A DECISION SUPPORT SYSTEM TAYLORED FOR ROMANIAN

SMALL AND MEDIUM ENTERPRISES

Razvan Petrusel

Faculty of Economical Sciences and Business Management, Babeş-Bolyai University

T. Mihali Street 58-60, 400569, Cluj-Napoca, Romania

Keywords: Decision support system, cash-flow based DSS, financial decisions, business intelligence.

Abstract: This paper presents an overview of a prototype of a real-world decision support system (DSS) that was

developed in order to improve financial decisions in Romanian small and medium enterprises (SME). The

goal of the paper is to show weaknesses in strategic, tactic and operative financial decision making in

Romanian SME and to show how improvement is possible by use of a cash-flow based DSS and several

specialised expert systems. The paper focuses mainly on requirements elicitation and on system validation.

The impact and benefits of using the Information Technology in decision-making processes within the

enterprise are highlighted.

1 INTRODUCTION

Romanian economy is undergoing an almost 20 year

transition from planned-economy in the communist

regime to market economy. One of the consequences

of this process was the creation of millions of small

and medium enterprises (SME) that looked to take

advantage of favourable circumstances. Only a

fraction of those enterprises succeeded to

consolidate their position and even less to grow

(Isaic, 2006). In the new, post European Union

integration market environment, many of the

Romanian small and medium enterprises must

increase economic efficiency or disappear.

In this paper we argue and demonstrate that for a

SME a DSS for financial decisions can be the

critical factor of success. Also, it can change the

whole decision making process by giving the

decisional process a scientifical base rather than an

empirical/intuitive one.

Another objective of this paper is to show how

data generated by the ERP system used by the

enterprise can be transformed and enriched so that it

better fits the needs of the managers. With this

objective we contribute to the Business Intelligence

layer of the enterprise’s information system, as

described by the domain’s literature (Moss, 2003).

This paper is structured as follows. After the

introductory remarks that introduce the objectives of

the paper, the second section briefly presents the

critical elements of the problem domain and the

research approach. The third section starts with the

architecture of the system, then presents some

remarks on the development process. The fourth

section presents the testing and validation of the

system, followed by the section of conclusions.

2 PROBLEM DOMAIN

The main focus of our paper is the real world

application of Information Technology, with support

from Artificial Intelligence. The paper wishes to

present a DSS that was developed for enhancing the

financial decisions of Romanian small and medium

enterprises, that also relies on five expert systems.

There are many different definitions for a DSS as

the ones of Turban, Finlay, Inmon and Holsapple.

The one that perfectly describes our system is

obtained from aggregating the points of view stated

by the authors mentioned above. We developed a

system named CFAssist that addresses decision

making in the financial department of the enterprise,

based on cash-flows. Our DSS implementation uses

both data (supplied by the enterprise information

system) and models (that are stored as decisional

models inside the DSS) in order to aid the decision

maker in semi-structured problems that relate to

financial management of the company. It also offers

the possibility to conduct what-if analyses in order to

208

Petrusel R. (2008).

A DECISION SUPPORT SYSTEM TAYLORED FOR ROMANIAN SMALL AND MEDIUM ENTERPRISES.

In Proceedings of the Tenth International Conference on Enterprise Information Systems - ISAS, pages 208-211

DOI: 10.5220/0001683002080211

Copyright

c

SciTePress

determine which of the decisional alternative

outcomes best fits the needs of the enterprise.

The need for such a system was revealed by

questionnaires and interviews with 46 financial

managers of Romanian small and medium

enterprises in the city of Cluj Napoca. Small and

medium enterprises are extremely important for

national economy since they produce 57% of GDP

and employ 55% of active population (RNSI, 2005).

This was doubled by an on-line questionnaire

(http://econ.ubbcluj.ro/~chestionar) applied to a

sample based on the population of SMEs in

Transylvania region. The sample considered the

distribution of enterprises according to their business

domain. The questionnaire (both on-line and face to

face) tried to determine the current status of

information system usage, the total amount that a

manager will spend on decision support software

and the domains of the enterprise where information

systems are needed. The analysis phase of the

system development is based on the knowledge

elicited by those two means and the former practical

experience of the author. The questionnaire results

showed that:

• 86% of the managers of Romanian SME do not

have any specific enterprise finance training;

• 93% do not understand accounting data and do

not use it in decision making.

• the sole data provided by the accounting

department that is used directly in decision

making is the lists with payables and

receivables. All other data is reported by the

accountant of the enterprise to the manager only

upon request.

Therefore, there is a strong need for a system that

can transform accounting data in more

understandable pieces of knowledge and provide it

directly to the managers on a daily basis and with

minimum effort for them. We approached this need

by creating a system that can extract data from the

ERP and transform it in information that is easy to

understand even for untrained managers. Even more,

we present it in an easy-to-understand format and in

a timely manner.

