EVALUATING LONGITUDINAL ASPECTS OF ONLINE BIDDING

BEHAVIOR

L. Rocha, A. Pereira, F. Mour˜ao, A. Silva, W. Meira Jr.

Department of Computer Science, Federal University of Minas Gerais, Brazil

P. Goes

School of Business, University of Connecticut, U.S.A.

Keywords:

Online auctions, e-business, temporal evolution, bidding behavior, reactivity.

Abstract:

Online auctions have become a major e-commerce strategy in terms of both number, diversity of participants

and revenue. Recent research has characterized online auctions as synchronous interactive computer systems,

considering successive interactions as a “loop feedback” mechanism, called reactivity, where the user behavior

affects the system behavior and vice-versa. Although some factors that explain user behavior in terms of

instantaneous bidding conditions are identified by previous research, there has been no effort to study how

bidders’ behavior changes over time. This work presents a longitudinal analysis of bidding behavior over a

series of auctions. The results show bidding behavior evolves over time and these changes are not random. The

identifiable evolution patterns can be partially explained by the presence of instantaneous reactivity patterns

that bidders experience throughout the series of auctions they participate. Bidders learn from these reactivity

instances and adapt their future participation.

1 INTRODUCTION

Online auctions are becoming a major electronic com-

merce strategy in terms of both number and diver-

sity of participants and revenue. Some recent stud-

ies, which we are going to discuss in this paper, have

considered online auctions as synchronous interactive

computer systems, that is, systems with which users

interact continuously, getting and providing informa-

tion. For example, users interact through their bids

while competing for an item, waiting to see how the

auction evolves, or giving up.

These studies consider interactions within an auc-

tion as a sequence, where successive interactions be-

come a “loop feedback” mechanism, called reactiv-

ity, where the user behavior affects the system behav-

ior and vice-versa. These papers describe a charac-

terization methodology for online auctions, consider-

ing reactivity. By concentrating on relevant periods

of bidding activity, they capture some important at-

tributes that characterize reactivity and use them to

identify auction negotiation patterns as well as bid-

ding behavior. Although they identify some factors

that lead a user to behave as observed in terms of

instantaneous surrounding conditions they have not

studied bidders’ behavior evolution over time. We ex-

pect the user’s interactions with the system to evolve

due to change in objectives but more importantly, due

to learning that takes place. With participation comes

acquired knowledge that can directly impact the bid-

der’s future bidding strategy.

In this paper we present a longitudinal analysis of

bidding behavior considering reactivity. We focus on

how the bidding behavior exhibited by auction partici-

pants evolvesover time reflected in the bidder-auction

interactions. In this context, there are some important

questions we want to investigate:

1. Are there changes in the bidding behavior over

time? What are these changes?

2. Are these random changes? Are there trends?

3. Does reactivity affect these changes over time?

In order to answer these questions we develop a

model of bidding evolution behavior and use a real

case study of eBay. This work is based on previous

works (Pereira et al., 2007b; Pereira et al., 2007c;

Pereira et al., 2007a).

Our analysis and results have wide applicabil-

ity for activities such as defining seller’s strategies,

calibrating economic models of bidding, designing

decision-support (Brown et al., 2005) and simulating

e-markets.

423

Rocha L., Pereira A., Mourão F., Silva A., Meira Jr. W. and Goes P. (2008).

EVALUATING LONGITUDINAL ASPECTS OF ONLINE BIDDING BEHAVIOR.

In Proceedings of the Fourth International Conference on Web Information Systems and Technologies, pages 423-430

DOI: 10.5220/0001515204230430

Copyright

c

SciTePress

2 RELATED WORK

In this section we first discuss previous research re-

lated to temporal evolution in other contexts such as

social networks. Then, we present some traditional

work of characterization of online auctions and bid-

ding behavior. Finally we show some studies of char-

acterization of reactivity in online auctions.

A social network consists of people who interact

in some way such as members of online communi-

ties sharing information via the WWW. To learn more

about how to facilitate community building, e.g., in

organizations, it is important to analyze the interac-

tion behavior of their members over time (Falkowski

et al., 2006). This paper proposes two approaches

to analyze the evolution of two different types of on-

line communities on the level of subgroups: The first

method consists of statistical analysis and visualiza-

tions that allow for an interactive analysis of subgroup

evolutions in communities that exhibit a rather mem-

bership structure. The second method is designed for

the detection of communities in an environment with

highly fluctuating members. For both methods, the

authors discuss results of experiments with real data

from an online student community.

In another context, with the rapid development

of e-commerce, the topic of mining and predicting

users’ navigation patterns has attracted significant at-

tention due to applications such as personalized ser-

vices in E-commerce (Tseng et al., 2006). Although

a number of studies have been done on this topic, few

of them take into account the temporal properties of

web user’s navigation patterns. This work proposes a

novelmethod named Temporal N-Gram for construct-

ing prediction models of Web user navigation by con-

sidering the temporality aspects.

Menasc´e and Akula have several works in char-

acterization of online auctions. (Menasc´e and Akula,

2003) provides a workload characterization of auction

sites including a multi-scale analysis of auction traffic

and bid activity within auctions, a closing time anal-

ysis in terms of number of bids and price variation

within auctions, some analysis of the auction winner

and unique bidder. In this work they use data from Ya-

hoo! Auctions site (Auctions, 2003) and present some

interesting overall conclusions about online auctions.

In (Akula and Menasc´e, 2007) they present a two-

level (site and user level) workload characterization

of a real online auction site.

There are some studies on bidding behavior anal-

ysis. Using data from ubid.com, Bapna et al. (Bapna

et al., 2004) develop a cluster analysis approach to

classify online bidders into five categories: early

evaluators, middle evaluators, opportunists, sip-and-

dippers, and participators. Moreover, they argue that

bidders pursue different bidding strategies that real-

ize different chances of winning and different levels

of consumer surplus. However, these studies are still

limited regarding how they explain bidding behavior

over the entire sequence of bids, as opposed to simply

outcome summaries (e.g., final prices, and number of

bids) in an auction (Ariely and Simonson, 2003).

