NEGOTIATION SUPPORTED THROUGH RISK ASSESSMENT

Sérgio Assis Rodrigues

1

, Jano Moreira de Souza

1,2

1

COPPE/UFRJ – Graduate School of Computer Science, Federal University of Rio de Janeiro, Brazil

2

DCC/IM – Institute of Mathematics, Federal University of Rio de Janeiro, Brazil

Melise de Paula

3

3

Department of Exact Sciences, Federal University of Alfenas, Brazil

Keywords: Negotiation, Risk Management, Project Management, Decision Tree, e-negotiation support.

Abstract: In organizations, decision-making processes usually require great effort in solving conflicts. These

disagreements are generally time-consuming and jeopardize negotiations. Thus, negotiation planning is the

key factor to balance negotiator’s expectations and reach an agreement. In this scenario, risk management

tools play an important role in identifying possibly controversial points of view. This paper aims at

presenting software which supports negotiation through risk assessment. The proposed software, named

RisNeg presents mechanisms which are able to identify, analyze, respond to, monitor, and control

negotiation risks. RisNeg also provides mechanisms to indicate the chances of achieving agreement.

Therefore, the use of such software may minimize the conflicts in the decision-making process.

1 INTRODUCTION

The globalization process has brought profound

transformations for the organizations. This new

environment has been characterized by uncertainty,

competition, gradually shorter project life cycles, as

well as superior requirements for quality, cost

reduction, and resources.

This scenario significantly influences the

organization processes and social relations. It is also

possible to observe large transformations in some

corporative strategies. These strategies have been

analyzed through the lenses of negotiation,

attempting to legitimize the agreements and to

manage conflicts thoroughly, which has varied the

platforms considered for the preparation of the

negotiation.

Negotiation can be defined as a decision-making

process involving two or more parts that cannot take

decisions independently (Kersten, 2002). As all

decision-making processes, negotiation is directly

related to risk assessment and can be more

productive if risks are considered not only as threats,

but also as opportunities.

Thus, the correct management of risks makes it

possible to lead a negotiation in a structured and pro-

active way, introducing strategies that may prevent,

control, and mitigate the risks that can lead to

negotiation failure. However, many organizations

are still developing their strategies and projects

without using risk management in their negotiations.

In this context, this article aims at presenting a

proposal of a negotiation management strategy

through the use of risk management methodologies.

2 RISK IN NEGOTIATIONS

Although the perception of risk in some negotiations

is more significant, risk is an element found in all

negotiations, no matter their nature (Bartlett, 2004).

Schneider (2007) states that the difference

between risk and uncertainty is how much

knowledge on a particular fact one has. In a

negotiation, it is difficult to know precisely the

entire context, mainly in relation to the background

of the other party (or parties) involved.

In Duzert, Paula and Souza (2006), the authors

present some indicators to evaluate the negotiation.

For them, risk is an element that can be considered

through the evaluation of the parties involved and

488

Assis Rodrigues S., Moreira de Souza J. and de Paula M. (2008).

NEGOTIATION SUPPORTED THROUGH RISK ASSESSMENT.

In Proceedings of the Tenth International Conference on Enterprise Information Systems - AIDSS, pages 488-491

DOI: 10.5220/0001697804880491

Copyright

c

SciTePress

must be analyzed taking into consideration the

different perceptions and reactions to them.

According to Bernstein (1997), any decision

related with risk involves two elements that are non-

separable but distinct in their nature: the objective

facts and the subjective vision of what will be lost or

gained with the decision. As in a negotiation, the

objective facts and the subjective vision of risks can

be perceived in different forms by the parties

involved.

However, it is necessary to approach a strategy

to facilitate this subjective vision of the risk or to

approach, at maximum potential, the perception of

the risk in the real scenario. In this context, the use

of a systemizing process of risk management in the

negotiations can be considered.

As claimed by Ward & Chapman (1994), risk

management can be understood as the use of human,

material, financial and technological resources in a

preventive way to try to reduce potential threats and

to intensify the probability of opportunities.

