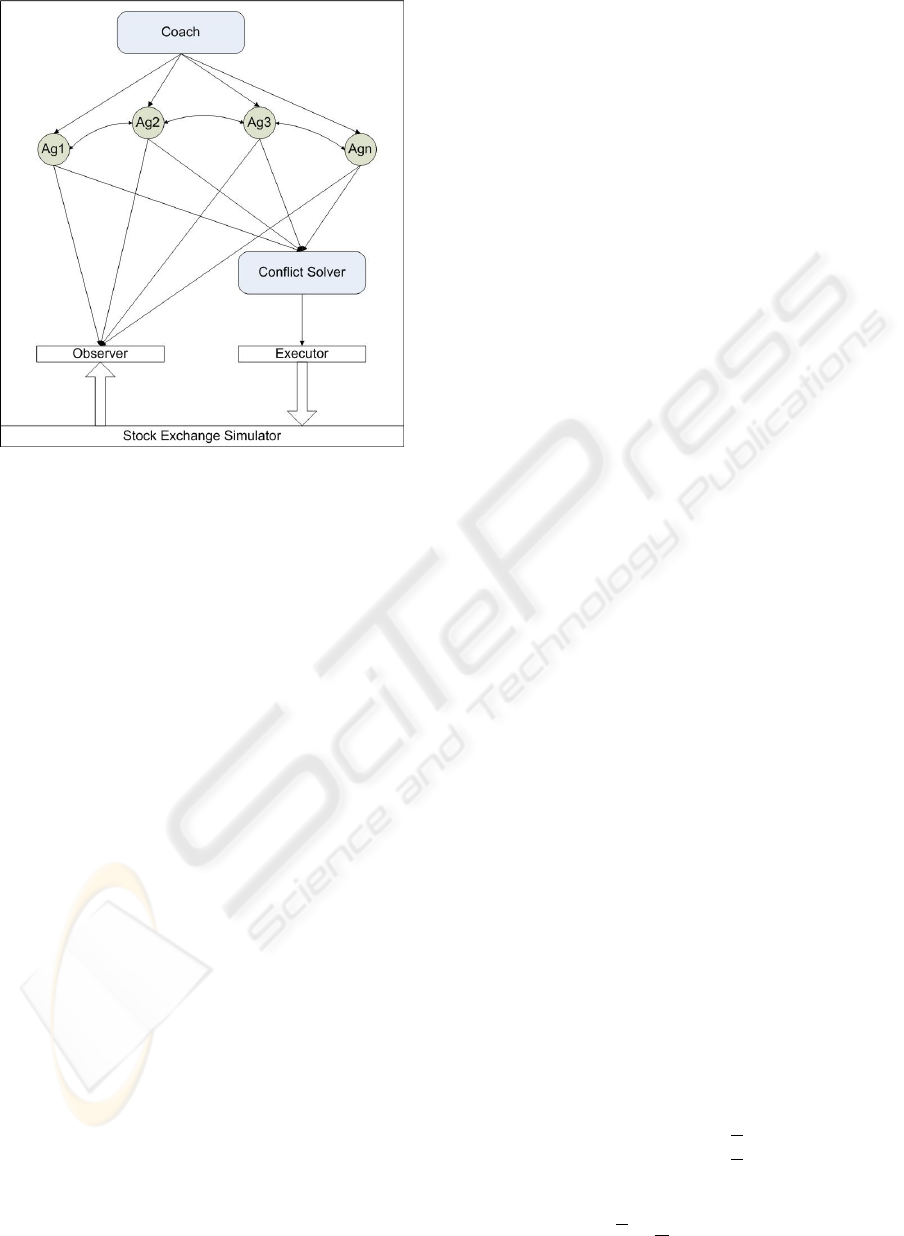

Figure 1: Architecture for Multiagent Stock Trading. Cir-

cles represent trader agents. The coach and conflict solver

agents are represented by gray rectangles and white rectan-

gles represent the assistance services.

facilitate their replacement and the incorporation of

third part agents, (iii)autonomy: system must be able

to trade without human intervention and (iv)dynamic

society: at any moment it is possible to reallocate re-

sources among agents in order to adapt society).

4.2 Kinds of Agents

The architecture is composed by a society of three

kinds of agents: coach, trader and conflict solver

agents, as shown in figure 1. The agents use two assis-

tance services: one to transfer order to the exchange

system, called executor and another, called observer,

to monitor market quotations. We opted to implement

these features as independent services to facilitate the

migration to others systems, for example, others ex-

change systems simulators or even a real exchange

system. We describe these three kinds of agents next.