Our work is fundamentally different in the sense

that we start from the fact that the bidder’s behavior

changes across time and auctions, motivating us to

understand the intra-auction interactions, that is, the

factors that characterize the auction negotiation. We

believethat it is the knowledge acquired in these intra-

auction interactions that affect the bidder, who then

adapts his/her behavior in the subsequent auctions.

3 AUCTION

CHARACTERIZATION

This section briefly describes the characterization

methodology presented in (Pereira et al., 2007b),

showing a real case study of online auctions (Pereira

et al., 2007c; Pereira et al., 2007a), that is the basis for

our work. First we describe the dataset for this case

study.

The dataset consists of 8855 eBay auctions com-

prising 85803 bids for Nintendo GameCubes from

05/25/2005 to 08/15/2005. eBay (Bajari and Hor-

tacsu, 2003; EBay, 2007) employs a complex mecha-

nism of second price auction, hidden winner, and hard

auction closing. Because of its inherent complexity,

we find it provides a good online auction environment

to demonstrate the applicability of the characteriza-

tion models and later, to show the evolution of bid-

ding behavior over time. From the original dataset,

we consider auctions that achieve success (selling the

item) that represent 75.7% of the dataset.

3.1 Auction Representation

This section presents the basic components of the

hierarchical model and characterization methodol-

ogy (Pereira et al., 2007b). The premise of the charac-

terization is to capture the relevant information about

the auction negotiation features to understand its dy-

namics. These criteria analyze the auction at various

levels of granularity and are organized as a hierarchy.

Reactivity can be defined in the context of agents

who react to events through actions thus affecting the

state of the system. In online auctions, agents are bid-

ders, their actions are their bids, and events are bids

from other bidders, which change the auction nego-

tiation state. In online auctions, there are two fun-

damental concepts that play roles in analyzing reac-

tivity: activity and synchronicity. As a consequence

of the auctions’ long duration and the bidders’ habits

in terms of how frequently they check an auction in

which they are participating, it is possible to observe

WEBIST 2008 - International Conference on Web Information Systems and Technologies

424

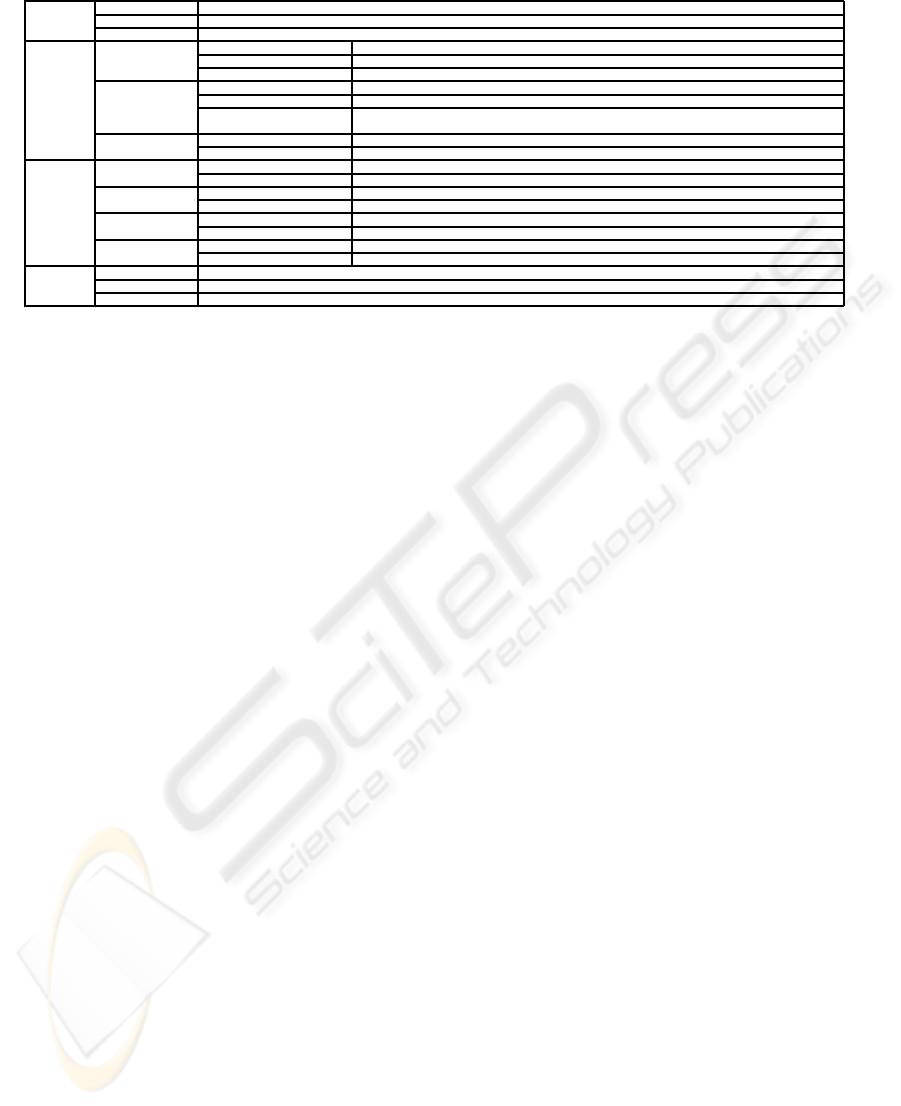

Table 1: Description of Auction Model Hierarchy.

Auction

Starting Price The minimum bid value previously set by the seller for the auction negotiation.

Duration The auction negotiation duration.

Seller The owner of the auction.

Time-Locality

Initial (I) The first sequence of the auction.

Intermediary (M) An intermediary sequence of the auction.

