PAYSTAR: A DENOMINATION FLEXIBLE MICROPAYMENT

SCHEME

Sung-Ming Yen, Hsi-Chung Lin, Yen-Chang Chen

Dept of Computer Science and Information Engineering

National Central University, Chung-Li, Taiwan 320, R.O.C.

Jia-Jun Hung, Jui-Ming Wu

Networks and Multimedia Institute, Institute for Information Industry, Taiwan, R.O.C.

Keywords:

Cryptography, Electronic payment, Micropayment, One-time password, One-way hash chain.

Abstract:

In this paper, a micropayment scheme with flexible coin denomination mintage is proposed. This varying

denomination approach might be more reasonable for most micropayment applications. Furthermore, the

proposed scheme improves extensively the computational performance of both the customer as well as the

merchant. Storage cost of the customer is exactly the same as in the original PayWord micropayment scheme

and is thus applicable to implementations on small portable devices, e.g., smart card.

1 INTRODUCTION

Micropayment schemes have received growing atten-

tion recently, primarily because that these schemes

provide solutions for numerous Internet based appli-

cations. Micropayment schemes allow a customer to

transfer to a merchant a sequence of small amount

payments in exchange for services or electronic prod-

ucts from the merchant. Usually, it is inappropriate

to pay the total amount of money either in advance or

afterwards in some applications, and this makes mi-

cropayment schemes be especially useful. The result

is that efficient and cryptographically strong micro-

payment schemes are highly demanded to provide ac-

ceptable performance and also to solve dispute when

occurred.

For most application scenarios of micropayment,

both the computational cost and the storage cost

should be reduced to maintain acceptable perfor-

mance.

• Computational cost reduction: Since the pay-

ment is small and might be very frequent, this cost

should be reduced. Evidently, the employment of

public key cryptography should be minimized if

possible.

• Storage cost reduction: For most micropayment

applications, huge amount of payment records

might need to take care. Therefore, minimization

on storage cost will be helpful.

Furthermore, administrative cost that includes the

interactions with the trusted third party (usually the

bank) and the frequency of doing withdraw and de-

posit should also be minimized.

Due to the potential applications, many research

results about micropayment schemes design and their

performance enhancement have been published in the

past few years (Glassmann et al., 1995; Rivest and

Shamir, 1997; Jutla and Yung, 1996; Pedersen, 1997;

Stern and Vaudenay, 1998; Yen et al., 1999; Micali

and Rivest, 2002). One large category of micropay-

ment schemes (e.g., the PayWord scheme (Rivest and

Shamir, 1997) by Rivest and Shamir) use one-way

hash chain as the primary cryptographic tool to de-

velop the schemes.

A conventional one-way hash chain is recursively

defined from a secret value by performing a se-

quence of cryptographic hash computations, e.g.,

(SHA-1, 1995). This simple design of linear one-

way hash chain makes the PayWord-like micropay-

ment schemes have their intrinsic disadvantage that

more longer a one-way hash chain will lead to a less

efficient performance of generating a micropayment

coin. Some approaches (Jutla and Yung, 1996; Yen

et al., 1999) had been proposed trying to overcome

the above mentioned disadvantage, however each of

them has its merit and also limitation or even disad-

vantage.

In the conventional PayWord-like schemes and the

modified versions (e.g., (Jutla and Yung, 1996; Yen

387

Yen S., Lin H., Chen Y., Hung J. and Wu J. (2008).

PAYSTAR: A DENOMINATION FLEXIBLE MICROPAYMENT SCHEME.

In Proceedings of the Fourth International Conference on Web Information Systems and Technologies, pages 387-393

DOI: 10.5220/0001521103870393

Copyright

c

SciTePress

et al., 1999)), each coin is defined to be of the same

smallest denomination, but this brings some perfor-

mance overhead for the merchant and also for the cus-

tomer if each payment will be a random times of the

smallest denomination.

Our Contribution. The main contribution of this

paper is that we propose a new micropayment

scheme, called the PayStar scheme, that employs the

proposed merged one-way hash chain and provides

a flexible design of varying denomination. The re-

sult is that average computational cost of generating

each smallest denomination for the customer is re-

duced extensively when compared with the conven-

tional PayWord scheme and the enhanced tree-based

scheme (Yen et al., 1999).

This performance enhancement is important for

micropayment schemes that will be implemented

based on small portable devices with limited resource,

e.g., smart card. Furthermore, the computational cost

of coin validation performed by the merchant is also

reduced extensively on average for most of the cases,

and the cost is basically independent to the amount to

pay.

2 RELATED WORK

Some notations and symbols used in this paper about

a one-way hash chain are given in the following.

