The Introduction of Value-added Services in Jamaica

Paul Golding

1

and Opal Donaldson

1

1

University of Technology, Jamaica

237 Old Hope Road Kingston 7 Jamaica

Abstract. Since the liberalization of the Jamaican telecommunications sector in

1999 the mobile market has become extremely competitive. The level of com-

petition in the market coupled with a high level of handset saturation has cre-

ated a ripened environment ideal for implementing mobile commerce services.

However based on reviewed literature the introduction of mobile commerce

services must be done from a consumer perspective. Telecommunication pro-

viders are becoming increasingly aware of the importance of understanding

consumer attitude towards wide scale adoption of mobile services. The ap-

proach of introducing applications to market without consumer input could re-

sult in the loss of time and financial investments. In order to develop best prac-

tices for launching mobile commerce products within the market, researchers

have taken the approach to study consumer interest in mobile commerce and to

evaluate the characteristics of the products that are found most desirable. Con-

sequently this research seeks to understand the interest of consumers within the

Jamaican telecommunication market and to determine what are the value-added

characteristics/ properties of services that are most desired by consumers.

1 Introduction

Jamaica is an island located in the Greater Antilles of the Caribbean. The population

of the island currently stands at 2.6M. Prior to 1999 the Jamaican telecommunications

sector was fully monopolized by Cable and Wireless Jamaica Ltd. The sector was

liberalized in 1999 and since then the industry has evolved into a competitive market.

The liberalization of the sector resulted in the issuing of 146 telecommunications

licenses. According to [1] Phase I of the liberalization process took effect on March

1

st

2001. This phase opened the market to competition in wireless cellular services. In

a publication by [2] it was explained that the since liberalization of the sector in 2001,

the number of mobile subscribers has increased significantly from approximately

300,000 to over 1.5M in 2004.

One of the early recipient of a license was Mossel Jamaica Limited a company

owned by Irish investors. On entering the market Mossel Jamaica Limited adopted

the name Digicel as their brand. According [2] Digicel was launched in April 2001

and had its customer base quickly expand to over 850,000 customers. Digicel had

expected to achieve the 100,000-customer mark by the end of its first year in opera-

tion. However this goal was achieve 100 days after its launch. The level of handset

Golding P. and Donaldson O. (2007).

The Introduction of Value-added Services in Jamaica.

In Proceedings of the 1st International Joint Workshop on Wireless Ubiquitous Computing, pages 54-60

DOI: 10.5220/0002433600540060

Copyright

c

SciTePress

penetration was increased further with the entry of Oceanic Digital (ODJ) in the mar-

ket. According to [3] ODJ entered the market in November 2001 operating under the

name MiPhone. Universal Service/ Access Obligation for Telecommunication Ser-

vices in Jamaica (2004) [2] highlights that MiPhone provides island wide services to

approximately 100,000 subscribers. [4] states that with this level of consumer cover-

age MiPhone currently possess 4.5% of market share in comparison to Digicel’s 64%

and Cable and Wireless 31%. The current state of the industry is consistent with the

vision of The Ministry of Commerce, Science and Technology, which highlight that it

intends “to develop a competitive and vibrant telecommunications industry to move

Jamaica towards becoming a knowledge-based connected society”.

The state of the telecommunication sector has created the opportunity for most Ja-

maicans to own a cell phone. According to [5] 75% of households had an average of

2 working mobile phones while 26% had mobile phones as their only telephone. [6]

present statistics highlighting that in 2000 the number of mobile subscribers per 1000

was 142 and in 2004 this figure had increased to 615 per 1000. [7] highlights that

within the European market the average penetration rate is approximately 65% and is

approaching saturation. This level of saturation experienced in Europe is similar in

other countries such as South Korea. According to [8] South Korea is one of the

world’s leaders in mobile technologies and currently has a penetration rate of

69.12%. Based on the number of handsets in the local market (1.5M) and the size of

the population (2.6M) it can be deduced that Jamaica’s mobile market is approaching

saturation with a mobile penetration rate of fifty seven percent (57%). The level of

handset saturation coupled with the competitive nature of the market and the intention

of mobile providers to deploy 3G networks in the near future, has created an ideal

environment for introducing mobile commerce applications. Consequently the pur-

pose of this research is to examine users’ perception of proposed mobile commerce

services to be introduced to the Jamaican telecommunications market and to under-

stand the mobile value-added features that are most appealing to consumers.