Final (F) The last sequence of the auction.

No competition (N) Does not present competition, only one bidder’s session.

Sequence Competition Successive competition (S) There is a competition, but no overlap between bidders’ actions.

Zigzag competition (Z) Characterizes a more direct competition, where two or more bidders compete with each other in

more than one time.

Winner’s Impact

Do not change winner (w) The sequence does not change the last winner bidder.

Change winner (W) The sequence changes the last winner bidder.

Size

One (O) Has just one bid.

More (M) Has more than one bid.

Session

Activity

Non-Trigger (t) Does not initiate the sequence’s activity.

Trigger (T) Initiates the sequence’s activity .

Recurrence

Non-Recurrent (r) The session is from a bidder who has not bid before in this auction.

Recurrent (R) The session is from a bidder who has already bid in this auction.

Winner’s Impact

Do not change winner (w) The session does not change the last winner bidder.

Change winner (W) The session changes the last winner bidder.

Bid

Time The time that each bid is placed during auction negotiation.

Price The bid value.

Bidder The participant who places this bid.

that online auctions present long periods of inactivity,

during which no bids are submitted.

They propose a four-level characterization: bid,

session, sequence, and auction, as shown in Table 1.

The bid is the finest grain level, representing the bid-

der’s action. It is characterizedby the time it is placed,

the bid value, and the bidder. A session is a group

of one or more bids from the same bidder, in which

the time interval between any two consecutive bids is

below a threshold θ

ses

. The session attributes are in-

tended to capture the reactivity the bidder exhibited

towards the auction within the defined session inter-

val: number of bids placed, the existence of compe-

tition, if the session impacted the sequence it is in-

serted in, and if the bidder is a recurrent one from

previous sessions. The sequence is a set of one or

more sessions, where the inactivity period between

two consecutive sessions is below a threshold θ

seq

.

They quantify the following sequence attributes that

are related to reactivity: the time locality in terms of

overall auction span, the amount of competition and

whether the sequence resulted in a winner change.

The auction is composed of one or more sequences.

The eBay auctions from this case study have a

small average number of sessions per sequence, just

1.53, since it is common to find one or more se-

quences with just one session in all auctions. On

the other hand, the average number of sequences per

auction shows that the dynamics of the negotiation

is rich, which motivates their analysis. Another as-

pect they analyze is the active and inactive times of

the auctions. The active time is the total time during

which the auction has activity, that is the sum of the

sequence times. They expected a short active time per

auction, since there are usually long intervals between

sets of bids, but an active time of just 1.72% is much

lower than their initial expectation. This motivates

the auction representation they provide through their

hierarchical model.

Table 1 presents the hierarchical characterization.

Based on the sequence attribute values, there are 15

valid combinations (since the 3 possibilities of Time-

Locality = I and Winner’s Impact = w are not valid

because all initial sequences change the winner) to

describe patterns of auction’s sequences. Consider-

ing the session’s characterization, all the 16 possi-

ble patterns are valid. In order to simplify the se-

quence and session patterns representation, we adopt

letters (lowercase or uppercase) as labels. For exam-

ple, the sequence pattern IZW (initial sequences, with

zigzag competition and winner changing) and the ses-

sion pattern OtrW (session with one bid, non-trigger,

non-recurrent, and winner changing). Each criterion

of both the sequence and session has mutually exclu-

sive values.

This detailed characterization of bids, sessions,

sequences and auctions provides a new approach for

understanding the negotiation patterns and bidding

behavior. By focusing on the sequences that comprise

an auction, we can better understand the negotiation

patters that evolved in the auction. Similarly, when

we focus on the sessions that an individual bidder

participated in throughout an auction, his bidding be-

havior in that auction emerges. The next subsections

present the characterization methodology for auction

negotiation (Pereira et al., 2007c) and bidding behav-

ior (Pereira et al., 2007a).

3.2 Auction Negotiation

Characterization

As previously mentioned, each auction is composed

of a set of one or more sequences and can therefore

be described by a vector, whose 15 components are

the types of possible sequences, and the values are

the relative frequency of each sequence pattern.

To identify auction negotiation patterns, they

group together vectors that exhibit similar distribu-

tion of sequence patterns by applying clustering algo-

rithms (Bock, 2002), more specifically the k-means

EVALUATING LONGITUDINAL ASPECTS OF ONLINE BIDDING BEHAVIOR

425

(Hartigan, 1975). The ideal number of clusters is

determined through the metric beta-CV, as described

in (Menasc´e and Almeida, 2000). The analysis

pointed out 7 as the best number of clusters for auc-

tions.

