MULTI-AGENT NEGOTIATION IN A SUPPLY CHAIN

Case of the Wholesale Price Contract

Omar Kallel

1,2

, Ines Ben Jaafar

1

, Lionel Dupont

2

and Khaled Ghedira

1

1

SOIE – Stratégies d’Optimisation des Informations et de la connaissancE,

ISG de Tunis Cité Bouchoucha, Bardo 2000, Tunisie

2

Ecole des Mines d’Albi-Carmaux Centre Génie Industriel

Campus Jarlard, Route de Teillet, 81013 Albi Cedex 09, France

Keywords: Multiagent systems, Automated negotiation, Contracts.

Abstract: In this paper, we propose a multi-agent negotiation model for the wholesale price contract (price: W,

quantity: Q) in a supply chain with a retailer buying from several subcontractors. We assumed that the

retailer stocks up from several subcontractors in order to face a market with fixed demand. Each

subcontractor has a normal production capacity (CN) which can be increased until a maximal capacity (CM)

but with an additional cost. The demand is superior to the sum of normal capacities and inferior to the sum

of maximal capacities. Thereby, the negotiated and agreed price between the retailer and each subcontractor

relies on the ordered quantity and the extra cost generated by any excess capacity (above the CN level).

Under asymmetric informational context, we propose a multi-agent model which is a duplication of the

considered supply chain; subcontractor agents negotiate a combination (price, quantity) in order to

maximize their benefits and a retailer agent negotiates several combinations (price, quantity) with the

different subcontractor agents in order to satisfy demand, allocate quantities and maximize its margin.

Experimental results shows that the objective of reaching agreements and establish a long-lasting “win-win”

partnership is totally reached but repartition of benefits is not so fair.

1 INTRODUCTION

In the current economic context, competition is no

more between different “stand-alone” companies but

between different groups of companies constituting

different supply chains. Founding strong links of

cooperation and synergy between companies of the

same supply chain has become a key success factor.

Therefore, companies try to establish a long-lasting

partnership between them. Those relations are

materialized by contractual engagements which are

subject of negotiations where each contracting party

tries to protect his interests in a long-lasting

relationship. Several contract types have been

investigated in the economic literature (Cachon,

2004) (Duvallet & al., 2006) (Gomez-Padilla, 2005).

These researches have focused on the impact that

these contracts may have on the performance of the

supply chain and its actors. They converge to the

point that such contractual modalities are fully

integrated into the decision-making process of

companies (Duvallet & al., 2006). Nevertheless, an

important aspect remains untreated (Cachon, 2004)

which is the negotiation of those contractual

relations. Those contracts were well studied in the

economic literature but ignored as to the negotiation

aspect. In order to investigate this important aspect,

we propose in this paper a multi-agent negotiation

system for a particular contract type which is the

wholesale price contract. With this contract, the

retailer pays the ordered quantity Q to a

subcontractor at a unitary price W.

Automated negotiation has received a significant

attention in the literature. Indeed, several approaches

have been studied (Jennings & al., 2001); game-

theoretic approaches, heuristic-based approaches,

and argumentation-based approaches. The first kind

of these approaches employs technics from game

theory in order to establish the negotiation process

and the strategies undertaken by the negotiator

agents. These negotiation technics have the

advantage and the ability of providing optimal

solutions. However, they require long and important

computation duration and capabilities. They also

assume that negotiator agents have complete

305

Kallel O., Ben Jaafar I., Dupont L. and Ghedira K. (2008).

MULTI-AGENT NEGOTIATION IN A SUPPLY CHAIN - Case of the Wholesale Price Contract.

In Proceedings of the Tenth International Conference on Enterprise Information Systems, pages 305-314

DOI: 10.5220/0001737603050314

Copyright

c

SciTePress

information. The heuristic-based approach allows

overcoming the limits of the game-theoretic

approach, however, it doesn’t produce optimal

solutions but good solutions. This approach provides

more flexibility for the designer of agents; models

are based on more realistic assumptions, negotiator

agents don’t need to have complete information to

evolve in the negotiation process and the

computation requirements is pretty low. The

argumentation-based approach is based on

information exchange. Indeed, an argumentation-

based model is a negotiation process whereby agents

are allowed to send information in addition to their

offers in order to influence the counterpart.

Among these approaches, we selected and used

the heuristic-based approach for two main reasons;

first, it allows dealing with more realistic

assumptions and second, in our context, information

exchange is asymmetrical at the beginning of the

negotiation (for assumptions) and useless during the

negotiation process.

In this paper, we propose a multi-agent

negotiation model for the wholesale price contract

(price: W, quantity: Q) (Cachon, 2004) (Gomez-

Padilla, 2005) (Spengler, 1950) in a supply chain

with a retailer buying from several subcontractors.

Each subcontractor has a normal production capacity

(CN) which can be increased until a maximal

capacity (CM) with an additional cost. For the goods

produced above the CN level, each subcontractor

has an additional cost which can be low or high

according to his productive system. Therefore, the

negotiated and agreed price with the retailer should

rely on the ordered quantity and the additional cost

caused by any excess capacity. On the other side, the

retailer faces a market with fixed demand which is

superior to the sum of normal production capacities

and inferior to the sum of maximal production

capacities of the different subcontractors. He musts

allocate quantities and agree on the wholesale prices

with the subcontractors in order to maximize his

benefits.

The information exchange is asymmetrical in the

model. Public information are the fixed demand, the

selling price and capacities (normal and maximal) of

each subcontractor. Information concerning costs

calculation systems of each actor are considered as

private and not shared.

The proposed multi-agent model is a

representation of the related supply chain;

subcontractor agents negotiate a combination (price,

quantity) in order to maximize their benefits and a

retailer agent negotiates several combinations (price,

quantity) with the different subcontractor agents in

order to satisfy demand, allocate quantities and

maximize its margin.

The objective of the proposed model is to help

agents reach an agreement for a long lasting

partnership and establish a win-win relation which is

a key success factor in every supply chain. The ideal

objective is that repartition of benefits happen as fair

as possible which means that repartition occur

approximately according to the added-value of each

actor (each actor costs relatively to the global chain

costs).

The paper is organized as follows. The next

section presents related works. In section 3, we

present the mathematic modelling of the related

supply chain. Section 4 describes the multiagent

model including the architecture and the negotiation

dynamic. Section 5 outlines experimental results.

And finally, the last section contains concluding

remarks and future works.

2 RELATED WORK

Coordination by contracts is one of the main

problems in the supply chain management area. A

contract is a convention between two or several

parties ending to create between them a legal bond.