2 Aim

The successful implementation and wide scale adoption of mobile commerce services

is best achieved by understanding consumers’ attitude, interests and needs. This prin-

ciple has been presented by researchers [9], 10] and [11], as the key to creating large

returns on investments in wireless telecommunication. This standard will be applied

to the Jamaican wireless telecommunication sector in order to increase the probability

of achieving successful integration of mobile commerce services within the market.

Consequently the aim of this research is to understand consumers within the Jamaican

telecommunication market and to determine what are the value-added characteristics/

properties of services that are most desired by consumers

55

3 Significance

According to [5] majority (72%) of Jamaica’s mobile subscribers utilize their phones

solely for voice communication. Therefore based on reports made by [5] and the

competitive nature of the local telecom market it can be deduced that in the near fu-

ture the average revenue per user for voice communication will be on the decline. The

aggressive competition that exist within the market, the high penetration of handsets

and the use of mobile phones primarily for voice communication are all indicators of

the need for a new revenue stream. Therefore the significance of this study is centered

on determining what type of cultural or regional content would be ideal for creating

new revenue streams for the mobile industry.

4 Literature Review

The views expressed by researchers on the issue of content creation have been consis-

tent based on the literature examined. The general stance taken is centered on the

creation of services based on consumer perspective. Researchers such as [9] high-

lights that in order to achieve high levels of acceptance of m-commerce it is important

to be knowledgeable of consumer’s need, definition of consumer usage context, and

possess the ability to maximize Mobile Content Quality (general value-added aspects

of mobility such as personalization, localization ubiquity etc.) for customers. The

importance of incorporating the user’s perspective in creating a marketable end prod-

uct is also emphasized by other scholars who believe that a consumer oriented ap-

proach is the key to mass market adoption. [10] explains that in earlier years of mo-

bile platform development, the emphasis was completely placed on technology and

not end users. [10] criticize the current linear approach in which mobile carriers dic-

tate terms of innovation and development to content providers and users. [10] sug-

gests a more ecological approach in which content providers, technology companies

and users of the platform all play an important role.

The views shared by [10] coincide with that of [11] and other researchers who ad-

vocate that the user perspective should be taken into consideration. Studies conducted

by [11] and [12] convey that the development and deployment of any mobile applica-

tion should be done from the consumer perspective. [12] explain that several compa-

nies have invested in projects from a ‘technocist focus’, which means they have ne-

glected the consumer perspective during development. The authors explain that this

approach have resulted in the failure of projects. According to [13] the need to evalu-

ate different opinions on value- added services lies in the possibility that one group

may have a high opinion of a specific value-added service feature, whereas another

group may completely reject this value-added offering.

The idea of using the consumer perspective to develop applications has lead re-

searchers such as [11] developing frameworks and guidelines that address the issue of

consumer needs. [11] propose an analytical framework that can be used to evaluate

the suitability of applications for M-commerce. The framework consists of two com-

ponents namely wireless-value and mobile-value. The wireless-value is defined as

the value, which arises when using unwired devices for example a laptop or a Per-

56

sonal Digital Assistance (PDA). On the other hand mobile-value is defined as the

value arising from the mobility of the new medium for example making an Internet

connection with a PDA. The authors made it clear that the fact that a device is wire-

less doesn’t mean it offers mobile-value.