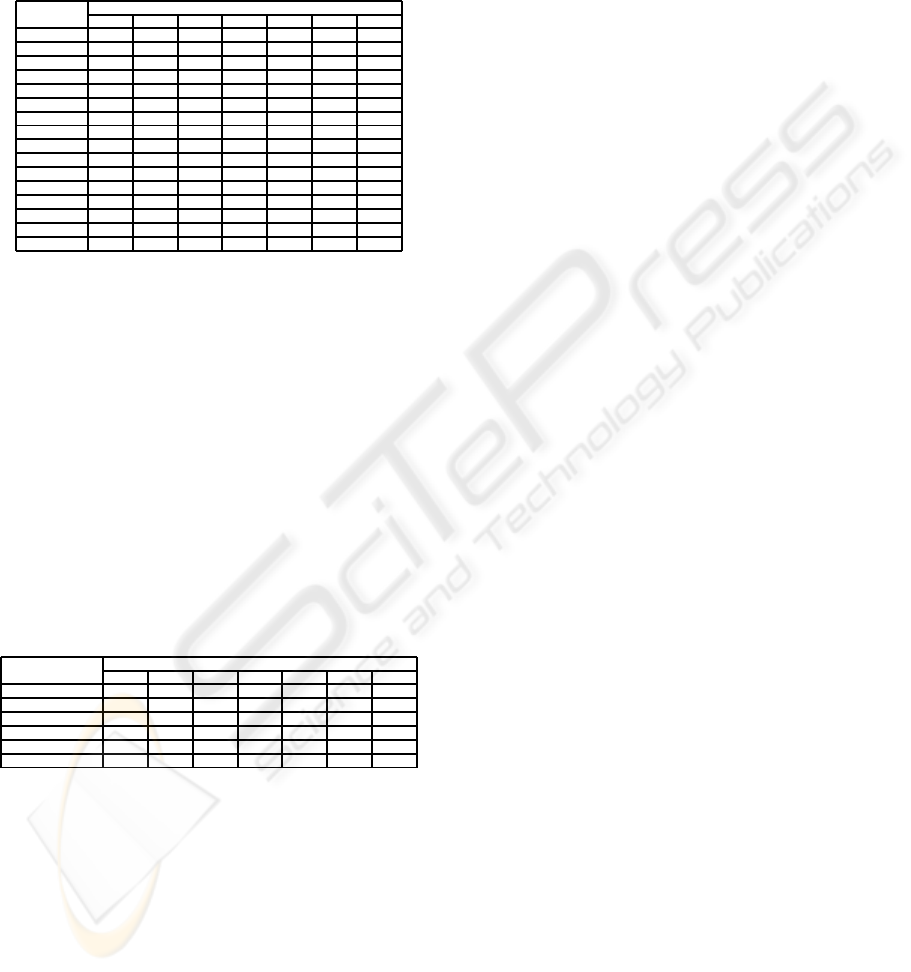

Table 2: Distribution of Cluster’s Sequences.

Sequence Clusters

A0 A1 A2 A3 A4 A5 A6

(I-N-W) 0.0 0.0 20.0 47.2 0.0 15.5 15.6

(I-S-W) 0.0 40.8 0.7 0.0 0.0 1.1 1.1

(I-Z-W) 0.8 0.0 0.4 0.0 8.7 1.4 0.2

(M-N-w) 0.0 3.3 8.6 1.1 0.0 36.3 10.1

(M-S-w) 0.0 0.7 1.1 0.8 0.0 1.9 1.2

(M-Z-w) 0.0 0.0 0.0 0.0 0.0 0.0 0.1

(M-N-W) 0.0 5.8 14.0 1.1 0.0 16.4 44.2

(M-S-W) 0.0 5.6 31.6 0.0 0.0 5.6 7.7

(M-Z-W) 0.0 3.0 2.6 2.7 0.4 2.7 2.9

(F-N-w) 0.0 6.4 2.8 11.5 0.0 3.0 2.2

(F-S-w) 0.0 2.2 1.0 1.5 0.0 1.1 0.8

(F-Z-w) 0.0 0.5 0.3 0.3 0.0 0.1 0.1

(F-N-W) 99.2 10.5 5.1 16.6 0.0 4.7 4.8

(F-S-W) 0.0 12.7 6.5 11.1 90.9 5.1 5.4

(F-Z-W) 0.0 8.5 5.3 6.1 0.0 5.1 3.6

Freq.(%) 19 4 16 12 1 20 28

Table 2 shows the frequency distribution of the 15

possible sequences for the clusters. The last row of

the table shows the percentage of auctions that falls

in each cluster. Based on this result, we can describe

each cluster. Due to lack of space, we present only

some examples:

A0: auctions with very small number of se-

quences, almost all of them unique and without com-

petition. All of them change the winner, as expected,

once the first sequence always do it in eBay.

A3: a set of auctions with characteristics similar

to A1 in terms of the number of auction sequences and

winner changing. However, most of their sequences

do not present competition (77.4%).

Table 3: Auction analysis.

Clusters

Aspects A0 A1 A2 A3 A4 A5 A6

St. Bid (US$) 71.4 36.4 20.9 47.1 43.3 16.9 17.7

Duration (days) 2.7 4.5 5.1 4.9 4.9 5.7 5.8

#Bids 1.1 9.7 16.3 4.8 5.4 15.8 17.1

#Bidders 1.0 5.0 7.5 2.7 3.0 7.1 7.5

1st Price (US$) 72.1 67.3 73.5 64.3 57.3 82.7 81.2

2nd Price (US$) 71.9 65.6 71.8 59.9 56.2 80.3 79.3

Once determined the seven auction clusters, they

analyze the relationships between auction inputs and

outputs with the negotiation. Table 3 shows some im-

portant aspects for each cluster. It presents two auc-

tion negotiation inputs (aspects defined before nego-

tiation starts - starting bid and duration) and four out-

puts (aspects determined after negotiation ends - num-

ber of bids and bidders, 1st and 2nd Prices).

A0 has the highest starting price and the short-

est duration. Although we previously identified low

activity and competition, it is interesting to note that

these auctions achieve a high winner price (the av-

erage 2nd price is US$71.9). These can be explained

by the fact that they present a very high starting price,

very close to the final price obtained.

A3 and A1 have similar characteristics, but differ-

ent behavior in terms of competition profile. It is im-

portant to note that they produce different results: the

average number of bids and bidders for A3 is almost

half of A1, which can be demonstrated by the com-

petition level. Moreover, the final negotiation price is

almost 10% higher for auctions of A1.

3.3 Bidding Behavior Characterization

In their approach, the bidding behavior can be char-

acterized by a distribution of session patterns, that is,

a frequency of occurrence of each valid session pat-

tern. Therefore, the bidding behavior exhibited by

each bidder in an auction is represented by a vector

with the following components: 16 session patterns

resulted from the combination of attributes (Size, Ac-

tivity, Recurrence, and Winner’s Impact) described in

Table 1 and 9 other values inherited from the sequence

the session is inserted in (considering Time-Locality

and Competition). Combining these 16 session pat-

terns and these 9 session attributes inherited from its

sequence, there are 144 possibilities.