This main problem has received significant

attention. Indeed, several researches (Cachon, 2004)

(Duvallet & al., 2006) (Gomez-Padilla, 2005) have

investigated the impact that several contract types

may have on the performance of a supply chain and

its actors. Seven contract types have been studied,

proposed and applied in order to find or to assure an

efficient coordination where we maximize, at the

same time, profit of the chain and profits of the

different actors (Cachon, 2004) (Gomez-Padilla,

2005) :

The wholesale price contract which stipulates

that the unit price is defined beforehand and

does not change whatever is the ordered

quantity for the contract duration.

The quantity discount contract represents an

improved variant of the wholesale price

contract. The difference is that price is

decreasing according to the bought quantity.

The buy back contract stipulates that the

supplier or subcontractor rebuys the unsold

quantity from the retailer at a price agreed

beforehand.

The quantity flexibility contract represents a

variant of the buy back contract. In this type,

the supplier or the subcontractor rebuys the

ICEIS 2008 - International Conference on Enterprise Information Systems

306

minimum between the unsold quantity and a

percentage agreed beforehand.

The sales rebate contract stipulates that the

supplier or subcontractor grants a rebate to the

retailer for the bought units above a threshold

prefixed in the contract.

The revenue sharing contract stipulates that

the retailer pays a fixed price (relatively low)

to the supplier or the subcontractor and enlists

to pour him a percentage of sold units.

The reservation capacity contract stipulates

that the retailer reserves a capacity at the

supplier or the subcontractor. Consequently,

he pays a price per reserved unit, a price per

unit actually ordered from the reserved

capacity and a price per ordered unit in excess.

Investigated researches converge to the point that

those contractual modalities are fully integrated into

the decision-making process of companies (Duvallet

& al., 2006). Those researches (Duvallet & al.,

2006) (Gomez-Padilla, 2005) (Cachon, 2004)

essentially focused on how to identify the set of

contracts that coordinate the supply chain and

arbitrarily allocate its profit. The agreed contract is

not a subject of negotiation process. In such cases, it

seems that either the firm that offers the contract

does not matter because the aim is the supply chain

coordination. However, it is unlikely in practice that

either firm makes a single offer which is considered

as the final offer (Cachon, 2004). It is more

convenient that companies exchange several offers

and counter offers before they settle on some

agreement. The negotiation aspect of those contracts

remains untreated and additional research is surely

needed on this issue (Cachon, 2004).

Among the approaches considering supply

chains and especially negotiation in supply chains,

the multi-agents systems is an approach spilt enough

in the academic literature (Jiao & al., 2006). The

choice of such paradigm is justified by the

distributed nature of a supply chain. Indeed, every

supply chain is composed generally by autonomous,

reactive and proactive actors. Those features are the

same of an agent (Ferber, 1995). Moreover,

negotiation using multi-agent systems has received a

significant attention in the literature and several

approaches have been investigated (Jennings & al.,

2001); game-theoretic approaches, heuristic-based

approaches, and argumentation-based approaches. In

the heuristic-based approach, which is the approach

we picked out, several negotiation strategies have

been proposed. Faratin implemented (Faratin, 2000)

a multi-agent system in which agents make trade-

offs under informational uncertainty and resource

limitations context. In order to make the trade-offs,

agents employ an algorithm using the notion of

fuzzy similarity. The authors’ objective has been to

find negotiation solutions that are beneficial for both

parties. (Kraus, 2001) presented a strategic model of

negotiation where a set of agents need to reach an

agreement on a given issue. The model consists of a

protocol for the agents’ interactions, utility functions

and strategies of the agents. The utility functions

have been used to evaluate possible terminations of

the negotiation and to respond consequently. (He &

al., 2003) implemented a muti-agent system in

which autonomous agents (seller agents and buyer

agents) trade services. Those agents employ

heuristic fuzzy rules and fuzzy reasoning

mechanisms to determine the best bid to make given

the state of the marketplace. (Zhang & al., 2005)

presented a cooperative, multi-step negotiation

mechanism for task allocation. This mechanism

combines marginal utility gain and marginal utility

cost to structure the search process. It searches over

multiple attributes that reflects the concerns of both

agents in the negotiation in order to find a solution

that maximizes the agents’ combined utility. In

(Rahwan & al., 2007), the authors present a

methodology for designing agent negotiation

strategies. The authors’ aim has been to provide

some guidance for designers of strategies either in

heuristic-based or argumentation-based approaches.

In this paper, we present a negotiation model

which consists of the interaction protocol of agents

and the decision-making model of each kind of

agent. The agents use heuristics, trade-offs functions

(reduce and Increase) and utility functions (margin)

in order to reach agreements. The model differs from

the proposed negotiation models not only by the

implemented heuristics and trade-offs functions, but

also because it is studied in a particular context

which is assuring a long-lasting partnership by the

wholesale price contract. The negotiation of the

several contracts mentioned above has not been

investigated. Those contracts were well studied in

the economic literature but ignored as to the

negotiation aspect.

3 MATHEMATIC MODELLING

The model is a supply chain composed by several

subcontractors and a retailer (Figure 1). The retailer

stocks up from several subcontractors in order to

face a market with fixed demand D. Each

subcontractor has a normal production capacity

MULTI-AGENT NEGOTIATION IN A SUPPLY CHAIN - Case of the Wholsale Price Contract

307

(CNi) which can be increased until a maximal

capacity (CMi) with an additional cost.

In order to satisfy the demand, the retailer order

from each subcontractor a quantity Qi (ΣQi=D) at a

unitary price Wi.

Figure 1: Considered supply chain.

3.1 Subcontractor

i

Each subcontractor has a normal production capacity

CNi. Until this capacity, he has a variable

production cost VSi. He can raise it proportionally

(overtimes, interim…) until a maximal capacity

CMi, but with a higher variable cost V2Si. In

addition to these variable costs, each subcontractor

supports fixed costs FSi.

A subcontractor’s costs CSi relies on the ordered

quantity Qi and on the normal and maximal

production capacities (CNi, CMi):

If Qi ≤ CNi Then CSi=FSi+VSi*Qi

If CNi < Qi ≤ CMi Then

CSi = FSi + VSi*CNi + V2Si*(Qi – CNi)

(2)

His profit margin MSi is as follows:

MSi = Wi*Qi- CSi (3)

3.2 Retailer

The retailer faces a market with fixed demand D.

His selling price P in the market is known. He stocks

up from several subcontractors. He supports fixed

costs FR (locals, staves ...) and variable costs per

unit VR (finishing, wrapping...).

The retailer costs CR are: fixed costs FR,

purchasing costs (financial transfers) from

subcontractors and other variable costs of production

and distribution per unit VR.

