A DATA MINING METHOD BASED ON THE VARIABILITY OF THE

CUSTOMER CONSUMPTION

A Special Application on Electric Utility Companies

F

´

elix Biscarri, Ignacio Monedero, Carlos Le

´

on, Ju

´

an I. Guerrero

Department of Electronic Technology, University of Seville, C/ Virgen de Africa, 7, 41011 Sevilla, Spain

Jes

´

us Biscarri, Roc

´

ıo Mill

´

an

ENDESA Distribuci

´

on, Avda. de la Borbolla, S/N, 41092 Sevilla, Spain

Keywords:

Data mining, power utilities.

Abstract:

This paper describes a method proposed in order to recover electrical energy (lost by abnormality or fraud)

by means of a data mining analysis based in outliers detection. It provides a general methodology to obtain a

list of abnormal users using only the general customer databases as input. The hole input information needed

is taken exclusively from the general customers’ database. The data mining method has been successfully

applied to detect abnormalities and fraudulencies in customer consumption. We provide a real study and we

include a number of abnormal pattern examples.

1 THE NATURE OF ELECTRICAL

UTILITY ANOMALIES

Acording to electrical utilities, a non-technical loss

is defined as any consumed energy or service which

is not billed because of measuring equipment fail-

ure or ill-intentioned and fraudulent manipulation of

said equipment. Therefore, detection of non-technical

losses includes detection of fraudulent users. (Art

´

ıs

et al., 1999)

All our data are drawn from Endesa databases,

with permission. Particularly, data in this paper is

based on two representative customer sectors: private

customers and lodging sector customers. We have se-

lected two samples from two activity sectors with a

historically high rate of non-technical losses, frauds

and anomalies, and with very different consumption

habits, in order to try to prove the mining method.

2 THE STATISTICAL APPROACH

TO OUTLIERS DETECTION

Very often, there exists data objects that do not com-

ply with the general behavior of the data. Such data

objects, which are grossly different from or inconsis-

tent with the remaining data, are called outliers.

Data mining is being applied to multiple fields

and detection of non-technical looses is one field in

which it has met with recent success (Kou et al., 2004)

(Daskalaki et al., 2003) (Editorial, 2006). Consider-

able progress has been made in identifying fraud by

mining methods (Kirkos et al., 2007) (Wheeler and

Aitken, 2000). The method proposed in this paper

is based in outliers’ detection and provides a general

methodology to obtain a list of abnormal users us-

ing only the general customer databases as input. It

has been successfully applied to detect inconsisten-

cies and fraudulencies in customer energy consump-

tion.

Outliers can be caused by measurement error or

by fraud in customer consumption. But, alternatively,

outliers may be the result of inherent data variability.

Thus, outliers detection and analysis is an interesting

data mining task, referred to as outliers mining.

The advantages of the proposed algorithm with re-

spect to the existing technology is:

• The elimination (or, at least, reduction) of the tem-

porary component and the local geographical lo-

cation component of the customer consumption.

Outliers can be caused by measurement errors, not

by the inherent data variability.

• The study of the comparative consumption among

clients of similar characteristics. This method

370

Biscarri F., Monedero I., León C., I. Guerrero J., Biscarri J. and Millán R. (2008).

A DATA MINING METHOD BASED ON THE VARIABILITY OF THE CUSTOMER CONSUMPTION - A Special Application on Electric Utility Companies.

In Proceedings of the Tenth International Conference on Enterprise Information Systems - AIDSS, pages 370-374

DOI: 10.5220/0001721103700374

Copyright

c

SciTePress

is based on the observation that fraudsters sel-

dom change their consumption habits (Art

´

ıs et al.,

2000). They are closely linked to other fraudsters,

but not to the rest of customers.