They then augment the vector by adding two ad-

ditional variables: ToE and ToX. These two variables

were used in (Bapna et al., 2004) and stand for the

time of entry and time of exit of the bidder in the auc-

tion and are measured through the timestamp of the

first and last bid respectively. They decide to con-

sider these timing attributes, since it is very important

to identify in which part of the auction negotiation a

bidder starts and ends her/his participation.

Similarly to the classification of auction patterns,

they also use a clustering technique to determine

groups of similar bidding behaviors. The analysis

pointed to 16 as the best number of clusters. Due to

lack of space, we present only some examples:

B0: bidders who act in initial (53%) and interme-

diary (44%) negotiation sequences, in sequences with

70% of competition, from which more than 80% have

successive type. Most of their sessions have only one

bid (57%), are triggered (63%), non-recurrent (74%),

and change winner (76%). They act during the earli-

est stages of the auction negotiation (24-33% of dura-

tion time), placing 2.6 bids in average. These bidders

represent 4.3% of bidding behaviors.

B1: these bidders mainly act in intermediary se-

quences of the auction (91%) and in competitive sit-

uations (91%) with successive type predominance.

Most of their sessions have more than one bid (89%),

are triggered (91%), non-recurrent (76%), and change

winner (92%). They act late in the auction negoti-

ation (85-88% of duration time), placing 3.4 bids in

average. They represent only 1.8% of the bidders.

B2: act in the last auction sequences, 74% with

competitivesituation (40% of zigzag type). Their ses-

WEBIST 2008 - International Conference on Web Information Systems and Technologies

426

sions have more than one bid in 68%, are triggered

in 76% and change winner in 65%. Moreover, they

are bidders who have not participated in the negotia-

tion yet, called non-recurrent bidders. They represent

11.5% of the bidding behaviors, act after 99% of auc-

tion negotiation timing, placing 2.4 bids in average.

B3: bidders that act typically in intermediary

sequences (93%), in scenarios with no competition

(85%). In general, their sessions have only one

bid (89%), are triggered (88%), and change winner

(89%). Only 28% of them have already participated

in the current negotiation before (recurrent). They act

typically after the middle of the auction negotiation,

from 72 to 78% of negotiation timing duration. They

are a popular class, occurring in 12.9% of the bidding

behaviors. They place 1.7 bids in average.

Based on the results obtained in these previous

works, in the next section we present an analysis of

bidding behavior evolution over time.

4 EVALUATING TEMPORAL

ASPECTS

As previously mentioned, in this section we discuss

each question presented in section 1. This section’s

analysis are based on the characterization presented

in last section. We divide this section in subsections

that analyze each one of the questions.

4.1 Behavioral Changes

Here we address the questions: Are there changes

in the bidding behavior over time? What are these

changes? In order to understand how bidder behav-

ior evolves over time, we capture the temporal series

of bidding profiles that each bidder displayed in each

auction he participated in. We also capture each tran-

sition between pairs of profiles i and i + 1, i+ 1 and

i + 2 etc. This characterization is like a dominoes

game, where each piece represents a bidder behavior

transition, and can be represented by a directed graph.

A directed graph or digraph G is an ordered pair

G = (V, A) where V is a set of vertices or nodes, and

A is a set of ordered pairs of vertices, called directed

edges, arcs, or arrows. An edge e = (x,y) is consid-

ered to be directed from x to y; y is called the head and

x is called the tail of the edge. Each bidding behavior

profile is a vertex and each transition (that represents

a temporal change in the bidder’s profile) is an edge.

We called this graph as a Bidding Behavior Model

Graph (BBMG), that is based on Customer Behav-

ior Model Graph (CBMG) (Menasc´e and Almeida,

2000). This is a state transition graph that has one

node for each possible bidding behavior and the edges

are transitions between these profiles. A probability is

assigned to each transition between two nodes, repre-

senting the frequency at which these two profiles oc-

cur consecutively.

Since we are interested in finding typical bidding

behavior and how they evolve over time, more than

identifying the probability of transition from one bid-

ding behavior to another one, we want to quantify

how a state (bidding behavior) is being reached from

source states. In order to do this, we create a matrix

of bidding behavior profiles, which consolidates all

transitions by all bidders. Each row shows the num-

ber of transitions from source state to any other one,

including itself. This matrix is showed by Table 4.

In the matrix, the sum of all transitions of each row

represents the state’s outdegree, which quantifies all

the transitions from a profile to any other one. Analo-

gously, each column has all transitions into each pro-

file. The sum of each column is the profile’s indegree.

We analyze each profile, observing the most fre-

quent transitions from and to each of them, repre-

sented by measures of indegree and outdegree. Then,

we group these profiles by transition similarity and

find the following groups of longitudinal behaviors.

• I: bidders who keep the same profile and/or

change to other similar profiles, such as group II.

Group I consists of profiles B0 and B5. This group

represents 9.5% of bidding behaviors.

• II: this group presents significant incidence of

bidding profiles from group I. This group changes

to profiles of group III and also present similar

incidence of these profiles. Moreover profiles of

group II migrate much to group IV, besidesreceiv-

ing some bidders who were group IV. These pro-

files are very frequent, representing 44.3% of the

occurrences. It is composed by bidders from B3,

B6, B7, B9, B11, and B13.

• III: this group has bidders that typically migrate

to profiles in groups II and IV. It also receives

an equivalent number of transitions from these

groups, establishing an exchange relation with

them. These profiles represent 10.0% of bidding

behaviors. B1, B8, B10, B12 and B15 belong to

this group.

• IV: this group has profiles that have high inci-

dence (indegree). They tend to keep in behav-

iors from themselves (group IV). Although they

also exchange with behaviors from groups II and

III, their outdegree to these groups is smaller than

their indegree. This group is composed by bid-

ders from B2, B4 and B14. Together they repre-

sent 36.2% of bidding behaviors.