[11] focused on the mobile-value perspective, which is broken down in the fol-

lowing areas:

Time-critical arrangements: Time-critical situations arise from external

events, which mean that the always-on connectivity of the medium is an im-

portant feature for example alerts for stock traders.

Spontaneous decisions and needs: These needs are related to products and

services that are characterized by the purchasing decision being straightfor-

ward, meaning that they do not require careful consideration. Spontaneous

needs can also be entertainment-related, efficiency-related or even time criti-

cal in nature.

Entertainment needs: These needs are centered on killing time/having fun,

especially in situations where there is no access to wired entertainment ap-

pliances. Entertainment needs are generally also spontaneous in character,

especially in mobile settings.

Efficiency ambitions: These applications are aimed at productivity

Mobile situations: These services are valuable only through a mobile me-

dium, as needs for these services predominantly arise when users are on the

move for example vending machine payments,

The results of the study carried out by [11] indicate that services offering mobile-

value on several dimensions prove to be more interesting than services that offer one

dimension of mobile-value.

The importance of mobile consumer perception and the offering of value added

services have also been examined by [14]. [14] states that the relationship between

consumers and suppliers in the wireless environment should be viewed from a value

proposition standpoint. Clarke defines the value proposition for mobile commerce

within four (4) categories (see table 1). The categories presented by [14], [11] are

similar to summaries made by [9] who concludes that the general value–adding fea-

tures of the mobile medium are personalization, localization, timeliness, ubiquity and

convenience.

[13] utilizes [14] value proposition framework to examine numerous mobile

commerce services offered in Taiwan and China. The findings from the study sug-

gested that each category of mobile commerce is characterized by a diverse combina-

tion of value proposition attributes. However, based on results obtained the authors

conclude that value- added service tendency is largely driven by entertainment as

these services were highlighted in the study as having the most value.

The ideas presented by [11], [14], [13] and [9] are all similar. All authors argue

that in order for m-commerce to be successful Mobile Content Quality (MCQ) must

be carefully examined in the presentation of services. The result of work conducted

by [9] indicates that media that adds value to the user will be the most successful

within the market. Therefore it must be reiterated that mobile users should have a say

in the types of services brought to market.

57

Table 1. Clarke’s Value-added Proposition Framework.

Value Proposition Definition

Ubiquity Mobile devices allow users to receive information and

perform transactions from any location on a real-time

basis. The question here is, what value offering will be

provided everywhere at the same time?

Personalization The personalization of messages based on time and

location for specific users. The issue that needs to be

evaluated within this category is, what individual

based target market can be employed?

Localization Supply of information relative to the current geo-

graphic location of the user. Developers should evalu-

ate, what location–based marketing strategies can be

offered?

Convenience The ability to access information and services without

the constraints and limitations of wired infrastructure.

The area of focus within this category is what factors

create time and space utility?

5 Methodology

The arguments presented by [13] highlighted that gathering consumer perspective

from different user groups is essential in understanding mixed reactions to the same

value offering. That is, one group may accept a particular service while another may

reject that same service. Based on this principle a study will be carried out that seeks

to understand the interest of mobile users within the Jamaican telecommunication

market. The method of data collection for this research is the survey technique. The

survey instrument will be pre-tested among a group of twenty-five (25) persons se-

lected randomly in order to determine the accuracy and level of clarity of the instru-