Definition 1 When a function h is iteratively applied

r times to an argument v

n

, the result will be denoted

as h

r

(v

n

), that is

h

r

(v

n

) = h(h(···(h

| {z }

r times

(v

n

))··· )).

When the function h() in the iteration is instan-

tiated with a one-way hash function, such as SHA

(SHA-1, 1995), the result is a one-way hash chain as

shown below

v

0

= h

n

(v

n

) ← v

1

= h

n−1

(v

n

) ← · ··

·· · ← v

n−1

= h

1

(v

n

) ← v

n

.

Note that within the chain, each element v

i

is com-

puted as h

n−i

(v

n

).

2.1 Brief Review of the PayWord

Scheme

PayWord is a credit-based micropayment scheme pro-

posed by Rivest and Shamir (Rivest and Shamir,

1997). Prior to the first transaction taking place be-

tween a customer C and a merchant M, the following

preparatory steps need to be carried out.

(1) The customer generates a payword chain as fol-

lows:

v

0

← v

1

← v

2

← ·· · ← v

n−1

← v

n

where v

i

= h(v

i+1

) for i = n − 1,n − 2, ··· ,1,0,

and h() is a cryptographic one-way hash function.

The value v

n

is a secret value selected at random

by the customer.

(2) The customer signs, e.g., using RSA (Rivest et al.,

1978), on the root v

0

, together with the merchant’s

identity and other information:

Sign

C

(Merchant-ID||v

0

||Cert)

where “Cert” used as a proof of credentials is a

digital certificate issued to the customer by the

bank B. The certificate authorizes the customer to

mint his own payword chains. Note that the sig-

nature on (Merchant-ID||v

0

||Cert) acts as a com-

mitment.

(3) The customer then sends

Sign

C

(Merchant-ID||v

0

||Cert),

Merchant-ID, v

0

,Cert

to the merchant.

After completing successfully the above steps be-

tween the customer and the particular merchant, the

number v

i

(i = 1,2,. .., n) can now be used as the ith

coin to be paid. Each coin v

i

in the sequence is pre-

defined to be of one smallest denomination. When re-

ceiving a new coin v

i

from the customer, the merchant

verifies whether v

i−1

?

= h(v

i

). The merchant accepts v

i

as a valid payment only if the verification is success-

ful. Note that the merchant can store a validv

i

in place

of v

i−1

. The above process ensures that a sequence of

small payments can be paid to a specific merchant and

the customer has to perform only one computationally

expensive public key based digital signature which is

for the purpose of commitment.

Suppose v

x

is the previously spent coin and the

customer now needs to spend t times of the smallest

denomination, then the customer computes and sends

v

i

= v

x+t

to the merchant. When receiving v

i

from the

customer, the merchant verifies whether v

x

?

= h

t

(v

i

).

2.2 Micropayment based on

Unbalanced One-way Binary Tree

At the customer’s side, suppose that he only stores the

last coin v

n

, then he has to compute each required new

coin by a sequence of hash function computations. It

is evident that on average each new coin generation

WEBIST 2008 - International Conference on Web Information Systems and Technologies

388

will cost ((n − 1) + (n− 2) + ··· + 1)/n = (n − 1)/2

(or roughly n/2 for large n) hash computations.

In (Yen et al., 1999), the technique of one-way

hash chain was extended into a multi-dimensional

tree-based approach which is called the unbalanced

one-way binary tree (UOBT). An unbalanced one-

way binary tree is essentially a bundle of many one-

way hash chains, with their secret values (called the

seed nodes in PayWord scheme) being tied together

via another separate one-way hash chain.

In the unbalanced one-way binary tree with n

nodes (coins), given the seed value v

n

, each v

i

can

be computed using on average

O

(n

1/2

) hash compu-

tations (Yen et al., 1999). Therefore, the usage of un-

balanced one-way binary tree brings extensive perfor-

mance improvement over the conventional linear one-

way hash chain.

3 THE PROPOSED

DENOMINATION FLEXIBLE

MICROPAYMENT SCHEME

In most applications, each payment request for dif-

ferent purchase might differ from each other. Sup-

pose that each payment is a random amount between

one time to 2

k+1

times of the smallest denomina-

tion (say one cent), and the expected average pay-

ment is roughly 2

k

cents. In the conventional one-

way hash chain and the unbalanced one-way binary

tree designs, each coin v

i

is defined to represent the

smallest denomination. In such fixed denomination

approaches, the merchant needs to perform 2

k

hash

computations to validate the correctness of a payment

with 2

k

cents.

In this section, a new micropayment scheme with

variable denomination is proposed in which the com-

putational cost of payment validation performed by

the merchant is reduced for the average case. Ba-

sically, the computational cost is independent to the

amount being paid.