• Classification methods are particularly useful

when a database contains examples that can be

used as the basic for future decision making (su-

pervised methods). Thus, researchers have fo-

cused on different types of classification algo-

rithms, including nearest neighbor (He et al.,

1997), (He et al., 1999), decision tree induc-

tion, error back propagation (Brokett et al., 1998),

(Brause et al., 1999), reinforcement learning and

rule learning. The data mining based in outlier

detection method presented is an unsupervised

method. This doesn’t require one to be confident

about the true classes of the original data used to

built the models. It can be used to detect frauds

or errors of a type which not have previously oc-

curred.

• The use of a simple tool, developed for mining

very large data set.

The statistical approach to outliers’ detection as-

sumes a distribution or probability model for the

given data set and then identifies outliers with re-

spect to the model using a discordance test (Barao

and Tawn, 1999), (Cabral et al., 2004). Application

of the test requires knowledge of the data set param-

eters (such as the assumed data distribution), knowl-

edge of the distribution parameters (such as the mean

and variance) and, mainly, knowledge of the inherent

data variability (Kantardzic, 1991).

3 DATA DISTRIBUTION

We have selected a sample of homogeneous data

(utility customers with similar characteristics: private

clients, that live in the same city, with similar eco-

nomic levels,...) and we have normalized this sam-

ple (we have ’eliminated’ the temporary and the lo-

cal components of the individual consumption). After

this process, we considered the probability distribu-

tion of the transformed sample, for the normal operat-

ing condition, as gausian. We calculated and adjusted

the threshold of the sample variance and, finally, we

used outliers to guide the inspections. The mining

process is described subsequently:

Figure 1: Selected sample of data for 105 private customers.

3.1 Data Preprocessing and

Discretization

Large real-world databases are incomplete, noisy

(containing errors) and inconsistent (containing data

of clients of not comparable electric consumption)

We have selected a complete (6 bimonthly bills

per year), unnoised (without errors) and consistent

(clients are ’similar’) data set. Figure 1 shows bi-

monthly electric consumption (Kwh vs. private cus-

tomers) of the selected sample. The showed tempo-

rary and local components of data must be eliminated

or highly reduced.

The data set description is the following:

105 private clients (not business). Living in the

same city (Specific geographical location: Utrera,

Seville, Spanish town). With the same power contract

(4 Kw). With the same yearly electric consumption:

between 0 and 5000 Kwh. Only one year, 6 bimonthly

bills per year.

The sample, in order to detect outliers, only con-

siders customer identification and 6 bimonthly bills.

Data format is:

Customer

identifier; bill 1; bill 2; bill 3; bill 4;

bill 5; bill 6

3.2 Data Transformation

This technique assumes there are no interactions

present between time and space. The temporary com-

ponent and the local geographical location component

must be eliminated.

1. Given

• A Data at a set of spatial locations (different

clients).

• Several data acquisitions of the data at each lo-

cation but spaced in time. It is assumed that all

A DATA MINING METHOD BASED ON THE VARIABILITY OF THE CUSTOMER CONSUMPTION - A Special

Application on Electric Utility Companies

371

the locations are sampled at the same time and

are sampled many times.

2. The operating equation is defined as follows: Data

acquired = D

lt

, where D is the actual data point

measurement, l is the location of the measurement

(number of client) and t is the time of the mea-

surement (this is the time at which all the data are

recorded at all locations).

3. The next step is to obtain the average at each time

across all locations. This is defined by the equa-

tion A

t

=

N

∑

l=1

D

lt

N

where A

t

is the average of all data

at time t, across all locations, l, and N is the num-

ber of locations.

4. It can now be observed, by considering the aver-

ages and their times, whether or not there is an

effect on change in time. This is something that

cannot be seen during an analysis of variance, but

which can be seen here.

5. Next, obtain the differences by comparing the data

at each location to the average at that time, that is:

δ

lt

= D

lt

− A

t

. where δ

lt

= the difference between

the data at each location, l, and this time, t, aver-

age.

6. Now it is necessary to obtain the average of the

differences,

¯

δ

l

, at each location across time, that

is:

¯

δ

l

=

M

∑

t=1

δ

lt

M

where

¯

δ

l

= the average of all δ

l

t at location, l,

across time, t, and M is the number of times aver-

aged.