CR = FR + ∑ Wi*Qi + VR * D (4)

His profit margin MR is the difference between

his sales on the final market and his whole costs:

MR = P*D – CR

(5)

3.3 The Supply Chain Margin and

Costs

The global chain costs CCH is the sum of the

different actors’ costs:

CCH = CR + ∑ CSi

(6)

The global chain margin MCH is the sum of the

different actors’ margin:

MCH = MR + ∑ MSi

(7)

CCH and MCH are not used in the negotiation

model. They will be used in section 5 to evaluate if

the found solutions present a fair margin repartition.

4 MULTI-AGENT MODEL

Modelling supply chains with the multi-agent

paradigm has received in the last decade a

significant attention (Jiao & al., 2006). This

approach allows building autonomous entities

(agents) which are able to communicate and interact

in order to cooperate or reach an agreement.

Retailer

A

g

ent

Subcontrac tor

A

g

ent 1

Subcontrac tor

A

g

ent 2

Subcontrac tor

A

g

en

t

3

Subcontrac tor

A

g

en

t

n

Figure 2: Multi-Agent Architecture.

4.1 Multi-Agent Architecture

The model, presented in Figure2, is a duplication of

the considered supply chain. It is constituted of two

kinds of agents: Subcontractor agent (SA) and

Retailer agent (RA).

Several researches (Fiala, 2005) have

demonstrated that sharing information is generally

beneficial for both the supply chain and the actors

that compose it. Indeed, knowing the whole

information generally brings down problems to

ordinary problems or linear programs. Nevertheless,

in the real world, companies have always the

reticence to share their information principally

Σ CNi < D < Σ CMi (1)

ICEIS 2008 - International Conference on Enterprise Information Systems

308

fearing of being cheated or betrayed with

contenders. So, we have chosen to analyze the

considered model in an asymmetric informational

context. Normal CNi and maximal CMi production

capacities of each subcontractor are public.

Information concerning costs calculation systems of

each actor are considered as private and not shared.

This section presents objectives, acquaintances

(the agents that it knows) and knowledge (static and

dynamic) of each kind of agent.

4.1.1 Subcontractor Agent

Each subcontractor Agent (SAi) has the objective of

maximizing its profit margin MSi.

Its only acquaintance consists of the RA. Its

static knowledge represents information about its

productive system: its normal production capacity

CNi, its maximal production capacity CMi, its fixed

costs FSi, its variable cost for the normal capacity

VSi and its variable cost V2Si for the production

above the CNi level. Its dynamic knowledge consists

of the parameters of the negotiated contract: the

price Wi and the quantity Qi.

4.1.2 Retailer Agent

The retailer Agent (RA) has two objectives: the first

is to allocate quantities because the demand is

superior to the sum of normal production capacities

and inferior to the sum of maximal production

capacities of the different subcontractors. The

second is to maximize its profit margin MR.

The RA acquaintances consist of the set of all

SAi. Its static knowledge represents demand D, its

selling price P, its fixed costs FR, its variable costs

VR, normal and maximal production capacities of

each subcontractor (CNi, CMi). Its dynamic

knowledge consists of the states of the different SAi

during the negotiation (active, inactive, stand-by,

busy) and the parameters of the negotiated contracts:

(Wi, Qi) with the differents SAi.

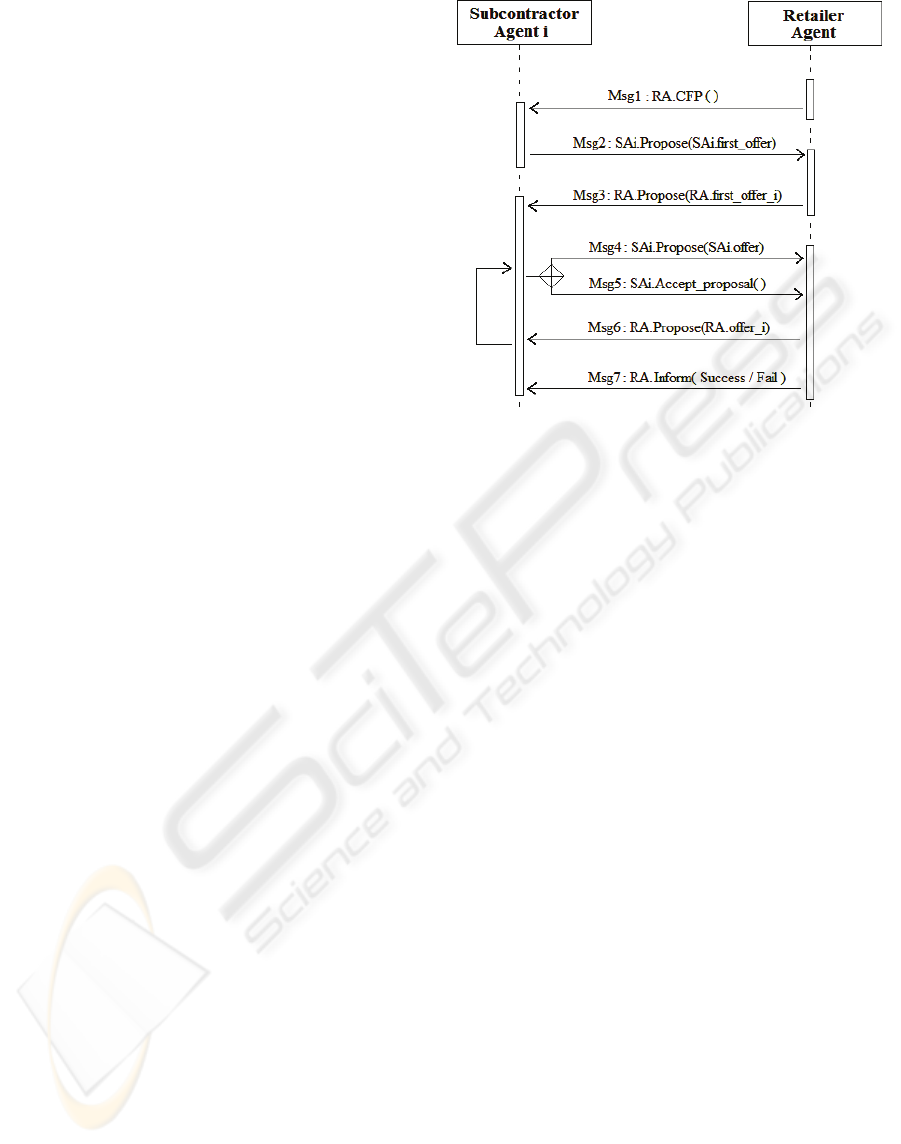

4.2 Multi-Agent Dynamic

The negotiation is one-to-N multiple bilateral

negotiation. The retailer agent negotiates with

several subcontractor agents who have the same

behaviours. The negotiating process, presented in

Figure 3, is described with a UML sequence

diagram. It describes exchanged messages (FIPA

ACL Messages) between a retailer and a

subcontractor agent.