3.1 Varying Denomination Mintage

Scheme

Each payment will be assigned a denomination be-

tween [1, 2

k+1

]. Suppose the denomination of the

ith payment is D cents and D− 1 be binary encoded

as (d

k

,· ·· ,d

1

,d

0

)

2

. For this payment of D cents, a

merged one-way hash chain will be defined in the fol-

lowing

c

i,k

= h(c

i,k−1

kh(x

i,k

))

← c

i,k−1

=h(c

i,k−2

kh(x

i,k−1

))

← ·· · ← c

i,0

=h(ckh(x

i,0

)) ← c

where x

i, j

(j = k,k− 1,··· ,0) are secret values and c

is a public information. To pay D cents, the sequence

of values below (called the trapdoor sequence) will

be released to the merchant

(h

1−d

k

(x

i,k

),··· ,h

1−d

1

(x

i,1

),h

1−d

0

(x

i,0

))

where h

0

(x

i, j

) = x

i, j

.

The basic idea is to encode the denomination D (a

positiveinteger) into a merged one-wayhash chain. In

the trapdoor sequence, h

1−d

k

(x

i,k

) and h

1−d

0

(x

i,0

) will

be used to encode the most significant bit d

k

and the

least significant bit d

0

of D− 1, respectively. If d

j

= 1

then the secret x

i, j

will be released to the merchant,

otherwise h(x

i, j

) will be released. So, given c, c

i,k

,

and the corresponding trapdoor sequence, a unique

denomination D can be specified by the merged one-

way hash chain.

For example, let k = 2, the denomination of six

cents can be minted by releasing (x

i,2

,h(x

i,1

),x

i,0

).

3.2 PayStar Scheme with Varying

Denomination

Let the payment of each purchase be a random

amount between one cent to 2

k+1

cents with the ex-

pected average payment of (2

k

+

1

2

) cents, and we

wish to prepare a payment token of totally n cents

on average. The proposed PayStar scheme with ℓ =

n/(2

k

+

1

2

) merged one-way hash chains is shown be-

low.

(1) The customer prepares ℓ = n/(2

k

+

1

2

) indepen-

dent merged one-way hash chains all with the

same public information c and each being capable

of encoding denomination between [1,2

k+1

]. All

the last values c

i,k

(i = 1,2,·· · ,ℓ) of all the cor-

responding merged one-way hash chains are com-

puted. Fig. 1 illustrates the construction.

All the secret values x

i, j

of the merged one-way

hash chains can be defined as x

i, j

= h(x,i, j) or

alternatively by using conventional block cipher

x

i, j

= E

x

(i, j) where x is a secret value selected at

random by the customer. So, the customer only

needs to store a secret value, i.e., x.

(2) The customer signs on the merchant’s identity, the

public information c (which can be any constant),

the roots (c

1,k

,· ·· ,c

ℓ,k

) of all the merged one-way

PAYSTAR: A DENOMINATION FLEXIBLE MICROPAYMENT SCHEME

389

c

↓

↓↓

↓

c

1,0

↓

↓↓

↓

c

1,1

↓

↓↓

↓

…

↓

↓↓

↓

c

1,k

c

↓

↓

↓

↓

c

i

,

0

↓

↓

↓

↓

c

i

,

1

↓

↓

↓

↓

↓

↓

↓

↓

c

i

,

k

…

c

↓

↓

↓

↓

c

l

,

0

↓

↓

↓

↓

c

l

,

1

↓

↓

↓

↓

↓

↓

↓

↓

c

l

,

k

…

c

↓

↓

↓

↓

c

2

,

0

↓

↓

↓

↓

c

2

,

1

↓

↓

↓

↓

…

↓

↓

↓

↓

c

2

,

k

c

↓

↓

↓

↓

c

j

,

0

↓

↓

↓

↓

c

j ,

1

↓

↓

↓

↓

↓

↓

↓

↓

c

j

,k

…

c

↓

↓

↓

↓

c

3

,

0

↓

↓

↓

↓

c

3

,

1

↓

↓

↓

↓

…

↓

↓

↓

↓

c

3

,

k

… …

… …

… …

Figure 1: PayStar scheme with varying denomination.

hash chains, an integer parameter k, and the cer-

tificate issued by the bank

Sign

C

(Merchant-IDkck(c

1,k

,· ·· ,c

ℓ,k

)kkkCert)

where k is used to indicate that the denomina-

tion of payment is between [1, 2

k+1

] cents. The

above signature (used as the payment commit-

ment), Merchant-ID, c, (c

1,k

,· ·· ,c

ℓ,k

), k, and Cert

will be sent to the merchant before the first pur-

chase.

The merchant validates the correctness of the pay-

ment commitment and stores the commitment as

well as the following values for further transaction

verification

{c,(c

1,k

,· ·· ,c

ℓ,k

),k}.