Another group of questions tried to determine the

financial decisions that require the most of support.

37% of the responders indicated for financing and

business development related issues and 31%

indicated payment and cashing activities. Our

software development process addressed the two

issues through several expert systems.

The third group of questions tried to determine

the critical factors of success for a DSS. The

overwhelming majority of responses (91% ranked it

as number one choice) showed that the essential

factor of success is the easiness of use.

As the overall conclusion, we argue that the

involvement of the user in the development process

creates the premises for a successful DSS for

financial decisions in Romanian SMEs. This is why

our development process was focused on the user

involvement and feedback. Our experimental study

concluded that the main features of a DSS for

Romanian SME financial planning are:

• transform accounting data in easily

understandable information;

• offer assistance in decisions relating to cash

management, financing decisions and business

expansion;

• offer possibility to conduct what-if analyses

and/or analyze different scenarios;

• present information in an concise format and no

more than a couple of clicks away;

• a low acquiring and maintenance cost regarding

the software product.

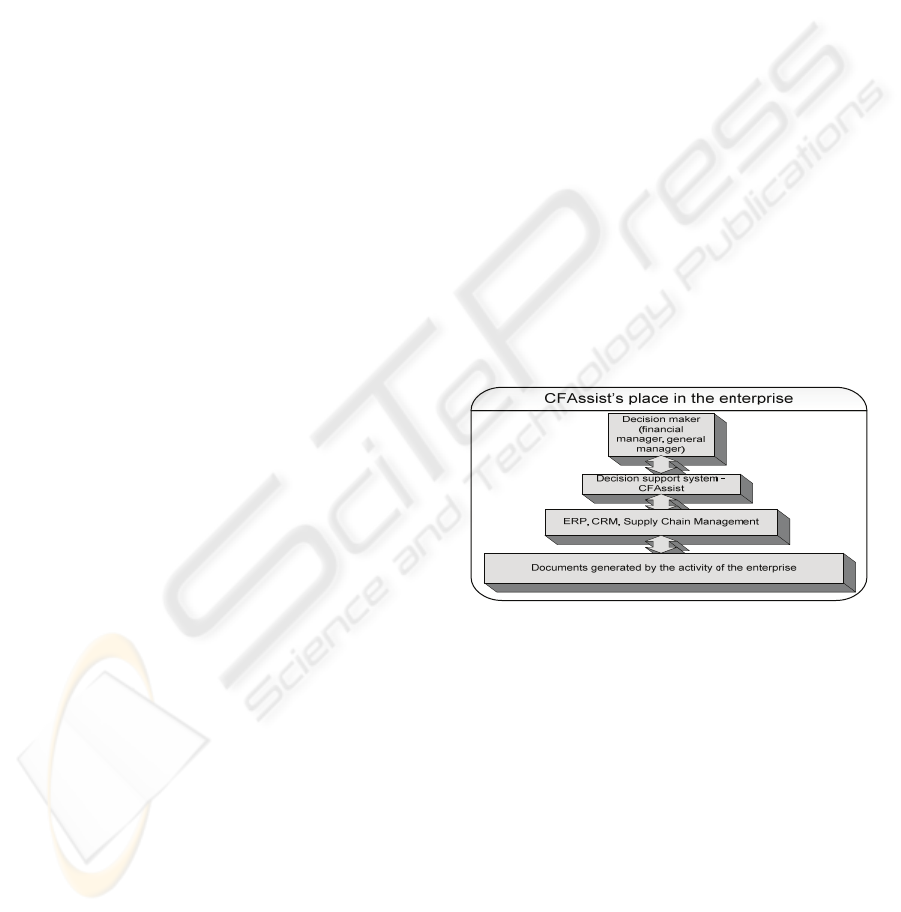

Our system fits the Business Intelligence (BI)

area, viewed as technologies, applications and

practices for the collection, integration, analysis and

presentation of business related information and

knowledge (Moss, 2003). Its position in a SME is:

Figure 1: The position of CFAssist in the environment.

We argue that a possible solution to the lack of

training in enterprise finance is the transformation of

regular accounting data (revenues and expenses) into

cashing and payments. This means the transition of

current accounting data to cash-flows. Cash-flow is

easier to understand. It is also better to evaluate the

enterprise based on cash flows than on net income

(Fernandez, 2006). The cash-flow report is required

as part of the financial statements for large

enterprises. However, the SMEs that we questioned

do not use it. Usually, even large companies hire

experts for drawing it up.