Figure 3: Negotiation process.

Before describing the dynamic, we define here

the variables used in the next procedures:

k : the k

th

iteration of the negotiation process

SAi : Subcontractor Agent number i

SAi.Q(k) : the quantity proposed in the k

th

iteration

SAi.W(k) : the price proposed in the k

th

iteration

SAi.offer(k) : the amount charged (W*Q) in the k

th

iteration

SAi.Min_turnover : the min accepted amount in the

negotiation = CSi

SAi.Begin_turnover : the amount proposed by SAi

at the start of negotiation

SAi.Hoped_turnover : the hoped amount

SAi.state : state of the SAi in the negotiation

process. Possible values are {active, inactive, stand-

by, busy}. This variable is used by RA to qualify the

evolution of each SAi in the negotiation

RA : Retailer Agent

RA.Qi(k) : the quantity proposed to SAi in the k

th

iteration

RA.Wi(k) : the price proposed to SAi in the k

th

iteration

RA.offer_i(k): the charged amount (Wi*Qi) to SAi

in the k

th

iteration

RA.offer(k): the sum of charged amounts (ΣWi*Qi)

in the k

th

iteration

RA.Min_turnover: the min accepted (global)

amount=CR

RA.Begin_turnover : the global amount (including

offers to all the SAi) proposed by RA at the start of

negotiation

RA.Hoped_turnover : the hoped (global) amount

The Begin_turnover and Hoped_turnover

influence significantly the negotiation. But those

parameters can be initiated differently according to

the business or to the commercial. In our model, we

MULTI-AGENT NEGOTIATION IN A SUPPLY CHAIN - Case of the Wholsale Price Contract

309

assumed that Begin_turnover = 1.5 * Min_turnover

and Hoped_turnover = 1.2 * Min_turnover. But the

model is generic and other values can be tested. We

can even assume different values for each agent.

In addition to these variables, we use the

following function to send messages from a source

agent to a destination agent:

Send (Msg, Source, Destination)

The negotiation process is initiated by the RA. It

sends a “call for proposition” (Msg1:RA.CFP) to the

different SAi. Therefore, each SAi generates its first

offer (Msg2) with quantity equal to its maximal

capacity and price satisfying the

SAi.Begin_turnover.

Msg2: SAi.Propose (SAi.first_offer)

1. SAi.Q(0) = CMi

2. SAi.W(0) = SAi.Begin_turnover / SAi.Q(0)

3. SAi.offer(0) = SAi.W(0) * SAi.Q(0)

4. Send ( (SAi.W(0),SAi.Q(0)) , SAi , RA)

The RA collects the first offers of the different

SAi. It generates its first offers (Msg3) to the

different SAi. It allocates quantities in function of

received prices (Msg3: line 1); from the cheapest to

the most expensive. According to the allocated

quantities and to its RA.Begin_turnover, the RA

tries, while calculating prices, to minimize the

difference with those received from SAi (Msg3: line

3 to 5). Therefore, it sends offers to the SAi (Msg3:

line7).

Msg3: RA.Propose (RA.first_offer)

1. Allocate quantities on SAi

2. RA.offer(0) = RA.Begin_turnover

3. Part = ( ΣSAi.Offer(0) – RA.Offer(0) ) / D

4. For Each SAi

5. RA.Wi(0) = SAi.W(0) – Part

6. RA.offer_i(0) = RA.Wi(0) * RA.Qi(0)

7. Send ( (RA.Wi(0),RA.Qi(0)) , RA , SAi )

8. End For

A reiterated process of offer/counter-offer is set

up (Msg4, Msg5, Msg6).

If the SAi receives an offer satisfying its

SAi.Hoped_turnover, it sends its acceptance to the

RA. Also, if it receives an offer satisfying the

SAi.Min_turnover and equal to the last received

offer it sends its acceptance (Msg4: line 1, 2).

On the other hand, for each new offer, the SAi

adopts the charged quantity by the RA (Msg4:

line 4), applies a reduction to its last offer while

SAi.Min_turnover is respected (Msg4: line 5 to 10),

determines accordingly the price (Msg4: line11) and

sends its proposition to the RA (Msg4 : line 12). The

reduction is calculated according to the following

function:

ε

*

2

)(

),(

YX

YXreduce

−

=

(8)

Where:

X = The last made offer by the SAi : SAi.Offer(k)

Y = The last made offer by the RA to SAi :

RA.offer_i(k)

ε = parameter determined experimentally = 0.2

This function allows differentiating the made

reductions from iteration to another. Indeed, more

the negotiation advances more the reduction

decrease. This function contains a parameter ε which

has to be determined experimentally. This parameter

is crucial for the efficiency of the negotiation

because it determines the steps made in each

iteration; we have to avoid an efficient negotiation

process but very long-lasting and a rapid process but

inefficient. Several values have been experimented

for the parameter ε = {0.1, 0.2, 0.3 and 0.4}. The

most convenient value is 0.2.

Msg4: SAi.Propose (SAi.offer)

1. If ( RA.offer_i(k) ≥ SAi.Hoped_turnover ) OR

( ( RA.offer_i(k) = RA.offer_i(k–1) ) AND

( RA.offer_i(k) ≥ SAi.Min_turnover ) ) Then

2. Send ( Acceptance , SAi , RA )

3. Else

4. SAi.Q(k) = RA.Qi(k)

5. R = reduce( SAi.Offer(k-1) , RA.offer_i(k) )

6. If (SAi.Offer(k) – R) > SAi.Min_turnover Then

7. SAi.Offer(k) = SAi.Offer(k-1) – R

8. Else

9. SAi.Offer(k) = SAi.Offer(k-1)

10. End If

11. SAi.W(k) = SAi.Offer(k) / SAi.Q(k)

12. Send ( (SAi.W(k),SAi.Q(k)) , SAi , RA )

13. End if

The RA collects the offers of all SAi. It updates

the state of each SAi; if one of them made a

satisfying offer, then, this one is set on stand-by

(Msg6 : line 2 to 4). If it made an offer equal to its

last offer which means that it can’t evolve anymore

in the negotiation, then, it is considered as inactive

(Msg6 : line 5 to 7). After that, the RA checks the

efficiency of the quantities’ allocation(Msg6 : line

9). Then, it generates its offers to the SAi not set on

stand-by; it applies an increase to the last made

offers while RA.Min_turnover is respected (Msg6 :

line 10 to 15). The increase is calculated according

to the same principle of the subcontractor’s

reduction function but with different parameters:

ICEIS 2008 - International Conference on Enterprise Information Systems

310

ε

*

2

)(

),(

YX

YXIncrease

−

=

(9)

Where:

X = The last made offer by all the SA: ΣSAi.offer(k)

Y = The last made offer by the RA to all the SA :

RA.offer(k)

ε = parameter determined experimentally = 0.2

Prices are calculated according to the made

increase and to the assigned quantities to each SAi

(Msg6: line 16 to 18). The RA sends then its

proposition to each active SAi (Msg6 : line 20).