4.3 Trader Agent

Trader agents are able to define buy and/or sell orders

for an specific stock. Their goals are to obtain the best

possible return and lower risks. Their decisions will

be evaluated by the coach, who compares the return of

each trader through its average revenue and its risks

through standard deviation of trader portfolio value.

Each trader agent works with some shares of one spe-

cific stock and some amount of money which are de-

fined in beginning of operation. These amounts are

changed by buy/sell operation and by reallocation per-

formed by coach agent. Moreover, each trader agents

adopts a particular strategy to decide when to buy or

sell their stocks, as described in section 3.

In this architecture, the society is composed by

an arbitrary number of trader agents and this number

may be changed along the operation. For instance,

new trader agents may be included in society at any

time and the coach may transfer all the resources from

one trader to the others, what would be equivalent to

exclude the former from society. Despite each trader

is able to deal with just one stock, the system is able

to deal with several stocks and to explore comple-

mentarity among stocks, due to the work of several

trader agents and coach reallocations. The portfolio

managed by the system is equivalent to the union of

all stocks and money managed by each trader agent.

The system result is a function of all traders results

weighted by its resource allocation, therefore the re-

allocations performed by coach agent may change the

system result.

4.4 Coach Agent

The goal of coach agent is to evaluate each trader

agent and to allocate more resources to the best

traders in order to improve system performance.

These two processes are described next.

4.4.1 Evaluation

Evaluation of a stock trader performance is a common

problem in financial analysis, which is naturally dealt

with by evaluating the performance of human traders.

Hence, there is no reason to create new ways of evalu-

ation for software agents that trade stocks. Therefore,

we decided to use well known methods of evaluation

from financial analysis. Among several ways found

in the field, one of the most used is the Sharpe in-

dex (Sharpe, 1994). Such indicator is a measure of

performance adjusted to the risk and takes in account

the average return and volatility associated to portfo-

lio. The Sharpe index uses as reference the return of

an asset free of risk. For simplicity, we will consider

that this return is zero. For each trader A

i

there is a R

i

,

that represents its return in a defined period. There-

fore, we may calculate Sharpe index for an period of

time from 1 to N as presented in equation 1:

SharpeIndex =

R

σ

(1)

where:

R =

1

N

∗

N

∑

i=1

R

i

(2)

ICEIS 2007 - International Conference on Enterprise Information Systems

140

σ =

s

1

N − 1

∗

N

∑

i=1

(R

i

− R)

2

(3)

The performance of one trader agent (A

i

) is based

on its Sharpe index and defined as P(A

i

), as shown in

equation 4:

P(A

i

) =

Sharpe(A

i

) − Min_Sharpe(A)

Max_Shar pe(A) − Min_Shar pe(A)

(4)

This evaluation is a real number in the interval

[0,1]. The expression Min_Sharpe(A) means the low-

est Sharpe index among all trader agents (this number

may be negative) and Max_Sharpe(A) is the biggest

Sharpe index among all traders. Sharpe(A

i

) means

the Sharpe index of the target trader agent A

i

for an

given evaluation period. This period is less or equal

to a quarantine period, described in section 4.4.2, to

avoid distortion in evaluation by reallocations.

4.4.2 Reallocation

The reallocation is based on the evaluation of traders

performance and its objective is to transfer resources

from trader agents with poor evaluations to trader

agents with better performance. One of the main is-

sues in reallocation is that the process should be fast

enough to adapt the systems to changes in stock mar-

ket. On the other hand, when reallocation happens too

often, the system may present oscillations or an incon-

sistent behavior. Another issue is to avoid that the re-

allocation interferes with the evaluation process. This

may happen because coach evaluation is impacted by

variation on assets, therefore a reallocation could in-

terfere in evaluation. We avoid such problems by

creating a quarantine period. After reallocation, the

agents involved are put in a quarantine period. Dur-

ing such period, agent performance is evaluated but it

does not participate of reallocation neither as source

or destiny. Therefore, the quarantine period is defined

as bigger or equal to evaluation period and it avoids

interference in evaluation.