Analyzing these groups and transitions between

them, we identify some temporal trends in bidding

behavior. Group I tends to migrate to II and, with

small frequency, to IV. Group II presents a strong

trend to change to IV and has an exchange relation

EVALUATING LONGITUDINAL ASPECTS OF ONLINE BIDDING BEHAVIOR

427

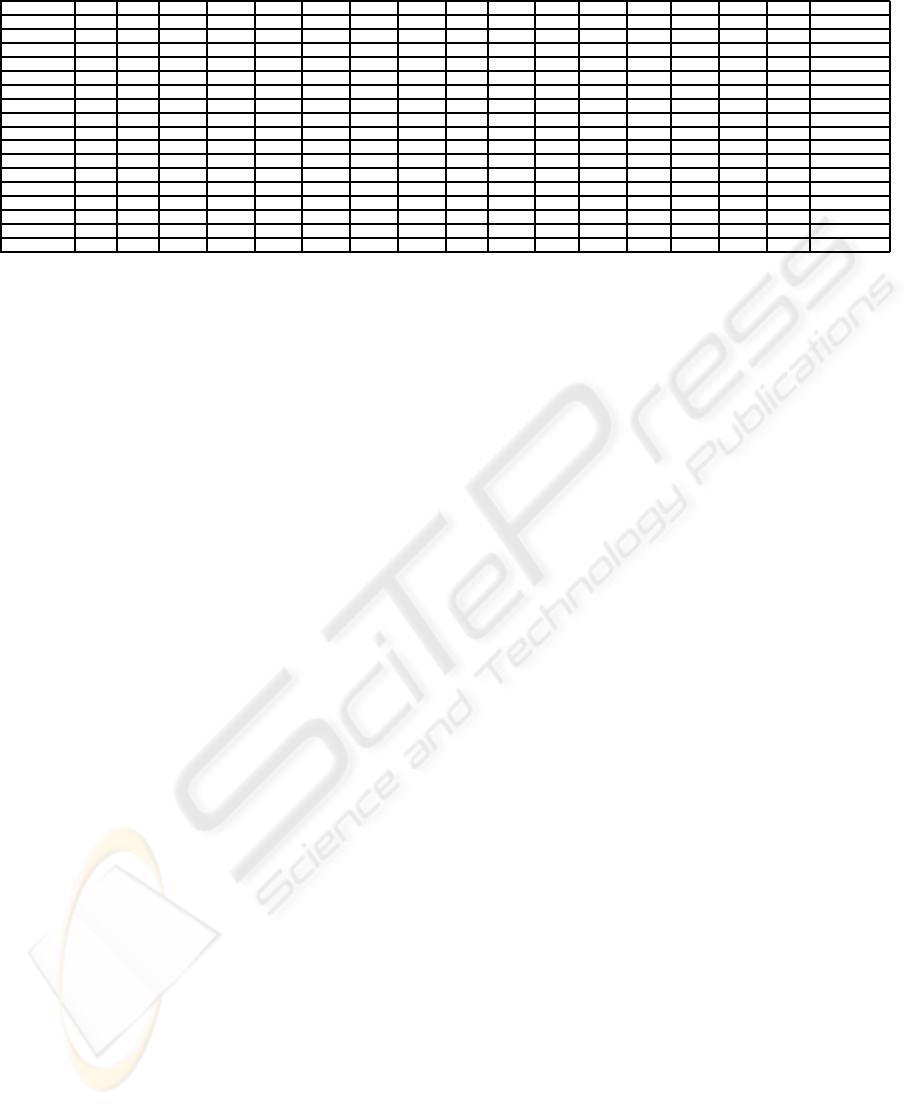

Table 4: Bidding Behavior Profiles - Matrix of Transitions.

From / To B0 B1 B2 B3 B4 B5 B6 B7 B8 B9 B10 B11 B12 B13 B14 B15 OutDegree

B0 114 7 28 78 53 106 53 41 29 43 13 25 12 34 17 11 664

B1 9 16 42 46 79 18 34 22 6 41 11 10 20 52 21 4 431

B2 44 39 516 182 553 46 51 73 17 107 62 101 72 203 322 26 2414

B3 112 37 200 637 358 160 132 235 42 167 75 175 64 300 129 51 2874

B4 84 84 553 373 926 61 146 181 24 196 119 158 142 431 342 82 3902

B5 107 11 34 141 54 266 41 63 40 45 16 34 4 38 50 10 954

B6 56 21 70 141 135 57 108 98 26 115 29 57 38 81 25 19 1076

B7 77 23 79 281 172 122 98 266 28 79 67 81 20 140 46 36 1615

B8 23 4 15 55 24 39 13 21 21 35 5 17 3 15 12 2 304

B9 94 39 138 183 214 70 115 78 18 163 26 71 56 102 45 17 1429

B10 22 13 54 79 116 15 30 62 6 28 55 23 18 80 34 22 657

B11 50 19 86 153 135 89 43 80 24 55 35 121 20 89 90 17 1106

B12 22 18 79 49 116 6 25 16 8 41 17 28 33 79 28 8 573

B13 65 29 243 330 405 47 75 143 20 104 74 112 47 281 148 39 2162

B14 19 6 176 82 250 30 20 32 3 29 17 43 14 75 294 12 1102

B15 11 3 30 51 72 14 22 50 5 19 20 22 9 44 13 16 401

InDegree 909 369 2343 2861 3662 1146 1006 1461 317 1267 641 1078 572 2044 1616 372 21680

with group III. Group II is a very popular group: al-

most all bidders have already belonged to it. Group

III is a group of transient behaviors. Finally, group IV

represents typical end states, since there is a strong

flow into it, mainly from group II. We can conclude

from this analysis that, besides the isolated trends of

each group, there is a typical trend to evolve to bid-

ding behaviors of group D. Moreover, considering the

amount of transitions that come to and leave from

group I (without the reincidences), it can be seen as

an initial state, that often migrate to II. Despite the

differences from groups II and III, both of them are

intermediary states of the typical trend observed in the

analysis.