Msg6: RA.Propose (RA.offer)

//UPDATE STATES

1. For Each SAi

2. If SAi.Offer(k) ≤ (RA.Hoped_turnover/SAi.Q(k))

Then

3. SAi.state = stand-by

4. End If

5. If ( SAi.Offer(k) = SAi.Offer (k-1) ) Then

6. SAi.state = inactive

7. End If

8. End For

9. Check_quantities_efficiency ( )

//UPDATE OFFERS

10. I = Increase ( ΣSAi.offer(k) , RA.offer(k-1) )

11. If RA.Offer(k-1) + I ≤ RA.Min_turnover Then

12. RA.Offer(k) = RA.Offer(k-1) + I

13. Else

14. RA.Offer(k) = RA.Offer(k-1)

15. End If

16. Part = ( ΣSAi.offer(k) – RA.offer(k) ) / D

17. For Each SAi Having ( SAi.state = active )

18. RA.Wi(k) = SAi.W(k) – Part

19. RA.offer_i(k) = RA.Wi(k) * RA.Qi(k)

20. Send ( (RA.Wi(k),RA.Qi(k)) , RA , SAi )

21.

End For

With the heuristic Check_quantities_efficiency(), the

RA verifies if the quantities’ allocation made in the

last iteration is efficient. Indeed, reducing the

ordered quantity to a subcontractor agent can have

as effect a big rise of the charged price from the

latter (line3:

SAi.W(k) > β*SAi.W(k–1) ). A big rise of

price can be regarded differently according to the

business or to the commercial. β is a generic

parameter which can be generated appropriately

according to the context. In our experiments, β=1.4 .

If reducing the ordered quantity to a SA has

produced a big rise of the charged price from the

latter, the RA reviews its quantities’ allocation; it

cancels the made reduction of quantity to this

subcontractor agent and makes it to other active or in

stand-by subcontractor agent in function of prices

from the most expensive to the cheapest (line 8 to

26).

Check_quantities_efficiency ( )

Qa : the quantity to reapportion

1. Qa = 0

2. For Each SAi Having ( SAi.state = active )

3. If ( SAi.W(k) > β*SAi.W(k–1) ) Then

4. RA.Qi(k) = RA.Qi(k-1)

5. Qa = Qa + (RA.Qi(k-1) – RA.Qi(k))

6. SAi.state = busy

// reducing Qa from other active or in stand-by SA in

function of prices from the most expensive to the cheapest

7. While (Qa > 0)

8. max_w = 0 , indmax = -1

9. For Each SAj Having ( SAj.state = active )

10. If (max_w < SAj.w(k)) Then

11. max_w = SAj.w(k)

12. indmax = j

13. End if

14. End For

15. If (indmax = -1) Then

16. For Each SAj Having (SAj.state=stand-by)

17. If (max_w < SAj.w(k)) Then

18. max_w = SAj.w(k)

19. indmax = j

20. End if

21. End For

22. SAj.state = active

23. End If

24. If (indmax <> -1) Then

25. RA.Qj(k) = RA.Qj(k) – Qa

26. End If

27. End While

28. End If

29. End For

30. For Each SAi Having ( SAi.state = busy )

31. SAi.state = active

32. End For

The reiterated process of offer/counter-offer is

engaged till the RA terminates the negotiation either

by sending “success” or “fail” to each SAi involved

in the negotiation (Msg7:RA.Inform(Success/Fail)).

When the state of each SAi is either stand-by or

inactive and an agreement is reached with at least

some SAi able to respond to the demand D, the RA

stops the negotiation and informs the counterparts of

“success” of the negotiation. When a number of

maximal iterations is reached without attaining an

agreement, the RA stops the negotiation and informs

the counterparts of the “fail”.

5 EXPERIMENTS

We have implemented this model with JADE

platform (Bellifemine & al., 2007) which is one of

the most known MAS platforms.

MULTI-AGENT NEGOTIATION IN A SUPPLY CHAIN - Case of the Wholsale Price Contract

311

Table 1: Experimental Results

Assumptions Margin Contracts

R P=80 D=500 FR=10000 VR=15 10924.969 C1 to C2

Case1 S1 CN=350 CM=420 FS=4000 VS=10 V2S=13 541.249 C1 (22.974, 350)

S2 CN=100 CM=150 FS=1500 VS=12 V2S=14 133.780 C2 (23.558, 150)

R P= 5 D=1000 F R=1000 VR= 1 528.907 C1 to C2

Case2 S1 CN=500 CM=550 FS=1000 VS=0.5 V2S=0.9 38.357 C1 (2.424, 550)

S2 CN=400 CM=500 FS=800 VS=0.7 V2S=1 7.735 C2 (2.528, 450)

R P= 3 D=10000 FR= 5000 VR=0.3 4469. 648 C1 to C3

Case3 S1 CN=2000 CM=2400 FS=2000 VS=1 V2S=1.2 70.359 C1 (2.035, 2000)

S2 CN=4000 CM=4300 FS=4000 VS=0.6 V2S=1.1 549.893 C2 (1.692, 4300)

S3 CN=3500 CM=3700 FS=3500 VS=0.7 V2S=1.1 10.099 C3 (1.67 , 3700)

R P= 40 D=500 F R=3000 VR=8 3551.001 C1 to C3

Case4 S1 CN=150 CM=190 FS=1600 VS=6 V2S=7.5 329.275 C1 (18.861, 150)

S2 CN=220 CM=250 FS=2000 VS=5 V2S=7 1369.716 C2 (18.718, 250)

S3 CN=80 CM=100 FS=1200 VS=7 V2S=7.8 24.006 C3 (19.4 , 100)

R P=15 D=3000 FR=4000 VR=3 4193.881 C1 to C4

S1 CN=800 CM=850 FS=4000 VS=4 V2S=5.5 175.882 C1 (9.001 , 850)