At each cycle, after agents evaluation, coach trans-

fers resources from worst performance agent (A) to

the best performance agent(B), except by those that

are in quarantine. The money and share amount (re-

sources) are proportional to difference between per-

formance according to equation 5:

Reallocated_Res = Res(A) ∗ λ ∗

P(B) − P(A)

P(A)

(5)

When agents A and B trade with same stock, the

coach reallocates not only money, but also an amount

of shares defined by an equation similar to equation

5. The symbol λ is a calibration constant used to

make the system faster or slower. The function P is

the agent performance measured by the coach agent

at the current moment, shown in equation 4.

4.5 Conflict Solver Agent

The conflict solver agent analyzes and eliminates in-

consistent orders from trader agents. For instance,

consider the case where trader agent A gives an or-

der to sell 1000 shares of stock X, meanwhile trader

agent B gives an order to buy 1000 shares of the same

stock X. This may happen when agent A believes that

price of stock X is going down, while B believes the

opposite. The problem is that if both orders are sent

to exchange, both agents would have to pay fees to

exchange and brokers. These fees are eliminated by

the conflict solver agent. This agent transfers 1000

shares of stock X from agent A to agent B and the

amount of money equals to 1000*(Price of stock X in

the market) from agent B to agent A and eliminates

the sell order from A and the buy order from B. This

allow both agents to follow their strategies and avoid

unnecessary costs to the system.

5 SIMULATION EXPERIMENTS

AND RESULTS

We have tested the proposed architecture by using a

simulator. The main characteristics of this procedure,

as well as the obtained results, are described next.

5.1 Simulation Characteristics

We have adopted a discrete time approach to simulate

our architecture, using real data from NASDAQ ex-

change market. Each trader agent gives an order at

every simulation cycle. In this work, one simulation

cycle is equivalent to one day

1

. The trader agent order

specifies the target stock, the operation type (buy or

sell) and the amount of shares to transact. Orders with

zero shares are acceptable and would be equivalent

to an agent decision to not operate at the current cy-

cle. Trader orders are executed at market price. Each

trader agent may access quotation from all previous

cycles, but never the current quotation. The simula-

tion allocates for each trader agent an initial capital

(usually 1 million dollars), that agents can use to buy

shares. One trader agent is limited to its capital. It can

not buy shares that worth more than his capital and it

can not sell shares that it does not hold in the current

1

If necessary, it would be easy to change the simulation

cycle duration.

TOWARDS COOPERATION AMONG COMPETITIVE TRADER AGENTS

141

cycle. For simplicity, we decide to not compute ex-

change or broker fees in agents transactions.

The sequence of action of agents and assistance

services is cyclic and determined by simulation mech-

anism according to the following sequence: observer,

coach, trader agents, conflict solver and executor.

5.2 Simulation Results

We have executed several simulations with real data

from Nasdaq market exchange. We used the Nas-

daq 100 Index (Exchange, 2007), which lists the top

100 stocks in Nasdaq, in order to select the papers.

The data refers to history prices in the period from

September 1986 to September 2006 obtained from

Yahoo Finance (Yahoo, 2007). However, many com-

panies listed on Nasdaq 100 Index are new compa-

nies and therefore don not have price information for

the whole period. We arranged the companies listed

in Nasdaq 100 index in four groups: 20 years (10

stocks), 15 years(40 stocks), 10 years (70 stocks) and

5 years (90 stocks), according with the price history

available. The number of agents in society is defined

by the product of the number of techniques by the

number of stocks plus two, these latter corresponding

to the coach and conflict solver agents.

We used trader agents that implemented the five

technical analysis techniques described in section

3: Relative Strength Index (RSI), Stochastic Index,

Moving Average (MA), Moving Average Conver-

gence Divergence, (MACD, we used 10 and 30-day

moving averages.) and Price Oscillator. In order to

achieve complete flexibility, the MAS will have for

each stock, five agents, one per each technique avail-

able. Additionally, each society has one Coach agent

and one Conflict Solver.