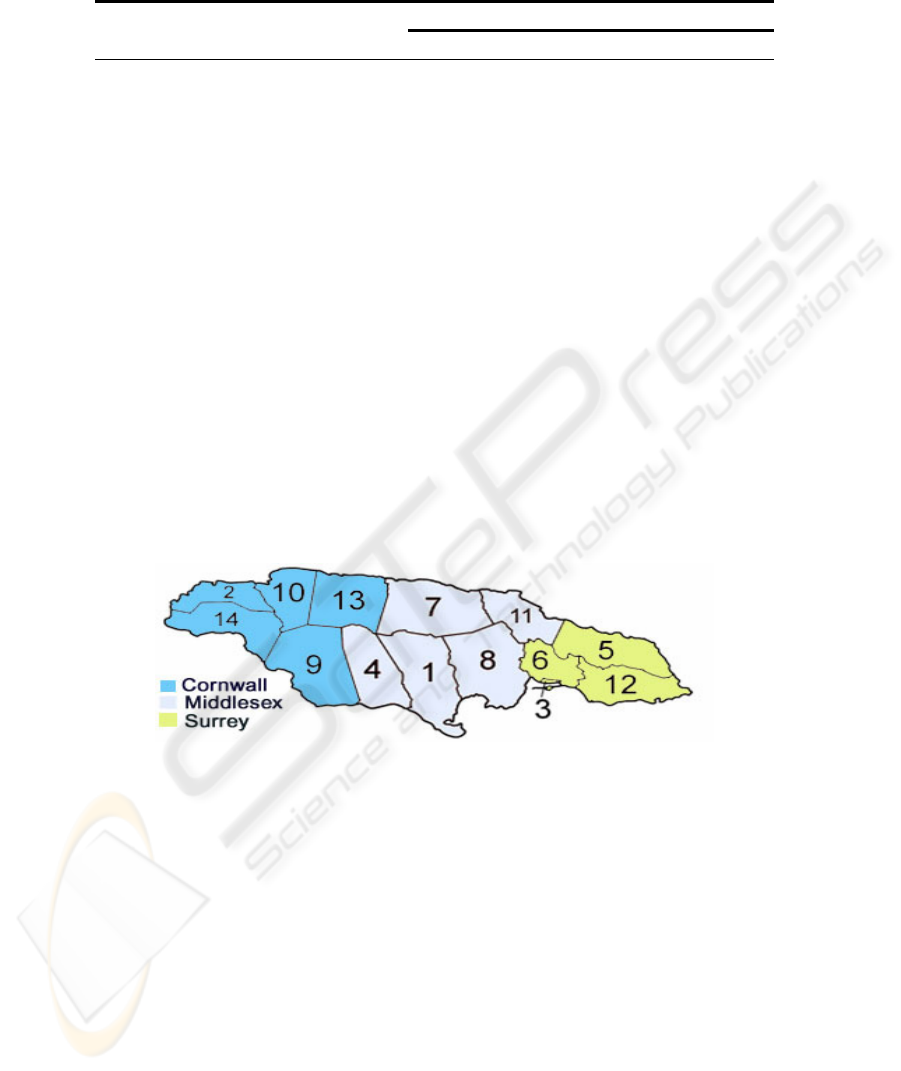

ment. Five Hundred (500) persons will be sampled from the three counties in Jamaica

(Cornwall, Middlex and Surrey, see fig. 1). The participants will be chosen at random

in order to negate any unforeseen bias. The data collected from the survey will be

analyzed with the SPSS software. Linear Regression technique will be applied to the

data to determine predictor variables for consumer choices. Frequencies, correlation

and means will also been calculated. The results from this phase of the investigation

will be used to develop the service which is most favoured by users/consumers.

Using the analytical framework created by [11] the following services will be clas-

sified based on their mobile value offering (see table 2).

Based on the classification stated below the research seeks to answer the following

questions:

1. To what extent is it likely that a particular service will gain popularity in the

early years of introduction?

2. How does mobile- value correspond with the demographics of users?

3. Are consumers likely to favour mobile services that offer a broad

range of mobile value?

58

Table 2. Mobile Service Classification.