7. It is then necessary to obtain the differences, ∆,

comparing each time difference, δ

lt

, to its average

at location, l, as shown in equation: ∆

lt

= δ

lt

−

¯

δ

l

Note that the δ

lt

values are the residual electrical

consumptions after the linear variations in time

and space averaged out.

4 DISTRIBUTION PARAMETERS

The next step is to calculate the standard deviation

associate with each customer with regard to the rest

of customers, ST D

∆

l

(l=1,· · · ,105; M=6), using equa-

tion:

ST D

∆

l

=

s

M

∑

t=1

∆

lt

−

¯

∆

l

M − 1

Where

¯

∆

l

=

M

∑

t=1

∆

lt

M

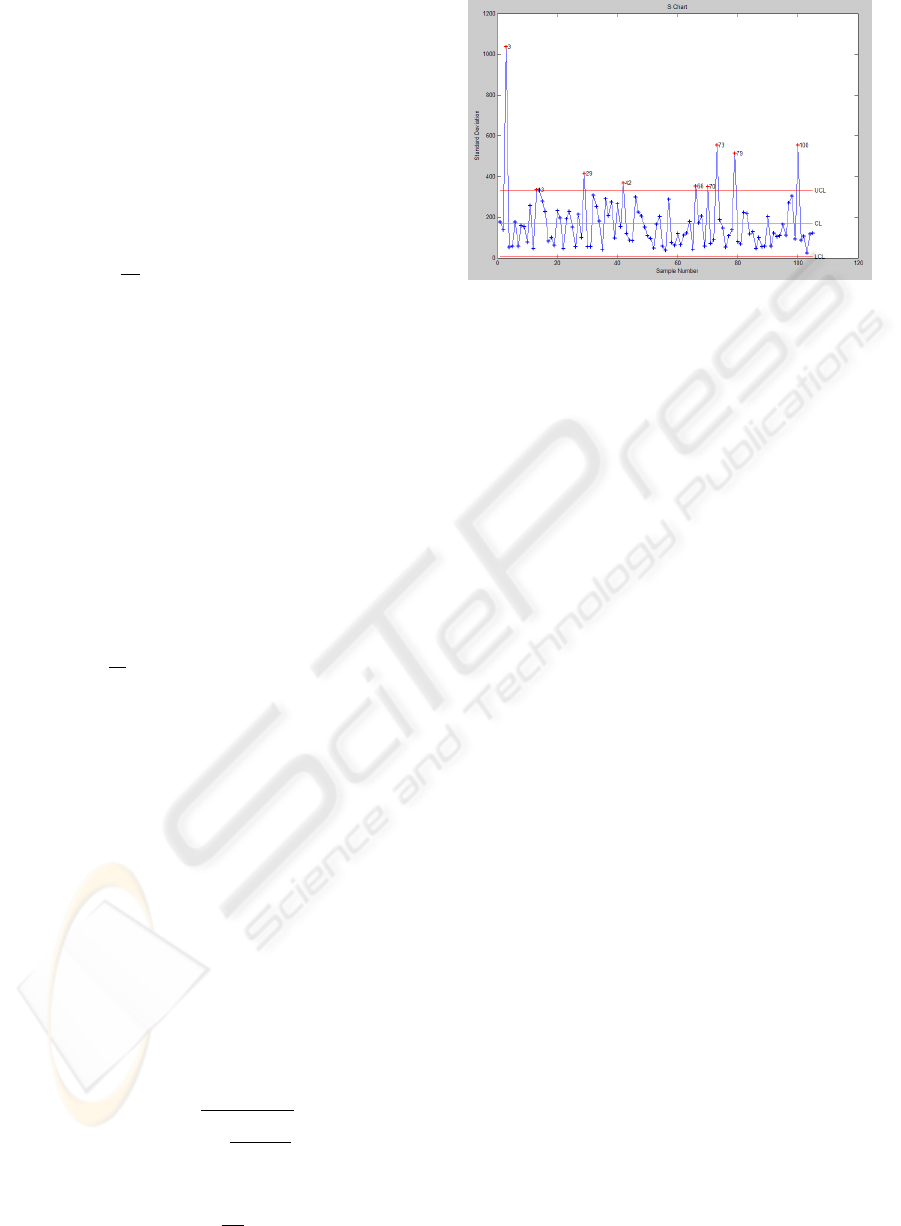

Figure 2: Schart for 105 private customers.