Case5 S2 CN=850 CM=870 FS=5000 VS=3.5 V2S=5 347.626 C2 (10.444, 770)

S3 CN=700 CM=800 FS=3000 VS=4.5 V2S=6.2 32.889 C3 (8.503 , 800)

S4 CN=500 CM=580 FS=2000 VS=5.2 V2S=7 149.719 C4 (9.154 , 580)

R P= 24 D=860 F R=750 VR=5 3805.19 C1 to C4

S1 CN=230 CM=260 FS=850 VS=8 V2S=9.2 578.726 C1 (13.633, 260)

Case6 S2 CN=340 CM=350 FS=110 VS=7 V2S=8 1267.429 C2 (13.792, 350)

S3 CN=160 CM=200 FS=700 VS=8.5 V2S=9.5 37.807 C3 (13.111, 160)

S4 CN=70 CM=90 FS=450 VS=9 V2S=10.5 24.845 C4 (14.609, 90)

R P=20 D=1200 FR=2400 VR=4 2292.64 C1 to C4

S1 CN=380 CM=410 FS=700 VS=9 V2S=10.5 136.443 C1 (11.149, 410)

Case7 S2 CN=300 CM=350 FS=600 VS=9.5 V2S=11 53.5393 C2 (11.581, 350)

S3 CN=250 CM=350 FS=500 VS=10 V2S=11 272.231 C3 (13.217, 240)

S4 CN=150 CM=200 FS=350 VS =11 V2S= 12 110.290 C4 (13. 551, 200)

R P=30 D=1000 FR=800 VR=6 5509.687 C1 to C5

S1 CN=200 CM=230 FS=1000 VS=10 V2S=12 666.035 C1 (17.504, 230)

Case8 S2 CN=370 CM=380 FS=1500 VS=9 V2S=10.5 1780.564 C2 (17.672, 380)

S3 CN=150 CM=200 FS=900 VS=11 V2S=12 169.872 C3 (18.132, 150)

S4 CN=100 CM=150 FS=500 VS=11.5 V2S=13 359.962 C4 (17.733, 150)

S5 CN=80 CM=90 FS=300 VS=12.5 V2S=14 128.878 C5 (17.431, 90)

R P=15 D=1080 FR=500 VR=3 3585.035 C1 to C5

S1 CN=250 CM=280 FS=700 VS=5 V2S=6.5 2.899 C1 (7.671, 280)

Case9 S2 CN=200 CM=220 FS=600 VS=5.3 V2S=6 39.157 C2 (9.059, 170)

S3 CN=300 CM=310 FS=900 VS=4.5 V2S=5 104.657 C3 (7.756, 310)

S4 CN=110 CM=145 FS=500 VS=5.8 V2S=6.5 51.727 C4 (9.773, 145)

S5 CN=120 CM=145 FS=470 VS=6 V2S=6.6 10.022 C5 (9.413, 145)

R P=22 D=5000 FR=12000 VR=7 5407.145 C1 to C5

S1 CN=1200 CM=1250 FS=8000 VS=4 V2S=6 438.674 C1 (10.83 , 1250)

Case10 S2 CN=900 CM=1000 FS=6000 VS=5 V2S=6.5 476.361 C2 (13.635, 750)

S3 CN=1000 CM=1150 FS=7000 VS=4.5 V2S=6.2 592.58 C3 (11.323, 1150)

S4 CN=600 CM=680 FS=3500 VS=5.5 V2S=7 355.438 C4 (11.346, 680)

S5 CN=1100 CM=1170 FS=7500 VS=4.2 V2S=6 549.799 C5 (11.187, 1170)

The implemented model differs from the iterated

contract net protocol (FIPA, 2002) because a Call

for propositions is sent only at the beginning and

there is no limitation of time to respond in each

iteration but there is a limitation in the number of

maximal iterations. Moreover, the RA can qualify its

contenders with states and acts with each SAi in the

negotiation according to its state which is not the

case in the iterated contract net protocol. For

example, the RA can put a SAi into a standby state

in some iterations and then reinstate it in the

negotiation process.

The experiments done allowed us to verify if the

proposed model can lead agents to reach an

agreement. Table1 presents some examples of our

experiments. These examples approach real

ICEIS 2008 - International Conference on Enterprise Information Systems

312

industrial cases. We assumed that different

subcontractors’ profiles exist: those who have

invested to automate their work process and

consequently have high fixed costs and relatively

low variable costs, and those who didn’t invest and

consequently have low fixed costs and relatively

high variable costs. In the case 1, we took as

assumptions a retailer negotiating with 2

subcontractors. The retailer respond to a fixed

demand D=500, his selling price P is 80, he supports

fixed costs FR=10000 and variable costs per unit

VR=15. The first subcontractor S1 has a normal

capacity CN=350, a maximal capacity CM=420,

fixed costs FS=4000, variable cost for the normal

capacity VS=10 and variable cost V2S=13 for the

production in excess (above the CN level). The

second subcontractor S2 has a normal capacity

CN=100, a maximal capacity CM=50, fixed costs

FS=1500, variable cost for the normal capacity

VS=12 and variable cost V2S=14 for the production

in excess. After simulation, the agreed contracts

were: C1(22.974, 350) and C2(23.558, 150).

The implementation of this model has been made

in two phases. First, we noticed that agreements can

be reached but sometimes with illogical prices. In

the case 1, agreed contracts were: C1(22.926, 420)

and C2(37.487,80). As noticed, it’s illogic to

negotiate, for the same product, price around 22 with

the first SA and around 37 with the second SA. Such

illogical prices are generated when the quantity

charged by the RA to a SA is relatively low. Thus,

we added the heuristic Check_quantity_efficiency()

in the decision-making process of the RA. This

heuristic allows the RA to verify if the quantities’

allocation made in the last iteration is efficient and

to review it if necessary. Experiments have

demonstrated that there are no more illogical

negotiated prices. With the heuristic

Check_quantity_efficiency(), agreed contracts in the

case 1 were : C1(22.974, 350) and C2(23.558, 150).

Among the experiments done, we found some

cases where results are the same with the two

models. In such cases, the quantities’ allocation had

no big impact on prices (Table1: Cases2, 3, 5, 10).