(3a) To pay D cents to the merchant as the ith payment,

the customer prepares the corresponding trapdoor

sequence S

(s

k

,· ·· ,s

1

,s

0

)

= (h

1−d

k

(x

i,k

),··· ,h

1−d

1

(x

i,1

),h

1−d

0

(x

i,0

))

of the denomination D where (d

k

,· ·· ,d

1

,d

0

)

2

is

the binary representation of D− 1.

(3b) After receiving the trapdoor sequence S , the mer-

chant verifies the validity of S by computing

c

i,k

?

= h(·· ·h(h(ckh

d

0

(s

0

))kh

d

1

(s

1

))··· kh

d

k

(s

k

))

based on the definition of the merged one-way

hash chain and the stored root c

i,k

. Correct vali-

dation of S confirms the committed denomination

D. In fact, after verifying and storing the trapdoor

sequence S , the root c

i,k

is no longer necessary.

Therefore, a PayStar token is essentially a bundle

of many merged one-way hash chains, with their pub-

lic information c being tied together by selecting a

common value.

To avoid the merchant searching among all the

previously received payment from a specific PayStar

token to detect any possible double spending, the root

c

i,k

of each merged one-way hash chain can be re-

defined as c

i,k

=h(ikc

i,k−1

kh(x

i,k

)).

3.3 Security Analysis of the PayStar

Scheme

In the PayStar scheme, it is impossible for a dishon-

est customer to double spend, as long as the mer-

chant ensures that each merged one-way hash chain

of a PayStar token can only be used once. In prac-

tice, since the customer is forced to spend his merged

one-way hash chains in sequence and the merchant

promptly deletes the root c

i,k

after the i-th payment

is validated, the PayStar scheme is evidently double

spending free.

Similarly, it is impossible for a dishonest merchant

to double encash at the redemption, as long as the

bank ensures that each payment corresponds to a dif-

ferent merged one-way hash chain. It is also impossi-

ble for a dishonest merchant to over encash at the re-

demption since enlarging the denomination of a used

merged one-way hash chain requires the ability of ex-

tracting pre-images of some (at least one) items in

the trapdoor sequence. Clearly, the merchant’s abil-

ity of extracting pre-images contradict the one-way

property of the underlying hash function.

4 PERFORMANCE ANALYSIS

4.1 Computational and Storage Cost

Analysis

We assume that the probability of appearance of de-

nomination D (1 ≤ D ≤ 2

k+1

) for each payment is

the same. So, the expected amount of money (in

cent) that will be embedded in a PayStar token with ℓ

merged one way hash chains is

E = (1+ 2

k+1

)ℓ/2

(roughly ℓ×2

k

for large k). The customer takes on av-

erage 1.5× (k+ 1) hash computations to obtain each

necessary trapdoor sequence. Therefore, to spend

the whole PayStar token, the customer needs totally

1.5× ℓ× (k+ 1) hash computations, and the spending

of each “cent” costs on average

(1.5× ℓ × (k+ 1))/E ≈ (1.5× (k + 1))/2

k

hash computations. Here, we ignore the computa-

tional cost to prepare the PayStar token since this can

WEBIST 2008 - International Conference on Web Information Systems and Technologies

390

be off-line performed. Totally, 3 × ℓ × (k + 1) hash

computations are necessary to prepare the PayStar to-

ken.

Like in the original PayWord scheme and the

UOBT-based micropayment scheme, the customer

needs only to store the secret value x.

For the merchant, after receiving the trapdoor se-

quence representing a committed denomination D,

the related merged one-way hash chain will be em-

ployed to validate the denomination with on aver-

age 1.5 × (k + 1) hash computations. Therefore, for

the whole PayStar token, the merchant needs totally

1.5× ℓ × (k+ 1) hash computations, and the verifica-

tion of each “cent” costs on average

(1.5× ℓ × (k+ 1))/E ≈ (1.5× (k + 1))/2

k

hash computations which is exactly the same cost of

spending each cent by the customer.

Knowledge of the trapdoor sequence (with k + 1

hash values) is sufficient for the committed denom-

ination D, so now the merchant can remove the re-

lated root c

i,k

. If the whole PayStar token is spent,

the merchant needs to store ℓ trapdoor sequences, i.e.,

ℓ × (k + 1) hash values, for all of the committed de-

nominations.

Suppose that ℓ = 100, k = 5, and the bit length of

each hash value is 160, then the expected total amount

of money embedded in the PayStar token is E = 3250

cents and it costs the merchant about 12 kilobytes to

store all of the 100 trapdoor sequences. In this exam-

ple, the amount of money embedded in the PayStar to-

ken is quite sufficient for micropayment applications

and the storage cost remains acceptable and practical.