In order to enrich this analysis, it is important to

investigate the typical characteristics of each group,

using semantic aspects of the negotiation. To do this,

we consider the aspects related to how they act in

the negotiation, that is, the reactivity aspects inher-

ited from the methodology presented in Section 3.3.

An analyze of these semantic aspects of each group is

presented following:

• I: they act during the earliest stages of the auction

(24-33% of duration time). Bidders here have not

participated in the negotiation yet; they are the so-

called non-recurrent bidders. As expected from

the previous characteristics described in section

3, their sessions are typically triggered (76%) and

change winner (65-95%).

• II: they act typically after the middle of the auc-

tion negotiation, (72 to 80% of duration). In gen-

eral, these bidders participate in scenarios with no

competition. Cluster B13 is an exception; its bid-

ders act late (91-93% of duration time) with com-

petition (94%), predominating successive type.

• III: usually act after the middle of the auction ne-

gotiation, close to the end of it (82 to 94% of ne-

gotiation duration). An exception is the cluster B8

that act during all auction. They act typically in

situations with successive competition type. They

represent the rarest bidding behavior profiles.

• IV: bidders who act very late in the auction, close

to 99% of auction negotiation timing. In general,

these bidders act in scenarios with competition

(successive and zigzag types). Most of them are

non-recurrent bidders and change winner.

From these observations, it is possible to identify

similar semantic characteristics for each of these four

groups, which describe some interesting behavioral

changes over time.

As previously explained, group I can be seen as

an initial state. Thus, initially, bidders act during

earliest stages of the auction negotiation and almost

always become the auction winner. However, they

rarely remain winners until the end. Bidders of group

I often migrate to II, an intermediary state of the

observed trend. In group II, bidders change to profiles

of the same group or migrate with high frequency to

IV. Therefore, bidders start to act very close to the

final of auction in scenarios with high competition.

This improves their chances to win the auction, since

they are close to the end. Group II also presents a

exchange relation with III that act close to the end

with successive competition type. However, both

of them are intermediary states of the typical trend,

tending to change to IV. Bidders from group I also

tend to migrate directly to IV with low frequency.

As we can observe in these analysis, there are

some changes in bidding behavior over time. Ini-

tially, bidders tend to act during earliest stages of

the auction negotiation. Later, when they acquire

more experience they start acting close to the end of

auction. This trend sometimes is fast (I migrating

directly to IV), however it usually occurs gradually,

where bidders first pass through intermediary states,

acting in the middle of the auction negotiation. An-

other trend is correlated with competition. Initially,

bidders act in situations without competition, then

in scenarios with successive competition type, and

later with high competition (successive and zigzag

types). This can be explained by the increasing trend

of the bidders to act at the end of the negotiation, thus

increasing the competition at the end of the auction

negotiation.

WEBIST 2008 - International Conference on Web Information Systems and Technologies

428

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(a) Group II - May

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(b) Group II - June

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(c) Group II - July

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(d) Group II - Aug.

Figure 1: Transition Probability Histogram. - Time Scale.

4.2 Time Scale Analysis

We now investigate the second main question pre-

sented in section 1: Are the changes random? Are

there trends? In order to do this, we divide the dataset

in four months: May, June, July and August.

We apply the same approach presented in the last

section to create the bidding behavior matrix for each

period. By analyzing these matrices, we investi-

gate each profile, finding the most frequent transitions

from and to each of them, represented by measures of

indegree and outdegree. We identify the same four

typical groups of bidding behavior presented in last

section and the same trend.

In order to illustrate this trend, we group the pro-

files that belong to the same group and compute the

transition frequency histogram of each group in dif-

ferent periods. Due to lack of space, we presented in

Figure 1 only histograms for group II. As expected,

we can observe the histograms are very similar. This

occurred in the same way for the other groups, that is,

they present the same trend.

We can observe that the bidding behaviorchanges

over time are not random; the trend really exists. We

also observed some additional differences. There are

some bidders that evolve faster while others evolve

more slowly. Others differences occur between pro-

files within the same group, for example, different

number of bids and in some profiles, bidders change

the winner more frequently than others. Our hypoth-

esis is that these differences occur motivated by dif-

ferent negotiation patterns due to the user reactivity to

different environment conditions (auction negotiation

characteristics).

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(a) Group II - A2

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(b) Group II - A3

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(c) Group II - A6

0

0.2

0.4

0.6

0.8

1

IVIIIIII

Transition Probability

Groups

(d) Group II - All Actions

Figure 2: Transition Probability Histogram.

4.3 Reactivity in Behavioral Changes

We now present an analysis to answer the last ques-

tion presented in section 1: Does reactivity affect

these changes over time? In order to do this, we group

the profiles that belong to the same group and com-

pute the transition frequency histogram of each one

of the four groups in different auction negotiation pat-

terns, introduced in section 3.1. The goal is to iden-

tify whether these histograms are similar or not. Due

to lack of space, in Figure 2 we present only the his-

tograms for the auction negotiation patterns A2, A3,

A6 and for all dataset for group II.

As we can observe in Figure 2, the behavioral

trends are different for the auction negotiation pat-

terns. For example, the trend of bidders from A6 is

very similar to the average trend for all dataset. How-

ever, the bidders from A2 and A3 present different

trends. Bidders from A2 tend to migrate to group IV

slower than A3, and many bidders from group II mi-

grate to III. For bidders that act in A3 there is a short

faster to migrate from group II directly to group IV.

In this analysis we consider the behavioral

changes between successive auctions of the same auc-

tion type. However we ignore the auctions of other

categories in which bidders had participated between

these successive auctions. This process is analogous

to sequence mining patterns (Agrawal and Srikant,

1995). That is, given a sequence pattern like I

1

;:::

;I

n

that I

i

is a item, we want to find relevant sub-

sequences in this pattern, without the need to be adja-

cent.