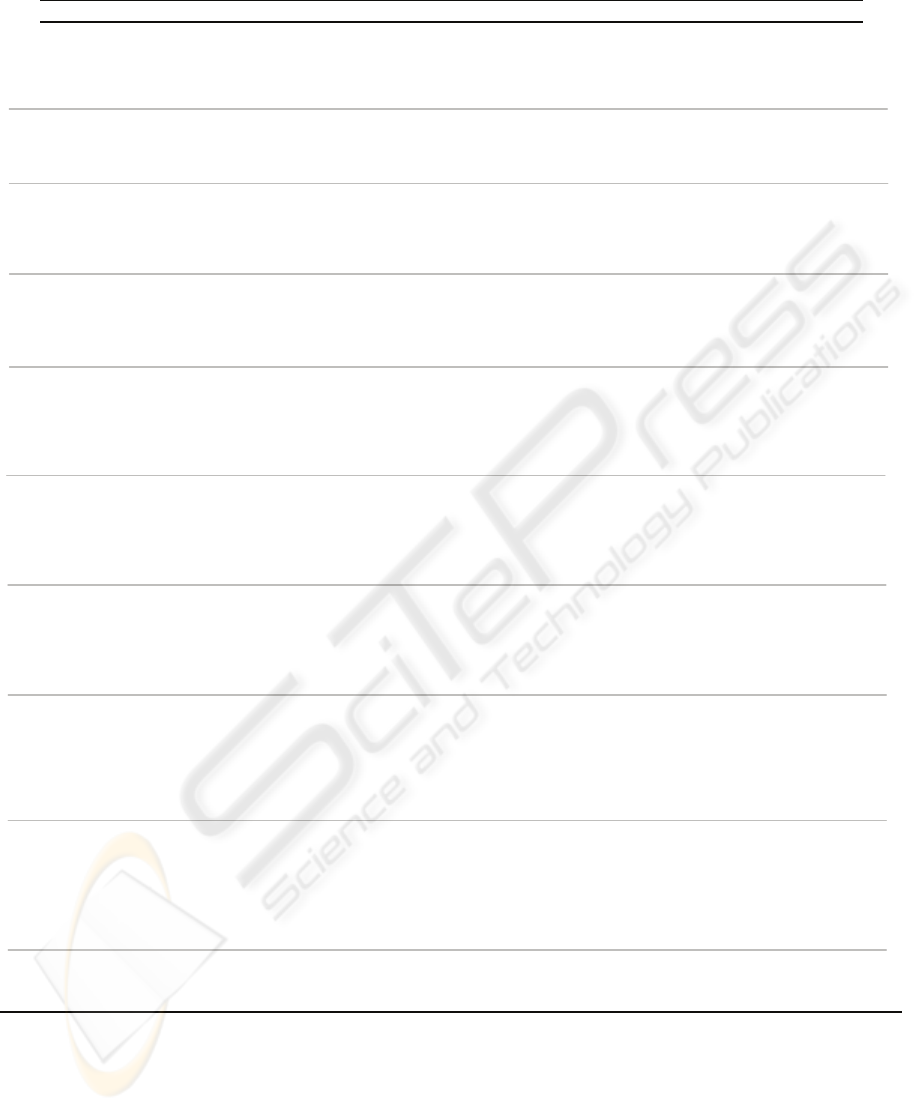

But, for many other examples, as those presented in

Figure4, the quantities’ allocation has produced a

big rise in at least one of the negotiated prices.

Figure 4 presents the min and the max prices

agreed for each model. We notice that without the

heuristic Check_quantity_efficiency(), the difference

between the min and the max agreed prices is huge

which is illogic. Nevertheless, using

Check_quantity_efficiency() allows the RA to

negotiate quite prices which is more realistic.

0

5

10

15

20

25

30

35

40

45

with

without

with

without

with

without

with

without

with

without

with

without

Case1 Case4 Case6 Case7 Case8 Case9

P

r

i

c

e

Min Max

Figure 4: Comparison with/without

Check_quantity_efficiency( ).