4.2 Alternative Merged One-way Hash

Chain

An alternative (generalized) merged one-way hash

chain is possible which can be used to improve the

performance of both the customer and the merchant.

Furthermore, this generalized merged one-way hash

chain will reduce the storage cost of the merchant.

To assign a denomination D, let D − 1 be repre-

sented with radix r as (d

k

,· ·· ,d

1

,d

0

)

r

where 0≤ d

i

≤

r − 1. With this design, the denomination can be in

the range 1 ≤ D ≤ r

k+1

. Now, a merged one-way hash

chain will be defined as

c

i,k

= h(c

i,k−1

kh

r−1

(x

i,k

))

← c

i,k−1

=h(c

i,k−2

kh

r−1

(x

i,k−1

))

← ·· · ← c

i,0

=h(ckh

r−1

(x

i,0

)) ← c

and the trapdoor sequence to be released to the mer-

chant becomes

(h

r−1−d

k

(x

i,k

),··· , h

r−1−d

1

(x

i,1

),h

r−1−d

0

(x

i,0

)).

In the trapdoor sequence, h

r−1−d

k

(x

i,k

) and

h

r−1−d

0

(x

i,0

) will be used to encode the most sig-

nificant digit d

k

and the least significant digit d

0

of

D− 1, respectively. Following the same reasoning in

Sect. 4.1, it is clear that the average cost for the cus-

tomer to spend and for the merchant to validate one

cent are both

(

r+ 1

2

× ℓ × (k + 1))/E = (r+ 1)(k+ 1)/(1+ r

k+1

)

hash computations, where E = (1+ r

k+1

)ℓ/2. As for

the storage cost, the customer needs only to store one

secret value and the merchant need to store ℓ trapdoor

sequences, i.e., ℓ × (k + 1) hash values.

Theorem 1 Let each x

i, j

be computed by x

i, j

=

h(x,i, j) with one hash computation. Then, the com-

putationally optimal design of merged one-way hash

chain for any predetermined maximum possible de-

nomination is to select r = 4.

Proof: Let D be the predetermined maximum pos-

sible denomination to be encoded, r the radix, k + 1

the length of the merged one-way hash chain, then

r

k+1

= D . The average number of hash computa-

tions that the customer needs to prepare the trapdoor

sequence is (k + 1) × (r + 1)/2, and this is also the

same amount of computation that the merchant needs

to verify the trapdoor sequence. For a specific radix

r, k+ 1 = log

r

D , so the computational cost becomes

(k+ 1) ×

r+1

2

=

r+1

lnr

×

lnD

2

.

For anypredetermined maximum possible denom-

ination D , to minimize the computational cost is to

minimize

r+1

lnr

and m(r) =

d(

r+1

lnr

)

dr

=

1

lnr

−

r+1

(lnr)

2

r

. We

have m(3.59114) = 0 when r ≥ 2, and the mini-

mum value of

r+1

lnr

(for r ∈ IN and r ≥ 2) becomes

4+1

ln4

= 3.6067375 (see Fig. 2).

The result is that r = 4 for any D is the best selec-

tion in the proposed merged one-way hash chain. ⊓⊔

The result obtained in Theorem 1 shows that the

implementation of the optimized merged one-way

hash chain can be very easy since a representation

with radix of four can be obtained easily from a repre-

sentation with radix of two. With the same example of

Figure 2: The best selection of radix r.

PAYSTAR: A DENOMINATION FLEXIBLE MICROPAYMENT SCHEME

391

ℓ = 100 and 1 ≤ D ≤ 64 (E = 3250) mentioned previ-

ously, the length of each merged one-way hash chain

will be reduced to 3 (k = 2) when the radix r = 4 is

selected. Therefore, the storage cost of the merchant

will be substantially reduced to about 6 kilobytes (i.e.,

50% reduction) and the computational cost will be re-

duced to 83% for both of the customer and the mer-

chant.

In some cases where the denomination D is de-

signed to be in the range [1 ≤ D ≤ r

k+1

− δ] (where

δ is a large positive integer and δ < r

k

), to assign a

denomination D into the merged one-way hash chain,

radix r representation of (D−1+δ) instead of (D−1)

can be used to compute the trapdoor sequence. In

this modified version, the most significant digit d

k

will now usually have a larger value and h

r−1−d

k

(x

i,k

)

will take fewerhash computations. On the other hand,

the merchant will take more hash computations (when

compared with the customer) to verify the received

trapdoor sequence since he needs more hash compu-

tations to obtain c

i,k

. This design is of course reason-

able because the customer might have only a resource

limited portable device, e.g., smart card, but the mer-

chant can be equipped witha powerful computer. This

modified design becomes especially important due to

the result obtained in Theorem 1 that the optimal radix

r is four but not two, so δ might be a large value.