Despite this simplification, our approach is able to

answer the third question, that is, the reactivity affects

the changes over time. For a more accurate evalua-

tion of how reactivity influences the evolution trend

and which factors are more relevant, we need to per-

form a more detailed analysis, which is part of ongo-

ing work.

EVALUATING LONGITUDINAL ASPECTS OF ONLINE BIDDING BEHAVIOR

429

5 CONCLUSIONS

In this work we developed a longitudinal analy-

sis of bidding behavior considering reactivity pat-

terns through bidder-auction interactions. In order

to do this, we first apply a reactivity characterization

methodology for online auctions, presented in recent

research, to identify auction negotiation patterns as

well as bidding behavior in a real case study of an

online auction’s service (eBay).

We then analyze the bidding behavior evolution

over time by considering the sequence of exhibited

bidding behavior by each bidder. We represent these

sequences as a directed graph (Bidding Behavior

Model Graph) in which each bidding behavior pro-

file is a vertex and each transition (that represents a

temporal change in the bidder’s profile) is an edge.

Analyzing this graph we identify some changes

in bidding behavior over time. We observe that ini-

tially bidders tend to act during earlier stages of the

auction negotiation without competition. Later, when

they acquire more experience they start acting close

to the end of the auction with high competition. We

proceeded to divide the longitudinal dataset in differ-

ent periods and apply this same approach on each pe-

riod. We observe the same trend in each sub-period of

the dataset, and conclude that the patterns of changes

are not random. We also apply this approach us-

ing different previously established auction negotia-

tion patterns to demonstrate that the negotiation influ-

ences the evolution of bidder behavior. We are able

to demonstrate that the reactivity patterns that bidders

are subject to during negotiation affect the bidding be-

havior evolution.

The results can be applied to define seller’s strate-

gies, forecasting of economic models, or to design de-

cision support tools for e-commerce, for example.

As future work, we want to conduct a detailed

analysis of how reactivity influences bidding behav-

ior evolution, identifying the main factors that affect

it. Since auctions involve both bidders and sellers,

we also plan to generate insights on how sellers learn

over time.

REFERENCES

Agrawal, R. and Srikant, R. (1995). Mining sequential pat-

terns. In Yu, P. S. and Chen, A. S. P., editors, Eleventh

International Conference on Data Engineering, pages

3–14, Taipei, Taiwan. IEEE Computer Society Press.

Akula, V. and Menasc´e, D. (2007). Two-level workload

characterization of online auctions. Electronic Com-

merce Research and Applications Journal, 6(2):192–

208.

Ariely, D. and Simonson, I. (2003). Buying, bidding, play-

ing, or competing? value assessment and decision dy-

namics in online auctions. Journal of Consumer Psy-

chology, 13(1):113–123.

Auctions, Y. (2003). Yahoo!, Inc. http:// auc-

tions.yahoo.com/.

Bajari, P. and Hortacsu, A. (2003). The winner’s curse,

reserve prices, and endogenous entry: Empirical in-

sights from ebay auctions. RAND Journal of Eco-

nomics, 34(2):329–55.

Bapna, R., Goes, P. B., Gupta, A., and Jin, Y. (2004).

User heterogeneity and its impact on electronic auc-

tion market design: An empirical exploration research

essays. MIS Quarterly, 28(1).

Bock, H.-H. (2002). Data mining tasks and methods - clas-

sification: the goal of classification. pages 254–258.

Brown, K. N., Burke, D. A., Hnich, B., and Tarim, A.

(2005). The trading agent competition as a test prob-

lem for constraint solving under change and uncer-

tainty. In Proc. Workshop on Constraint Solving under

Change and Uncertainty, CP, pages 9–12.

EBay (2007). eBay, Inc. http://www.ebay.com/.

Falkowski, T., Bartelheimer, J., and Spiliopoulou, M.

(2006). Mining and visualizing the evolution of sub-

groups in social networks. In WI ’06: Proceedings

of the 2006 IEEE/WIC/ACMInternational Conference

on Web Intelligence, pages 52–58, Washington, DC,

USA. IEEE Computer Society.

Hartigan, J. (1975). Clustering Algorithms. John Wiley and

Sons, Inc.

Menasc´e, D. and Akula, V. (2003). Towards workload char-

acterization. In Proceedings of the IEEE 6th Annual

Workshop on Workload Characterization (WWC-6),

Austin, Texas, USA. IEEE Computer Society.

Menasc´e, D. A. and Almeida, V. A. F. (2000). Scaling for

E Business: Technologies, Models, Performance, and

Capacity Planning. Prentice Hall PTR, Upper Saddle

River, NJ, USA.

Pereira, A., Rocha, L., ao, F. M., Jr., W. M., and G´oes, P.

(2007a). Characterizing bidding behavior in internet

auctions. In NAEC’07: Proceedings of Networking

and Electronic Commerce Research Conference, Lake

Garda, Italy.

Pereira, A., Rocha, L., ao, F. M., Torres, T., G´oes, P., and

Jr., W. M. (2007b). A hierarchical characterization

model for online auctions. In ICISTM’07: Proceed-

ings of the First International Conference on Infor-

mation Systems, Technology and Management, New

Delhi, INDIA.

Pereira, A., Rocha, L., ao, F. M., Torres, T., Jr., W. M.,

and G´oes, P. (2007c). Analyzing ebay negotiation pat-

terns. In WEBIST’07: Proceedings of the 3rd Inter-

national Conference on Web Information Systems and

Technologies, Barcelona, SPAIN.

Tseng, V. S., Chang, J.-C., and Lin, K. W. (2006). Min-

ing and prediction of temporal navigation patterns for

personalized services in e-commerce. In SAC ’06:

Proceedings of the 2006 ACM symposium on Applied

computing, pages 867–871, New York, NY, USA.

ACM Press.

WEBIST 2008 - International Conference on Web Information Systems and Technologies

430