In this article, PMBOK (2004) was used as a

reference because it contains a significant set of

phases and tools to support risk management in

project’s environment: Risk Identification, Risk

Analysis, Response Plan and Monitoring & Control.

Risk identification involves the activities that try

to identify, organize, and classify the risks. Risk

identification must be an iterative process because

new risks can be identified at any time. Once

identified, risks need to be evaluated, with the

prioritizing of key risk elements for future attention

and action (PMBOK, 2004). This involves the

activities of qualitative and quantitative analysis for

each risk identified.

Quantitative analysis uses mathematical models

to simulate and prioritize risks according to their

probability of impact, while qualitative analysis

evaluates, through numerical data and probability,

the eventual consequences each risk poses.

According to Grinstein (2003), risk

quantification can give the negotiator a general view

of the situation in relation to negotiation risks, which

are prioritized according to their impacts and

probability of occurrence. In addition, costs and

duration values may be established and, in this stage,

the list of risks is again brought up to date to have all

main negotiation threats and opportunities well

prioritized.

Strategy development is the stage where the

mapping of the strategies and actions to increase the

opportunities and reduce threats take place, through

appropriate answers for both. The reactions to

threats could be: hindering, transferring or reducing

the threats while responding to the opportunities

could be: exploring, sharing or developing the

chances to make their occurrence possible (Hillson,

2007).

The Monitoring and Control step attempts to

guarantee that the risk management plan is followed

and sets the risks under control. It must be a

continuous and iterative process.

Derived from these steps, a software prototype

was developed to manage risks in negotiations.

3 RISNEG – A SYSTEM TO

MANAGE RISK IN

NEGOTIATIONS

In this paper, the goal of computational proposal is

to present a tool to make the management of

negotiation risks easier. Based on the survey of

potential risks, the proposed software will suggest

some metrics parameters to evaluate major threats

and opportunities as well as the reactions priority for

each risk.

3.1 Identifying Threats and

Opportunities

Identification is the first step in risk management. In

RisNeg, two types of risk can be stored: threats and

opportunities. Threats are incidents which impair

the negotiation, while Opportunities are events

which dig up unexpected gains. The analysis of

these risks, if there is any, takes their possible causes

and effects into consideration.

As a quantification measurement, the negotiator

needs to indicate the probability and the impact for

all stored risk elements. Based on this data, the

system calculates the Expected Value (EV),

calculated through the multiplication of probability

by impact (EV = probability x impact).

Probability and impact measurement are specific

points which can generate disagreements because it

is difficult to guess a value without enough

experience. However, through accumulating

negotiations, the history on stored data may

gradually minimize the risk for normalized values.

Hence, even if EV seems to display less precision at

first sight, the values indicated are essential for

future metric comparisons.

As Constantino (2006) says, tools such as the

Monte Carlo Analysis can also assist in this

measurement, especially if there are inconsistencies

found in the first estimates.