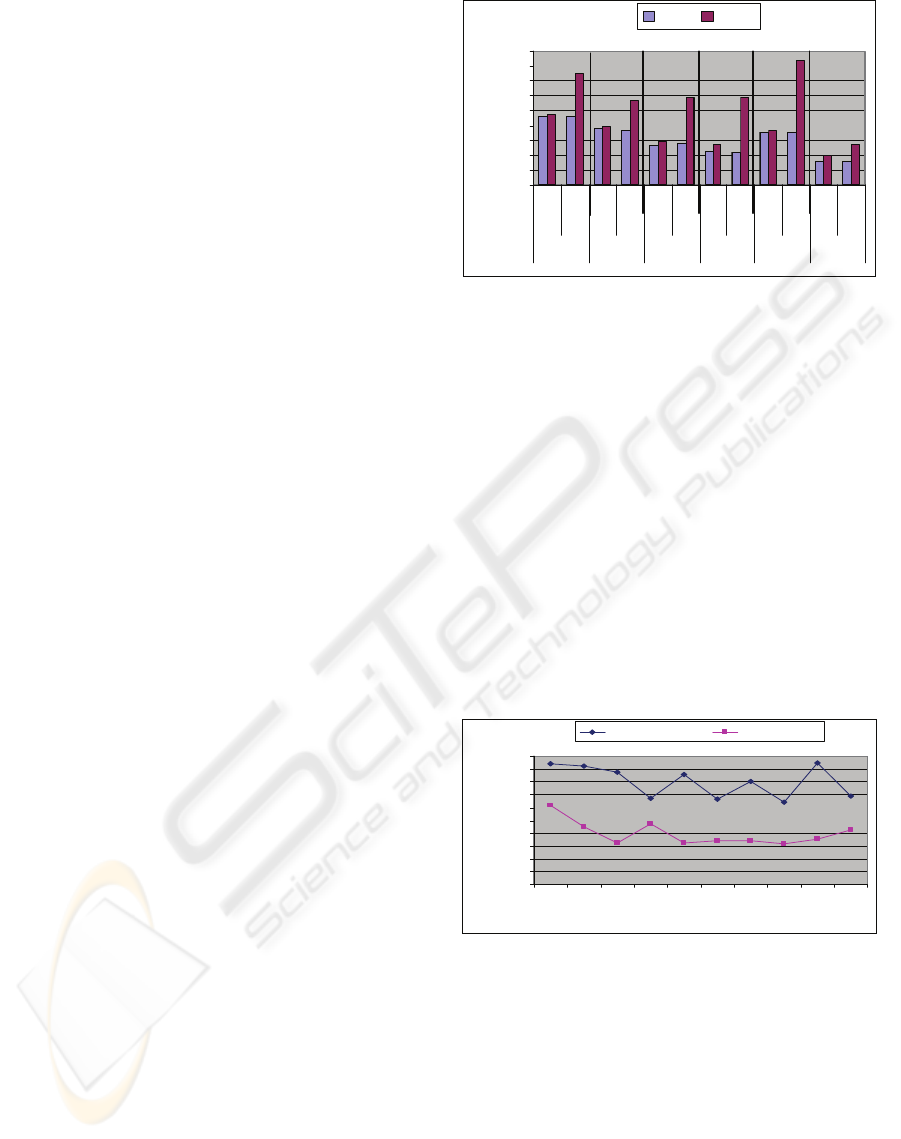

The objective of the proposed model is to help

agents reach agreements for a long lasting

partnership and establish a win-win relation which is

a key success factor in every supply chain. This

objective has been largely reached. But, the ideal

objective is that repartition of benefits happen as fair

as possible which means that margin’s repartition

has to occur according to the costs of each actor

relatively to the chain costs. Figure 5 presents a fair

repartition and the results we found (Model

repartition). We conclude that agents certainly reach

an agreement to establish a win-win long lasting

partnership but the repartition is not so fair. Agents

have to be more cooperative to reach more equitable

repartition of benefits.

0

0,1

0,2

0,3

0,4

0,5

0,6

0,7

0,8

0,9

1

2233444555

Number of Subcontractors

Retailer Margin /

Chain Margin (%

)

Model repartition fair repartition

Figure 5: Comparison fair repartition (CR/CCH) –Model

repartition (MR/MCH).

6 CONCLUSIONS AND FUTURE

WORKS

In this work, we focused on a supply chain

constituted by several subcontractors and a retailer

in a particular contractual context which is the

wholesale price contract (Price: W, Quantity: Q).We

assumed that the retailer stocks up from several

MULTI-AGENT NEGOTIATION IN A SUPPLY CHAIN - Case of the Wholsale Price Contract

313

subcontractors in order to face a market with fixed

demand. Each subcontractor has a normal

production capacity (CN) which can be increased

until a maximal capacity (CM) but with an

additional cost. However, the demand is superior to

the sum of normal capacities and inferior to the sum

of maximal capacities. Thereby, the negotiated and

agreed price between the retailer and each

subcontractor relies on the ordered quantity and the

extra cost generated by any excess capacity (above

the CN level). The objective of the proposed model

is to help actors in an asymmetric informational

context to reach agreements for a long lasting

partnership via the wholesale price contract and

establish a win-win relation which is a key success

factor in every supply chain. The ideal objective is

that repartition of benefits happen as fair as possible

which means that it occurs approximately according

to the added-value of each actor (each actor costs

relatively to the global chain costs).

To handle this problem, we have chosen the

multi-agent approach. The model is a representation

of the related supply chain; subcontractor agents

negotiate a combination (price, quantity) in order to

maximize their benefits and a retailer agent

negotiates several combinations (price, quantity)

with the different subcontractor agents in order to

satisfy demand, allocate quantities and maximize its

margin. The model has been implemented in two

phases. First, we have found that agreements are

reached but sometimes with illogical prices. Then,

we added the check_quantity_efficiency() in the

decision-making process of the RA. This heuristic

allows the RA to verify if the quantities’ allocation

is efficient and to review it if necessary. Since, we

found agreements with logical prices.

Experiments have demonstrated that agreements

are possible. The objective of assuring a long-lasting

partnership via the wholesale price contract is

largely reached and a win-win relation can be

established. However, the ideal objective of making

the repartition as fair as possible is not totally

reached and more investigation has to be done.

This research has several perspectives. First, we

intend to extend the proposed model by making

agents more cooperative in order to reach a more fair

repartition of benefits under incomplete

informational context. This can be done by

integrating learning technics in agents or by treating

the problem as a multicriteria problem. Second, we

plan to treat the model with a stochastic demand.

And finally, we intend to propose a negotiation

model combining several contract types.

REFERENCES

Bellifemine, F., Caire, G. and Greenwood., D., 2007.

"Developing Multi-Agent Systems with JADE". John

Wiley & Sons, Chichester, UK.

Cachon, G.P., 2004. "Supply Chain Coordination with

Contracts", In S. Graves & T. de Kok (Eds.),

Handbooks in Operations Research and Management

Science. North Holland Press.

Duvallet, J., Gomez-Padilla, A., LLERENA, D., 2006.

"Approche économique de la coordination dans les

chaînes logistiques". MOSIM’06. Rabat, Maroc.

Faratin, P., 2000. "Automated service negotiation between

autonomous computational agents". Ph.D. thesis,

University of London, Queen Mary and Westfield

College, Department of Electronic Engineering.

Ferber, J., 1995. "Les Systèmes Multi-Agents, vers une

intelligence collective". InterEdition. Paris.

Fiala, P., 2005. "Information sharing in supply chains".

Omega, Volume 33, Issue 5, Pages 419-423.

FIPA, 2002. "FIPA Iterated Contract Net Interaction

Protocol Specification", Foundation for Intelligent

physical agents,http://www.fipa.org/specs/fipa00030/

Gomez-Padilla, A., 2005. "Modélisation des relations

verticales : une approche économique et logistique".

PhD Thesis. I.N.P. de Grenoble. September 2005.

He, M., Leung, H., Jennings, N. R., 2003. "A fuzzy logic

based bidding strategy for autonomous agents in

continuous double auctions". IEEE Transaction on

Knowledge and Data Engineering 15(6):1345–1363.

Jennings, N., Faratin, P., Lomuscio, A., Parsons, S.,

Sierra, C., Wooldridge, M., 2001. "Automated

negotiation: Prospects, methods and challenges".

International Journal of Group Decision and

Negotiation 10, 199–215.

Jiao, J., You, X., Kumar, A., 2006. "An agent-based

framework for collaborative negotiation in the global

manufacturing Supply Chain network", Robotics and

Computer-Integrated Manufacturing, Volume 22,

Issue 3, Pages 239-255.

Kraus, S. 2001. "Strategic Negotiation in Multi-Agent

Environments". Cambridge, MA: MIT Press.

Rahwan, I., Sonenburg, L., Jennings, N. R. and

McBurney, P., 2007. "Stratum: A methodology for

designing heuristic agent negotiation strategies".

International Journal of Applied Artificial Intelligence,

21 (6). pp. 489-527.

Spengler, J., 1950. "Vertical integration and antitrust

policy". Journal of Political Economy. 347-52.

Zhang, X., Lesser, V., and Podorozhny., R., 2005.

"Multidimensional, multistep negotiation for task

allocation in a cooperative system". Autonomous

Agents and Multi-Agent Systems, Vol. 10, No. 1, pp.

5-40.

ICEIS 2008 - International Conference on Enterprise Information Systems

314