5 OUTLIERS ANALYSIS AND

INHERENT DATA

VARIABILITY

The threshold of ST D

∆

l

is estimated by the mean of

ST D

∆

l

multiplied by a constant (1.96 correspond to a

level of significance σ = 0.05).

Plotting ST D

∆

l

(l=1,...,105) and the threshold, we

obtain that 9 customers are outliers (figure 2, Standard

Deviation, in Kwh Vs. Sample Number, 1 to 105).

As we have already said, these outliers can be

caused by measurement error or by fraud in customer

consumption. But, alternatively, outliers may be the

result of inherent data variability.

In anomaly detection, the Standard Deviation

Chart (Schart) offers a signature for each customer,

that is, itself, the baseline for comparison. In clas-

sical research, new consumption for a customer is

compared against their individual signature to deter-

mine if the user’s behavior has changed (Fraud and

Intrusion detection, (Burge and Shawe-Taylor, 1997),

(Denning, 1987), (Fawcett and Provost, 1997), (Lunt,

1993)). A significant departure from baseline is a

signal that the account may have been compromised.

The research presented in this paper offers another

point of view: consumptions for a group of customers

are compared against their group signature to deter-

mine if the behavior of an individual customer is

anomalous.

We have carefully studied the six more likely

fraudulent customers of this group. The Endesa staff

has recommended inspections, two of them. One of

the two has been detected as anomalous (a fraudulent

customer).

ICEIS 2008 - International Conference on Enterprise Information Systems

372

6 SECOND EXAMPLE: LODGING

SECTOR

This new example analyzes 4047 customers from the

lodging sector in Andaluca (Spain). They have a

yearly electric consumption between 0 and 12 ∗ 10

4

Kwh and an extensive contract power range. This in-

consistent sample is divided into 18 subsamples with

similar yearly consumption. Then, general methodol-

ogy is applied, independently, to each one of subsam-

ples.

Customers classified as outliers, based on each

threshold of each subsample, are analyzed in order to

classify them as:

• group 1: Possibly incorrect or fraudulent (due, for

example, to an anomaly in measurement equip-

ment or a fraudulent loss of invoiced energy)

• group 2: Possibly correct, different from the re-

maining data, but not fraudulent and without mea-

surement errors.