NEGOTIATION SUPPORTED THROUGH RISK ASSESSMENT

489

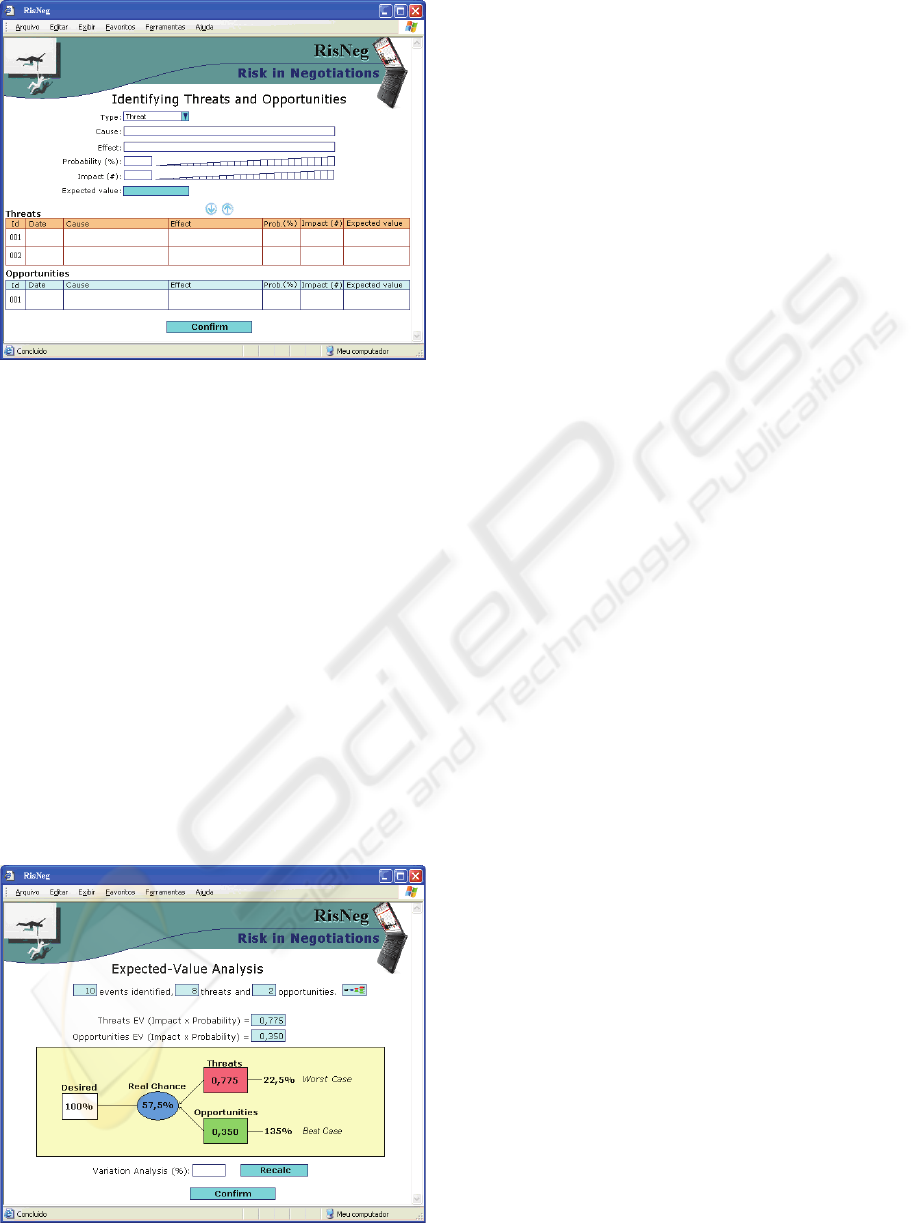

Figure 1: Identifying Threats and Opportunities.

As shown in Figure 1, the fields for Probability

and Impact can be set either manually or by clicking

in the gauge graphs near each field. In this case,

even an inexperienced negotiator may have the

graphical perception of impact and possible

probability sizes.

Once these values are defined, the EV for each

registered risk is calculated. After identification, the

main risks make up the initial EV visualization.

3.2 Initial Expected Value

After the initial risk identification, RisNeg

consolidates the identified events, separating them

into threats and opportunities. As shown in Figure

2, the software presents a diagram containing the

threats and probabilities that may influence the real

agreement possibility. These values represent a sum

regardless of the risk reactions.

Figure 2: Expected-Value Analysis.

After the threats and opportunities Expected

Values (EV Threats and EV Opportunities) are

calculated, the system can show the Initial Real

Chance and the Best and Worst Case Values.

This summary allows the negotiator to visualize

the quantified impacts. Then, the negotiator will be

able to prepare the negotiation strategy. At first, the

RisNeg allows recalculations through the “Variation

Analysis” field which guarantees high flexibility for

the measured data.