4.3 Comparisons with other Schemes

In this section, comparisons of performance among

the PayWord scheme (Rivest and Shamir, 1997), the

UOBT scheme (Yen et al., 1999), and the proposed

PayStar will be given. It is assumed that the smallest

denomination is one cent and the cost of each pay-

ment is uniformly distributed over the range of [1,t].

On average, each payment costs A =

1+t

2

cents.

Lemma 1 Let n be the length of a conventional one-

way hash chain and each payment costs A cents on

average. Then, in the PayWord scheme, the expected

computational costs for the customer to spend and for

the merchant to validate each cent are (

n

A

− 1)/2 and

one hash computations, respectively.

Proof: The expected total number of hash com-

putations required to be done by the customer dur-

ing the

n

A

payment transactions (an average case) is

T =

∑

n

A

i=1

(i− 1) · A =

n·(

n

A

−1)

2

.

Therefore, the expected computational cost for the

customer to spend each cent is T/n = (

n

A

− 1)/2 hash

computations. Apparently, the computational cost for

the merchant to validate each cent is one hash compu-

tation. ⊓⊔

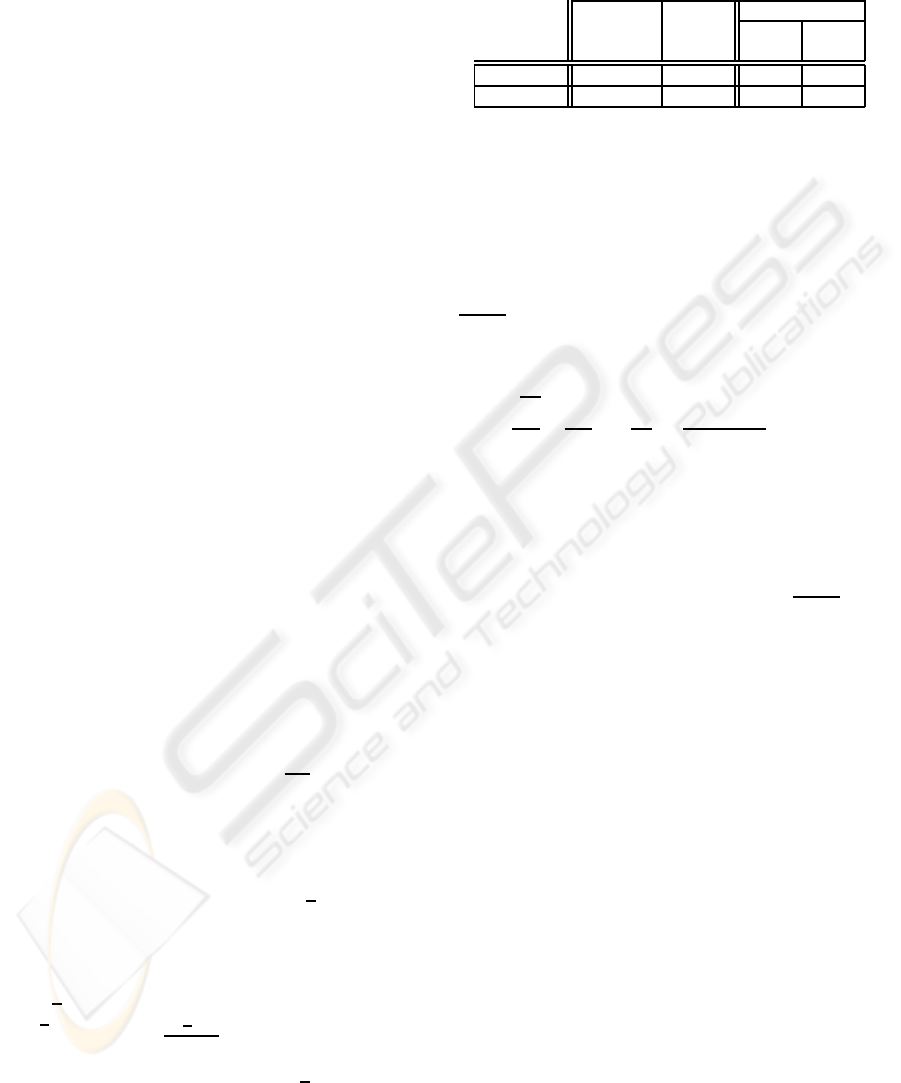

Table 1: Comparison of computational cost per cent among

PayWord, UOBT, and PayStar.