For example, the consumption patterns of outliers,

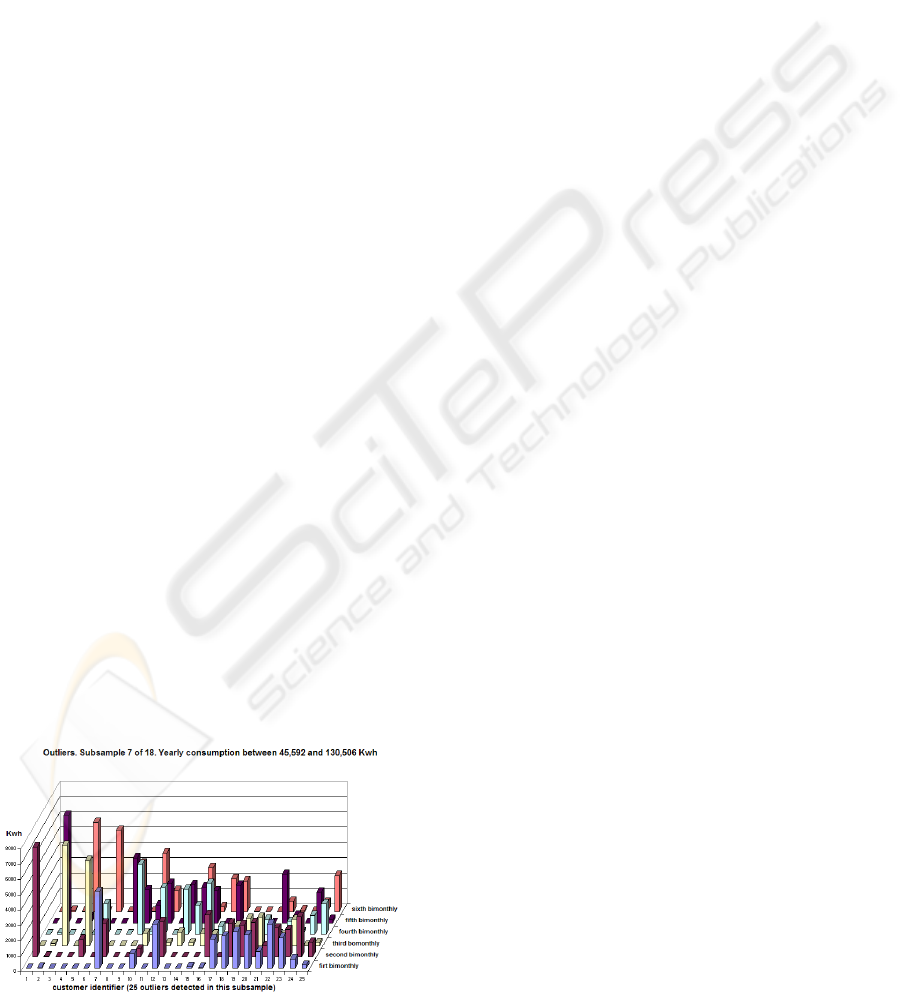

referring to the subsample 7 of 18, are shown in Fig-

ure 3.

In the lodging sector, the use of new sources of

information, as the power factor or the ’quality’ of

the contract, are necessary to distinguish group one

and group two. The experienced Endesa staff has

checked the general database information, referring

to the group of selected customers (6 private cus-

tomers and 35 lodging sector customers, see Table 1)

by means of a manual task. A specific inspection cam-

paign is included in this selected subgroup.