Figure 2 illustrates a summarized analysis

considering the threats and opportunities Expected

Values. Based on the graph, the negotiator can

study the real chances of agreement, the threat and

opportunity effects, and the worst and best

negotiation cases.

It is important to observe that the software still

allows many risk measurement identification rounds.

In each round, the Expected Value is assessed and,

the more rounds there are, the more accurate the

negotiation Expected Value is. In this case, the

software user must indicate the relevance (between 0

and 100) for each round and the software will

calculate the agreement probability according to

previous negotiation rounds.

3.3 Responses

After risk identification and expected value analysis,

for each proposal reaction, the negotiator can

measure the reaction qualitative cost (concession)

and the new probabilities and impacts.

For the threats, there are two types of response:

i) prevention, where the negotiator tries to mitigate

or eliminate the risk and ii) contingency, which

represents the response to be implemented if the risk

event occurs.

Opportunities deserve two types of action: i)

search, in which the negotiator will attempt to

maximize the likelihood of opportunity and ii)

during the opportunity, which corresponds to the

actions taken if the opportunity occurs.

Once action and reaction to risks have been

planned and executed, threat risks tend to decrease

and opportunity risks tend to increase. This enables

the updating of the EV Real Chance. This analysis is

important because the negotiator can verify if the

action / reaction contingencies are close to or over

the risk expected value.

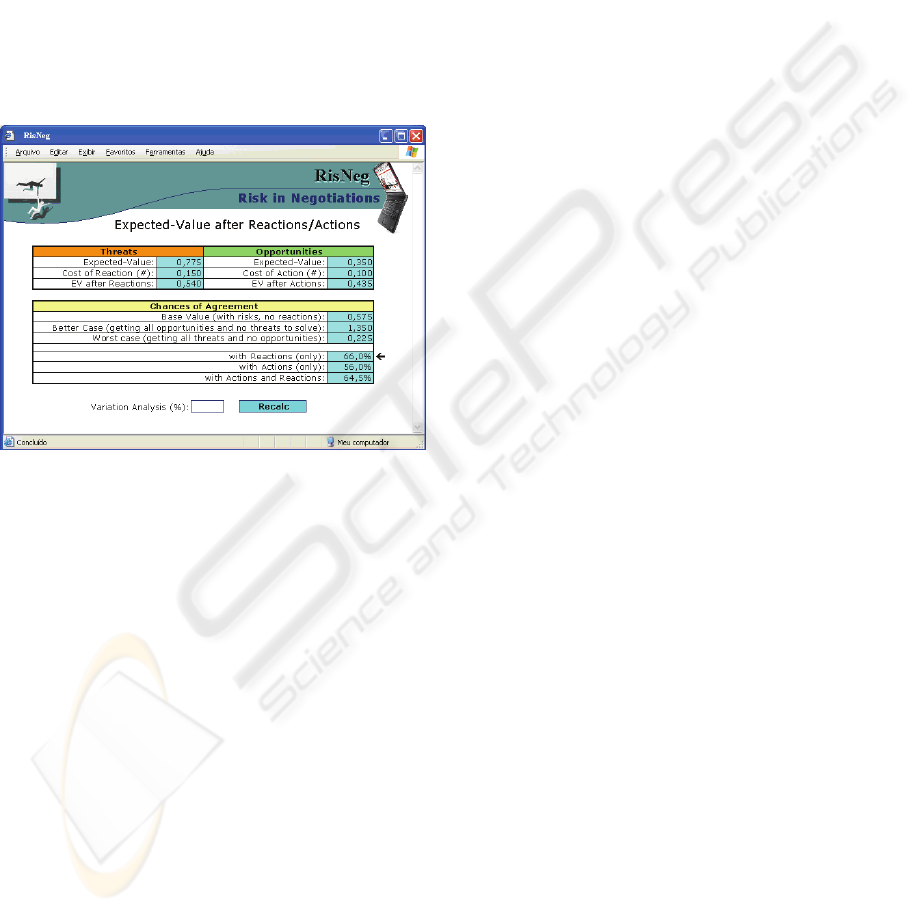

3.4 Post-Reaction Expected Value

Figure 3 shows an overview of the calculated

expected values, considering the new impacts after

ICEIS 2008 - International Conference on Enterprise Information Systems

490

the risk actions and reaction. Moreover, the RisNeg

presents the EV variations in relation to negotiation

strategies such as assuming positive and negative

risks; responding only to threats; assuming the threat

from risks and executing actions to search for

opportunities; and disregarding actions and

reactions.