A DECISION SUPPORT SYSTEM TAYLORED FOR ROMANIAN SMALL AND MEDIUM ENTERPRISES

209

3 DEVELOPMENT PROCESS

AND ARCHITECTURE

We aimed to look at different methodologies and

techniques for system development since this is a

research project and not commercial software. The

system development was a mixture between

established or emerging software engineering (SE)

methodologies. The main approach to the software

process was the one recommended by Rational

Unified Process (RUP) because it allows the usage

of abstractions, thus giving the system a higher

degree of generality and modularity. At the same

time we used a rapid prototyping for getting a quick

feedback from the potential users group. Some ideas,

like the feature driven paradigm and permanent

delivery of functional parts of the system, from

Agile software development process were also used.

For object modelling and specification purposes we

used UML artefacts. For model generation and

analyze we used morphological analyze and MTIS.

As additional model representation techniques we

used decision trees, influence diagrams, rules and

occasionally Bayes networks.

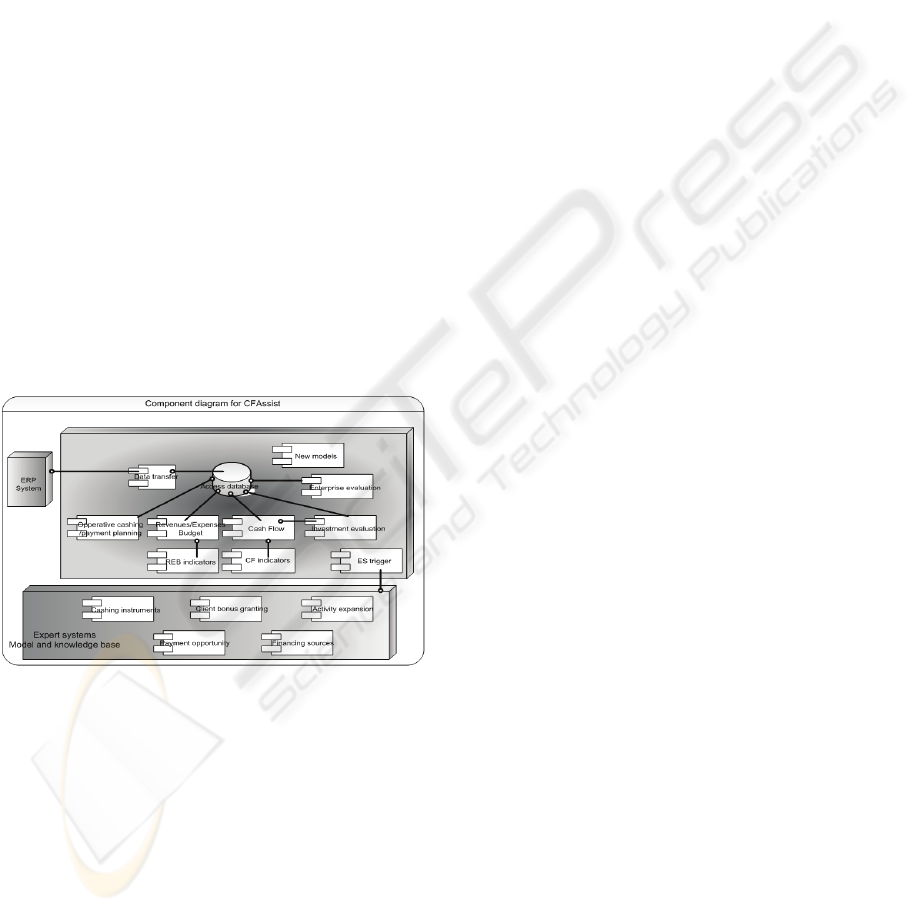

The components of the system are presented in

the following figure:

Figure 2: Architecture of CFAssist prototype.

According to the general use-case created in the

requirements analysis phase the system was divided

into two major sub-systems:

• the data intensive sub-system which extracts

data from the ERP used by the company and

constructs: the cash-flow; the operative cashing

and payments report; and the revenues and

expenses budget;

• the model intensive sub-system that produces

recommendations based on several expert

systems.

The cash-flow, the operational cashing and

payment report and the revenues and expenses

budget (REB) are built based on previous periods

and also include forecasts. As shown in Figure 2, the

cash-flow and REB (both historic and forecast) are

the starting point for enterprise evaluation based on

several selected indicators. This gives the decision

maker an overview of the enterprise and constitutes

the base for comparisons of company’s health over

several periods. For this class of financial decisions

we built two expert systems that give

recommendations to the decision maker regarding

the cashing method for an invoice and regarding the

opportunity of payments at a certain time.

Granting of bonuses for clients and the choice of

the most suited financing sources affects the

finances of the enterprise for a medium period of

time. Two expert systems were implemented

focusing on the above problems.

In what concerns the strategic decisions (that

affect the activity of the enterprise for a period over

five years) the most important one regards the

expansion of the business. The problem is similar for

decisions on increasing production for the current

markets or for expansion to new ones. Actually, the

latter is becoming increasingly important since

Romania joined the EU common market.