PayStar

PayWord UOBT r = 2 r = 4

k = 5 k = 2

Customer 49.5 1.72 0.28 0.23

Merchant 1 1 0.28 0.23

Lemma 2 Suppose that there are p· q nodes (coins)

in an Unbalanced One-way Binary Tree (i.e., q one-

way hash chains each of length p, with their seeds tied

together via another one-way hash chain of length q)

and each payment costs A cents on average. Then,

the expected computational costs for the customer to

spend and for the merchant to validate each cent are

p+q−2

2A

and one hash computations, respectively.

Proof: The expected total number of hash com-

putations required to be done by the customer dur-

ing the

p·q

A

payment transactions (an average case) is

T =

p−1

2

+

q−1

2

×

p·q

A

=

p·q·(p+q−2)

2A

. In this anal-

ysis, for the sake of simplicity, we do not explicitly

consider the case in which a payment may need to

deliver two hash values from two adjacent one-way

hash chains. However, the above brief estimation re-

flects the usual cases in a UOBT setting.

Therefore, the expected computational cost for the

customer to spend each cent is T/(p·q) =

p+q−2

2A

hash

computations. Apparently, the computational cost for

the merchant to validate each cent is one hash compu-

tation. ⊓⊔

Following the example used in Sect. 4.1, a con-

crete comparison can be made by letting the cost of

each payment be a random value in the range [1, 64]

with the average cost A = 32.5, and the expected to-

tal amount embedded in a payment token be about

3250 cents. So, each payment token can be used

for approximately 100 payment transactions before

being exhausted. Parameters corresponding to the

above scenario are n = 3250 for the PayWord scheme,

p = q = 57 (p×q= 3249) for the UOBT scheme, and

ℓ = 100 for the proposed PayStar. Performance com-

parisons of the expected computational cost (number

of hash computations per cent) among these four pay-

ment schemes with the above setting are summarized

in the Table 1.

Table 1 shows that for the computational perfor-

mance of the customer, the proposed PayStar scheme

is substantially superior to all other schemes; and for

the computational performance of the merchant, the

proposed PayStar scheme is also superior to the Pay-

Word scheme and the UOBT scheme.

WEBIST 2008 - International Conference on Web Information Systems and Technologies

392

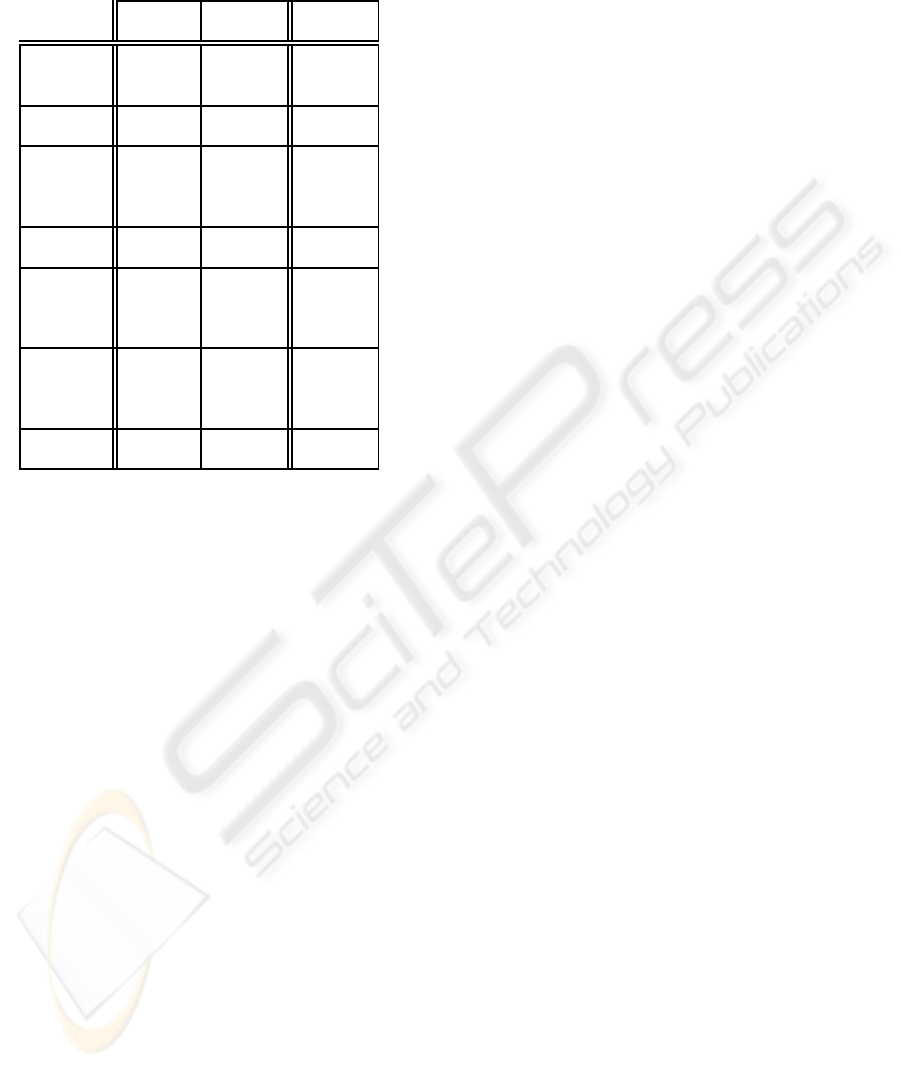

Table 2: Overall comparisons among PayWord, UOBT, and

PayStar.