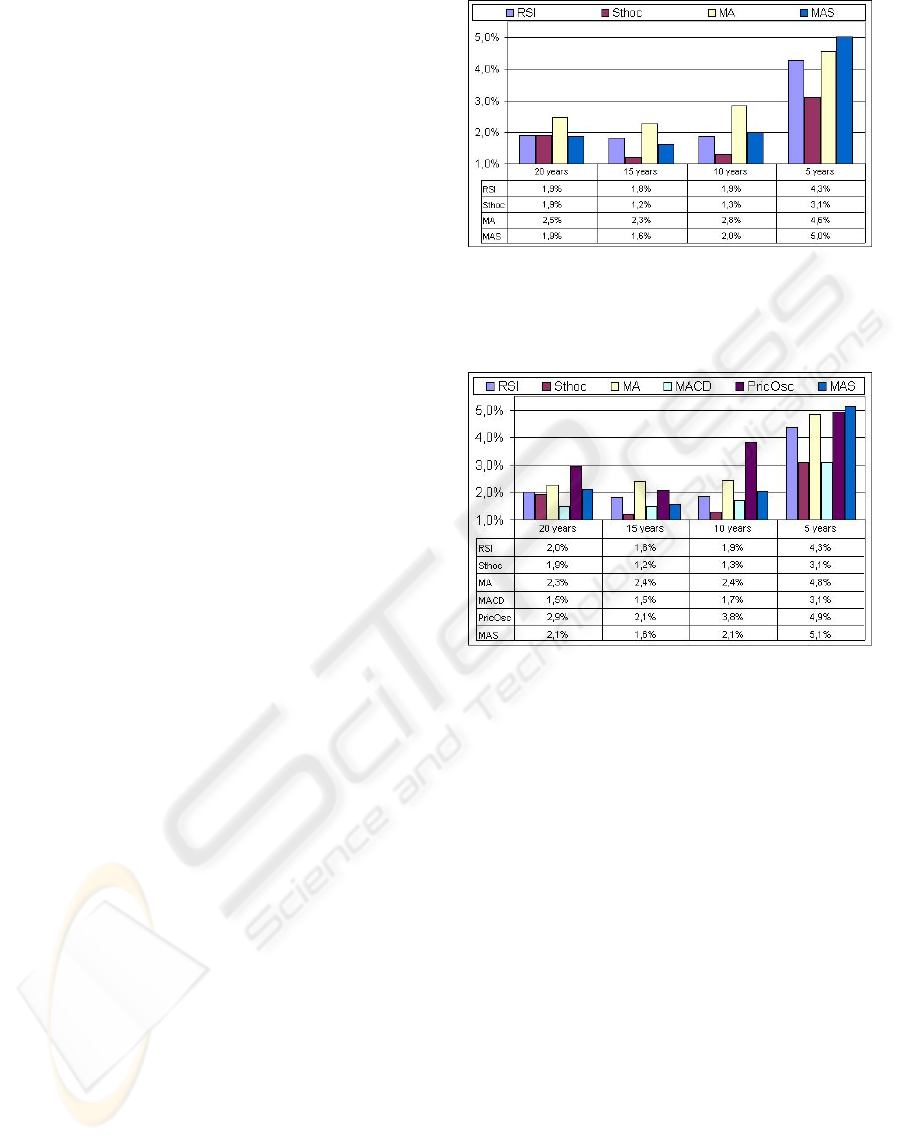

We have performed some experiments using only

three technical agents to analyze the impact of fewer

agents in system performance 2. It is possible to real-

ize that system performance improves when the num-

ber of stocks increases, since the best performance is

obtained by 5 years groups, which deals the great-

est number of stocks. In the experiment with five

technical agents, the system performance was im-

proved 3.These results show better MAS performance

than when it was used only three techniques. This sit-

uation confirms our expectation about the use of more

techniques. The society seems to present better per-

formance when it has more options to do reallocation,

or in another words, when it has more trader agents.

In all experiments, we have adopted the values for the

observation period and the calibration constant of re-

sources λ respectively as 40% of total estimated time

and 0.999.

Figure 2: Sharpe Index obtained for agents groups of three

specific techniques and a Multiagent System (MAS) built

within the architecture proposed in this paper. Each column

indicates the stock group managed by each group of agents.

Figure 3: Sharpe Index obtained for agents groups of five

specific techniques and a Multiagent System (MAS) built

within the architecture proposed in this paper. Each column

indicates the stock group managed by each group of agents.

5.3 Result Analysis

The obtained results show that a multiagent system

built with the architecture proposed here achieved su-

perior result according to Sharpe Index compared to

all individual trader agents in the group of 90 stocks (5

years). In groups with fewer stocks, the results were

in the average. This happens because with more op-

tions to choose, the coordination mechanism has more

power to redistribute the resources among stocks. We

realized that the better average return from RSI is ob-

tained at cost of higher volatility (50% at RSI, and

34% at MAS).