Thus, the RisNeg calculates the likelihood for

agreement. Figure 3 shows an example of the best

agreement chance that happened when the negotiator

neglected actions to increase opportunities while

reacting strongly to threats, reducing their impact.

This signals that the negotiator is using his

concessions only to mitigate the threats and he does

not want to jeopardize grants based on opportunities.

Figure 3: Information after reactions and actions.

Based on this analysis, it is possible to reserve

contingency concessions for the negotiation. It is

important to note that the success of these initiatives

is directly proportional to the capacity of the

negotiator in quantifying and evaluating his

expectations and goals. Furthermore, the negotiator

should be able to observe and quantify the most

important items according to the counterpart’s point

of view.

4 CONCLUSIONS

Negotiations, in general, are subject to various types

of risks. As previously discussed, a risk can be

negative or positive and should be identified during

the negotiation preparation due to the necessity of

having an actual view of the negotiation context.

This work aims at addressing the negotiation

through the prism of project management in an

attempt to develop a strategy to facilitate negotiation

risk identification and quantification, inferring

suggested probabilities and impacts.

Although it seems to be difficult for many

people to quantify the attributes of negotiation,

quantification is a key factor to identify what

priority in the negotiation is. The proposed system

would easily accept the allocation of values from

simulation tools such as Monte Carlo. A further

alternative would be to use monetary values, which

can be very intuitive since most negotiations have

financial aspects.

Thus, at the end of the risk identification and

response process, the negotiator will be closer to the

strategic objectives to be achieved, which

significantly increases the chances of success.

As an example of the evolution of the tool, the

goal is to examine other approaches to supplement

the RisNeg software, such as the inference of

Knowledge Management and Data Warehousing to

observe the negotiation and risk background.

Furthermore, the expectation is that the tool can

automatically suggest adjustments in the probability

and impact parameters as well as present the list of

successful reactions.

REFERENCES

Bartlett, J., 2004. Project Risk Analysis and Management

Guide, Apm Publishing Ltd., page 186.

Bernstein, P. L., 1996. Against the Gods: The Remarkable

Story of Risk. Wiley & Sons Inc., New York, USA.

Constantino, M., 2006. Computational Finance and its

Applications II, Transaction: Modelling and

Simulation volume 43. Royal Bank of Scotland

Financial Markets, UK and C.A. BREBBIA, Wessex

Institute of Technology, UK.

Duzert, Y., Paula, M.M.V., Souza, J.M., 2006. Case study

on complex negotiation analysis, Technical Report,

Computer and System Engineering Program. UFRJ.

Grinstein, M., 2003. Technical Risk´s Management

Process applied to Civil Engineering and Viability,

Fundação Getúlio Vargas – FGV. Rio de Janeiro.

Hillson, D., 2007. Managing Project Risks. World PM

Magazine. Rio de Janeiro.

Kersten, G. E., 2002. The Science and Engineering of E-

negotiation: Review of the Emerging Field, InterNeg,

Ottawa, INR 05/2002.

PMBOK, 2004. Project Management Body of Knowledge,

2004 Edition. Project Management Institute.

Schneider, C., 2007. Risk Analysis in IT Projects, Rio

Grande do Sul Federal University, Brazil.

Ward, S., Chapman, C., 1994. Transforming Project Risk

Management into Project Uncertainty Management,

International Journal of Project Management.

NEGOTIATION SUPPORTED THROUGH RISK ASSESSMENT

491