Mobile –Value

Mobile service

TC S EN EA MS

Watching TV on the cell phone 9 9 9

Downloading and listening to music 9 9

Playing a game that predicts the lottery 9 9

Viewing sports (cricket, football, racing) 9 9

Accessing information on local recipes 9 9

Video calls 9 9

Sending pictures to friends 9 9

Pay utilities (Light/water) 9 9 9

Playing the lottery 9 9

Voting for election candidates 9 9

Check advertisment for houses 9 9 9

Viewing weather Report 9 9 9

Purchasing movie Tickets 9

Time Critical –TC

Spontaneous – S

Entertainment Needs – EN

Efficiency Ambitious – EA

Mobile Situation – MS

Fig. 1. This Figure illustrates the location of the different counties in Jamaica.

6 Conclusions

The Jamaican telecommunication market is at the ideal stage for introducing wide

scale mobile commerce applications. However in order to achieve a successful intro-

duction to the market consumer interest must be accessed. Therefore this research will

be instrumental in understanding what content is most appealing to consumers and

what will drive mass adoption for sustainability in the market. The results of this

study will provide a foundation for understanding consumer preferences in the local

telecommunication market. The findings of this study will also be useful to telecom-

munication providers both locally and internationally. The results will also be instru-

59

mental in providing insight on what services would be most suitable for development

within the local market.

References

1. Brown A.: Telecommunications Liberalization in Jamaica International Journal of Regula-

tion and Governance 2(2): (2002) 107-127

2. Office of Utilities Regulation: Toward Universal Service/ Access Obligation for Telecom-

munication Services in Jamaica: Recommendation of the Office of Utilities Regulation to

the minister of Commerce, Science and Technology. Publication of the Office of Utilities

Regulation (2004)

3. Golding, P.: The Wireless War in Jamaica Proceedings of Conference Frontiers in Educa-

tion 05 (2005)

4. Cellular-news: ZTE Wins Jamaican CDMA Upgrade Contract retrieved 6/7/2006 form

http://www.cellular-news.com/story/17899.php (2006)

5. Office of Utilities Regulation: Toward a Dominant Public Voice Carrier Office of Utilities

Regulation toward (2003)

6. World Bank Jamaica at a Glance retrieved 12

th

/11

th

/2006 from

http://siteresources.worldbank.org/INTJAMAICA/Resources/Jamaica.AAG.pdf (2006)

7. Standard and Poor: Industry Profile: How to analyze a wireless Telecom Company re-

trieved on 12/5/2003 from http://0-

www.netadvantage.standardandpoors.com.novcat.nova.edu/netahtm.../tws51103.ht (2003)

8. ITU (International Telecommunication Union): Ubiquitous Network Societies: The Case of

the Republic of Korea ITU (2005)

9. Landor, P.: Understanding the Foundations of Mobile Content Quality, a Presentation of a

new Research Field Proceedings of the 36th Hawaii International Conference on System

Sciences (HICSS’03) (2003)

10. Ziv, N.: Toward a New Paradigm of Innovation on the Mobile Platform: Redefining the

Roles of Content Providers, Technology Companies, and Users Proceedings of the Interna-

tional Conference on Mobile Business (ICMB’o5) on the Radio538 ringtunes i-mode ser-

vice case study proceedings of ICEC ACM (2005) 433 -441

11. Anckar, B., D’Incau, D.: Value-Added Services in Mobile Commerce: An Analytical

Framework and Empirical Findings from a National Consumer Survey Proceedings of the

35

th

Hawaii Conference on System Sciences (2002)

12. Kar, E., Maitland, C., Montalvo, U., Bouwman, H.: Design guidelines for Mobile Informa-

tion and Entertainment Services based on the Radio538 ringtunes i-mode service case

study” proceedings of ICEC ACM (2003) 433 -441

13. Sun, S., Su, C., Ju, T.: A Study of Consumer Value-added Services in Mobile Com-

merce—Focusing on Domestic Cellular Phone Companies in Taiwan, China proceedings

of ICEC’05, Xi’an, China (2005)

14. Clarke, I. III.: Emerging Value Propositions for Mcommerce. Journal of Business Strate-

gies, Vol. 18, No. 2, (2001) 133-148

60