Our modelling efforts were directed towards the

decisional process but also towards the creation of

decisional patterns that can be recommended as

“best practice advice” by the system for several

common decisional situations. A modeling

technique we used is morphological analysis. We

employed it with success as a knowledge acquisition

tool because users found it easy to understand and

the scale of the created models could be decreased

by elimination of solution areas containing

incompatible decisional variables (Swemorph,

2002).

Regarding the expert system development we

decided that the knowledge base should be

composed of rules derived after several interviews

with a domain expert. The form of the rules was

ECA (event condition action). This simple approach

allowed us to explain to the users the logic behind

each model and involve them into the knowledge

acquisition process as secondary experts. The

learning and updating of the models are manually

done by the knowledge engineer based on user

detection of the need for a change and on user

inputs.

ICEIS 2008 - International Conference on Enterprise Information Systems

210

4 SYSTEM VALIDATION

CFAssist testing was concerned in the discovery of

conceptual misjudgements regarding the design of

each generation of prototypes. We did not necessary

aimed to find errors (debug the prototype) but tried

to prove that it satisfies the goals that were set in the

requirement phase. Testing was done at several

levels (Copeland, 2003), while keeping in mind that

the developed prototype does not have a target

customer and is not a commercial product.

We used for testing: test cases, test suites and

scenario testing. A test case is defined by IEEE as a

known input and an expected result. There were two

test cases for each requirement, one for positive

testing and one for negative testing, as required by

RUP. Since the development process is centered on

the user we considered usability testing as a major

concern. It aroused some interesting conclusions

like, for example, to remove menus in the prototype

and instead to use only buttons.

We consider implementation to be the final step

of testing, more like beta-testing or user-acceptance

testing. We did not present the prototype to the users

as independent software but we integrated it in an

enterprise simulated environment. CFAssist

addresses the business intelligence level, as shown

in the first section, and cannot function as stand-

alone. This is why, for the implementation effort, we

followed several steps: determine the environment;

determine necessary data; train the users; observe

the user’s reactions; request the user to describe

good and bad parts of the prototype.

5 CONCLUSIONS

This paper tried to briefly present a DSS developed

for financial decisions in Romanian SMEs. We

shortly presented the requirements determination

phase, the architecture and the validation of the

system. We argue that such a system is needed for

financial decisions in SMEs because this kind of

enterprises does not have well trained managers in

financial department and also lack adequate

computer-based systems for decision support. A tool

that can provide easy to understand data and is also

user friendly is essential. Second, success for such a

system can be achieved only if the system is used

regularly in daily decisions. In order to achieve such

a system the user must be involved in all stages of

the development. Involving the user can bring two

advantages: the user will understand the system and

will consider it as a personal project becoming more

attached to it and the user will be able to provide all

necessary data for initial correct and complete

modelling and for future updates of the system. The

architecture of the system must be a dual one, with

data processing components and also with a model

base (several expert systems). The data intensive

part is concerned in transforming hard to understand

accounting data in easy to understand cash flows and

allows what-if analyses. The expert systems give

advice for tactical and strategic decisions. The

development was done using a mixture of

methodologies and techniques, ranging from

traditional to emerging. The result is a knowledge-

based system that can improve enterprise position

and can prevent uninformed and intuitive decisions

regarding the finances of Romanian SMEs.

ACKNOWLEDGEMENTS

This research was founded through Grant type PN2

no. 91-049 / 2007 “Intelligent Systems for Business

Decision Support (SIDE)”.

We would like to acknowledge the valuable advice

of Mr. Cosmin Gheorghe Silaghi.

REFERENCES

Copeland, L., 2003. A Practitioner's Guide to Software

Test Design, Artech House, London.

Drudzel, M.J., Flynn, R.R., 2002. Decision Support

Systems, Encyclopedia of Library and Information

Science, Allen Kent, New York, 2

nd

edition.

Fernandez, P., 2006, Cash flow is cash and is a fact. Net

income is just an opinion,

http://www.iese.edu/research/pdfs/DI-0629-E.pdf;

Isaic-Maniu, A., Nicolescu, O., Isaic, I., 2006. Cartea

albă a IMM-urilor din România, Arvin Press,

Bucharest, 4

th

edition.

Moss L.T., Atre S, Business Intelligence Roadmap: The

Complete Project Lifecycle for Decision-Support

Applications, Addison Wesley Professional, Boston

MA.

Romanian National Statistics Institute

http://www.insse.ro/anuar_2005/zip_r2005/cap7-

rezult.pdf

http://www.swemorph.com/pdf/it-webart.pdf , 2002.

A DECISION SUPPORT SYSTEM TAYLORED FOR ROMANIAN SMALL AND MEDIUM ENTERPRISES

211