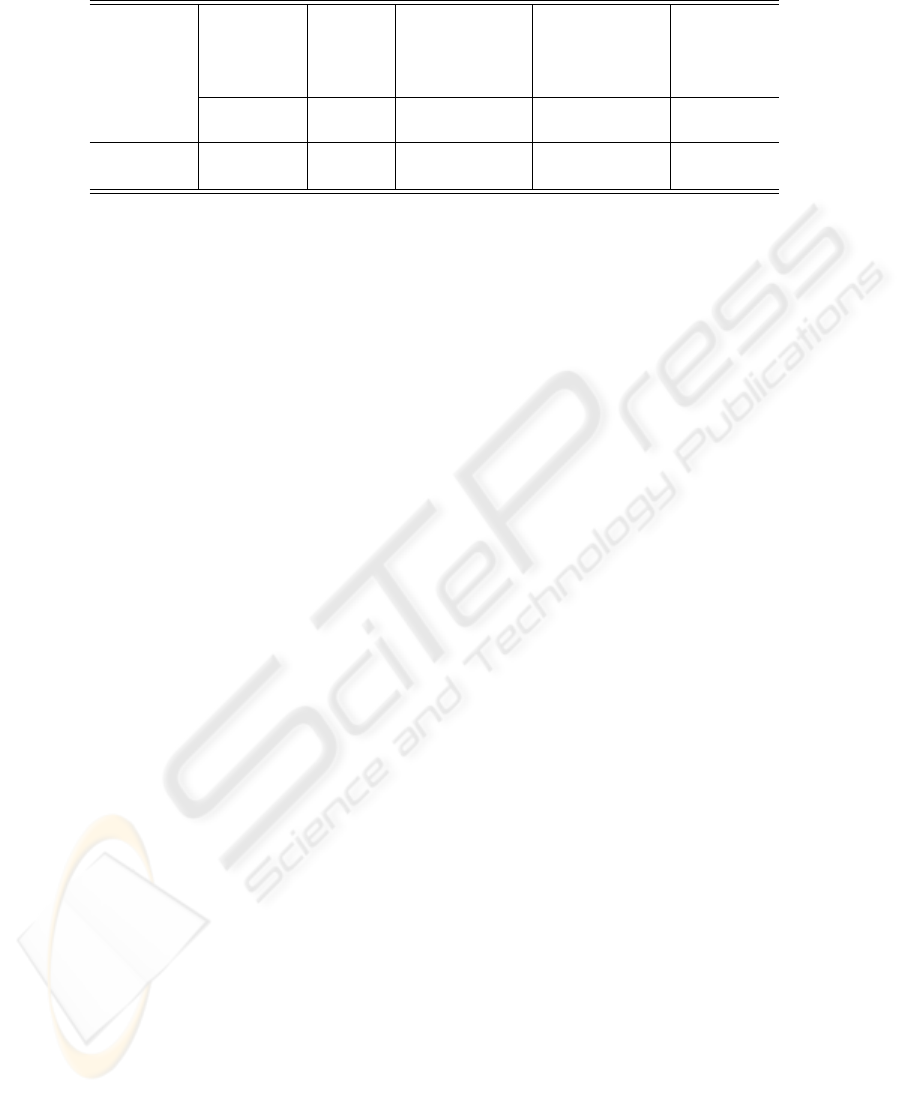

7 DISCUSSION AND RESULTS

The nature of the problem suggests an unsupervised

mining method. There is no evidence of the num-

ber of anomalies or fraud in customer data bases, be-

Figure 3: Some outliers consumption patterns in lodging

sector.

cause all customers are not inspected. Thus, there is

no evidence of the consumption range on anomalous

or fraudulent customers percentage.

This methodology is general and not bound to a

particular set variables or customer type. The whole

input information needed is taken exclusively from

the general customers’ database. The methodology

has been applied to two different types of users (see

Table 1), and it is now being integrated in a global

customer service, described below:

1. First step. In the proposed mining method, a cus-

tomer’s consumption is compared with the other

customers in the same sample. Similar consump-

tion habits are expected. Only data of bills are

used. We have selected the most relevant outliers

in both samples.

2. Second step. In this point we use contract

database and other data informations, different of

bills (i.e.,read consumption data). The method

supposes that a customer’s consumption habits are

similar under the period of study. We reject, in this

step, customers with a high number of unreliable

readings, customers who have initiated, changed

or canceled their contract in the period of study

and simple abnormalities so obvious: customers

with zero or very low consumption.

3. Third step. Endesa staff have analyzed and in-

spected the ’relevant’ customers. Customers that

Endesa staff are often interested in, include cus-

tomers with long-term high consumption and a

geographical criteria.

In this study, the (customers detected, selected and

inspected)/(anomalous customers) percentage had

reached up to 50%.

The confidence level is high, but the support level,

the percentage of transactions from a transaction data

base that the study satisfies, should be improved. So,

one of the main task in our future research lines is

to analyze and include new sources of information (as

the power factor) in our model. On the other hand, the

customer consumption variability appears as interest-

ing input to current data mining tools, as Bayesian

networks, decision trees, neural networks and other

supervised methods (Kirkos et al., 2007), (Editorial,

2006).

ACKNOWLEDGEMENTS

We would like to thank the initiative and collabora-

tion of Endesa, in particular Tom

´

as Bl

´

azquez, Ignacio

Cuesta, Jes

´

us Ochoa, Miguel Angel L

´

opez and Fran-

cisco Godoy.