PayWord UOBT PayStar

unbalanced merged

Building one-way

one-way one-way

block hash chain

binary tree hash chain

Denomi-

nation

fixed fixed flexible

Customer

computation very

cost

inefficient efficient

efficient

(per cent)

Customer

storage cost

very small very small very small

Merchant

computation very

cost

efficient efficient

efficient

(per cent)

Merchant

validation

depend on depend on independent

cost (each

total total to total

transaction)

amount amount amount

Merchant

storage cost

very small very small reasonable

4.4 Further Extension of the PayStar

Scheme

One further extension of the PayStar scheme is pos-

sible by collecting a few groups of merged one-

way hash chains together and each group with their

own predetermined maximum possible denomination.

This design is especially useful when the cost of each

payment might be diverse with large values.

On the other hand, if the PayStar token consists

of a few groups of merged one-way hash chains and

each group with their own predetermined merchant

identity, then a micropayment scheme for multiple

merchants can be readily constructed. One possible

approach of encoding the merchant’s identity into the

merged one-way hash chain is shown below

c

i,k

=h(Merchant-IDkc

i,k−1

kh(x

i,k

)).

5 CONCLUSIONS

The proposed PayStar micropayment scheme with

varying denomination by employing the merged one-

way hash chain performs substantially superior to

both the original PayWord scheme and also the

UOBT-based scheme. Computational performances

of both the customer as well as the merchant have

been enhanced. In the PayStar scheme, storage cost of

the customer is very small which enables the imple-

mentation of the scheme on small portable devices.

Although the merchant suffers from the penalty of

more storage cost, but the overhead is in fact ac-

ceptable according to our analysis on reasonable ex-

amples. Overall comparisons among the PayWord

scheme, the UOBT-based scheme, and the proposed

PayStar scheme are summarized in the Table 2.

ACKNOWLEDGEMENTS

This work was supported in part by Institute for Infor-

mation Industry, R.O.C.

REFERENCES

Glassmann, S., Manasse, M., Abadi, M., Gauthier, P., and

Sobalvarro, P. (1995). The millicent protocol for inex-

pensive electronic commerce. In Proc. of 4th Interna-

tional World Wide Web Conference, pages 603–618.

Jutla, C. and Yung, M. (1996). Paytree: Amortized-

signature for flexible micropayments. In Proc. of 2nd

USENIX Workshop on Electronic Commerce, pages

213–221.

Micali, S. and Rivest, R. (2002). Micropayments revisited.

In Proc. of Cryptographer’s Track at the RSA Confer-

ence, CT-RSA ’02, volume Lecture Notes in Computer

Science 2271, pages 149–163. Springer-Verlag.

Pedersen, T. (1997). Electronic payments of small amounts.

In Proc. of Security Protocols Workshop, volume Lec-

ture Notes in Computer Science 1189, pages 59–68,.

Springer-Verlag.

Rivest, R. and Shamir, A. (1997). Payword and micromint:

Two simple micropayment schemes. In Proc. of

Security Protocols Workshop, volume Lecture Notes

in Computer Science 1189, pages 69–87. Springer-

Verlag. Also in CryptoBytes, Pressed by RSA Lab-

oratories, Vol. 2, No. 1, pp. 7–11, 1996.

Rivest, R., Shamir, A., and Adleman, L. (1978). A method

for obtaining digital signatures and public-key cryp-

tosystem. Commun. of ACM, 21(2):120–126.

SHA-1 (1995). FIPS 180-1, secure hash standard. Technical

report, NIST, US Department of Commerce, Washing-

ton D.C.

Stern, J. and Vaudenay, S. (1998). Svp: A flexible micro-

payment scheme. In Proc. of Financial Cryptography

Conference, FC ’97, volume Lecture Notes in Com-

puter Science 1318, pages 161–172. Springer-Verlag.

Yen, S., Ho, L., and Huang, C. (1999). Internet micro-

payment based on unbalanced one-way binary tree.

In Proc. of International Workshop on Cryptographic

Techniques and E-Commerce, CrypTEC ’99, pages

155–162.

PAYSTAR: A DENOMINATION FLEXIBLE MICROPAYMENT SCHEME

393