By the graphs in figure 3, it is possible to realize

that RSI and Price Oscillator (PricOsc) have very con-

sistent Sharpe index compared to other agents. This

situation leaves very low space for improvement to

MAS, because there are few moments where these

agents are outperformed by others. The MAS ex-

plores this moments to achieve better results than in-

ICEIS 2007 - International Conference on Enterprise Information Systems

142

dividual agents, but the difference obtained is not very

significant. This limitation may be overcome with the

introduction of new trader agents. As pointed in sec-

tion 5.2, we achieved better results with higher num-

ber of techniques and higher number of stocks in sim-

ulation. Therefore, we believe that the design and im-

plementation of new trader agents may improve the

overall system performance when analyzed by Sharpe

index.

Our architecture reduces the effort to design and

implement such new trader agents. Even the imple-

mentation of techniques created by economists to be

used by human analysts (like the five examples pre-

sented in the section 3) can be done quickly, because

the designer does not need to care about communi-

cation with the exchange system or to achieve good

performance in all market situation. These problems

are treated by the assistance services and by the agents

society.

The growth of the number of traders types causes a

fast growth of the number of agents in the society, be-

cause each type is multiplied by the number of stocks.

However despite the big number of agents (452) in

the group of 90 stocks, the system was able to fulfill

a complete cycle in less than 25 ms. This good per-

formance and the discrete time approach allows the

use of such systems in intra-day operations. Where,

the interval between orders would not be one day, but

some fraction of a second.

6 CONCLUSIONS AND FUTURE

WORK

We presented here an architecture based on au-

tonomous trader agents, each one with its own inde-

pendent strategy. The trader agents are permanently

assessed and resources may be transferred to agents

with better performance. This approach allows adap-

tation in the agent society behavior, because agents

with more allocated resources have greater influence

on the overall system performance.

The proposed architecture may reach very good

results, as shown by the simulation results presented

in section 5.2. The improvement introduced is more

relevant when there are more stock managed and

more trader agents in the system. This is consistent

with the common notion in financial market, that port-

folio diversification is usually a good strategy. Fur-

thermore, the architecture reduces the effort to design

and implement new trader agents, even when their

strategies were developed to be used by human be-

ings. We intend to perform in the future some simula-

tions with a larger number of techniques and stocks,

to achieve better performance. The competitive ap-

proach may be also used in another problems with

similar characteristics: strategic games (the state is

determined by action of all players and one agent does

not know other agents strategies) and multiagent (sev-

eral agents act at the same environment). We intend

to study new applications for this approach in new do-

mains with these properties.

ACKNOWLEDGEMENTS

Jaime Sichman is partially supported by CNPq/Brazil

grants 304605/2004-2, 482019/2004-2 and

506881/2004-1.

REFERENCES

Appel, G. (2005). Technical Analysis: Power Tools for Ac-

tive Investors. Financial Times Prentice Hall, New

York.

Decker, K., Pannu, A., Sycara, K., and Williamson, M.

(1997). Designing behaviors for information agents.

In Johnson, W. L. and Hayes-Roth, B., editors, Pro-

ceedings of the First International Conference on Au-

tonomous Agents (Agents’97), pages 404–412, New

York. ACM Press.

Exchange, N. (2007). Nasdaq website.

http://www.nasdaq.com.

Kearns, M. and Ortiz, L. (2003). The penn-lehman au-

tomated trading project. IEEE Intelligent System,

18(6):22–31.

Sharpe, W. F. (1994). The sharpe ratio. Journal of Portfolio

Management, 13(3):227–286.

Sherstov, A. and Stone, P. (2004). Three automated stock-

trading agents: A comparative study. In Proceedings

of the Agent Mediated Electronic Commerce (AMEC)

Workshop - AAMAS 2004, New York.

Subramanian, H., Ramamoorthy, S., Stone, P., and Kuipers,

B. J. (2006). Designing safe, profitable automated

stock trading agents using evolutionary algorithms. In

GECCO ’06: Proceedings of the 8th annual confer-

ence on Genetic and evolutionary computation, pages

1777–1784, New York, NY, USA. ACM Press.

Yahoo (2007). Yahoo finance website.

http://finance.yahoo.com.

Yu, R. and Stone, P. (2000). Performance analysis of

a counter-intuititive automated stock-trading agent.

In Proceedings of the 16th Conference on Intelli-

gent Information Processing - 16th World Computer

Congress, Beijing, China.

Yuan Luo, K. L. and Davis, D. N. (2002). A multi-agent

decision support system for stock trading. IEEE Net-

work, 16(1):20–27.

TOWARDS COOPERATION AMONG COMPETITIVE TRADER AGENTS

143