A DATA MINING METHOD BASED ON THE VARIABILITY OF THE CUSTOMER CONSUMPTION - A Special

Application on Electric Utility Companies

373

Table 1: Real study results.

Number

of data in

the sample

Outliers Second Step

filter

Customers

inspected by

the ENDESA

staff

Anomalous

customers

Private

customers

105 9 6 2 1

Lodging

sector

4047 440 35 15 8

REFERENCES

Art

´

ıs, M., Ayuso, M., and Guill

´

en, M. (1999). Modeling

different types of automobile insurance frauds behav-

ior in the spanish market. In Insurance Mathematics

and Economics 24 67–81. Elsevier Press.

Art

´

ıs, M., Ayuso, M., and Guill

´

en, M. (2000). Phenomenal

data mining. In SIGKDD Explorations 1(2) (2000)

24–29. SIGKDD Press.

Barao, M. I. and Tawn, J. A. (1999). Extremal analysis

of short series with outliers: sea-levels and athletic

records. In Journal of the Royal Statistical Society

Series C-Applied Statistics 48 67–81.

Brause, R., Langsdorf, T., and Hepp, M. (1999). Neural

data mining for credit card fraud detection. In Pro-

ceeding 11th IEEE International Conference on Tools

with Artificial Intelligence. IEEE press.

Brokett, P. L., Xia, X., and Derrig, R. A. (1998). Using

kohonen’s self-organizing feature map to uncover au-

tomobile bodily injury claims fraud. In The Journal of

risk and Insurance 65(2) 245–274.

Burge, P. and Shawe-Taylor, J. (1997). Detecting cellular

fraud using adaptative prototypes. In Proceeding on

AI Approaches to Fraud Detection and Risk Manage-

ment. 9–13. Menlo Park, CA: AAAI Press.

Cabral, J., Pinto, P., Gontijo, E. M., and Reis, J. (2004).

Fraud detection in electrical energy consumers using

rough sets. In 2004 IEEE International Conference on

Systems, Man and Cybernetics. IEEE press.

Daskalaki, S., Kopanas, I., Goudara, M., and Avouris, N.

(2003). Data mining for decision support on customer

insolvency in the telecommunication business. In Eu-

ropean Journal of Operational Research 145 239–

255. Elsevier press.

Denning, D. (1987). An intrusion-detection model. In

IEEE transactions on Software Engineering 13 222–

232. IEEE press.

Editorial (2006). Recent advances in data mining. In Engi-

neering applications of Artificial Intelligence 19 361–

362.

Fawcett, T. and Provost, F. (1997). Adaptative fraud de-

tection. In Data mining and Knowledge Discovery 1

291–316.

He, H., Graco, W., and Yao, X. (1999). Application of

genetic algorithm and k-nearest neighbors in medical

fraud detection. In Lecture Notes in Computer Science

1585 74–81. LNCS.

He, H. X., Wang, J. C., Graco, W., and Hawkins, S. (1997).

Application of neural networks to detection of medical

frauds. In Expert Systems with Applications 13 (4)

329–363. Elsevier press.

Kantardzic, M. (1991). Data mining: concepts, models

methods ans algorithms. Ed. AAAI/MIT Press, first

edition.

Kirkos, E., Spathis, C., and Manolopoulos, Y. (2007). Data

mining techniques for the detection of fraudulent fi-

nancial statements. In Expert Systems with Applica-

tions 32 995–1003.

Kou, Y., Lu, C.-T., Sinvongwattana, S., and Huang, Y.-P.

(2004). Survey of fraud detection techniques. In Pro-

ceeding of the 2004 IEEE International Conference

on Networking, Sensing and Control. Taiwan, march

21 89–95. IEEE press.

Lunt, T. (1993). A survey of intrusion detection techniques.

In Computers & Segurity, 12 405–418.

Wheeler, R. and Aitken, S. (2000). Multiple algorithms for

fraud detection. In Knowledge based systems 13 93–

99. Elsevier.

ICEIS 2008 - International Conference on Enterprise Information Systems

374